PDF Attached includes several various charts and tables

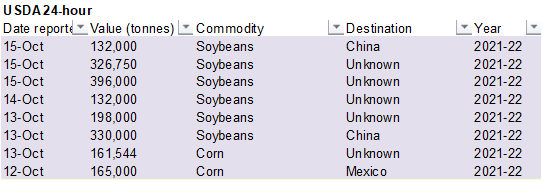

USDA

– private exporters reported sales of:

-396,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

-326,750

metric tons of soybeans received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year

-132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

Higher

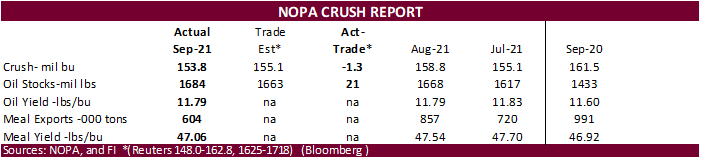

trade across the board on technical buying and thoughts that the US corn and soybean exports will improve. The USD was near unchanged and WTI higher. NOPA published a bearish September US crush number, but the trade ignored it, in my opinion.

7-day

MOST

IMPORTANT WEATHER AROUND THE WORLD

-

A

slow-moving tropical disturbance is expected to bring excessive rain to the coast of central Vietnam through the weekend and into early next week

-

Rainfall

of 4.00 to more than 15.00 inches may result in some serious coastal flooding -

It

would not be surprising to see some amounts getting to 20.00 inches north of Quang Ngai to Vinh -

The

excessive rain is not likely to move inland very far and it should not reach Laos, Cambodia or Thailand, although significant rain will fall in those areas as well -

Horrific

flooding and property damage is expected -

Soil

moisture is decreasing in the middle and lower Volga River Basin, but most of the key winter crop areas in this region should have had enough moisture to establish relatively well -

However,

air temperatures during late September and early October were not as warm as crops would have liked and crops may not be as established as they ought to be at this time of year especially since the region was dry in the early part of the planting season -

Soil

temperatures are cooling enough that some crops are becoming semi-dormant limiting the potential for additional development and precipitation will be lighter than usual for the next ten days and perhaps longer -

Northern

China will continue to be dry biased over the next ten days inducing improvements to crop maturation and harvest progress after too much rain fell in recent weeks

-

East-central

China will receive rain through Saturday and then get more precipitation next week -

The

region may trend a little too wet over time slowing winter crop planting and establishment and delaying some of the region’s summer crop harvest -

Recent

weather has been favorable for fieldwork and the disruption may not have a big impact, but it will be worth watching for a while -

A

few minor cotton areas could experience some quality concerns -

Northeastern

Xinjiang, China weather has finally turned drier -

Frequent

precipitation in recent weeks and cold temperatures has hurt the quality of unharvested cotton -

Conditions

will remain favorable for good drying conditions and harvest progress for the next full week -

Western

and central Xinjiang cotton maturation and harvest weather has been good in recent weeks with little change likely -

Central

and northeastern India will turn wetter than desired this weekend into early next week causing some delay to summer crop harvesting -

The

moisture will be good for future wheat planting, emergence and establishment

-

Northern

Uttar Pradesh and a part of Nepal may get too much rain resulting in some flooding

-

The

area will dry down again next week -

Australia

will experience nearly ideal conditions for reproducing winter wheat, barley and canola during the next ten days with alternating periods of rain and sunshine -

Some

greater rain will be needed in South Australia -

Unirrigated

summer sorghum and cotton areas in central Queensland need rain, but not much is expected for a while -

Sugarcane

areas along the lower Queensland coast will get frequent rain improving crop conditions -

Argentina

weather this week was good for winter crop development and helped improve planting conditions for early corn and sunseed -

The

nation will be drying down over the coming week and crop development may eventually slow once again because firming soil, but for now the situation is much improved -

Brazil

weather will be ideal for fieldwork and early season crop development during the next two weeks -

All

areas will get rain at one time or another -

A

welcome respite from rain is expected in southern Brazil next week that will favor some drier topsoil and faster planting progress -

A

boost in shower activity in center west, northern center south and northeastern Brazil will be ideal for accelerating the planting and emergence of soybeans and early corn -

Sugarcane,

coffee and citrus crop development is already accelerating with flowering of coffee and citrus to continue for a while as sugarcane develops more aggressively -

Excessive

rain is expected in southern Myanmar rice and sugarcane areas this weekend with 5.00 to 12.00 inches resulting in some flooding -

A

little rice damage is possible -

A

small tropical cyclone may evolve in the northern Bay of Bengal Sunday and will induce heavy rainfall in long the middle and upper coast of Myanmar resulting in some additional flooding -

Some

areas in southeastern Bangladesh will also be impacted by this storm -

Flooding

could become serious near the Bangladesh/Myanmar coastal border where 10.00 to 20.00 inches of rain might occur Sunday into Wednesday -

Southeastern

Europe’s rainy weather pattern of late will end this weekend -

The

western and southern Balkan Countries were suffering from drought like conditions previously and now are too wet -

Some

flooding has likely occurred -

Delays

to summer crop harvesting have been prolonged and will last into next week -

The

moisture will eventually be good for some winter crop planting, but a few areas may have to replant -

Central

parts of Europe will experience net drying weather over the coming week which will be good for winter crop planting and summer crop harvesting

-

U.S.

