PDF Attached

Attached

includes US wheat by class S&D’s

Another

choppy trade in the agriculture markets. Soybean oil continued to slide; meal was higher which supported soybeans. Corn and wheat ended higher led by a corn.

![]()

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Hot

temperatures in Argentina Tuesday exacerbated drying and crop stress in portions of the nation - Rain

is still needed in many areas, but especially in the west-central and northwestern portions of the nation - No

rain was noted - Eastern

Argentina, Southern Brazil, Uruguay and far southern Paraguay will receive light amounts of rainfall during the next 10 days to two weeks, although not completely dry - This

is a classic La Nina pattern and the bias for less than usual precipitation in these areas will likely become a festering issue during November eventually leaving behind a growing moisture deficit - For

now, many crops in this described region are adequately to excessively wet and a short-term drying bias might be good for agriculture especially in southern Brazil and southern Paraguay - Tropical

Depression 26W has moved inland Vietnam’s lower central coast today and will move into Cambodia later today and Thursday - The

storm brought up to 7.00 inches of rain along the lower central coast Tuesday and will produce 1.00 to 3.00 inches in Vietnam’s Central Highlands and neighboring areas of Cambodia.

- Most

of the storm’s greater rainfall will occur farther north along the central coast where 3.00 to 7.00 inches of new rain may fall causing more flooding in coastal areas - Vietnam’s

central coast has reported over 49.00 inches of rain since October 1 with many other areas near by reporting more than 20.00 inches and flooding has been quite a problem especially in coastal areas - Drier

weather is expected, but not before the end of this weekend - Next

week’s weather will be much improved - Western

and northern Colombia agricultural areas will be closely monitored over the next few weeks as the potential for flooding increases.

- The

risk may be greatest starting in the second week of the forecast and continuing into mid-November.

- Coffee,

sugarcane, corn and a host of other crops may eventually impacted by too much rain - Western

Venezuela may also be involved with the excessive moisture - Northwestern

Argentina will receive some important rainfall Friday easing long term dryness in northwestern Formosa, northwestern Chaco and Santiago del Estero, although more rain will still be needed - The

region has been critically dry for an extended period of time and the moisture will improve summer crop prospects - Southern

Argentina (especially the southwest) will get some important rainfall Sunday into Monday that should improve topsoil moisture for winter and spring crops - Rain

amounts may range from 1.00 to 3.00 inches from San Luis into northwestern Buenos Aires and northeastern La Pampa with lighter rainfall farther to the east - Brazil’s

greatest rainfall in the next seven days will occur from Mato Grosso to Minas Gerais and a part of Sao Paulo with some heavy rain possible in portions of Goias and Minas Gerais

- Local

flooding might occur - Well-timed

rainfall is expected elsewhere in the nation’s summer crop areas - Less

rain in the south will help reduce moisture surpluses in the topsoil which should help expedite fieldwork after some additional drying takes place.

- U.S.

weather will be rainy again in the western Corn Belt and Delta today into Thursday and in the remainder of the Midwest and southeastern states Thursday into Saturday morning - The

additional rainfall of 0.50 to 1.50 inches and local totals over 2.00 inches will occur after previous rain this week already saturated the fields especially in the Midwest - Harvest

delays will continue into the weekend across the Midwest and in parts of the Delta and southeastern states

- Winter

wheat planting delays will also continue - Western

portions of U.S. hard red winter wheat production areas will be dry biased for the next week to ten days, despite a few brief showers - The

region is in need of rain especially in unirrigated fields in the high Plains region - These

areas will likely remain drier biased well into the winter, although not completely dry - Eastern

wheat areas have plenty of moisture and are experiencing a good establishment environment

- Recent

rain and mountain snow in the U.S. Pacific Northwest has helped improve water supply and runoff potentials - There

is still need for greater moisture in the Yakima Valley, Columbia River Basin and Snake River Valley - Some

additional precipitation will impact these areas periodically over the next two weeks with mountains getting far greater precipitation than the valleys - Northern

California may see some periodic light precipitation over the next ten days, but no more heavy, soaking, rainfall is expected for a while - Runoff

form the recent excessive precipitation event is raising water reservoir levels in many areas - Southern

