PDF Attached

WASHINGTON,

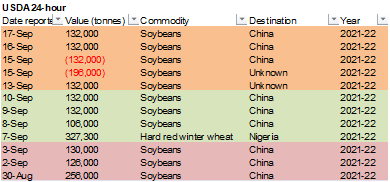

September 17, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

Risk

off session as good US weather promoting harvesting and winter grain plantings coupled with profit taking sent US agriculture futures lower. The USD was up 31 points and WTI fell 65 cents.

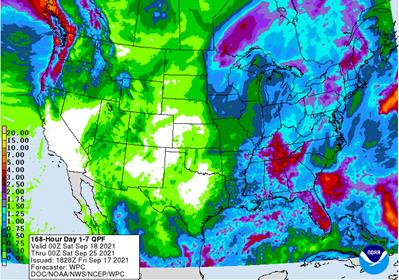

7-day

WORLD

WEATHER HIGHLIGHTS FOR SEPTEMBER 17, 2021

- Less

rain is advertised in the northern Plains and upper U.S. Midwest today relative to Thursday’s model forecast.

- This

change was needed and should verify. - It

will still rain, but not as much as advertised earlier this week. - The

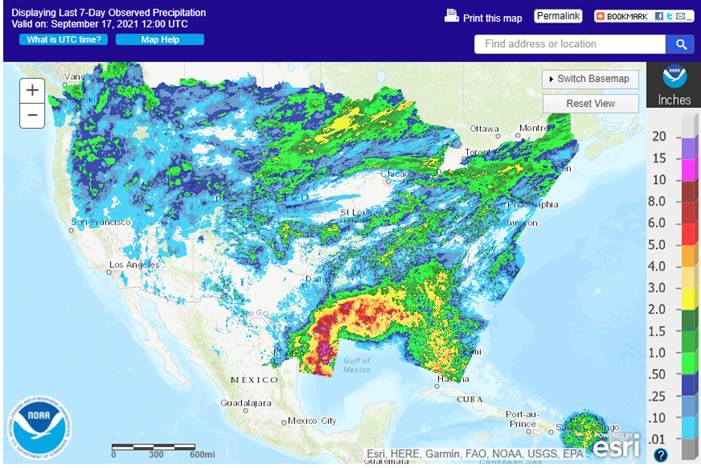

U.S. central and eastern Gulf of Mexico Coast States will remain wet for another week with frequent showers keeping harvest progress and crop maturation slow.

- A

tropical cyclone will evolve off the North Carolina coast this weekend, but it will turn to the northeast and should not directly impact the U.S. or southeastern Canada.

- Argentina

weather will remain quiet for a while with only a few showers impacting parts of the nation.

- Brazil’s

week two outlook continues to promote some pre-monsoonal showers and thunderstorms in center west and center south crop areas and that will be welcome for early season soybean and corn planting if it verifies.

- Sugarcane,

coffee and citrus crops would also benefit if the moisture evolves in late September as advertised.

- China’s

Yellow River Basin will get another round of excessive rain through the first part of next week inducing some flooding, but ensuring good wheat planting conditions.

- Russia’s

key winter wheat production region is still expecting significant rain over the next several days and that will improve their emergence and establishment outlook. - Australia

rainfall will be light and periodic in southern crop areas leaving the north in a drier bias - India’s

monsoon is unlikely to withdraw from the north for at least another week, but shortly thereafter the withdrawal should begin - Europe

weather will remain favorably mixed across much of the continent for a while - Tropical

Storm Chanthu will impact Japan this weekend, but should not be a serious threat to agriculture or personal property - A

tropical disturbance in the central tropical Atlantic Ocean will continue to evolve over the weekend and may eventually reach tropical storm intensity as it moves to the northeast of the Lesser Antilles

Monday,

Sept. 20:

