PDF Attached

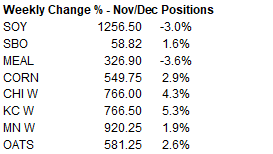

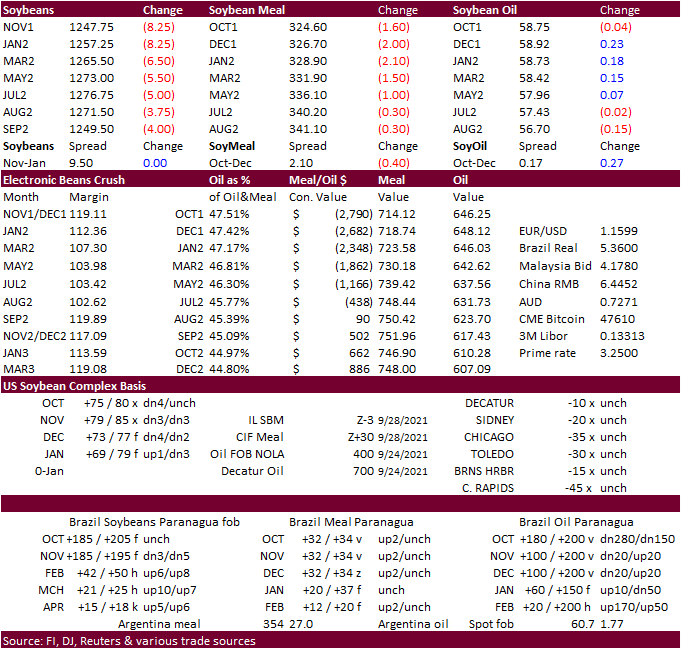

New month/new money. Lower trade in soybeans and meal. Higher trade in soybean oil. Corn was led higher by a surge in US wheat futures on follow through buying from a reduction in US 2021 production. USD was 21 points lower. There was talk China was pricing agriculture products today but no confirmation of buying materialized.

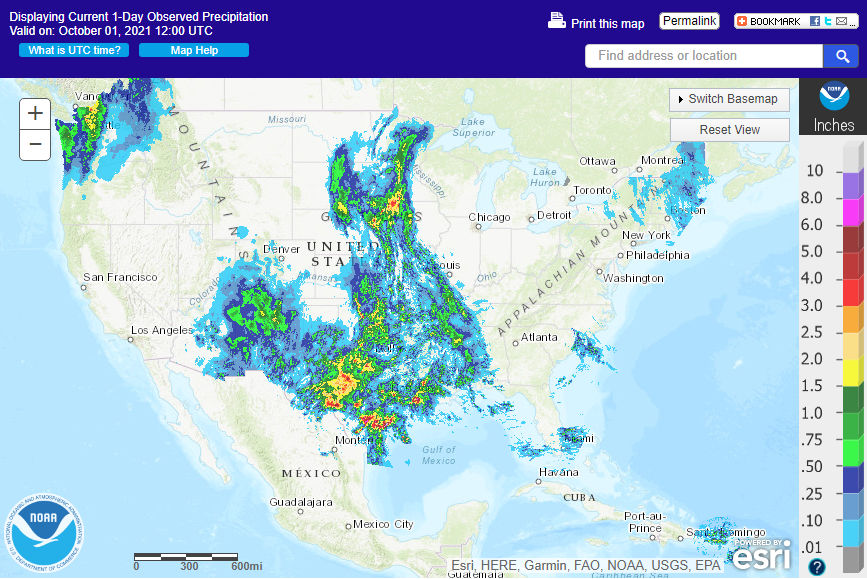

7-day

World Weather Inc.