Northern Plains and eastern parts of Canada’s Prairies received significant moisture this week and the northern Plains started to dry down Thursday -

Moisture

over the past week in the Dakotas and eastern Montana was a boon for winter wheat establishment. Fieldwork of all kinds has been delayed and drier weather expected through the coming week will be good for getting summer crop harvesting back on track.

-

Little

to no rain and warming is expected through late next week except for South Dakota and southern Minnesota where some rain showers will occur briefly during mid-week next week -

Central

Montana, southern and eastern Alberta, Canada and central through western Saskatchewan are still too dry and have a huge need for significant precipitation -

These

areas will remain dry biased for an extended period of time -

Winter

wheat is not establishing well in central Montana or some neighboring areas in Canada.

-

U.S.

hard red winter wheat areas will experience less precipitation over the next week to ten days -

Recent

rain has improved planting and emergence conditions, especially in Oklahoma and western Kansas -

Dryness

is still an issue from the Texas Panhandle into Colorado and a few western most counties in Kansas

-

U.S.

Delta will get additional rain today while overnight precipitation impacts the southeastern states into Saturday

-

Resulting

rainfall should be light and the impact on harvesting should not be great -

Another

bout of rain is expected late next week, but good drying conditions will occur between the events -

No

serious declines in unharvested crop quality is expected, although the Delta and southeastern states need a prolonged period of dry weather to protect cotton fiber quality and to ensure faster harvesting -

Warming

will return to much of the central and western United States this weekend into next week -

West

Texas cotton, corn, peanut and sorghum areas will receive rain briefly during mid- to late week next week and again one week later

-

Cool

temperatures are expected this weekend with lows slipping into the middle and upper 30s Saturday

-

No

freeze is expected, but some patches of soft frost are possible -

A

few areas in the northwestern most counties of West Texas cotton country will experience temperatures near freezing Saturday. -

Warming

is expected again late this weekend into next week -

Rain

is not expected to be a huge problem for West Texas, although drier weather is preferred.

-

Texas

Blacklands will dry down this weekend and early next week after this week’s heavy rainfall delayed farming activity -

More

rain may occur late next week -

California

and the interior Pacific Northwest and a part of the far northwestern U.S. Plains will continue dry for the next ten days -

U.S.

Midwest weather will improve after this week’s rain with better harvest conditions expected -

Mexico

rainfall will be erratic over the next week with pockets of the nation a little wetter biased while other areas are a little drier biased -

Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail -

Philippines,

Indonesia and Malaysia rainfall is expected to occur favorably over the next week to ten days -

Seasonably

dry biased weather will continue in North Africa for a while -

Central

Africa will continue to experience periodic rainfall during the next ten days maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions -

Drier

weather will soon be needed in some cotton areas -

South

Africa rainfall will be restricted for a while, but next week will be wetter -

Many

areas away from the coast will be left dry or experience net drying conditions until next week when a boost in rainfall is expected in key summer crop areas -

Most

summer crop areas will receive frequent rainfall next week and into the following weekend -

Winter

crops will develop favorably following previous rainfall and some early spring planting will be starting soon if it has not already begun -

Today’s

Southern Oscillational Index was +10.32 and it was expected to move higher during the coming week -

New

Zealand weather is expected to be a little wetter and cooler biased this week and then drier and warmer next week -

Central

America rainfall will be below average this week except in Costa Rica, Panama and El Salvador where rainfall will be near to above normal

Friday,

Oct. 15:

- ICE

Futures Europe weekly commitments of trader’s report (6:30pm London) - CFTC

commitments of trader’s weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

monthly data on green coffee stockpiles - Malaysia

Oct. 1-15 palm oil exports - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Monday,

Oct. 18:

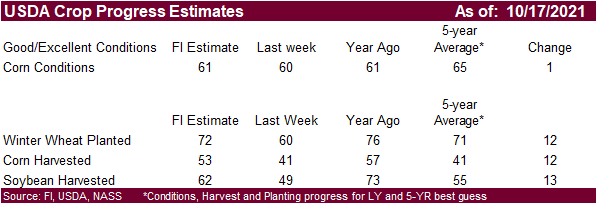

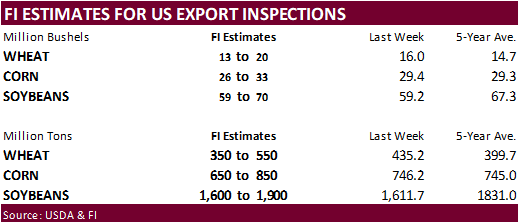

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn and cotton; soybeans harvested; winter wheat planted, 4pm - China’s

second batch of trade data, including corn, wheat, sugar, pork imports - China

3Q pork output and inventories - GrainCom

conference, Geneva, day 1 - Ivory

Coast cocoa arrivals

Tuesday,

Oct. 19:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - S&P

Global Platts European Sugar Virtual Conference, day 1 - GrainCom

conference, Geneva, day 2 - HOLIDAY:

