PDF Attached

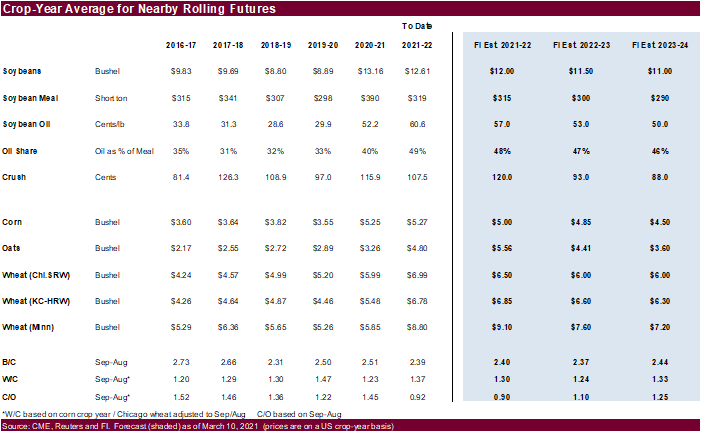

Improving soybean crush margins, good ethanol margins, firm US domestic cash prices, lack of producer selling, rally in energy markets, strong global vegetable oil prices, and

new contract highs in Paris wheat and rapeseed contracts are just some of the factors influencing the impressive upside movement in CBOT agriculture futures. We think this is a short-term event unless global weather turns unfavorable. 2021-22 global stocks

for soybeans and corn are expected to expand or end up near unchanged from 2020-21. Long-term we look for prices to gradually fall from current levels.

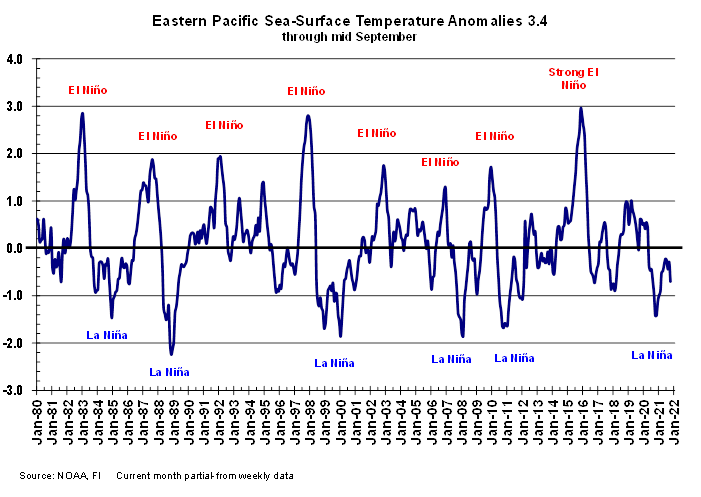

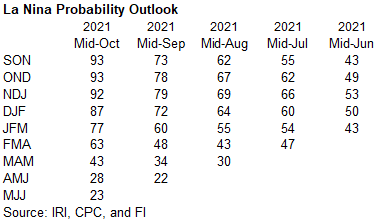

First

half October SST’s average -0.7 versus -0.29 for September, and there is a 92 to 93 percent probability La Nina will occur from now until at least January 2022.

La

Nina has been developing more aggressively in recent weeks but nothing like what we saw last year when La Nina peaked in November 2020. While La Nina is expected to continue into the Northern Hemisphere’s winter, this event has yet to have a major influence

on world weather patterns, but something we need to monitor. A strong La Nina event tends to yield greater rainfall than normal across many tropical and subtropical areas of the world. On the other hand, La Nina can also reduce rainfall for the US central

Great Plains and western Corn Belt. Dryness can also impact eastern Argentina, southern Brazil, Uruguay, and far southern Paraguay. Meanwhile a wet bias could occur in eastern Australia, Southeast Asia, India, and South Africa.

