PDF Attached

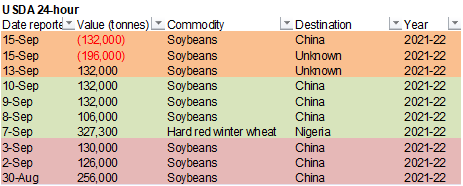

-Cancellations

export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

-Cancellations

export sales of 196,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Higher

trade in soybeans led by soybean oil despite USDA cancellation announcements. Meal fell while corn and wheat rallied. Many think short term lows are in. WTI crude was up more than $2.00 and the USD was down 13 by late afternoon.

![]()

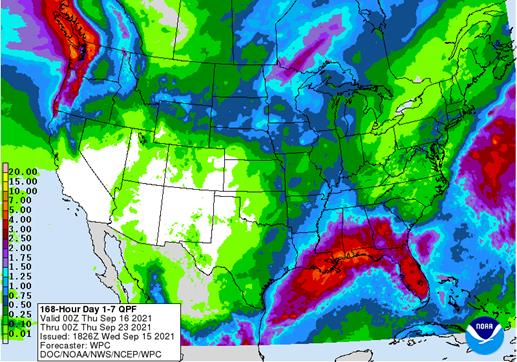

7-day

MOST

IMPORTANT WEATHER OF THE DAY

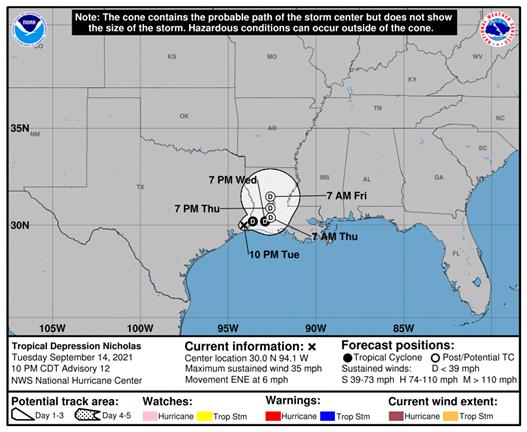

- Tropical

Depression Nicholas dissipated overnight with the remnant low still drifting near the southwest coast of Louisiana

o

Total rainfall since Monday has ranged from 2.00 to 5.17 inches in central and southern Louisiana and 2.00 to 7.00 inches along the upper Texas Coast

o

Frequent rain will continue to fall over the next week in Louisiana, central and southern Mississippi, the southwest half of Alabama and far western parts of the Florida Panhandle as a strong on-shore flow of tropical moisture

continues through the next week

- Additional

rainfall will vary from 2.00 to 6.00 inches with a few greater amounts - Flooding

is expected, but the rain intensity is not likely to be excessive on any given day

o

Sugarcane sucrose levels will fall because of too much moisture ahead of harvest and harvest delays are likely into early October because of wet fields

- A

tropical wave northeast of the Bahamas is still expected to become a tropical cyclone later this week

o

A tropical depression or tropical storm is likely to evolve later today or Thursday and the storm system is expected to move near the North Carolina coast Thursday before turning back out to sea Friday and Saturday

o

Some rain will fall in eastern North Carolina and neighboring states, but no damaging wind or flooding is expected

- Today’s

forecast is wetter in the northern U.S. Plains and upper Midwest as well as southeastern parts of Canada’s Prairies next week

o

Today’s 06z GFS model run reduced rain previously advertised for the western Dakotas and eastern Montana down to a more reasonable 0.10 to 0.50 inch after the 00z GFS run had much greater rain in the region

o

The European model run is too wet for the western Dakotas

o

Eastern Dakotas, eastern Nebraska, Minnesota, western Wisconsin and parts of Iowa get 1.00 to 3.00 inches and locally more

- Harvest

delays are expected, but no quality decline is expected - Wettest

from extreme eastern Dakotas into western Ontario, including northern Minnesota

o

The model rainfall is overdone and persists too long

- Other

U.S. Midwestern crop areas will experience a good mix of rain and sunshine over the next ten days favoring summer crop maturation and harvest progress around brief period of rain - West

Texas weather will be mostly good for the next ten days with only a few showers expected later this week

o

Temperatures will be warm enough to promote quick crop development

- U.S.

southeastern states will experience a good mix of weather

o

Rainfall may be a little more abundant than desired, but no serious impact is expected other than slowing crop maturity and some fieldwork

- U.S.

