PDF Attached

Initial

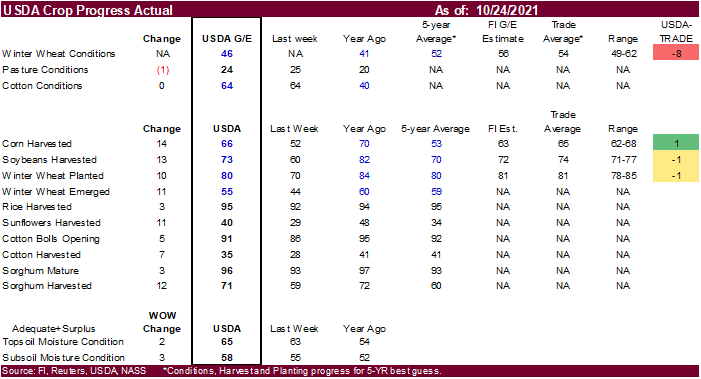

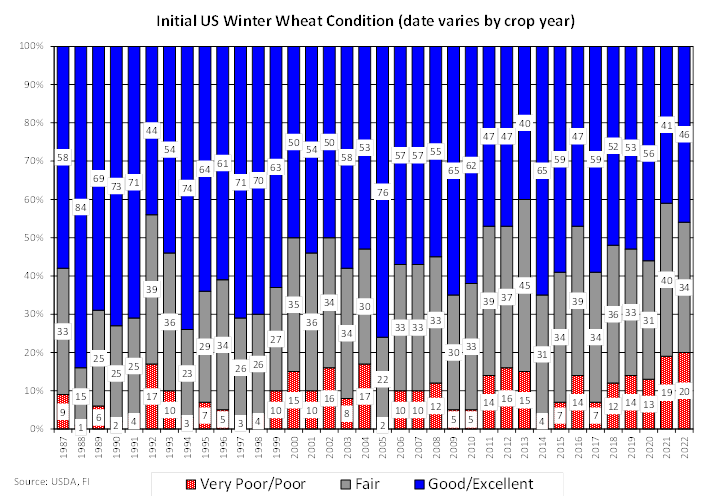

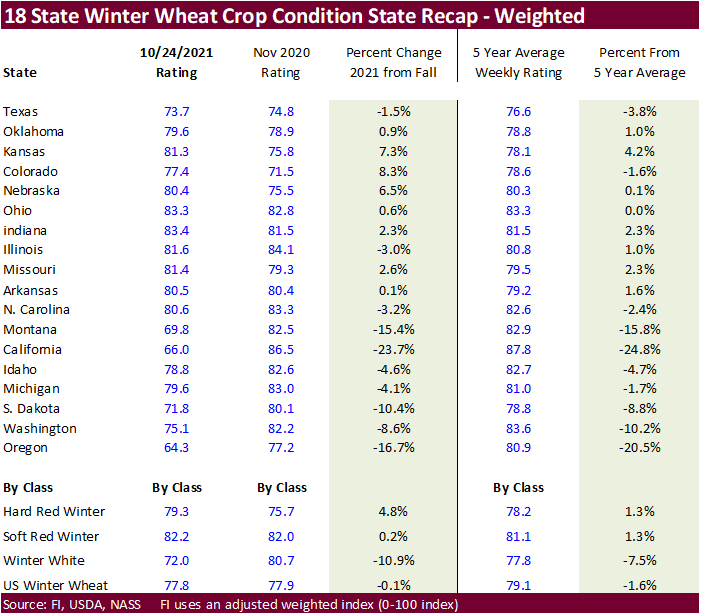

US winter wheat conditions were reported 8 points below a average trade guess. Winter white wheat, on our adjusted calculation, came in below a 5-year average, while HRW and SRW were above average.

