PDF Attached

WASHINGTON,

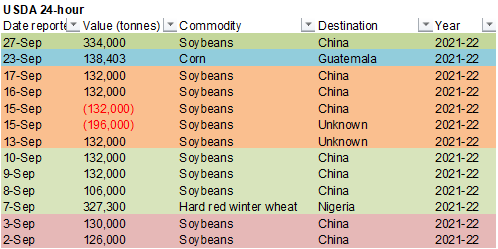

September 27, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 334,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

There

were no surprises in the USDA crop progress report. We left our corn and soybean yields unchanged. Corn and oats rallied the most today for the ag space. Soybeans, meal and SBO were also higher. US wheat markets were mixed (bear spreading in Chicago, bull

spreading in KC, and MN overall higher).

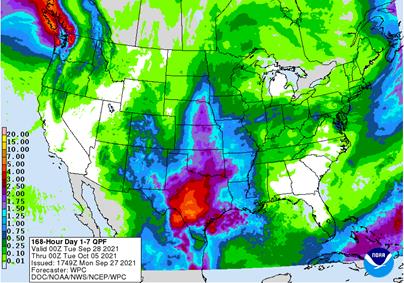

7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Brazil

experienced scattered showers during the weekend from Mato Grosso do Sul to southern Minas Gerais and Goias

o

Rainfall through early afternoon Sunday varied from 0.05 to 0.30 inch most often, but local totals to 0.71 inch occurred in Mato Grosso do Sul, and 0.79 to 1.77 inches occurred in southern Minas Gerais and southwest of Brasilia

o

Some coffee areas in Sul de Minas received up to 0.79 inch of rain late Friday into Saturday which was a little greater than expected

o

Sugar areas of Sao Paulo received a minimal amount of rain

o

Mato Grosso rainfall was limited to a few pockets

o

Satellite imagery Sunday suggested additional isolated to scattered showers were occurring at the time of this writing

o

Temperatures were very warm in central and northern crop areas of Brazil and seasonable in the far south

- Extreme

highs in the 90s to 102 occurred in center west and parts of center south Brazil

- Brazil

rainfall will be limited today through Thursday with much of center west and center south crop areas drying down until the coming weekend when showers will ramp up once again.

o

In the meantime, rain will impact far southern Brazil Tuesday into Wednesday and again Thursday into Saturday

- Daily

rainfall in the south will vary from 0.25 to 0.75 inch with a few amounts to 1.50 inches

o

Precipitation in the south will shift to the interior southern and some center south crop areas this weekend and next week at which time precipitation will expand northwestward into Mato Grosso

- The

daily precipitation will be highly varied ranging from 0.05 to 0.60 inch in center west crop areas while center south and interior southern areas get 0.20 to 0.75 inch and a few amounts over 1.00 inch each day - Temperatures

in Brazil will heat up again later this week and into the weekend ahead of the next wave of precipitation

o

Highs will reach back into the 90s and upwards to 110 in southern Mato Grosso, Goias, northern Mato Grosso do Sul and in the 80s and 90s in many other areas

o

Southern Brazil will not be as warm to hot with many 70- and 80-degree highs during the wetter days

- The

bottom line for Brazil will be good for early planting of corn and soybeans in areas that get some rain; however, the return of hot and dry, conditions for a while this week will slow field progress and germination, but rain this coming weekend into next week

might help to induce some improvements once again. Wheat harvesting in Parana will advance early this week, but rain later this week will disrupt that process. Winter crops in Rio Grande do Sul will remain in good shape as will the early corn planting, emergence

and establishment - Argentina

was dry and mild to warm during the weekend

o

Highest temperatures Friday and Saturday were in the 60s and 70s Fahrenheit in the southeast and in the 80s and lower 90s northwest

- Argentina’s

weather is not likely to bring much rain to the northwest or west-central parts of the nation during the next ten days which are still too dry for spring planting or winter crop development

o

Rain is expected to fall from southern Cordoba to southern Entre Rios and southern Uruguay southward to Buenos Aires

- Amounts

will vary from 0.50 to 2.00 inches - The

region does include some important winter crop areas and a few corn and sunseed production areas and all will benefit from the moisture - Hot

temperatures occurred Sunday in the central United States with most of the Great Plains reporting afternoon temperatures in the upper 80s and 90s Fahrenheit

o

Very low humidity was also present in much of the region, especially in hard red winter wheat areas where temperatures were in the upper 90s and humidity was 8-26% while wind speeds were gusting 30-40 mph

o

Outside of the wind the environment was great for drying down summer crops and supporting their harvest, but winter crops need moisture for germination and emergence

