PDF Attached

Many

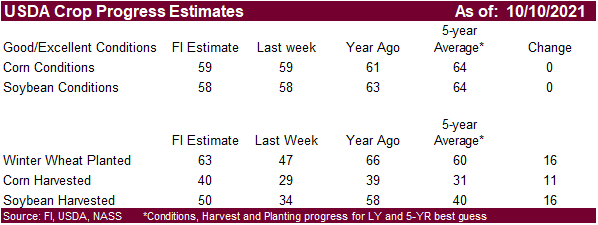

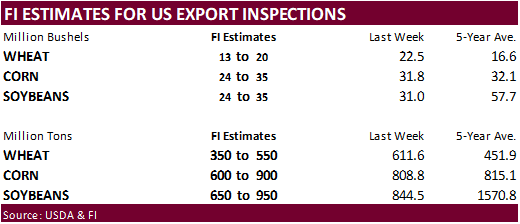

US government agencies were closed for holiday therefore USDA export inspections and crop progress will be released on Tuesday. EIA weekly ethanol production/stocks will be released Thursday and USDA export sales on Friday.

CBOT

agriculture markets traded two-sided. November soybeans ended at their lowest level since March 31. Corn was higher and wheat mixed.

7-day

MOST

IMPORTANT WEATHER AROUND THE WORLD

-

Tropical

Depression Lionrock dissipated over northern Vietnam Sunday -

The

storm produced some heavy rain from Hainan and western Guangdong, China into northern Vietnam during the weekend with reported totals through dawn Sunday varying up to 3.50 inches, although satellite imagery suggested a few greater amounts in parts of the

region -

Very

little serious crop impact was suspected, although some rice and sugarcane may have been negatively impacted for a short period of time -

Tropical

Storm Kompasu was located 285 miles north northeast of Manila, Philippines near 18.9 north, 122.4 east moving westerly at 12 mph and producing maximum sustained wind speeds of 58 mph -

Kompasu

was expected to pass between the Philippines and Taiwan today and then continue westerly toward Hainan, China and northern Vietnam

-

Landfall

is possible over Hainan late Tuesday of early Wednesday and into northern Vietnam late this week -

Strong

wind and heavy rain will accompany the storm with Hainan, China most impacted along with a part of northern Vietnam possibly -

Tropical

Storm Namtheun was located far out into the western Pacific Ocean over open water near 18.8 north, 155.4 east moving west northwesterly 17 mph and producing maximum sustained wind speeds of 52 mph. This position was 352 miles south southeast of Minami, Tori

Shima, Japan or over open water well to the northwest of the Marshall Island and northeast of the Mariana Islands

-

The

storm will pass well to the east of Japan this weekend -

Tropical

Storm Pamela was located southwest of Mexico, but was expected to turn to the northeast later this week after reaching hurricane status Tuesday -

Landfall

is possible Wednesday over southern Sinaloa, Mexico -

Moisture

from the storm will stream to the northeast across central Mexico and into a part of central Texas -

The

storm will move across Mexico and diminish to tropical storm status relatively quickly after moving inland, but may be a dissipating depression near the Texas border Thursday -

Moisture

will not only stream across Texas from this storm, but into a parts of the Midwest, as well -

Crop

damage is possible near the coast, but conditions will improve with distance away from the coast -

Corn,

sorghum, some dry beans and a few other crops will be impacted, but losses are expected to be low -

Most

of Brazil will receive rain during the next ten days and the rain will be sufficient to bolster soil moisture for future soybean and corn planting as well as recently planted crop development -

Rainfall

will vary from 2.00 to 6.00 inches by October 20 in many areas from southeastern Paraguay, southern Mato Grosso do Sul and Parana into southern Minas Gerais and a part of southern Goias -

Lighter

rainfall of 0.50 to 1.50 inches will occur in other areas in the nation’s agricultural region -

The

moisture will also be good for previously planted corn, soybeans, rice, cotton, sugarcane, citrus and coffee -