7-day

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Another

round of flooding rain is expected along the central Vietnam Coast beginning this weekend and lasting through Monday - Rain

totals of 6.00 to 12.00 inches and locally more will result with the Hue and Da Nang areas to be most impacted - The

area impacted was already hit with flooding rainfall during the weekend and early on Monday of this week - A

tropical cyclone may impact the same region during the middle part of next week and into the following weekend further perpetuating the flood conditions - Personal

property damage has been and will likely continue greater than that on agriculture with a human impact likely greatest - A

tropical disturbance will evolve over the Philippines this weekend and it will organize into the tropical cyclone over the south China Sea Sunday and Monday while trekking to the west toward Vietnam - The

storm may move across Vietnam’s Central Highlands raising some concern over coffee and other crops in the region - The

developing system will need to be closely monitored, but the impact on coffee and Vietnam is nearly a week away - A

Low pressure center moving off the Tunisia, Africa coast this weekend will move over the central Mediterranean Sea and intensify - This

system has potential to possibly become a subtropical storm with impacts on Sicily, Greece and far southern Italy next week

- The

storm could produce torrential rainfall and strong wind speeds - Confidence

is low, but the potential storm will need to be closely monitored - A

tropical disturbance off the southwestern Mexico coast Thursday will evolve into a tropical storm Friday before turning into Mexico over Michoacan

- The

storm may also impact western Guerrero and southeastern Jalisco with heavy rain and strong wind speeds - Landfall

is expected Sunday - Moisture

from this storm will stream into the Texas coastal region and may help enhance rain in the U.S. Delta next week - Argentina

will receive some welcome rain Thursday into Saturday - Coverage

will be high, but resulting rainfall may be a little light varying from 0.25 to 0.75 inch and locally more - Net

drying is expected after this for Sunday through most of next week - Argentina

still needs greater rain in northwestern parts of the nation where dryness is still significant in the topsoil - Subsoil

moisture is still low over a larger part of the west-central and north parts of the nation

- Next

week’s temperatures will likely trend warmer than usual while dry weather prevails resulting in notable drying for much of the nation - Southern

Brazil’s forecast continues to have a drier bias for the next couple of weeks, although some showers will occur briefly this weekend and possibly again in the second weekend of the outlook - Net

drying in southern Brazil, Uruguay, southern Paraguay and eastern Argentina is not unusual for La Nina events during late spring and summer - La

Nina is still evolving, but as it does this potential for dryness is likely to be reinforced during November warranting a close watch

- Center

west, center south and interior southern parts of Brazil will continue to experience a good mix of rain and sunshine over the next two weeks resulting in favorable planting, germination and emergence conditions for corn and soybeans - Cotton

will also benefit from the pattern - Sugarcane,

citrus and coffee crops are rated favorably and expected to continue benefiting from alternating periods of rain and sunshine during the next two weeks - Australia’s

western and southern crop areas will experience a good mix of rain and sunshine over the next two weeks

- The

environment will be ideal for support of reproducing and filling winter crops - The

nation is well on its way to a huge winter wheat, barley and canola crop - Interior

Eastern Australia is expecting dry weather for the next ten days favoring sorghum and cotton areas in irrigated areas and in areas with good soil moisture, but dryland production areas need moisture - Winter

wheat, barley and canola will continue performing very well with good yields possible - Northern

China will experience a mostly good weather pattern for summer crop maturation and harvest progress

- Winter

crop planting in the North China Plain and Yellow River Basin will advance well - East-central

and interior southern China will experience alternating periods of rain and sunshine maintaining good field moisture for wheat and rapeseed planting while supporting some summer crop maturation and harvest progress - India’s

weather will be mostly good over the next couple of weeks now that excessive rain in the northeast is over - Rain

will fall most often in the far south and extreme eastern parts of the nation - Summer

crop harvesting and winter crop planting should advance well - Russia’s

Volga River Basin will continue in need of greater moisture, although winter crops are semi-dormant and established well enough to survive winter if there is good snow cover during period of extreme cold - Soil

conditions are little dry, but moisture was present when crops were emerging - Ukraine

and most of Europe away from the North and Baltic Seas will see tranquil weather for a while allowing late season farming activity to wind down - Winter

crop planting and summer crop harvesting continues to advance well across the European Continent and little change is likely - U.S.

