PDF Attached

WASHINGTON,

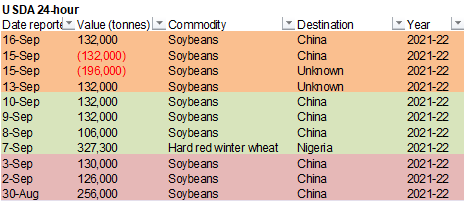

September 16, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

Higher

close in front month soybean contracts and soybean meal. Spreading sent soybean oil lower. Corn ended lower and Chicago wheat mixed (light bull spreading). KC wheat ended higher in part to dryness across the Great Plains. MN saw bull spreading. USDA export

sales were within expectations for the soybean complex, below for corn, and higher end of a range of expectations for all-wheat.

![]()

7-day

MOST

IMPORTANT WEATHER OF THE DAY

- Some

of Russia’s wheat, barley and rye production region in the upper and middle Volga River Basin will see improving weather conditions over the week as periods of rain evolve

o

Dryness has had some producer and traders a little concerned about long term wheat production potentials because of dry planting conditions

o

The lower Volga River Valley, Kazakhstan and a small part of Russia’s Southern Region will remain drier biased

o

All other areas will get rain

- Eastern

Ukraine will also need rain for its winter crops, but central and western parts of the nation will good or improving conditions for wheat emergence and establishment.

- Flooding

rain will return to a part of China’s northern Yellow River Basin over the next few days disrupting fieldwork

o

The moisture may raise some concern over the condition of summer crops, but it will be good for future wheat planting and emergence

- Northeastern

China will see a good mix of rain and sunshine during the next ten days - Interior

southeastern and east-central China will experience several more days of net drying which will be very good for summer crop maturation and eventual harvesting - India’s

monsoon withdrawal is still being delayed for another week to ten days

o

Rain will be widespread in the central, east and interior north while the south receives restricted rainfall and experiences some net drying

- Southeast

Asia rainfall is expected to be frequent and sufficient to support long term crop needs and boost runoff for winter water supply

o

This is true for the mainland areas as well as Philippines and a part of both Indonesia and Malaysia

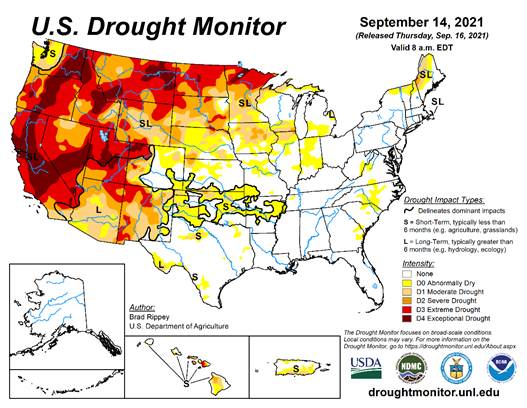

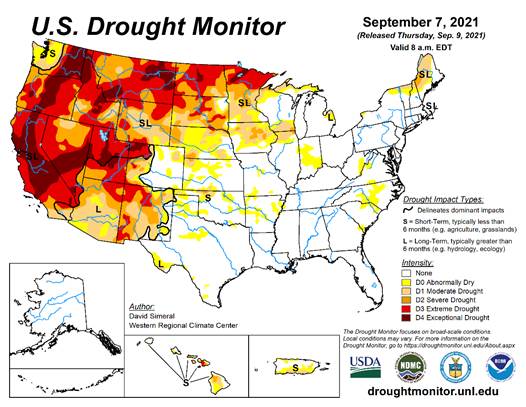

- U.S.

NWS 30-Day Outlook for October suggested warmer than usual temperatures will occur in most of the contiguous states except in the Pacific Northwest and from the Texas coast through southeastern Arkansas and areas east from there to western Georgia and all

of Florida where equal chances for above, below and near normal temperatures were suggested

o

Precipitation was advertised to be greater than usual from Minnesota through the Great Lakes region and from southwestern New York southward through the Middle Atlantic Coast States to southeastern Louisiana and Florida

o

The Pacific Northwest was also advertised to be wetter than usual while below average precipitation was suggested for the central and southern Plains, southern Rocky Mountain region and southwestern desert region

o

Equal chances for above, below and near normal precipitation were given for all other areas in the contiguous U.S.

- U.S.

