PDF Attached

End

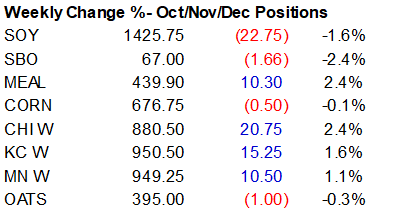

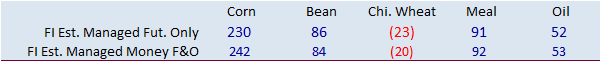

of week risk off with widespread commodity selling sent ags lower. Fundamental news was light. The USD was up 167 points by the end of Friday and WTI off $4.06/barrel. Equities were sharply lower. Many developing country central banks raised key interest rates

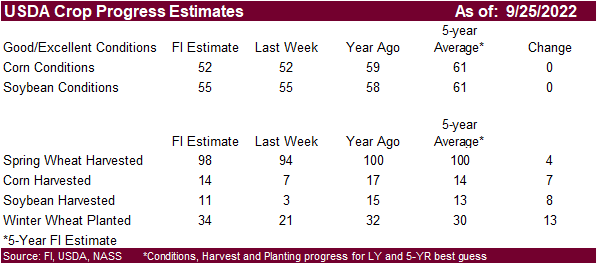

this week, an indication global recession might be on hand. US harvesting progress increased last week and should ramp up next week.

US

weather forecast was unchanged. Rains favor the northwest Midwestern growing areas today and north central/eastern areas Saturday this weekend. Overall net drying will be good for the Delta and Midwest over the next week. Temperatures will be warmer next week

than that of the cold air blast seen during the second half of this week for the upper US. The central and northern areas of the US Great Plains will see rain this weekend. Brazil will see rain over the next week while Argentina’s forecast is unchanged, calling

for light rain across La Pampa and southern BA Sunday into early next week.