PDF Attached

Despite

a lower trade in WTI and higher USD (up 56 points and highest level since Sep. 2020), major CBOT agriculture markets moved higher on positioning and concerns over global supply chain concerns.

Grain Stocks and Small Grains Annual Summary reports

are due out at 11 am CT on Thursday.

![]()

7-day

World

Weather Inc.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Tropical

Depression 20 has formed west of the Africa coast

o

The system will likely become a tropical storm and move to the central Atlantic over the next few days

- The

system poses no threat to land - Category

Four Hurricane Sam was located 455 miles east of the northern Leeward Islands at 0500 EDT today moving northwesterly at 9 mph and producing maximum sustained wind speeds of 130 mph.

o

The storm’s path is such that it should stay over open water in the Atlantic passing to the northeast of the northern Leeward Islands early during the middle part of this week and then pass to the east of Bermuda late this week

or early into the weekend

- Another

disturbance in the central tropical Atlantic has lost its potential for development as it moves toward the Lesser Antilles over the next few days - Typhoon

Mindulle was located 316 miles west of Iwo To, Japan at 25.4 north, 135.7 east moving northerly at 8 mph and producing maximum sustained wind speeds of 132 mph near its center.

o

Mindulle should move northerly today before turning to the northeast Thursday and especially Friday

o

If this path verifies, Japan should be spared from the storm’s intense wind and torrential rainfall, but it will need to be closely monitored

o

The storm will slowly weaken, but remain a typhoon as it passes Honshu, Japan Friday

- Beneficial

rain fell in eastern Australia Tuesday and overnight

o

Moisture totals varied up to 1.57 inches in interior southeastern Queensland and 1.60 inches occurred at one location in central New South Wales; however, most amounts varied from 0.05 to 0.71 inch

o

The moisture was great in raising topsoil moisture for future sorghum and cotton planting in Queensland, although more rain is still needed

o

The moisture also helped improve reproductive conditions for parts of New South Wales wheat, barley and canola

- Additional

rain will fall in eastern Australia today and early Thursday to further improve crops as noted above

o

Western and southern Australia will also start receiving periods of rain later this week and it will continue through next week, but on an infrequent basis

- Winter

crops throughout the south will benefit from the shower activity - India’s

monsoon should begin to withdraw over the next couple of weeks beginning in the north this weekend and next week and in central areas during the following week

o

The monsoon’s late withdrawal this year should bode well for winter crop planting, but summer crop maturation and harvesting are expected to be behind average

- China’s

weather will be mixed over the next ten days with too much rain falling periodically north of the Yellow River and from Liaoning to southern Jilin

o

Will become heaviest in the north starting this weekend and it will last well into next week

o

The wetter areas in the north will experience delays in summer crop maturation and harvest progress, but the moisture will be good for wheat emergence and establishment later this season

- Planting

delays are expected during the wetter periods

o

East-central and southeastern China will experience a good mix of weather supporting crops and fieldwork

- Xinjiang

China will be trending colder with harvest disruptions in the northeast because of frequent showers over the next several days

o

Western and central crop areas in the province will not be as cold or wet as the northeast, but some frost will be possible next week

- Remnants

of Tropical Cyclone Gulab produced some heavy rain in Gujarat and southern Sindh Pakistan Tuesday and early today and additional heavy rain is expected through Thursday

o

Most crops will not be seriously harmed by the rain

o

Rain totals of 2.00 to more than 4.00 inches and local totals to 7.00 inches will result with coastal areas of Pakistan and northwestern Gujarat wettest

o

Rainfall Monday was not much more than 3.00 inches in Telangana, but Sunday’s rainfall reached over 10.00 inches along the Andhra Pradesh coast

- Other

areas of India will experience a good mix of rain and sunshine

o

Worry remains over the condition of some northern crops where seasonal drying normally occurs at this time of year

- Today’s

forecast has removed more rain from Rajasthan, Punjab and Haryana and that change was needed and should bode well for cotton in the open boll stage of development - Russia’s

winter crop areas will be cool with limited shower activity for a while

o

Warming is needed for improved wheat establishment, but next week’s forecast has removed the previous potential for warming

o

Precipitation should be limited for about ten days, although it will not be completely dry