California remains drought ridden and needs significant rain that is not likely to occur anytime soon - Montana

and neighboring areas of Canada’s Central Prairies will experience some brief bouts of rain and snow late this week as colder air arrives - The

moisture will be good for surface moisture boosting, but much more is needed to ensure better winter crop establishment - Some

of Montana and southern Alberta should see improved soil moisture later this autumn and winter - Ontario,

Canada received additional precipitation Tuesday - The

region has been frequently wet this autumn slowing harvest progress for corn and soybeans - Some

wheat planting has also been slowed - Quebec

weather has not been nearly as wet - Weather

conditions should slowly improve in Ontario - South

Africa will receive some shower and thunderstorm activity during the next ten days that will help moisten up topsoil for more aggressive spring planting - Today’s

forecast has removed some rain from the outlook relative to other days this week - India’s

greatest rain will be in the southern one-third of the nation for a while - Some

showers will occur in the eastern states as well - The

greatest drying will be in the central and north which will translate into a very good environment for winter wheat, rapeseed, millet, sorghum and pulse crop planting as well as supporting summer crop harvesting - Northern

and east-central China weather will be favorably dry over the next ten days supporting good summer crop maturation and harvest conditions - Winter

grain and rapeseed planting will also advance favorably - Rain

in southwestern China may disrupt farming activity for a while, but no serious harm will come to unharvested crop quality - Xinjiang,

cotton, corn and other crop harvesting is advancing relatively well, although periodic showers in northeastern production areas have slowed fieldwork at times and raised some cotton quality concerns as well - Europe

weather will remain very good for the next few days and then trend wetter from the northwest half of the Iberian Peninsula through France and into western Germany - The

moisture will be well timed for the recently planted winter crops and should help them emerge and establish favorably - Eastern

Europe will remain in a dry weather mode for a while along with the Ukraine and much of Russia’s winter crop region in the Volga River Basin - Most

of the crops in these areas should be establishing well enough to get through winter, but snow cover will be needed in parts of the region during extreme cold to protect crops – especially those that may not be as well established as they should be

- A

boost in eastern Europe and western CIS precipitation is expected in the second week of the outlook, Nov. 2-8 - Typhoon

Malou was located 255 miles south southwest of Iwo To near 21.7 north, 139.6 east moving north northeasterly at 7 mph and producing wind speeds to 74 mph near the storm center - The

storm will stay to the southeast of Japan and will pose no threat to land - A

mid-latitude storm 100 miles south of Cape Cod, Massachusetts today will stay near the New England coast today before turning to the southeast and then to the northeast tonight and Thursday.

- High

wind speeds, heavy rain and rough seas will impact southeastern New England, southeastern New York and New Jersey into Thursday - The

storm will then move away from land Thursday into the weekend allowing winter conditions in the northeastern U.S. to improve - The

system may acquire subtropical characteristics as the storm moves southeast from near the New England Coast Wednesday into Thursday - Rainy

weather and some windy conditions are expected today - Australia

weather continues nearly ideal for the development of winter wheat, barley and canola - A

boost in rainfall is needed in the interior east to support better spring planting for cotton and sorghum - Most

winter wheat, barley and canola production areas will continue to experience highly favorable weather conditions, although there is some concern over the potential for wet harvest conditions in a part of the east. - Southeast

Asia will see routinely occurring rainfall maintaining moisture abundance in Indonesia, Philippines, Malaysia and the mainland areas of Southeast Asia. - A

Low pressure center in the south-central Mediterranean Sea will move across Sicily Thursday and approach the southwest coast of Italy Friday

- This

system has potential to possibly become a subtropical storm - The

storm will produce heavy rainfall and strong wind speeds over Sicily resulting in some flooding - North

Africa will receive rain today and Thursday northeastern Morocco through northern Tunisia and then dry weather will occur until mid-week next week when northern Algeria will get some additional rain - Southwestern

Morocco will remain driest - Central

Africa will continue to experience periodic into the end of this week maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions - Drier

weather will soon be needed in some cotton, coffee and cocoa areas - Weather

this weekend into next week will trend drier favoring better crop maturation conditions - Southern

Mexico will be wetter than usual over the next ten days causing some delay to fieldwork - Central

America rainfall will be greater than usual in El Salvador and Guatemala and near to below average elsewhere - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +10.97 and it was expected to drift lower a little further over the next few days - New

Zealand weather is expected to be a little drier than usual except in central parts of North Island where rainfall will be greater than usual

- Temperatures

will be seasonable.