Great Plains weather will be mostly favorable for summer crop maturation, harvesting and some winter crop planting; however greater rain is needed in the northwestern Plains and in many other winter wheat production areas to adequately prepare the soil for

planting, germination and emergence

o

Some showers are advertised for a part of the northwestern Plains this weekend, but resulting rainfall will not be enough to seriously change soil moisture

- Frost

and freezes coming up later this week and early next week in the Canadian Prairies will have no negative impact on summer crops because of their faster than usual maturation this year - Frost

and freezes will also impact a part of the northwestern U.S. Plains early next week and that, too, should have a low impact on crops because of their advanced state this year - Another

bout of rain is expected in the U.S. Pacific Northwest this weekend into Monday, but the moisture will be mostly confined to the Cascade Mountains and the northern Rocky Mountains with very little moisture in the Yakima, Snake or Columbia River Basins.

- Central

and southern California weather will continue mostly dry for the next ten days

o

some northern California areas will get some rain during the weekend, but amounts will be light away from the coast

- Most

of the southwestern U.S. monsoon rainfall has ended - The

heart of Canada’s Prairies will not receive much rain over the next ten days

o

The exceptions will be in western Alberta and in a few Manitoba locations where some rain is expected

o

Good crop maturation and harvest weather is expected

o

Planting of winter crops will advance, too, although some areas are still too dry for quick germination and plant emergence

- Mexico

precipitation will continue greater than usual in central and southern parts of the nation during the coming ten days

o

The moisture will be good for late season crops; including dry beans, corn, sorghum, citrus, sugarcane and coffee

o

Northern Mexico rainfall will be more limited

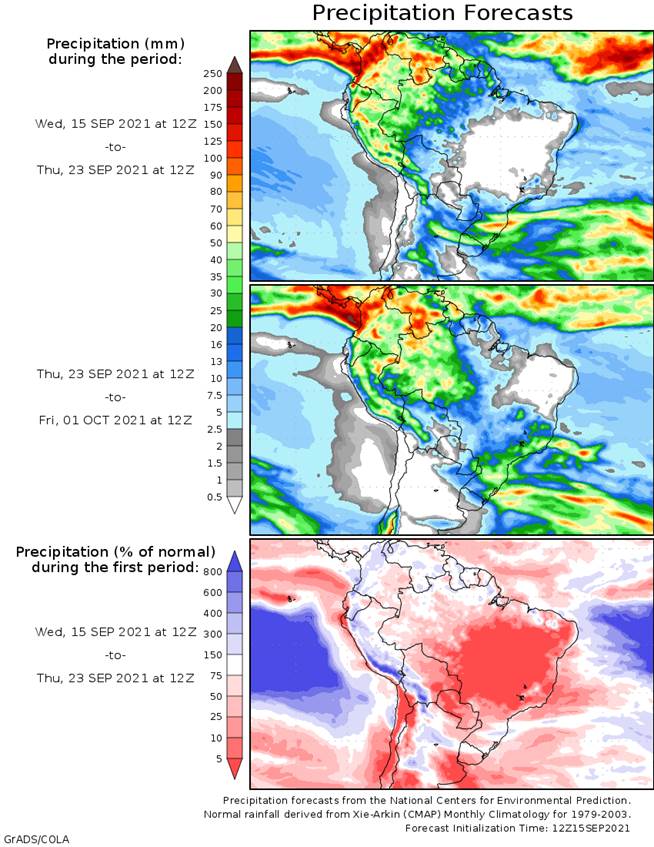

- Argentina

rainfall will continue lacking significance in the driest areas of the west and north for at least another ten days

o

No rain is expected through Sunday

o

Showers will develop next week across much of Argentina, but rain amounts will be lightest in parts of the west

- Southern

Brazil received additional rain Tuesday with amounts through 0600 GMT today varying from 0.05 to 0.60 inch from southern Mato Grosso do Sul to southern Sao Paulo, Parana and in a few eastern Santa Catarina locations.

o

Central Parana reported 0.71 to 1.14 inches and one location in southern Mato Grosso do Sul reported 1.04 inches

o

Temperatures were seasonably warm to hot in center west and northern parts of center south Brazil where highs in the 90s to 102 degrees Fahrenheit resulted

