PDF Attached includes updated US soybean complex S&D’s

USDA

report day. Another surprise with a bullish US soybean production estimate. CBOT ag markets ended mixed with corn near unchanged, wheat lower and soybeans higher. Meal gained on soybean oil. After the FOMC minutes were released at 1 pm CT, USD rallied. 50-75

basis point rate increase was indicated for both November and December meetings. US equities were higher and WTI remained under pressure. US PPI released this morning was higher than expected, sending WTI crude oil lower. Private exporters reported sales of

526,000 metric tons of soybeans received in the reporting period for delivery to China during the 2022/2023 marketing year. There were no major changes to the US weather forecast. The Midwest will see light rain across the northeastern and central areas today

& Thursday. Parts of the southern Great Plains will see rain, bias eastern Kansas, eastern Oklahoma today. Additional rain is expected to return to OK and include TX late this weekend. Brazil will see widespread rains this week while Argentina will be dry

over the next week.

![]()

USDA

released their October S&D report

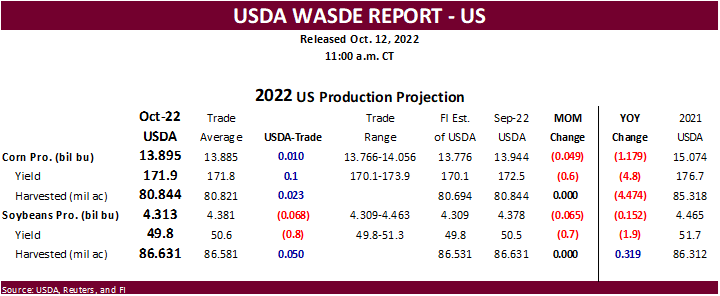

Reaction:

Bullish

soybeans and bearish grains. Largest

surprise was the US soybean yield/production. Trade was looking for a slightly higher yield but it was lowered 0.7/bu to 49.8 bushels per acre. 2022-23 soybean stocks were 48 million bushels below expectations while US corn and wheat stocks came in 48 and

22 million above trade expectations, respectively.

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

The

trade was looking for slightly higher US soybean yield and it was lowered 0.7/bu to 49.8 bushels per acre (at our expectations). 2022-23 soybean ending stocks were 48 million bushels below expectations at 200 million. They lowered US soybean exports by 40

million bushels.

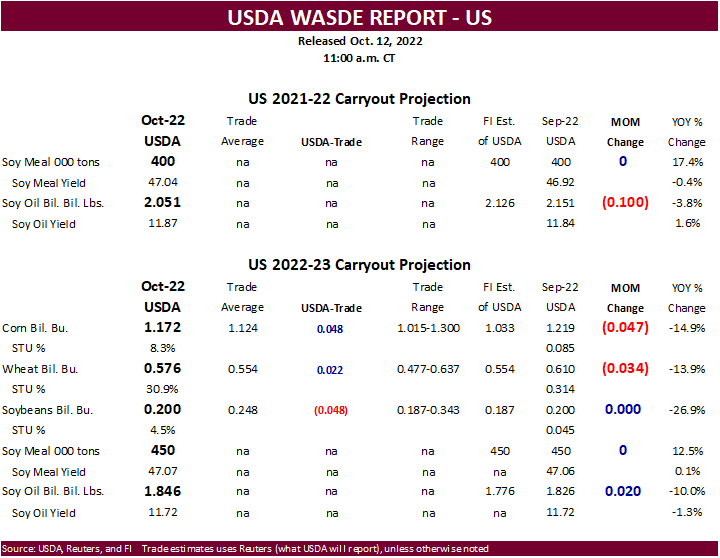

There

were a lot of moving parts in today’s USDA October update for the US soybean complex. Looking beyond the production cut in soybeans of 65 million bushels to 4.313 billion, there are many demand factors to think about for 2022-23. USDA in its October update

raised 2022-23 US crush by 10 million bushels. Profitable US crush margins, finance problems in Argentina creating uncertainty for product availability from December beyond, and negative Brazil crush margins could keep the US rate at high levels at least over

the next six months. For exports, USDA took their estimate down by 40 million bushels, a reasonable amount, but at 2.045 billion, still too large, in our opinion. Midwest River barge disruptions could leave October and November Gulf soybean exports short of

average, and with Brazil exports revised higher by 500,000 tons to 89.5 million tons, competing with 2023 NA market (12.5 percent above 2021-22), along with about 3.5 million tons of Argentina soybeans recently sold to China (at a time when US normally sells),

fall quarter US exports (SON) could end up at a very low level. Based on September inspections and slow start for October shipments (pace expected to increase), and expectations for slower than normal November inspections (barge issues), SON US soybean exports

could end up between 475 and 525 million bushels, lowest since either 2018 or 2011 (low end). In 2011-12, exports ended up at 1.328 billion bushels. For 2022-23, we lowered our US soybean export projection to 2.000 billion bushels, 45 million below USDA, and

raised crush to 2.240 billion, about 10 million higher than previous and 5 million above USDA.

We

are surprised USDA did not increase old crop soybean oil use for biofuel. The also left new-crop unchanged. Soybean oil for biofuel was reported better than expected for the month of July and projected near 945 million pounds for both August and September.

In 2022-23, soybean oil for biofuel demand is projected to rise 1.600 billion pounds from 2021-22. We are more optimist (see S&D). Soybean oil production was increased 120 million pounds, but stocks were only up 20 million pounds due to an increase in 2021-22

SBO use. USDA increased old crop soybean meal production by 100,000 short tons, offset by higher domestic use. For 2022-23, USDA increased meal production by 250,000 short tons, again offset by higher domestic use.

Brazil

soybean production was lifted 3MMT to 152MMT, and exports were raised 500,000 tons. There were no changes to the upcoming Argentina soybean production. For old crop, Brazil soybean production was increased 1.0 million tons to 127MMT and Argentina was unchanged

at 44MMT.

US

corn production fell a less than expected 49 million bushels from the previous month to 13.895 billion. The yield was 171.9 bushels per acre, 0.1/bu above an average trade guess. What got into the selling in corn futures earlier was US corn ending stocks coming

in 48 million bushels above expectations at 1.172 billion bushels. Imports were raised 25 million bushels to 50 million, and total supply was lowered 172 million bushels (148 lower carryout from 2021-22) to 15.322 billion, about a billion less than total supply

last season. USDA increased corn for feed by 50 million for the current marketing year and lowered ethanol use by 50 (needed). EU corn was lowered 2.6MMT to 56.2, still too high, in our opinion.

US

all-wheat wheat stocks of 576 million bushels were 22 above expectations and 34 million below what was projected last month, despite a 133 million known decline in production. USDA lowered wheat for feed use to a low 50 million and exports were taken down

50 million to 775 million, also a very low level when compared to the last few decades. USDA took Argentina wheat production down 1.5MMT to 17.5 million, still 1.5 million tons above the Attaché that revised their estimate yesterday to 16 million tons.

Attached

PDF includes FI snapshot