PDF Attached

Private

exporters reported the following sales activity:

-392,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-198,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

-230,000

metric tons of soybean cake and meal for delivery to the Philippines during the 2022/2023 marketing year

A

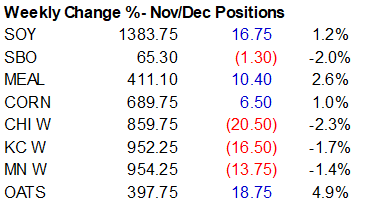

firm USD and lower energy prices sent US agriculture futures lower. Mixed views over Black Sea safe passage agreement are seen. Note the UN will visit Moscow on Sunday to continue talks on extending the agreement by addressing issues raised by Russia earlier

this week. US harvesting pressure is seen next week with favorable weather, but geopolitical headlines and swings in outside markets could continue to dominate price fluctuations in CBOT ag markets.

There

were no major changes to the US weather forecast on Friday. Brazil’s outlook is unchanged, and Argentina turned slightly unfavorable. Argentina will see some rain across eastern Cordoba, central Santa Fe, and Entre Rios through Saturday before turning drier

through Tuesday. Brazil will continue to see favorable rains bias western Mato Grosso, southwest MGDS, south Sao Paulo, Parana, Santa Catarina, north RGDS. The US southwestern Great Plains will see additional rain, bias southern OK and TX. The Midwest will

be mostly dry over the next week.