PDF Attached

Higher

trade expected tonight led by wheat. Winter wheat conditions were three points below expectations. Soybeans 2-5 higher, corn 1-3 higher, and wheat 3-6 higher.

USDA:

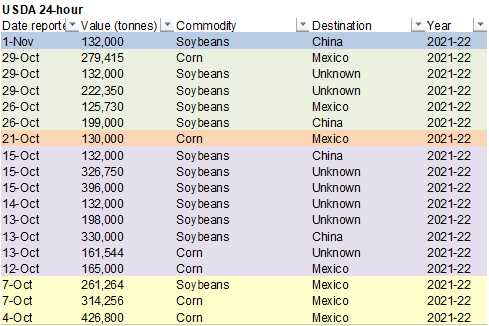

Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

New

month/new money. Chicago wheat hit a near 9-year high. Paris wheat traded at a 13-1/2 year high. Global demand remains strong for wheat. Corn rallied. Soybeans traded two-sided, meal lower and soybean oil higher. Europe was on holiday.

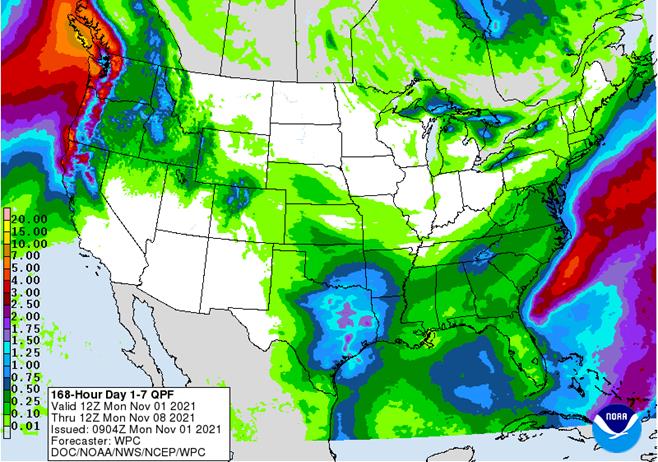

USD was down 17 points by 1 pm CT. WTI crude oil was about 30 cents higher. Rain will return to the southern Great Plains Tuesday through Wednesday. It was very wet across the US Corn Belt over the weekend, bias eastern growing areas

but will turn drier this week. SA saw rain including southern Argentina, a welcome sight. Rains this week will fall across Mato Grosso, Goias, Minas Gerais, southern Parana, Santa Catarina, and RGDS. For Argentina rains is expected across most of the growing

areas, favoring Cordoba, Santa Fe, northern Entre Rios.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- No

changes occurred overnight - U.S.

weather will be beneficially drier this week in the Midwest and a portion of the southeastern states - Totally

dry weather is not expected, but the few showers that occur should be brief and light favoring a net drying trend and supporting a gradual resumption in fieldwork after last week’s generalized rain - Temperatures

will be seasonable - U.S.

Delta may get some rain during mid-week this week; otherwise the week will be dry biased

- U.S.

Midwest weather will become more active weather again during the middle to latter part of next week

- Some

mid-week rain is expected with rainfall not more than 0.60 inch - A

late week storm next week will produce the next generalized precipitation event

- Nov.

11-15 will produce another 0.50 to 1.50 inches of rain and possibly more, but confidence is low since the event is out so far in time - U.S.