- Harvest

progress for summer crops in the western CIS will advance around brief showers during the next ten days - Europe

weather will trend wetter in the western half of the continent resulting in some summer crop harvest delays

o

The moisture will ease dryness in some areas and help improve planting and emergence moisture for winter crops

- France

and Germany need the precipitation most, but too much rain may fall and fieldwork may be on hold for a while

o

Eastern Europe will experience good field working conditions, although a few showers might disrupt progress infrequently

- North

Africa rainfall is not likely to be significant over the next ten days, although a few showers are likely - U.S.

hard red winter wheat areas will receive some welcome rainfall over the next several days with sufficient amounts to improve planting, emergence and establishment for many areas

o

The precipitation may not be as well distributed as advertised in some of the computer weather forecast models and the situation will be closely monitored, but a short-term improvement is certainly expected

- West

Texas weather will deteriorate Thursday and Friday with rain and cooler temperatures expected

o

Improving weather next week will restore a good environment for crop maturation

- U.S.

Delta weather will become wetter through the weekend causing some delay in summer crop maturation and harvest progress

o

Open boll cotton fiber quality and boll rot issues will resume, but drying expected next week should prevent this bout of rain from being a serious threat to crops in the region

- U.S.

southeastern states will see more sunshine than rain over the next week ten days which should bode well for summer crop maturation and harvest progress - U.S.

northwestern Plains and much of Canada’s Prairies will remain drought ridden with very little opportunity for relief in the next ten days

o

Temperatures were unseasonably warm to hot again Tuesday with extreme highs reaching into the 80s and 90s

- Dickinson,

North Dakota reached 100 Fahrenheit - Temperatures

reaching the lower to middle 90s Fahrenheit reached into east-central and southern Saskatchewan and southwestern Manitoba

o

Cooling is expected from west to east across these areas during the next few days, but another round of very warm weather is expected next week

- Interior

parts of the U.S. Pacific Northwest and California will continue drier biased for an extended period of time, despite a few showers infrequently

- Southern

Brazil will be wettest into the weekend

o

Wheat and corn in the far south will benefit most from the rain, although some of the moisture will be good for rice planting as well.

- Far

southern rice areas in Rio Grande do Sul are not likely to get much rain - Center

west and center south Brazil showers will become more significant again during the late weekend and especially next week

o

Planting moisture will increase in pockets, but no general soaking is expected

- Brazil

coffee areas will receive some rain Saturday through Monday and again Oct. 7-9 with sporadic showers expected at other times

o

Some localized flowering is expected

- Greater

rain will be needed to support widespread flowering - Argentina’s

weather is not likely to bring much rain to the northwest or west-central parts of the nation during the next ten days which are still too dry for spring planting or winter crop development

o

Rain will fall periodically in the south and some eastern crop areas to maintain good crop conditions in those areas

- Central

Africa rainfall will occur favorably over the next two weeks

o

Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

- South

Africa weather will trend wetter in the next couple of weeks and that should prove beneficial for future spring and summer crop planting and for reproducing winter crops. - Indonesia

and Malaysia rainfall is expected to be frequent and sufficient to support long term crop needs

o

This is true for the Philippines as well as with a tropical cyclone possible next week threatening the archipelago

- Mexico

precipitation will be greater than usual over the next five days week in most of the south and east followed by drier conditions next week

o

The moisture will be good for late season crop development

o

Dryness in the northeast part of the nation will be briefly eased by this week’s rain

- Today’s

Southern Oscillation Index was +9.43 and will likely move higher over the next few days

- New

Zealand rainfall will be near to below average over the next week with temperatures near to below average as well

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Wednesday,

Sept. 29:

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

General Statistics Office releases Sept. trade data - Brazil’s

Unica releases sugar output and cane crush data (tentative)

Thursday,

Sept. 30:

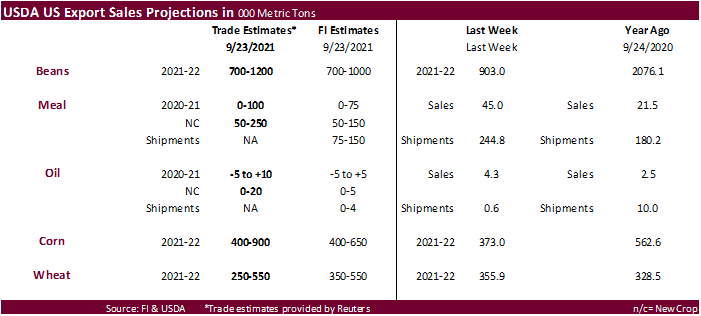

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

quarterly stocks – corn, soy, wheat, barley, oat and sorghum, noon - U.S.

wheat production, noon - U.S.

agricultural prices paid, received, 3pm - Ivory

Coast farmgate cocoa prices to be announced - Malaysia

September palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

Canada

Friday,

Oct. 1:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

cocoa season in Ivory Coast starts - U.S.

DDGS production, corn for ethanol - USDA

soybean crush, 3pm - Australia

commodity index - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong

Source:

Bloomberg and FI

FND

Delivery Estimates

SBO

Oct/Dec spread moved 36 points (44-point range). Spread broke so hard, we could see some new registrations put out tonight for delivery.

-

0-500

SBO -

0

to 50 Meal.

Macros

S

DoE Crude Oil Inventories (W/W) 24 Sep: 4.578M (est -1.652M; prev -3.481M)

–

Distillate (W/W): 0.385M (est -1.648M; prev -2.555M)

–

Cushing (W/W): 0.131M (prev -1.476M)

–

Gasoline (W/W): 0.193M (est 1.400M; prev 3.475M)

–

Refinery Utilization (W/W): 0.6% (est 0.5%; prev 5.4%)

80

Counterparties Take $1415.840 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1365.185 Bln, 83 Bidders)

·

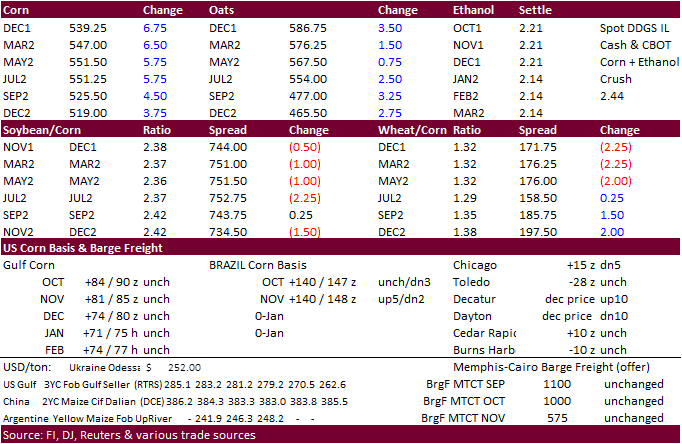

Corn traded higher on technical buying and positioning ahead of the USDA reports. Some traders are eyeing dry conditions for the South American crops that are currently getting planted. Argentina will see light rain this week

and producers in central Brazil are still waiting for the start of the rain season. Some attributed the strength in today’s trade to rising global fertilizer prices that may prompt some producers to slightly cut back on upcoming South American and Northern

Hemisphere corn plantings (NA and China).

·

Funds bought an estimated net 9,000 corn contracts.

·

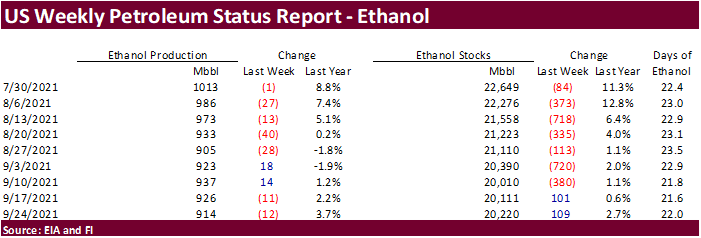

US weekly ethanol production, which fell an unexpected 12 barrels, is negative for December corn futures, but the trade seemed to have ignored it.

