PDF Attached

Please note I will be out the balance of the week, attending the AFOA conference in Nashville.

USDA FSA Acreage is delayed. When updated, it will be posted here https://www.fsa.usda.gov/news-room/efoia/electronic-reading-room/frequently-requested-information/crop-acreage-data/index

Macro selloff in ags today continuing from yesterday’s bearish WASDE report. Harvest pressure also weighing on corn and soybeans.

7-day

Macros

– U.S. SEP CPI +0.4 PCT , EXFOOD/ENERGY +0.2 PCT

– U.S. SEP CPI YEAR-OVER-YEAR +5.4 PCT, EXFOOD/ENERGY +4.0 PCT

– U.S. SEP UNADJUSTED CPI INDEX 274.310 VS AUG 273.567

– U.S. SEP CPI ENERGY +1.3 PCT, GASOLINE +1.2 PCT, NEW VEHICLES +1.3 PCT

– U.S. SEP REAL EARNINGS ALL PRIVATE WORKERS +0.8 PCT VS AUG -0.2 PCT (PREV +0.3 PCT)

– U.S. SEP CPI FOOD +0.9 PCT, HOUSING +0.5 PCT, OWNERS’ EQUIVALENT RENT OF PRIMARY RESIDENCE +0.4 PCT

Wednesday, Oct. 13:

- China’s first batch of September trade data, including imports of soybeans, meat, and edible oils

- New Zealand food prices

- France AgriMer monthly grains report

- European cocoa grindings

- Brazil Unica cane crush, sugar output data (tentative)

- HOLIDAY: Thailand

Thursday, Oct. 14:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am

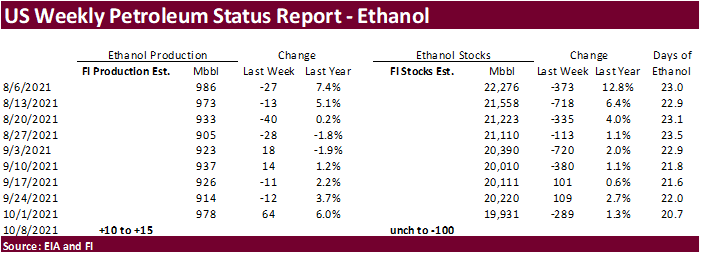

- EIA weekly U.S. ethanol inventories, production

- Port of Rouen data on French grain exports

- North America cocoa grindings

- Suedzucker half-year earnings

- Agrana half-year earnings

- HOLIDAY: Hong Kong

Friday, Oct. 15:

- ICE Futures Europe weekly commitments of trader’s report (6:30pm London)

- CFTC commitments of trader’s weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. monthly data on green coffee stockpiles

- Malaysia Oct. 1-15 palm oil exports

- FranceAgriMer weekly update on crop conditions

- HOLIDAY: India

Source: Bloomberg and FI

· Corn fell to a four-week low on follow through selling from yesterday’s USDA report. Long liquidation was noted from the macro side as Reuters reported that funds sold a net 14,000 corn contracts.

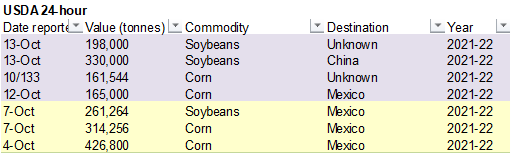

· Lending support to the market was the weaker USD and the corn sales on the 24-hour window.

· Russia reported bird-flu outbreak at two poultry farms in the southern part of the country. The World Organisation for Animal Health (OIE) said the virus was of serotype H5, but no further details.

· Harvest pace is rolling along, up 10 percentage points from the 5-year average, at 41% complete. US basis levels are firming as the farmer is holding onto the harvested grain.

· Brazil’s ANEC sees Brazil’s corn exports reaching 1.968 million tons in October vs last week’s forecast of 1.420 million tons.

Export developments.

- Turkey seeks 325,000 tons of feed corn on October 14 for November 14 through December 6 shipment.

