PDF Attached does not include daily estimate of funds as they were not available at the time this was sent

Private

exporters reported the following sales activity:

-126,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-198,000

metric tons of soybeans for delivery to Spain during the 2022/2023 marketing year

USD

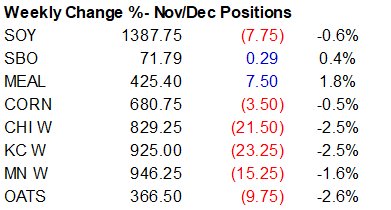

was higher, WTI crude oil lower and US equities higher. US Feds meet mid next week and may increase rates by 75 points. CBOT futures were lower for SBO & grains, and higher for soybeans and meal, ahead of the weekend. Daylight savings time ends in the UK and

in much of Europe, including Germany, France, Italy and Spain, when clocks “fall back” by an hour.

Weather

The

southern Great Plains have an opportunity for rain today through Saturday before returning Tuesday. Parts of the US Midwest southwestern, central and southern areas will see rain sometime through Sunday. Argentina’s BA, eastern Santa Fe and Entre Rios will

see rain this weekend before turning drier next week. Brazil’s central and northern growing areas will continue to get rain for the balance of this week. Temperatures in Argentina and Brazil will fall early next week bringing potential frosts to some of the

growing areas.