- Additional

waves of rain are likely in southern Brazil through next week with areas from Parana to Rio Grande de Sul wettest

o

Another 0.20 to 0.75 inch will occur in Parana while areas to the south receive 0.75 to 2.50 inches with a few amounts in Santa Catarina and northeastern Rio Grande do Sul getting upwards to 4.00 inches

- Center

west and center south Brazil will experience net drying over the next ten days

o

Rain is still needed in all coffee, citrus and sugarcane production areas and it would be good for soybean and corn areas in center west and center south

- The

earliest that these areas will get rain is in about ten days and confidence is low - South

Africa crop areas will continue to receive periodic rainfall near the coast and rain would be welcome in many winter wheat areas to support aggressive spring crop development - Australia

rainfall will continue limited in Queensland, northern New South Wales and northern parts of Western Australia through the weekend stressing some reproductive crops that do not have much subsoil moisture

o

Queensland winter wheat and barley yields are likely to slip lower this year because of frost, freezes and dryness in unirrigated areas

o

The remainder of Australia’s winter crops are still poised to perform quite favorably

- Tropical

Storm Chanthu was located 249 miles southwest of Sasebo, Japan at 0900 GMT today moving east southeasterly at 4 mph and producing maximum sustained wind speeds of 52 mph

o

Chanthu will move to the northeast today and then to the east northeast during the rest of this week and through the weekend

- The

path will take the storm through the Korea Strait and then across Hokkaido Friday and Saturday - Heavy

rainfall of 2.00 to more than 6.00 inches will accompany the storm across parts of western Japan and there will be some local flooding, but damage to crops and property will be low

o

Chanthu has moved far enough away from eastern China to allow port activity to return to normal today

- Eastern

China crop areas will see another couple of days of drying before rain resumes in the north

o

Recent drying was welcome, and more is needed to support summer crop maturation and harvest progress

o

Drying will continue in the interior southeast and in some east-central locations for the next week to nearly ten days

o

Rain is expected to resume in Gansu, Shaanxi and eastern Sichuan Friday before advancing northeast through the Yellow River Basin and the northeastern provinces disrupting farming activity once again through Monday

- Rainfall

will range from 2.00 to 6.00 inches with a few greater amounts possible - Some

local flooding will be possible

o

Another wave of rain will impact northern China crop areas late next week and into the following weekend, but resulting rainfall will not be as great

- India’s

monsoon will continue to last longer than usual

o

Another ten days of frequent rainfall will occur in the central and north parts of the nation raising some concern over the condition of early maturating crops

- Cotton

in the open boll stage in the north needs to dry out for harvesting - Too

much rain may harm its quality and could string some fiber out of open bolls

o

Southern India will continue dry biased for the next two weeks with rainfall well below average

o

Eastern India will see frequent rain as well

o

Above normal rainfall in central and northern India will be good for some late season crops, but some drying will soon be needed

- Interior

parts of mainland Southeast Asia will receive near to above normal precipitation over the next ten days resulting in an improvement in soil moisture and water supply which is needed for winter crops

o

Some local flooding will be possible

- Philippines

rainfall will be greater than usual for a while and a new tropical cyclone could impact the nation next week

o

Some local flooding will be possible

- Southwestern

Russia and central and western Ukraine will receive some needed rain this weekend into next week that will help improve soil moisture for winter wheat, rye and barley planting and emergence

o

Lower parts of the Volga River Basin, eastern Ukraine and Kazakhstan will remain dry

- Northern

Russia will continue wet biased, but planting in those areas should be mostly complete - Europe

weather Tuesday was good for widespread fieldwork, although rain shifted from Portugal and Spain into France

o

The moisture in the southwest will continue to shift into France, northern Italy and parts of Germany over the next few days.

o

Temperatures will be warm biased

o

Eastern Europe will get rain Thursday into the weekend and again later next week causing some disruption in fieldwork

- Rain

will be good in improving topsoil moisture for winter crops in the southeast - North

Africa showers over the next ten days will be brief and light - West-central

Africa rain will continue to come and go favorably for coffee, sugarcane, rice, cocoa and other crops

o

Cotton production from the region has been better than last year in some areas especially Mali and Senegal

- East-central

Africa coffee, cocoa and other crop development has advanced well due to timely rainfall that will continue for a while - Today’s

Southern Oscillation Index was +9.38 and will rise over the next several days - Ontario

and Quebec weather will continue favorably mixed over the next two weeks for late season farming activity and harvesting of summer crops - New

Zealand will be wetter than usual in the next seven days in North Island and western parts of South Island while lighter rain falls in eastern parts of South Island

o

Next week will be wetter in western parts of South Island

Source:

World Weather Inc.

