RUSSIA

PRESIDENT PUTIN SAYS WE ARE NOT ENDING OUR PARTICIPATION IN BLACK SEA GRAIN EXPORT DEAL, JUST SUSPENDING IT – Reuters News

US

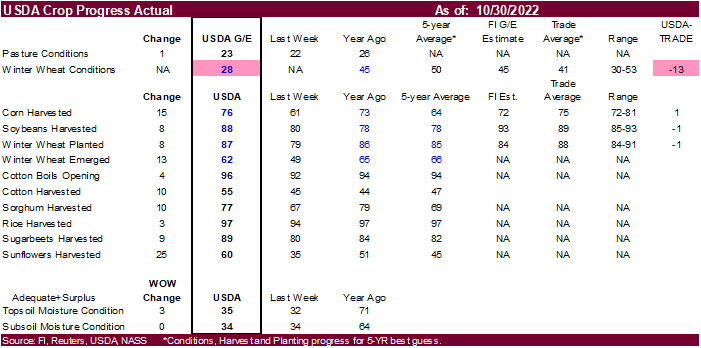

winter wheat conditions were only 28 percent good and excellent, down from 45 year ago. The initial fall rating was lowest since at least 1987 when USDA started reporting.

Calls:

Soybeans

4-8 higher

Soybean

meal $1-3 higher

Soybean

oil 10 to 30 points higher

Corn

5-7 higher

Wheat

10-15 higher

Russia

said they will not extend the Ukraine grain safe passage agreement and that is sent CBOT agriculture commodities higher. We are hearing many firms and major importers were prepared for this announcement. Officials are noting up to 218 vessels are “blocked”

after the decision. Traders should monitor grain movement over the next few weeks. Twelve vessels embarked from Ukrainian ports early Monday.

Weather