PDF attached

7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Rain

was removed from Canada’s Prairies Outlook by the 06z GFS model run today for the early to middle part of next week after the 00z model run reduced it;

o

The 06z run was too dry

o

Rain is still expected in southeastern Manitoba this weekend and again during the middle part of next week

- The

impact will be low since harvesting is mostly complete, but rain is needed prior to frost getting into the ground so that the soil has at least some moisture for use next spring - Today’s

06z GFS model run was much too cold for the second week of the outlook in the central and eastern United States – frost and freezes will not be widespread as suggested - Northern

U.S. Plains and Minnesota are still expecting significant rain Friday and Saturday and again during the middle part of next week

o

Fieldwork will be disrupted, but the precipitation will be good in restoring favorable topsoil moisture

o

Rain is needed most in the western Dakotas and Montana

o

Some excessive rain is possible in the eastern Dakotas and western Minnesota, although confidence is low and the situation will be closely monitored

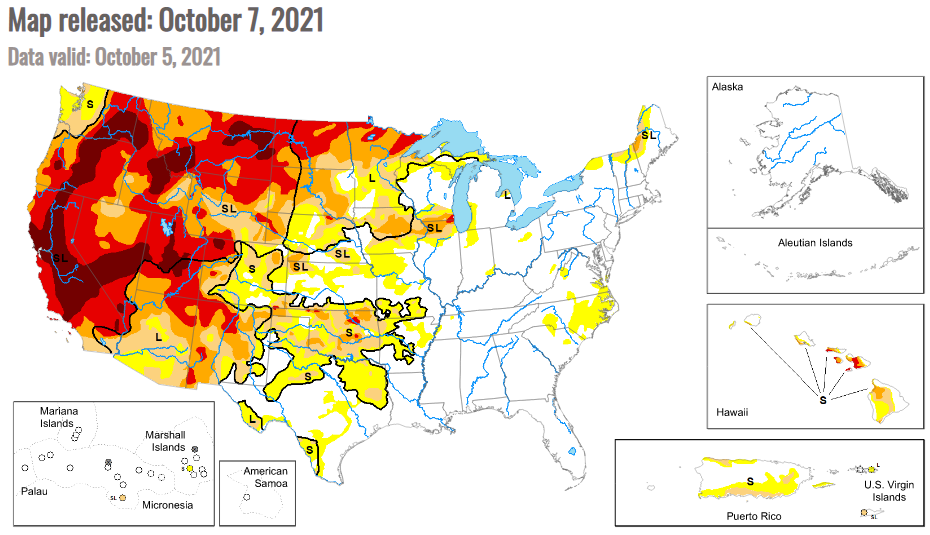

- Drought

remains a serious concern from the northwestern U.S. Plains through the heart of Canada’s Prairies and rain expected in this coming week to ten days will only offer a temporary reprieve to some of the driest areas; much more rain will be needed - West

Texas is expected to heat up over the next few days with extreme highs in the 90s Fahrenheit which should be ideal in speeding along summer crop maturation and some grain harvesting

o

Cooling is expected late in the weekend and especially next week with a few showers possible

- Heavy

rain is advertised to occur from occur in the southwestern U.S. Corn Belt into Wisconsin and Illinois, mostly during the early to middle part of next week

o

Some of this event was likely overdone

- U.S.

rainfall Wednesday and overnight was greatest from the southeastern states into the lower eastern Midwest where a little too much rain fell in pockets impacting harvest progress - U.S.

temperatures Wednesday continued unseasonably warm to hot in the northern Plains where highs reached into the 80s and lower 90s Fahrenheit

o

Normal temperatures at this time of year are in the 50s and 60s with lows in the 30s and 40s

- Cooling

will impact the north-central and western United States starting this weekend and extending through the second weekend of the forecast with temperatures falling from the 80s and lower 90s in the northern Plains and 70s and 80s in Canada’s Prairies down to

the 40s and 50s in Canada and the 50s and 60s in the northern Plains

o

Freezing nighttime temperatures will occur in many of these areas during the second half of next week after the second storm passes

- Brazil

precipitation Wednesday occurred in many areas; including southern Mato Grosso do Sul, Parana, southeastern Paraguay and areas northeast into southern Minas Gerais

o

Some coffee areas in Sul de Minas received enough rain for a little more flowering

o

Temperatures continued very warm to hot from northeastern through center west crop areas

- Most

of Brazil’s agricultural areas except the far northeast will get rain over the next two weeks

o

Amounts will be erratic and often light in parts of center west and center south production areas, but enough should occur to support a boost in planting, seed germination and plant emergence over time

o

Greater rain would be best for the most aggressive planting and establishment, but that is not likely to occur for a while

- The

best rainfall in the near-term part of the outlook will be from southern Minas Gerais to southern Mato Grosso do Sul, Parana and Paraguay this weekend into Monday and again at the end of next week and into the second weekend of the two week outlook - Center

west and northern parts of center south crop areas will get their greatest rain during the second week of the forecast - Argentina

will continue to get a poor distribution of rainfall during the coming week resulting in ongoing concern over dryness in west-central and northwestern parts of the nation

o

Today’s 06z model run offered greater rainfall to west-central dry areas during the middle part of next week, but the precipitation was likely overdone

o

Showers will occur in many areas, but only a few will get enough for a notable boost in soil moisture

o

Some of the drier areas will continue to experience slow winter crop development and a poor environment for early corn and sunseed germination and emergence