Calls:

Wheat:

2-4 higher Chicago, 3-5 higher KC and 5-8 higher MN

Corn

1-4 higher

Soybeans

2-5 higher

CBOT

soybeans were sharply higher in part to a 100+ point increase in soybean oil. Paris rapeseed futures were 10.75 euros higher at 685 euros. Soybean meal traded two-sided, ending moderately higher. Corn also saw a two-sided trade with losses limited from

higher soybeans and wheat. MN led the US wheat markets higher. US soybean and corn harvesting delays were noted.

MOST

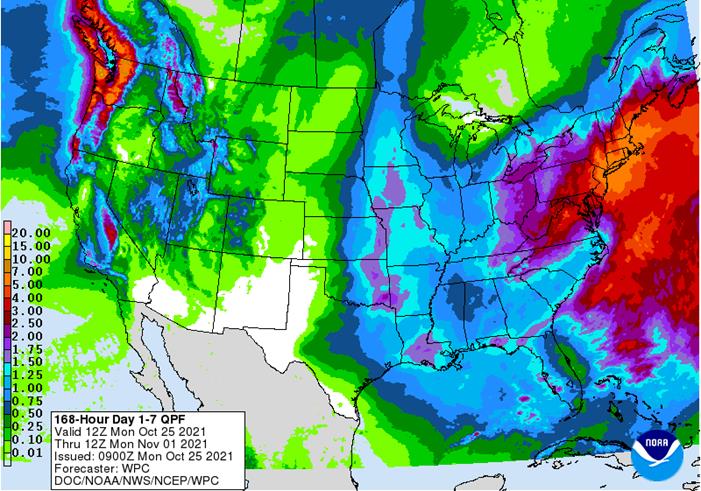

IMPORTANT WEATHER AROUND THE WORLD

- Torrential

rain fell along the central Vietnam coast during the weekend as expected with rainfall of 6.00 to more than 19.00 inches resulting from the Quang Tri area through Hue and Da Nang to Qui Nhon - Recent

frequent flooding along the central coast has damaged personal property and infrastructure and drier weather is badly needed - A

similar bout of excessive rainfall with amounts to 18.00 inches occurred a week earlier

- Less

rain will fall this week, but it will not be dry as noted in the second bullet on this weather product.

- A

tropical disturbance in the south China Sea was located 124 miles east southeast of Nha Trang, Vietnam was moving westerly and will reach the lower central Vietnam coast near Nha Trang around 0001 GMT Wednesday - The

system may reach land as a tropical depression - Heavy

rain will fall along the central and lower Vietnam Coast during the early to middle part of this week with rainfall of 2.00 to 6.00 inches resulting - Some

heavy rain may move up the central coast briefly in the second half of this week - Very

little serious impact from the storm is anticipated - The

system will not be significant enough to have a big impact on coffee production areas in Vietnam which is a change from Friday’s forecast, but similar to that of Sunday - Tropical

Storm Malou formed west of Guam during the weekend and was 441 miles west southwest of the northern most Mariana Islands at 0900 GMT today near 18.6 north, 138.4 east - The

storm will intensity to typhoon intensity Tuesday while turning to the northeast over open water in the western Pacific Ocean - The

storm will stay to the southeast of Japan and will pose no threat to land - Hurricane

Rick will moved inland over the southwestern Mexico Coast this morning - Landfall

occurred in Michoacan and the system will move north northwesterly today and Tuesday while slowly diminishing

- Damage

should be confined to a small part of the coast from far western Guerrero through Michoacan to Colima.