Malaysia, Pakistan

Wednesday,

Oct. 20:

- EIA

weekly U.S. ethanol inventories, production - China’s

third batch of trade data, including soy, corn and pork imports by country - Malaysia

Oct. 1-20 palm oil exports - S&P

Global Platts European Sugar Virtual Conference, day 2 - USDA

total milk production, 3pm - GrainCom

conference, Geneva, day 3 - HOLIDAY:

Indonesia

Thursday,

Oct. 21:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm

Friday,

Oct. 22:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - USDA

NASS Chicken and Eggs. - HOLIDAY:

Thailand

Source:

Bloomberg and FI

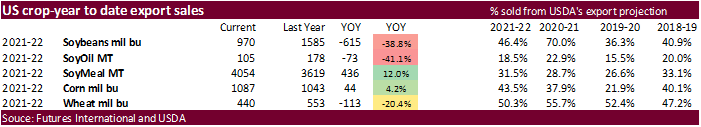

USDA

export sales

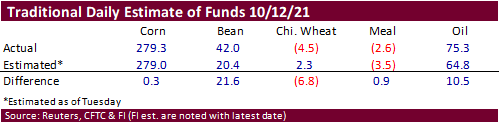

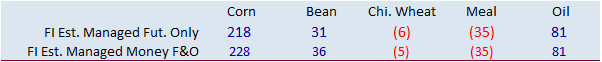

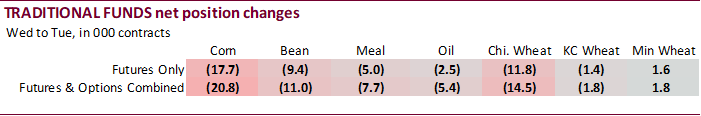

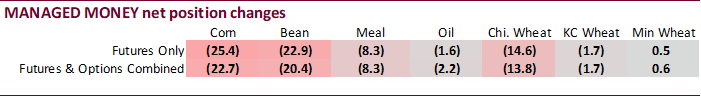

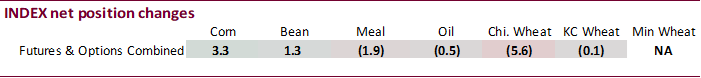

CFTC

Commitment of Traders

Funds

were 21,600 more long than expected in soybeans and 10,500 more long in soybean oil.

CFTC

COT

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

148,925 -22,031 387,557 3,305 -476,543 19,804

Soybeans

-12,297 -12,040 180,524 1,323 -127,587 17,368

Soyoil

44,193 -6,122 117,983 -540 -172,374 6,194

CBOT

wheat -36,361 -11,580 127,842 -5,598 -83,790 14,384

KCBT

wheat 25,179 -2,157 57,272 -104 -83,363 2,367

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

227,931 -22,665 225,228 7,712 -455,550 14,132

Soybeans

29,068 -20,385 104,859 89 -103,369 17,568

Soymeal

-40,324 -8,261 86,819 1,468 -89,996 5,228

Soyoil

72,984 -2,194 101,260 3,188 -183,373 1,755

CBOT

wheat -8,546 -13,759 84,250 907 -65,209 10,822

KCBT

wheat 48,286 -1,660 32,480 -1,010 -75,719 2,928

MGEX

wheat 15,896 559 1,559 50 -30,608 -1,303

———- ———- ———- ———- ———- ———-

Total

wheat 55,636 -14,860 118,289 -53 -171,536 12,447

Live

cattle 35,469 10,312 84,394 -1,265 -129,842 -6,366

Feeder

cattle -1,254 3,010 4,241 360 752 -1,674

Lean

hogs 68,632 -6,514 56,108 -1,155 -121,683 6,060

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

62,331 1,900 -59,939 -1,080 1,830,438 4,100

Soybeans

10,082 9,380 -40,640 -6,651 978,147 69,947

Soymeal

19,731 564 23,769 1,000 470,906 25,952

Soyoil

-1,071 -3,218 10,199 468 460,957 12,425

CBOT

wheat -2,802 -764 -7,692 2,793 470,730 11,212

KCBT

wheat -5,958 -152 912 -107 260,494 4,437

MGEX

wheat 7,554 1,236 5,600 -542 81,687 833

———- ———- ———- ———- ———- ———-

Total

wheat -1,206 320 -1,180 2,144 812,911 16,482

Live

cattle 20,909 -249 -10,931 -2,432 326,185 -8,051

Feeder

cattle 1,110 552 -4,848 -2,248 43,754 -4,228

Lean

hogs 15,860 2,290 -18,918 -681 317,055 -6,986

=================================================================================

Source:

CFTC, Reuters and FI

Macros

US

Empire State Manufacturing Index Oct: 19.8 (est 25.0, prev 34.3)