- Early

season planting of corn and sunseed will advance swiftly in the wetter areas of the east and south, but poorly in the north and west-central crop areas - Southeast

Canada crop areas will see a mix of precipitation and sunshine over the next two weeks with the drier days more numerous than the wet ones

o

Harvest progress should advance well around the precipitation

- Too

much rain has been falling near and north of China’s Yellow River Basin recently and it will continue into the weekend, but after that the region will begin drying down

o

Additional rainfall of 0.25 to 0.75 inch with a few totals of 1.00 to 3.00 inches is expected with southern Liaoning and far southwestern Jilin wettest

- Delays

in winter crop planting are expected, but the moisture will see to it that winter crops are well established later this autumn as long as warm weather prevails after the crop gets sown - Planting

will slowly increase after a few days of drying next week - Some

concern over unharvested summer crop quality is expected especially for cotton, but the weather will improve after mid-week next week

o

Drier weather will evolve next week

- Western

Australia will be dry biased over the next ten days except near the southwest coast.

- Eastern

Australia rainfall this weekend and early next week will be good for reproducing and filling winter crops in New South Wales and for future planting of spring and summer crops in both New South Wales and Queensland

o

Some follow up moisture will be possible in the second weekend of the two week outlook

- Colombia

and western Venezuela may receive frequent rainfall in the next ten days impacting coffee, cocoa, sugarcane, rice, corn and many other production areas

o

Most of the precipitation will not be excessive

- India’s

monsoon is withdrawing from the north where dry weather is expected over the next couple of weeks

o

Rain will fall in southern parts of the nation during the next ten days supporting late season crops in the south

- Some

of the rain will be heavy from Maharashtra to Telangana, Andhra Pradesh and southern Odisha

o

Drying in the north will be good for crop maturation and harvest progress

- Too

much rain too late in the season this year hurt the quality of early maturing cotton and a few other crops in the north

- Punjab,

Haryana, and a few Rajasthan crops were most impacted by the wetter bias

o

Drying in Gujarat will be good for crops

- Late

season rainfall has been ideal for supporting crop production after planting got delayed in early summer by late arriving monsoonal rainfall - Southeast

Asia rainfall has been and will continue to be well distributed for rice, sugarcane, oil palm, coffee, cocoa, corn and a huge range of other crops

o

Rainfall continues a little more erratic than usual in Sumatra and Java where there is need for greater rain, but the situation is not critical

- Tropical

Depression 22 evolved in the south China Sea west of the Philippines Wednesday

o

The system will be closely monitored for possible impact on Vietnam and/or southern China during the weekend and early part of next week

o

Rain will continue abundantly in parts of the Philippines for another day as the storm evolves and pulls away from the nation, but no damaging wind or serious flooding is expected

- Another

tropical cyclone will form east of the Philippines late this week

o

Movement will be to the northwest initially and then to the north or northeast

- This

storm system could become a large tropical cyclone and it should be closely monitored once it evolves

- Landfall

would not likely occur prior to mid-week next week - The

system may threaten Taiwan, southeastern China, South Korea and western Japan and it needs to be closely monitored - A

tropical disturbance is also possible in the Bay of Bengal late next week and a close watch on the system is needed for possible impact on eastern in the following weekend - Russia,

Ukraine, the Baltic States and Kazakhstan will continue dry biased through the weekend with temperatures close to normal

o

The environment will be good for establishing winter crops and for additional harvesting of summer crops

o

Warming would be better for late season winter crop establishment

o

Some rain will move through Ukraine to interior western Russia next week, but only light amounts of moisture will result

- Europe

rain into the weekend will occur mostly in south-central and southeastern parts of the continent, although some showers will occur briefly in Germany and immediate neighboring areas - Southern

Europe is getting some relief from recent dryness with Italy and the western Balkan countries most impacted by rain recently

o

Additional relief is expected into the weekend, but there will still be some need for additional moisture

- South

Africa rainfall in recent days has been good for improving topsoil moisture for spring planting and winter crop development, although more moisture is needed

o

Additional showers of light intensity will occur later this workweek while dry conditions occur prior to and after that period of time

- Central

Africa rainfall will continue periodic and timely for coffee, cocoa, sugarcane, cotton and rice through the next two weeks - North

Africa showers will be limited to Tunisia and far northeastern Algeria late this weekend into early next week with rainfall of 0.05 to 0.35 inch resulting

o

Dry weather will continue farther to the west

- Mexico

weather will include erratic rainfall during the next week with some potential for tropical cyclone to impact west-central parts of the nation next week, although confidence is low - Central

America weather will see an erratic rainfall distribution for a while with most areas getting at least some rain periodically

o

Rain amounts will be lighter than usual except in Costa Rica and Panama where near normal amounts are expected