- Citrus

and sugarcane will be most impacted, although a little rice, corn and sorghum may also be impacted by the storm’s rain - Crop

damage and losses should be low - A

mid-latitude storm is forming off the U.S. Carolina coast today will move to a point off the New England coast late Tuesday into Wednesday. The storm will develop very quickly and could be a “bomb” cyclone in which the storm center deepens more than 24 millibars

in a 24-hour period. - High

wind speeds, heavy rain and rough seas will impact southeastern New England during mid-week this week - The

storm will move southeasterly Wednesday and the east northeasterly Thursday and Friday taking the storm away from North America - The

system may acquire subtropical characteristics as the storm moves southeast from near the New England Coast Wednesday into Thursday - Northern

California was being impacted by torrential rain, strong wind speeds and heavy mountainous snowfall Sunday after beginning Saturday - Moisture

totals through mid-afternoon Sunday had varied from 3.00 to 9.00 inches with local totals over 11.00 inches

- Some

flooding is under way and it may worsen today - Flooding

has been greatest in the northern Mountainous areas of the Sierra Nevada and near the coast from north and San Francisco to near Leggett, California - Very

heavy snow was impacting the highest elevated areas and it will increase today - Some

mountainous areas of northern California will receive 2 to 4 feet of total snowfall by Tuesday morning - Much

of the snow will be limited to the highest elevated areas - Weather

conditions will be much improved the remainder of this week, although there will be waves of light rain and mountain snow continuing in the Pacific Northwest - U.S.

Midwest weekend rainfall verified well with areas from eastern Nebraska and eastern Kansas to the heart of the Midwest being most impacted - Rainfall

of 1.00 to 3.00 inches occurred in Iowa and 2.00 to nearly 6.00 inches occurred in northeastern Missouri while up to 4.00 inches resulted in central Illinois and 3.00 inches in central Indiana - Other

areas in the Midwest reported 0.50 to 1.50 inches with Minnesota, the eastern Dakotas, Wisconsin, northern Michigan and parts of the Ohio River Valley receiving very little to no rain

- Some

heavy rain also fell in southeastern coastal areas of Florida where 1.00 3.68 inches resulted - Rain

also fell in the Dakotas, central Florida and along the Texas coast with moisture totals rarely more than 0.50 inch - Temperatures

in the United States during the weekend were mild to cool across the northern Midwest and northeastern Plains and in the Pacific Northwest while warm conditions occurred in most other areas - Highs

contrasted from the 40s and 50s in the cooler areas in the Midwest, northern Plains and Pacific Northwest to readings in the 80s and lower 90s in the southern Plains and a part of the far southeastern corner of the nation - Freezes

occurred in the upper Midwest and northeastern Plains as well as in a part of the northeastern states and in the Rocky Mountain region - Weather

in the U.S. this week…… - Stormy

weather in northern California will end today, but waves of rain and mountain snow will continue in the Pacific Northwest and in the northern Rocky Mountain region - Sunday’s

Midwest storm will shift east through the eastern Midwest today - Rainfall

of 0.25 to 1.25 inches will result today - Ohio

and southeastern Michigan will be wettest - Another

storm center and associated frontal boundary will move across the central United States Tuesday into Wednesday through the western Corn Belt Wednesday into Thursday morning and across the eastern Midwest, Delta and southeastern states Thursday into Saturday

morning - 0.50

to 1.50 inches of rain will occur this last weather disturbance and a few local totals to 2.00 inches - Next

week’s U.S. weather….. - Much

drier weather will occur this coming weekend through next week in key U.S. Midwest, Delta and southeastern states crop areas - Cooling

is expected in the middle of North America next week forcing temperatures below average for a little while

- Some

shower activity may occur in the southern Plains and into a part of the Delta and southeastern states briefly next week, but resulting precipitation amounts should be light - The

bottom line to U.S. crop weather during the next two weeks will be mixed with slow field progress in the Midwest, Delta and southeastern states this week due to rain, although the Midwest will be wettest. Little to no rain will fall in hard red winter wheat

areas continuing a drying bias for a while. The Northern Plains and neighboring areas of Canada will be dry this week and may receive light precipitation briefly next week. Drier weather will also come to the northwestern U.S. this weekend and next week. As

a result of the drier weather in many areas during the latter part of this week into next week, fieldwork should advance more swiftly, although a few days of drying will be needed in the Midwest and the Pacific Northwest after this first week of stormy weather.