US

Retail Sales Advanced (M/M) Sep: 0.7% (est -0.2%; prevR 0.9%)

–

US Retail Sales ex Autos (M/M) Sep: 0.8% (est 0.5%; prevR 2.0%)

–

US Retail Sales Ex Auto & Gas Sep: 0.7% (est 0.4%; prevR 2.1%)

–

US Retail Sales “Control Group” (M/M) Sep: 0.8% (est 0.5%; prevR 2.6%)

Volume

Of Russian Gas Pumped Through Ukraine To Europe Has Fallen Below Level Under Current Transit Contract – RTRS Citing Ukraine

US

Import Price Index (M/M) Sep: 0.4% (est 0.6%; prev -0.3%)

–

US Export Price Index (M/M) Sep: 0.1% (est 0.7%; prev 0.4%)

78

Counterparties Take $1.642 Tln At Fed’s Fixed-Rate Reverse Repo ($1.446 Tln, 83 Bidders)

·

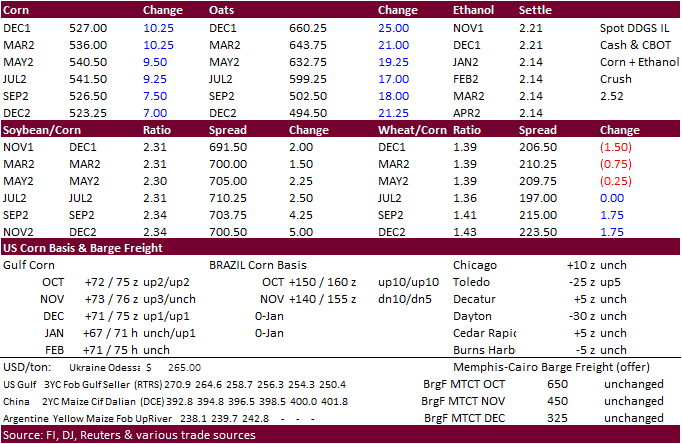

Corn traded higher after Argentina commercial merchants confirmed the government “is printing money and closing exports.” Corn and wheat shipments were “virtually closed” as government is not signing off on new licenses declarations

until they define a way to monitor and limit them. We heard little or no corn registrations have been recorded in more than a week, but we can’t confirm that. We did not see the newswires pickup on this, but this should be monitored as it could shift business

to the US.

·

Decent USDA export sales, strength in soybeans, and crude oil up more than $1.30 also supported corn.

·

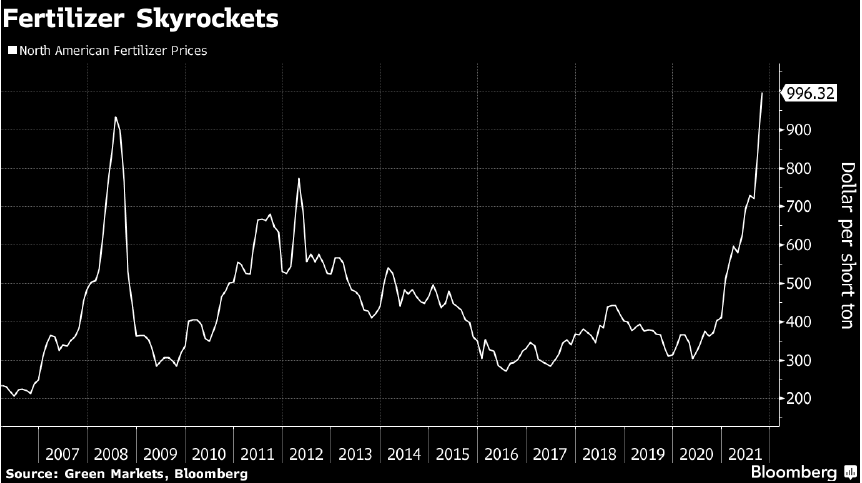

There are concerns the US 2022 corn area will be trimmed from high fertilizer prices. We think normal crop rotation will be the norm but some corn acres could shift to wheat and other feedgrains due to high corn input prices.

·

French corn harvest progress is slow with only 15 percent of the crop collected as of October 11, up 7 points from the week earlier and below 62 percent year ago.

·

The US Midwestern southern and eastern areas will see rain today. Over the weekend it looks like mostly net drying.

·

USDA Turkey Hatchery

-

Eggs

in Incubators on October 1 Down 1 Percent from Last Year -

Poults

Hatched During September Down 3 Percent from Last Year -

Net

Poults Placed During September Up 1 Percent from Last Year

·

Next Friday USDA NASS will report Cattle on Feed and Chicken and Eggs reports.

·

USDA FSA Acreage is delayed. When updated, it will be posted here

https://www.fsa.usda.gov/news-room/efoia/electronic-reading-room/frequently-requested-information/crop-acreage-data/index

Export

developments.