·

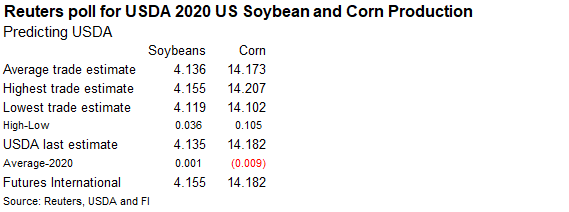

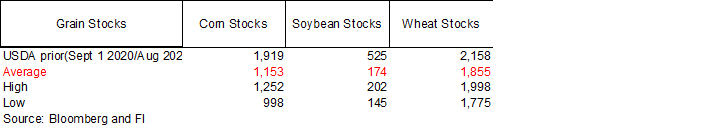

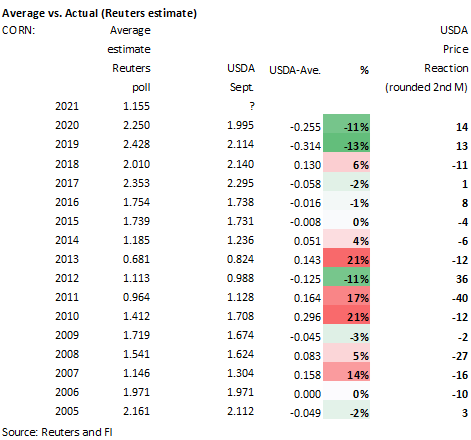

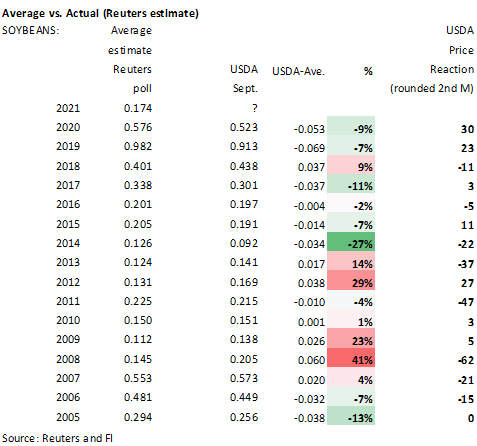

A Reuters trade estimate for ending US 2020-21 corn stocks is 1.155 billion bushels, 32 million below USDA’s current projection. History between average September 1 stocks versus average estimates suggests corn prices should

be more prone to price reactions (in percentages) given the discrepancies, but price reactions among years vary due to the corn/soybean/wheat price relationships. We think corn reacts the best to stocks when looking at price reactions, then soybeans followed

by wheat.

·

The Corn Belt will see favorable harvest weather this week.

·

Brazil’s Deral reported corn plantings for the week ending September 27 at 45 percent complete, up from 34 percent at this time last year.

·

South Africa’s CEC slightly lowered their corn production to 16.211 million tons, 6% more than the 2020-21 season, including 8.609 million tons of white and 7.602 million tons of yellow.

·

Argentina will resume beef exports to China after the government restricted exports to around 50% typical volumes. Argentina capped volumes to fight inflation. About 75% of Argentina’s beef exports went to China in 2020.

·

The US has allocated 500 million dollars to monitor African swine fever and prevention.

·

The USDA Broiler Report showed eggs set in the United States up 6 percent and chicks placed down 3 percent. Cumulative placements from the week ending January 9, 2021, through September 25, 2021, for the United States were 7.09

billion. Cumulative placements were up slightly from the same period a year earlier.