Delta and southeastern states will get some rain during mid-week next week and again after Nov. 12 and sufficient amounts will fall to disrupt farming activity at times, but the moisture will be good for future winter crops - U.S.

hard red winter wheat areas will get some precipitation this week that will benefit some of the crop

- Moisture

totals will be less than 0.20 inch in the high Plains region while varying from 0.05 to 0.60 inch farther to the east in Oklahoma and south-central Kansas - Dry

weather is expected late this weekend into early next week - Next

storm system is due into the region late next week, but early indications suggest the high Plains region will be driest

- Temperatures

will be cool early this week and then warming this weekend into next week bring back near to above average temperatures - Winter

crops will continue to experience improved establishment, although greater volumes of moisture will still be needed in the west - West

Texas rainfall will be minimal next week, but a few showers are possible today into Wednesday - Moisture

totals will be less than 0.30 inch in the high Plains region and 0.25 to 0.75 inch with a few amounts near 1.00 inch in the Rolling Plains - None

of the rain will be great enough to seriously set back harvest progress or threaten unharvested cotton quality - Northern

California and a part of the U.S. Pacific Northwest will continue to get periods of rain this week and especially next week - The

moisture will help restore better soil moisture and runoff potential - Next

week’s rain will be much greater than that of this week - Canada’s

Prairies and the Northwestern U.S. Plains will remain drought stricken through the next two weeks with only a minimal amount of moisture expected - Argentina

and Brazil weather will continue favorable during the next two weeks, but there will be some net drying in eastern Argentina, Uruguay, southern Paraguay and southern Brazil which is traditional for La Nina years. Most of the region will not be critically dry.

Timely rain will continue, but resulting rain will be less than usual. - Argentina

will be impacted by two weather systems this week that together will produce sufficient rain across the entire nation to support winter, spring and summer crops - Rainfall

is expected to vary greatly with 1.00 to 3.00 inches possible in central crop areas while 0.50 to 1.50 inches occurs in the north and far south - There

may be some areas in eastern and southern Buenos Aires that will receive less than 0.50 inch of moisture and the same may be true in southern parts of Entre Rios - Temperatures

will be near to below average - If

the forecast verifies many crops in the nation will benefit from the moisture. Concern will rise over crop conditions in southern Buenos Aries and central and southern La Pampa as well as northeastern Buenos Aires and southeastern Entre Rios. However, the

bulk of corn, sunseed, soybean and peanut production areas will get enough rain to improve topsoil moisture and ease recent heat and dryness stress - Argentina’s

second week forecast will start out dry and warmer, but rain may develop after November 11 that may impact western areas more than the east - Argentina

experienced showers and thunderstorms during the weekend that concentrated on western Buenos Aires, La Pampa and portions of Cordoba with lighter coverage in northwestern parts of the nation - Rain

fell from western Santiago del Estero through Cordoba to central and western Buenos Aires and eastern La Pampa - Rainfall

ranged from 0.60 to 2.50 inches with one location in Buenos Aires reporting 4.26 inches - Eastern

Argentina was dry through this morning - Temperatures

were very warm to hot Friday with highest readings getting into the middle and upper 90s to 105 degrees Fahrenheit - Some

cooling occurred Saturday - Brazil

rainfall during the weekend was greatest from southeastern Paraguay through Parana and southern Mato Grosso do Sul to southern and western Minas Gerais and from Goias into Mato Grosso - Rain

amounts varied widely with 0.40 to 1.25 inches common - Far

northern Minas Gerais reported 4.30 inches of rain and more than 4.00 inches also occurred in southeastern Paraguay near the Misiones, border - Several

other areas reported 1.25 to more than 3.00 inches mostly in northern Sao Paulo and southern Minas Gerais - Most

of Brazil will get rain over the coming week, although amounts may be sporadic and light from western and southern Parana through Parana to northern Rio Grande do Sul and southern Paraguay

- These

lighter rainfall areas will get less than 1.25 inches of moisture during the week - The

wetter areas will be from eastern Mato Grosso and Tocantins through central and northern Goias to Minas Gerais and southern Bahia where 3.00 to more than 7.00 inches will occur - Rainfall

elsewhere by this time next week will range from 1.00 to 2.00 inches - Temperatures

will be seasonable - Brazil

rainfall for Nov. 7-14 will continue frequent in center west and center south as well as the northeast part of the nation - Rain

will be more than sufficient to maintain aggressive crop development - Southern

Brazil will experience showers and thunderstorms, albeit less frequently and less significantly than that of northern and central parts of the nation

- Some

areas may experience a little net drying and the region will be closely monitored - Temperatures

will be near to below average - China’s

weather over the next two weeks will include a good mix of weather favoring winter crop planting and establishment while supporting some harvest progress of summer crops.

