PDF Attached

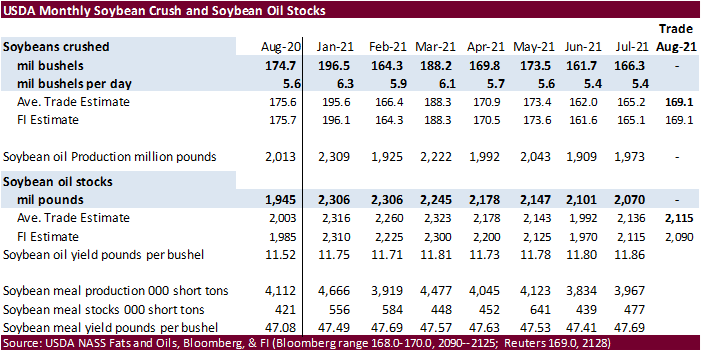

USDA

NASS Recap

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2021/09-30-2021.pdf

September

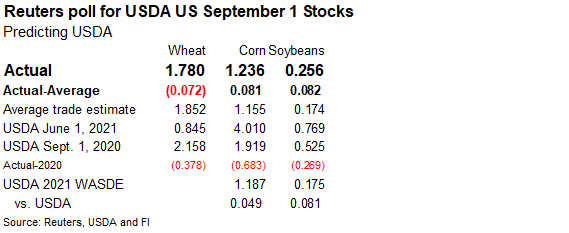

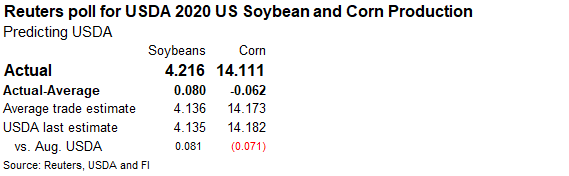

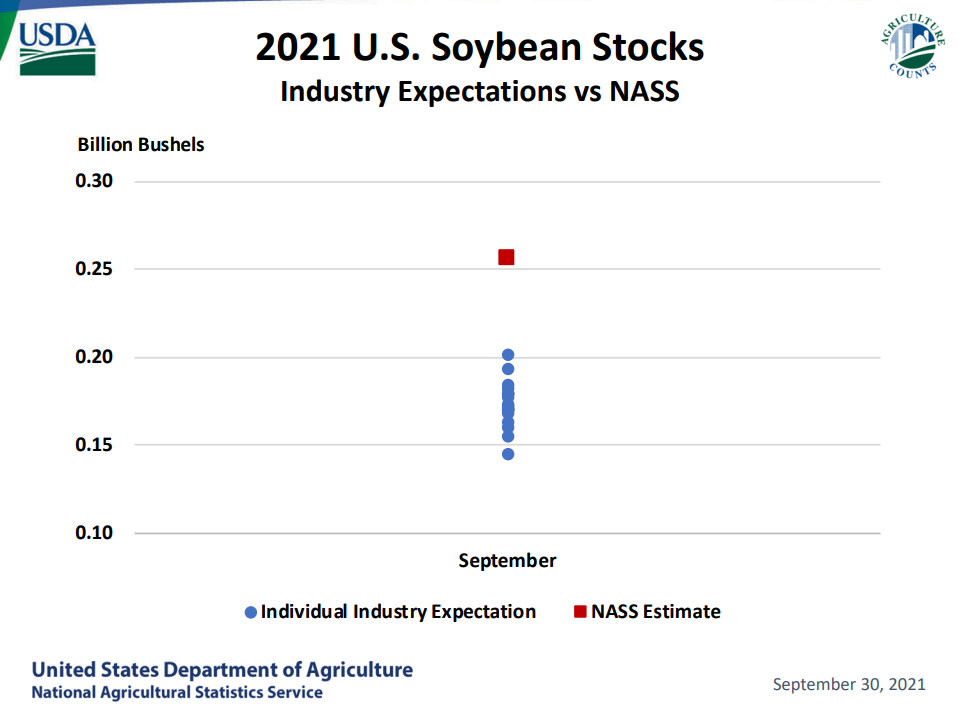

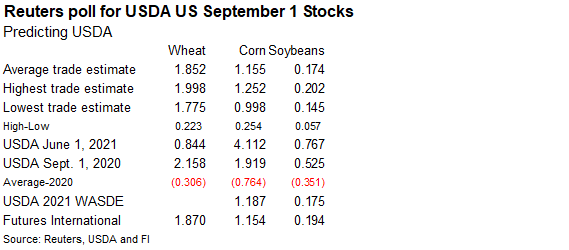

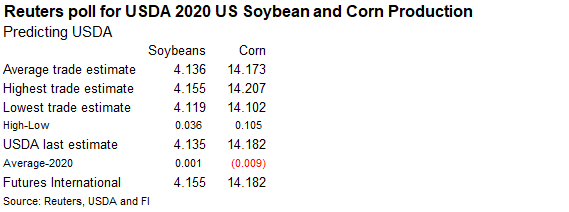

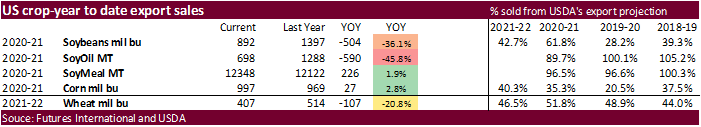

one US soybean stocks were reported at 256 million bushels versus USDA’s S&D outlook of 175 million, a huge difference, and 82 million above an average trade guess. The trade was about stop on with the September 1 stocks estimate, it was an upward revision

to the 2020 US soybean crop that inflated the USDA number. 2020 US soybean production was taken up 81 million bushels to 4.216 billion. Trade was looking for only an 8-million-bushel increase. Regardless how one interprets it, stocks are higher than expectations

and that should reflect lower prices for the 2021-22 crop year. Note we recently cut exports, so when we adjust out balance for US 2021-22, look for a 300 million plus carryout. We raised 2021-22 US exports for soybeans by 10 million bushels to 2.050 billion,

below USDA’s 2.090 billion estimate. Our crop year average price for soybeans is now $12.00-$12.50/bu, down from $12.50 previous. Look for FI to pass an updated price forecast early next week. We will be adjusting 2021-22 price average and adding 2022-23.