Enough

rain will fall for many of the coffee and citrus crops to induce flowering -

Some

delay to spring planting should be expected because of the frequency and intensity of some rain totals -

Brazil

temperatures will be seasonable with a warmer than usual bias in the northeast and some readings will be cooler than usual during periods of heavy rainfall in the interior south and center south production areas -

Brazil

rainfall during the weekend was greatest in Mato Grosso do Sul and western Parana where 1.00 to 3.00 inches resulted with upwards to 4.20 inches in central Paraguay -

Over

5.00 inches also occurred along the Espirito Santo coast -

Rainfall

of 0.20 to 1.25 inches occurred in many other areas with local totals of 1.00 to 3.00 inches in southwestern Minas Gerais and in a few random other areas in far southern and east-central Minas Gerais.

-

Temperatures

were seasonably warm to hot in center west and northeastern parts of the nation where extremes in the middle and upper 90s to 100 degrees resulted

-

High

temperatures elsewhere were in the 70s and 80s with a few 60-degrees readings near the Atlantic coast from Rio de Janeiro southward into Santa Catarina -

Argentina

rainfall during the weekend scattered lightly in nearly 40% of the nation with amounts varying from 0.05 to 0.62 inch

-

Central

and northern Cordoba, northeastern San Luis and areas from northern Entre Rios to Chaco were wettest -

Temperatures

were seasonable with high sin the 60s and 70s except in the far north where readings were in the 80s -

No

freezing temperatures occurred at night -

Argentina

will receive rain this workweek, although most of it will be light -

Coverage

may be close to 85% and moisture totals will vary from 0.15 to 0.75 inch most often -

A

few areas will receive 1.00 to 2.00-inches, but such amounts will be rare except in the east-central and northeastern parts of the nation -

A

few locations in southern Cordoba and neighboring areas may receive 0.75 to 1.50 inches which would be great for the region’s crops -

Buenos

Aires and La Pampa may be driest, but some of that region received rain late last week -

Temperatures

will be seasonable -

Welcome

and beneficial rain fell across North Dakota during the Friday through Sunday morning period -

Rain

totals reached 1.00 to 3.00 inches with a local amount of 4.46 inches in several counties of southeastern North Dakota -

Several

counties in the central, west-central and southwest parts of North Dakota received 0.75 to 1.61 inches

-

Amounts

in northeastern North Dakota, west-central through northwestern Minnesota and northern South Dakota ranged from 0.40 to 1.50 inches with a few amounts over 2.00 inches -

Rainfall

elsewhere in the United States Friday through Sunday was more limited, but locally heavy rain impacted parts of Florida and areas from the Carolinas to northeastern Ohio where more than 1.00 inch resulted.

-

4.96

inches was reported at Raleigh, North Carolina -

Showers

also occurred from the Great Basin through the central Rocky Mountain region

-

Rain

fell Sunday and early today in 50% of hard red winter wheat production areas with rainfall of 0.50 to 1.62 inches in eastern parts of the region including central Oklahoma and south-central Kansas -

Lighter

rainfall occurred in the southwestern Plains where 0.10 to 0.50 inch resulted -

No

rain fell in Nebraska, most of western Kansas or eastern Colorado -

Most

other crop areas in the nation were dry -

U.S.

weekend temperatures were quite warm to hot in the central and southern Plains Friday and Saturday with readings in the 90s to slightly over 100 degrees Fahrenheit -

In

contrast temperatures were mild in the western states with highs in the 50s and 60s in the mountains and 60s and 70s elsewhere followed by frost and freeze conditions in portions of the interior northwest, northern Great Basin and Rocky Mountains -

A

second wave of rain will impact the northern U.S. Tuesday and Wednesday with some of the moisture reaching into eastern Canada’s Prairies Wednesday and Thursday -

Additional

moisture totals will vary from 0.75 to 2.50 inches in the Dakotas and 0.50 to 1.50 inches in eastern Saskatchewan and Manitoba -

Some

heavy wet snow will occur along with strong wind speeds resulting in some livestock stress and travel delays -

The

moisture will interrupt harvest activity, but will bring some much needed moisture to the region and hopefully stave off another year of drought in 2022 -

The

moisture will benefit winter crops in the northwestern Plains, but the heart of Montana will miss the storm’s benefits -

A

slightly larger part of South Dakota will get rain from this storm as will a part of Minnesota, eastern Montana and from the central and southeastern Plains into the central Midwest.