- Argentina

rainfall Friday through Sunday advanced northward across central and northeastern parts of the nation bolstering soil moisture for early season corn and sunseed planting as well as winter crop development - Rain

occurred from central and northeastern Buenos Aires to Cordoba and northeast to eastern Chaco and Corrientes - Amounts

ranged from 0.30 to 1.00 inch with a few greater amounts mostly in the east-central and northeast parts of the nation - Northwestern

Argentina and the far southwest were left dry, but portions of the southwest received rain Thursday into Friday morning - The

bottom line was good for future spring planting and for winter crop development but follow up rain will be very important since temperatures will be trending warmer this week.

- Argentina’s

outlook for rain has improved for next two weeks - This

week’s rain will be mostly confined to western parts of the nation, although a few showers will occur in the east as well - Next

week’s outlook for rain is probably overdone, but there will be an opportunity for rain to occur in a timely manner after some net drying and warm biased weather this week - Brazil

weekend precipitation was widespread in Mato Grosso do Sul, Paraguay, Rio Grande do Sul, Santa Catarina and Parana into southern Minas Gerais and Goias Friday through early afternoon Sunday - Rainfall

was greatest in the wetter areas of Mato Grosso do Sul, Parana and northwestern Rio Grande do Sul perpetuating wet field conditions in those areas - Fieldwork

advanced well on France, but rain thereafter may have slowed farming activity. The moisture was good for summer crop planting, emergence and development. Some greater rain is still needed in parts of western Mato Grosso, Goias and a few Minas Gerais locations

as well as the far northeast. - Brazil

weather in the next two weeks will continue favorable for much of the nation with alternating periods of rain and sunshine - Some

areas in Rio Grande do Sul and immediate neighboring areas may experience some net drying for a while - The

drier bias will be good for winter wheat filling, maturation and harvesting

- Better

planting weather will also occur in the far southern Brazil during the drier biased period - Temperatures

will be near to below average over the next week in interior southern areas and close to normal elsewhere - Australia

weather during the weekend and that which is expected through the next two weeks will be favorably mixed for some spring planting and winter crop development - A

boost in rainfall is needed in the interior east to support better spring planting conditions for cotton and sorghum - Most

winter wheat, barley and canola production areas will continue to experience highly favorable weather conditions - India

rainfall during the weekend was greatest in the far south and extreme north.

- Some

disruption to fieldwork resulted, but most of it should not have a lasting impact - There

was some concern for unharvested cotton fiber quality in the north, but weather conditions will improve this week - India’s

greatest rainfall this week will continue in the far south where some flooding may result due to already saturated or nearly saturated soil - Rainfall

will range from 3.50 to more than 8.00 inches this week with locally more especially in Tamil Nadu and southern Andhra Pradesh during the weekend coming up - Some

lower east coastal locations may receive more than 12.00 inches - A

tropical cyclone may evolve next week to help generate the excessive rainfall, but confidence in the cyclone is not high and a close watch on the situation is warranted - Changes

in the forecast for next week may result as the tropical cyclone gets re-directed - A

tropical cyclone may evolve in the Arabian Sea next week, but such a development if it occurs would be off the lower west India coast and the storm will move over open water during much of the week

- China

rainfall will be restricted in northern and eastern parts of the nation this week favoring fieldwork and net drying conditions - Good

harvest progress is expected along with winter crop planting - Rain

will fall in Sichuan and areas southwest into Yunnan, Guangxi and parts of western Hunan - Southeast

Asia will see routinely occurring rainfall maintaining moisture abundance in Indonesia, Philippines, Malaysia and the mainland areas of Southeast Asia. - A