NWS 90-Day Outlook for October through December suggested warmer than usual temperatures would be warmer than usual in much of the contiguous states except from Washington and much of Oregon through the northern Plains to the upper Midwest where equal chances

for above, below and near normal temperatures was given.

o

Precipitation will be below average from South Dakota to Texas and from southern California into the central and southern Rocky Mountain region. Most of the Gulf of Mexico coast states and both Georgia and South Carolina were

also advertised to be drier than usual

o

Above average precipitation was suggested for the Pacific Northwest and from the eastern Great Lakes region down the St. Lawrence River Valley including much of New York and the northwest half of New England

o

Equal chances for above, below and near normal temperatures were given the remainder of the nation

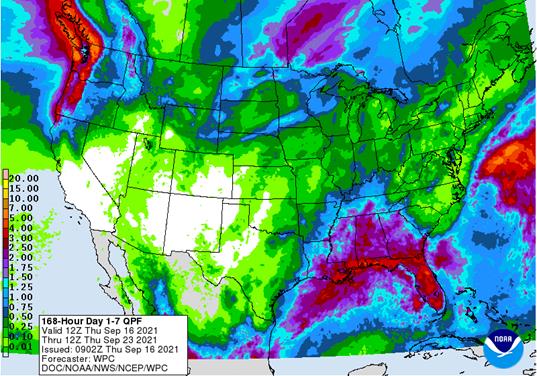

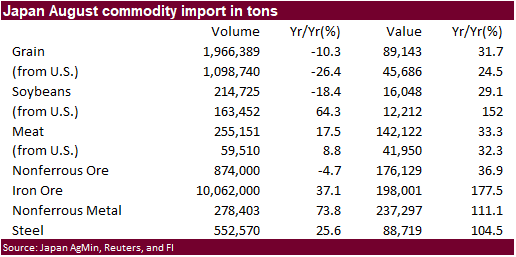

- Tropical

Storm Chanthu will move through Japan’s main islands over the next few days producing heavy rain and some flooding, but wind damage is not likely to be much of a problem - A

tropical disturbance near the southwestern Philippines this weekend will evolve into a tropical cyclone that may threaten Vietnam with heavy rain and strong wind late next week - Tropical

Depression Nicholas remains a factor for the central U.S. Gulf of Mexico Coast states where its remnants and another tropical wave over Cuba will perpetuate rain from Florida to Tennessee, Georgia and the lower U.S. Delta over the next several days

o

Some flooding rain has already occurred in a part of Louisiana

o

Rainy weather will not bode well for open boll cotton in the southeastern U.S.

o

Sugarcane sucrose levels in Louisiana will fall because of too much moisture ahead of harvest and harvest delays are likely into early October because of wet fields

- A

tropical disturbance approaching the North Carolina coast will possibly develop into a tropical or subtropical storm as it passes by to the east

o

The developing system will not likely directly impact key North America crop areas, but it will be close enough to the middle and northern Atlantic Coast to induce some rough seas, breezy conditions and a little rain

o

The system should turn out to sea without having much impact

o

Nova Scotia and Newfoundland, Canada may also be impacted by this system.

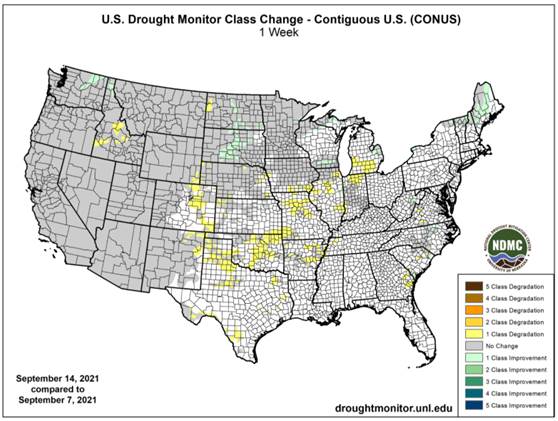

- Today’s

forecast in the northern U.S. Plains and upper Midwest is not quite as wet for as long as advertised in the model data Wednesday

o

Rain is still expected to evolve late Sunday and Monday in the western Dakotas and eastern Montana before shifting to the upper Midwest Monday and Tuesday

- Resulting

rainfall will be disruptive to farming activity and will induce a little short term boost in soil moisture, but it is not likely to have a lasting impact - Other

U.S. Midwestern crop areas will experience a good mix of rain and sunshine over the next ten days favoring summer crop maturation and harvest progress around brief period of rain - West

Texas weather will be mostly good for the next ten days with only a few showers expected later this week

o

Temperatures will be warm enough to promote quick crop development

- U.S.

southeastern states will experience a mix of weather

o

Rainfall may be a little more abundant than desired, but no serious impact is expected other than slowing crop maturity and some fieldwork

- There

will be a little concern over cotton fiber quality as well - U.S.

Great Plains weather will be mostly favorable for summer crop maturation, harvesting and some winter crop planting; however greater rain is needed in the northwestern Plains and in many other winter wheat production areas to adequately prepare the soil for

planting, germination and emergence

o

Some showers are advertised for a part of the northwestern Plains this weekend, but resulting rainfall will not be enough to seriously change soil moisture

- Frost

and freezes coming up later this week and early next week in the Canadian Prairies will have no negative impact on summer crops because of their faster than usual maturation this year - Frost

may also impact a part of the northwestern U.S. Plains Friday and that, too, should have a low impact on crops because of their advanced state this year - Another

bout of rain is expected in the U.S. Pacific Northwest this weekend into Monday, but the moisture will be mostly confined to the Cascade Mountains and the northern Rocky Mountains with very little moisture in the Yakima, Snake or Columbia River Basins.