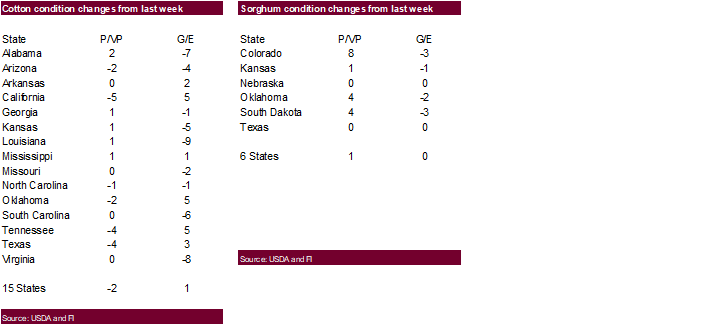

- U.S.

hard red winter wheat areas will have a chance for rain Tuesday and Wednesday and again Thursday into Saturday

o

Most of the first rain will be greatest in central Nebraska and north-central Kansas and the second wave of moisture will favor central and eastern Oklahoma, northern Texas and a few areas in eastern Kansas

o

The driest areas over the next ten days will be in eastern Colorado, western Kansas, the Texas Panhandle and southwestern Nebraska

o

There will be plenty of time of improved rainfall later in October, but the situation should be closely monitored because of anticipated dryness that might threaten winter crop establishment

- Montana,

Canada’s Prairies, the central and western Dakotas and areas southward into the Texas Panhandle will be dry or mostly dry for the next ten days

o

Temperatures will be well above average over the next two weeks

- U.S.

Midwest weather will be favorably mixed with periods rain and sunshine

o

Wednesday through Sunday will be wettest with rain moving from west to east across the region and rain amounts of 0.50 to 2.50 inches resulting

o

Soil moisture will remain favorably rated

o

Fieldwork will be disrupted periodically, but not often enough to present much of a problem

- Drier

weather will be important after several days of rainfall this week

o

Eastern Midwest will be driest during the coming week

o

Temperatures will be warm enough for quick drying when rain is not falling

- West

Texas rainfall will be limited to showers today and again late this week

o

The moisture should be brief and light enough to minimize its impact on cotton fiber and generalize grain, oilseed and cotton maturation progress

o

Temperatures will trend cooler late this week and into the weekend slowing the drying rates and crop maturation, but warming should return quickly next week

- U.S.

Delta and southeastern states precipitation will be erratic and light enough during the next ten days to allow fieldwork to advance around the shower activity

o

No serious crop quality issues are expected

- U.S.

far western states rainfall over the next two weeks will be limited outside of the Cascade Mountains and northern Rocky Mountain region keeping may crop areas dry

- Greater

than usual moisture in the U.S. southern Rocky Mountain region and southwestern desert region is expected this week due to sporadic showers and thunderstorms - U.S.

weekend weather was not very wet, but showers occurred across the northern and eastern Midwest with most amounts less than 0.50 inch.

o

Most other areas were dry and temperatures turned hotter in the Plains and western Midwest with many highs in the 70s and 80s with some 90s in the central U.S.

- Recent

rain in Russia and Ukraine winter crop areas has helped to lift soil moisture for improved winter wheat, barley and rye establishment. However, many areas in the lower half of the Volga River Basin still need a substantial amount of moisture to improve the

long term crop development potential

o

Recent temperatures have been cool limiting crop development

- Highest

temperatures Friday and Saturday were in the 40s and 50s in most winter crop areas and lowest morning temperatures were in the 40s

o

Soil temperatures are cooling, but still supportive of crop development

- Temperatures

will remain mild to cool this week, but should trend warmer than usual next week - Additional

precipitation in Russia and Ukraine will be limited over the coming week to ten days which will be great for farming activity, but more moisture will be needed in eastern winter crop areas to restore soil moisture to normal prior to dormancy - Europe

weather during the weekend was great for advancing fieldwork; including the planting of winter crops and the harvest of summer crops

o

France reported most of the rain Friday and Saturday and precipitation was expected to shift into central Europe early this week

- Temperatures

have been and will continue to be seasonably warm

o

Soil moisture is still a little low in much of southern Europe and in a few areas in France and the United Kingdom

- The

lower Danube River Basin, Greece, southern Italy and Spain are driest - Europe

precipitation will be limited for a while this week except for the rain in central parts of continent; next week’s precipitation should increase across the northern and central parts of the continent

o

Temperatures will be seasonable to slightly warmer than usual

- China

will be warmer than usual over the coming week and waves of rain will continue in the Yellow River Basin, North China Plain and northeastern provinces while east-central parts of the nation dry down

o

China’s wet bias in the north is not likely to be persistent enough to halt all farming activity