2020

US corn production was downward revised 71 million bushels to 14.111 billion. September 1 stocks were reported at 1.236 billion bushels, 49 million above USDA’s latest S&D carryout and 81 million above an average trade guess. Note USDA revised previous quarter

June one corn stocks upward by 101 million bushels, so the discrepancy in the trade outlook for summer feed demand was not that bad as expected. The trade missed feed/residual demand by roughly 20 million bushels, in our opinion, using their stocks estimate.

Adjusting to production, look for USDA to lower feed by about 150 million bushels in September, if our calculations are correct.

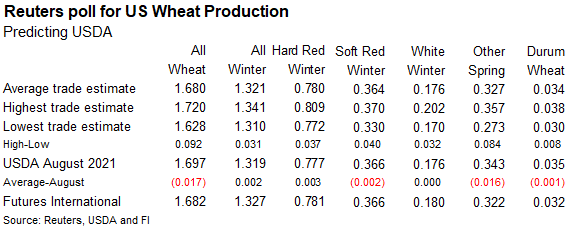

US

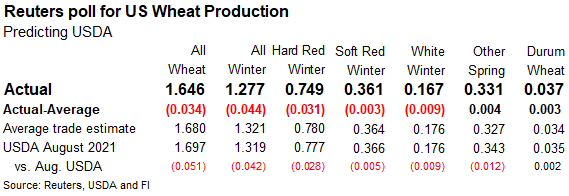

wheat production came in lower than the trade estimate by 34 million bushels to 1.646 billion led by a surprise downward revision to winter wheat by 42 million bushels to 1.277 billion (44 million below trade expectations). HRW was lowered 28 million, SRW

down 5, and winter white down 9 million. Wheat stocks came in below trade expectations by 72 million at 1.780 billion bushels, implying a potential 30 to 50 million-bushel downward revision to USDA’s feed demand in the upcoming supply and demand report.

However, since production was revised lower, and Q1 exports were down from the same period a year ago, implied summer feed demand was better than expected (260 million bu on our working calculation, and highest since summer 2016), USDA might be inclined to

leave its feed outlook unchanged. USDA could reduce US wheat exports for the crop year could be reduced by at least 25 million bushels in the upcoming USDA S&D report after they raise their average domestic cash price outlook.

7-day

World

Weather Inc.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Tropical

Storm Victor formed in the eastern Tropical Atlantic Ocean Overnight

o

The system will likely become a hurricane briefly and move to the central Atlantic over the next few days

- The

system poses no threat to land and will be quick to weaken after a few days - Category

Four Hurricane Sam was located 355 miles northeast of the northern Leeward Islands at 0800 EDT today moving northwesterly at 12 mph and producing maximum sustained wind speeds of 145 mph.

o

The storm’s path is such that it should stay over open water in the Atlantic passing to the east of Bermuda Saturday

o

No major landmass will be impacted by the storm

o

Weakening is expected this weekend

- Typhoon

Mindulle was located 455 miles south southwest of Yokosuka, Japan at 28.6 north, 137.8 east moving north northeasterly at 17 mph and producing maximum sustained wind speeds of 103 mph near its center.

o

Mindulle should turn to the northeast today and especially Friday

o

If this path verifies, Japan should be spared from the storm’s intense wind and torrential rainfall, but it will need to be closely monitored

o

The storm will slowly weaken and should be downgraded to tropical storm status as it pass to the southeast of Tokyo Friday

- Beneficial

rain fell in eastern Australia the past two days

o

The moisture has been great in raising topsoil moisture for future sorghum and cotton planting in Queensland and far northern New South Wales, although more rain is still needed

o

The moisture also helped improve reproductive conditions for parts of New South Wales wheat, barley, and canola

- Additional

rain will fall in eastern Australia today to further improve crops as noted above

o

Western and southern Australia will also start receiving periods of rain later this week and it will continue through next week, but on an infrequent basis

- Winter

crops throughout the south will benefit from the shower activity - India’s

monsoon should begin to withdraw over the next couple of weeks beginning in the north this weekend and next week and in central areas during the following week

o

The monsoon’s late withdrawal this year should bode well for winter crop planting, but summer crop maturation and harvesting are expected to be behind average

- China’s

weather will be mixed over the next ten days with too much rain falling periodically north of the Yellow River and from Liaoning to southern Jilin

o

The greatest rainfall is expected in the north starting this weekend and it will last well into next week

- Some

rain will begin today and Friday, though

o

The wetter areas in the north will experience delays in summer crop maturation and harvest progress, but the moisture will be good for wheat emergence and establishment later this season

- Planting

delays are expected during the wetter periods

o

East-central and southeastern China will experience a good mix of weather supporting crops and fieldwork

- Xinjiang

China will be trending colder with harvest disruptions in the northeast because of frequent showers over the next several days

o

Western and central crop areas in the province will receive rain briefly Saturday into Monday and then turn drier and colder with some frost possible, but no freeze

- Remnants

of Tropical Cyclone Gulab produced some additional heavy rain in Gujarat and southern Sindh Pakistan Wednesday and rain will linger today

o

Most crops will not be seriously harmed by the rain

o

The greatest rain in Gujarat, India is now over

- Other

areas of India will experience a good mix of rain and sunshine

o

Worry remains over the condition of some northern crops where seasonal drying normally occurs at this time of year

- Today’s

forecast has removed more rain from Rajasthan, Punjab and Haryana and that change was needed and should bode well for cotton in the open boll stage of development - Russia’s

winter crop areas will be cool with limited shower activity for a while

o

Warming is needed for improved wheat establishment, but next week’s forecast has removed the previous potential for warming

o

Precipitation should be limited for about ten days, although it will not be completely dry