Wednesday,

Oct. 27:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica releases cane crush, sugar output data (tentative)

Thursday,

Oct. 28:

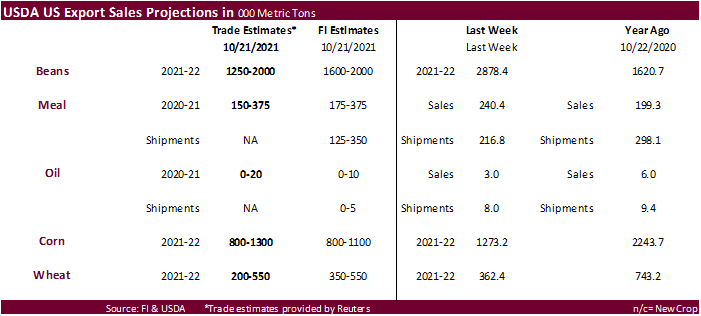

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Oct. 29:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases October trade data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm

Source:

Bloomberg and FI

Macros

US

Durable Goods Orders Sep P: -0.4% (est -1.1%; prev 1.8%; prevR 1.3%)

–

Durables Ex Transportation Sep P: 0.4% (est 0.4%; prev 0.3%)

–

Cap Goods Orders Nondef Ex Air Sep P: 0.8% (est 0.5%; prev 0.6%; prevR 0.5%)

–

Cap Goods Ship Nondef Ex Air Sep P: 0.4% (est 0.5%; prev 0.8%; prevR 0.6%)

US

Wholesale Inventories (M/M) Sep P: 1.1% (est 1.0%; prev 1.2%)

–

Retail Inventories (M/M) Sep: -0.2% (est 0.2%; prev 0.1%; prevR 0.2%)

US

Advanced Goods Trade Balance Sep: -$96.3B (est -$88.3B; prev -$87.6B; prevR -$88.2B)

US

DoE Crude Oil Inventories (W/W) 27-Oct: 4268K (est 1914K; prev -0.431K)

–

Distillate: -432K (est -2311K; prev -3913K)

–

Cushing OK Crude: -3899K (prev -2320K)

–

Gasoline: -1993K (est -1862K; prev -5368K)

–

Refinery Utilization: 0.4% (est 0.3%; prev -2.0%)

·

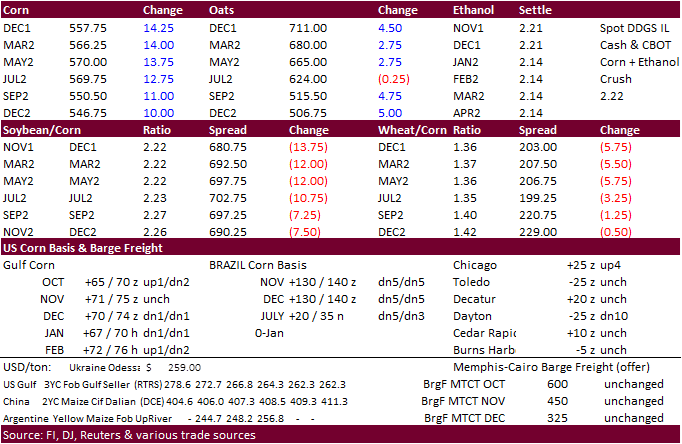

December corn hit a 2-month high on technical buying, settling 13.75 cents higher to its highest level since August 30. One news source noted strong ethanol margins, high fertilizer prices and strength in wheat. Another source

out of EU told us there is an import margin on corn into China. December

corn did see some buying after it broke above the 100-day MA of 5.4575. As of early afternoon, we still have not picked up on any rumors of Chinese buying. Remember China tends to lay off buying corn during their own harvest season.

·

Funds bought an estimated net 13,000 corn contracts.

·

December corn traded above the top end of our trading range of $5.55/bu. The March contract also topped our high end of the range of $5.70. We raised our prices by 25 cents each. Note our crop year price forecast is attached.

·

South Africa’s CEC sees the 2020-21 corn crop at 16.211 million tons, up from the 15.300 million tons last season and unchanged from the previous forecast. It consists of 8.609 million tons of white and 7.602 million tons of

yellow.

·

Germany reported a bird flu H5N1 outbreak at a goose farm in Brunsbüttel in Schleswig-Holstein.

