PDF Attached does not include funds. We will send that out separately in the Commitment of Traders email. CFTC report is attached, however.

Volatile

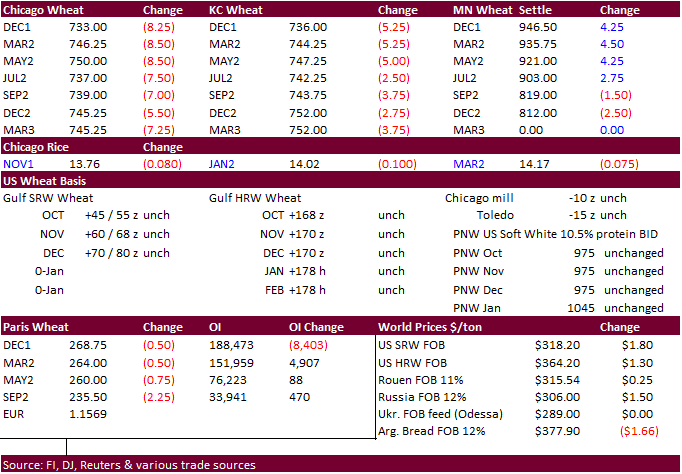

trade today with prices settling lower except for the oats market that staged a large rally and front month Minneapolis contracts. Soybeans, corn, and Chicago wheat found early support from a lower USDA and a rally in soybean oil as related global vegetable

oils appreciated throughout the week. Profit taking during the last half of the day session eventually weighed on prices.

7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Northern

China will experience drier weather over the next couple of weeks

o

The change is very important since the region from the Yellow River Basin into a part of the northeastern Provinces have been saturated with moisture since mid-August except for a ten-day period in mid-September when adequate

soil moisture was noted

o

Improved late season crop maturation and harvest progress will result

o

Winter wheat planting and establishment will improve in the Yellow River Basin

- Southern

China will experience heavy rain this weekend from coastal Guangdong into southern Guangxi and neighboring areas of northern Vietnam as Tropical Storm Lionrock impacts the region.

- Xinjiang,

China will trend a little warmer over the next ten days, but especially today and Saturday and again toward mid-month

o

Showers will disrupt farming activity later this weekend into early next week in northeastern parts of the province

- Tropical

Storm Lionrock was located 310 miles east southeast of Hanoi, Vietnam near 18.7 north latitude, 110.6 east longitude moving northwesterly at 7 mph and producing maximum sustained wind speeds of 40 mph.

o

The storm will intensify briefly today and then begin to weaken

o

Lionrock will move across Hainan Island later today and tonight and then move into northern Vietnam during the weekend

o

The storm’s greatest rainfall and convection will occur from Hainan and southwestern Guangdong, China to southern Guangxi and northeastern Vietnam

- Rain

amounts of 4.00 to 12.00 inches will occur west of Hong Kong in western Guangdong, southern Guangxi and near the Guangxi/Vietnam border - Rainfall

farther to the north into Hunan, Guizhou and far southern Sichuan will range from 2.00 to 6.00 inches

o

Flooding is expected in some china rice and sugarcane areas inducing a little minor damage

- A

new tropical cyclone will form in the eastern Philippines Sea this weekend and move toward Taiwan and southeastern China

o

The storm could impact Taiwan early next week with torrential rain, flooding, rough seas and some damaging wind

- Damage

to rice and sugarcane will be possible

o

The storm should break up over Taiwan and not be much of a threat to southeastern China, but it will need to be closely monitored

- Italy

and some of the Balkan Countries have received some dryness easing rainfall this week

o

Additional precipitation is expected through the weekend and into early next week

- Favorable

drying conditions will impact western Europe during the next full week and perhaps a little longer

o

Aggressive summer crop harvesting and winter grain planting should result

- Northeastern

Europe will receive light rain for a while next week, but drying this weekend will be good for farming activity - Rain

will return to western Ukraine, Belarus, the Baltic States and far western Russia next week

o

Amounts will be light and the moisture will be good for the region’s winter crops

- Restricted

rain will continue in Russia’s Volga Basin for the coming week, but previous rain has the crop becoming a little better established

o

Cool temperatures in the past few weeks have limited aggressive establishment, but the crop should end up in fair shape