- There

will be periods of drying that will allow some harvesting of summer crop and planting of winter grain to advance, although some fields will be rather wet for a while

o

Drying in east-central China will be great for summer crop maturation and may eventually be good for wheat and rapeseed planting, although it is a little early for that process to begin

- China

weekend rainfall was greatest in the Yellow River Basin

o

Amounts on Friday varied from 0.40 to 2.50 inches from Gansu to Shandong and southern Hebei

- Satellite

imagery suggested additional rain fell Saturday in the same region or just slightly to the south and Sunday’s rainfall was occurring mostly over east-central parts of the nation, but at very light intensity - China’s

bottom line should have been good for harvest progress in east-central and southern China during the weekend where rainfall was most limited. The northeastern provinces also experienced relatively dry weather, although some showers were evolving Sunday and

will continue early this week. The moisture may be keeping summer crop maturation and harvest progress a little slow and could delay a little wheat planting progress, but enough drying this week will allow some farming activity to advance between rain events.

Drying is needed to promote faster field progress. - Heavy

rain from the remnants of tropical cyclone Dianmu moved through Thailand during the weekend with local totals of 4.00 to more than 8.00 inches occurring in several areas

o

For the first time this monsoon season surplus rain has moved through sugarcane and rice areas of Thailand to induce a serious bolstering of runoff that might help improve water supply for the winter dry season crops

o

Rain in Laos and Vietnam diminished during the weekend after Dianmu moved over the mountains into Thailand

- Mainland

areas of Southeast Asia will experience quieter weather over the next ten days with daily showers and thunderstorms distributed erratically and lightly

o

The environment will be good for crops

o

Surplus moisture will runoff and the ground may begin to firm up in a few areas, although showers will continue periodically preventing any area from becoming too dry

- Remnants

of Tropical Cyclone Dianmu entered the Bay of Bengal and redeveloped during the weekend becoming Tropical Cyclone Gulab and then moved into Andhra Pradesh and dissipated

o

Heavy rain fell from Andhra Pradesh into Telangana with lighter rain in southern Chhattisgarh and extreme eastern Maharashtra Coastal areas reported 4.00 to more than 10.00 inches

o

The storm’s remnant low pressure center was expected to be over northern Telangana by 1800 GMT today

o

Remnants of the storm will produce 3.00 to 7.00 inches of rain from Telangana to Maharashtra today and Tuesday

- India’s

monsoon will withdraw from the north this week, but some forecast models are bringing rain back to the north for a little while early next week

o

This event next week may be overdone and could be removed from the forecast later this week

o

A more significant withdrawal in the monsoon pattern is expected during the second half of next week into the following weekend

- India’s

bottom line is still very good for winter crop planting due to the extra weeks of rainfall. Summer crops may not have performed as well as usual this year because of some areas being too wet while others were a little dry, but the impact on production should

be low. Improving weather over the next two weeks will be good for crops and future farming activity - Category

Four Hurricane Sam was located 800 miles east southeast of the northern Leeward Islands at 0500 EDT today near 15.2 north, 51.1 west moving northwesterly at 8 mph and producing maximum sustained wind speeds of 130 mph.

o

The storm’s path is such that it should stay over open water in the Atlantic passing to the northeast of the northern Leeward Islands early during the middle part of this week and then pass to the east of Bermuda late this week

or early into the weekend before possibly turning to the northeast in the early days of October.

o

The storm may move closer to southeastern Canada next week

- Remnants

of Tropical Storm Odette dissipated over the Atlantic during the weekend - Remnants

of Tropical Storm Peter remain southeast of Bermuda today, but have some potential redevelopment today - A

wave coming off the West Africa coast will be closely monitored for possible development into a tropical cyclone later this week

o

The system may diminish to a tropical wave as it moves toward the northern Leeward Islands next week

- Another

disturbance in the central tropical Atlantic will also be monitored for possible development this week

o

It will move toward the Leeward Islands may dissipate to a tropical wave while moving in that area this weekend

- Typhoon

Mindulle was located 393 miles southwest of Iwo To, Japan at 20.1 north, 136.5 east moving north northwesterly at 3 mph and producing maximum sustained wind speeds of 109 mph near its center.

o

Mindulle should move north northwesterly over the next couple of days before turning to the northeast during the second half of this week

o

If this path verifies, Japan should be spared from the storm’s intense wind and torrential rainfall, but it will need to be closely monitored

o

The storm will intensify a little more early this week and then begin weakening as it turns to the northeast

- Xinjiang

China weather will not be ideal during the next ten days

o

Rain is expected in many areas during the second half of this week into next week slowing fieldwork and raising a little concern over cotton fiber quality

o

Cold temperatures will follow the rain and end the growing season many areas that have not already seed freezes

o

Improved harvest weather should occur after the freeze when the weather turns dry and starts warming again, but that may come gradually

- Eastern

Australia’s rain this week will be great for reproducing winter crops in New South Wales and for filling and maturing wheat in Queensland.

