PDF Attached

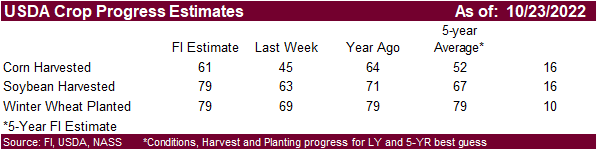

*U.S. CORN CROP 61% HARVESTED LAST WEEK, USDA SAYS. Market was looking for 62% versus 45% last week and 52% 5-year average.

*U.S. SOYBEANS 80% HARVESTED LAST WEEK, USDA SAYS. Market was looking for 77% versus 63% last week and 67% 5-year average.

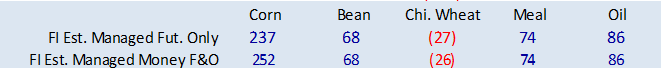

CBOT soybean complex is lower on widespread selling and higher USD. Corn and wheat are lower, in part to some traders thinking the Black Sea safe passage

agreement will be extended. Xi Jinping was elected, for the third term, as China’s leader for another 5 years. We see no change in China ag flows.

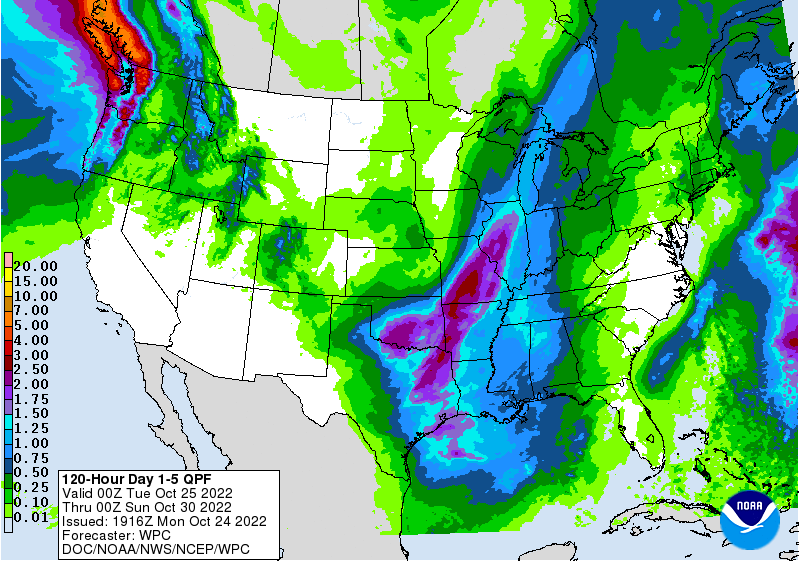

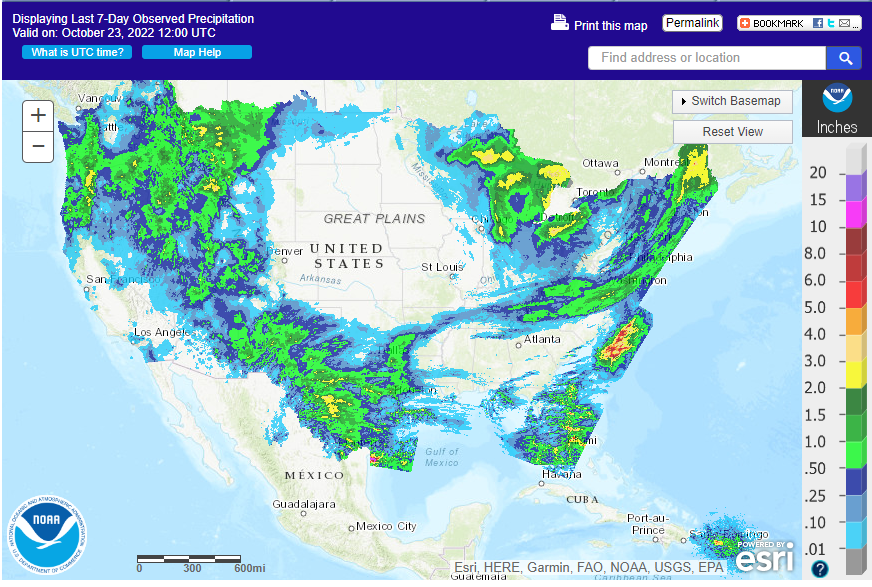

Most of the US growing areas saw above normal temperatures, record in some places, over the weekend, and much of the area was dry, with exception to the PNW. The dry areas of the southwestern US Plains will see rain today before drying down midweek.