- Snow

cover will be needed to protect the crop from any extreme temperatures that evolve during the winter - Brazil’s

weather this week has the ground plenty moist from southeastern Paraguay and much of Rio Grande do Sul into southern Minas Gerais

o

The moisture boost has been most welcome to sugarcane, citrus and coffee

o

Corn planting and establishment has been slowed along with some soybean planting

- Waves

of rain will continue in interior southern Brazil over the next ten days maintaining wet field conditions which may slow the planting pace in some areas

o

Showers will slowly increase in center west and northern parts of center south Brazil during the next two weeks

- The

greatest rainfall is expected to occur near mid-month - Argentina

will receive some periodic showers and thunderstorms during the next week to ten days

o

The moisture will be welcome wherever if falls, but not all areas will get rain and some of those that do might not get enough to fix areas of dryness

- Rain

is needed in Cordoba, Santa Fe, Santiago del Estero and other areas farther to the north

o

Winter wheat needs moisture in the west and central crop areas to support the best yield potentials

o

Early corn and sunseed planting are advancing, but without significant moisture some of the crop is not expected to germination, emerge or establish very well

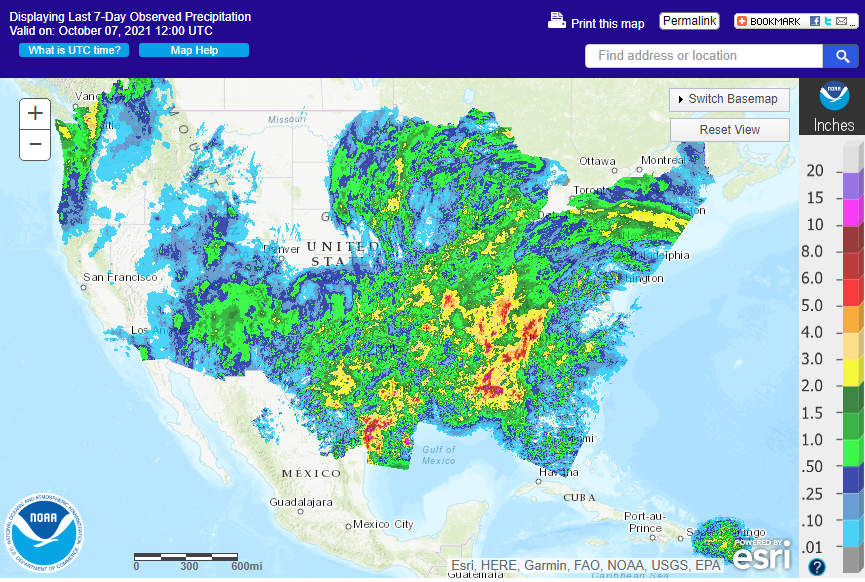

- U.S.

southeastern states have been too wet during the past week

o

Rain totals of 3.00 to more than 8.00 inches have impacted many areas east of the Delta to the Carolina and Georgia

- Some

pockets of drier biased weather were noted, but some areas received rain nearly every day this week resulting in disrupted fieldwork and raised some concerns over crop condition - Cotton

in southwestern Georgia and southeastern Alabama was not impacted as much as other areas in Alabama, central and northern Georgia and the western Carolinas

- This

region will dry down over the coming week to ten days - U.S.

Delta weather has been improving after it was impacted by too much rain earlier this month and in late September

o

The trend will continue, although there will be some additional showers occurring infrequently over the next week to ten days

- South

Texas may get some beneficial moisture at the end of next week

o

The moisture would be extremely beneficial for recharging the soil with moisture before La Nina takes control and dries out the region over the winter

- West

Texas cotton, corn, sorghum and peanut areas will receive very little rainfall for a while and that will support crop maturation and harvesting - U.S.

west-central and southwestern high Plains wheat areas will not likely get much precipitation for a while and that could lead to some poor emergence and establishment for unirrigated hard red winter wheat areas

o

Crop moisture is more favorable farther to the east and establishment should advance a little better there with some timely precipitation

- U.S.