- Harvest

progress for summer crops in the western CIS will advance around brief showers during the next ten days - Europe

weather will trend wetter in the western half of the continent resulting in some summer crop harvest delays

o

The moisture will ease dryness in some areas and help improve planting and emergence moisture for winter crops

- France

and Germany need the precipitation most, but too much rain may fall and fieldwork may be on hold for a while

o

Eastern Europe will experience good field working conditions, although a few showers might disrupt progress infrequently

- North

Africa rainfall is not likely to be significant over the next ten days, although a few showers are likely - U.S.

hard red winter wheat areas began receiving needed rain Wednesday and more will fall today and Friday with sufficient amounts to improve planting, emergence, and establishment for many areas

o

The precipitation may not be as well distributed as advertised in some of the computer weather forecast models and the situation will be closely monitored, but a short-term improvement is certainly expected

o

Drier weather will follow

- West

Texas weather will deteriorate Thursday and Friday with rain and cooler temperatures expected

o

Improving weather next week will restore a good environment for crop maturation

- U.S.

Delta weather will become wetter through the weekend with some follow up rainfall expected next week causing some delay in summer crop maturation and harvest progress

o

Open boll cotton fiber quality and boll rot issues will resume, but drying expected next week should prevent this bout of rain from being a serious threat to crops in the region

- U.S.

southeastern states will see more sunshine than rain over the next week ten days which should bode well for summer crop maturation and harvest progress - U.S.

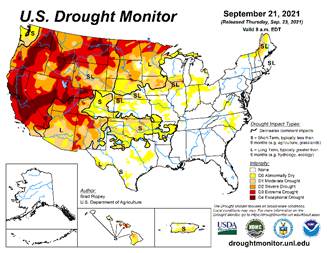

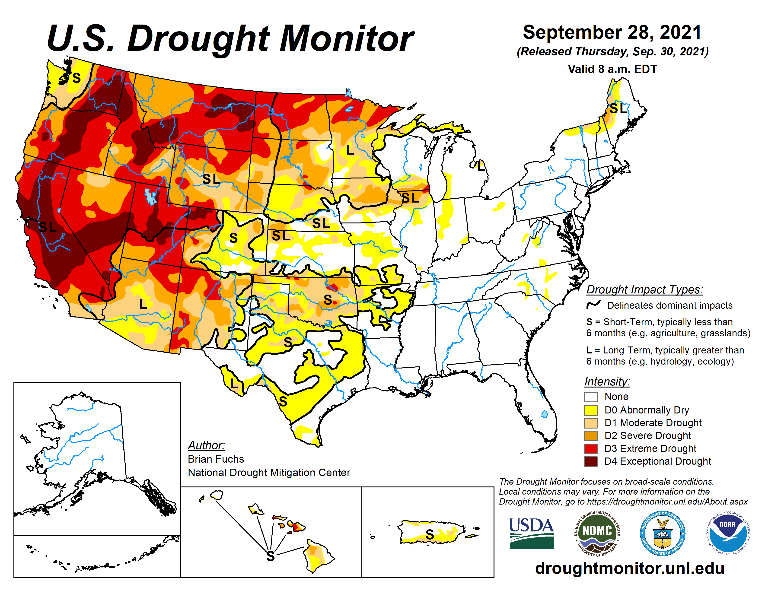

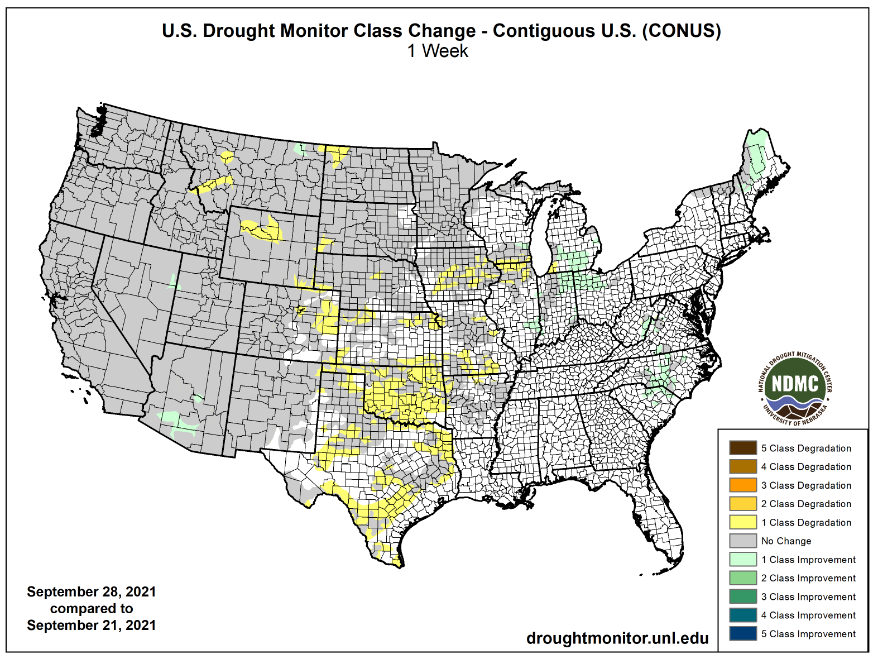

northwestern Plains and much of Canada’s Prairies will remain drought ridden with very little opportunity for relief in the next nine days

o

Temperatures will be more seasonably warm over the next few days, but may turn briefly hotter again next week ahead of a late week rain and cooling event

- Interior

parts of the U.S. Pacific Northwest and California will continue drier biased for an extended period of time, despite a few showers infrequently

- Interior

southern Brazil will be too wet into Monday with waves of moderate to heavy rain expected

o

Areas from northern Rio Grande do Sul to Parana will be wettest with total rainfall of 3.00 to 7.00 inches possible by Tuesday

o

Wheat and corn in the far south of Rio Grande do Sul will benefit most from the rain, although some of the moisture will be good for rice planting as well.