- Central

and southern California weather will continue mostly dry for the next ten days

o

some northern California areas will get some rain during the weekend, but amounts will be light away from the coast

- Most

of the southwestern U.S. monsoon rainfall has ended - The

heart of Canada’s Prairies will not receive much rain over the next ten days

o

The exceptions will be in western Alberta and in a few Manitoba locations where some rain is expected

o

Good crop maturation and harvest weather is expected

o

Planting of winter crops will advance, too, although some areas are still too dry for quick germination and plant emergence

- Mexico

precipitation will continue greater than usual in central and southern parts of the nation during the coming ten days

o

The moisture will be good for late season crops; including dry beans, corn, sorghum, citrus, sugarcane and coffee

o

Northern Mexico rainfall will be more limited

- Argentina

rainfall will continue lacking significance in the driest areas of the west and north for at least another ten days

o

No rain is expected through Saturday

o

Showers will develop Sunday into next week across Argentina, but rain amounts will be lightest in parts of the west

- Southern

Brazil will receive additional of rain through next week with areas from Parana to Rio Grande de Sul wettest

o

Another 0.20 to 0.75 inch will occur in Parana while areas to the south receive 0.75 to 2.50 inches with a few amounts in Santa Catarina and northeastern Rio Grande do Sul getting upwards to 4.00 inches

- Center

west and center south Brazil will experience net drying over the next ten days

o

Rain is still needed in all coffee, citrus and sugarcane production areas and it would be good for soybean and corn areas in center west and center south

- The

earliest that these areas will get rain is in about ten days and confidence is low - South

Africa crop areas will continue to receive periodic rainfall that will be greatest near the coast

o

The moisture will be good for early season crop use, although more rain is needed to induce the best wheat, canola and barley development

- Australia

rainfall will be erratic and mostly light during the next ten days

o

Queensland winter wheat and barley yields are likely to slip lower this year because of frost, freezes and dryness in unirrigated areas

o

The remainder of Australia’s winter crops are still poised to perform quite favorably

- Europe

will experience a good mix of rain and sunshine over the next two weeks

o

Temperatures will be warm biased

- Eastern

Europe will get rain today into the weekend and again later next week causing some disruption in fieldwork, but the rain will be good in improving topsoil moisture for winter crops in the southeast - North

Africa showers over the next ten days will be brief and light - West-central

Africa rain will continue to come and go favorably for coffee, sugarcane, rice, cocoa and other crops

o

Cotton production from the region has been better than last year in some areas especially Mali and Senegal

- East-central

Africa coffee, cocoa and other crop development has advanced well due to timely rainfall that will continue for a while - Today’s

Southern Oscillation Index was +9.74 and will rise over the next several days - Ontario

and Quebec weather will continue favorably mixed over the next two weeks for late season farming activity and harvesting of summer crops - New

Zealand will be wetter than usual in the next seven days in North Island and western parts of South Island while lighter rain falls in eastern parts of South Island

o

Next week will be wetter in western parts of South Island

Source:

World Weather Inc.

Thursday,

Sept. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Malaysia

Friday,

Sept. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

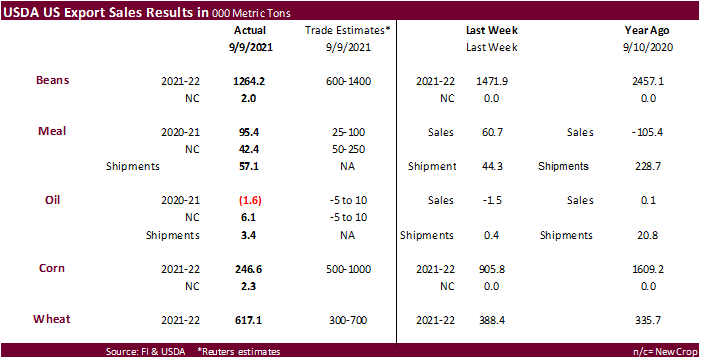

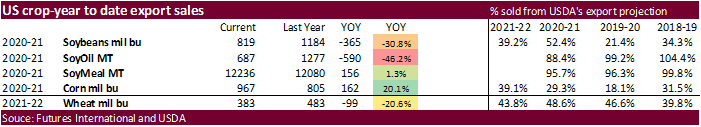

USDA

Export Sales

USDA

export sales for soybeans were 1.264 million tons, within expectations. They included China (945,200 MT, including decreases of 100 MT), and unknown destinations (163,000 MT). Soybean meal sales of 95,400 tons old crop and 42,400 tons new-crop were also

within expectations. Shipments were slow at 57,100 tons. Soybean oil sales were negative 1,600 tons old crop and new-crop were positive 6,100 tons.