Northern Plains and upper Midwest and eastern Canada’s Prairies will receive some very important rainfall and a little snow possibly during the coming full week

o

Rain will impact North Dakota, northern Minnesota and southeastern Manitoba today into Sunday

- Moisture

totals of 0.30 to 0.90 inch and local totals of 1.00 to 2.00 inches will be possible with eastern North Dakota to southeastern Manitoba wettest

o

Rain and snow from Nebraska and Wyoming to Minnesota, Wisconsin, western Ontario and Manitoba during the middle part of next week will produce 0.75 to 2.00 inches of rain and locally more

o

The moisture improvements expected in Manitoba and the Dakotas will be welcome and should help ease drought, although more moisture will be needed

- Montana

and far northwestern North Dakota as well as the heart of Canada’s Prairies will not get relief from drought during the coming week and may continue to be quite dry going into the following week - Interior

parts of the U.S. Pacific Northwest will continue quite dry for the next ten days - California

precipitation will be minimal, although a few showers will occur in the Sierra Nevada briefly - Southwestern

U.S. crop areas will be dry biased over the next ten days - Western

Australia will be dry biased over the next ten days except near the southwest coast.

- Eastern

Australia rainfall this weekend and early next week will be good for reproducing and filling winter crops in New South Wales and for future planting of spring and summer crops in both New South Wales and Queensland

o

Drier weather for the following week should be sufficient to protect crop quality

- Colombia

and western Venezuela may receive frequent rainfall in the next ten days impacting coffee, cocoa, sugarcane, rice, corn and many other production areas

o

Most of the precipitation will not be excessive

- India’s

monsoon is withdrawing from the north where mostly dry weather is expected over the next couple of weeks

o

Rain will fall in southern parts of the nation during the next ten days supporting late season crops in the south

- Some

of the rain will be heavy from Maharashtra to Telangana, Andhra Pradesh and southern Odisha

o

Drying in the north will be good for crop maturation and harvest progress

- Too

much rain too late in the season this year hurt the quality of early maturing cotton and a few other crops in the north

- Punjab,

Haryana, and a few Rajasthan crops were most impacted by the wetter bias

o

Drying in Gujarat will be good for crops

- Late

season rainfall has been ideal for supporting crop production after planting got delayed in early summer by late arriving monsoonal rainfall - Southeast

Asia rainfall has been and will continue to be well distributed for rice, sugarcane, oil palm, coffee, cocoa, corn and a huge range of other crops

o

Rainfall continues a little more erratic than usual in Sumatra and Java where there is need for greater rain, but the situation is not critical

- A

tropical disturbance is also possible in the Bay of Bengal late next week and a close watch on the system is needed for possible impact on eastern India during the following weekend - South

Africa weather will trend drier and warmer over the next ten days

o

The change will be good for general farming activity and for new season winter crop development

- The

strong warming will accelerate drying and raise the need for more moisture over time - Central

Africa rainfall will continue periodic and timely for coffee, cocoa, sugarcane, cotton and rice through the next two weeks - North

Africa showers will be limited to Tunisia and far northeastern Algeria late this weekend into early next week with rainfall of 0.05 to 0.35 inch resulting

o

Dry weather will continue farther to the west

- Mexico

weather will include erratic rainfall during the next week with some potential for tropical cyclone to impact west-central parts of the nation next week, although confidence is low - Central

America weather will see an erratic rainfall distribution for a while with most areas getting at least some rain periodically

o

Rain amounts will be lighter than usual except in Costa Rica and Panama where near normal amounts are expected

- New

Zealand weather is expected to be well mixed over the next ten days with seasonable temperatures and precipitation - Southern

Oscillation Index was +11.04 this morning and the index will move erratically higher over the coming week

Bloomberg

Ag Calendar

Friday,

Oct. 8:

- Labor

Department’s September jobs report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish supply-demand reports on corn, soybeans, and other commodities - FranceAgriMer

weekly update on crop conditions

Monday,

Oct. 11:

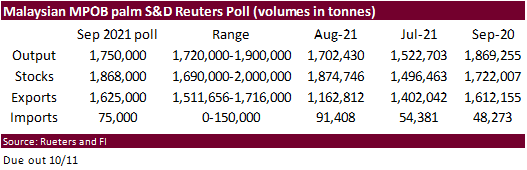

- Malaysian

Palm Oil Board data for September stockpiles, production and exports, 12:30pm Kuala Lumpur time - Malaysia

Oct. 1-10 palm oil exports - Ivory

Coast cocoa arrivals - HOLIDAY:

Argentina, Canada

Tuesday,

Oct. 12:

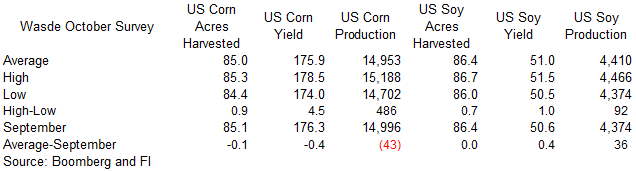

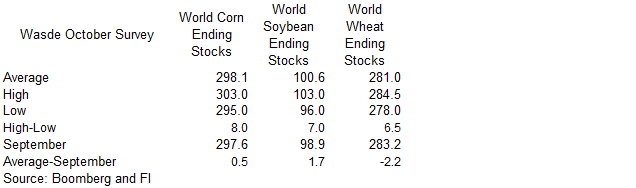

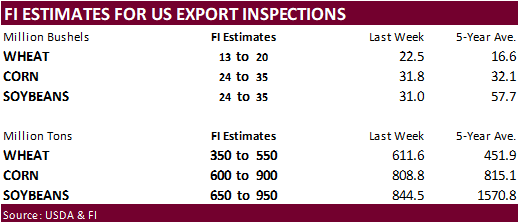

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - USDA

export inspections – corn, soybeans, wheat, 11am - China

farm ministry’s CASDE outlook report - U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm - AHDB

grain market outlook conference - French

agriculture ministry’s crop production estimate - EU

weekly grain, oilseed import and export data - Vietnam

customs to release September commodity trade data - HOLIDAY:

Brazil

Wednesday,

Oct. 13:

- China’s

first batch of September trade data, including imports of soybeans, meat and edible oils - New

Zealand food prices - France

AgriMer monthly grains report - European

cocoa grindings - Brazil

Unica cane crush, sugar output data (tentative) - HOLIDAY:

Thailand

Thursday,

Oct. 14:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - Port

of Rouen data on French grain exports - North

America cocoa grindings - Suedzucker

half-year earnings - Agrana

half-year earnings - HOLIDAY:

Hong Kong

Friday,

Oct. 15:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

monthly data on green coffee stockpiles - Malaysia

Oct. 1-15 palm oil exports - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

