PDF attached includes updated FI US acreage for 2022

Higher

close in the soybean complex led by soybean meal (strong cash basis and export demand), and lower to mixed trade in grains.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Torrential

rain fell in Utarakhand, India Sunday and Monday resulting in serious flooding - Rainfall

for the 24 hours ending at dawn today varied up to 341 millimeters or 13.43 inches

- Neighboring

areas of northwestern Nepal and Uttar Pradesh were also impacted - Flooding

in portions of the Ganges River Basin has been reported - Damage

to agriculture and personal property has occurred, but the extent of the damage is not known yet - Another

round of flooding rain is expected along the central Vietnam Coast beginning at the end of this week and lasting through Monday - Rain

totals of 6.00 to 12.00 inches and locally more will result with the Hue and Da Nang areas to be most impacted - The

area impacted was already hit with flooding rainfall during the weekend and early on Monday of this week - A

tropical cyclone may impact the same region at the end of next week and into the following weekend further perpetuating the flood conditions - Personal

property damage has been and will likely continue greater than that on agriculture with a human impact likely greatest - Argentina

will receive only light amounts of rain late this week into the weekend and net drying is expected most other days for nearly ten days - Far

southern Brazil will dry down over the next ten days, although a few showers will occur infrequently - Brazil’s

best distribution of rain will be in center west and center south crop areas during the next two weeks favoring spring and summer crop planting, germination and emergence - Australia’s

western crop areas will experience rain over the next few days and then trend drier - The

moisture will be ideal for support of reproducing and filling winter crops - The

nation is well on its way to a huge winter wheat, barley and canola crop - Eastern

Australia is expecting dry weather for the next ten days favoring sorghum and cotton areas in irrigated areas and in areas with good soil moisture, but dryland production areas need moisture - Winter

wheat, barley and canola will continue performing very well with good yields possible - Northern

China will experience a mostly good weather pattern for summer crop maturation and harvest progress

- Winter

crop planting in the North China Plain and Yellow River Basin will advance well - East-central

and interior southern China will experience alternating periods of rain and sunshine maintaining good field moisture for wheat and rapeseed planting while supporting some summer crop maturation and harvest progress - India’s

weather will be mostly good over the next couple of weeks now that excessive rain in the northeast is abating - Rain

will fall most often in the south and far eastern parts of the nation - Summer

crop harvesting and winter crop planting should advance well - Russia’s

Volga River Basin will continue in need of greater moisture, although winter crops are semi-dormant and established well enough to survive winter if there is good snow cover during period of extreme cold - Soil

conditions are little dry, but moisture was present when crops were emerging - Ukraine

and most of Europe will see tranquil weather for a while allowing late season farming activity to wind down - Winter

crop planting and summer crop harvesting continues to advance well across the European Continent and little change is likely - U.S.

weather the remainder of this week….. - Rain

will be limited to tonight into Thursday across the interior northern Plains and Midwest and Delta

- Resulting

amounts will be very light ranging from 0.10 to 0.35 inch except from South Dakota into the Great Lakes region where a few amounts of 0.50 to 1.50 inches 35 are possible - The

southeastern states will be dry - Hard

red winter wheat areas will be mostly dry as well - Northwestern

parts of the U.S. Plains and neighboring areas in Canada will be dry - Cooling

is likely in the north-central states with highs only in the 40s and 50s and nightly freezes the remainder of this week - Temperatures

will be seasonable to slightly warmer than usual with the central and southern Plains and interior western states warmest - Favorable

field progress will advance around this week’s precipitation - Both

the planting of winter crops and the harvest of summer grain and oilseeds will advance favorably during the week - Cotton

maturation and harvest progress is also expected along with other crops - U.S.

weather next week will be more active in with at least one large storm system bringing precipitation to the northern and eastern Plains, Midwest, Delta and southeastern states - Rainfall

will be sufficient to disrupt farming activity and to bolster topsoil moisture for a short period of time - Rain

is not likely to be significant in the west-central or southwestern Plains

- Waves

of rain will impact the Pacific Northwest and northern Rocky Mountain region

- Rain

and mountain snow will fall in the Sierra Nevada - A

minor disturbance may produce a few showers this weekend and a second large storm system is possible in the eastern Midwest late next week after the first large system occurs in the upper Midwest and western Corn Belt