- Near

to above average precipitation will also impact Colombia, Peru and Venezuela over the next ten days - New

Zealand weather is expected to be well mixed over the next ten days with seasonable temperatures and precipitation - Southern

Oscillation Index was +10.72 this morning and the index will move erratically higher over the coming week - Xinjiang

China will be quite cool with showers in the northeast through today

o

Warming is expected Friday into the weekend with some improved crop harvest conditions resulting

Bloomberg

Ag Calendar

Thursday,

Oct. 7:

- FAO

Food Price Index & cereals supply/demand brief - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Brazil’s

Conab report on yield, area and output of corn and soybeans - Port

of Rouen data on French grain exports - HOLIDAY:

China

Friday,

Oct. 8:

- Labor

Department’s September jobs report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish supply-demand reports on corn, soybeans, and other commodities - FranceAgriMer

weekly update on crop conditions

Monday

- U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm

Tuesday

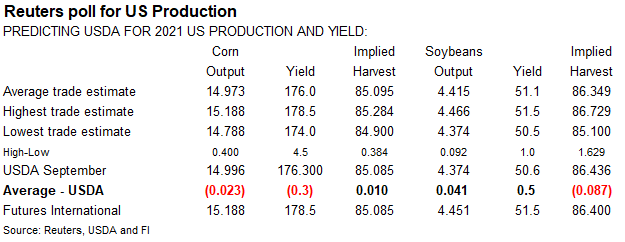

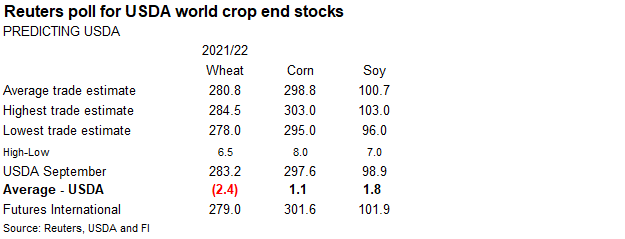

- USDA

S&D’s, Crop production

Source:

Bloomberg and FI

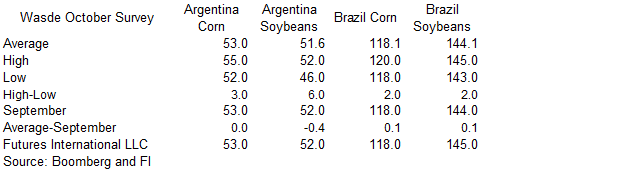

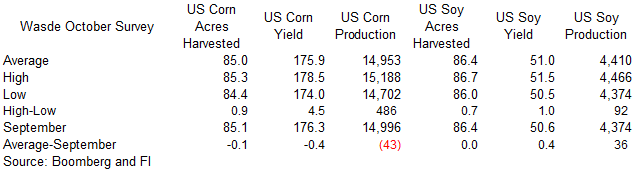

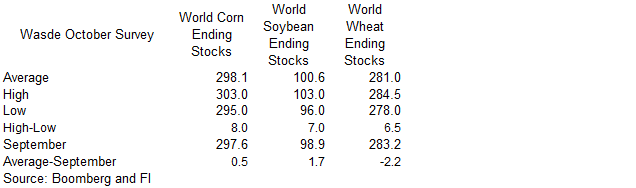

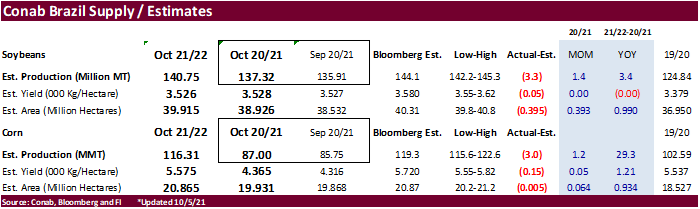

Conab

Brazil estimates: Note old crop was upward revised from September

USDA

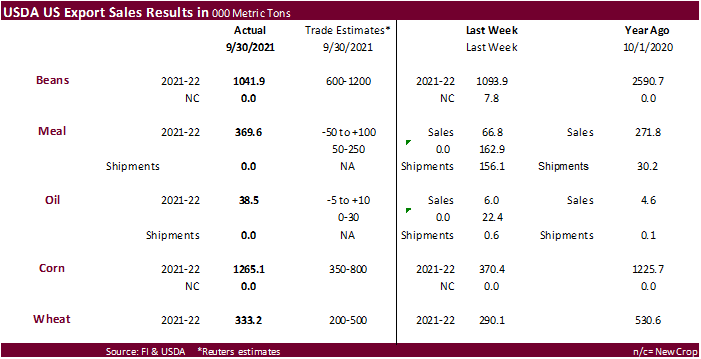

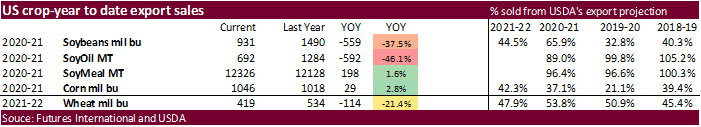

export Sales

USDA

export sales for soybeans of 1.042 million tons were within expectations. China booked 671,300 tons but included 131,000 tons switched from unknown. Soybean meal sales were above an average trade estimate at 369,600 tons and soybean oil was a large 38,500

tons, supportive for SBO futures. Corn export sales were well above expectations at 1.265 million tons and this should be friendly for futures. Mexico booked 801,400 tons. All-wheat sales increased to 333,200 tons and were within expectations.