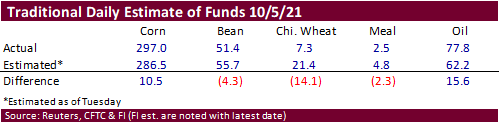

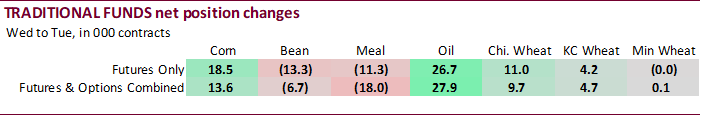

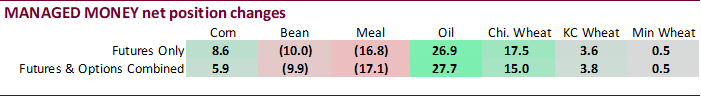

Commitment

of traders

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

170,955 830 384,251 3,776 -496,346 -11,228

Soybeans

-258 -9,438 179,201 6,073 -144,955 11,687

Soyoil

50,315 23,918 118,523 2,847 -178,568 -30,741

CBOT

wheat -24,782 12,287 133,440 -4,085 -98,174 -4,840

KCBT

wheat 27,336 4,946 57,376 93 -85,731 -7,375

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

250,596 5,854 217,515 -10,062 -469,682 -10,194

Soybeans

49,453 -9,858 104,770 4,472 -120,937 10,506

Soymeal

-32,064 -17,100 85,351 2,847 -95,223 11,799

Soyoil

75,178 27,689 98,072 -748 -185,128 -31,099

CBOT

wheat 5,212 15,027 83,343 -7,790 -76,031 1,498

KCBT

wheat 49,946 3,819 33,489 238 -78,648 -7,248

MGEX

wheat 15,337 549 1,509 -98 -29,305 370

———- ———- ———- ———- ———- ———-

Total

wheat 70,495 19,395 118,341 -7,650 -183,984 -5,380

Live

cattle 25,157 -3,613 85,660 -1,266 -123,476 4,609

Feeder

cattle -4,264 -1,894 3,880 240 2,425 660

Lean

hogs 75,146 9,513 57,264 1,385 -127,743 -6,481

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

60,431 7,780 -58,859 6,621 1,826,338 1,566

Soybeans

701 3,202 -33,989 -8,322 908,200 36,858

Soymeal

19,167 -893 22,769 3,347 444,953 47,757

Soyoil

2,147 184 9,731 3,976 448,531 10,339

CBOT

wheat -2,038 -5,372 -10,485 -3,362 459,518 29,427

KCBT

wheat -5,807 854 1,019 2,336 256,057 11,531

MGEX

wheat 6,318 -413 6,141 -409 80,853 1,471

———- ———- ———- ———- ———- ———-

Total

wheat -1,527 -4,931 -3,325 -1,435 796,428 42,429

Live

cattle 21,158 -1,491 -8,499 1,761 334,237 -16,447

Feeder

cattle 558 306 -2,600 688 47,981 -126

Lean

hogs 13,570 -1,233 -18,237 -3,183 324,041 19,164

=================================================================================

Source:

CFTC, Reuters and FI

Macros

WTI

Crude Hits $80 a Barrel for First Time Since 2014

US

Change In Nonfarm Payrolls Sep: 194K (est 500K; prevR 366K; prev 235K)

US

Unemployment Rate Sep: 4.8% (est 5.1%; prev 5.2%)

US

Average Hourly Earnings (M/M) Sep: 0.6% (est 0.4%; prevR 0.4%; prev 0.6%)

US

Average Hourly Earnings (Y/Y) Sep: 4.6% (est 4.6%; prevR 4.0%; prev 4.3%)

US

Change In Private Payrolls Sep: 317K (est 450K; prevR 332K; prev 243K)

US

Change In Manufacturing Payrolls Sep: 26K (est 25K; prevR 31K; prev 37K)

US

Average Weekly Hours All Employees Sep: 34.8 (est 34.7; prev 34.7)

US

Labour Force Participation Rate Sep: 61.6% (est 61.8%; prev 61.7%)

US

Underemployment Rate Sep: 8.5% (prev 8.8%)

Canadian

Net Change In Employment Sep: 157.1K (est 60.0K; prev 90.2K)

Canadian

Full Time Employment Change Sep: 193.6K (prev 68.5K)

Canadian

Part Time Employment Change Sep: -36.5K (prev 21.7K)

Canadian

Unemployment Rate Sep: 6.9% (est 6.9%; prev 7.1%)

Canadian

Hourly Wages Rate Permanent Employees (Y/Y) Sep: 1.7% (est 1.8%; prev 1.2%)

Canadian

Participation Rate Sep: 65.5% (est 65.2%; prev 65.1%)

US

Wholesale Trade Sales (M/M) Aug: -1.1% (est 0.9%; prev 2.0%; prevR 2.1%) ***

·

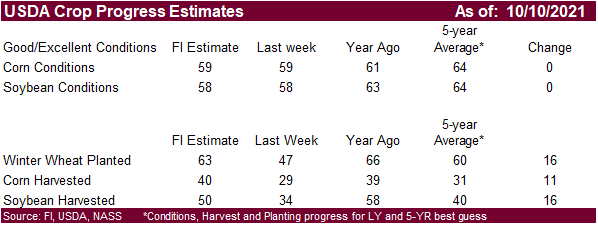

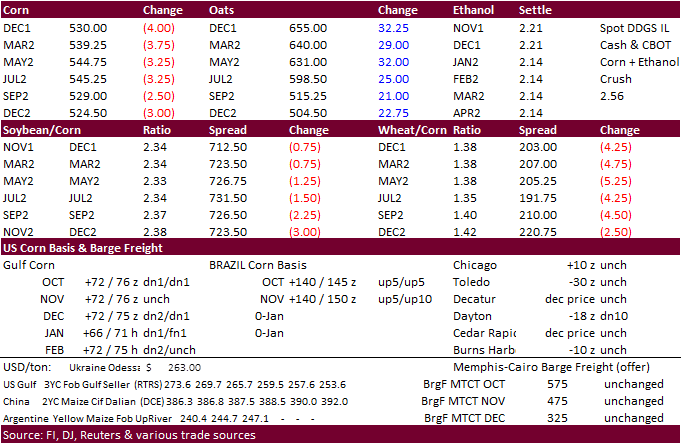

Higher trade to start in corn but futures fell towards late session trading on profit taking. Higher energy prices and a lower USD supported corn early but prices caved on talk of US harvesting pressure and some long lifting

profits off the table ahead of the weekend. Parts of the upper Great Plains and western Corn Belt will see rain this weekend that will slow harvesting, but in our opinion, producers are focused on getting soybeans out of the ground before corn anyway. Parts

of northern China saw and will continue to receive too much rain, but we still expect a bumper crop this year.