- Temperatures

will turn colder in the western states and be warmer than usual in the central and eastern states - Farming

activity will be slowed for a little while next week because of rain, but the delays are not expected to be problematic and the moisture will be good for winter crop establishment - Another

wave or two of rain and snow will move through eastern Canada’s Prairies next week while this week will be dry biased - Harvesting

of this year’s crops is complete, but the rain is needed to restore soil moisture after a multi-year drought seriously reduced production in 2021 - The

moisture must occur to improve spring planting conditions in 2022; however, central parts of the Prairies (southern and eastern Alberta and central through western Saskatchewan) are unlikely to get much meaningful moisture

- South

Africa will receive periodic rainfall during the coming week and that will bolster soil moisture for improved conditions for late season wheat development and early planting of summer crops - Showers

through Wednesday will impact half of the crop region, but rain amounts will not be more than 0.50 inch - Greater

rain is expected Thursday through and Friday with coverage of 75% from interior parts of Northern Cape and Eastern Cape through Mpumalanga, Natal and southwestern Limpopo - Alternating

periods of rain and sunshine are expected in the coming weekend and next week further supporting summer crop planting and late season winter crop development - North

Africa will be mostly dry this week, but rain will develop next week in Algeria - Central

Africa will continue to experience periodic rainfall during the next ten days maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions - Drier

weather will soon be needed in some cotton areas - Rainfall

this week is expected to be greater than usual - Rain

will fall frequently in Indonesia, Malaysia and Philippines through the next ten to 12 days maintaining a good outlook for palm oil, coconut, corn, rice, sugarcane, citrus and many other crops - There

were no tropical cyclones around the world today and none was expected for a while

- Mexico

rainfall will be erratic over the next week with pockets of the nation a little wetter biased while other areas are a little drier biased - Southern

areas will be wetter biased - Central

America rainfall will be below average this week except in Costa Rica, Panama and El Salvador where rainfall will be near to above normal - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +11.45 and it was expected to move higher during the coming week - New

Zealand weather is expected to be a little drier than usual and temperatures will be seasonable.

Tuesday,

Oct. 19:

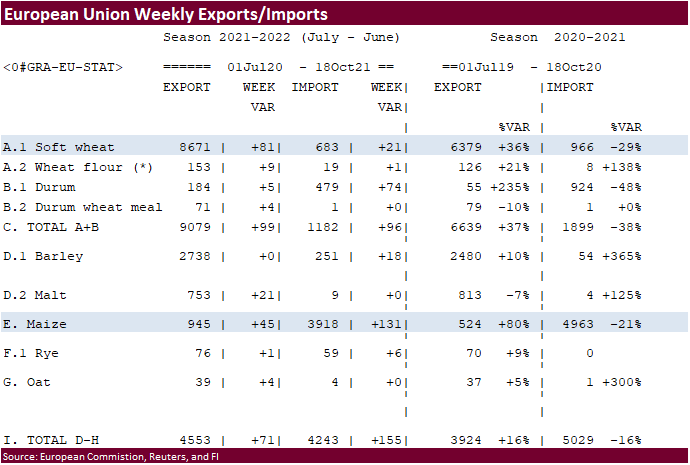

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - S&P

Global Platts European Sugar Virtual Conference, day 1 - GrainCom

conference, Geneva, day 2 - HOLIDAY:

Malaysia, Pakistan

Wednesday,

Oct. 20:

- EIA

weekly U.S. ethanol inventories, production - China’s

third batch of trade data, including soy, corn and pork imports by country - Malaysia

Oct. 1-20 palm oil exports - S&P

Global Platts European Sugar Virtual Conference, day 2 - USDA

total milk production, 3pm - GrainCom

conference, Geneva, day 3 - HOLIDAY:

Indonesia

Thursday,

Oct. 21:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm

Friday,

Oct. 22:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - USDA

NASS Chicken and Eggs. - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Macros

76

Counterparties Take $1.471 Tln At Fed’s Fixed-Rate Reverse Repo ($1.477 Tln, 79 Bidders)

·

Corn ended 0.75-2.75 cents lower despite a lower USD. It was higher after the open and strength in soybeans, but eventually traded two-sided after wheat paired gains.