The US equities rallied strong to close the session at the highs as bad news is good news for equities. We have

entered the Fed blackout period ahead of the November FOMC meeting where the market is now returning back to the near 50/50 chance of a 50 bps or a 75bps hike.

Last

7 days

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Tropical

Storm Sitrang was moving into Bangladesh this morning and will produce some heavy rainfall that may lead to flooding

- Rainfall

of 3.00 to 8.00 inches and local totals over 10.00 inches are expected in Bangladesh and some immediate neighboring areas in India’s far Eastern States - Lighter

rain will impact northwestern Myanmar - Damage

to rice is possible, but the storm is weak enough to minimize the potential for loss - Peak

wind speeds may be near 58 mph when the storm center finally reaches Bangladesh - The

center of the storm at 0900 GMT was 215 miles southwest of Chittagong, Bangladesh moving north northeasterly at 16 mph

- Some

damage to infrastructure and personal property is possible - Today’s

forecast brings some greater rainfall to east-central Argentina this weekend instead of mostly the northeast as advertised Sunday - Entre

Rios, portions of Santa Fe and areas north into Corrientes , Chaco and Formosa will be most impacted during the weekend - In

the meantime, southern Argentina will get rain later today through Tuesday and ending Wednesday with some locally great amounts in La Pampa, southern Cordoba and western Buenos Aires - Rain

totals may vary from 0.50 to 1.70 inches and local totals over 2.00 inches into mid-week

- Argentina

rainfall from La Pampa through Buenos Aires to Entre Rios and Uruguay during the weekend was welcome and good for improving winter wheat development

- The

moisture was also good for early corn and sunseed planting and emergence - Additional

rain is still needed and there will be two additional bouts of rain in the coming week – one in the south and one in the north; then drying is expected to resume - Rain

totals through dawn Sunday varied from 0.10 to 0.50 inch with a few amounts to 0.83 inch - This

moisture was still too light for a lasting improvement and the advertised rain will be imperative to induce a more meaningful improvement - Dry

weather prevailed farther to the north during the weekend - Temperatures

were quite warm in the central and north with highest readings in the 80s to near 90 Fahrenheit while readings in the south were no warmer than the 60s and 70s - Southeastern

Argentina experienced frost and freezing temperatures during the weekend – mostly in Buenos Aires and La Pampa without much permanent damage to crops - Argentina

rainfall this coming weekend will focus on northern and east-central areas where rainfall of 0.20 to 0.80 inch and locally more than 1.00 inch is expected - Mostly

dry weather will occur in most of the nation next week - Argentina

temperatures will be above normal this week and near to below normal next week

- Argentina’s

bottom line will be one of partial improvement from ongoing drought during this coming week, but much more rain will still be needed to improve long term crop development potentials. Some improved wheat development and production will result from recent rain

and that coming early this week, but more rain is necessary to induce the best yields. Northern wheat is too far advanced to benefit from rain, but early season corn and sunseed will certainly put the moisture to good use. Much more rain will still be needed

to induce the best possible soybean, corn, sorghum and sunseed planting. Soybean and sorghum planting will begin next month. Cotton areas will also need more moisture.

- Brazil

weather during the weekend was mixed with net drying in the central and south which benefited fieldwork of all kinds.

- Rain

fell in central Mato Grosso and from Espirito Santo and northern Rio de Janeiro into Goias and Minas Gerais was welcome - 0.72

inch to 1.81 inches occurred in central Mato Grosso while up to 2.44 inches occurred in southern Espirito Santo and northern Rio de Janeiro - Net

drying occurred elsewhere - Temperatures

were seasonable with highs in the 80s and 90s Fahrenheit in the north and 70s and 80s in the south - All

of Brazil will get rain at one time or another during the next ten days to two weeks - Sufficient

amounts are expected to support most farming and crop needs - South

Africa weekend rain and that coming in the next ten days will support summer crop planting, emergence and establishment, although more will be required - Temperatures

will be seasonably warm - China’s

weather did not change during the weekend - Net

drying is expected in most of eastern China during the coming ten days, although some rain of significance will occur in Sichuan, southern Shaanxi as well as Hubei and some neighboring areas in this coming week with rainfall of 0.50 to 1.50 inches is expected

with local totals to more than 2.00 inches - Some

showers will also impact the northeastern provinces periodically resulting in some increase in soil moisture and a little disruption to summer crop harvest progress - Overnight

models offered some very light showers for the lower Yangtze River Basin in the coming week, to ten days, but resulting rainfall will not be more than 0.50 inch which is still too light for a serious boost in rapeseed planting moisture - China’s

summer crop harvest has progressed well in recent weeks after seasonal drying kicked in

- Little

change is expected for a while - Xinjiang,

China harvest weather should be favorable for most of the coming week with limited rainfall and seasonable temperatures - Seasonably

dry weather will continue in China’s North China Plain and Yellow River Basin - Most

areas in India will be dry during the next ten days, although some rain will fall periodically along the east coast and in the far south periodically

- Hurricane

Roslyn moved inland near Santa Cruz, Nayarit, Mexico Sunday morning as a Category Three hurricane producing maximum suspected wind speeds to 125 miles out 25 miles from the center of the storm.