Low pressure center in the south-central Mediterranean Sea will meander aimlessly this week staying mostly over open water; however, the system will produce some heavy rain in southern Italy and eastern Sicily - This

system has potential to possibly become a subtropical storm - The

storm could produce torrential rainfall and strong wind speeds - Confidence

is low, but the potential storm will need to be closely monitored - There

is also some potential that it could impact Greece as well - Russia’s

Volga River Basin will continue in need of greater moisture, although winter crops are semi-dormant and established well enough to survive winter if there is good snow cover during period of extreme cold - Soil

conditions are little dry, but moisture was present when crops were emerging - Ukraine

and most of Europe away from the North and Baltic Seas will see tranquil weather for a while allowing late season farming activity to wind down - Limited

rainfall is expected through Friday - France

will trend wetter during the weekend with some of that moisture reaching into western Germany early next week

- Eastern

Europe will be driest along with Ukraine and the lower Volga River Basin - Winter

crop planting and summer crop harvesting continues to advance well across the European Continent and little change is likely - A

few periods of snow and rain will impact a part of Canada’s Prairies over the next two weeks, but resulting precipitation will not break the drought - Harvesting

of this year’s crops is complete, but the rain is needed to restore soil moisture after a multi-year drought seriously reduced production in 2021 - Southeastern

Canada crop conditions and harvest progress has been varied - Southwestern

Ontario is too wet, and fieldwork has been slowed - Most

of Quebec weather has been more favorable for fieldwork to advance normally - These

conditions may prevail for a while - South

Africa will receive periodic rainfall during the coming ten days and that will bolster soil moisture for improved conditions for late season wheat development and early planting of summer crops - North

Africa will receive rain this week from northeastern Morocco through northern Tunisia

- No

heavy rain is expected except in a few coastal Tunisia locations - Southwestern

Morocco will remain driest - Central

Africa will continue to experience periodic rainfall during the coming week maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions - Drier

weather will soon be needed in some cotton, coffee and cocoa areas - Rainfall

in the next seven days is expected to be greater than usual mostly near coastal areas - Weather

in the second week of the forecast will trend drier favoring better crop maturation conditions - Mexico

rainfall will be erratic over the next week with pockets of the nation a little wetter biased while other areas are a little drier biased - Southern

areas will be wetter biased into Tuesday due to Hurricane Rick moving inland and dissipating

- Central

America rainfall will be below average in the coming week except in Costa Rica, Panama and El Salvador and Guatemala where rainfall will be near to above normal - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +11.40 and it was expected to fall this week - New

Zealand weather is expected to be a little drier than usual and temperatures will be seasonable.

Monday,

Oct. 25:

- Monthly

MARS bulletin on crop conditions in Europe - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

poultry slaughter, 3pm - U.S.

cotton condition; corn, soy and cotton harvesting; winter wheat planting, 4pm - Malaysia

Oct. 1-25 palm oil exports - Ivory

Coast cocoa arrivals - HOLIDAY:

New Zealand

Tuesday,

Oct. 26:

- EU

weekly grain, oilseed import and export data - EARNINGS:

WH Group

Wednesday,

Oct. 27:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica releases cane crush, sugar output data (tentative)

Thursday,

Oct. 28:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Oct. 29:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases October trade data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

140,413 versus 150000-450000 range

Corn

545,127 versus 750000-1200000 range

Soybeans

2,103,505 versus 1800000-2625000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 21, 2021

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 10/21/2021 10/14/2021 10/22/2020 TO DATE TO DATE

BARLEY

0 0 798 8,147 9,867

CORN

545,127 1,048,617 680,823 4,712,999 6,169,627

FLAXSEED

0 0 0 24 389

MIXED

0 0 0 0 0

OATS

0 0 0 200 1,196

RYE

0 0 0 0 0

SORGHUM

80,090 37,990 73,531 417,943 545,094

SOYBEANS

2,103,505 2,449,732 2,888,760 8,129,440 14,782,896

SUNFLOWER

192 144 0 336 0

WHEAT

140,413 141,450 399,645 9,478,304 11,089,774

Total

2,869,327 3,677,933 4,043,557 22,747,393 32,598,843

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

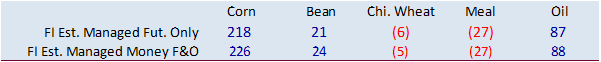

Corn ended unchanged to mixed. Higher soybeans and wheat limited losses as the USD rallied points. News was very thin for the corn market. Traders remain concerned over high global fertilizer prices and dryness across the far

western Corn Belt.