-

Moisture

totals from Oklahoma and central Texas to eastern Iowa and Wisconsin will range from 0.75 to 2.50 inches and locally more -

Eastern

U.S. Midwest will get rain Friday into Saturday of this week with 0.30 to 0.80 inch and a few totals to 1.50 inches; otherwise, the week will be dry except for a few showers Monday and again Wednesday producing less than 0.50 inch east of Illinois -

U.S.

Delta will be dry into Thursday and then receive a few showers late Thursday into Friday

-

Rainfall

vary from 0.20 to 0.75 inch and locally more -

U.S.

southeastern states will be drier than usual this workweek and then receive some brief showers Saturday that produce less than 0.65 inch of rain -

Dry

weather then resumes after that continues through at least the middle part of next week and perhaps longer -

Most

U.S. crop areas will be drier biased during much of next week improving harvest progress and crop maturation conditions after this week’s wetter weather -

U.S.

temperatures will be warmer than usual in the eastern half of the nation and cooler biased in the west this week -

Temperatures

next week will be near to above average in much of the nation, although the far west may develop a cooler bias once again toward the end of next week.

-

Europe

will be cooler biased this week and warmer biased next week -

Rainfall

will be greatest early this week and again late next week in the Balkan Countries with rain early and again late this week totaling 2.00 to 6.00 inches from Greece to southern Romania, southern Serbia and Albania -

Rainfall

elsewhere in Europe over the next ten days is expected to be restricted with less than 0.50 inch of moisture resulting except in the North Sea region where some moderate to heavy rain is possible -

Parts

of France, Spain, Portugal, northern Italy and southwestern parts of U.K. may be left completely dry for ten days -

Fieldwork

will advance favorably -

Rain

in Europe during the weekend was greatest in the Balkan Countries where relief from persistent dryness has begun -

The

moisture boost will be great for improving winter crop planting, emergence and establishment -

Temperatures

were in the 50s and 60s -

Most

of the Commonwealth of Independent States were left unaffected by precipitation during the weekend -

Temperatures

were seasonably mild with freezes occurring in many areas -

Winter

crop establishment advanced, albeit slowly -

CIS

precipitation this week will be restricted, and temperatures will be warmer biased -

Not

much change will occur next week -

The

environment will be good for late season farming activity. Winter crops will continue to become a little better established during this period -

China

weather improved during the weekend with much less rain falling in the Yellow River Basin and northeastern provinces, although some of that region did still report some lingering rain Friday into Saturday -

Temperatures

were seasonable -

China’s

north will be dry biased this week, although a few showers may occur briefly -

The

change will be welcome and good for winter crop planting and summer crop harvesting -

Northeastern

China will trend a little wetter again next week slowing summer crop harvest progress.

-

Greater

rain will also occur next week in the Yangtze River Basin where some heavy rain may evolve late in the week -

Some

rain is expected in the same region briefly at the end of this week -

Xinjiang,

China weather will improve this week with less rain and some warming expected -

Harvest

progress in the northeast was slowed last week and fiber quality might have been compromised because of periodic rain and cool temperatures

-

India

weather will be wetter biased in the interior south and especially over the far eastern parts of the nation along with Bangladesh this week.