·

WTI crude oil today hit $80/barrel, highest level since 2014.

·

Oats made a fresh new lifetime high overnight. What is impressive today was the 32.25 cent increase in the December contract to 6.55/bu while corn fell 4.00 cents to 5.30/bu.

·

The Bloomberg fertilizer index hit a record today and some traders are concerned US 2022 US corn plantings could be slightly hindered this spring.

·

Mexican safety regulators rejected a new variety of GMO corn for the first time, signaling a move that they are trying to phase out domestic GMO corn use.

·

FranceAgriMer estimated 7% of French corn crop had been harvested by Oct. 4, up from 2% a week earlier and well below 47% progress a year ago.

·

China harvesting across the northern corn production areas have seen heavy rains delaying harvesting progress. China still looks for a large corn crop. The rains were so heavy that some producers in Shanxi province were pumping

water out of flooded fields.

·

US RINs have been firming recently.

Export

developments.

Turkey

seeks 325,000 tons of feed corn on October 14 for November 14 through December 6 shipment.

Updated

10/4/21

December

corn is seen in a $4.85-$5.65 range

March

corn is seen in a $5.00-$5.80 range.

December

oats could trade as high as $7.00/bu if this rally continues.

·

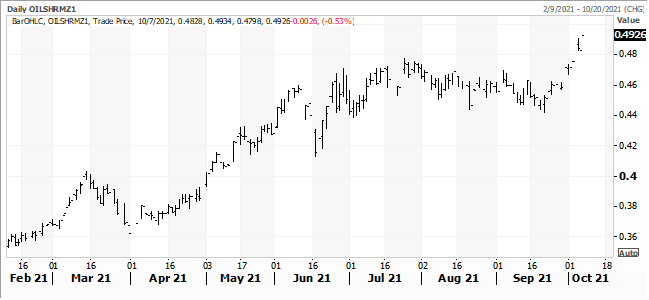

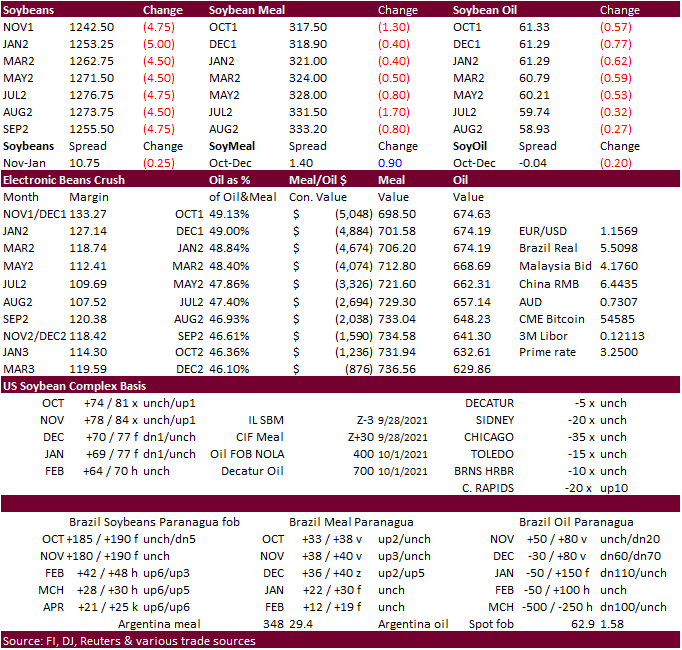

Overnight CBOT soybeans rallied after China trading resumed after a one-week holiday, and another leg up in global vegetable oil prices. China soybeans rallied 3.4%. We also heard there was Chinese interest in soybeans, bit

there were no 24-hour announcements. But as day trading went along, soybean oil started to lose steam, perhaps from profit taking (Dec oil share was at a contract high that held that level as settlement) that eventually triggered sell stops. December soybean

oil traded in a wide range, an indication like other cash and future global oil prices swings this week, the trade is looking for direction. Our general feeling is that if energy prices rally, look for general appreciation in soybean oil. Sunday evening’s

open may depend on where WTI and Brent crude oil opens, as oil prices may have a good influence not only on soybean oil, but palm oil as well. Soybean meal ended lower despite unwinding of oil/meal spreading.