- Tropical

storm force wind of more than 39 mph was occurring out 80 miles from the center of the storm - Depression

Roslyn reached the northeastern corner of Mexico overnight and finally dissipated, but its remnant moisture will stream into the U.S. over the next couple of days

- The

storm came inland producing damaging wind and flooding rain and the impact on personal property and infrastructure will be assessed over the next few days. In the meantime, rain from the system will stream to the northeast through Texas to help induce greater

rain from northeastern Texas and eastern Oklahoma through Missouri and western Arkansas to Illinois.

- Southwestern

Canada Prairies and the northwestern U.S. Plains received significant rain and some snow during the weekend - Moisture

totals surpassed 1.00 inch in several areas bolstering topsoil moisture for better winter crop establishment - The

moisture will also improve soil conditions for use in the spring - Drought

remains, but it was and will continue to be eased by this event - Additional

rain and snow will impact areas from eastern Saskatchewan through Manitoba, Canada today while only light rain falls in the far northern U.S. Plains.

- Additional

moisture totals will vary from 0.10 to 0.60 inch with local totals to 1.25 inches

- Snow

accumulations will total 3 to 10 inches with local totals to 15 inches favoring northeastern Montana, southern and eastern Saskatchewan and far western Manitoba - Much

of that snow has already fallen - Unusually

hot and windy weather occurred in the central U.S. during the weekend with highest temperatures in the 80s and 90s Fahrenheit in the central Plains and 80s in the western Corn and Soybean Belt - Relative

humidity dropped to between 7% and 25% Sunday afternoon while wind speeds gusted to 66 mph. These conditions occurred from the Texas Panhandle to western Nebraska and parts of South Dakota - Rapid

soil moisture losses occurred and stress expanded in some of the driest hard red winter wheat production areas - Some

U.S. hard red winter wheat areas will get rain both early and again late this week - Oklahoma

will be wettest today into Tuesday with 0.75 to 2.50 inches of rain expected - The

Texas Panhandle will get 0.10 to 0.75 inch with a few amounts over 1.00 inch - Most

of Kansas, Colorado and Nebraska wheat areas will be left dry or mostly dry - Another

storm system this weekend will produce 0.05 to 0.50 inch of moisture with most of that occurring in the southwestern high Plains and Oklahoma once again while eastern Colorado, western Kansas and Nebraska experience dry and warm weather. - A

couple of weather systems will bring rain to a part of the U.S. Midwest, Delta and interior southeastern states over the next ten days - Sufficient

rain is expected to support improved wheat establishment conditions and new planting - The

moisture will delay fieldwork of all kinds; including the harvest of summer crops - Enough

rain will fall to raise soil moisture and induce “some” runoff that may raise river levels briefly that might help reduce barge restrictions for a very short period of time - Follow

up rain will be very important - Rain

is most likely today into Wednesday for Missouri and Illinois and then in the Delta and Tennessee River Basin late this week and into the weekend

- Rain

totals of 0.75 to 2.00 inches will be possible in each of these areas which may be enough for a short term rise in soil moisture - U.S.

Pacific Northwest weekend precipitation was erratic, but topsoil moisture improvements occurred in Oregon and Idaho inducing some benefit to topsoil moisture

- Follow

up rain will be very important and a few showers will occur periodically during the coming two weeks

- West

Texas rainfall over the next couple of weeks will be sporadic and often light, but some disruption to crop maturation will occur for brief periods of time - No

serious threat to unharvested cotton fiber quality is expected - U.S.

temperatures will be cooler than usual in the west and warmer than usual in the east this week and then more definitively warm biased next week in the central and east while temperatures continue cool biased in the west. - Ontario

and Quebec rainfall will be favorably mixed for summer crop harvest progress and winter wheat planting - Some

infrequent rainfall will occur to disrupt precipitation periodically - Mexico

rainfall is expected to limited to the far south parts of the nation after remnants of Tropical Storm Roslyn dissipate over Durango and neighboring states early this week - Europe

precipitation will be limited over the next ten days except in the North and Baltic Sea regions and from the Baltic States through Belarus to Ukraine where waves of rain are expected.