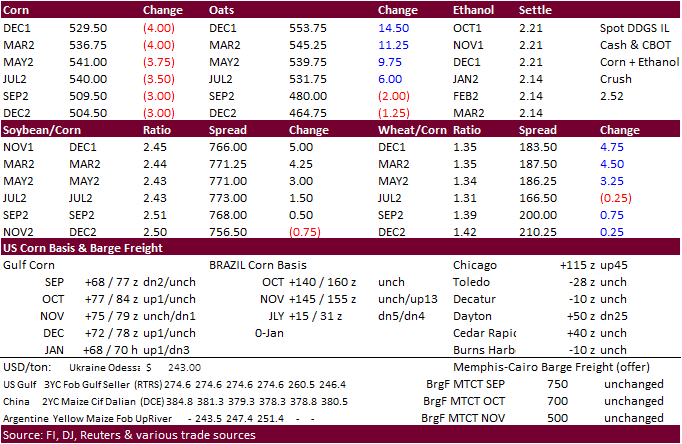

Corn

sales were a low 246,600 tons and well down from 905,800 tons week earlier.

All-wheat

export sales were a good 617,100 tons.

74

Counterparties Take $1147.494 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1081.342 Bln, 75 Bidders)

US

Retail Sales Advance (M/M) Aug: 0.7% (est -0.7%; prev -1.1%)

US

Retail Sales Ex-Auto (M/M) Aug: 1.8% (est 0.0%; prev -0.4%)

US

Retail Sales Ex-Auto, Gas Aug: 2.0% (est 0.0%; prev -0.7%)

US

Philadelphia Fed Business Outlook Sep: 30.7 (est 19.0; prev 19.4)

US

Initial Jobless Claims Sep 11: 332K (est 323K; prevR 312K; prev 310K)

US

Continuing Claims Sep 4: 2665K (est 2740K; prevR 2852K; prev 2783K)

Canadian

Wholesale Trade Sales (M/M) Jul: -2.1% (est -2.0%; prev -0.8%)

Canadian

International Securities Transactions Jul: 14.19B (prev 19.70B)

·

US corn ended 3.25-4.00 cents lower on poor USDA export sales of only 246,600 tons. December settled at $5.2950/bu. There was some technical selling after prices hit a 2-week high. It was higher early in the morning from an

increase in South Korean demand, US yield concerns and fund buying coupled with slowing harvest progress across the far southern US Delta. Concerns over small grain production are supportive for corn. Note CBOT oats prices are sitting at their highest level

since March 2014 and trading at a premium over corn. Oats ended 12.25 cents higher at $5.5150/bu.

·

The slow start of 2021-22 US corn shipments, slowdown in commitments, and projections for the China corn harvest to expand nicely from last year has traders wondering if USDA is too high on their US export projection.

·

WTI was 4 to 16 cents higher, WTI up 33 points and gold lost around $40.

·

Funds sold an estimated net 4,000 corn contracts.

·

Argentina producers started corn plantings. BA Grain Exchange said 2.3 percent of the crop had been planted. They look for a 55 million ton production for 2021-22.

·

The US generated 1.2 billion gallons of ethanol (D6) blending credits in August, versus 1.3 billion in July.

·

CHS Inc expects its Myrtle Grove, Louisiana, grain export terminal to be operational by the height of the US corn and soy harvest. The facility remains without power.

·

The weekly USDA Broiler Report showed eggs set in the US up 4 percent and chicks placed down 1 percent from a year ago. Cumulative placements from the week ending January 9, 2021 through September 11, 2021 for the United States

were 6.72 billion. Cumulative placements were up slightly from the same period a year earlier.

Export

developments.

-

South

Korea’s MFG bought 198,000 tons of corn in three consignments. One consignment was purchased at an estimated premium of 304 cents c&f over the Chicago December 2021 contract. Prices for the other two purchases were not provided. Shipment was between Oct.

10-29 and/or Oct. 20 and Nov. 10. -

South

Korea’s NOFI bought an estimated 201,000 tons of animal feed corn and 65,000 tons of feed wheat. -

68,000

tons of corn was bought at a premium of 304 cents over the December for arrival in South Korea around Dec. 10. -

68,000

tons was bought at 303 cents over December for arrival in South Korea around Dec. 20. -

65,000

tons was bought at 302.5 cents over the December for arrival in South Korea around Dec. 20.