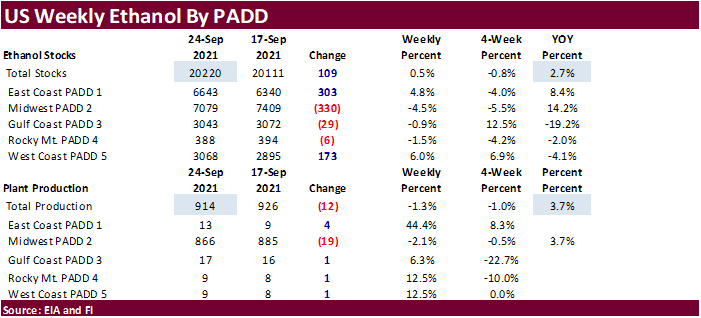

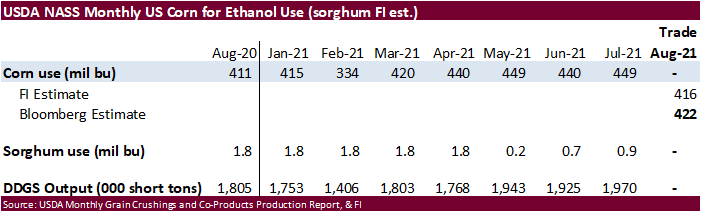

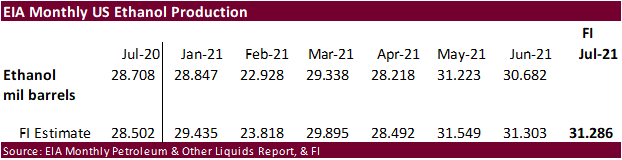

Weekly

US ethanol production

fell an unexpected 12,000 barrels per day (trade weas looking for up 13,000) to 914,000 barrels, lowest since late August. PADD2 was down 330,000 barrels per day. Stocks increased for the second consecutive week by 109,000 to 20.220 million barrels, near

expectations. Gasoline stocks increased a small amount to 221.8 million barrels. Ethanol % blended into finished motor gasoline was 92.3%, down from 92.4% from the previous week. Annualized corn use for ethanol production is under 5.1 billion bushels, below

the rate during September 2020. The poor start of the corn calendar year (Sep-Aug) rate of US ethanol production is negative for corn. 2021-22 September through December US domestic corn demand could be down from last year. Recall last Friday’s pig report

implies lower corn for feed demand for the summer quarter, and upcoming fall quarter.

Export

developments.

-

None

reported

Updated

9/27/21

December

corn is seen in a $4.95-$5.60 range

March

corn is seen in a $5.00-$5.80 range.