- Western

Russia precipitation will be infrequent, but occasional - Eastern

parts of Russia will see periods of snow that will raise snow cover and help reinforce future colder biased weather in eastern Asia - Australia

will continue to experience periodic rainfall that will maintain wet field conditions in the eastern part of the nation - Western

Australia is expecting some timely rainfall to support very good winter crop yield potentials and crop quality for wheat, barley and canola - North

Africa weather has trended drier for a while and not much precipitation is expected in the coming ten days - Rain

will be needed in November and December to support planting of wheat and barley - Interior

Thailand and northern Laos will experience limited rainfall over the next ten days - Rain

will fall in Cambodia and much of Vietnam during the next ten days with some moderate to locally heavy rainfall possible - Waves

of heavy rain will be impacting central Vietnam over the next ten days resulting in more flooding for areas that already experienced such conditions in recent weeks - Indonesia,

Malaysia and Philippines will experience frequent rain with some bouts of heavy accumulations - Local

flooding will still be possible, but no widespread serious problems are anticipated - West-central

Africa rainfall will occur periodically enough to support coffee, cocoa, sugarcane, rice and other crops during the next couple of weeks - The

precipitation will be greatest in the south with Cameroon getting some heavy rainfall - There

is a southward shift in seasonal rainfall occurring which should be helping to support maturing cotton in the north - East-central

Africa rainfall will be sufficient to support coffee and cocoa as well as a few other crops - Limited

rainfall is expected in Tanzania until late next week when some rain may develop - Central

America rainfall will continue periodically maintaining adequate to abundant soil moisture - Today’s

Southern Oscillation Index was +20.02 and it will move erratically over the next few days

Source:

World Weather INC

Monday,

Oct. 24:

- MARS

monthly EU crop conditions report - USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions and harvesting for corn, soy, cotton; winter wheat plantation and condition, 4pm - US

cold storage data for pork, beef, poultry, 3pm - Cane

crush, sugar output data by Brazil’s Unica (tentative) - HOLIDAY:

India, Singapore, Malaysia, New Zealand, Thailand

Tuesday,

Oct. 25:

- Malaysia’s

Oct. 1-25 palm oil export data - EU

weekly grain, oilseed import and export data - EARNINGS:

ADM

Wednesday,

Oct. 26:

- Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 1 - EIA

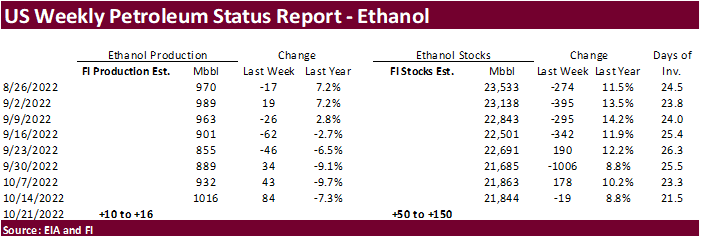

weekly US ethanol inventories, production, 10:30am - EARNINGS:

Bunge, Pilgrim’s Pride - HOLIDAY:

India

Thursday,

Oct. 27:

- Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 2 - Virtual

New Food Invest Conference, EMEA - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Oct. 28:

- Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 3 - FranceAgriMer

weekly update on crop conditions - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for - various

US futures and options, 3:30pm

Source:

Bloomberg and FI

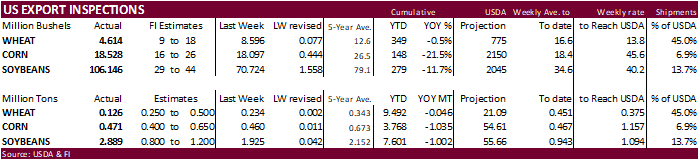

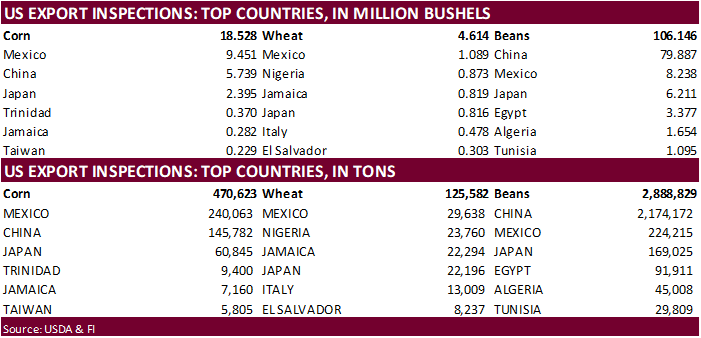

USDA

inspections versus Reuters trade range

Wheat

125,582 versus 200000-500000 range

Corn

470,623 versus 300000-650000 range

Soybeans

2,888,829 versus 1000000-2000000 range

Inspections

for soybeans better than expected and China was top taker. Corn slightly improved but running below average. Wheat was poor.