- Western

Australia will receive some needed early this week and again during the weekend

o

The moisture will improve topsoil moisture for wheat development

o

Some of the rain will move to southern crop areas in the nation next week

- Central

Africa rainfall will occur favorably over the next two weeks

o

Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

- South

Africa weather will trend wetter in the next couple of weeks and that should prove beneficial for future spring and summer crop planting and for reproducing winter crops. - Indonesia

and Malaysia rainfall is expected to be frequent and sufficient to support long term crop needs

o

This is true for the Philippines as well as with a tropical cyclone possible next week threatening the archipelago

- Mexico

precipitation will be greater than usual this week in most of the south and east followed by drier conditions next week

o

The moisture will be good for late season crop development

o

Dryness in the northeast part of the nation will be briefly eased by this week’s rain

- Today’s

Southern Oscillation Index was +8.57 and will likely move high over the next few days

- New

Zealand weather will be wetter biased in North Island and below average in South Island

o

Temperatures will be near to below average

Source:

World Weather Inc.

Monday,

Sept. 27:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm - Ivory

Coast cocoa arrivals

Tuesday,

Sept. 28:

- EU

weekly grain, oilseed import and export data

Wednesday,

Sept. 29:

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

General Statistics Office releases Sept. trade data - Brazil’s

Unica releases sugar output and cane crush data (tentative)

Thursday,

Sept. 30:

- USDA

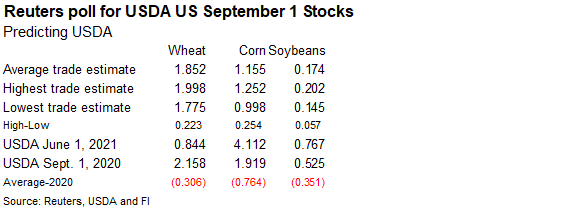

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

quarterly stocks – corn, soy, wheat, barley, oat and sorghum, noon - U.S.

wheat production, noon - U.S.

agricultural prices paid, received, 3pm - Ivory

Coast farmgate cocoa prices to be announced - Malaysia

September palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

Canada

Friday,

Oct. 1:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

cocoa season in Ivory Coast starts - U.S.

DDGS production, corn for ethanol - USDA

soybean crush, 3pm - Australia

commodity index - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong

Source:

Bloomberg and FI

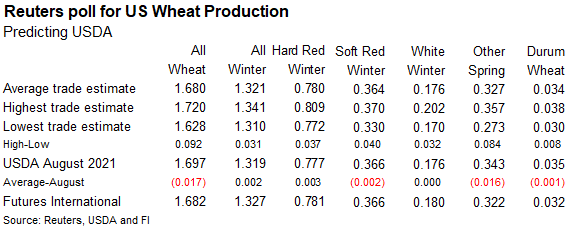

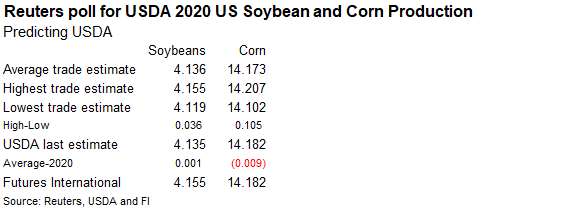

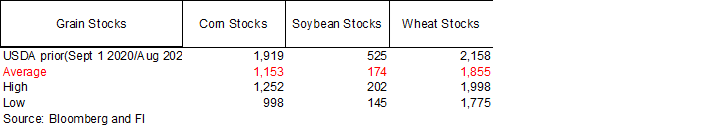

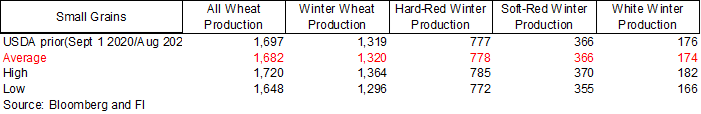

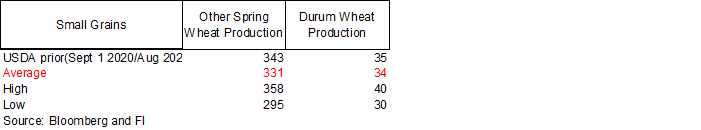

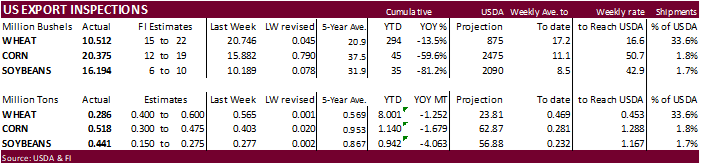

USDA

inspections versus Reuters trade range

Wheat

286,087 versus 400000-625000 range

Corn

517,539 versus 300000-575000 range

Soybeans

440,742 versus 150000-500000 range

Macros

77

Counterparties Take $1297.050 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1313.657 Bln, 78 Bidders)