- Next

week will be the driest week, but rain and snow that fall across eastern China this week will be brief and mostly confined to Friday through Monday or Tuesday of next week - Snow

will be confined to the northeastern provinces during the weekend and early part of next week - Temperatures

will be much colder in the north half of the nation next week - Fieldwork

will advance around the precipitation and the moisture will help to ensure good emergence and establishment of wheat and rapeseed. None of the precipitation will be intense or frequent enough to threaten crop quality; including rice and cotton which are most

vulnerable to rain right now - India

will be wetter biased in the south during the next couple of weeks - Parts

of the region will become a little too wet and drying will be needed to protect late season crop development and quality - Central

and northern India will experience net drying conditions during much of this period favoring good field progress - Some

rain may reach into Gujarat briefly next week - Some

forecast models suggest a tropical cyclone will form off the west coast of India next week and move into Gujarat next week

- Confidence

is low on the landfall - Southeast

Asia will continue to experience a good mix of weather during the next two weeks

- Rain

will fall routinely and sufficiently to support normal crop development - This

is true for Philippines, mainland areas and both Indonesia and Malaysia - Russia

and Ukraine will experience a more frequent mix of rain and sunshine with a little snow possible in Russia, as well - The

precipitation will reach into some of the drier areas of Ukraine and the Volga River Basin which will help raise soil moisture for use in the spring of 2022 - Winter

crops are becoming dormant or semi-dormant and that may restrict crop development for a while, but this is normal at this time of year. Most of the crops are favorably established, although snow cover will be important during periods of bitter cold

- Europe’s

greatest precipitation over the next ten days will be in Italy, the eastern coastal areas of the Adriatic Sea region as well as southern France and a few areas in Spain - The

precipitation will interfere with farming activity, but will improve topsoil moisture for use in the future - Good

field working conditions should occur in other parts of the continent due to less frequent and less significant precipitation relative to the areas noted above

- Temperatures

will be near normal in the west and warmer than usual in the east - North

Africa will experience some showers Tuesday through Friday - The

precipitation will impact Algeria and Tunisia most significantly with coastal areas wettest - Morocco

still needs significant rain to end multiple years of drought - Central

Africa rainfall is expected to be a little more infrequent over the next two weeks, but timely showers will continue to support late season coffee, cocoa, rice, sugarcane and cotton development - Any

rain that falls significantly should be short-lived and followed by a welcome period of dry weather - The

bottom line should be good for long term crop development - South

Africa experienced some weekend shower activity, although the resulting rain was erratic and a little too light to seriously change soil moisture - Weather

over the next two weeks will bring other showers periodically, but no general soaking of rain is expected and the need for more generalized rain of greater significance will remain - This

is a La Nina year and that usually translates into timely rainfall for the late spring and summer and World Weather, Inc. does not believe that a serious deficiency of precipitation will occur for any prolonged period of time this season. Timely rain should

evolve eventually and planting of summer grain and oilseeds will accelerate once that evolves. In the meantime, the more limited rainfall pattern will be ideal for winter crop maturation and harvest progress - Australia

has been experiencing a good mix of rain and sunshine in recent weeks supporting winter wheat, barley and canola development and protecting production potentials - The

pattern will not change much in the next two weeks. - There

is no sign of excessive rain impacting maturing winter crops over the next two weeks - Summer

crop planting will advance with irrigated areas and the dryland areas in eastern Queensland and New South Wales that received rain recently experiencing the greatest field progress - There

is need for greater rain for summer crops, but plenty of time remains for a further boost in precipitation - Western

and northern Colombia agricultural areas will be closely monitored over the next few weeks as the potential for flooding increases.