*soybeans

are 2021-22, not 2020-21 as above

Macros

76

Counterparties Take $1.376 Tln At Fed’s Fixed-Rate Reverse Repo (prev $1.451 Tln 83 Bidders)

US

Initial Jobless Claims Oct 2: 326K (est 348K; prevR 364K; prev 362K)

US

Continuing Claims Sep 25: 2714K (est 2762K; prevR 2811K; prev

US

EIA Natural Gas Storage Change (BCF) Oct 1: +118 (est +105; prev +88)

–

Salt Dome Cavern NatGas Stocks (BCF): +20 (prev +11)

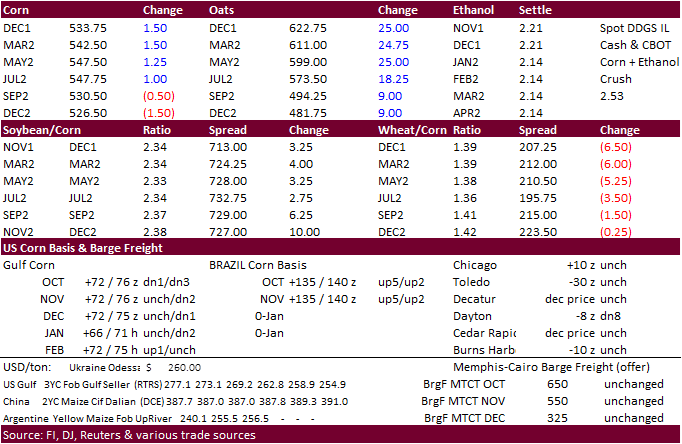

Corn

·

Corn ended higher after a two-sided. Earlier there was talk of improving US domestic demand. Inflation jitters were also noted. Energies were volatile and they finished higher after trading lower earlier this morning. The

oats market made a new lifetime high. For the corn market, many ethanol plants are coming back online from maintenance. Yesterday’s US ethanol production number was supportive for corn.

·

The US WCB could see heavy rains next week delaying harvesting.

·

Conab reported their initial 2021-22 projection for Brazil corn production at 116.3 million tons, 3.0 million below a Bloomberg trade guess and 29.3 million above 2020-21 (2020-21 revised 1.2 million higher from September).

·

The weekly USDA Broiler Report showed eggs set in the US up 2 percent and chicks placed down 1 percent. Cumulative placements from the week ending January 9, 2021 through October 2, 2021 for the United States were 7.27 billion.

Cumulative placements were up slightly from the same period a year earlier.

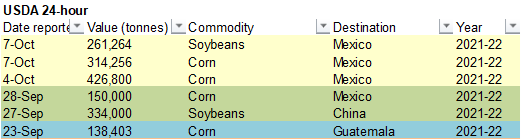

Export

developments.

-

USDA

under the 24-hour announcement system announced 314,256 tons of corn sold to Mexico for 2021-22 delivery.

-

Turkey

seeks 325,000 tons of feed corn on October 14 for November 14 through December 6 shipment.

Updated

10/4/21

December

corn is seen in a $4.85-$5.65 range

March

corn is seen in a $5.00-$5.80 range.

·

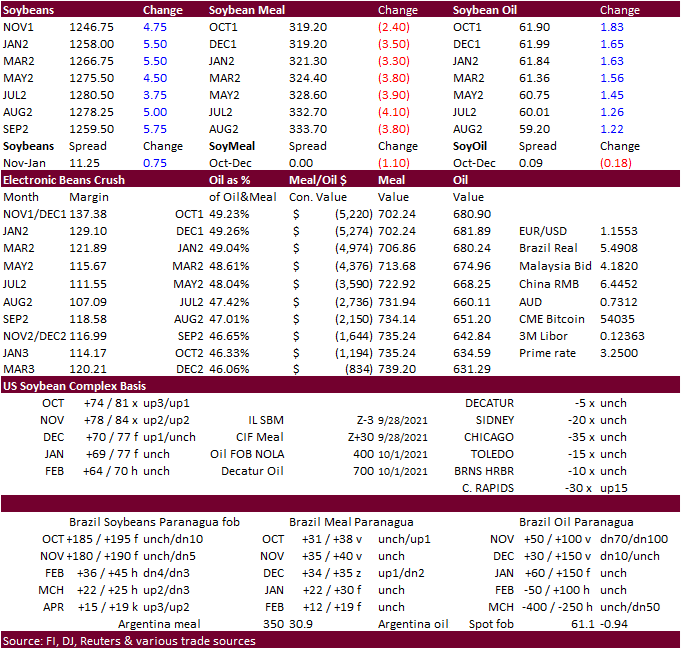

Higher trade in the soybean complex to start turned into a choppy two sided trade, with soybean oil gaining 131-183 points at the close. Soybean oil saw an outside day higher. December SBO traded lower on sell stops but that

led to an opportunity for new longs to take advantage of the dip. Meal finished lower and soybeans were supported by the rally in SBO. USDA export sales were good for the complex but note there were no soybean oil and meal shipments.