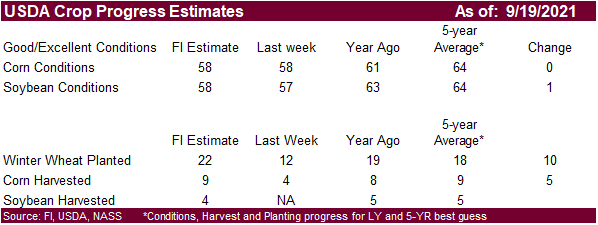

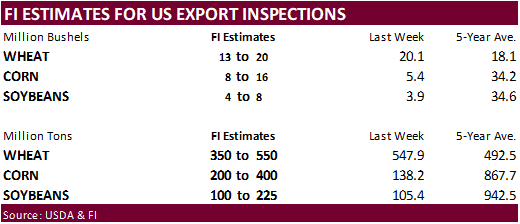

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm - China’s

third batch of country-wise August trade data, including soy, corn and pork imports - Monthly

MARS bulletin on crop conditions in Europe - USDA

total milk production, 3pm - Ivory

Coast cocoa arrivals - Malaysia

Sept. 1-20 palm oil exports - HOLIDAY:

China, Japan, Korea

Tuesday,

Sept. 21:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

China, Korea

Wednesday,

Sept. 22:

- EIA

weekly U.S. ethanol inventories, production - U.S.

cold storage data – pork, beef, poultry, 3pm - HOLIDAY:

Hong Kong, Korea

Thursday,

Sept. 23:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Globoil

India – international vegetable oil conference, day 1 - The

UN Food Systems Summit - USDA

red meat production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Japan

Friday,

Sept. 24:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Globoil

India – international vegetable oil conference, day 2 - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed, hogs and pigs inventory, poultry slaughter, 3pm

Saturday,

Sept. 25:

- Globoil

India – international vegetable oil conference, day 3

Source:

Bloomberg and FI

IHS

Markit 2021 US acreage estimates

Corn

plantings 420,000 acres from USDA’s September Crop Production report to 93.7 million

Soybean

plantings 150,000 acres to 87.4 million.

IHS

Markit is projecting 2022 US corn acreage at 94.3 million acres and US soybean plantings at 86.6 million acres.