- The

risk may be greatest starting in the second week of the forecast and continuing into mid-November.

- Coffee,

sugarcane, corn and a host of other crops may eventually impacted by too much rain - Western

Venezuela may also be involved with the excessive moisture - Southern

Mexico will be wetter than usual over the next ten days causing some delay to fieldwork - Central

America rainfall will be greater than usual in Guatemala and from Costa Rica into Panama while near to below average elsewhere - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +7.06 and it was expected to drift a little lower over the next few days, although it should gradually level off - New

Zealand weather is expected to be drier than usual during the coming week - Temperatures

will be seasonable. - Next

week will trend a little wetter

Monday,

Nov. 1:

- Australia

Commodity Index, 1:30am - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

corn for ethanol, DDGS production, 3pm - USDA

soybean crush, 3pm - U.S.

cotton condition; corn, soy and cotton harvesting; winter wheat planting, 4pm - Malaysia’s

October palm oil export data from AmSpec and SGS - Honduras

and Costa Rica monthly coffee exports - Global

cotton balance report from International Cotton Advisory Committee - Ivory

Coast cocoa arrivals - HOLIDAY:

France, Italy, Spain, Ivory Coast

Tuesday,

Nov. 2:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - HOLIDAY:

Brazil

Wednesday,

Nov. 3:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Japan

Thursday,

Nov. 4:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price, 8pm Wednesday ET time - Port

of Rouen data on French grain exports - HOLIDAY:

India, Malaysia, Singapore

Friday,

Nov. 5:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish demand-supply reports on corn, soy and other commodities - FranceAgriMer

weekly update on crop conditions - Malaysia

Nov. 1-5 palm oil exports - HOLIDAY:

India

Source:

Bloomberg and FI

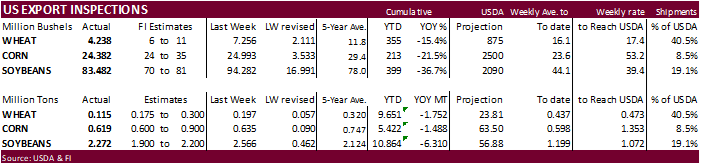

USDA

inspections versus Reuters trade range

Wheat

115,341 versus 150000-500000 range

Corn

619,340 versus 475000-900000 range

Soybeans

2,272,003 versus 1850000-2300000 range

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 28, 2021

-- METRIC TONS --

-------------------------------------------------------------------------

CURRENT PREVIOUS

----------- WEEK ENDING ---------- MARKET YEAR MARKET YEAR

GRAIN 10/28/2021 10/21/2021 10/29/2020 TO DATE TO DATE

BARLEY 1,596 0 0 9,743 9,867

CORN 619,340 634,864 740,612 5,422,076 6,910,239

FLAXSEED 0 0 0 24 389

MIXED 0 0 0 0 0

OATS 0 0 0 200 1,196

RYE 0 0 0 0 0

SORGHUM 77,108 80,090 103,320 495,051 648,414

SOYBEANS 2,272,003 2,565,929 2,390,548 10,863,867 17,173,444

SUNFLOWER 96 192 0 432 0

WHEAT 115,341 197,479 313,355 9,651,110 11,403,129

Total 3,085,484 3,478,554 3,547,835 26,442,503 36,146,678

-------------------------------------------------------------------------

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

CBOT

updated daily price limits

for many agriculture contracts. Corn futures will move 5 cents lower. Soybeans will be down 10 cents. SBO will expand 50 points and meal will decline $5. KC and Chicago wheat will expand 5 cents.

https://www.cmegroup.com/trading/price-limits.html

StoneX

US

soybean crop 4.490 billion, up from 4.436 previous. Yield 51.9 vs. 51.3 previous.