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

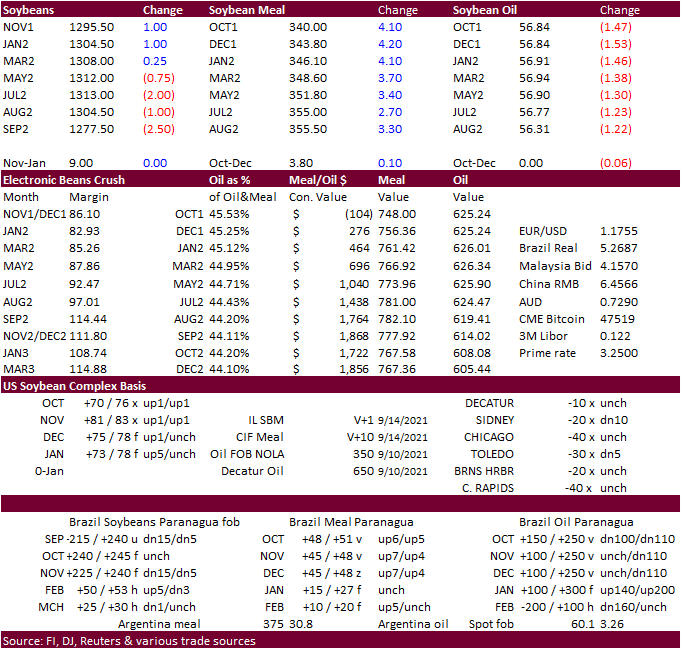

Soybeans

·

Soybeans ended higher through the May 2022 contracts and lower in the back 2022 contracts. Follow through buying and a 24-hour sales announcement followed by strength in soybean meal limited selling pressure in soybeans related

to the 128-153 point loss in soybean oil.

·

Funds bought an estimated net 2,000 soybeans, bought 3,000 soybean meal and sold 6,000 soybean oil.

·

We did not pick up any chatter of China buying Brazil soybeans on Thursday. They have bought at least ten cargoes of Brazil soybeans earlier this week and cancelled a handful of US cargoes. Oil World estimates Brazil will export

86.2 million tons of soybeans in 2021, up from 83 million in 2020. But for the September through December period, they projected 13.5 million tons for exports, a 61 percent increase from the same period a year ago. Recall last crop season the trade for a

while believed they oversold their 2020 crop.

·

Rumors circulated that the Biden Administration could release biofuel mandates as early as Thursday, but some industry analysts rejected this idea after reviewing the White House Office of Management and Budget (OMB) schedule

for this week. Some speculate the mandates, when released, will send a bearish undertone to biofuel feedstocks.

·

The US generated 421 million gallons of biodiesel (D4) blending credits in August, versus 359 million in July.

·

Despite the slowdown in US domestic demand over the past 3-4 months, we are long-term bullish soybean oil based on the growth in demand for biofuel feedstock.

·

AgriCensus noted Ukraine sunflower oil prices increased 4 percent since the start of the week, in part to lack of producer selling and harvesting delays.

·

ICE canola futures ended $4.30 lower basis the November at $875.50/ton, snapping a four day winning streak. It was up earlier this week after StatsCan pegged the Canadian canola crop at a 13-year low.

·

Brazil will see rain across southern Parana and Santa Catarina through Saturday, and southern RGDS Sunday-Monday.

·

China’s CNGOIC reported China soybean stocks at 6.43 million tons, down 390,000 tons from the same period a month ago and 1.1 million tons below the comparable period a year ago. Soybean crush increased from the previous week.

·

Malaysia was on Holiday today.

·

CBOT delivery process is done and there were no changes in registrations.

·

French oilseed growers group FOP looks for rapeseed sowings for 2022 to rise between 15% and 20%. The also estimated this year’s rapeseed crop at 3.35 million tons, up 2% from 2020.

·

EU rapeseed prices nearly reached 600 euros today. It hit a contract high of 599.75 euros. Canadian production estimate drove EU prices higher this week.

Export

Developments

- Algeria’s

ONAB bought 30,000 tons of soymeal. Shipment was sought from optional origins in two periods, between Nov. 10-30 and Dec. 1-15. - Under

the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to China for 2021-22 delivery.

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range, short term $12.70-$13.30.

Soybean

meal – December $310-$385

Soybean

oil – December 53-62 cent range

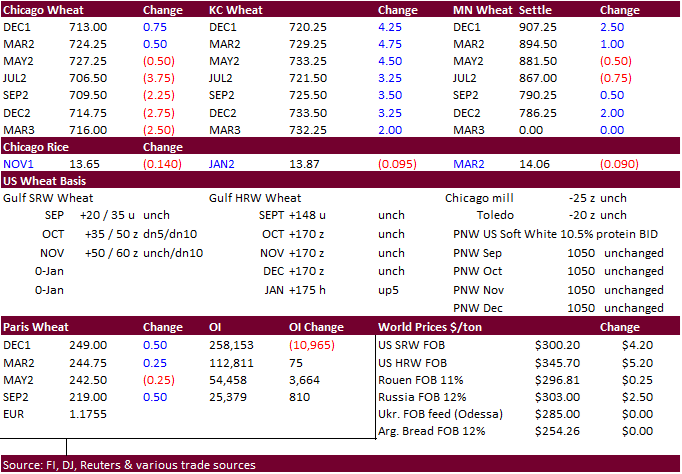

·

Chicago wheat ended higher in the nearby contracts and lower in the back months. December settled 0.75 cent higher at $7.13. KC was 3.25-5.0 cents higher and MN 0.25-2.0 cents higher. USDA export sales were good for wheat,

taking into consideration the already known sales to Nigeria.