US

NatGas Futures Extend Gains, Rise To 7-Year High

·

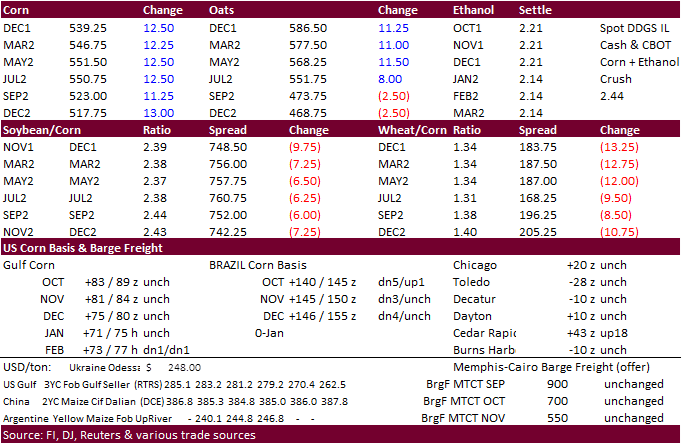

Corn was lower overnight but rebounded from several factors, including a nearly 30 percent increase in US corn inspections. Disappointing US hog inventories did not factor into today’s action for corn futures, but sure did the

in the CME hog markets. Commodities in general traded higher and outside markets lent support. December corn took out $5.3475 recent high. Fueling the rally included higher WTI crude oil, persistent dryness in Brazil, and ongoing concerns over back to back

La Nina events.

·

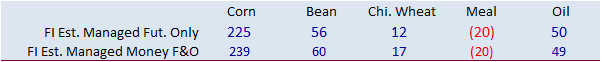

Funds bought an estimated net 12,000 corn contracts.

·

Oats were again higher and at contract highs for the nearby positions.

·

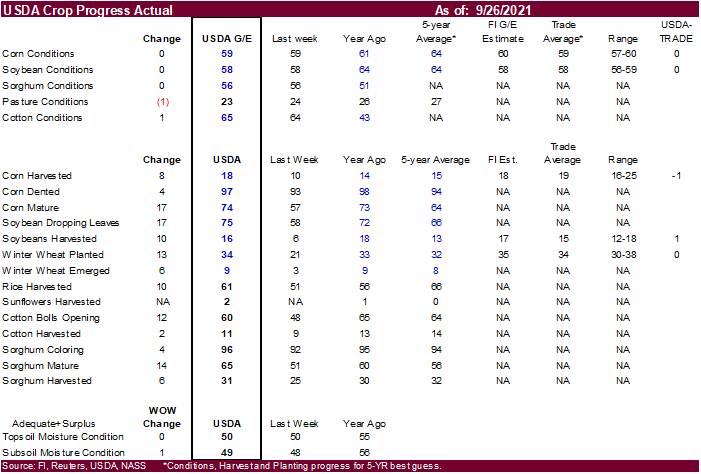

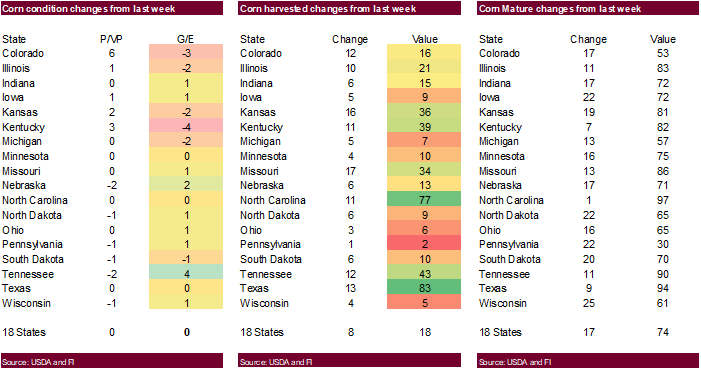

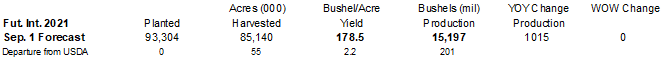

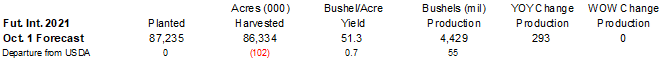

US corn conditions were unchanged and at trade expectations. Harvest progress was 18 percent, one point below expectations and 3 points above average. We left our yield estimate unchanged.