- Far

southern rice areas in Rio Grande do Sul are not likely to get much rain

o

Too much rain from northern Rio Grande do Sul to Parana may hurt unharvested wheat quality and warrant a little replanting of early full season corn.

- Center

west and center south Brazil showers will become more significant again during the late weekend and especially next week

o

Planting moisture will increase in pockets, but no general soaking is expected

- Brazil

coffee areas will receive some rain Saturday through Monday and again Oct. 7-9 with sporadic showers expected at other times

o

Some localized flowering is expected, but most of the rain will stay a little too light for such conditions

- Greater

rain will be needed to support widespread flowering - Argentina’s

weather is not likely to bring much rain to the northwest or west-central parts of the nation during the next ten days which are still too dry for spring planting or winter crop development

o

Rain will fall periodically in the south and some eastern crop areas to maintain good crop conditions in those areas

- Central

Africa rainfall will occur favorably over the next two weeks

o

Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice, and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

- South

Africa weather will trend wetter in the next couple of weeks and that should prove beneficial for future spring and summer crop planting and for reproducing winter crops. - Indonesia

and Malaysia rainfall is expected to be frequent and sufficient to support long term crop needs

o

This is true for the Philippines as well as with a tropical cyclone possible next week threatening the archipelago

- Mexico

precipitation will be greater than usual over the next few days week in most of the south and parts of the east followed by drier conditions next week

o

The moisture will be good for late season crop development

o

Dryness in the northeast part of the nation has already been eased by some rain this week and a little more is expected, but no in the lower Rio Grande Valley

- Today’s

Southern Oscillation Index was +9.19 and will likely move higher over the next few days

- New

Zealand rainfall will be below average over South Island and near to above normal in North Island

Source:

World Weather Inc.

Thursday,

Sept. 30:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - USDA

quarterly stocks – corn, soy, wheat, barley, oat and sorghum, noon - U.S.

wheat production, noon - U.S.

agricultural prices paid, received, 3pm - Ivory

Coast farmgate cocoa prices to be announced - Malaysia

September palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

Canada

Friday,

Oct. 1:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

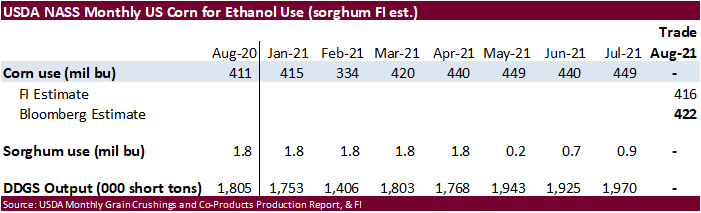

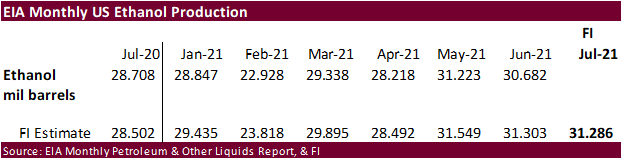

cocoa season in Ivory Coast starts - U.S.

DDGS production, corn for ethanol - USDA

soybean crush, 3pm - Australia

commodity index - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

China, Hong Kong

Source:

Bloomberg and FI

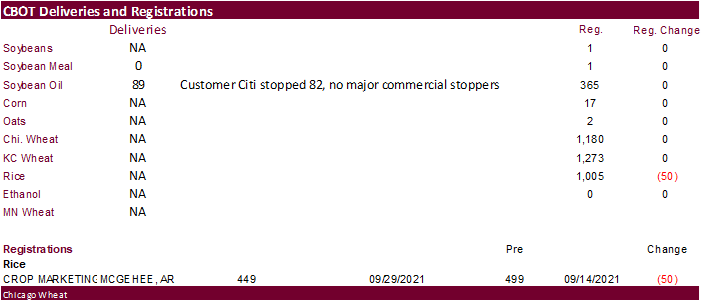

First

Notice Day Deliveries (Wed evening release)

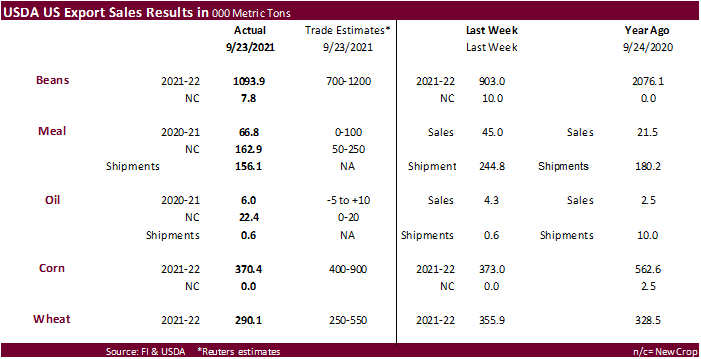

USDA

Export Sales

USDA

export sales for soybeans were above expectations at 1.094 million tons and included China for 776,500 tons (204,000 tons switched from unknown) and Egypt for 92,500 tons. Combined old and new-crop soybean meal sales were within expectations and shipments

of 156,100 tons were down from 244,800 previous week. Soybean oil sales for old crop improved to 6,000 tons and new-crop was much better than expected 22,400 tons. New-crop soybean oil sales included Guatemala (17,000 MT). Corn export sales were 370,400

tons, below expectations, near unchanged from the previous week, and included Guatemala(138,400 MT), Mexico (102,600 MT, including decreases of 5,900 MT). All-wheat sales were poor at 290,100 tons and low end of expectations.