·

KC wheat rallied by mid-morning despite light rain falling across the central NE today. Rains them move into the eastern areas of NE Friday.

·

Funds bought an estimated net 2,000 soft wheat contracts.

·

The USD was 32 points higher as of 2:10 pm CT.

·

IKAR estimated the Russian 2021 wheat crop at 74-75 million tons. In August, IKAR expected the crop at 77 million tons. USDA is at 72.50 million tons (85.35MMT year ago).

·

Strategie Grains said reduced its forecast for 2021 EU soft wheat production by 2.4 million tons to 129.1 million tons, 10.3 million tons above last year.

·

December Paris wheat was up 0.50 at 248.75 euros.

Export

Developments.

·

Results awaited: Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat. Lowest price offer assessed at $421.19 a ton CIF liner out.

·

South Korea’s NOFI bought an estimated 201,000 tons of animal feed corn and 65,000 tons of feed wheat. The Black Sea feed wheat was for shipment between Sept. 20 and Oct. 15 and bought at $339.00 a ton.

-

Taiwan

seeks 49,580 tons of US wheat on September 23 between November 6 and November 20.

-

Jordan

seeks 120,000 tons of wheat on September 22 for LH December through FH February shipment.

-

Russia

shipped 30,000 tons of Black Sea wheat to Algeria last week.

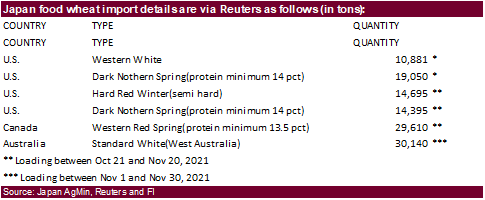

·

Japan bought 118,771 tons of food wheat this week.

·

Pakistan issued a new import tender for 500,000 tons of wheat set to closed on September 20.

·

Turkey seeks 260,000 tons of feed barley on September 21 for October 8-October 31 shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Morocco seeks 363,000 tons of US wheat on September 21 for arrival by the end of the year.

Rice/Other

-

A

Reuters article noted India could account for as much as 45% of global rice exports in 2021 but exported as much as 22 million tons of rice this year.

-

South

Korea’s Agro-Fisheries & Food Trade Corp. bought an estimated 42,222 tons of rice from the United States and Thailand. It included 20,000 tons of U.S.-origin medium grain brown rice at an estimated $1,238.42 a ton c&f. 22,222 tons of long grain brown rice

from Thailand was bought at an estimated $485.00 and $487.00 a ton c&f in two equal consignments. The rice was sought for arrival in South Korea between Feb. 28 and April 30, 2022. (Reuters)

·

Bangladesh seeks 50,000 tons of rice on September 23.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

U.S. EXPORT SALES FOR WEEK ENDING 09/09/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

449.6 |

1,742.6 |

1,705.7 |

214.4 |

2,332.7 |

3,210.4 |

0.0 |

0.0 |

|

SRW |

24.3 |

762.7 |

478.3 |

21.9 |

907.8 |

639.7 |

0.0 |

0.0 |

|

HRS |

76.4 |

994.3 |

1,794.9 |

131.4 |

1,807.2 |

2,052.9 |

0.0 |

0.0 |

|

WHITE |

46.8 |

569.2 |

1,244.2 |

146.4 |

1,241.6 |

1,491.9 |

0.0 |

0.0 |

|

DURUM |

20.0 |

27.4 |

236.8 |

0.0 |

43.2 |

277.9 |

0.0 |

0.0 |

|

TOTAL |

617.1 |

4,096.3 |

5,459.9 |

514.1 |

6,332.5 |

7,672.8 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

20.5 |

30.8 |

0.8 |

4.7 |

8.4 |

0.0 |

0.0 |

|

CORN |

246.6 |

24,212.8 |

19,308.4 |

192.0 |

359.9 |

1,147.7 |

2.3 |

333.2 |

|

SORGHUM |

204.6 |

2,147.7 |

2,464.2 |

1.8 |

1.8 |

105.4 |

0.0 |

0.0 |

|

SOYBEANS |

1,264.2 |

22,031.2 |

30,084.0 |

244.4 |

258.3 |

2,143.3 |

2.0 |

2.0 |

|

SOY MEAL |

95.4 |

1,290.4 |

752.1 |

57.1 |

10,945.6 |

11,328.0 |

42.4 |

2,148.8 |

|

SOY OIL |

-1.7 |

13.3 |

101.1 |

3.4 |

674.1 |

1,175.9 |

6.1 |

7.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

9.5 |

179.1 |

230.6 |

72.3 |

169.8 |

51.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.1 |

27.4 |

0.1 |

1.1 |

1.5 |

0.0 |

0.0 |

|

L G BRN |

2.3 |

3.2 |

8.1 |

0.2 |

12.3 |

4.1 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

22.3 |

19.1 |

0.1 |

13.7 |

13.9 |

0.0 |

0.0 |

|

L G MLD |

17.0 |

176.3 |

73.2 |

7.8 |

84.8 |

38.1 |

0.0 |

0.0 |

|

M S MLD |

2.6 |

42.0 |

49.4 |

2.6 |

47.5 |

56.0 |

0.0 |

0.0 |

|

TOTAL |

31.5 |

431.0 |

407.8 |

83.1 |

329.1 |

165.5 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

284.8 |

5,132.2 |

5,959.6 |

237.5 |

1,174.8 |

1,669.9 |

0.0 |

686.8 |

|

PIMA |

9.6 |

135.6 |

207.0 |

3.1 |

39.1 |

63.6 |

0.0 |

0.0 |

This summary is based on reports from exporters for the period September 3-9, 2021.