·

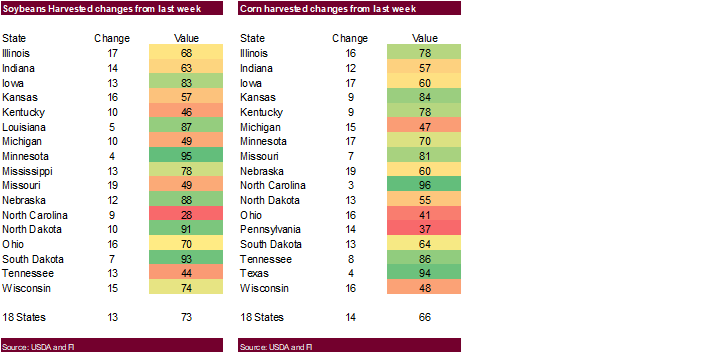

US corn harvest progress advanced 14 points to 66 percent and compares to 70 year ago and 53 average. Traders were looking for the US harvest progress to be reported at 65 percent.

·

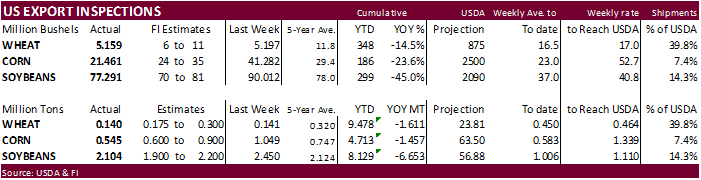

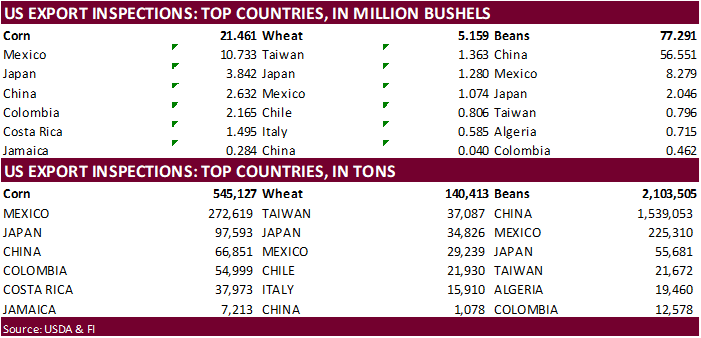

USDA US corn export inspections as of October 21, 2021 were 545,127 tons, below a range of trade expectations, below 1,048,617 tons previous week and compares to 680,823 tons year ago. Major countries included Mexico for 272,619

tons, Japan for 97,593 tons, and China for 66,851 tons. Cumulative inspections so far this marketing year are running 24 percent below the same period a year ago.

·

MARS estimated the average EU corn yield at 7.79 tons per hectare, up marginally from 7.78 forecast last month.

·

China hog futures hit limit higher overnight, in part to expectations for demand to increase ahead of the Lunar New Year holiday season.

·

(Bloomberg) — China’s northern regions will probably see sunny weather and normal-to-higher temperatures in the coming days, which should be beneficial for the harvesting and drying of autumn crops, according to the National

Meteorological Center.

·

(Reuters) – Corn prices in Shandong province were 2,640 yuan per ton, slightly higher than wheat prices in the region at 2,610 yuan per ton as of last Friday.

EIA

forecasts U.S. winter natural gas bills will be 30% higher than last winter

https://www.eia.gov/todayinenergy/detail.php?id=50076&src=email

Export

developments.