-

The

heavy rain in Bangladesh, West Bengal and the far Eastern States will be associated with a tropical cyclone that may evolve in the Bay of Bengal later this week -

Other

areas in India will experience relatively good drying conditions favoring widespread fieldwork and normal crop maturation and harvest progress -

Australia

will experience a good mix of rain and sunshine in eastern areas over the next ten days while the west is mostly dry except in coastal areas -

Rain

in the east will be good for unirrigated cotton and sorghum planting, although the precipitation will not be well distributed in western production areas in Queensland or northern New South Wales -

Winter

crops in Victoria and a few areas near the western slopes of the Great Dividing rain will experience frequent rain

-

Southeast

Asia rainfall is expected to be greatest from the northern Philippines through Hainan, China and into much of Vietnam, Laos, Cambodia and Thailand during the next week to ten days -

Rain

will also fall in Indonesia and Malaysia, although it will be a little more erratic and light -

Central

Africa will continue to experience periodic rainfall during the next ten days maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions -

Drier

weather will soon be needed in some cotton areas -

North

Africa is not likely to see much rain for a while, but that is not unusual for this time of year -

South

Africa rainfall will be restricted for a while, but totally dry weather is not expected -

Many

areas away from the coast will be left dry or experience net drying conditions -

Winter

crops will develop favorably following previous rainfall and some early spring planting will be starting soon if it has not already begun -

Rain

will be needed later this month to ensure good maize and other early season crop planting

-

Sunday’s

Southern Oscillational Index was +10.71 and it was expected to move erratically during the coming week -

New

Zealand weather is expected to be a little wetter and cooler biased this week and then drier and warmer next week -

Mexico

rainfall will be restricted this week except for the heavy rain associated with Tropical Storm Pamela -

Central

America rainfall will be below average this week except in Costa Rica, Panama and El Salvador where rainfall will be near to above normal

Bloomberg

Ag Calendar

Monday,

Oct. 11:

- Malaysian

Palm Oil Board data for September stockpiles, production and exports, 12:30pm Kuala Lumpur time - Malaysia

Oct. 1-10 palm oil exports - Ivory

Coast cocoa arrivals - HOLIDAY:

Argentina, Canada

Tuesday,

Oct. 12:

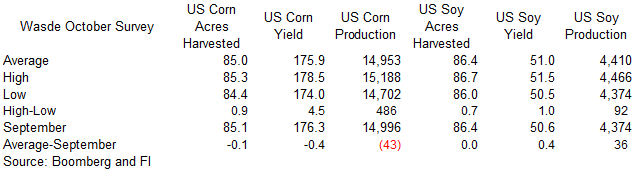

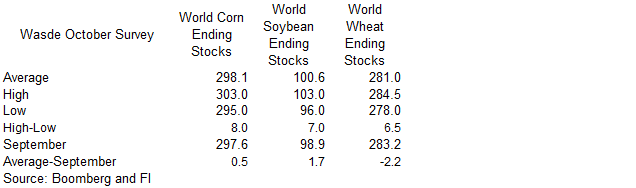

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - USDA

export inspections – corn, soybeans, wheat, 11am - China

farm ministry’s CASDE outlook report - U.S.

crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm - AHDB

grain market outlook conference - French

agriculture ministry’s crop production estimate - EU

weekly grain, oilseed import and export data - Vietnam

customs to release September commodity trade data - HOLIDAY:

Brazil

Wednesday,

Oct. 13:

- China’s

first batch of September trade data, including imports of soybeans, meat and edible oils - New

Zealand food prices - France

AgriMer monthly grains report - European

cocoa grindings - Brazil

Unica cane crush, sugar output data (tentative) - HOLIDAY:

Thailand

Thursday,

Oct. 14:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - Port

of Rouen data on French grain exports - North

America cocoa grindings - Suedzucker

half-year earnings - Agrana

half-year earnings - HOLIDAY:

Hong Kong

Friday,

Oct. 15:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

monthly data on green coffee stockpiles - Malaysia

Oct. 1-15 palm oil exports - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