·

The Midwest will see rain on and off through the end of the week, favoring late summer crop development.

·

Conab reported their initial 2021-22 projection for Brazil soybean production at 140.75 million tons, 3.3 million below a Bloomberg trade guess and 3.4 million above 2020-21 (2020-21 revised 1.4 million higher from September).

·

Brazil will see rain during the balance of the week and Argentina will remain mostly dry.

·

Argentina’s markets are closed Friday and Monday for local holidays.

·

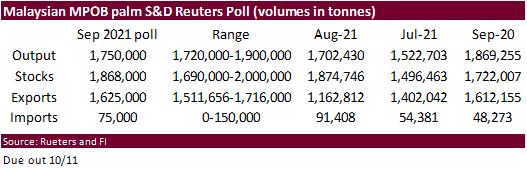

Malaysian palm futures snapped a 3-day winning streak by settling 23 MYR lower at 4,843 and cash was down $10.00/ton to $1,237.50/ton.

·

November Paris rapeseed futures ended up 4 at 676.25 euros.

·

We are heard some EU soybean (not rapeseed) crushing plants are struggling with production due to the surge in energy prices over the past week.

Export

Developments

-

USDA

under the 24-hour announcement system announced 261,264 tons of soybeans sold to Mexico for 2021-22 delivery.

Updated

10/05/21

Soybeans

– November $12.00-$13.50 range, March $12.00-$14.00

Soybean

meal – December $305-$360, March $300-$3.80

Soybean

oil – December 60-67 cent range, March 58-67.50

·

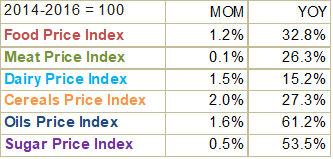

World food prices (FAO) averaged 130.0 points for September, up about 32 percent from a year earlier and highest since September 2011, up from 128.5 for August.

·

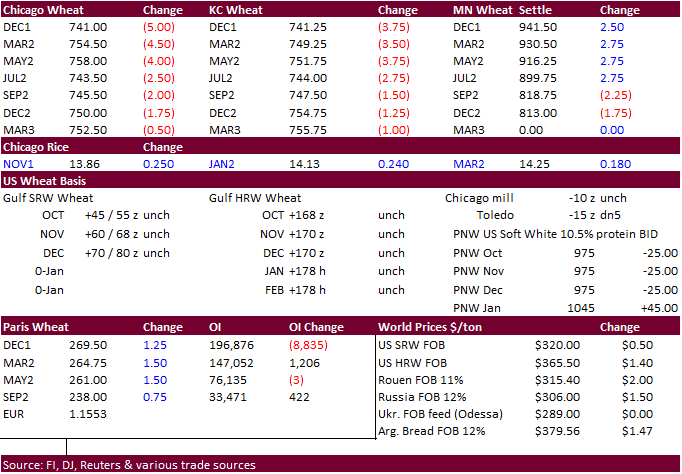

December Paris milling wheat settled up 1.00 euro, or 0.4%, at 269.25 euros ($311.15) a ton.

FOA

Index (tables/charts attached)

Export

Developments.

·

The Philippines seeks 224,000 tons of feed wheat for shipment between December 2021 and March 2022.

·

Tunisia bought 100,000 tons of durum wheat at $677.29 and $680.67/ton for November 1-December 20 shipment.

·

Taiwan bought 48,000 tons of milling wheat from the United States for shipment from the PNW between Nov. 25 and Dec. 9. It included 27,170 tons of U.S. dark northern spring wheat with 14.5% protein content at $404.47 a ton, 14,460

tons hard red winter wheat with 12.5% protein at $367.83 a ton FOB, and 6,370 tons of soft white wheat with 11% protein at $393.15 a ton FOB.

·

Jordan saw three offers for 120,000 tons of barley .

·

Jordan issued a new import tender for 120,000 tons of wheat set to close October 13.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

·

Turkey seeks 310,000 tons of feed barley, on Oct. 8.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 13 for arrival by February 24.

·

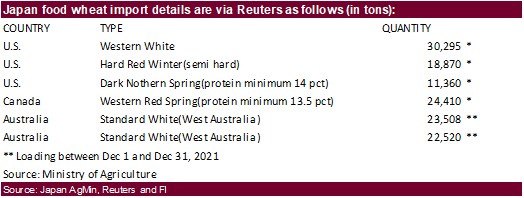

Japan seeks 130,963 tons of food wheat from the US, Canada, and Australia for December loading.

·

Pakistan seeks 90,000 tons of optional origin wheat on October 13. They already bought 550k and 575k since September 23.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

·

China To Sell Cotton From State Reserves From October 8

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.44m bales, 264,000 bales below USDA’s previous est., according to the avg in a Bloomberg survey of 11 analysts.