·

Spot basis for soybean and soybeans were stronger at Midwest river locations but weaker at some processing locations (ethanol plants and crushers). A Lincoln, NE, corn elevator location was 22 under the December, down 17 cents.

·

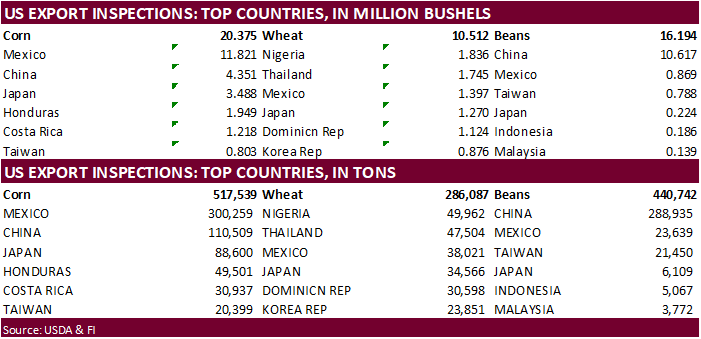

USDA US corn export inspections as of September 23, 2021 were 517,539 tons, within a range of trade expectations, above 403,422 tons previous week and compares to 826,995 tons year ago. Major countries included Mexico for 300,259

tons, China for 110,509 tons, and Japan for 88,600 tons.

·

Russia reported an African Swine fever outbreak in central Russia, at one of its largest pork producer sites (Miratorg in the Belgorod region ).

·

Concerns over fertilizer prices for 2022 US sowings continue to hang over the market. Natural gas hit a fresh 7-year high today.

·

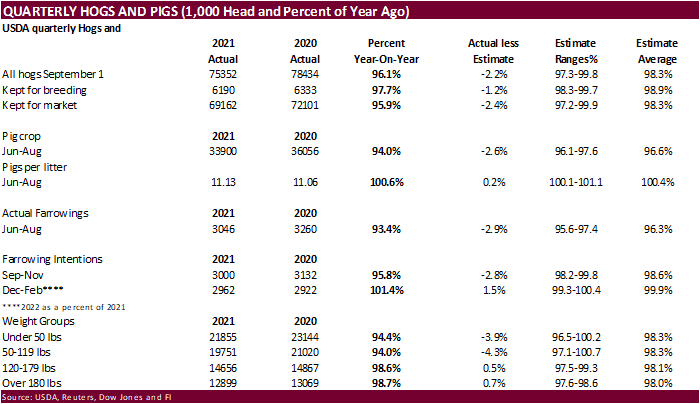

Friday’s Hogs and Pigs report underpinned hog futures. CME hogs were up the limit 475 basis the December and February contracts.

https://www.cmegroup.com/trading/price-limits.html

Export

developments.

-

Taiwan’s

MFIG seeks 65,000 tons of corn September 28 for shipment between Dec. 6 and Dec. 25, 2021, or later if from the PNW.

Updated

9/27/21

December

corn is seen in a $4.95-$5.60 range

(up 20, down 15)

March

corn is seen in a $5.00-$5.80 range.

