PDF Attached

US

agriculture markets opened lower following weakness in outside related markets and sharply lower wheat after a Russian official said they may remove their grain-export quota. Typically, Russia limits grain exports late in the crop season. Recession concerns

kept many commodity market volatile. Soybeans and meal ended mostly higher on late fund buying and soybean oil lower. Grains finished lower. USDA is due out with its October S&D report on Wednesday.

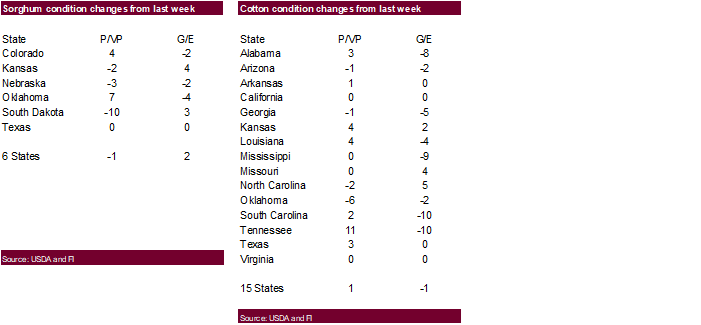

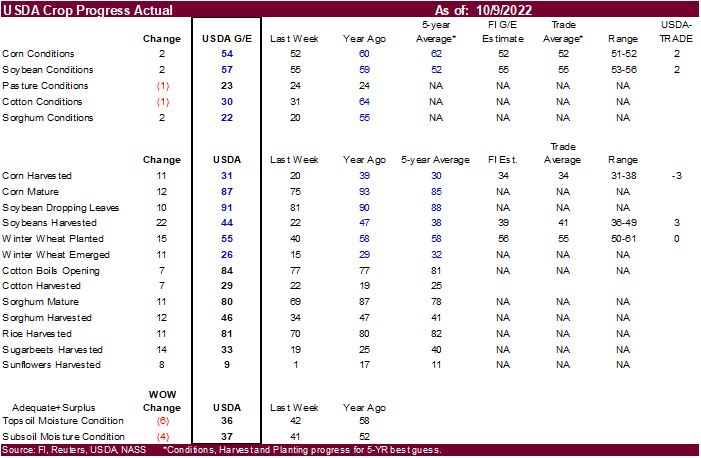

USDA

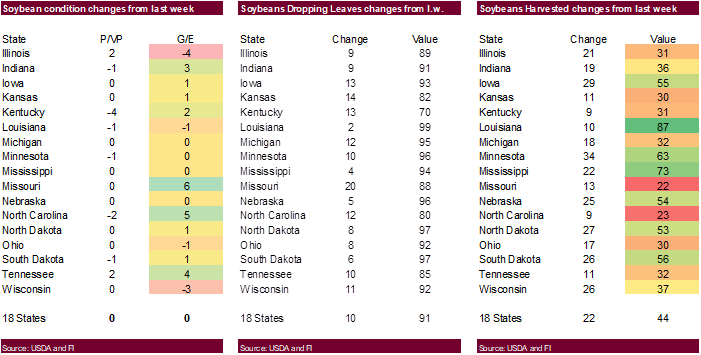

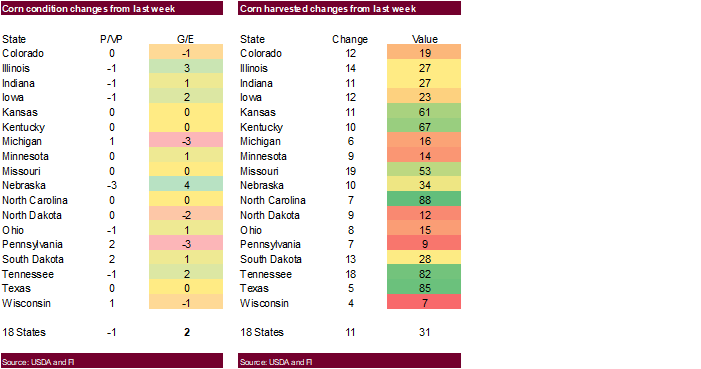

US crop progress was bearish for soybeans, neutral wheat and semi-bearish for corn. US corn and soybean conditions improved 2 points from the previous week while traders were looking for unchanged. Harvest progress for the corn crop advanced 11 points to 31

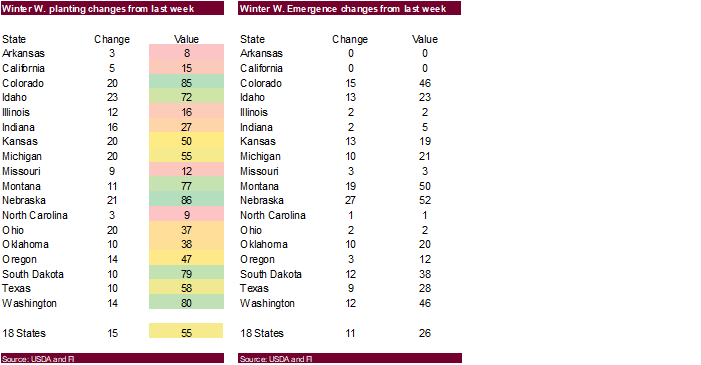

percent, 3 points below trade expectations. Soybeans collected were 44 percent, 3 points above trade expectations. Both corn and soybean harvest progress are above their respected 5-year averages. US winter wheat plantings came in at 55 percent, at expectations,

and 3 points below a 5-year average.

Calls:

Soybeans

1-4 lower

Corn

steady to lower

Wheat

steady

US

weather forecast was unchanged. The Midwest will see light rain across the northern and southwestern areas today, and eastern and central areas Wed. & Thur. eastern KS, eastern NE, and central OK will see rain today. More rain for OK is expected to fall this

weekend. Brazil will see widespread rains this week while Argentina will be dry over the next ten days. Brazil will see rain bias west and interior south.