US

corn crop 15.119 billion, up from 15.022 previous. Yield 177.7 vs. 176.6 previous.

Macros

US

ISM Manufacturing Oct: 60.8 (est 60.5; prev 61.1)

–

Prices Paid: 85.7 (est 82.0; prev 81.2)

–

New Orders: 59.8 (est ; prev 66.7)

–

Employment: 52.0 (prev 50.2)

74

Counterparties Take $1.359T At Fed’s Fixed Rate Reverse Repo (prev $1.403, 79 Bidders)

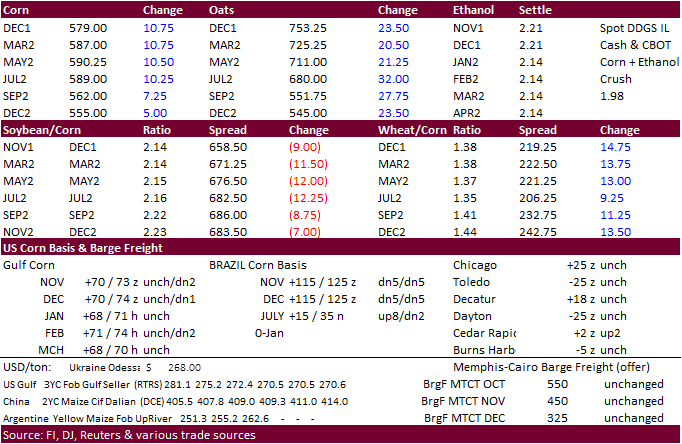

Corn

·

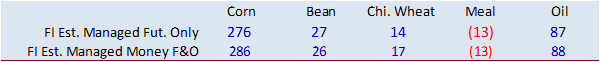

Corn futures ended 5.25-10.75 cents higher (bull spreading) from good US ethanol margins and sharply higher wheat. Funds bought an estimated net 14,000 corn contracts.

·

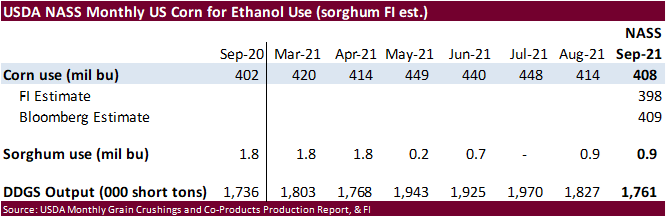

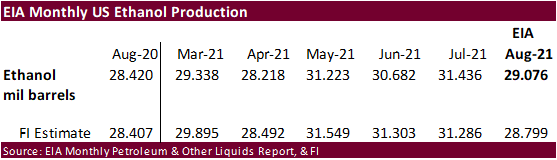

Latest weekly EIA ethanol reports on ethanol production and slightly higher than expected US August output (monthly released Friday) suggests a sizeable rebound in this sector. We are currently using 5.300 billion bushels for

corn use for the current crop year (up 50 from previous), 100 million above USDA, and have a bias to lift our estimate higher if production holds above 1.75 million barrels per day over the next month or two. That’s easily in reach. Highest corn for ethanol

use was in 2017-18 when the US crushed 5.605 billion bushels of corn. That puts our 2021-22 carryout around 1.45 billion bushels, 50 million below USDA.