Wednesday,

Sept. 15:

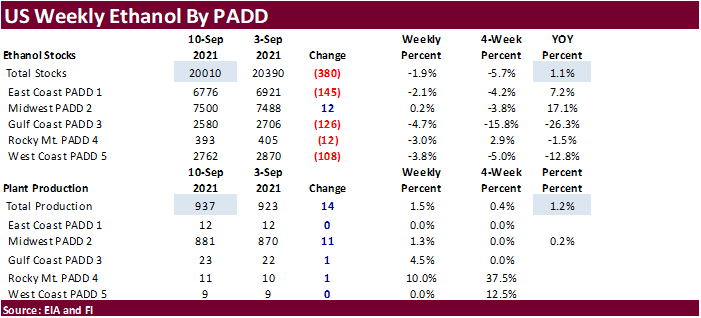

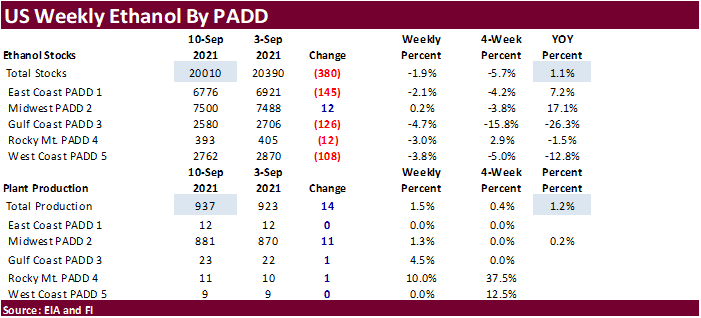

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

monthly grains report - Malaysia

Sept. 1-15 palm oil exports - Brazil’s

Unica releases cane crush and sugar output data (tentative)

Thursday,

Sept. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Malaysia

Friday,

Sept. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

75

Counterparties Take $1081.342 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1169.28 Bln, 80 Bidders)

US

Import Price Index (M/M) Aug: -0.3% (est 0.2%; prev 0.3%)

US

Import Price Index Ex-Petroleum (M/M) Aug: -0.1% (est 0.2%; prev 0.1%)

US

Import Price Index (Y/Y) Aug: 9.0% (est 9.4%; prev 10.2%)

US

Export Price Index (M/M) Aug: 0.4% (est 0.4%; prev 1.3%)

US

Export Price Index (Y/Y) Aug: 16.8% (est 17.0%; prev 17.2%)

US

Empire Manufacturing Sep: 34.3 (est 17.9; prev 18.3)

Canadian

CPI NSA (M/M) Aug: 0.2% (est 0.1%; prev 0.6%)

Canadian

CPI (Y/Y) Aug: 4.1% (est 3.9%; prev 3.7%)

Canadian

CPI Core-Common (Y/Y) Aug: 1.8% (est 1.8%; prev 1.7%)

Canadian

CPI Core-Median (Y/Y) Aug: 2.6% (est 2.7%; prev 2.6%)

Canadian

CPI Core-Trim (Y/Y) Aug: 3.3% (est 3.1%; prev 3.1%)

US

DoE Crude Oil Inventories (W/W) 10-Sep: -6422K (est -3574K; prev -1528K)

–

Distillate (W/W): -1689K (est -1950K; prev -3141K)

–

Cushing OK Crude (W/W): -1103K (prev 1918K)

–

Gasoline (W/W): -1857K (est -2900K; prev -7215K)

–

Refinery Utilization (W/W): 0.20% (est 2.25%; prev -9.40%)