·

December SBO oil share

·

November Paris rapeseed futures hit another contract high but fell 10.25 to 667.50 euros.

·

On Friday Malaysian palm futures settled at 4,966 ringgit; 117 points higher for the day. The December palm contract was up 10 percent this week. Cash palm was up $25/ton.

·

GAPKI reported Indonesia August palm oil exports, including refined products, were up 59% year on year to 4.27 million tons. India and China demand is very good. Indonesia crude palm production was 4.56 million tons in August

and stocks were 3.43 million tons.

·

Rotterdam cash rapeseed oil hit new highs this week. Oil World noted the nearby positions rocketed to around $182-$1850/ton.

·

Reuters on Friday in article noted Brazil’s Paranagua port exported 419,314 tons of soymeal last month, a 35% rise from August and almost 33% higher from September 2020. This comes after Argentina shipping woes slowed exports.

But official country statistics suggest all of Brazil exported 1.31 million tons of soybeans meal during September, down from 1.57 million tons a year earlier and 1.54 million tons during August 2021. In comparison, Argentina shipped about 2.7 million tons

of soybean meal versus 2.36 million a year ago and 2.67 million tons during August 2020.

·

Argentina’s markets were closed Friday and will be closed Monday for local holidays.

·

China cash crush margins were last 187 cents/bu on our analysis versus 176 cents late last week and 88 cents around a year ago.

Export

Developments

-

None

reported

Updated

10/05/21

Soybeans

– November $12.00-$13.50 range, March $12.00-$14.00

Soybean

meal – December $305-$360, March $300-$3.80

Soybean

oil – December 60-67 cent range, March 58-67.50

·

Wheat started higher on a lower USD and strength in outside related commodity markets but ended lower in Chicago and KC on fund selling after soybeans turned lower. Minneapolis caught a bid on persistent dryness across parts

of Canada and Russia. Ukraine is expected to trend dryer over the short term. In addition, global supplies for high protein wheat are shrinking from good global demand.

·

December Paris wheat established a new contract high but settled 0.50 euro lower at 269 euros.

·

Russia plans to raise the export taxes on all grains for the October 13-19 period. Wheat will be raised $0.90 cents to $58.70/ton. Barley increases by $6.30/ton to $49.30/mt. Corn will go up $2/ton to $47.20.

·

Ukraine’s 2021 grain harvest was 70 percent complete, or 49.4 million tons, including 32.3 million tons of wheat, 9.6 million barley and 4.2 million tons of corn.

·

The US Great Plains will be mostly dry through Sunday then rain develops across OK, KS, and northern TX on Monday.

Export

Developments.

·

The Philippines bought at least 56,000 tons (224k sought) of feed wheat at $365/ton

for

shipment between December 2021 and March 2022.

·

Turkey bought 310,000 tons of feed barley for November shipment at between $310 and $319.90/ton.

·

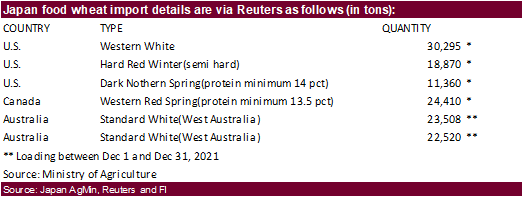

Japan bought 130,963 tons of food wheat. Original details below.

·

The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

·

Jordan issued a new import tender for 120,000 tons of wheat set to close October 13.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 13 for arrival by February 24.

·

Japan seeks 130,963 tons of food wheat from the US, Canada, and Australia for December loading.

·

Pakistan seeks 90,000 tons of optional origin wheat on October 13. They already bought 550k and 575k since September 23.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.44m bales, 264,000 bales below USDA’s previous est., according to the avg in a Bloomberg survey of 11 analysts.

Estimates

range from 3.16m to 3.75m bales

Global

ending stocks seen 181,000 bales lower at 86.5m bales

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $8.65‐$9.75, March $8.50-$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.