Soybeans

out of the Gulf

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 20, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 10/20/2022 10/13/2022 10/21/2021 TO DATE TO DATE

BARLEY

147 0 0 1,561 8,147

CORN

470,623 459,696 634,864 3,768,124 4,803,201

FLAXSEED

0 100 0 100 24

MIXED

0 0 0 0 0

OATS

0 0 0 6,486 300

RYE

0 0 0 0 0

SORGHUM

28,424 5,148 80,090 138,115 419,388

SOYBEANS

2,888,829 1,924,790 2,568,133 7,600,918 8,603,350

SUNFLOWER

288 288 192 1,680 336

WHEAT

125,582 233,937 197,479 9,491,684 9,537,355

Total

3,513,893 2,623,959 3,480,758 21,008,668 23,372,101

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US Chicago Fed Nat Activity Index Sep: 0.10

(est -0.10; prevR 0.10)

China’s economy increased 3.9% in the third

quarter from the previous year and up from 0.4% for Q2.

US midterm elections are nearly two weeks

away.

US Markit Manufacturing PMI Oct P: 49.9 (est

51.0; prev 52.0)

– Services: 46.6 (est 49.5; prev 49.3)

– Composite: 47.3 (est 49.2; prev 49.5)

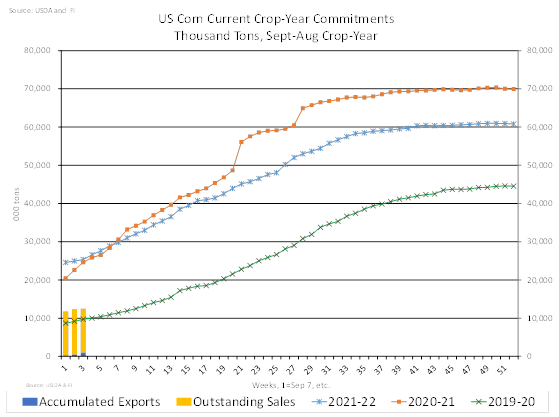

Corn

·

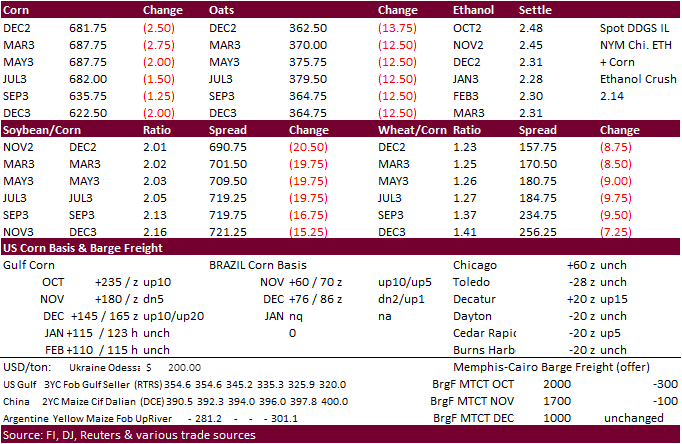

Corn futures closed lower on harvest pressure selling and higher USD. The weaker soybean and wheat market weighed on corn today.

·

Safras estimated Brazil’s summer crop at 25.2 million tons, above 21.9 million for 2021-22. The area is projected to rise to 4.2 million hectares or 4.3% from the previous season. All 2022-23 corn

production is seen at 126.3 million tons, above 119.5 million in 2021-22. USDA is at 126 million tons for the Brazil 2023-22 corn crop.

·

China September corn imports were 1.53 million tons, more than half of what was imported year earlier. US corn commitments are off to a slow start this year.

·

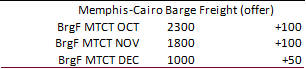

Barge freight costs were up on Friday

·

Bird flu concerns are increasing for the US and Europe.

·

The Netherlands culled 44,000 turkeys on a farm in the southern areas due to bird flu.

·

Bulgaria began culling 19,000 laying hens in the southern part of the country after detecting bird flu.

Export developments.

·

None reported

Updated 10/09/22

December corn is seen in a $6.50-$7.15 range. March $6.50-$7.50

range.