weather the remainder of this week….. - Rain

will be limited to areas from South Dakota to the Great Lakes region today and Thursday - Rainfall

will range from 0.20 to 0.75 inch except in parts of eastern South Dakota, far southeastern North Dakota and west-central Minnesota where 1.00 to 2.00 inches of rain will result - A

new disturbance in the southwestern Corn Belt Saturday will shift to the east while expanding across a larger part of the Midwest Sunday into Monday - Moisture

totals of 0.30 to 1.00 inch and local totals of 1.00 to 2.00 inches will result - The

southeastern states will be mostly dry - Showers

in the Delta and Tennessee River Basin during this first week of the outlook will range from 0.20 to 0.75 inch with a few amounts over 1.00 inch - Hard

red winter wheat areas will be mostly dry as well - Northwestern

parts of the U.S. Plains and neighboring areas in Canada will be dry - Waves

of rain will impact California and the Pacific Northwest Friday through Monday with significant moisture in the Sierra Nevada and Cascade Mountains

- Some

needed drought relief is expected in the Pacific Northwest - Cool

weather is expected over the next few days in the north-central states with highs only in the 40s and 50s and nightly freezes the remainder of this week - Temperatures

will be warmer than usual with the central and southern Plains and interior western states

- Favorable

field progress will advance around this week’s precipitation - Both

the planting of winter crops and the harvest of summer grain and oilseeds will advance favorably during the week - Cotton

maturation and harvest progress is also expected along with other crops - U.S.

weather next week will be more active with at least one large storm system and probably two bringing precipitation to the northern and eastern Plains, Midwest, Delta and southeastern states - Rainfall

will be sufficient to disrupt farming activity and to bolster topsoil moisture for a short period of time - Rain

is not likely to be significant in the west-central or southwestern Plains

- Waves

of rain will impact the Pacific Northwest and northern Rocky Mountain region

- Rain

and mountain snow will fall in the Sierra Nevada, although the precipitation should diminish over time. - Temperatures

will turn colder in the western states and be warmer than usual in the central and eastern states - Farming

activity will be slowed for a little while next week because of rain, but the delays are not expected to be problematic as drier weather evolves in the following week. The moisture will be good for winter crop establishment - A

few periods of snow and rain will impact a part of Canada’s Prairies over the next two weeks, but resulting precipitation will not break the drought - Harvesting

of this year’s crops is complete, but the rain is needed to restore soil moisture after a multi-year drought seriously reduced production in 2021 - South

Africa will receive periodic rainfall during the coming week and that will bolster soil moisture for improved conditions for late season wheat development and early planting of summer crops - Showers

through Wednesday will impact half of the crop region, but rain amounts will not be more than 0.50 inch - Greater

rain is expected Thursday through and Friday with coverage of 75% from interior parts of Northern Cape and Eastern Cape through Mpumalanga, Natal and southwestern Limpopo - Alternating

periods of rain and sunshine are expected in the coming weekend and next week further supporting summer crop planting and late season winter crop development - North

Africa will be mostly dry this week, but rain will develop next week in Algeria - Central

Africa will continue to experience periodic rainfall during the next ten days maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions - Drier

weather will soon be needed in some cotton areas - Rainfall

this week is expected to be greater than usual - Rain

will fall frequently in Indonesia, Malaysia and Philippines through the next ten to 12 days maintaining a good outlook for palm oil, coconut, corn, rice, sugarcane, citrus and many other crops - Mexico

rainfall will be erratic over the next week with pockets of the nation a little wetter biased while other areas are a little drier biased - Southern

areas will be wetter biased - Central

America rainfall will be below average this week except in Costa Rica, Panama and El Salvador where rainfall will be near to above normal - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +11.41 and it was expected to move higher during the coming week - New

Zealand weather is expected to be a little drier than usual and temperatures will be seasonable.