-

None

reported

Updated

10/12/21

December

corn is seen in a $4.85-$5.55 range

March

corn is seen in a $5.00-$5.70 range

·

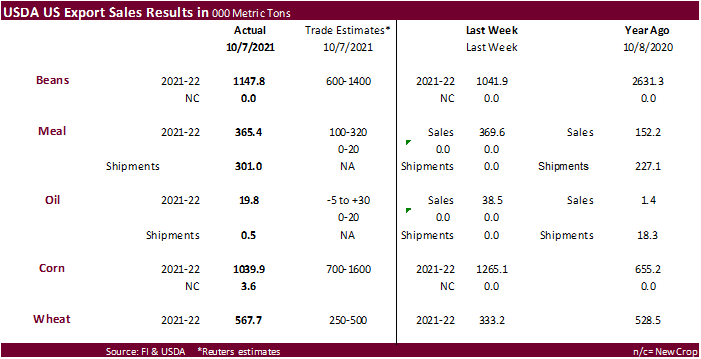

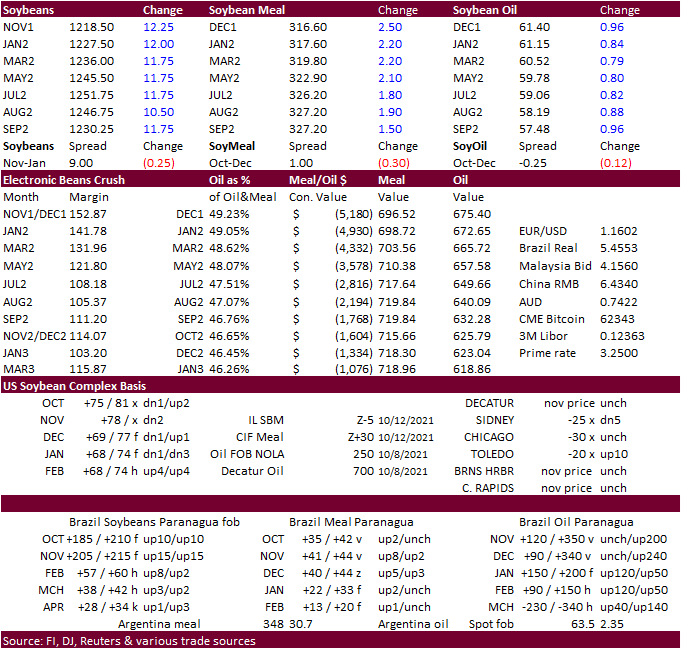

Soybeans traded higher on good USDA export sales and three more USDA 24-hour sales announcements. We look for USDA export sales to surpass 2.1 million tons when reported next week. Earlier this week soybeans fell below $12/bu

but failed to generate a good amount of selling, so ongoing technical buying was seen today. Light commercial buying might have been in play after prices dropped earlier this week. Outside product markets this morning were lending support to soybean oil

and meal. Higher WTI lent support to soybeans and soybean oil.

·

We see gains in soybeans, if any next week, to be limited on improving Brazilian weather that will promote soybean plantings during the second half of October.

·

NOPA reported a lower-than-expected September US crush of 153.8 million bushels, a three-month low, from the 158.843 million bushels crushed in August and 4.8% below the 161.491 million bushels in crushed September 2020. Soybean

oil stocks of 1.684 billion pounds from 1.668 billion at the end of August

·

China cash crush margins were last 206 cents/bu (219 previous) on our analysis versus 187 cents late last week and 97 cents around a year ago.

NOPA

reported

a lower-than-expected September US crush of 153.8 million bushels, a three-month low, from the 158.843 million bushels crushed in August and 4.8% below the 161.491 million bushels in crushed September 2020. The September crush was lowest since 2019 for that

month. Daily adjusted the crush improved slightly from August despite chatter there was more downtime taken. Soybean oil stocks of 1.684 billion pounds from 1.668 billion at the end of August, compares to 1.433 billion a year earlier and highest for that

month since 2012! The SBO yield was unchanged from the previous month at 11.79 and compares to 11.60 year ago. Soymeal exports last month fell to 603,545 short tons, down from 856,619 in August and 991,134 tons in September 2020. September meal exports

were lowest since 2017 for that month and lowest for any month since mid-2019.

Export

Developments

-

Under

the USDA 24-hour announcement system, private exporters reported sales of: -

396,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year -

326,750

metric tons of soybeans received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year -

132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

Updated

10/12/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 57-63 cent range, March 56-65

·

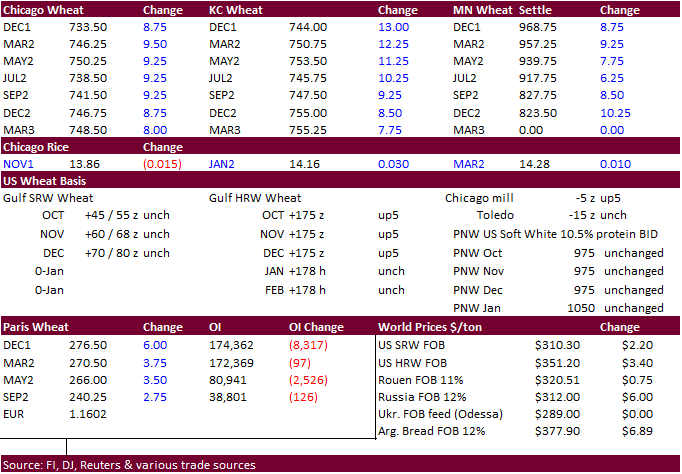

USDA wheat export sales were above expectations and supported US wheat futures. KC rose by most as dry weather is expected for the US HRW wheat country. Paris wheat reached a 9-year high this week.