Macros

US

Initial Jobless Claims Sep 25: 362K (est 330K; prev 351K)

US

Continuing Claims Sep 18: 2802K (est 2790K; prevR 2820K; prev 2845K)

US

GDP Annualized (Q/Q) Q2 T: 6.7% (est 6.6%; prev 6.6%)

US

Core PCE (Q/Q) Q2 T: 6.1% (est 6.1%; prev 6.1%)

US

Personal Consumption Q2 T: 12.0% (est 11.9%; prev 11.9%)

US

GDP Price Index Q2 T: 6.1% (est 6.1%; prev 6.1%)

US

Chicago PMI Sep: 64.7 (est 65.0; prev 66.8)

92

Counterparties Take $1604.881 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1415.840 Bln, 80 Bidders)

·

Month/quarter end. Corn was higher prior to the USDA reports, fell hard on a bearish stocks figure, and paired losses from higher wheat to close 2.25 cents lower in December. December 2022 closed 2.75 cents higher on spreading.

Corn export sales were poor, IMO.

·

Corn stocks were

·

We are hearing Tar Spot impacted many plots across central and northern Indiana into southern Michigan during the growing season. Some yields for irrigated yields were seen around 170 bu/ac and unirrigated around 220 bu/ac.

Guide to Tar Spot https://crop-protection-network.s3.amazonaws.com/publications/tar-spot-filename-2019-03-25-120313.pdf

·

China set the 2022 corn import quota at 7.2 million tons, unchanged from 2021 & 2020, but several agencies believe they will well surpass that level. We believe 60 percent of that amount will go to state-owned firms, same as 2021.

Export

developments.

-

None

reported

Updated

9/30/21

December

corn is seen in a $4.80-$5.45 range (down 15 cents)

March

corn is seen in a $5.00-$5.80 range. (unch)

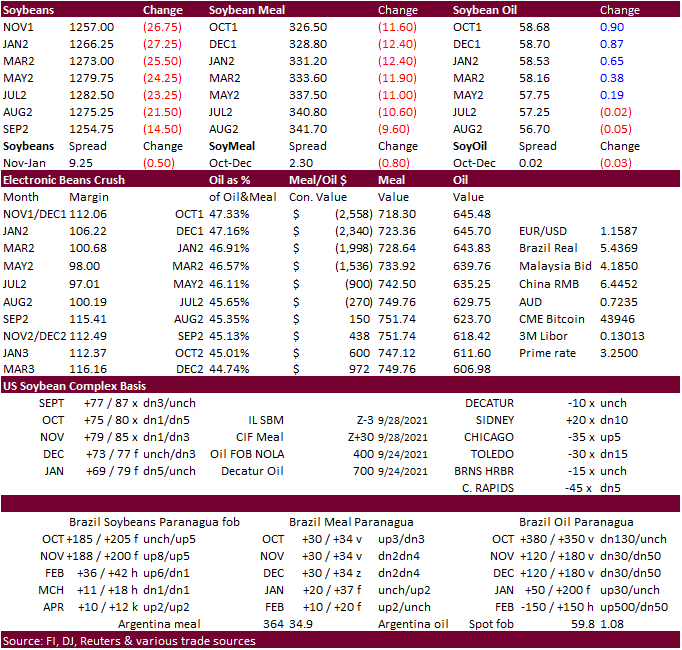

Soybeans

·

Soybeans traded higher pre-USDA report but ended sharply lower with November down 27.75 cents to 12.56/bu. December meal fell $12.50/short ton while soybean recovered to close 86 points higher basis the December position. USDA

soybean stocks and upward revision to 2020 soybean production were the two bearish factors for soybeans (recap above).

·

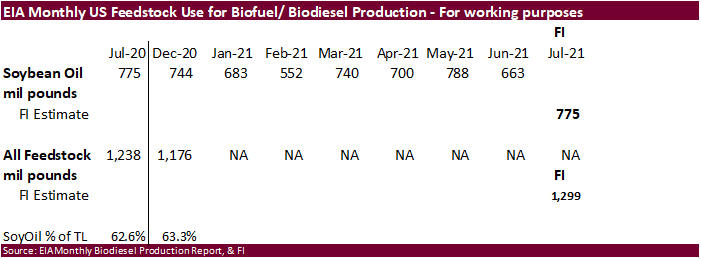

There was an article released Wednesday that the US Renewable Volume Obligations under the Renewable Fuel Standard won’t be set below recent levels.

·

US weather will turn drier after a light weekend event for the Corn Belt and temperatures will remain above normal over the next week to two weeks.

·

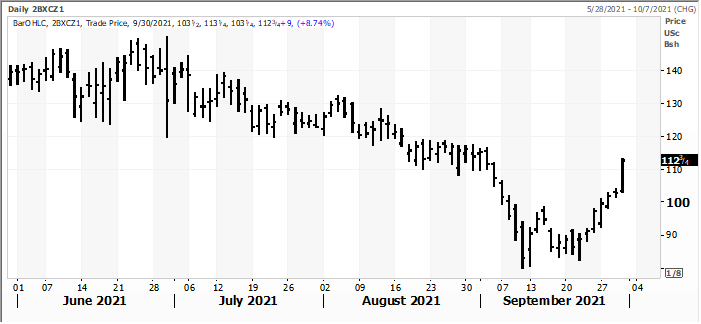

Over 12,000 crush traded today, heavy volume, with December’s high at 112.75 before last trade was posted at 111.50, slightly above its 50-day MA.

·

Third month rolling Malaysian palm oil futures hit an all-time record high of 4,598 before settling 140 higher at 4,595 ringgit. Cash palm rose $20/ton to $1,172.50/ton.

·

AmSpec reported Malaysian exports of Malaysian palm oil for September increased 33.6% to 1,628,168 tons from 1,219,166 tons during August.

·

Cargo surveyor ITS reported a 40 percent increase to 1.699 million tons from 1.2131 million during August.

·

China is on holiday October 1-8.

·

Coal shortages continue to hamper China industrial production, especially three northeastern provinces. Some warn the problem will persist throughout the fall quarter.