Wednesday,

Oct. 20:

- EIA

weekly U.S. ethanol inventories, production - China’s

third batch of trade data, including soy, corn and pork imports by country - Malaysia

Oct. 1-20 palm oil exports - S&P

Global Platts European Sugar Virtual Conference, day 2 - USDA

total milk production, 3pm - GrainCom

conference, Geneva, day 3 - HOLIDAY:

Indonesia

Thursday,

Oct. 21:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm

Friday,

Oct. 22:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - USDA

NASS Chicken and Eggs. - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Macros

US

DoE Crude Oil Inventories (W/W) 15-Oct: -431K (est +2000K; prev +6088K)

–

Distillate: -3913K (est -1150K; prev -24K)

–

Cushing OK Crude: -2320K (prev -1968K)

–

Gasoline: -5368K (est -950K; prev -1958K)

–

Refinery Utilization: -2.00% (est -0.15%; prev -2.90%)

Canadian

CPI NSA (M/M) Sep: 0.2% (est 0.2%; prev 0.2%)

Canadian

CPI (Y/Y) Sep: 4.0% (est 4.3%; prev 4.1%)

Canadian

CPI Core-Common (Y/Y) Sep: 1.8% (est 1.9%; prev 1.8%)

Canadian

CPI Core-Median (Y/Y) Sep: 2.8% (est 2.6%; prev 2.6%)

Canadian

CPI Core-Trim (Y/Y) Sep: 3.4% (est 3.3%; prev 3.3%)

·

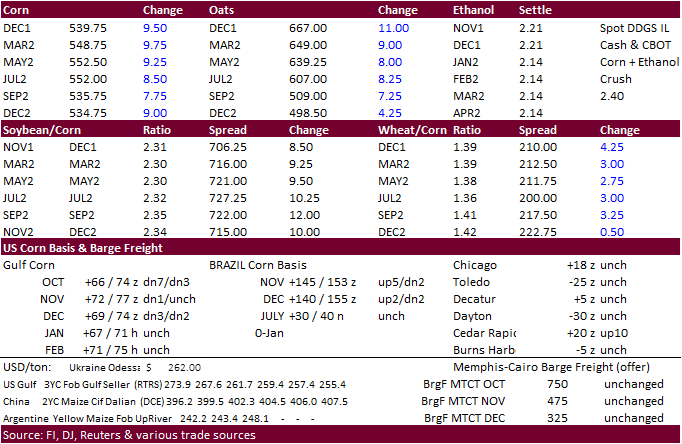

Corn rose to the highest level in two weeks on demand and money flow. Also lending support was the weaker US dollar.

·

There is talk here and there of China committing to soybeans and wheat, but we have not seen them in for corn for a while (last USDA 24-hour corn sale to China was reported May 20). China is looking to limit speculation in the

energy markets and procure future needs, so we would not be surprised by them adding coverage for other commodities.

·

China’s AgMin said the fall grain harvest was around 80 percent and the recent rainy weather was “generally limited.”

·

China’s AgMin warned pig prices may continue to fall after the Lunar New Year next year if production is not substantially reduced, causing heavy losses in pig farming. (Reuters) The sow herd in August to September was 10% higher

than normal levels and that the number of commercial pigs in the fourth quarter of 2021 and the first quarter of 2022 will significantly increase year-on-year.

·

China approved imports of beef imports from Russia, effective October 18. They also recently approved breeding pigs from Ireland.

·

Bloomberg Survey: U.S. Cattle on Feed Herd Seen Down 0.6% Y/y. Oct. 1 herd seen falling y/y to 11.65m head. That would be the fourth straight month that the feedlot herd declined.

·

Most of Brazil is forecast to receive 0.75 to 2.50 inches of rain through Friday. Mato Grosso do Sul and neighboring states will remain dry.

·

Weekly US ethanol production increased a large 64,000 barrels to 1.096 million (trade was looking for up 10,000), highest level since June 7, 2019, and a record for this time of year. This was the third consecutive increase.