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- U.S. hard red winter wheat precipitation will linger today as a last wave of rain moves across the region today and early Saturday

o This week’s rainfall has been a little disappointing in some counties in the west while other areas have benefited greatly

o A full week of warm, dry and windy conditions will evolve after today and Saturday’s event winds down

o More rain will be needed, but those areas getting significant moisture this week will see some aggressive fieldwork and quick seed germination

- Portions of the U.S. Northern Plains and a part of Canada’s Prairies may get some needed moisture a week from now, but until then precipitation will be minimal and temperatures still well above average

o Harvesting in Canada is nearly complete and progress in the northern Plains has advanced quite well

- U.S. Delta weather remains a little too wet and frequent showers will continue over the coming week keeping field progress slow or on hold

o Some crop quality concerns remain especially to cotton

- U.S. southeastern states are advertised a little wetter for Monday through Thursday of next week

o The moisture will slow crop maturation and harvest progress, but cause little to no serious impact on unharvested crops

- West Texas crop weather will improve this weekend and next week with dry, sunny and warmer weather evolving after this week’s showery and cooler biased conditions

o Cotton will benefit most from the change

- U.S. far west will be dry through mid-week next week, but may get some rain late in the week and into the following weekend as the region turns much cooler

o The moisture will be good for winter crop planting in the interior parts of the Pacific Northwest

- Interior southern Brazil will be too wet into Monday with waves of moderate to heavy rain expected

o Some follow up rainfall is expected later next week to perpetuate the wet conditions

o Areas from northern Rio Grande do Sul to Parana will be wettest with total rainfall of 3.00 to 7.00 inches possible by Thursday

o Some rain of significance already started overnight with some 1.00 to 2.00-inch totals noted through dawn today in southern Paraguay, northern Rio Grande do Sul, Santa Catarina and southern Parana

o Wheat and corn in the far south of Rio Grande do Sul will benefit most from the rain, although some of the moisture will be good for rice planting as well.

- Far southern rice areas in Rio Grande do Sul are not likely to get nearly as much rain as northern areas in the state

o Too much rain from northern Rio Grande do Sul to Parana may hurt unharvested wheat quality and warrant a little replanting of early full season corn.

- Center west and center south Brazil showers will increase during the late weekend and next week, but no general soaking of rain is expected

o Greater and more frequent rain will be needed

o Planting moisture will increase in pockets resulting in only localized improvements in planting for Mato Grosso, northern Mato Grosso do Sul, Goias, Sao Paulo and southwestern Minas Gerais

o Greater rain will fall in interior southern Brazil where fieldwork will be delayed for a while, but improved planting should occur after a short period of drying

- Brazil coffee areas will receive some rain Saturday through Tuesday and again Oct. 8-10 with sporadic showers expected at other times

o Some flowering is expected in the wetter areas from Parana to Sao Paulo and Rio de Janeiro, but rain elsewhere will be a little too light and sporadic for such conditions

- Greater rain will be needed to support widespread flowering especially in Sul de Minas, Zona de Mata and Cerrado Mineiro

- Argentina’s weather is not likely to bring much rain to the northwest or west-central parts of the nation during the next ten days which are still too dry for ideal spring planting or winter crop development

o Rain will fall periodically in the south and some eastern crop areas to maintain good crop conditions in those areas

- Tropical Storm Victor will remain over open water in the central Atlantic during the coming week

o The system was located 630 miles west southwest of Cabo Verde Islands at 0500 EDT today

- The system could briefly become a hurricane, but if it does it will just as quickly become a tropical storm once again as it moves northwesterly through the weekend and more northerly next week

- Category Four Hurricane Sam was producing 150 mph wind speeds out 70 miles from the center of the storm nearly 435 miles south southeast of Bermuda today

o The storm’s path is such that it should stay over open water in the Atlantic passing well to the east of Bermuda Saturday

o No major landmass will be impacted by the storm

o Weakening is expected this weekend and next week with a turn to the northeast expected

- Typhoon Mindulle was located 183 miles east southeast of Yokosuka, Japan at 35.0 north latitude, 144.1 east longitude moving northeasterly at nearly 30 mph and producing maximum sustained wind speeds of 86 mph near its center.