None

reported

Updated

10/12/21

December

corn is seen in a $4.85-$5.55 range

March

corn is seen in a $5.00-$5.70 range

·

CBOT soybeans, meal and oil were higher from US harvest delays and higher outside related markets. Nearby meal did close slightly lower while the back months were moderately higher. Soybeans ended near contract highs, up 13.50-16.75

cents on the day. Soybean oil rallied an impressive 101-106 points, impart to higher energy prices (nearby WTI was slightly lower at the time SBO closed) and talk of renewable fuel expansion.

·

Paris November rapeseed was up 10.75 euros to 685 euros per ton.

·

US soybean harvest progress was 73 percent, one point shy of expectations, up 13 points from the previous week and compares to 82 percent year ago and 70 average. Traders were looking for the US harvest progress to be reported

at 74 percent.

·

US harvest delays this week across the Corn Belt could be supportive. The ECB will remain very wet this week, bis northern growing areas. There will be a small window of dry weather, but it will take a few days for fields to

dry down.

·

USDA US soybean export inspections as of October 21, 2021 were 2,103,505 tons, within a range of trade expectations, below 2,449,732 tons previous week and compares to 2,888,760 tons year ago. Major countries included China for

1,539,053 tons, Mexico for 225,310 tons, and Japan for 55,681 tons.

·

Cumulative inspections so far this marketing year are running 45 percent below the same period a year ago.

·

Late last week the CFTC showed funds for soybeans not as long as expected (as of Tuesday) and open interest on Friday dropped 57,730 contracts for soybeans (Nov down 68,839 lots). There were a lot of EFPs executed on Friday and

our thinking is traders are positioning ahead of FND deliveries that are due out at the end of this week.

·

Argentina and Brazil saw scattered showers over the weekend, but Argentina is in need of additional rain and the outlook this week looks fairly dry.

·

Safras & Mercado: 35.8% of soybeans had been planted in Brazil, well up form this time year ago (slow arrival of rains in 2020) and compares to 37% average. AgRural estimated plantings at 38%.

·

China cash crush margins on our analyses were 263 cents/bu versus 247 cents late last week and 95 cents around a year ago.

·

AmSpec reported Malaysian palm 1-25 shipments at 1.201 million tons, down from a revised 1.313 million tons during the same period a month earlier.

·

ITS reported a 12.1% decrease in palm shipments to 1.209 million tons from 1.375 million during the September 1-25 period.

·

Malaysian palm futures were up 45 ringgit overnight to 4,969. Cash palm was up $2.50/ton to $1,270/ton.

ADM

in a press release said it signed a memorandum of understanding with a company called Gevo to produce up to 500M gallons of sustainable aviation fuel.

https://bit.ly/3GmAgqO

Export

Developments

·

The USDA seeks 20 tons of vegetable oil in 4 liter cans for Dec 1-13 shipment on November 2.

Updated

10/18/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59-65 cent range, March 56-65

·

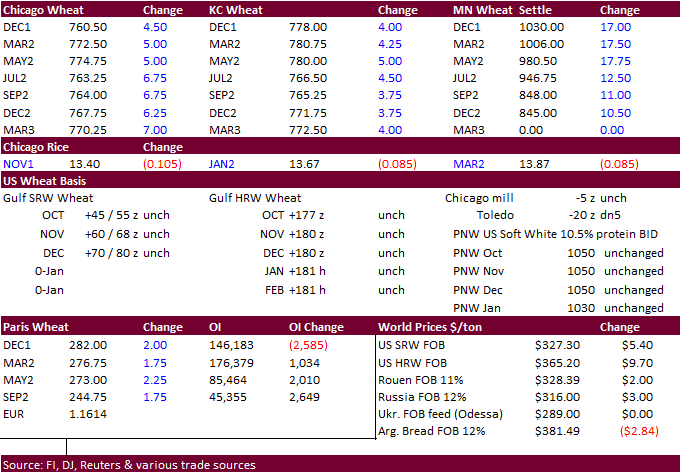

US wheat futures prices were 3.50-15.25 cents higher from ongoing concerns over tight global stocks. Chicago is at a 2-month high (bear spreading and up 3.50-7.00 cents). Some noted recent bullish developments including rising

Russian export taxes, increase in US wheat demand and EU wheat quality downgrades. Kansas hard red winter wheat futures are near a 2014 high and were up 3.75-3.75 cents on Monday. Minneapolis spring wheat futures are at highest level since 2012 and were

up 6.50 to 15.75 cents.