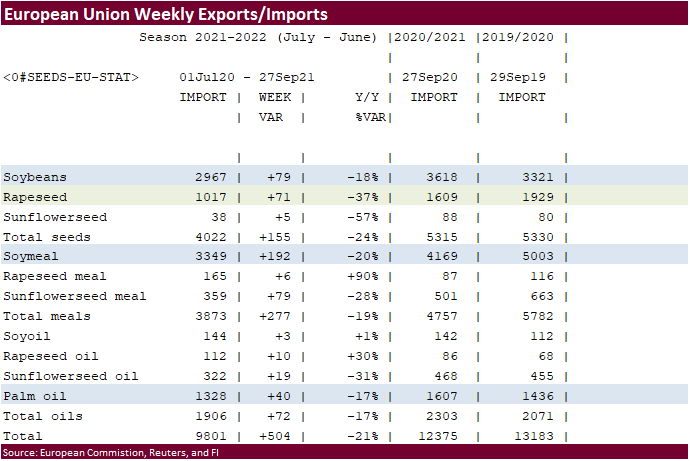

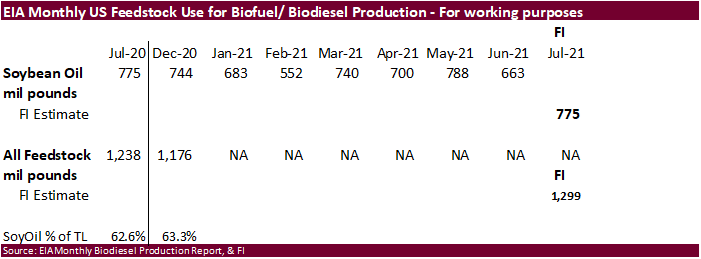

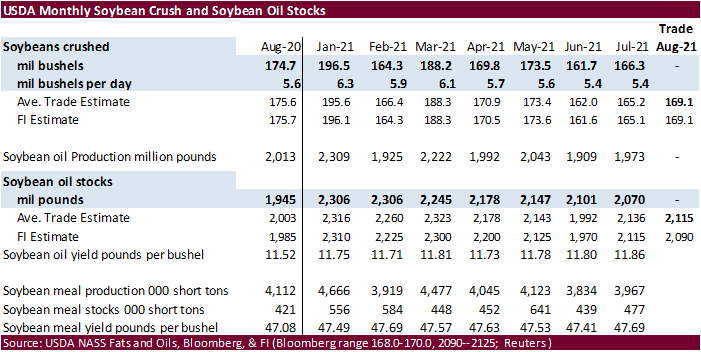

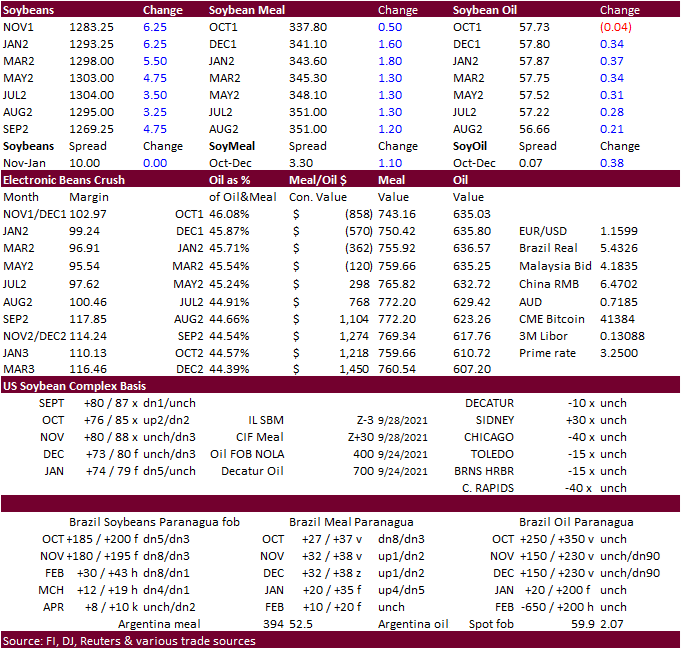

Soybeans

·

November EU rapeseed traded 12.50 euros higher at a record settlement of 646.25 euros. 648.75 was the high.

·

CBOT’s soybean oil market appreciation today looked relatively mellow compared to many other global vegetable oil markets. Cash Rotterdam rapeseed oil prices were up 30-65 euros from early yesterday afternoon.

·

Funds bought an estimated net 6,000 soybeans, 2,000 meal and 2,000 soybean oil.

·

The US ECB will see rain later this week that may lightly disrupt harvest progress.

·

A Reuters trade estimate for ending US 2020-21 soybean stocks is 174 million bushels, only one million below USDA’s current projection.

·

Note Canada is on holiday Thursday.

·

Brazil’s Deral reported soybean plantings across Parana were 7 percent complete as of Sep 27, up four percent from the previous week.