·

CNGOIC reported China’s soybean crush fell nearly 200,000 tons last week to 1.71 million tons. Year ago, it was near 2.2 million tons.

·

Canada was on holiday today.

Export

Developments

- None

reported

December

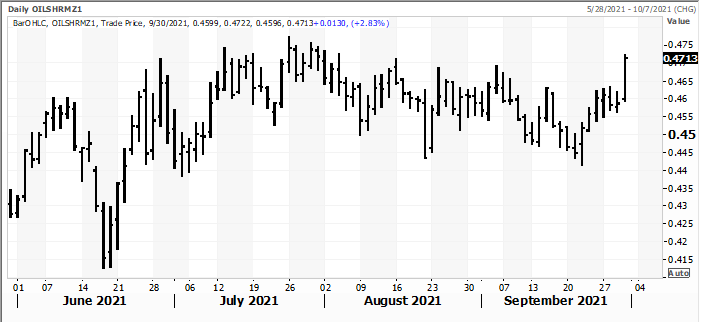

oil share

December

crush

Monthly,

Malaysian 3rd month rolling palm oil futures

Updated

9/30/21

Soybeans

– November $12.00-$13.50 range (down 15, unch), March $12.00-$14.00 (unch)

Soybean

meal – December $305-$360 (down $15, unch), March $300-$3.80 (unch)

Soybean

oil – December 54-62 cent range, March 54-64 (unchanged for both)

·

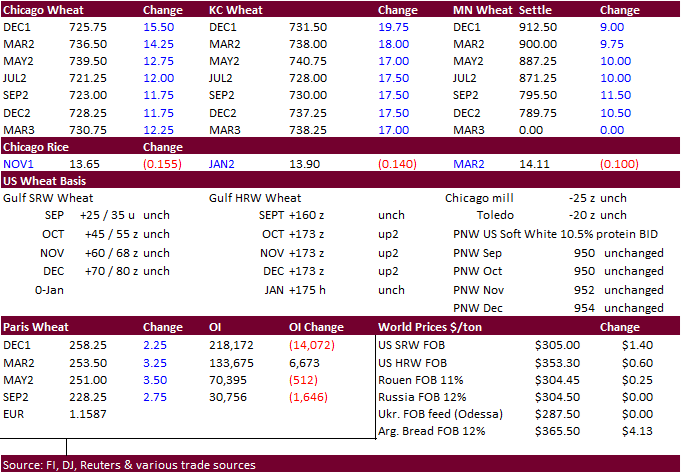

Wheat ended higher on a bullish USDA September 1 all-wheat stocks in large part to an unexpected decline in US winter wheat production to a 14-year low. Spring and durum production, updated by USDA, were in line with trade expectations.

We remain bullish wheat on good demand for high protein wheat. Look for US domestic end users to extend coverage over the next week in anticipation for prices to trend higher.

·

Wheat was higher pre-USDA report on steady global demand despite export sales coming in at the low end of expectations.

·

Lower US Great Plains saw as expected rain yesterday. The central and southern areas will see rain today through Sunday.

·

Paris December wheat was up 2.25 at 258.00 euros, but well-off contract highs (new contract high).

·

The European Commission on Thursday raised its estimate of usable production of common wheat in European Union’s 27 member countries in 2021-22 to 131.0 million tons from 127.2 million projected last month.

·

China set the 2022 wheat import quota at 9.636 million tons, unchanged from 2021 & 2020. We believe 90 percent of that amount will go to state-owned firms, same as 2021.

·

England’s wheat area for 2020 rose 31% in 2021 to 1.66 million hectares from 2020, an upward revision from 28% estimated last month, according to the AgMin. Rapeseed plantings in England were down 22% to 268,000 hectares.

·

Moldova’s wheat harvest was 1.551 million tons, highest since records began 30 years ago. The country’s largest agriculture contributors to GDP include sunflower seeds, corn, wheat, and grapes.

Export

Developments.

·

Tunisia seeks 125,000 tons of soft wheat and 100,000 tons of barley on Friday for shipment in November and December.

·

Jordan passed on 120,000 tons of feed barley. Export sales due out at the bottom of the hour.

·

Yesterday it was noted Pakistan’s lowest offer for 640,000 tons of wheat was $377.00/ton

for

shipment between January and February 2022.

·

Algeria ended up buying 580,000 tons of wheat this week, optional origin, at prices around $364/ton c&f for November 1-15 and November 16-30 shipment. They last paid about $353 to $356.60/ton back in late August.

·

Bangladesh plans to buy 100,000 tons of wheat from Russia in a government-to-government tender.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

Rice/Other

·

China set the 2022 rice import quota at 5.32 million tons, unchanged from 2021 & 2020.

·

China cotton import quotas for 2022 was set at 5.32 million tons.

·

Bangladesh seeks 50,000 tons of rice on October 4.

December

Chicago wheat is seen in a $7.00‐$7.75 range (up 20, up 25), March $6.50-$7.75 (unch)

December

KC wheat is seen in a $6.95‐$7.80 (up 20, up 20), March $6.75-$8.00 (up 25 for both)

December

MN wheat is seen in a $8.65‐$9.75 (up 25, up 25), March $8.50-$9.75 (unch)

U.S. EXPORT SALES FOR WEEK ENDING 09/23/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