·

Estimates range from 3.16m to 3.75m bales

·

Global ending stocks seen 181,000 bales lower at 86.5m bales

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $8.65‐$9.75, March $8.50-$9.75

U.S. EXPORT SALES FOR WEEK ENDING 09/30/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

WHEAT |

THOUSAND METRIC TONS |

|||||||

|

HRW |

97.8 |

1,517.9 |

1,512.5 |

147.7 |

2,839.2 |

3,874.7 |

0.0 |

0.0 |

|

SRW |

50.3 |

672.1 |

314.3 |

44.9 |

1,093.3 |

849.5 |

0.0 |

0.0 |

|

HRS |

107.1 |

851.9 |

1,667.4 |

243.7 |

2,232.7 |

2,602.7 |

0.0 |

0.0 |

|

WHITE |

78.0 |

552.8 |

1,315.8 |

107.1 |

1,526.1 |

1,842.2 |

0.0 |

0.0 |

|

DURUM |

0.0 |

60.5 |

220.3 |

0.0 |

61.4 |

321.6 |

0.0 |

0.0 |

|

TOTAL |

333.2 |

3,655.3 |

5,030.1 |

543.4 |

7,752.7 |

9,490.7 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

24.5 |

33.3 |

1.0 |

5.7 |

8.7 |

0.0 |

0.0 |

|

CORN |

1,265.1 |

24,084.6 |

22,170.0 |

974.6 |

2,496.6 |

3,677.8 |

0.0 |

333.3 |

|

SORGHUM |

2.4 |

2,190.2 |

2,542.4 |

47.9 |

163.5 |

392.7 |

0.0 |

0.0 |

|

SOYBEANS |

1,041.9 |

23,326.5 |

33,970.0 |

940.2 |

2,001.7 |

6,577.4 |

0.0 |

19.8 |

|

SOY MEAL |

369.6 |

3,689.0 |

3,436.8 |

0.0 |

0.0 |

30.2 |

-1.4 |

29.9 |

|

SOY OIL |

38.5 |

85.2 |

176.7 |

0.0 |

0.0 |

0.1 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

66.2 |

199.0 |

567.2 |

52.7 |

227.8 |

55.0 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

7.7 |

26.5 |

0.3 |

1.5 |

2.4 |

0.0 |

0.0 |

|

L G BRN |

0.4 |

3.7 |

13.3 |

1.1 |

14.5 |

6.2 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

54.3 |

24.1 |

0.1 |

14.0 |

25.3 |

0.0 |

0.0 |

|

L G MLD |

3.2 |

137.7 |

61.6 |

5.2 |

138.7 |

64.1 |

0.0 |

0.0 |

|

M S MLD |

3.5 |

69.6 |

96.6 |

2.3 |

69.0 |

67.2 |

0.0 |

0.0 |

|

TOTAL |

73.4 |

471.9 |

789.3 |

61.7 |

465.5 |

220.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

|

|||||

|

UPLAND |

246.7 |

5,829.9 |

5,822.0 |

125.1 |

1,640.6 |

2,312.4 |

55.0 |

741.8 |

|

PIMA |

13.7 |

170.4 |

227.2 |

3.7 |

58.4 |

103.1 |

0.0 |

0.0 |

|

FINAL 2020/21 MARKETING YEAR |

||||

|

COMMODITY |

NET SALES |

CARRYOVER

SALES 1/ |

09/30/21

EXPORTS |

ACCUMULATED

EXPORTS |

|

SOY MEAL |

-21.7 |

791.3 |

188.3 |

11,534.7 |

|

SOY OIL |

-5.4 |

16.7 |

0.4 |

675.6 |

|

|

|

|

|

|

|

|

|

|

|

|

This

summary is based on reports from exporters for the period September 24-30, 2021.

Wheat: Net

sales of 333,200 metric tons (MT) for 2021/2022 were up 15 percent from the previous week, but down 19 percent from the prior 4-week average. Increases primarily for Mexico (89,100 MT, including decreases of 9,400 MT), South Korea (82,700 MT), the Philippines

(69,300 MT, including decreases of 5,400 MT), Indonesia (59,000 MT), and Nigeria (32,000 MT, including 30,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (42,200 MT), Brazil (19,500 MT), and the Dominican

Republic (16,700 MT). Exports of 543,400 MT were up 47 percent from the previous week and 22 percent from the prior 4-week average. The destinations were primarily to the Philippines (242,300 MT), Peru (67,500 MT), South Korea (55,000 MT), Guatemala (36,000

MT), and Japan (35,600 MT).

Corn: Net

sales of 1,265,100 MT for 2021/2022 primarily for Mexico (801,400 MT, including decreases of 500 MT), Colombia (192,500 MT, including 100,000 MT switched from unknown destinations and decreases of 32,800 MT), Honduras (96,800 MT, including decreases of 10,300

MT), Canada (94,600 MT, including decreases of 100 MT), and Guatemala (60,000 MT), were offset by reductions for unknown destinations (149,500 MT). Exports of 974,600 MT were primarily to Mexico (349,100 MT), China (212,300 MT), Japan (193,100 MT), Colombia

(125,800 MT), and Venezuela (24,800 MT).