·

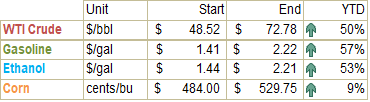

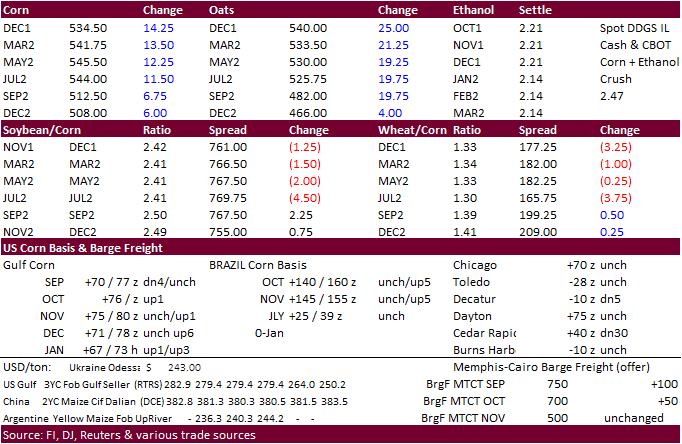

US corn futures ended 5.50 to 13.25 cents higher led by bull spreading from a lower USD, sharply higher energy futures prices and technical buying. We are now thinking the December over the next few weeks may trade in a $5.05-$5.60

range. We change our position that harvesting pressure could pull the December contract below $5.00, at least anytime soon, and see the December potentially rallying as high as $5.60 from managed money extending long positions. As of this afternoon they

are sitting at estimated net long 231,000 contracts after adding 12,000 corn contracts today.

·

US weekly EIA production and stocks were seen supportive for corn.

·

WTI crude oil ended at their highest level since August 2.

·

US field reports this week, unlike last week, are showing signs some producers will harvest lower yields than that of last year across areas of the Midwest.

·

Argentina producers have been aggressive sellers of corn this month, selling 250,000 tons for the week ending the 8th which brings new-crop corn sales to about 6.5 million tons.

![]()

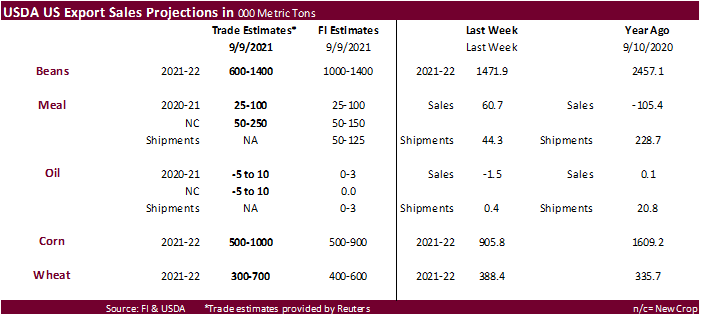

Export

developments.

·

South Korea’s KFA bought 68,000 tons of corn at an estimated $326.39/ton c&f and 305 cents over the December for arrival around December 5.

US

DoE Crude Oil Inventories (W/W) 10-Sep: -6422K (est -3574K; prev -1528K)

–

Distillate (W/W): -1689K (est -1950K; prev -3141K)

–

Cushing OK Crude (W/W): -1103K (prev 1918K)

–

Gasoline (W/W): -1857K (est -2900K; prev -7215K)

–

Refinery Utilization (W/W): 0.20% (est 2.25%; prev -9.40%)