o Mindulle should turn continue to the northeast through the weekend and into early next week while steadily weakening

o If this path verifies, Japan should be spared from the storm’s intense wind and torrential rainfall, but it will need to be closely monitored

o The storm will slowly weaken and should be downgraded to tropical storm status as it passes to the southeast of Honshu, Japan today

- Tropical Cyclone Gulab was located 183 miles southwest of Karachi, Pakistan near 23.1 north, 63.9 east moving westerly at 11 mph and producing maximum sustained wind speeds of 58 mph out 90 miles from the center of the storm

o Gulab will move through the northwestern Arabian Sea and will pass to the north of Muscat, Oman before moving inland in the far northernmost tip of Oman and then across the United Arab Emirates Sunday into Monday

o Most of the storm’s wind and heavy rain will stay over water through Saturday, but it will produce wind speeds of more than 45 mph and heavy rainfall of more than 4.00 inches in northern parts of Oman where flooding will be possible Sunday into Monday

- A tropical disturbance is expected over the Philippines this weekend that may persist through mid-week next week producing heavy rain and flooding

o The system may develop into a tropical cyclone during mid- to late-week next week before moving across the South China Sea possibly impacting northern Vietnam after October 10.

- Another tropical cyclone may form in the Philippines Sea next week and it could become the next major tropical cyclone, but not for ten days and confidence is low on its position and intensity

- Beneficial rain fell in eastern Australia the past three days

o The moisture has been great in raising topsoil moisture for future sorghum and cotton planting in Queensland and far northern New South Wales, although more rain is still needed

o The moisture also helped improve reproductive conditions for parts of New South Wales wheat, barley and canola

- Australia rainfall over the coming week will be greatest in the south

o Western and southern Australia will also start receiving periods of rain today and this weekend and it will continue through next week, but on an infrequent basis

- Winter crops throughout the south will benefit from the shower activity

- India’s monsoon should begin to withdraw over the next couple of weeks beginning in the north this weekend and next week and in central areas during the following week

o The monsoon’s late withdrawal this year should bode well for winter crop planting, but summer crop maturation and harvesting are expected to be behind average

- China’s weather will be mixed over the next ten days with too much rain falling periodically north of the Yellow River and from Liaoning to southern Jilin

o The greatest rainfall is expected in the north starting this weekend and it will last well into next week

- Some rain will begin today and Friday, though

o The wetter areas in the north will experience delays in summer crop maturation and harvest progress, but the moisture will be good for wheat emergence and establishment later this season

- Planting delays are expected during the wetter periods

o East-central and southeastern China will experience a good mix of weather supporting crops and fieldwork

- Xinjiang China will be trending colder with harvest disruptions in the northeast because of frequent showers over the next several days

o Western and central crop areas in the province will receive rain briefly Saturday into Monday and then turn drier and colder with some frost possible, but no freeze

- Russia’s winter crop areas will be cool with limited shower activity for a while

o Warming is needed for improved wheat establishment, but next week’s forecast has removed the previous potential for warming

o Precipitation should be limited for about ten days, although it will not be completely dry

- Harvest progress for summer crops in the western CIS will advance around brief showers during the next ten days

- Europe weather will trend wetter in the western half of the continent over the next five to seven days resulting in some summer crop harvest delays

o The moisture will ease dryness in some areas and help improve planting and emergence moisture for winter crops

- France and Germany need the precipitation most, but too much rain may fall and fieldwork may be on hold for a while

o Eastern Europe will experience good field working conditions, although a few showers might disrupt progress infrequently

o Rain is still needed in the lower Danube River Basin and it may get some of that moisture in the second week of October

- North Africa rainfall is not likely to be significant over the next ten days, although a few showers are likely especially in Tunisia this weekend

- Central Africa rainfall will occur favorably over the next two weeks

o Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

- South Africa weather will trend wetter in the next couple of weeks and that should prove beneficial for future spring and summer crop planting and for reproducing winter crops.