Stocks increased 233,000 barrels (trade was looking for a 127,000 increase) to 20.080 million, still relatively low for this time of year. Early September to date ethanol production is up 5.9 percent from same period year ago. US gasoline demand increased

448,000 barrels to 9.634 million barrels. Using a 4-week average, US gasoline demand is running about 1 percent below a comparable period during 2019 (up about 7 percent from 2020). Ethanol blended into finished motor gasoline fell to 91% from 93.1% previous

week.

Cattle

on Feed Report – Survey Report

Due out Friday at 2:00 PM CST

All

figures, except headcount, for feedlots with 1,000-plus head of cattle shown as percentage vs year ago:

|

|

|

|

|

|

On |

|

99.4 |

11.647 |

|

Placements |

97.5-104 |

101.4 |

2.258 |

|

Marketings |

97-98.9 |

97.5 |

1.800 |

Source:

Reuters and FI

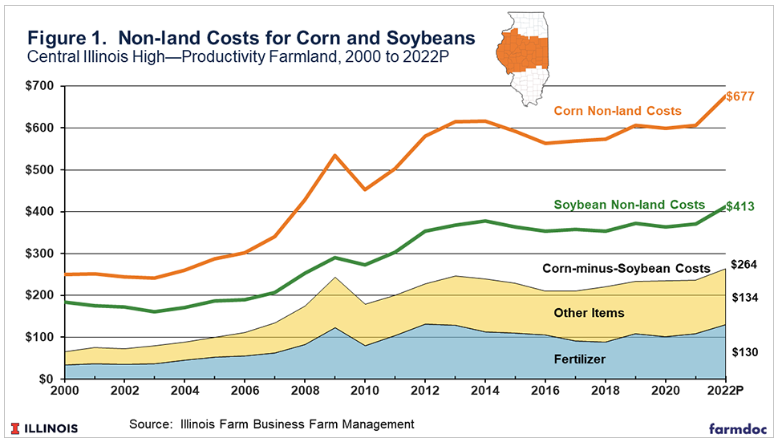

University

Of Illinois 2022 Planting Decisions

Schnitkey,

G., C. Zulauf, K. Swanson and N. Paulson. “2022 Planting Decisions, Nitrogen Fertilizer Prices, and Corn and Soybean Prices.”

farmdoc

daily

(11):145, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 19, 2021.

Export

developments.

None

reported

Updated

10/12/21

December

corn is seen in a $4.85-$5.55 range

March

corn is seen in a $5.00-$5.70 range

·

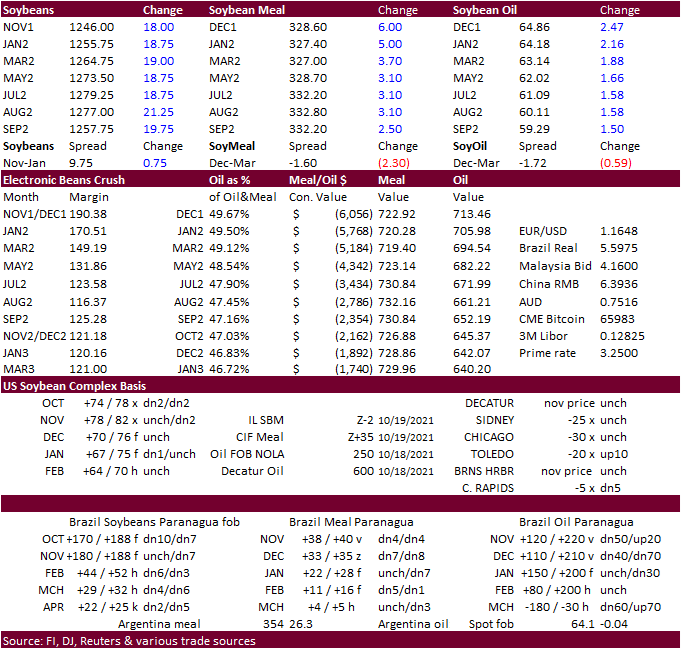

CBOT soybeans and meal are higher, led by soybean oil on global vegoil supply worries. Soybean oil hit the highest level in three months while other vegoils are near record highs.

·

CBOT crush prices basis the nearby positions remain unusually high. Lack of US producer selling for soybeans and corn continues to support cash prices.