Since

January 1, 2021

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

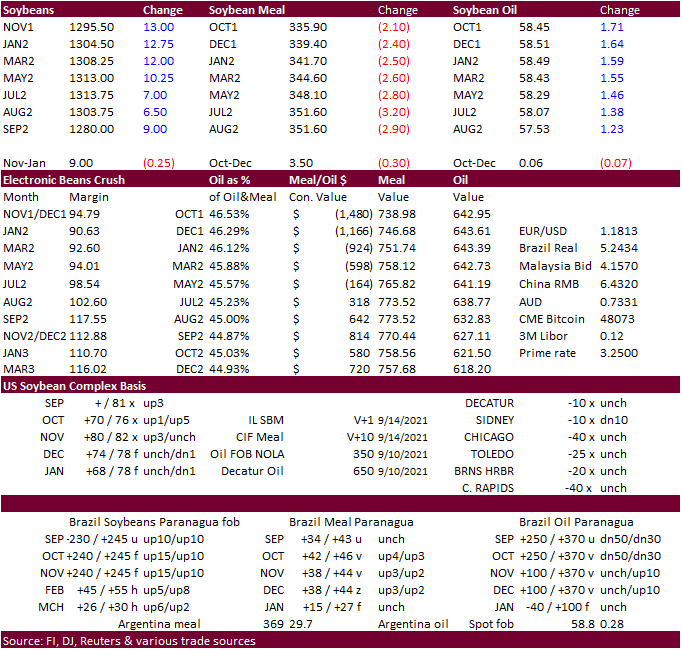

Soybeans

·

Soybeans traded higher following strength in grains and Chinese demand for Brazilian spot soybeans, despite USDA announcing 24-hour cancellations of a combined 328,000 tons. There was chatter China bought additional Brazil soybean

cargoes. Some say they bought 6 cargoes, others more than 10 this week. SA soybean premiums firmed 10-15 cents higher this morning for the nearby positions. Talk of dry SA weather was noted but it’s too early to see any impact on soybean planting progress.

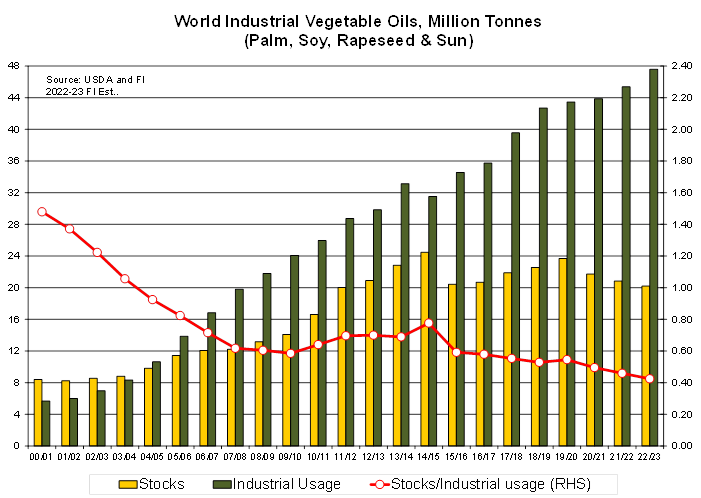

We included a 10-day SAs outlook map on page two. We see short term upside for November soybeans at $13.30. We changed our tune for soybean oil, recognizing traders are looking at the long term outlook for global biofuel demand and technical buying over

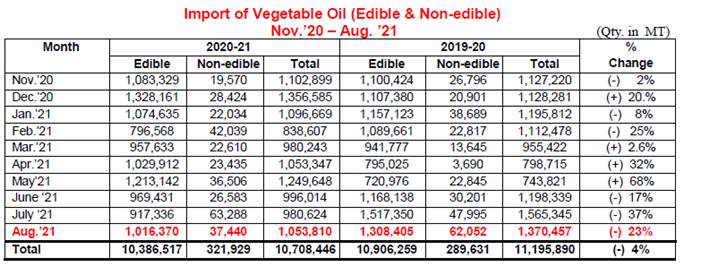

the short term along with India demand for palm oil. India imports of vegetable oils during August 2021 is reported at 1,053,810 tons compared to 1,370,457 tons in August 2020. November 2020 to August 2021 ( 10 months) is reported at 10,708,446 tons compared

to 11,195,890 tons, down by 4% compared to last year.

·

Talk of disappointing early yield assessments for the US Midwest were also seen supportive for soybeans.

·

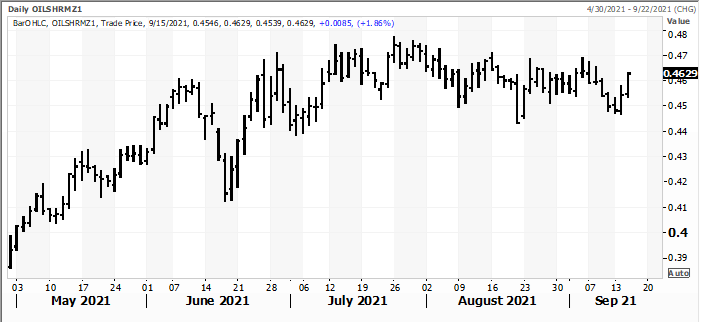

Soybean oil was sharply higher, keeping soybean meal on the defensive. Malaysian palm posted a 100 point gain for the November position to 4,440 MYR/ton and cash was up $17.50 to $1,152.50/ton.