Optional Origin

Sales: For 2021/2022, the current outstanding balance of 170,000

MT is for unknown destinations.

Barley: No

net sales were reported for the week. Exports of 1,000 MT for 2021/2022 were for Japan (800 MT) and Taiwan (200 MT).

Sorghum: Total

net sales of 2,400 MT for 2021/2022 were reported for Mexico, including decreases of 600 MT. Exports of 47,900 MT were to Mexico (45,500 MT) and China (2,400 MT).

Rice: Net

sales of 73,400 MT for 2021/2022 were down 2 percent from the previous week, but up 73 percent from the prior 4-week average. Increases were primarily for Mexico (38,200 MT), Honduras (16,100 MT), Nicaragua (12,000 MT), Guatemala (3,000 MT), and Canada (2,300

MT). Exports of 61,700 MT were up 13 percent from the previous week and 32 percent from the prior 4-week average. The destinations were primarily to Mexico (53,800 MT), Canada (3,800 MT), Jordan (2,100 MT), Saudi Arabia (900 MT), and Costa Rica (500 MT).

Soybeans: Net

sales of 1,041,900 MT for 2021/2022 primarily for China (671,300 MT, including 131,000 MT switched from unknown destinations), Indonesia (128,400 MT, including 110,000 MT switched from unknown destinations and decreases of 300 MT), Germany (86,300 MT), Taiwan

(84,000 MT), and Spain (72,400 MT, including 64,000 MT switched from the Netherlands), were offset by reductions for unknown destinations (246,000 MT) and Peru (7,000 MT). Exports of 940,200 MT were primarily to China (276,800 MT), Indonesia (119,100 MT),

the Netherlands (91,300 MT), Germany (86,300 MT), and Mexico (79,200 MT).

Export for Own

Account: For 2021/2022, the current exports for own account outstanding

balance is 5,800 MT, all Canada.

Soybean Cake and

Meal: Net sales for the 2021/2022 marketing year, which began October

1, totaled 369,600 MT primarily for the United Kingdom (60,000 MT), Colombia (55,400 MT, including decreases of 100 MT), the Philippines (54,300 MT), Honduras (43,700 MT), and Canada (30,900 MT), were offset by reductions for Venezuela (4,500 MT) and Guatemala

(1,500 MT). A net sales reduction of 21,700 MT was carried over from the 2020/2021 marketing year, which ended September 30. Exports for the period ending September 30 of 188,300 MT brought accumulated exports to 11,534,700 MT, down 2 percent from the prior

year’s total of 11,818,300 MT. The primary destinations were to the Philippines (46,300 MT, including 200 MT – late), Ecuador (32,400 MT), Canada (28,500 MT), Mexico (27,900 MT), and Venezuela (26,900 MT).

Late

Reporting: For 2020/2021,

exports totaling 200 MT of soybean cake and meal were reported late for the Philippines.

Soybean Oil: Net

sales for the 2021/2022 marketing year, which began October 1, totaled 38,500 MT primarily for Morocco (19,000 MT), South Korea (10,000 MT), Canada (3,400 MT), Guatemala (2,500 MT, including decreases of 8,900 MT), and Cameroon (2,500 MT), were offset by reduction

for Mexico (100 MT). A total net sales reduction of 5,400 MT was carried over from the 2020/2021 marketing year, which ended September 30. No exports for the period ending September 30. Exports for the period ending October 1 of 400 MT brought accumulated

exports to 675,600 MT, down 45 percent from the prior year’s total of 1,234,600 MT, with Canada being the destination.

Cotton: Net

sales of 246,700 RB for 2021/2022 were down 57 percent from the previous week and 40 percent from the prior 4-week average. Increases primarily for China (174,500 RB, including decreases of 11,000 RB), Guatemala (33,000 RB), Turkey (18,200 RB), Vietnam (14,200

RB, including 100 RB switched from Japan), and Indonesia (11,400 RB, including 1,200 switched from Vietnam), were offset by reductions for India (20,700 RB) and Pakistan (2,200 RB). Net sales for 2022/2023 of 55,000 RB were primarily for China (40,000 RB). Exports

of 125,100 RB–a marketing-year low–were down 24 percent from the previous week and 32 percent from the prior 4-week average. The destinations were primarily to China (30,800 RB), Mexico (16,700 RB), Bangladesh (12,600 RB), Vietnam (11,200 RB), and Turkey

(11,100 RB). Net sales of Pima totaling 13,700 RB were down 19 percent from the previous week and 12 percent from the prior 4-week average. Increases were primarily for India (8,300 RB) and Peru (4,700 RB). Exports of 3,700 RB were down 68 percent from

the previous week and 51 percent from the prior 4-week average. The destinations were primarily to China (2,200 RB), India (900 RB), Thailand (400 RB), and Guatemala (200 RB).