·

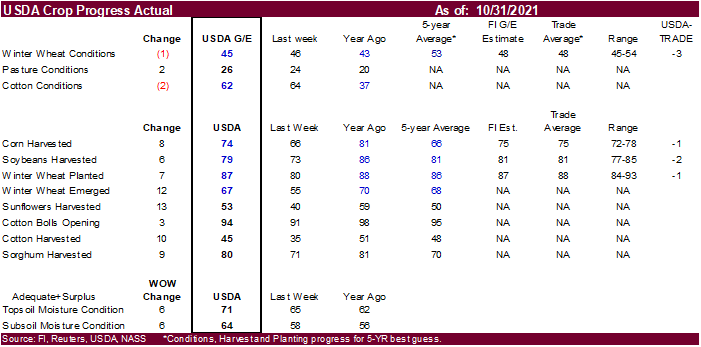

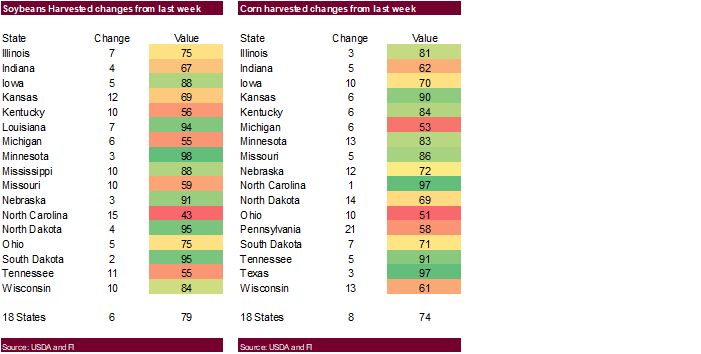

US corn harvested was reported at 74 percent, up 8 points and compares to 81 year ago and 66 average. The 74 percent was one point below a trade average.

·

After the close USDA reported 408 million bushels of corn was used during the month of September, one bushel below a Bloomberg estimate, down from 414 million from August 21 and up from 402 million during September 2020.

·

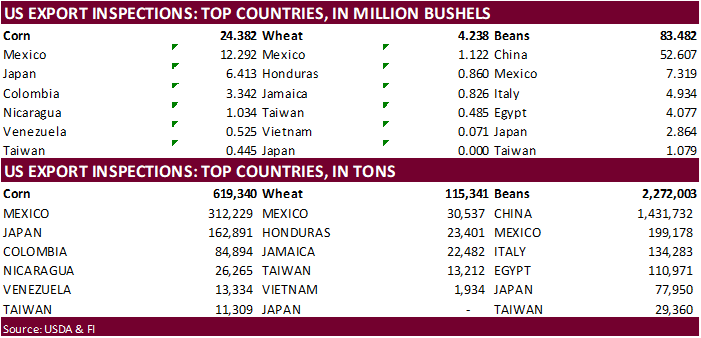

USDA US corn export inspections as of October 28, 2021 were 619,340 tons, within a range of trade expectations, below 634,864 tons previous week and compares to 740,612 tons year ago. Major countries included Mexico for 312,229

tons, Japan for 162,891 tons, and Colombia for 84,894 tons.

·

US weather improves this week for harvesting progress. It will be cold in many areas but that tends to keep rains away. Some additional snow will occur across the far northern states.

·

AgRural: Brazil 2021-22 corn plantings reached 63 percent compared to 53% previous week and 54 percent year ago.

Export

developments.

-

None

reported

Source:

Trade News Service

Updated

11/01/21

December

corn is seen in a $5.30-$6.10 range (up 20, up 30 back end)

March

corn is seen in a $5.25-$6.25 range

(up 25, up 25)