149.3 |

1,567.8 |

1,633.2 |

153.9 |

2,691.5 |

3,658.2 |

0.0 |

0.0 |

|

SRW |

19.6 |

666.7 |

321.0 |

102.8 |

1,048.5 |

806.5 |

0.0 |

0.0 |

|

HRS |

51.5 |

988.5 |

1,709.8 |

43.8 |

1,988.9 |

2,345.7 |

0.0 |

0.0 |

|

WHITE |

74.8 |

582.0 |

1,304.5 |

68.3 |

1,419.0 |

1,679.0 |

0.0 |

0.0 |

|

DURUM |

-5.0 |

60.5 |

233.8 |

0.0 |

61.4 |

298.6 |

0.0 |

0.0 |

|

TOTAL |

290.1 |

3,865.5 |

5,202.3 |

368.9 |

7,209.3 |

8,787.9 |

0.0 |

0.0 |

|

BARLEY |

5.0 |

25.5 |

33.6 |

0.0 |

4.7 |

8.5 |

0.0 |

0.0 |

|

CORN |

370.4 |

23,794.1 |

21,879.2 |

676.2 |

1,522.0 |

2,743.0 |

0.0 |

333.2 |

|

SORGHUM |

78.8 |

2,235.7 |

2,567.6 |

112.5 |

115.6 |

235.1 |

0.0 |

0.0 |

|

SOYBEANS |

1,093.9 |

23,224.8 |

33,447.8 |

528.7 |

1,061.4 |

4,565.4 |

7.8 |

19.8 |

|

SOY MEAL |

66.8 |

1,001.3 |

520.2 |

156.1 |

11,346.5 |

11,602.0 |

162.9 |

2,528.1 |

|

SOY OIL |

6.0 |

22.4 |

68.7 |

0.6 |

675.2 |

1,219.0 |

22.4 |

30.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

11.5 |

185.5 |

358.2 |

1.8 |

175.1 |

54.5 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.0 |

27.0 |

0.0 |

1.2 |

2.0 |

0.0 |

0.0 |

|

L G BRN |

0.2 |

4.4 |

13.8 |

0.6 |

13.4 |

5.5 |

0.0 |

0.0 |

|

M&S BR |

12.1 |

54.3 |

15.1 |

0.1 |

13.9 |

18.2 |

0.0 |

0.0 |

|

L G MLD |

7.1 |

139.7 |

57.4 |

46.2 |

133.5 |

60.9 |

0.0 |

0.0 |

|

M S MLD |

44.1 |

68.4 |

75.9 |

6.0 |

66.6 |

63.0 |

0.0 |

0.0 |

|

TOTAL |

75.1 |

460.3 |

547.3 |

54.8 |

403.7 |

204.1 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

571.4 |

5,708.3 |

5,785.9 |

163.9 |

1,515.5 |

2,170.1 |

0.0 |

686.8 |

|

PIMA |

16.9 |

160.4 |

221.3 |

11.7 |

54.6 |

87.4 |

0.0 |

0.0 |

This

summary is based on reports from exporters for the period September 17-23, 2021.

Wheat: Net

sales of 290,100 metric tons (MT) for 2021/2022 were down 19 percent from the previous week and 30 percent from the prior 4-week average. Increases primarily for Japan (51,500 MT, including decreases of 5,700 MT), Taiwan (49,600 MT), Nigeria (44,700 MT, including

44,000 MT switched from unknown destinations), the Philippines (41,500 MT), and Colombia (41,300 MT, including decreases of 1,400 MT), were offset by reductions primarily for unknown destinations (66,400 MT). Exports of 368,900 MT were down 27 percent from

the previous week and 19 percent from the prior 4-week average. The destinations were primarily to China (71,400 MT), Nigeria (50,000 MT), Thailand (47,500 MT), Mexico (46,400 MT), and Venezuela (38,900 MT).

Corn:

Net sales of 370,400 MT for 2021/2022 primarily for Guatemala (138,400 MT), Mexico (102,600 MT, including decreases of 5,900 MT), Canada (87,600 MT, including decreases of 200 MT), Japan (77,400 MT, including 88,600 MT switched from unknown destinations and

decreases of 11,800 MT), and Costa Rica (33,000 MT, including 30,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (110,900 MT). Exports of 676,200 MT were primarily to Mexico (262,200 MT), China (140,400

MT), Japan (107,900 MT), Honduras (49,500 MT), and Costa Rica (30,900 MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 170,000 MT is for unknown destinations.

Barley:

Total net sales of 5,000 MT for 2021/2022 were for Japan. No exports were reported for the week.

Sorghum:

Net sales of 78,800 MT for 2021/2022 were reported for unknown destinations (65,000 MT), Mexico (11,300 MT), and China (2,500 MT, including decreases of 1,400 MT). Exports of 112,500 MT were to China (110,500 MT) and Mexico (2,000 MT).

Rice:

Net

sales of 75,100 MT for 2021/2022 were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for Japan (39,300 MT), Taiwan (12,000 MT), Guatemala (6,000 MT), El Salvador (5,400 MT), and Canada (3,900 MT). Exports

of 54,800 MT were up noticeably from the previous week and up 29 percent from the prior 4-week average. The destinations were primarily to Iraq (43,100 MT), Canada (2,900 MT), Mexico (2,800 MT), Jordan (2,600 MT), and Saudi Arabia (2,500 MT).

Soybeans:

Net sales of 1,093,900 MT for 2021/2022 primarily for China (776,500 MT, including 204,000 MT switched from unknown destinations), Egypt (92,500 MT), the Netherlands (86,300 MT, including 84,000 MT switched from unknown destinations), Turkey (55,000 MT), and

Mexico (43,400 MT), were offset by reductions for unknown destinations (131,400 MT). Total net sales of 7,800 MT for 2022/2023 were for Cuba. Exports of 528,700 MT were primarily to China (292,200 MT), the Netherlands (86,300 MT), Italy (39,200 MT), Mexico

(33,900 MT), and Spain (33,000 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 66,800 MT for 2020/2021 were up 48 percent from the previous week and 22 percent from the prior 4-week average. Increases primarily for the Philippines (47,300 MT), Spain (31,900 MT, including 30,000 MT switched from Italy), Canada (5,800 MT),

Costa Rica (4,900 MT), and Guyana (3,700 MT switched from unknown destinations), were offset by reductions primarily for Italy (30,000 MT).

For 2021/2022, net sales of 162,900 MT primarily for Guatemala (59,400 MT), the Dominican Republic (38,500 MT), Mexico (21,900 MT), Canada (15,000 MT), and Colombia (8,900 MT), were offset by reductions for Costa Rica (4,900 MT).