·

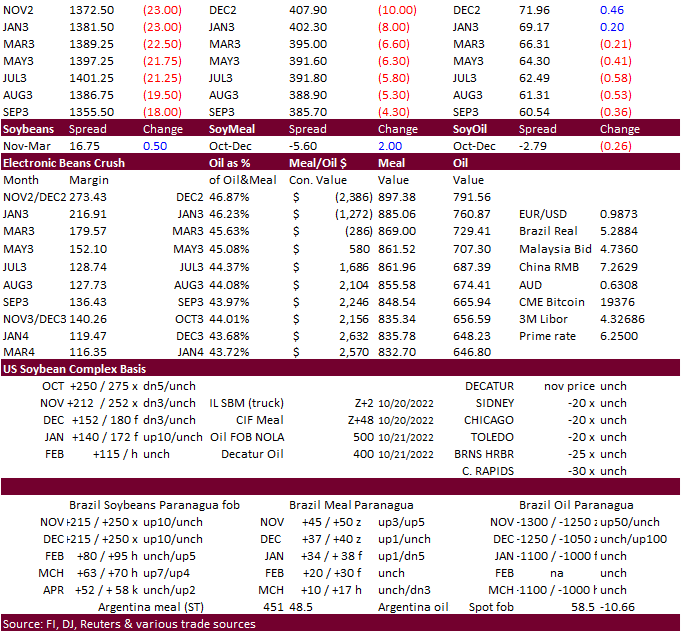

CBOT soybeans finished sharply lower led by weakness in soybean meal, lower outside commodity markets and higher USD. Soybean oil is lower but nearby oil share is higher with limited losses in December

relative to the back months. The US biofuel discussion and slower than expected crush is supporting spreads.

·

China’s soybean imports in September were up 12% from a year earlier to 7.72 million tons, which will provide some relief to near record high soybean meal prices. Jan-Sep soybean imports are running

6.6% below year earlier at 69.04 MMT.

·

A few light rains in Argentina over the weekend will increase plantings but more rains are needed.

·

AgRural reported Brazil soybean plantings reached 34 percent from 24% previous week and compares to 38% year ago. The good pace is expected to bring early soybeans to market around January 15. Center-south

is 51% percent complete.

·

Argentina’s September soybean crush was 2.87 million tons, down 9 percent from 3.15 million during August and well below September 2021 (off 22 percent).

·

Malaysia is closed for holiday, returning Tuesday.

·

China November soybeans were down 0.6%, meal 0.3% lower, soybean oil 0.1% higher and palm oil 1.0% lower.

·

Rotterdam vegetable oils were mixed (SBO higher and RSO lower) from this time Friday morning. SA meal was mostly higher.

·

Offshore values this morning were leading soybean oil 63 points lower earlier this morning and meal $0.40 short ton lower.

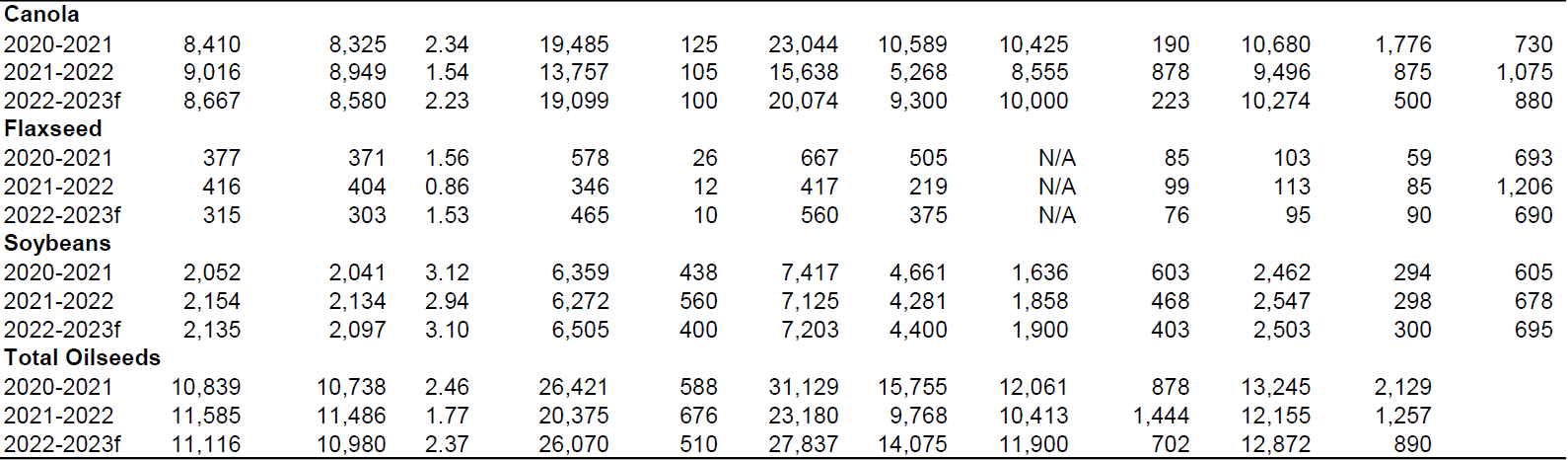

Agriculture

and Agri-Food Canada

https://agriculture.canada.ca/en

Export

Developments

-

Egypt seeks vegetable

oils (no specific amounts noted) on October 26 for Dec 10-30 arrival, and some local vegetable oils. They are looking for 180-day letters of credit.