Wheat: Net

sales of 617,100 metric tons (MT) for 2021/2022–a marketing-year high–were up 59 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for Nigeria (328,900 MT, including decreases of 200 MT), Mexico (78,300

MT, including decreases of 3,700 MT), South Korea (69,100 MT), Taiwan (54,600 MT), and Guatemala (34,900 MT switched from unknown destinations), were offset by reductions for unknown destinations (31,300 MT). Exports of 514,100 MT were up 32 percent from

the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to Mexico (172,800 MT), the Philippines (111,100 MT), China (71,000 MT), Taiwan (52,800 MT), and Nigeria (47,600 MT).

Corn: Net sales for 2021/2022 of 246,600 MT primarily for Mexico (154,300 MT, including

decreases of 65,400 MT), unknown destinations (75,200 MT), Canada (15,100 MT), Jamaica (5,000 MT), and Honduras (3,500 MT, including decreases of 3,700 MT), were offset by reductions for Colombia (12,000 MT). Total net sales for 2022/2023 of 2,300 MT were

for Canada. Exports of 192,000 MT were to Mexico (177,500 MT), El Salvador (7,200 MT), Canada (6,100 MT), Taiwan (1,000 MT), and South Korea (200 MT).

Optional Origin Sales: For 2021/2022, new optional origin sales of 60,000 MT were

reported for unknown destinations. The current outstanding balance of 170,000 MT is for unknown destinations.

Barley: No net sales were reported for the week. Exports of 800 MT were unchanged

from the previous week, but up 88 percent from the prior 4-week average. The destination was to Japan.

Sorghum: Net sales for 2021/2022 of 204,600 MT were reported for China (115,500 MT),

unknown destinations (53,000 MT), and Mexico (36,100 MT). Exports of 1,800 MT were to Mexico.

Rice: Net sales of 31,500 MT for 2021/2022 were down 7 percent from the previous week

and 39 percent from the prior 4-week average. Increases primarily for Haiti (15,200 MT), Mexico (8,900 MT, including decreases of 8,800 MT), Canada (5,100 MT), El Salvador (4,100 MT switched from Guatemala), and Venezuela (2,500 MT), were offset by reductions

for Guatemala (5,700 MT). Exports of 83,100 MT were up noticeably from the previous week and up 38 percent from the prior 4-week average. The destinations were primarily to Mexico (31,700 MT), Venezuela (27,500 MT), Guatemala (9,900 MT), the Dominican Republic

(4,400 MT), and El Salvador (4,100 MT).

Export for Own Account: For 2021/2022, new exports for own account totaling 100 MT

were for Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans: Net sales for 2021/2022 of 1,264,200 MT were primarily for China (945,200

MT, including decreases of 100 MT), unknown destinations (163,000 MT), Egypt (80,000 MT), Taiwan (20,500 MT, including decreases of 1,000 MT), and Indonesia (16,000 MT, including decreases of 200 MT). Total net sales for 2022/2023 of 2,000 MT were for Indonesia. Exports

of 244,400 MT were primarily to China (139,800 MT), Mexico (68,700 MT), Indonesia (10,800 MT), Malaysia (5,300 MT), and Taiwan (5,000 MT).

Export for Own Account: For 2021/2022, the current exports for own account outstanding

balance is 5,800 MT, all Canada.

Soybean Cake and Meal: Net sales of 95,400 MT for 2020/2021 were up 57 percent from

the previous week and 80 percent from the prior 4-week average. Increases primarily for Mexico (54,700 MT, including decreases of 1,800 MT), Canada (26,000 MT), Taiwan (4,600 MT), the Philippines (3,500 MT), and Sri Lanka (3,100 MT, including decreases of

200 MT), were offset by reductions primarily for Costa Rica (6,800 MT). For 2021/2022, net sales of 42,400 MT were primarily for the Philippines (20,000 MT), Canada (13,500 MT), Mexico (3,300 MT), Costa Rica (2,300 MT), and unknown

destinations (2,000 MT). Exports of 57,100 MT were up 29 percent from the previous week, but down 67 percent from the prior 4-week average. The destinations were primarily to Mexico (23,300 MT), Canada (16,500 MT), El Salvador (6,000 MT), Cambodia (2,500

MT), and Japan (2,200 MT).