·

Dry weather across the Great Plains is concerning.

·

Paris December wheat settled 2 euros higher, at 282/ton, a new contract high.

·

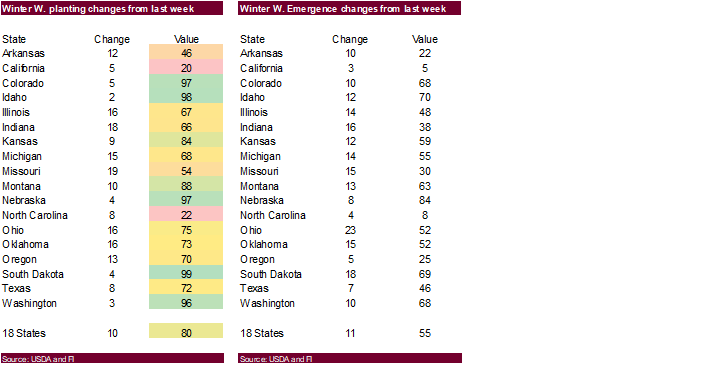

US winter wheat plantings reached 80 percent, one point below expectations, up 10 points from the previous week and compares to 84 year ago and 80 average. Traders were looking for the US planting progress for winter wheat to

be reported at 81 percent.

·

Initial winter wheat conditions were reported at a low 46 percent, well below a Reuters trade guess of 54 percent (49-62 range) and compares to 41 year ago and 52 average.

·

USDA US all-wheat export inspections as of October 21, 2021 were 140,413 tons, below a range of trade expectations, below 141,450 tons previous week and compares to 399,645 tons year ago. Major countries included Taiwan for 37,087

tons, Japan for 34,826 tons, and Mexico for 29,239 tons.

·

Cumulative US all-wheat inspections so far this marketing year are running 15 percent below the same period a year ago.

·

Morocco plans to drop its import duty on soft wheat and durum wheat starting November 1. The current duty is 135%.

·

IKAR reported Russian 12.5% protein wheat from Black Sea ports, for first half of November was $312 a ton free on board at the end of last week, up $2 from the previous week. SovEcon reported a $3/ton increase to $316 a ton.

·

Russia’s Federal Center of Quality and Safety Assurance for Grain and Grain Products reported a 12% decline in wheat shipments for the 2021-22 season to 14.7 million tons as of Oct. 21.

·

China sold 88.5% of the amount available or 891,938 tons of wheat out of auction at an average price of 2,366 yuan per ton or $371/ton.

2022

initial winter wheat projections (late October/early November)

G/E

reported at 46 percent versus 41 percent year ago and 52 for the 5-year average. By class, it appears winter white wheat conditions were well below average, while hard red winter and soft red winter are above our adjusted 5-year average.

Export

Developments.

·

Pakistan’s lowest offer for 90,000 tons of wheat was $394.38 a ton c&f. No purchase has been reported.

·

Turkey seeks 235,000 tons of feed barley on October 26.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

Updated

10/25/21

December

Chicago wheat is seen in a $7.15‐$7.90 range (up 15, up 15), March $6.75-$8.00 (up 25, up 25)

December

KC wheat is seen in a $7.10‐$7.95, March $6.82-$8.25

December

MN wheat is seen in a $9.45‐$10.50 (up 20, up 20), March $9.00-$10.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.