o Some rain fell across central and eastern crop areas Thursday

- Indonesia and Malaysia rainfall is expected to be frequent and sufficient to support long term crop needs

o This is true for the Philippines as well as with a tropical cyclone possible next week threatening the archipelago

- Mexico precipitation will be greater than usual over the next few days week in most of the south and parts of the east followed by drier conditions next week

o The moisture will be good for late season crop development

o Dryness in the northeast part of the nation has already been eased by some rain this week and a little more is expected, but no in the lower Rio Grande Valley

- Today’s Southern Oscillation Index was +9.24 and will likely move slowly higher over the next few days

- New Zealand rainfall will be below average over South Island and near to above normal in North Island

Source: World Weather Inc.

Monday, Oct. 4:

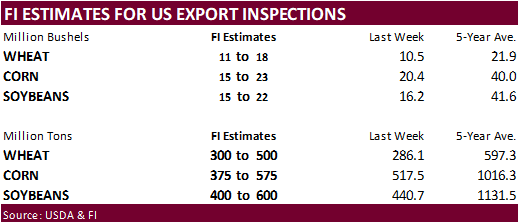

- USDA export inspections – corn, soybeans, wheat, 11am

- U.S. crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm

- Ivory Coast cocoa arrivals

- HOLIDAY: China

Tuesday, Oct. 5:

- EU weekly grain, oilseed import and export data

- Moscow Golden Autumn Agriculture conference (Oct. 5-8)

- Malaysia Oct. 1-5 palm oil exports

- U.S. Purdue Agriculture Sentiment, 9:30am

- New Zealand Commodity Price

- New Zealand global dairy trade auction

- HOLIDAY: China

Wednesday, Oct. 6:

- EIA weekly U.S. ethanol inventories, production

- Agricultural Technology and Food Salon, a virtual event organized by IFIC (Oct. 6-7)

- HOLIDAY: China

Thursday, Oct. 7:

- FAO Food Price Index & cereals supply/demand brief

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Brazil’s Conab report on yield, area and output of corn and soybeans

- Port of Rouen data on French grain exports

- HOLIDAY: China

Friday, Oct. 8:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China’s CNGOIC to publish supply-demand reports on corn, soybeans and other commodities

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

Selected Brazil exports

BRAZIL EXPORTS 2,855,263 T CORN IN SEPTEMBER VS 6,371,263 T YR AGO – GOVERNMENT

BRAZIL EXPORTS 4.83 MLN T SOYBEANS IN SEPTEMBER VS 4.26 MLN T YR AGO – GOVERNMENTBRAZIL EXPORTS 1,112,652 T PULP IN SEPTEMBER VS 1,186,789 T YR AGO – GOVERNMENT

