PDF Attached

USD

was 90 points higher by 1:50 pm CT, WTI crude oil $0.97 higher and US equities mixed. US GDP was better than expected. USDA export sales were good for soybeans and all wheat, poor for corn and soybean oil and ok for soybean meal. Many of the ag markets traded

two-sided. Meal / oil spreading dominated the products. Soybean ended mixed. Grains settled lower.

Weather

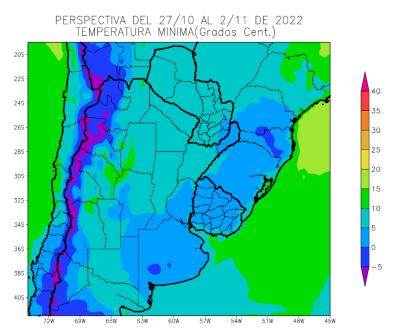

US

and South American weather forecasts were mainly unchanged from yesterday. The Great Plains have an opportunity for rain Sat-Mon. The 6-10 day for the Midwest calls for above normal temperatures then trending cooler than normal for the 11-15 day. Parts of

the US Midwest southwestern, central and southern areas will see rain sometime through Sunday. Argentina’s BA (drier after today through Oct 29), Santa Fe and Entre Rios will see rain this weekend and Brazil’s central and northern growing areas will continue

to get rain for the balance of this week. One weather group sees only 20 percent of Argentina seeing meaningful rain over the next 5 days. Temperatures in Argentina and Brazil will fall next week bringing potential frosts to some of the growing areas. Commodity

weather group warned Brazil’s Rio Grande do Sul and Santa Catarina states, along with Argentina could see risks for emerged corn and wheat.