US

Frozen Pork Belly Stocks were reported at 36.592 million pounds on September 30.

US

Frozen Beef Stocks were reported at 522.862 million pounds on September 30.

Updated 10/21/22

Soybeans

– November is seen in a $13.25-$14.50 range, January $13.25-$15.00

Soybean

meal – December $375-$430, January $360-$475

Soybean

oil – December 68.00-76.00, January wide 60.00-73.00 range

·

Wheat ended lower from a higher USD and positive sentiment that Russia will agree to extend the safe passage deal for Ukraine grain exports due to expire November 19th. Ukraine’s energy

and military infrastructures were targeted over the weekend. A UN spokesman said they need to unclog a backload of 150 ships under the safe passage deal. No specifics were provided. Russia is looking to negotiate opening selected trade flows, such as fertilizer.

·

The dry areas of the southwestern US Plains will see rain today before drying down midweek.

·

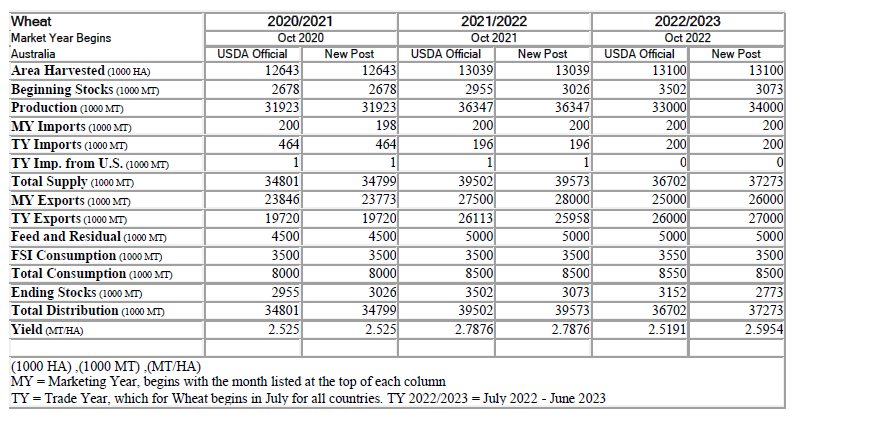

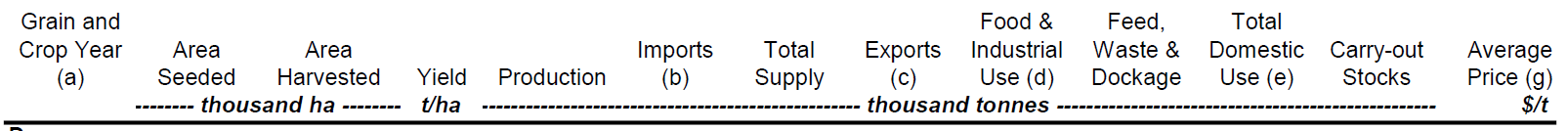

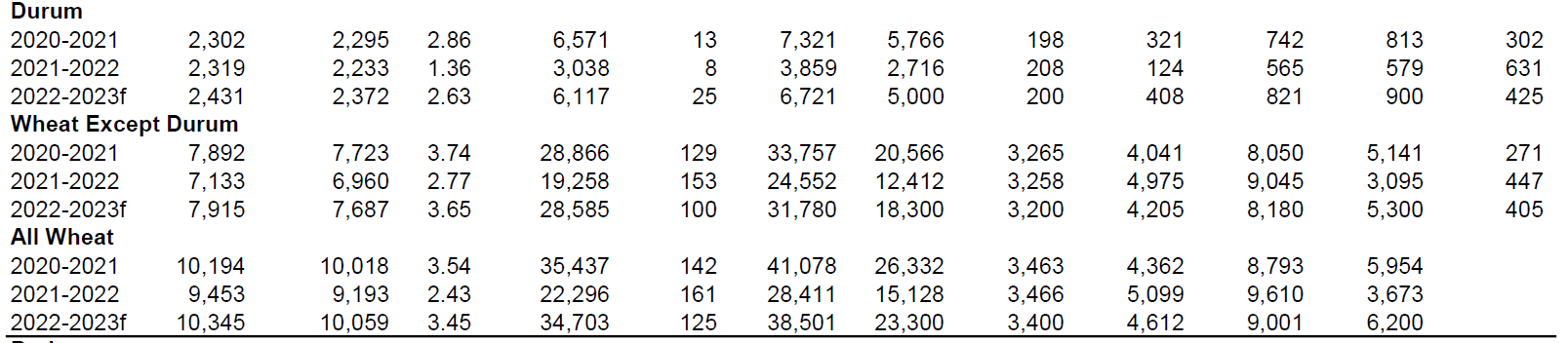

The USDA Attaché estimated Australia’s wheat crop at 34 million tons, 1 million above USDA official, despite heavy rainfall hurting the crop across parts of the eastern growing area.

·

APK-Inform lowered Ukraine 2022 grain production to 53.2-53.6 million tons from 54.1-55.7 million previous, including 19 MMT wheat and 27.9 MMT corn.

·

Ukraine grain exports since the start of the marketing year are down 33.4%.

·

Russian wheat prices fell last week. IKAR consultancy reported Russian prices for wheat with 12.5% protein content, Black Sea, at $312 per ton FOB at the end of last week, down $11 from a week earlier.

Russia’s grain exports rose to 1.06 million ton last week from 910,000 tons a week earlier, according to SovEcon.

·

Egypt said they have enough wheat stocks for 5.5 months.

·

Paris December wheat ended down 3.50 euros at 338.50 euros a ton.

·

China auctioned off 40,026 tons of wheat from state reserves at an average price of 2,829 yuan per ton ($390.75). They sold 41,359 tons on October 12.

USDA

Attaché on Australia – 34 MMT wheat versus 33 USDA official

“Australia

is on the path to a third consecutive bumper grain crop in marketing year (MY) 2022/23 after a record-setting winter crop and strong summer crop production in MY 2021/22. After another strong start to the planting season followed up by great rainfalls, there

is ample moisture to carry the wheat and barley crops through the grain fill stage. The key risk is rainfall at harvest causing grain quality downgrades.