Exports of 156,100 MT were down 36 percent from the previous week, but up 17 percent from the prior 4-week average. The destinations were primarily to the Philippines (48,200 MT), Spain (31,900 MT), Mexico (25,800 MT), Colombia (17,500 MT), and Panama

(11,000 MT).

Soybean

Oil:

Net sales of 6,000 MT for 2020/2021 were up 39 percent from the previous week and up noticeably from the prior 4-week average. Increases were reported for Costa Rica (2,500 MT), Morocco (1,900 MT), the Dominican Republic (900 MT), Venezuela (500 MT), and

Canada (200 MT). Net sales for 2021/2022 of 22,400 MT were primarily for Guatemala (17,000 MT), the Dominican Republic (2,400 MT), and Canada (2,300 MT). Exports of 600 MT were up 6 percent from the previous week, but down 71 percent from the prior 4-week

average. The destinations were to Canada (500 MT) and Honduras (100 MT).

Cotton:

Net sales of 571,400 RB for 2021/2022 were up 65 percent from the previous week and 92 percent from the prior 4-week average. Increases primarily for China (418,600 RB), Turkey (39,600 RB, including decreases of 100 RB), Indonesia (33,400 RB), Mexico (16,400

RB), and Vietnam (15,400 RB, including 1,600 RB switched from China), were offset by reductions for Bangladesh (100 RB). Exports of 163,900 RB were down 7 percent from the previous week and 11 percent from the prior 4-week average. The destinations were

primarily to China (36,000 RB), Pakistan (34,000 RB), Mexico (23,100 RB), Turkey (16,000 RB), and Thailand (9,200 RB). Net sales of Pima totaling 16,900 RB were down 28 percent from the previous week, but up 13 percent from the prior 4-week average. Increases

were primarily for India (10,600 RB), Peru (2,500 RB), China (1,700 RB), Bangladesh (500 RB), and Turkey (400 RB). Exports of 11,700 RB were up noticeably from the previous week and up 99 percent from the prior 4-week average. The destinations were primarily

to China (5,600 RB), India (2,800 RB), Egypt (1,700 RB), Pakistan (800 RB), and Peru (700 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides

and Skins:

Net sales of 284,600 pieces for 2021 were down 22 percent from the previous week and 17 percent from the prior 4-week average. Increases primarily for China (186,300 whole cattle hides, including decreases of 19,500 pieces), Mexico (40,900 whole cattle hides,

including decreases of 3,300 pieces), South Korea (34,200 whole cattle hides, including decreases of 2,600 pieces), Thailand (17,200 whole cattle hides, including decreases of 800 pieces), and Taiwan (5,600 whole cattle hides, including decreases of 200 pieces),

were offset by reductions for Germany (200 pieces) and Japan (200 pieces). Exports of 213,600 pieces were down 38 percent from the previous week and 45 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (151,900 pieces),

South Korea (21,900 pieces), Thailand (11,300 pieces), Mexico (11,300 pieces), and Taiwan (6,900 pieces).

Net

sales of 130,600 wet blues for 2021 were down 9 percent from the previous week and 5 percent from the prior 4-week average. Increases were primarily for Italy (31,700 unsplit and 15,600 grain splits, including decreases of 400 unsplit), Thailand (28,500 unsplit,

including decreases of 300 unsplit), Vietnam (25,900 unsplit, including decreases of 100 unsplit), China (20,000 unsplit), and Mexico (8,600 grain splits, including decreases of 200 grain splits). Exports of 123,000 wet blues were

down

15 percent from the previous week and 12 percent from the prior 4-week average. The destinations were primarily to Italy (45,200 unsplit and 4,800 grain splits), Vietnam (30,400 unsplit), China (18,900 unsplit), Mexico (10,300 grain splits), and Thailand

(6,900 unsplit). Net sales of 139,700 splits were reported for China (137,600 pounds) and Taiwan (2,100 pounds). Exports of 376,600 pounds were primarily to China (212,600 pounds) and Vietnam (120,000 pounds).

Beef:

Net

sales of 16,100 MT reported for 2021 were up 2 percent from the previous week and 9 percent from the prior 4-week average. Increases primarily for Japan (5,500 MT, including decreases of 800 MT), South Korea (5,300 MT, including decreases 500 MT), China (2,800

MT, including decreases of 100 MT), Taiwan (1,100 MT, including decreases of 100 MT), and Mexico (700 MT), were offset by reductions for the Philippines (800 MT). Net sales of 1,000 MT for 2022 were primarily for Guatemala (500 MT), Mexico (200 MT), and Japan

(200 MT). Exports of 18,500 MT were up 2 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Japan (5,500 MT), South Korea (4,900 MT), China (3,500 MT), Taiwan (1,100 MT), and Mexico (1,000 MT).

Pork:

Net

sales of 42,500 MT reported for 2021 were up 31 percent from the previous week and 36 percent from the prior 4-week average. Increases were primarily for Mexico (20,400 MT, including decreases of 400 MT, 200 MT – late), China (14,000 MT, including decreases

of 500 MT), Japan (2,600 MT, including decreases of 300 MT), Colombia (1,400 MT, including decreases of 200 MT), and Nicaragua (900 MT). Total net sales of 100 MT for 2022 were for Australia. Exports of 30,300 MT were down 16 percent from the previous week,

but up 2 percent from the prior 4-week average. The destinations were primarily to Mexico (14,700 MT, including 200 MT – late), China (4,400 MT), Japan (3,600 MT), Canada (1,600 MT), and South Korea (1,600 MT).

Export

Adjustment: Accumulated

exports of pork to China were adjusted down 118 MT for week ending September 16th. This shipment was reported in error.

Late

Reporting: For

2021/2022, net sales and exports totaling

200 MT of pork were reported late for Mexico.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.