·

There was talk China bought up to 40 cargoes of soybeans on last week’s break, from various origins. We would think most of it would be from Brazil.

·

Paris November rapeseed hit a contract record of 700

€/ton

and

settled up 9.00 to 698.25 €/ton.

·

US Midwest rain this week should favor the north central Midwest today and eastern areas Thursday through Friday.

·

Malaysia October 1-20 palm oil exports were reported by ITS at 956,987 tons, down 15 percent from 1.121 million during the same period last month. AmSpec reported an 8 percent decrease from month earlier to 978,917 tons.

·

Southern Paraguay and southern Brazil will see a drier weather pattern through the next two weeks that will be beneficial for fieldwork. Regular rounds of showers and thunderstorms will occur through the next two weeks across

northern Brazil. The west central and southern areas will see rain Saturday and Sunday.

·

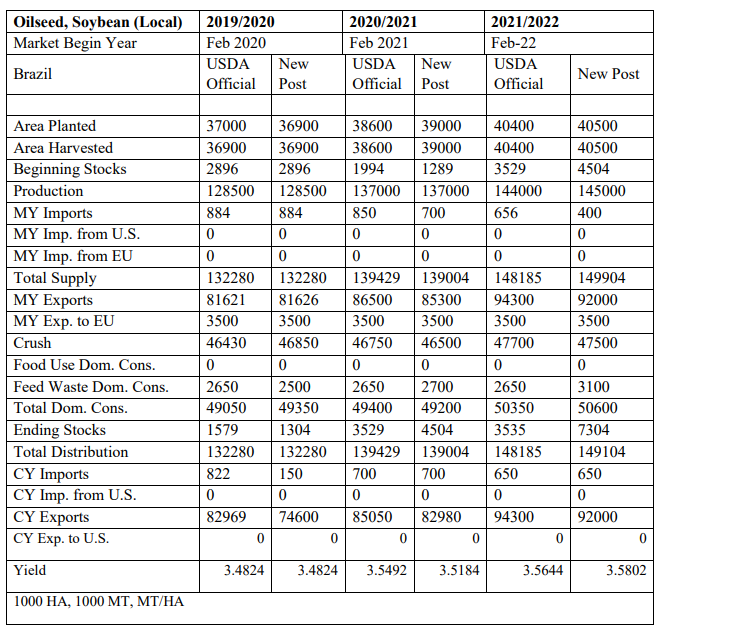

USDA Attaché: Brazil 2021-22 soybean crop at 145 million tons, above 137MMT 2020-21.

Export

Developments

·

Egypt’s GASC bought 25,000 tons of soyoil at $1,468 a ton c&f for shipment arriving in Egypt between Dec. 5-25.

·

Egypt’s GASC was seeking 10,000 tons of sunflower oil and received a low offer of as $1,475 a ton c&f for Dec 5-25 arrival but made no purchase.

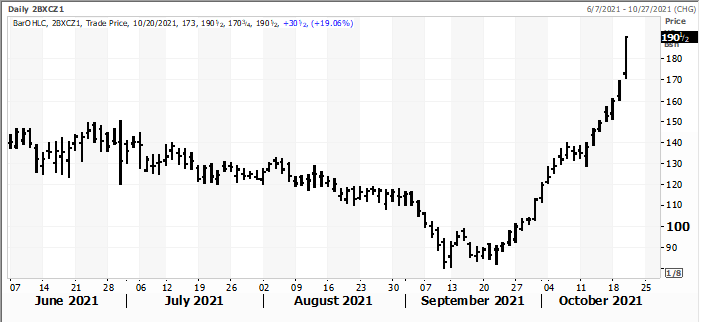

December soybean crush

Source: Reuters and FI

Updated 10/18/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59-65 cent range, March 56-65