BRAZIL EXPORTS 388,951 T POULTRY IN SEPTEMBER VS 319,519 T YR AGO – GOVERNMENT

BRAZIL EXPORTS 2.58 MLN T SUGAR IN SEPTEMBER VS 3.39 MLN T YR AGO – GOVERNMENT

BRAZIL EXPORTS 187,017 T BEEF IN SEPTEMBER VS 142,351 T YR AGO – GOVERNMENT

BRAZIL EXPORTS 33.68 MLN T IRON ORE IN SEPTEMBER VS 37.47 MLN T YR AGO – GOVERNMENT

BRAZIL EXPORTS 5.52 MLN T CRUDE OIL IN SEPTEMBER VS 5.03 MLN T YR AGO – GOVERNMENT

BRAZIL EXPORTS 169,588 T OF GREEN COFFEE IN SEPTEMBER VS 220,956 T YR AGO – GOVERNMENT

Commitment of Traders

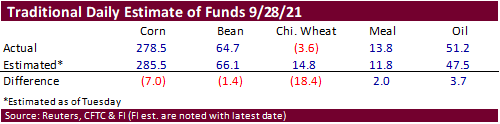

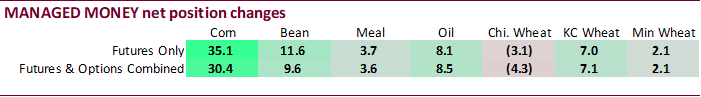

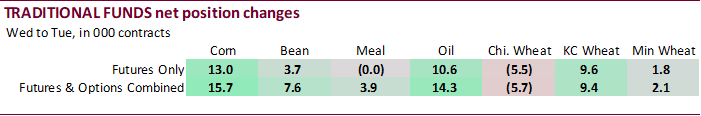

The traditional fund position for Chicago wheat ended up net short 3,600 contracts, rather than net long the trade expected, at a 18,400 difference (more short). Funds were more less long than expected in corn. For the soybean complex, the fund positions were near expectations. Index funds added a good amount of net longs to corn, soybean oil and KC wheat, while they sold Chicago wheat.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 170,126 10,911 380,475 1,912 -485,119 -22,335

Soybeans 9,180 4,616 173,128 3,452 -156,643 -8,220

Soyoil 26,396 12,057 115,676 1,838 -147,827 -16,731

CBOT wheat -37,069 -5,623 137,525 6,043 -93,334 -3,713

KCBT wheat 22,390 9,308 57,283 -4,790 -78,356 -3,165

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 244,741 30,392 227,577 -6,983 -459,488 -18,257

Soybeans 59,311 9,609 100,298 938 -131,442 -8,733

Soymeal -14,964 3,589 82,504 -317 -107,023 -1,123

Soyoil 47,490 8,510 98,821 -5,922 -154,030 -11,176

CBOT wheat -9,815 -4,324 91,132 5,766 -77,529 -3,401

KCBT wheat 46,127 7,093 33,251 -7,051 -71,399 -952

MGEX wheat 14,788 2,116 1,607 -440 -29,675 -2,137

———- ———- ———- ———- ———- ———-

Total wheat 51,100 4,885 125,990 -1,725 -178,603 -6,490

Live cattle 28,770 -5,934 86,925 -87 -128,085 4,183

Feeder cattle -2,370 -707 3,641 -18 1,765 274

Lean hogs 65,633 9,775 55,879 -857 -121,261 -4,209

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 52,651 -14,662 -65,482 9,511 1,824,772 -805

Soybeans -2,500 -1,967 -25,666 152 871,342 14,207

Soymeal 20,060 348 19,423 -2,498 397,196 -8,869

Soyoil 1,963 5,750 5,755 2,836 438,193 -7,751

CBOT wheat 3,335 -1,335 -7,123 3,294 430,091 -1,176

KCBT wheat -6,661 2,262 -1,317 -1,351 244,526 445

MGEX wheat 6,731 -59 6,551 519 79,382 1,931

———- ———- ———- ———- ———- ———-

Total wheat 3,405 868 -1,889 2,462 753,999 1,200

Live cattle 22,649 621 -10,259 1,216 350,683 1,900

Feeder cattle 253 -596 -3,289 1,045 48,107 -88

Lean hogs 14,803 -4,116 -15,054 -592 304,877 2,235

Source: CFTC, Reuters and FI

Macros

US Personal Income Aug: 0.2% (est 0.2%; prev 1.1%)

US Personal Spending Aug: 0.8% (est 0.7%; prevR -0.1%; prev 0.3%)

US Real Personal Spending Aug: 0.4% (est 0.4%; prevR -0.5%; prev -0.1%)

US PCE Core Deflator (Y/Y) Aug: 3.6% (est 3.5%; prev 3.6%)

US PCE Core Deflator (M/M) Aug: 0.3% (est 0.2%; prev 0.3%)

US PCE Deflator (Y/Y) Aug: 4.3% (est 4.2%; prev 4.2%)

US PCE Deflator (M/M) Aug: 0.4% (est 0.3%; prev 0.4%)