December

Paris wheat settled up 5.50 euros, or 2.0%, at 276.00 euros ($319.97) a ton.

·

China plans to start a new round of wheat auctions from state reserves, starting October 20.

·

US hard red winter wheat areas will trend drier for at least more than a week, good for harvest progress but bad for recently emerged wheat.

Export

Developments.

·

Pakistan passed on 90,000 tons wheat this week.

·

Japan’s AgMin received no offers for feed wheat and barley for arrival by Feb 24.

·

Jordan seeks 120,000 tons of wheat on October 20.

·

Turkey seeks 300,000 tons of wheat on Oct. 21 for shipment between Dec. 10 and Dec. 31.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $6.95‐$7.80, March $6.75-$8.00

December

MN wheat is seen in a $9.00‐$9.75, March $9.00-$9.75

U.S. EXPORT SALES FOR WEEK ENDING 10/7/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

244.7 |

1,546.4 |

1,533.4 |

216.2 |

3,055.4 |

4,096.7 |

0.0 |

0.0 |

|

SRW |

30.3 |

609.3 |

317.9 |

93.1 |

1,186.5 |

876.4 |

0.0 |

0.0 |

|

HRS |

190.9 |

955.3 |

1,530.0 |

87.5 |

2,320.2 |

2,825.8 |

0.0 |

0.0 |

|

WHITE |

101.8 |

592.5 |

1,450.0 |

62.1 |

1,588.2 |

1,876.9 |

0.0 |

0.0 |

|

DURUM |

0.0 |

60.5 |

220.6 |

0.0 |

61.4 |

321.6 |

0.0 |

0.0 |

|

TOTAL |

567.6 |

3,764.0 |

5,051.9 |

458.9 |

8,211.6 |

9,997.4 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

24.5 |

33.2 |

0.0 |

5.7 |

8.9 |

0.0 |

0.0 |

|

CORN |

1,039.9 |

24,206.3 |

22,010.1 |

918.1 |

3,414.8 |

4,492.9 |

3.6 |

336.9 |

|

SORGHUM |

2.5 |

2,130.5 |

2,541.8 |

62.3 |

225.8 |

393.4 |

0.0 |

0.0 |

|

SOYBEANS |

1,147.8 |

22,760.5 |

34,217.2 |

1,713.8 |

3,629.2 |

8,906.7 |

0.0 |

19.8 |

|

SOY MEAL |

365.4 |

3,753.4 |

3,361.9 |

301.0 |

301.0 |

257.3 |

0.7 |

30.5 |

|

SOY OIL |

19.8 |

104.5 |

159.8 |

0.5 |

0.5 |

18.4 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

29.6 |

220.5 |

543.6 |

8.2 |

235.9 |

78.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

7.5 |

26.5 |

0.2 |

1.7 |

2.4 |

0.0 |

0.0 |

|

L G BRN |

0.6 |

3.8 |

11.3 |

0.5 |

15.0 |

9.0 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

54.3 |

23.0 |

0.1 |

14.1 |

25.4 |

0.0 |

0.0 |

|

L G MLD |

1.5 |

135.8 |

61.2 |

3.4 |

142.1 |

66.7 |

0.0 |

0.0 |

|

M S MLD |

2.1 |

68.1 |

98.4 |

3.6 |

72.6 |

72.1 |

0.0 |

0.0 |

|

TOTAL |

33.9 |

490.0 |

764.1 |

15.9 |

481.3 |

254.4 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

146.7 |

5,881.4 |

5,728.2 |

95.2 |

1,735.8 |

2,505.0 |

10.6 |

752.4 |

|

PIMA |

6.4 |

166.2 |

232.4 |

10.6 |

69.0 |

115.8 |

0.0 |

0.0 |

This summary is based on reports from exporters for the

period October 1-7, 2021.

Wheat: Net

sales of 567,600 metric tons (MT) for 2021/2022 were up 70 percent from the previous week and 42 percent from the prior 4-week average. Increases primarily for the Philippines (142,000 MT), Mexico (127,800 MT, including decreases of 400 MT), Taiwan (49,600

MT), Nigeria (45,100 MT, including decreases of 1,700 MT), and El Salvador (42,300 MT), were offset by reductions primarily for the Dominican Republic (6,500 MT). Exports of 458,900 MT were down 16 percent from the previous week and 5 percent from the prior

4-week average. The destinations were primarily to Japan (125,800 MT), Colombia (103,400 MT), China (68,000 MT), Nigeria (48,100 MT), and Taiwan (34,300 MT).