·

The weekly USDA Broiler Report showed broiler-type eggs set in the United States up 6 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 9, 2021 through October 23, 2021 for the United

States were 7.80 billion. Cumulative placements were up slightly from the same period a year earlier.

·

WTI crude oil traded lower after data showed US crude oil supplies were higher than expected. US crude oil inventories rose by 2.3 million barrels in the week ending Oct. 22, according to the American Petroleum Institute. That

was more than the expected 1.9-million-barrel gain.

·

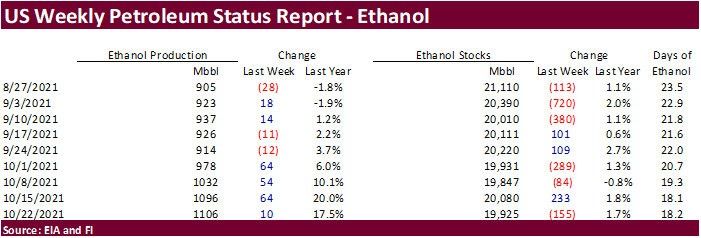

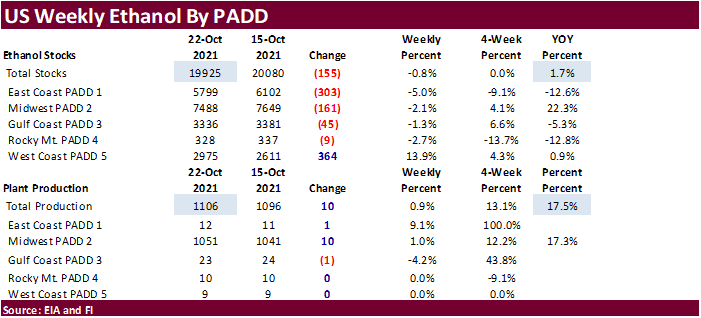

Weekly US ethanol production was up 10,000 barrels to 1.106 million and stocks fell 155,000 barrels to 19.925 million. This was unexpected as the trade looked for production to increase 1,000 and stocks to increase 261,000 barrels.

The report was seen supportive for corn.

Export

developments.

-

None

reported

Updated

10/27/21

December

corn is seen in a $5.10-$5.80 range (up 25, up 25)

March

corn is seen in a $5.00-$6.00 range

(unch, up 30)

·

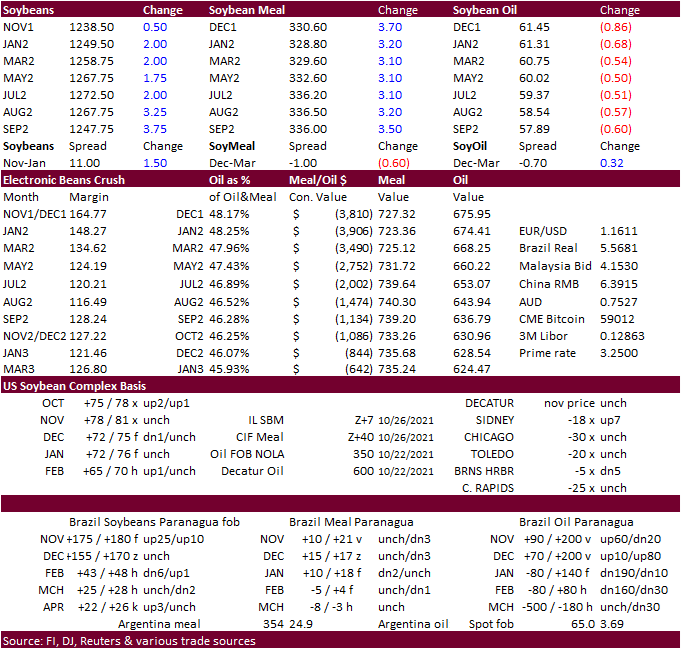

Another wild day. CBOT soybeans, meal and oil started the day lower. January soybeans were up 2.25 cents, December meal was up $4.00 and December soybean oil fell 89 points. For the second day in a row, soybeans rallied hard

then sold off. Soybean meal ended higher on follow through unwinding of oil/meal spreading. Soybean oil was hit by lower energy markets. Outside commodity markets initially influenced the soybean complex. Soybean oil was lower with WTI off nearly $2.00

by the time soybean oil closed. Some people noted the recent outbreak of Covid-19 in China were weighing on vegetable oil prices, and another source cited India demand concerns, but we think the weaker vegetable values were more related to global energy prices

and weakness in SA soybean oil cash prices on Tuesday.