Soybeans

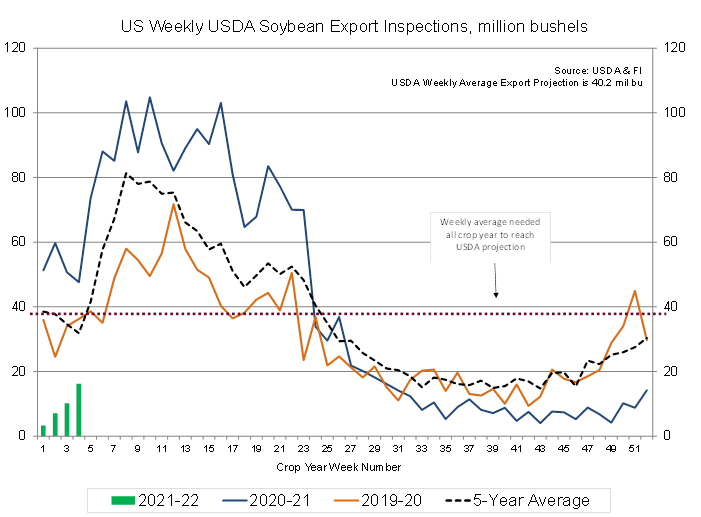

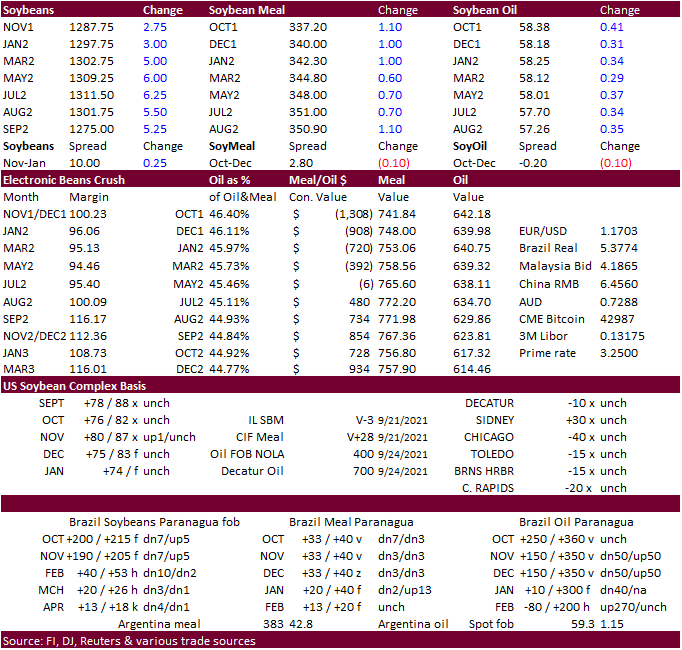

·

Soybeans were higher from USDA 24-hour sales, rising export inspections and a rally in soybean meal on concerns China power outages will reduce feed supplies. Grains in soybeans and meal were trimmed on light profit taking.

USDA announced 334,000 tons of soybeans were sold to China for 2021-22 delivery, following rumors they bought 6-9 cargoes late last week. Global Covid concerns and power outages in China affecting crush operations may have limited gains.

·

Funds bought an estimated net 2,000 soybeans, 1,000 meal and 1,000 soybean oil.

·

Soybean oil was lower to start but rallied shortly after the open on higher energy prices. Some gains were trimmed by late morning and December soybean oil finished 24 points higher.

·

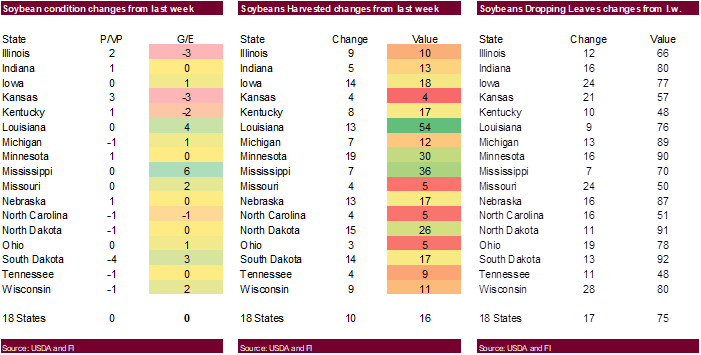

US soybean conditions were unchanged and at trade expectations. Harvest progress was 16 percent, one point above expectations and 3 points above average. We left our yield estimate unchanged.

·

Spot US Gulf soybeans are cheaper than FOB Argentina and Brazil premiums, but shipments remain slow for this time of year.

·

USDA US soybean export inspections as of September 23, 2021 were 440,742 tons, within a range of trade expectations, above 277,297 tons previous week and compares to 1,297,596 tons year ago. Major countries included China for

288,935 tons, Mexico for 23,639 tons, and Taiwan for 21,450 tons.

·

La Nina is expected to linger into the winter months, keeping some traders wondering if it will impact South American production and palm oil output for Indonesia/Malaysia.

·

Brazil’s center-west and southeast crop regions should see isolated rains and heat this week, slowing planting progress as producers try to avoid second plantings in the event of germination failure. Goias and Tocantins saw beneficial

rains over the weekend. Mato Grosso was mostly dry. IMEA reported 1.2% complete for soybean sowings as of September 24 for Mato Grosso.

·

Oil World sees global vegetable oil prices weakening during the fourth quarter of 2021 and FH 2022 due to a recovery in global vegetable oil stocks. They look for a 7.4 million ton increase in global vegetable oil production

in 2021-22, led by palm oil and sunflower oil.

·

Rapeseed futures ended at fresh all-time high, up 4.75 euros at 625.50 euros.

·

Indonesia will leave its October crude palm oil (CPO) export tax unchanged at $166/ton from September, and refined palm oil export tax unchanged at $175/ton.

Export

Developments

- Under

the USDA 24-hour reporting system, private exporters sold 334,000 tons of soybeans to China for 2021-22 delivery.