Corn: Net

sales of 1,039,900 MT for 2021/2022 were down 18 percent from the previous week, but up 85 percent from the prior 4-week average. Increases primarily for Mexico (790,200 MT, including decreases of 21,400 MT), Guatemala (102,600 MT, including 17,400 MT switched

from Panama, 8,800 MT switched from unknown destinations, and decreases of 2,500 MT), Japan (70,400 MT, including 28,300 MT switched from unknown destinations), Costa Rica (51,700 MT, including 12,900 MT switched from Nicaragua, 7,800 MT switched from Guatemala,

and decreases of 5,500 MT), and Colombia (49,600 MT, including 33,000 MT switched from unknown destinations and decreases of 30,900 MT), were offset by reductions primarily for unknown destinations (53,100 MT) and Panama (26,700 MT). Net sales of 3,600 MT

for 2022/2023 resulting in increases for Costa Rica (3,900 MT), were offset by reductions for Canada (400 MT). Exports of 918,100 MT were down 6 percent from the previous week, but up 58 percent from the prior 4-week average. The destinations were primarily

to Mexico (365,900 MT), China (137,500 MT), Colombia (131,000 MT), Honduras (56,800 MT), and Guatemala (56,700 MT).

Optional Origin Sales: For

2021/2022, new optional origin sales of 130,000 MT were reported for unknown destinations. The current outstanding balance of 300,000 MT is for unknown destinations.

Barley: No

net sales or exports were reported for the week.

Sorghum: Total

net sales of 2,500 MT for 2021/2022 were up 6 percent from the previous week, but down 98 percent from the prior 4-week average. The destination reported was China. Exports of 62,300 MT were up 30 percent from the previous week and 52 percent from the prior

4-week average. The destinations were to China (59,900 MT) and Mexico (2,400 MT).

Rice: Net

sales of 33,900 MT for 2021/2022 were down 54 percent from the previous week and 35 percent from the prior 4-week average. Increases were primarily for Mexico (29,600 MT), Canada (3,600 MT, including decreases of 200 MT), Guatemala (200 MT, including decreases

of 100 MT), the United Kingdom (200 MT), and Guam (100 MT). Exports of 15,900 MT were down 74 percent from the previous week and 71 percent from the prior 4-week average. The destinations were primarily to Guatemala (5,700 MT), Canada (4,200 MT), Mexico

(3,200 MT), Saudi Arabia (700 MT), and Jordan (500 MT).

Exports for Own Account:

For 2021/2022, new exports for own account totaling 100 MT were for Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans: Net

sales of 1,147,800 MT for 2021/2022 were up 10 percent from the previous week and 9 percent from the prior 4-week average. Increases primarily for China (640,000 MT, including 264,000 MT switched from unknown destinations and decreases of 5,100 MT), Mexico

(273,800 MT, including decreases of 600 MT), Egypt (102,500 MT, including 52,000 MT switched from unknown destinations), the Netherlands (68,000 MT, including 65,000 MT switched from unknown destinations and decreases of 3,000 MT), and Bangladesh (57,400 MT,

including 55,000 MT switched from unknown destinations), were offset by reductions for unknown destinations (186,400 MT). Exports of 1,713,800 MT were up 82 percent from the previous week and up noticeably from the prior 4-week average. The destinations

were primarily to China (1,285,500 MT), Taiwan (71,500 MT), Mexico (68,900 MT), the Netherlands (68,000 MT), and Bangladesh (57,400 MT).

Export for Own Account: For

2021/2022, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Export Adjustments: Accumulated

export of soybeans to the Netherlands were adjusted down 86,296 MT for week ending September 23rd. The correct destination for this shipment is Germany.

Soybean Cake and Meal: Net

sales of 365,400 MT for 2021/2022 primarily for Ecuador (127,800 MT), Canada (74,600 MT, including decreases of 3,800 MT), the Philippines (51,100 MT), Colombia (43,700 MT, including 20,800 MT switched from unknown destinations and decreases of 12,200 MT),

and Guatemala (34,100 MT, including 9,600 MT switched from Panama, 6,200 MT switched from El Salvador, 6,000 MT switched from Nicaragua, and decreases of 1,100 MT), were offset by reductions primarily for the United Kingdom (60,000 MT) and Panama (13,900 MT). Total

net sales for 2022/2023 of 700 MT were for Canada. Exports of 301,000 MT were primarily to Mexico (76,700 MT), Japan (63,700 MT), Colombia (33,000 MT), Ecuador (27,600 MT), and Guatemala (25,400 MT).