·

Funds bought an estimated net 3,000 soybeans, bought 3,000 soybean meal and sold 2,000 soybean oil.

·

There was a big January crush trade at 148 today.

·

It was dry across Brazil over the past day, promoting soybean planting progress. Argentina will remain on the drier side for the balance of the workweek with some rain expected this weekend but the country will need additional

rain going forward.

·

Argentina soybean sales as of October 20 were running at 32.7 million tons (2020-21 crop year), below 33.9 million year earlier.

Export

Developments

·

The USDA seeks 20 tons of vegetable oil in 4-liter cans for Dec 1-13 shipment on November 2.

Updated

10/18/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59-65 cent range, March 56-65

·

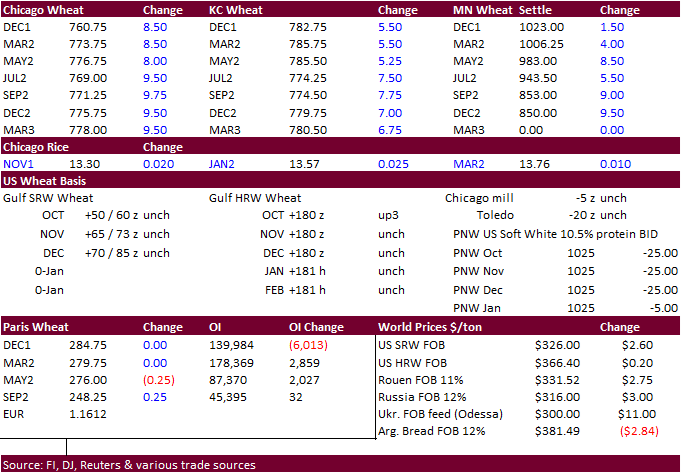

US wheat futures opened lower but traded higher after corn rallied and Egypt bought 360,000 tons of Black Sea wheat. Chicago wheat settled 7.50 cents higher basis December at $7.5975/bu. December KC was up 5.50 cents and December

MN ended 0.50 cent higher. Note December oats are sitting at $7.11/bu, only 48.75 cents discount to Chicago wheat! Going back to 1979, we could not find a day oats traded at a premium to Chicago wheat, but it did come close nearly two decades ago. Same

with KC. We did find that on 7/5/1988, KC wheat closed only at a 7-cent premium to oats.

·

Funds bought an estimated net 4,000 Chicago wheat contracts.

·

Attached are our US wheat by class S&D’s. Like USDA, we are looking for very tight white wheat and durum stocks.

·

The US Great Plains weather forecast this morning appeared to be wetter for the Great Plains bias NE into Texas. Rains will occur across the eastern areas today into early Thursday before turning drier Friday through the weekend.

·

Paris December wheat was unchanged at 284.75 euros.

·

Ukraine exported 18.2 million tons of grain so far in the 2021-22 July-June season, up 17.5% from 15.5 million tons year earlier. That included 11.7 million tons of wheat, 4.2 million tons of barley and 2 million tons of corn.

Export

Developments.

·

Egypt’s GASC bought 360,000 tons of wheat (180k Russian, 120k Ukrainian and 60,000 tons Romanian) for shipment between Dec. 1-10.

60,000

tons Russian, $327.00 FOB plus $29.50 freight, total $356.50 c&f

60,000

tons Romanian, $328.36 FOB plus $31.50 freight, total $359.86 c&f

60,000

tons Ukrainian, $327.50 FOB plus $32.95 freight, total $360.45 c&f

60,000

tons Russian, all at $328.36 FOB plus $32.64 freight, total $361.00 c&f

60,000

tons Ukrainian, $328.70 FOB plus $33.20 freight, total $361.90 c&f

·

Jordan passed on 120,000 tons of wheat.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

Updated

10/26/21

December

Chicago wheat is seen in a $7.15‐$7.90 range, March $6.75-$8.00 December KC wheat is seen in a $7.10‐$7.95, March $6.82-$8.25

December

MN wheat is seen in a $9.45‐$10.50, March $9.00-$10.50.

some are calling for $11 MN wheat

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.