- Under the USDA 24-hour announcement system, private exporters reported sales of:

- 161,544 metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year

![]() Bloomberg Survey for EIA Ethanol (10 analysts)

Bloomberg Survey for EIA Ethanol (10 analysts)

Avg Low High Prev

Production (k bpd) 985 969 995 978

Stockpiles (m bbl) 19.834 19.350 20.200 19.931

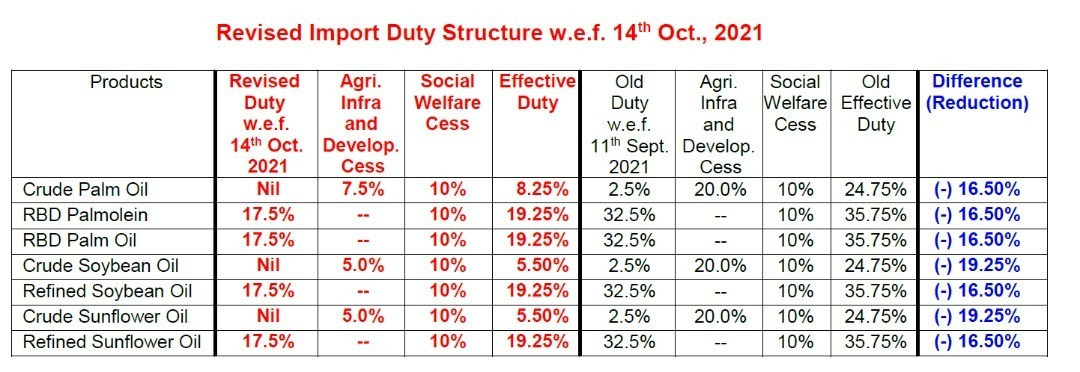

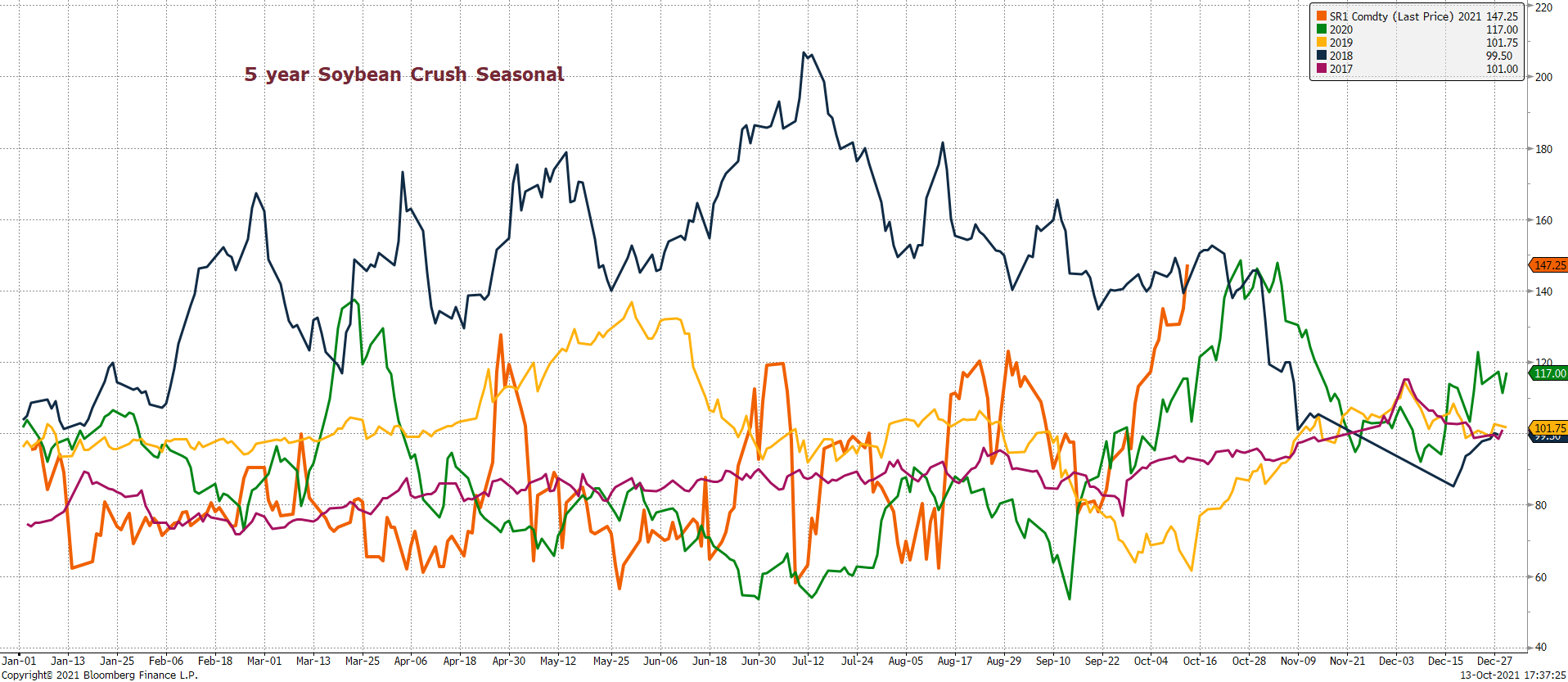

· Soybeans turned lower on fund liquidation, and that pressured soybean meal also. Soybean oil was higher on the session on the heels of the firmer palm oil overnight. Palm oil was sharply higher amid India import duty headlines and talk of reduced Indonesian exports.

· USDA 24-hour sales announcements limited losses for soybeans along with the weaker dollar.

· China September soybean imports fell to 6.88 million tons from 9.79 million a year ago. China January through September soybean imports were 73.97 million tons, down 0.7% from the same period LY.

· USDA Attaché sees the 2021/2022 soy crop in Argentina at 49.7 million tons on dry weather and better margins on other crops like corn. USDA is at 52 million tons.

· Brazil’s ANEC sees Brazil’s soy exports reaching 2.973 million tons in October vs last week’s forecast of 2.678 million tons.

· India cut their duties on selected vegetable oil imports.

Crude palm oil imports tax cut to 8.25% from 24.75%

Crude soyoil, sunflower oil import taxes cut to 5.5% vs 24.75%

Refined grades import tax 19.25% vs 35.75% earlier