Soybean Oil: Net

sales of 19,800 MT for 2021/2022 reported for Guatemala (15,100 MT), Costa Rica (4,200 MT), Jamaica (3,000 MT), Nicaragua (1,500 MT), and El Salvador (1,200 MT), were offset by reductions primarily for Cameroon (2,500 MT) and Canada (2,200 MT). Exports of

500 MT were to Canada.

Cotton: Net

sales of 146,700 RB for 2021/2022 were down 41 percent from the previous week and 60 percent from the prior 4-week average. Increases primarily for Turkey (62,000 RB), Mexico (52,900 RB), China (12,100 RB, including decreases of 3,100 RB), Thailand (9,500

RB, including 400 RB switched from Indonesia), and Peru (5,800 RB), were offset by reductions for Vietnam (2,200 RB), Honduras (1,700 RB), and Pakistan (1,700 RB). Net sales of 10,600 RB for 2022/2023 resulting in increases for Mexico (15,000 RB), were offset

by reductions for Turkey (4,400 RB). Exports of 95,200 RB–a marketing-year low–were down 24 percent from the previous week and 46 percent from the prior 4-week average. The destinations were primarily to Mexico (23,400 RB), China (23,000 RB), Vietnam (11,300

RB), Bangladesh (9,500 RB), and Turkey (6,600 RB). Net sales of Pima totaling 6,400 RB–a marketing-year low–were down 53 percent from the previous week and 60 percent from the prior 4-week average. Increases were primarily for Peru (5,200 RB) and Bangladesh

(1,100 RB). Exports of 10,600 RB were up noticeably from the previous week and up 91 percent from the prior 4-week average. The destinations were primarily to India (6,800 RB), Peru (1,500 RB), South Korea (700 RB), Turkey (600 RB), and Italy (400 RB).

Optional Origin Sales: For

2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports for Own Account: For

2021/2022, the current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides and Skins: Net

sales of 256,800 pieces for 2021 were down 55 percent from the previous week and 31 percent from the prior 4-week average. Increases primarily for China (109,000 whole cattle hides, including decreases of 20,200 pieces), Thailand (57,200 whole cattle hides,

including decreases of 1,700 pieces), Mexico (35,500 whole cattle hides, including decreases of 900 pieces), South Korea (29,300 whole cattle hides, including decreases of 3,900 pieces), and Indonesia (19,100 whole cattle hides, including decreases of 200

pieces), were offset by reductions primarily for Brazil (200 pieces) and Japan (100 pieces). Exports of 344,800 pieces were down 31 percent from the previous week and 7 percent from the prior 4-week average. Whole cattle hide exports were primarily to China

(217,700 pieces), South Korea (48,000 pieces), Mexico (25,600 pieces), Thailand (19,200 pieces), and Brazil (17,500 pieces).

Net sales of 54,100 wet blues for 2021 were

down 68 percent from the previous week and 66 percent from the prior 4-week average. Increases reported for Italy (23,000 grain splits and 8,200 unsplit, including decreases of 14,700 unsplit and 100 grain splits), China (18,400 unsplit), Vietnam (5,000 unsplit,

including decreases of 100 unsplit), and Brazil (100 unsplit), were offset by reductions for Thailand (400 unsplit) and Mexico (200 grain splits). Total net sales of 13,200 wet blues for 2022 were for Italy. Exports of 130,400 wet blues were down 1 percent

from the previous week and 16 percent from the prior 4-week average. The destinations were primarily to China (47,600 unsplit), Italy (30,700 unsplit and 7,800 grain splits), Vietnam (20,300 unsplit), Mexico (8,200 grain splits and 900 unsplit), and Thailand

(7,600 unsplit). Total net sales of 943,000 splits were reported for China. Exports of 166,200 pounds were to China (86,200 pounds) and Vietnam (80,000 pounds).

Beef: Net

sales of 15,700 MT reported for 2021 were up 1 percent from the previous week, but unchanged from the prior 4-week average. Increases were primarily for Japan (4,400 MT, including decreases of 800 MT), China (3,400 MT, including decreases of 100 MT), South

Korea (2,400 MT, including decreases of 500 MT), Taiwan (1,900 MT, including decreases of 100 MT), and Mexico (1,700 MT, including decreases of 100 MT). Net sales reductions of 300 MT for 2022 resulting in increases for Chile (500 MT) and Taiwan (300 MT),

were more than offset by reductions primarily for South Korea (1,000 MT). Exports of 15,500 MT were down 1 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to Japan (4,400 MT), South Korea (3,800

MT), China (2,400 MT), Taiwan (1,200 MT), and Mexico (1,100 MT).

Pork: Net

sales of 33,500 MT reported for 2021 were up 51 percent from the previous week and 9 percent from the prior 4-week average. Increases primarily for Japan (11,800 MT, including decreases of 200 MT), Mexico (8,200 MT, including decreases of 700 MT), China (4,300

MT, including decreases of 700 MT), South Korea (3,900 MT, including decreases of 100 MT), and Canada (2,400 MT, including decreases of 600 MT), were offset by reductions for El Salvador (100 MT). Exports of 29,700 MT were up 2 percent from the previous

week, but down 2 percent from the prior 4-week average. The destinations were primarily to Mexico (13,900 MT), China (4,000 MT), Japan (3,600 MT), Colombia (1,900 MT), and South Korea (1,800 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.