Updated

9/27/21

Soybeans

– November $12.15-$13.50 range (up 40, down 25), March $12.00-$14.00

Soybean

meal – December $320-$360 (up 10, down 25), March $300-$3.80

Soybean

oil – December 54-62 cent range

(up

100, unchanged), March 54-64

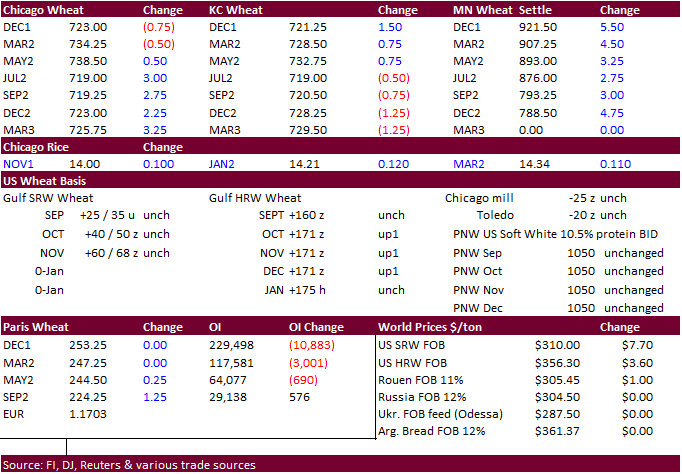

·

US wheat markets were mixed (bear spreading in Chicago, bull spreading in KC, and MN overall higher). News was light. Higher corn supported prices early, but wheat gave up gains from a US weather forecast calling for good rains

from Texas into the lower northern Great Plains. The timing of these rains will be beneficial for recently planted winter wheat (one reason back month KC contracts settled lower). Chicago wheat for the nearby could have been down in part to poor USDA export

inspections. MN was supported by good high protein wheat demand. Three import tender announcements were reported since late Friday, including Algeria which helped underpin December Paris wheat.

·

Funds sold an estimated net 1,000 Chicago wheat.

·

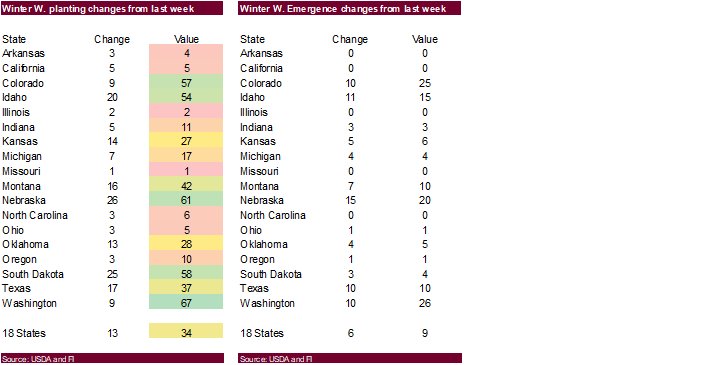

US winter wheat plantings were 34 percent, at expectations and 2 points above average.

·

USDA US all-wheat export inspections as of September 23, 2021 were 286,087 tons, below a range of trade expectations, below 564,608 tons previous week and compares to 589,025 tons year ago. Major countries included Nigeria for

49,962 tons, Thailand for 47,504 tons, and Mexico for 38,021 tons.

·

Paris December wheat was unchanged at 253.25 euros.

·

The USD was 2 points higher as of 1:35 pm CT.

·

Russian grain exports are down 22.4% from July 1 through September 23, according to the AgMin. Wheat exports are lagging a good amount. Trade groups vary on the amount of Russian wheat exports since the start of the crop year,

but the consensus is they are running at least 9 percent below the previous period year ago.

·

Russia’s currency was up for the fifth day in part to brent crude oil appreciation (above $80/barrel).

·

The Brazilian Wheat Industry Association (Abitrigo) that represents flour millers are threatening to stop buying wheat from Argentina if Brazil approves GMO wheat imports. About 60 percent of the wheat consumed in Brazil is imported,

and about 80 percent of that comes from Argentina. .

Export

Developments.

·

Algeria seeks 50,000 tons of wheat, optional origin, on September 28, with results likely September 29, for November 1-15 and November 16-30 shipment.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

·

Jordan seeks 120,000 tons of feed barley on September 30 for Dec-Feb shipment.

·

Pakistan seeks 640,000 tons of wheat on Sep. 29

for

shipment between January and February 2022.

·

Jordan seeks 120,000 tons of wheat on September 29.

·

Results awaited: Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

·

Results awaited: Lowest offer $428.94/ton CIF. Bangladesh seeks 50,000 tons of rice on September 23.

·

Bangladesh seeks 50,000 tons of rice on October 4.

Updated

9/27/21

December

Chicago wheat is seen in a $6.80‐$7.50 range (up 30, down 30), March $6.50-$7.75

December

KC wheat is seen in a $6.75‐$7.60 (up 35, down 40), March $6.50-$7.75

December

MN wheat is seen in a $8.45‐$9.50 (unch), March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.