Late Reporting: For

2020/2021, exports totaling 6,000 MT of soybean cake and meal were reported late for El Salvador.

Soybean Oil: Net sales reductions for 2020/2021 of 1,700 MT resulting in increases

for Mexico (100 MT), were more than offset by reductions for Canada (1,800 MT). Net sales for 2021/2022 of 6,100 MT were for Canada (6,000 MT) and Mexico (100 MT). Exports of 3,400 MT were up noticeably from the previous week and from the prior 4-week average. The

destinations were to Venezuela (3,000 MT), Canada (300 MT), and Mexico (100 MT).

Cotton: Net sales of 284,800 RB for 2021/2022 were down 37 percent from the previous

week, but up 9 percent from the prior 4-week average. Increases were primarily for China (183,900 RB), Pakistan (33,800 RB), Turkey (17,600 RB), Peru (12,300 RB), and Vietnam (10,100 RB, including 1,300 RB switched from Japan). Exports of 237,500 RB were

up 53 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to China (86,600 RB), Pakistan (39,200 RB), Vietnam (35,600 RB), Bangladesh (25,000 RB), and Turkey (13,700 RB). Net sales of Pima totaling

9,600 RB were down 21 percent from the previous week and 26 percent from the prior 4-week average. Increases were primarily for India (2,600 RB), Peru (2,400 RB), Indonesia (2,000 RB), China (1,300 RB), and Japan (600 RB). Exports of 3,100 RB were down 74

percent and 57 percent from the prior 4-week average. The destinations were primarily to India (2,500 RB) and China (400 RB).

Optional Origin Sales: For 2021/2022, the current outstanding balance of 8,800 RB

is for Pakistan.

Exports for Own Account: For 2021/2022, the current exports for own account outstanding

balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides and Skins: Net

sales of 277,400 pieces for 2021 were down 31 percent from the previous week and 3 percent from the prior 4-week average. Increases primarily for China (177,700 whole cattle hides, including decreases of 12,600 pieces), South Korea (43,300 whole cattle hides,

including decreases of 1,900 pieces), Thailand (25,500 whole cattle hides, including decreases of 300 pieces), Indonesia (13,700 whole cattle hides, including decreases of 100 pieces), and Brazil (8,800 whole cattle hides, including decreases of 100 pieces),

were offset by reductions primarily for Japan (200 pieces). Exports of 422,300 pieces were up 21 percent from the previous week and 1 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (241,500 pieces), South Korea

(90,100 pieces), Mexico (27,600 pieces), Thailand (23,600 pieces), and Brazil (21,100 pieces).

Net sales of 199,300 wet blues for 2021 were up noticeably from the previous week and up 80 percent from

the prior 4-week average. Increases primarily for Italy (91,400 unsplit and 44,400 grain splits, including decreases of 300 unsplit), China (28,700 unsplit), Vietnam (27,500 unsplit), Mexico (4,300 grain splits, including decreases of 1,700 unsplit), and

Brazil (4,100 unsplit). Exports of 219,500 wet blues were up noticeably from the previous week and up 60 percent from the prior 4-week average. The destinations were primarily to Italy (69,000 unsplit and 14,600 grain splits), China (54,500 unsplit), Vietnam

(54,000 unsplit), Thailand (7,800 unsplit), and Taiwan (7,400 unsplit). Total net sales of 83,400 splits, including decreases of 3,600 splits, were for China. Exports of 160,000 pounds were to Vietnam.

Beef: Net

sales of 15,300 MT reported for 2021 were up 23 percent from the previous week and 24 percent from the prior 4-week average. Increases primarily for Japan (6,000 MT, including decreases of 500 MT), South Korea (5,000 MT, including decreases 300 MT), China

(1,400 MT, including decreases of 100 MT), Mexico (700 MT, including decreases of 200 MT), and Canada (500 MT, including decreases of 100 MT), were offset by reductions for Panama (100 MT). Net sales for 2022 of 3,900 MT were for South Korea (3,700 MT) and

Japan (200 MT). Exports of 16,900 MT were down 10 percent from the previous week and from the prior 4-week average. The destinations were primarily to Japan (6,500 MT), South Korea (4,000 MT), China (2,300 MT), Taiwan (1,000 MT), and Hong Kong (700 MT).

Pork: Net sales of 25,300 MT reported for 2021

were down 25 percent from the previous week and 9 percent from the prior 4-week average. Increases were primarily for Mexico (5,800 MT, including decreases of 500 MT), the Dominican Republic (3,500 MT, including decreases of 100 MT), Japan (3,100 MT, including

decreases of 100 MT), Canada (2,700 MT, including decreases of 400 MT), and China (1,800 MT, including decreases of 100 MT). Exports of 25,800 MT were down 11 percent from the previous week and from the prior 4-week average. The destinations were primarily

to Mexico (8,400 MT), China (3,700 MT), Japan (2,600 MT), the Dominican Republic (2,300 MT), and Chile (2,000 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.