Export

Developments

- None

reported

Updated

9/27/21

Soybeans

– November $12.15-$13.50 range, March $12.00-$14.00

Soybean

meal – December $320-$360, March $300-$3.80

Soybean

oil – December 54-62 cent range,

March 54-64

·

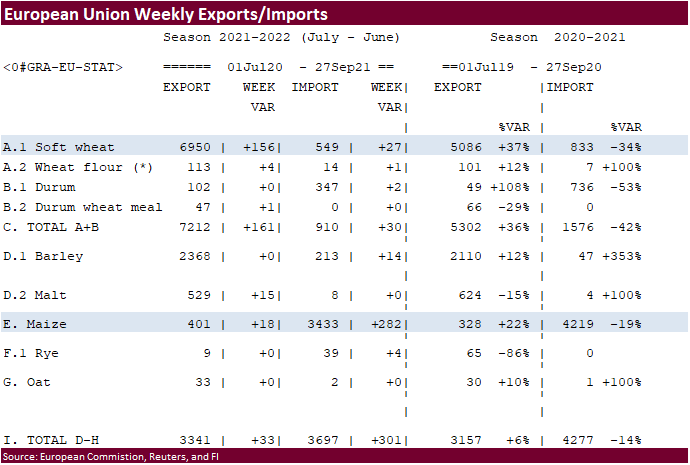

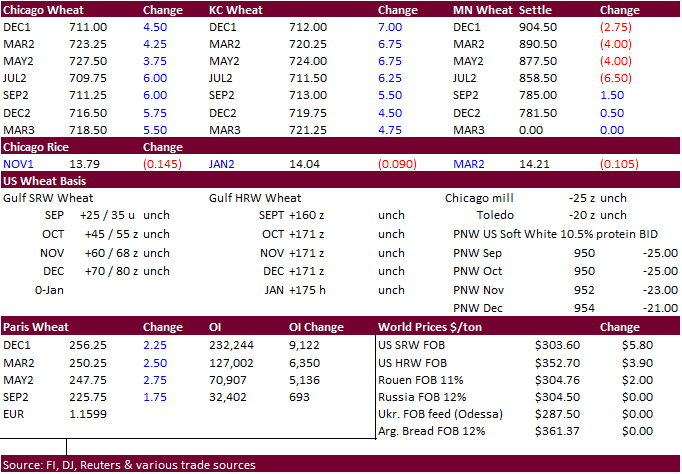

Wheat was higher on good import demand and higher EU wheat. The high in December EU wheat of 257.75 matched an earlier absolute contract high established August 13. Algeria bought more wheat than expected (about 580,000 tons

instead of 500k reported earlier). Pakistan is seeing offers for 640,000 tons of wheat.

·

Funds sold an estimated net 1,000 Chicago wheat.

·

The USD was 57 points higher as of 12:40 pm CT, highest level since September 2020.

·

Paris December wheat was up 2.25 at 256.00 euros.

·

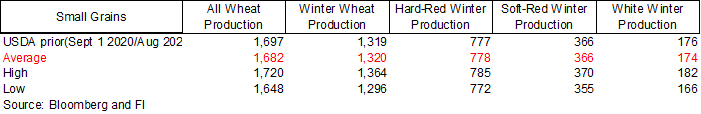

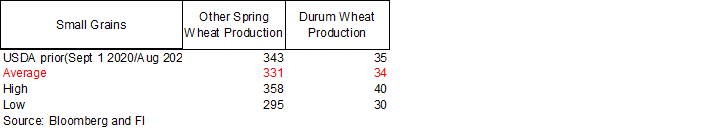

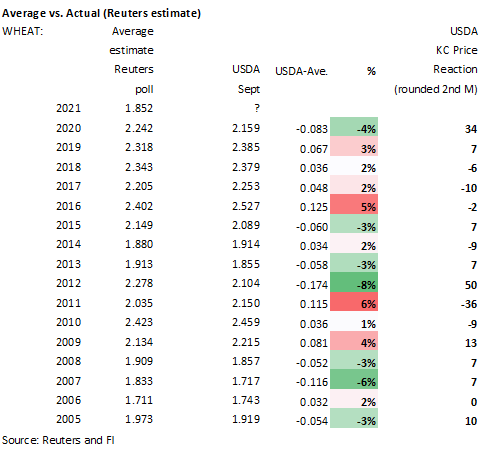

US wheat production when updated on Thursday should end up at a 19-year low. A Reuters survey calls for all-wheat production to end up at 1.680 billion bushels, below USDA August estimate of 1.697 billion. In 2002, US wheat

output stood at 1.606 billion bushels, with 24 percent of the planted area abandoned. This year USDA looks for 26 percent abandonment, and that figure should rise based on analysts’ estimates for spring wheat. The focus on the all-wheat crop for this report

will be on other spring and durum production. The trade looks for a 16-million-bushel reduction in other spring to 327 million from 343 million, and a 1 million reduction in durum to 34 million from 35 million in August.

·

US all-wheat stocks are estimated at 1.852 billion bushels and if realized would be the lowest for the end of the summer quarter since 2007-08, and down from 2.158 billion year earlier.

·

Russia’s AgMin reported wheat harvest at 74.2 million tons as of late September, down from 85.2 million tons same time last year.

·

Bangladesh plans to buy 100,000 tons of wheat from Russia in a government-to-government tender.

Export

Developments.

·

Algeria bought about 500,000 tons of wheat, optional origin, at prices around $364/ton c&f for November 1-15 and November 16-30 shipment. They last paid about $353 to $356.60/ton back in late August.

·

Pakistan’s lowest offer for 640,000 tons of wheat was $377.00/ton

for

shipment between January and February 2022.

·

Jordan passed on 120,000 tons of wheat on September 29.

·

Jordan seeks 120,000 tons of feed barley on September 30 for Dec-Feb shipment.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on October 4.

Updated

9/27/21

December

Chicago wheat is seen in a $6.80‐$7.50 range, March $6.50-$7.75

December

KC wheat is seen in a $6.75‐$7.60, March $6.50-$7.75

December

MN wheat is seen in a $8.45‐$9.50, March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.