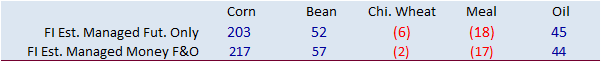

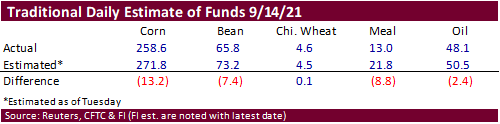

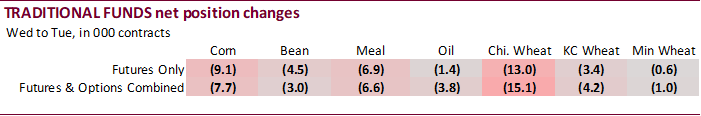

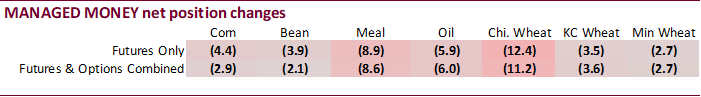

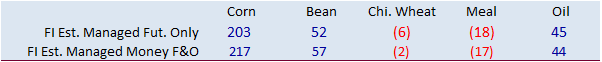

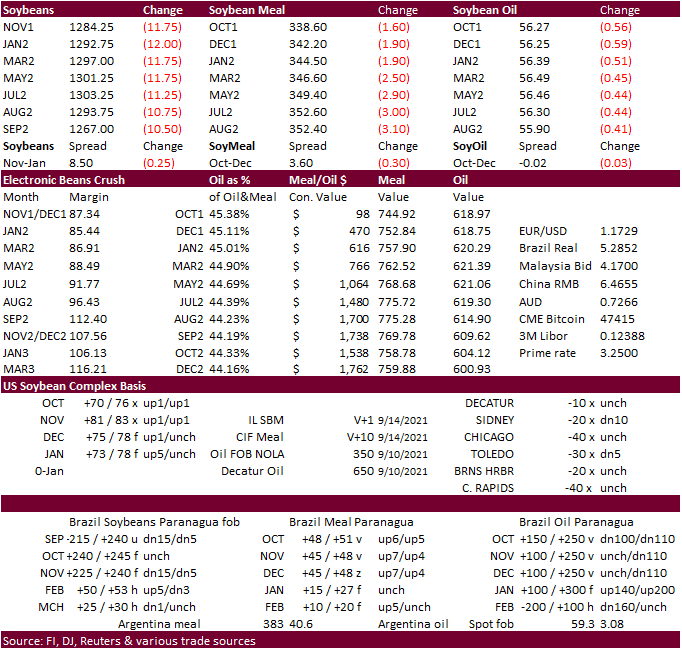

Fund

long positions were less than expected for corn, soybeans and soybean meal. Near expectations for soybean oil and wheat.

US

Univ. Of Michigan Sentiment Sep P: 71.0 (est 72.0; prev 70.3)

–

Current Conditions: 77.1 (prev 78.5)

–

Expectations: 67.1 (prev 65.1)

–

1-Year Inflation: 4.7% (est 4.7%; prev 4.6%)

–

5-10 Year Inflation: 2.9% (prev 2.9%)

·

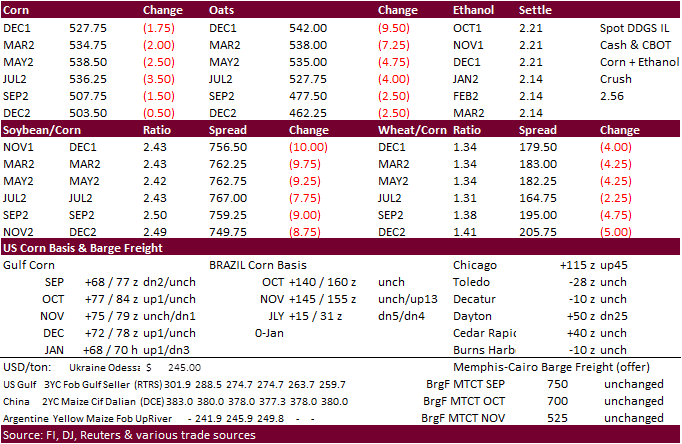

Corn ended lower on lack of bullish news and chatter of higher corn yields versus last season We picked up several local field report and most were positive, especially for some non-irrigated fields across the heart of the Corn

Belt. Harvesting weather looks good for the US over the weekend bias central and lower Midwest. Disruptions are expected for the lower Delta and Southeast amid the tropical storm.

·

Funds sold an estimated net 3,000 corn contracts.

·

There was not much in the way of news.

·

Planting progress is expected to run near normal for South America next week. Argentina producers started corn plantings.

·

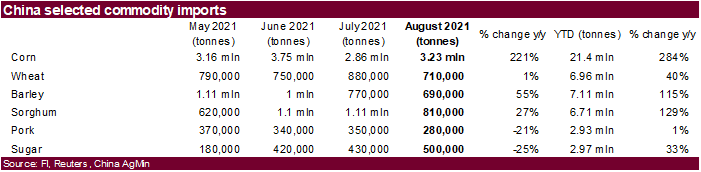

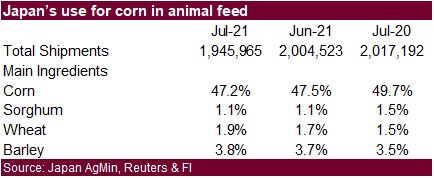

China August corn imports were 3.23 million tons, more than 220% above year ago and year to date imports are 21.4 million tons, more than double year ago.

USDA

Attaché

China

Biofuels Annual https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Biofuels%20Annual_Beijing_China%20-%20People%27s%20Republic%20of_08-16-2021.pdf

Argentina

Livestock update

Export

developments.