·

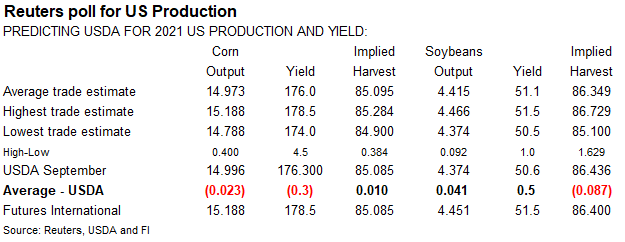

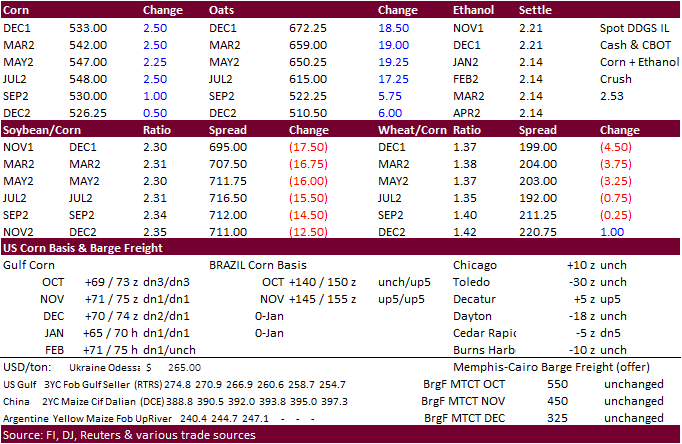

Corn opened higher on higher outside commodity markets, traded two-sided, and ended 1.50-2.75 cents higher.

·

WTI crude oil hit its highest level since October 2014. US retail gasoline prices are up more than a $1.00/gallon from this time last year and are at 7-year highs. Chinese raw energy and product futures prices surged to multi-year

and record highs on Monday.

·

Rain this week will fall across northern and eastern Plains and most of the Midwest, delaying harvest progress, particularly across North Dakota, eastern Iowa, and Missouri.

·

Corn futures on the Euronext exchange rose for a 14th straight session to a new contract high of 251.50 euros.

·

China renewed a ban on UK beef imports over mad cow concerns.

·

China live hog futures traded up 8% limit to a one month high.

·

China sow inventories are getting tighter. China bought 30,000 tons of pork for state reserves on October 10.

·

Cargill loads soy shipment in Texas after Ida damages Louisiana terminal

https://reut.rs/3lvDbVX

·

SovEcon cut its 2021 estimates for Ukraine’s corn crop by 1.2 million tons to 38.4 million tons.

·

Oats made a fresh new lifetime high.

Export

developments.

-

Turkey

seeks 325,000 tons of feed corn on October 14 for November 14 through December 6 shipment.

Updated

10/4/21

December

corn is seen in a $4.85-$5.65 range

March

corn is seen in a $5.00-$5.80 range.

December

oats could trade as high as $7.00/bu if this rally continues.

·

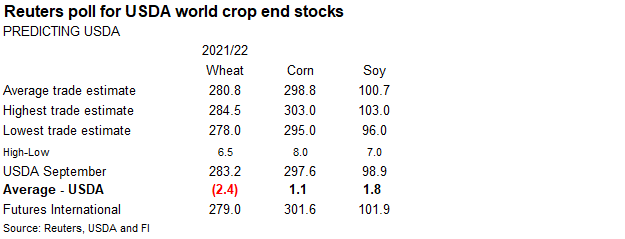

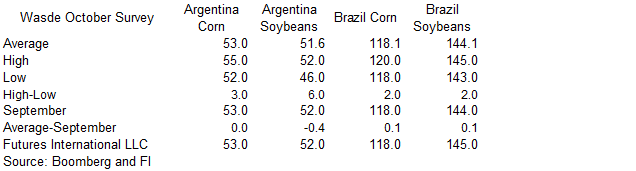

Soybeans started higher but turned lower early during the day session. November eventually stumbled to its lower level since March 31, ending 14.75 cents lower, near its session low. Traders were positioning ahead of the USDA

S&D report. Meal was mixed to start and ended lower. Soybean oil traded in a wide two-sided range. December traded more than 100 points lower, in part to profit taking. It started higher on tightening global vegetable oil supplies and sharply higher WTI

crude oil.