·

WTI crude continued to rally and is currently near $83/barrel.

·

US ethanol margins have improved with higher energy prices (WTI) and some estimated they are approaching 2.00.

·

China approved imports of breeding pigs from Ireland. The pigs must be in quarantine no less than 30 days before getting shipped.

·

Most of Brazil is forecast to receive 0.75 to 2.50 inches of rain through Friday. Mato Grosso do Sul and neighboring states will remain dry.

·

Bloomberg Survey: U.S. Cattle on Feed Herd Seen Down 0.6% Y/y. Oct. 1 herd seen falling y/y to 11.65m head. That would be the fourth straight month that the feedlot herd declined.

·

A Bloomberg poll looks for weekly US ethanol production to be up 10,000 barrels (1020-1055 range) from the previous week and stocks up 127,000 barrels to 19.974 million.

Export

developments.

-

None

reported

Updated

10/12/21

December

corn is seen in a $4.85-$5.55 range

March

corn is seen in a $5.00-$5.70 range

·

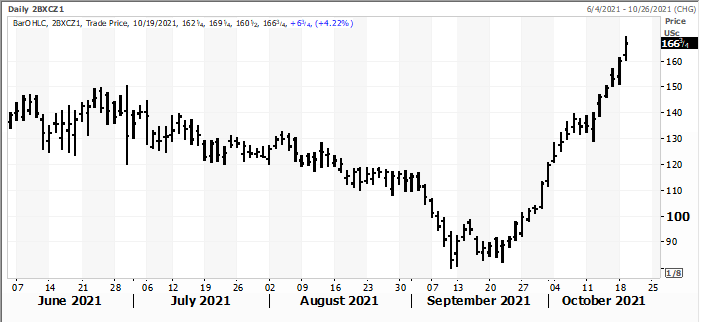

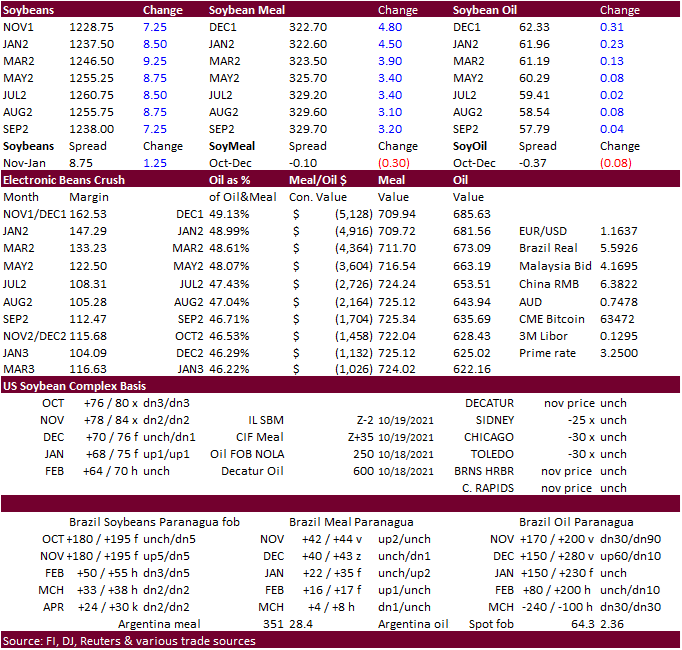

CBOT soybeans and meal were higher during most of the day, led by meal that pressured soybean oil. Soybean oil also saw lack of direction with Malaysia on holiday. But soybean oil managed to rebound to trade and close higher.

November soybeans were 6.50 cents higher, December meal up $4.70 and December soybean oil up 37 points. Note Paris November rapeseed prices were up 14.25 euros to a new record of 689.25 euros.

·

Soybean meal was the leader today. December traded to an October 4 high. We think the bullish undertone is in large part to a slower than expected September crush followed by very firm cash values across the eastern and western

Corn Belt, not so much demand driven by meat consumers. End users are in the market for meal and they are competing with strong export demand. Processors need to see the US harvest pace pick up.

·

December crush overnight traded at an impressive $1.6925 before settling around $1.6675. January was around $1.54.