·

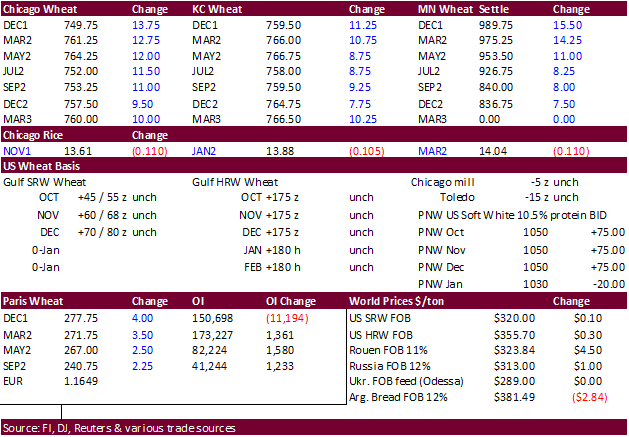

US wheat futures prices ended higher on continuing talk of tight global supplies, money flow from funds, and the weaker USD.

·

Minneapolis December wheat reached a nine-year high at $9.9450/bushel as high-quality wheat is in demand globally while supplies are shrinking.

·

We are hearing China recently bought 2-4 cargoes of SRW for December/January shipment.

·

Paris December wheat hit a contract high of 278.75 and settled up 4.50 euros at 278.25 euro/ton.

·

China planted 26% of winter wheat by October 19, below the 27% average for normal years, due to constant rains since September, according to the China AgMin.

·

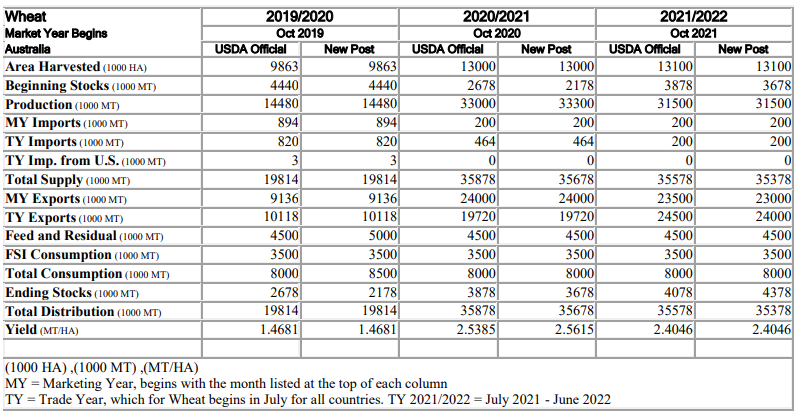

USDA Attaché: Australian 2021-22 wheat crop at 31.5 million tons, 1.8MMT below the record 2020-21 crop and 30 percent above a 10-year average.

·

The Great Plains will see light showers across the central TX Thursday, eastern KS Saturday, and NE and eastern parts of KS and OK on Sunday. Rest of the Great Plains will be mainly dry this week.

·

Ukraine grain exporters and the AgMin agreed to a 25.3-million-ton wheat export cap for the 2021-22 season, well up from 17.5 million tons in 2020-21.

Export

Developments.

·

Jordan bought 60,000 tons of wheat at $365/ton c&f for second half of January shipment. Earlier they saw 5 participants in its 120,000-ton wheat import tender.

·

Russian grain trader Demetra supplied 60,000 tons of wheat to Algeria.

·

Turkey seeks 300,000 tons of wheat on Oct. 21 for shipment between Dec. 10 and Dec. 31.

·

Jordan seeks 120,000 tons of feed barley on October 21 for FH January through FH March shipment.

·

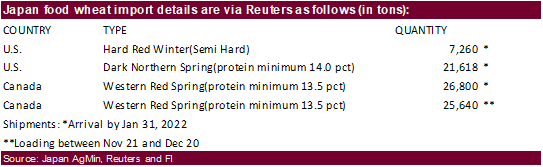

Japan seeks 81,318 tons of food wheat on Thursday.

·

Pakistan seeks 90,000 tons of wheat on October 25.

·

Turkey seeks 235,000 tons of feed barley on October 26.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December KC wheat is seen in a $7.10‐$7.95, March $6.82-$8.25

December MN wheat is seen in a $9.00‐$10.00, March $9.00-$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.