·

Funds bought an estimated net 7,000 soybeans, sold 2,000 meal and bought 4,000 soybean oil.

·

We lowered our US September soybean export projection to 110 million bushels, well down from 264 million from September 2020. Our 2021-22 export projection was also lowered by 15 million bushels to 2.065 billion, below USDA’s

current 2.090 billion outlook and compares to USDA’s 2020-21 projection of 2.260 billion.

·

AmSpec estimated Malaysian palm oil exports for the September 1-15 period at 832,355 tons, up 54% from the same period a month ago. ITS reported 853,625 vs 528,736, up 61.5%.

·

India set their CPO benchmark import price at $1,130/ton and soybean oil at $1,328 per ton, up from $1,029 and $1,228/ton respectively.

https://pib.gov.in/PressReleasePage.aspx?PRID=1755264

·

Results are awaited on Algeria’s import tender for soybean meal.

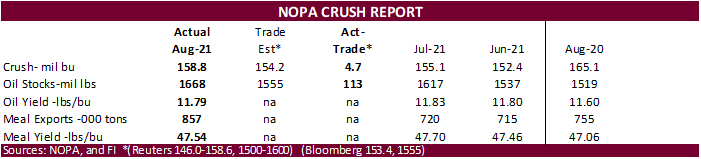

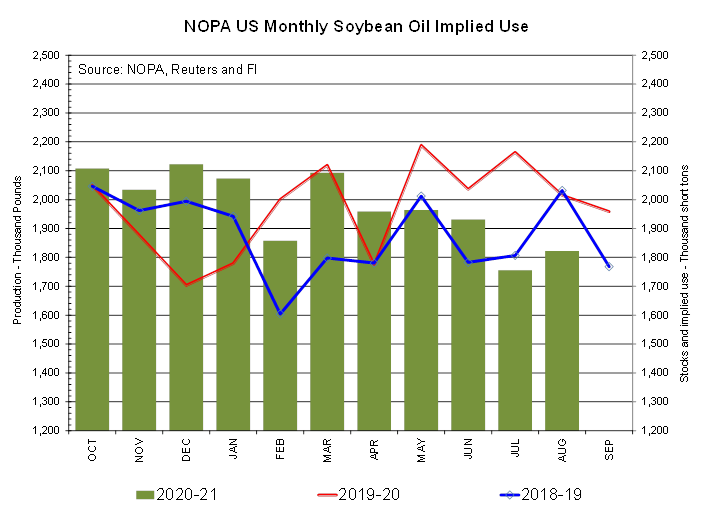

NOPA

reported the August crush at 158.8 million bushels, exceeding expectations by a large 4.7 million bushels from August. Soybean oil stocks were reported 113 million pounds above trade expectations. Although stocks are big, implied soybean oil demand improved

in August from July. Soybean meal shipments improved from July and year ago. USDA will likely adjust higher their 2020-21 crush up by 5 million bushels.

Export

Developments

- Algeria’s

ONAB seeks up to 30,000 tons of soymeal on Wednesday, for shipment between Nov. 10-30 and Dec. 1-15. - WASHINGTON,

September 15, 2021- Private exporters reported to the U.S. Department of Agriculture the following activity: - Cancellations

export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

- Cancellations

export sales of 196,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

December

soybean oil share

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range, short term $12.70-$13.30.