Canadian GDP (M/M) Jul: -0.1% (est -0.2%; prev 0.7%)

Canadian GDP (Y/Y) Jul: 4.7% (est 5.0%; prev 8.0%)

Canadian MLI Leading Indicator (M/M) Aug: 0.3% (prevR 0.9%; prev 1.0%)

ISM Manufacturing PMI Sep: 61.1 (est 59.5; prev 59.9)

US Construction Spending (M/M) Aug: 0.0% (est 0.3%; prev 0.3%)

Michigan Consumer Sentiment Sep F: 72.8 (est 71.0; prev 71.0)

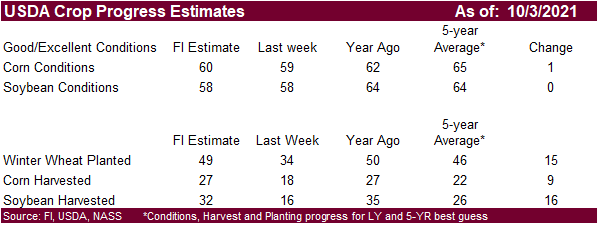

· Corn started the day up sharply but gave up gains within the first 45 minutes of the day session. Prices recovered to close 4.75 to 9.25 cents higher with emphasis on bear spreading. Strength in wheat futures lent support.

· Harvest delays of the Ukraine corn crop was noted supportive for corn by European traders.

· France is only 2% complete for their corn harvest progress, well below 31% at this time last year.

· There were no corn tender announcements overnight.

· We are hearing Tar Spot impacted many plots across central and northern Indiana into southern Michigan during the growing season. Some yields for irrigated yields were seen around 170 bu/ac and unirrigated around 220 bu/ac. Guide to Tar Spot https://crop-protection-network.s3.amazonaws.com/publications/tar-spot-filename-2019-03-25-120313.pdf

Export developments.

- None reported

Updated 9/30/21

December corn is seen in a $4.80-$5.45 range

March corn is seen in a $5.00-$5.80 range.

· Soybeans saw follow through selling. Soybean meal started higher but turned lower on renewed oil/meal spreading. European November rapeseed traded 5.50 euros higher to 644.25, just shy of its contract record.

· There was talk China was pricing agriculture products today but no confirmation of buying materialized. On Monday the US trade representative will unveil the Biden Administration US-China trade strategy. A Reuters article noted U.S. exports through August are running at about 62% of the Phase 1 targets.

· CBOT crush is higher this morning at 114 cents basis December.

· Soybean oil traded higher. December traded in a 100-point range during the 3 min. of trade.

· StoneX estimated the new-crop Brazil soybean crop at 144.26 million tons, up from previous 143.33 million.

· Soybean oil started lower on profit taking but turned higher on speculation the US will soon release biofuel mandates favoring biodiesel/renewable fuel producers.

· European gas oil hit a record on Friday.

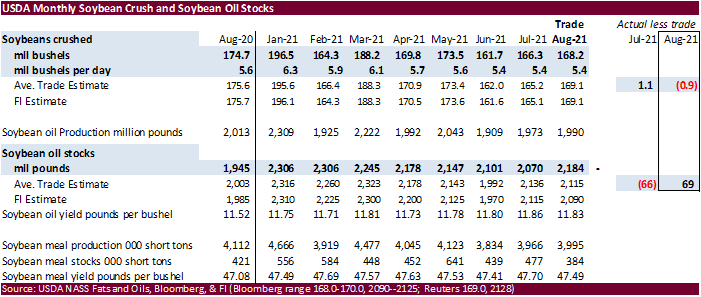

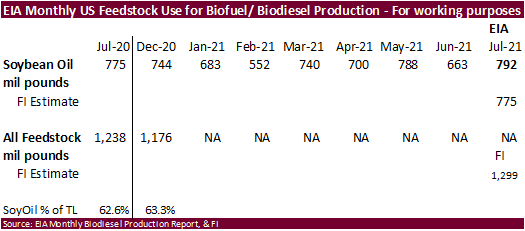

· US soybean oil for biofuel production improved for the month of July to 792 million pounds from 663 million during June, and up from 775 million during July 2020. With two months of data left for SBO for biofuel for the Oct-Sep crop year, we are using 8.750 billion pounds, 50 less than USDA’s estimate.