·

We are hearing some Brazilian producers expected to receive fertilizer and glyphosate have seen contracts canceled due to lack of supply.

·

US Midwest weather forecast was mostly unchanged this morning. US Midwest rain this week should favor the north central Midwest mid-workweek and eastern areas Thursday through Friday.

·

We are hearing better than expected soybean yields for IA. ECB bean harvest was delayed last week and should increase this week. WCB harvest progress is running hard

·

Egypt is in for vegetable oils on Wednesday.

·

Southern Paraguay and southern Brazil will see a drier weather pattern through the next two weeks that will be beneficial for fieldwork. Regular rounds of showers and thunderstorms will occur through the next two weeks across

northern Brazil.

Export

Developments

·

Egypt seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on Wednesday for arrival during December 5-25.

December

soybean crush

Source:

Reuters and FI

Updated

10/18/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59-65 cent range, March 56-65

·

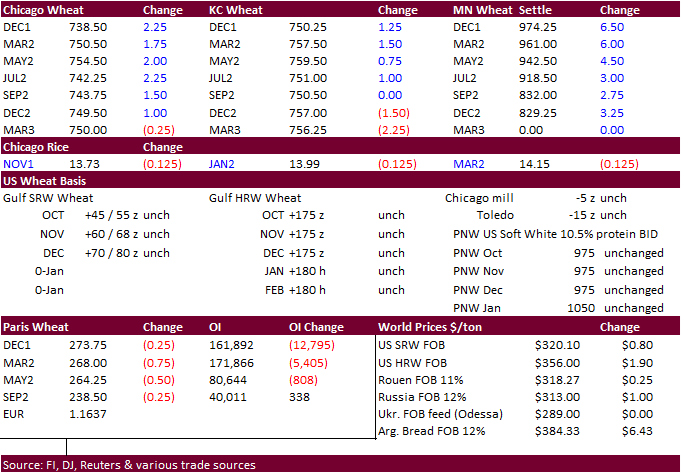

US wheat futures prices ended mostly moderately lower in Chicago and KC and higher in MN. Demand for high protein wheat remains good. Unfavorably dry weather across the US Great Plains bias western and southern areas supported

MN prices and likely limited losses in KC futures. Note Russian wheat export prices were stable last week after 13 weeks of consecutive gains.

·

USD was 26 points lower around the CBOT ag close.

·

Paris December wheat was down 0.25 euro at 273.75.

·

Egypt’s GASC will drop its 15% price advantage given to Egyptian state shipping line National Navigation Company (NNC) to transport wheat. “GASC operates a parallel freight tender to buy ocean shipping capacity. But offers by

other shipping companies in the freight tender are generally thin because of the price advantage given to NNC.” (Reuters) Since shipping costs are higher, the current “policy results in higher ocean shipping prices than seeking ships on the open market.”

This should have a minimal impact on future import tenders and should improve competition.

·

Ukraine 2022 winter wheat plantings are around 75 percent complete, or 5 million hectares of the expected 6.68 million hectares, according to the AgMin.

·

The Great Plains will see light showers across eastern NE Tuesday and central TX Thursday. Rest of the Great Plains will be mainly dry this week.

·

China plans to start a new round of wheat auctions from state reserves, starting October 20.

Export

Developments.

·

Turkey seeks 235,000 tons of feed barley on October 26.

·

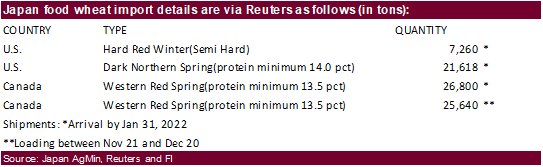

Japan seeks 81,318 tons of food wheat on Thursday.

·

Jordan seeks 120,000 tons of wheat on October 20.

·

Turkey seeks 300,000 tons of wheat on Oct. 21 for shipment between Dec. 10 and Dec. 31.

·

Jordan seeks 120,000 tons of feed barley on October 21 for FH January through FH March shipment.

·

Pakistan seeks 90,000 tons of wheat on October 25.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $7.10‐$7.95, March $6.82-$8.25

December

MN wheat is seen in a $9.00‐$10.00, March $9.00-$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.