· SEA: India’s vegetable oil imports in September jumped by 66% from a year ago to a record 1.76 million tons, including 397,386 tons of refined palm oil.

Export Developments

- Under the USDA 24-hour announcement system, private exporters reported sales of:

- 330,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year

- 198,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

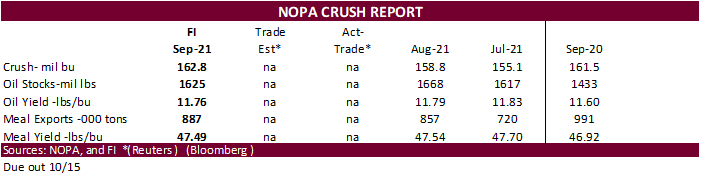

Soybean Crush reached the highest level since early 2018.

· US wheat traded lower on profit-taking from yesterday’s USDA report rally.

· December Paris wheat ended down 6.75 euros at 264.74 €/MT.

· France’s AgMin lowered soft wheat stocks to 2.4 million tons from 2.9 million, for the end of 2021-22.

· Iran is seen buying a record amount of wheat after they witnessed their worst drought in 50 years. They may need to but 8 million tons this season (March-Feb) according to a source via Reuters and about 2 million tons had been delivered.

Export Developments.

· Pakistan’s lowest offer for 90,000 tons of optional origin wheat was $388.83 a ton c&f.

· Jordan seeks 120,000 tons of wheat on October 20 for LH January-FH March shipment.

· Jordan canceled today’s tender for 120,000 tons of wheat for LH December-FH February shipment.

· Results awaited: Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

· Jordan seeks 120,000 tons of barley on October 14 for LH December through FH February delivery.

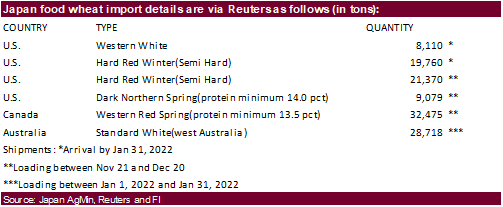

· Japan seeks 119,512 tons of food wheat on Thursday for arrival by January 31.

· Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

· Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.