· Third month rolling Malaysian palm oil futures traded off an all-time record high established Thursday by trading 90 lower at 4,505 ringgit. Cash palm declined $20/ton to $1,152.50/ton.

· Cargo surveyor SGS reported September Malaysian palm exports at 1,705,713 tons, 514,660 tons above the same period a month ago or up 43.2%, and 100,984 tons above the same period a year ago or up 6.3%.

· China is on holiday October 1-7.

· China cash crush margins were last 176 cents/bu on our analysis (176 previous) versus 159 cents late last week and 90 cents around a year ago.

Export Developments

- None reported

Updated 9/30/21

Soybeans – November $12.00-$13.50 range, March $12.00-$14.00

Soybean meal – December $305-$360, March $300-$3.80

Soybean oil – December 54-62 cent range, March 54-64

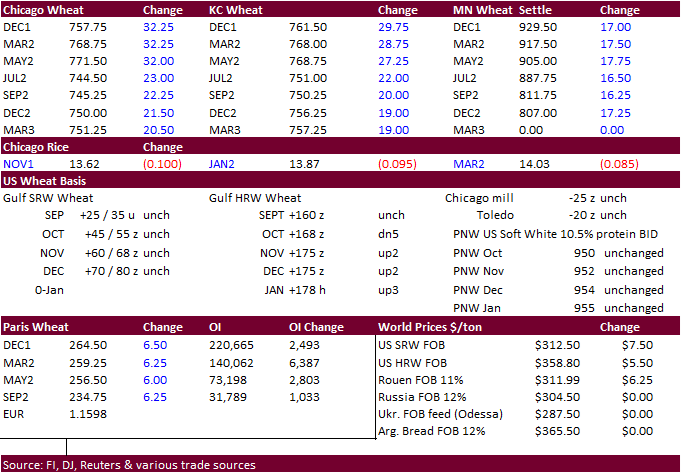

· Paris December wheat was up 6.50 at 264.25 euros, a new contract high.

· The USD was 21 points lower as of 1:15 pm CT.

· The US central and southern areas of the Great Plains will see rain today through Saturday.

· Ukraine harvested 46.99 million tons of grain from 67.3% of its planted area with the yield averaging 4.38 tons per hectare (AgMin), including 32.2 million tons of wheat, 9.6 million tons of barley, and 1.9 million tons of corn.

· Ukraine exported 14.36 million tons of grain so far in the 2021-22 July-June season versus 12.15 million at the same point a year earlier, including 8.94 million tons of wheat, 3.78 million tons of barley and 1.43 million tons of corn. Production may end up near a record 80.6 million tons, up from 65 million tons in 2020.

· Russian wheat export duty is expected to increase to $57.8/ton as of Oct 6 (AgMin) from the current $53.5, which has applied since September 29.

· The European Commission on Thursday raised its estimate of usable production of common wheat in European Union’s 27 member countries in 2021-22 to 131.0 million tons from 127.2 million projected last month.

Export Developments.

· Earlier this week Pakistan ended up buying as expected 550,000 tons of wheat at $377.00/ton c&f for January and February shipment.

· Tunisia bought 100,000 tons of soft wheat and 50,000 tons of animal feed barley for shipment in November and December. Details were lacking.

· Turkey seeks 310,000 tons of feed barley, on Oct. 8.

· Bangladesh plans to buy 100,000 tons of wheat from Russia in a government-to-government tender.

· The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

Rice/Other

· Bangladesh seeks 50,000 tons of rice on October 4.

December Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December MN wheat is seen in a $8.65‐$9.75, March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.