Wheat production is forecast at 34 million metric tons (MMT), down from the record-breaking MY 2021/22 crop of 36.3 MMT but still the second largest in history. Similarly, barley production is forecast at 12.2 MMT, down from the previous year’s 13.9

MMT record. Sorghum production is forecast to achieve the fourth largest on record in MY 2022/23 at 2.6 MMT and exports at a near-record 2.1 MMT. With plentiful irrigation water available, rice production in MY 2022/23 is forecast to continue to grow for the

third successive year to 575,000 MT.”

https://agriculture.canada.ca/en

US

Wheat Associates

“This

week (ending 10/21), basis was mixed in the Gulf and Pacific Northwest (PNW). Secondary rail rates rose 6% compared to last week and an astonishing 1500% compared to the same week last year. Barge traffic resumed last week along the Mississippi River, a key

artery for grain exports through the Gulf, but lagged behind their pace from a year ago, according to USDA’s weekly Grain Transportation Report (GTR). Export elevations are also firm, as wheat competes with corn and especially soybeans for available elevator

space. Overall, the story remains the same: sluggish railroad performance, the consistently high value of the U.S. Dollar, persistent dry weather in wheat growing areas, and uncertainty over the Black Sea grain deal are all combining to keep wheat prices high.

“

Agriculture

and Agri-Food Canada

·

Saudi Arabia’s SAGO bought 566,000 tons of wheat at an average price of $384.75/ton CIF for March and April shipment. It includes 12.5% protein hard milling wheat. European Union, Black Sea region,

North America, South America and Australia were noted origins.

·

Iraq seeks 50,000 tons of wheat on October 30, nearly one week later than their original close date.

·

Algeria seeks wheat on October 25, valid until the next day, for November 16-December 31 shipment.

·

Thailand seeks up to 180,000 tons of optional origin feed wheat for Feb-Apr shipment.

·

Jordan seeks 120,000 tons of wheat on October 25 after buying 60,000 tons this week at $374/ton c&f for FH March shipment.

·

Pakistan seeks 500,000 tons of wheat on October 26.

·

Jordan reopened another import tender for barley set to close October 26.

·

Mauritius seeks 25,800 tons of wheat flour, optional origin, on October 28 for January through September 30, 2023, shipment.

Rice/Other

·

Egypt seeks 50,000 tons of sugar, optional origin, on October 25 for arrival between Dec 1-31.

Updated 10/19/22

Chicago – December $8.15-$9.00, March $8.00 to $10.00

KC – December $9.25-$10.00, March 8.50-$10.50

MN – December $9.25-$10.25, March $9.00 to $10.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.