Optional Origin

Sales: For 2021/2022, the current outstanding balance of 8,800

RB is for Pakistan.

Exports for Own

Account: For 2021/2022, the current exports for own account outstanding

balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides

and Skins: Net sales

of 568,800 pieces for 2021 were up noticeably from the previous week and up 71 percent from the prior 4-week average. Increases primarily for China (310,500 whole cattle hides, including decreases of 116,900 pieces and 72,900

whole cattle hides – late), South Korea (102,600 whole cattle hides, including decreases of 3,000 pieces and 30,800 whole cattle hides – late), Thailand (38,100 whole cattle hides,

including decreases of 6,300 pieces), Taiwan (34,200 whole cattle hides, including decreases of 1,300 pieces), and Mexico (26,300 whole cattle hides, including decreases of 13,600 pieces and 11,000 whole cattle hides – late),

were offset by reductions for Italy (400 pieces). Exports of 501,000 pieces were up noticeably from the previous week and up 51 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (261,600 pieces), South Korea (114,900

pieces), Thailand (34,500 pieces), Mexico (33,800 pieces), and Taiwan (18,700 pieces). Total net sales of 16,700-kip skins, including decreases of 100 pieces, were reported for Belgium. Exports of 5,500 pieces were to Belgium.

Net

sales of 166,500 wet blues for 2021 were up 28 percent from the previous week and 40 percent from the prior 4-week average. Increases primarily for Italy (98,700 unsplit, including decreases of 1,100 unsplit and 16,200

unsplit – late), China (47,000 unsplit and 8,600 unsplit – late), Thailand (10,200 unsplit, including decreases of 300 unsplit), Vietnam (5,100 unsplit, including decreases of 100

unsplit), and the Dominican Republic (3,200 unsplit), were offset by reductions for India (100 unsplit). Net sales of 400 unsplit resulting in increases for China (6,000 unsplit), were offset by reductions for Italy (5,600 unsplit). Exports of 131,900 wet

blues were up 7 percent from the previous week, but down 5 percent from the prior 4-week average. The destinations were primarily to Italy (41,200 unsplit and 6,100 grain splits), China (28,800 unsplit), Vietnam (24,900 unsplit), Mexico (5,000 grain splits

and 3,700 unsplit), and Thailand (7,500 unsplit). Total net sales of 3,900 splits, including decreases of 1,000 pounds, were reported for China. Exports of 325,300 pounds were to Vietnam (200,000 pounds) and China (125,300 pounds).

Late

Reporting: For

2021, net sales totaling 139,500 pieces were reported late for China (72,900 whole cattle hides), South Korea (30,800 whole cattle hides), and Mexico (11,000 whole cattle hides). Exports totaling 7,800 pieces were to China (4,200 pieces), South Korea (2,800

pieces), and Mexico (800 pieces). Net sales totaling 24,800 wet blues were for Italy (16,200 unsplit) and China (8,600 unsplit). Exports totaling 1,600 wet blues were for Italy.

Beef: Net

sales of 15,600 MT reported for 2021 were down 3 percent from the previous week, but up 5 percent from the prior 4-week average. Increases primarily for China (6,000 MT, including decreases of 100 MT), Japan (3,200 MT, including decreases of 600 MT), South

Korea (2,600 MT, including decreases of 400 MT), Mexico (1,500 MT), and Taiwan (1,100 MT, including decreases of 100 MT), were offset by reductions for Chile (100 MT), Colombia (100 MT), and Italy (100 MT). Net sales for 2022 of 500 MT were for Japan (400

MT) and Mexico (100 MT). Exports of 15,700 MT were down 15 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to Japan (4,700 MT), South Korea (3,700 MT), China (2,700 MT), Mexico (1,200 MT), and

Taiwan (1,100 MT).

Pork: Net

sales of 22,100 MT reported for 2021 were down 48 percent from the previous week and 34 percent from the prior 4-week average. Increases were primarily for Mexico (16,000 MT, including decreases of 600 MT), Colombia (1,700 MT, including decreases of 700 MT),

Canada (1,200 MT, including decreases of 1,100 MT), South Korea (1,000 MT, including decreases of 200 MT), and Japan (700 MT, including decreases of 1,100 MT). For

2021/2022, net sales of 529,300 MT were primarily for Mexico (172,000 MT), unknown destinations (150,000 MT), Colombia (129,100 MT), and Japan (50,000 MT). Exports of 29,000 MT were down 4 percent from the previous week

and from the prior 4-week average. The destinations were primarily to Mexico (14,600 MT), China (4,200 MT), Japan (3,200 MT), Canada (1,600 MT), and South Korea (1,500 MT).

October 7, 2021 1 FOREIGN

AGRICULTURAL SERVICE/USDA

SUMMARY OF EXPORT TRANSACTIONS

Reported Under the Daily Reporting System

For Period Ending September 30, 2021

Commodity Destination

Quantity (MT) Marketing

CORN MEXICO

576,800 MT 1/ 2021/2022

SOYBEANS CHINA

198,000 MT 1/ 2021/2022

1/ Export Sales.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.