PDF Attached

PDF

includes updated US corn balance sheet.

Private

exporters reported the following sales activity:

-264,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-242,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

The

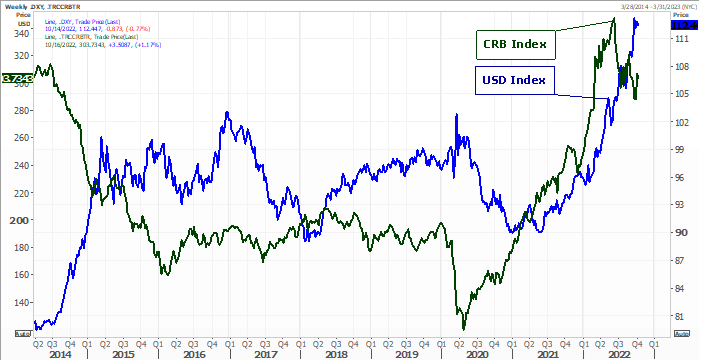

US CPI (negative sentiment) and macro headlines (ECB) dominated fund flows today. The USD was higher early this morning post CPI report, sending commodities lower until the European Central Bank said they may not be as aggressive with increasing rates, which

sent the USD sharply lower. The massive fluctuation in the USD from higher to lower created a wide trading range for major US equities and commodities. Before the majority of commodities rallied, wheat found strength from a Reuters exclusive story. The Russia

Geneva U.N. ambassador warned Moscow submitted concerns to the United Nations over the Black Sea safe passage agreement and may not renew the deal next month unless demands are met.

![]()

USD-Daily

Dow

– Daily

There

were no major changes to the US weather forecast. Brazil is unchanged and Argentina turned slightly unfavorable. The Midwest will see light rain across the northeastern and central areas today. Parts of the southern Great Plains will see rain to return to

OK and TX late this weekend. Brazil will see additional rain while Argentina will be dry over the next week.