-

South

Korea’s FLC bought 66,000 tons of animal feed corn, optional origin, at an estimated $328.99 a ton c&f with 12,700 tons of the total also bought at a premium of 298.5 U.S. cents over the December contract. Shipment was between Oct. 21 and Nov. 20 from South

America, the U.S. Gulf or Black Sea region.

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

Soybeans

·

The US soybean complex traded lower on Friday in a risk off session ahead of the weekend after gains were posted earlier this week. Another 132k of 24-hour soybean sales were announced to China. This didn’t get traders excited

as China washed out several cargoes earlier in the week. Look for September and October US soybean shipments to be down sharply from last year.

·

Funds sold an estimated net 6,000 soybeans, sold 2,000 soybean meal and sold 1000 soybean oil.

·

We don’t expect a US RVO biofuel announcement over the next few business.

·

Malaysia was back from holiday and November futures traded 70 lower. The December contract settled 74 ringgit lower, or 1.7%, at 4,255 ringgit, lowest since September 2.

·

Cargo surveyor SGS reported month to date September 15 Malaysian palm exports at 839,533 tons, 261,561 tons above the same period a month ago or up 45.3%, and 93,968 tons above the same period a year ago or up 12.6%.

·

European November rapeseed traded above 600 euros per ton and are near a contract high.

Export

Developments

- Under

the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to China for 2021-22 delivery.

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range, short term $12.70-$13.30.

Soybean

meal – December $310-$385

Soybean

oil – December 53-62 cent range

·

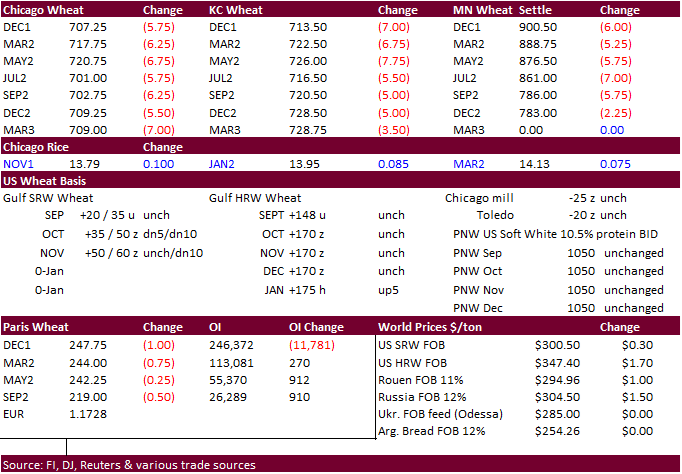

Another quiet trade and with the USD climbing 31 points and weakness in soybeans, US wheat futures fell. Lack of direction should be noted. Some additional wheat business was announced but volumes lowed from what was reported

early in the week. Concerns over the Russian wheat crop size continues to underpin the markets.

·

Funds sold an estimated net 3,000 soft wheat contracts.

·

The central US Great Plains will need additional rain ahead of the bulk of winter wheat plantings.

·

Ukraine has exported 11.75 million tons of grain so far this season (started July 1), up from 10.48 million tons year ago. This included 6.9 million tons of wheat, 3.2 million tons of barley and 1.5 million tons of corn.

·

December Paris wheat was down 1.00 at 247.75 euros.

·

For those interested in PNW wheat export logistics, US Wheat Associates published an interesting video on the process

https://vimeo.com/578602836

Export

Developments.

·

Results awaited: Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat. Lowest price offer assessed at $421.19 a ton CIF liner out.

·

Pakistan issued a new import tender for 500,000 tons of wheat set to closed on September 20.

·

Turkey seeks 260,000 tons of feed barley on September 21 for October 8-October 31 shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Morocco seeks 363,000 tons of US wheat on September 21 for arrival by the end of the year.

-

Jordan

seeks 120,000 tons of wheat on September 22 for LH December through FH February shipment.

-

Taiwan

seeks 49,580 tons of US wheat on September 23 between November 6 and November 20.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 23.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.