Soybean

meal – December $310-$385

Soybean

oil – December 53-62 cent range

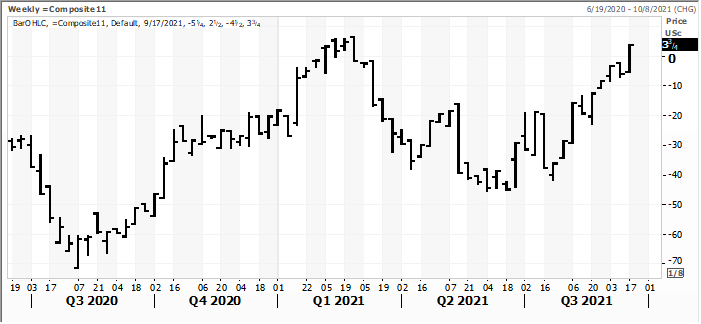

·

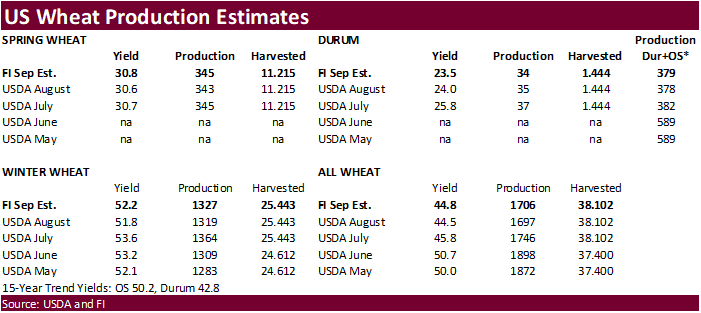

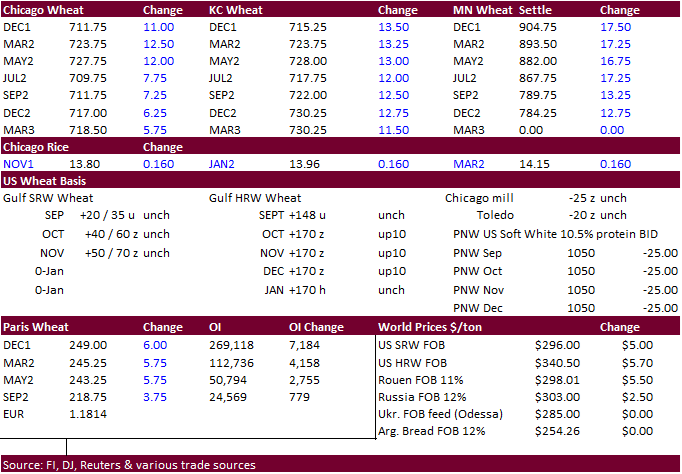

Wheat was higher as traders extended long positions on crop concerns. The KC wheat contract is back trading at a premium over Chicago wheat. MN was the leader for the US wheat markets today. The less than expected spring wheat

Canadian production estimate is getting people to think USDA will lower US spring wheat production at the end of the month. We think otherwise and estimate US spring wheat at 345 million bushels (USDA 343 million) and durum at 34 million (USDA at 35).

·

We see short term Chicago wheat in a $6.80-$7.40 range.

·

Reuters noted Russia could see winter wheat sowings down 0.5-1 million hectares from 17.8 million last year.

·

KCZ-WZ spread

·

Funds bought an estimated net 5,000 soft wheat contracts.

·

December Paris wheat was up 6.00 at 248.50 euros.

·

The central Great Plains saw some rain over the past day, and we look for winter wheat plantings to increase across Kansas and Oklahoma.

·

FranceAgriMer lowered its 2021-22 forecast of French soft wheat exports for the non-European Union to 9.6 million tons from 10.5 million in July. 2021-22 soft wheat stocks were projected at 2.9 million tons from 3.7 million estimated

in July.

·

China will relax on quality specifications for French wheat imports. They will now accept test weight readings of 75 kgs (165 lb.) per hectoliter, compared with a 77 kg minimum initially required. Algeria and Saudi Arabia have

already eased weight requirements. (Reuters)

Export

Developments.

·

Jordan passed on 120,000 tons of wheat for

last half December through first half February shipment.

·

Japan in a SBS import tender bought 220 tons of feed barley and passed on wheat (they were in for 100,000 tons of feed barley and 80,000 tons of wheat).

·

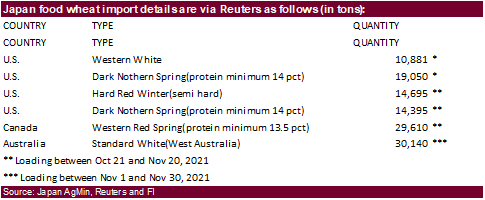

Japan seeks 118,771 tons of food wheat this week.

·

Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat on September 16.

·

Jordan seeks 120,000 tons of feed barley on September 16 for Dec/Jan/Feb shipment.

·

Pakistan issued a new import tender for 500,000 tons of wheat set to closed on September 20.

·

Turkey seeks 260,000 tons of feed barley on September 21 for October 8-October 31 shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Morocco seeks 363,000 tons of US wheat on September 21 for arrival by the end of the year.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 23.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.