·

USD was 27 points higher.

·

Earlier traders were eyeing outside markets with energy prices trading sharply higher, but that eventually faded after long buying in soybean oil dried.

·

December soybean oil share saw another correction today after hitting a high of 49.79 on Friday. Today it settled near 48.8%.

·

CBOT crush was down 1 cent to $1.27 basis the January position.

·

November Paris rapeseed futures fell hard by 17.75 to 650.50 euros.

·

Malaysian palm oil hit a record on Friday but eased 11 ringgit on Monday and cash palm was up $10/ton to $1,272.50/ton. Malaysian end of September palm oil stocks fell by a more than expected amount to 1.75 million tons after

hitting a 14-month peak at the end of August. September production fell 0.4% to 1.7 million. ITS reported October palm exports at 528,904 tons, down 7.6 percent from 5572,345 tons during the same period a month early. AmSpec reported October palm exports

at 500,381 tons, down from 540,915 tons during the same period a month early.

·

Argentina’s markets are closed Monday for local holidays.

·

AgRural: Brazil soybean crop plantings reached 10% of the estimated area as of Oct. 7, up six percentage points from the previous week and compared to 3% in the same period of 2020/21. “There was rainfall in a large part of Brazil

last week, which favored fieldwork in regions where the planting was already advanced and also allowed the sowing to start in regions where producers were waiting for better humidity conditions,” per Reuters.

·

China saw very heavy rain across the provinces of Shanxi and Shaanxi, triggering emergency responses.

More

than 17,000 houses collapsed and 190,000ha of farmland were damaged by the flooding, according to The Straight Times.

·

(Bloomberg) — India has imposed limits on inventories of edible oils and oilseeds to ease soaring prices in the world’s biggest buyer of soybean, palm and sunflower oils.

Export

Developments

-

None

reported

Updated

10/11/21

Soybeans

– November $12.00-$13.50 range, March $12.00-$14.00

Soybean

meal – December $305-$335, March $300-$360 (revised lower)

Soybean

oil – December 60-65 cent range (unch, down 200), March 58-67

(unch, down 50)

·

Chicago wheat started the day session higher on strength in outside related markets and ended mixed (bear spreading. KC and MN ended lower. Welcome rains across the northern Great Plains over the weekend should benefit recently

planted winter grains.

·

The US Great Plains will see rain developing across the eastern areas Tuesday and Wednesday. The southern areas will see rain Thursday and Friday.

·

December Paris wheat was 0.25 euro lower at 268.50 euros a ton.

·

IKAR reported Russian wheat with 12.5% protein for second half October shipment were $310 a ton fob, up $3 from the previous week. Russian wheat export prices are up for the 13th consecutive week. SovEcon reported a $6/ton increase

to $312.

·

Russia exported 19.3 million tons of wheat during the Jan-Aug period, down from 19.7 million during the same period a year ago.

·

SovEcon cut its 2021 estimates for Russia’s wheat crop by 0.1 million tons to 75.5 million tons.

Export

Developments.

·

Egypt said they have enough wheat for strategic reserves to last 5.5 months.

·

Jordan seeks 120,000 tons of wheat set to close October 13.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on October 13 for arrival by February 24.

·

Pakistan seeks 90,000 tons of optional origin wheat on October 13. They already bought 550k and 575k since September 23.

·

Jordan seeks 120,000 tons of barley on October 14 for LH December through FH February delivery.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.44m bales, 264,000 bales below USDA’s previous est., according to the avg in a Bloomberg survey of 11 analysts.

·

Estimates range from 3.16m to 3.75m bales

·

Global ending stocks seen 181,000 bales lower at 86.5m bales

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

·

Sugar is at a 4-year high.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $9.00‐$9.75 (up 35, unch), March $9.00-$9.75

(up 50, unch)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.