·

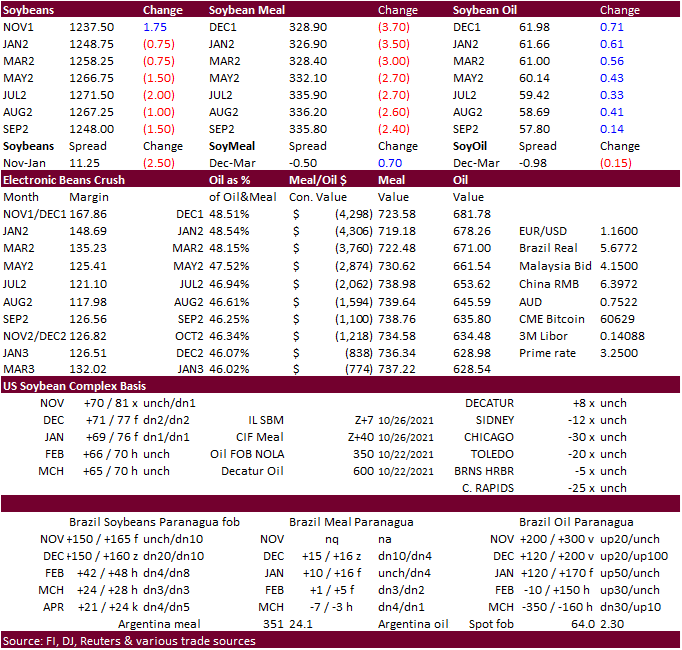

CBOT soybeans ended 0.75-1.25 cents lower in the non-expiring contracts, meal lower on product spreading and SBO higher led by bull spreading. The strength in soybean oil was thought to be tied with related energy margins in

the corn (ethanol market), fund buying (first of the month) and thin trade with many countries in Europe on holiday (All Saints Day). Soybeans and meal may have seen pressure from grain spreading.

·

Funds were flat in soybeans, sold 3,000 soybean meal and bought 4,000 soybean oil.

·

US soybeans harvested was reported at 79 percent, up 6 points and compares to 86 year ago and 81 average. The 79 percent was 2 points below a trade average.

·

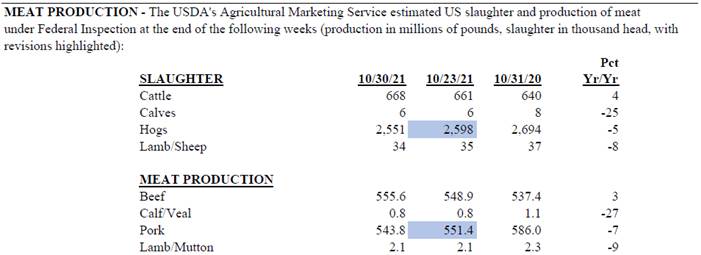

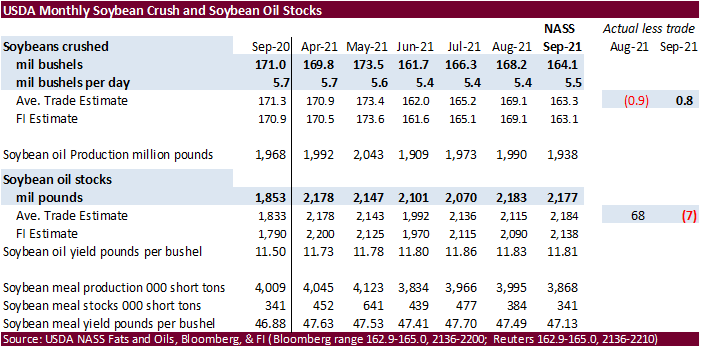

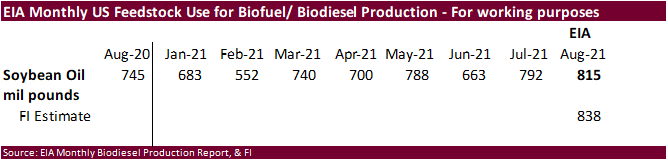

There were no major surprises in USDA’s monthly crush report, although soybean oil stocks came in above our working projection. September 1 soybean oil stocks, the end of the 2020-21 crop year, ended up 2.177 billion pounds,

7 million pounds below expectations, slightly be 2.183 billion at the end of August, and above 1.853 billion at the end of September 2020. Soybean meal stocks were 341,000 short tons, below 384,000 previous month. USDA reported the September 2021 crush at

164.1 million bushels, 0.8 bu above expectations, and down from 171.0 million year ago.

·

USDA US soybean export inspections as of October 28, 2021 were 2,272,003 tons, within a range of trade expectations, below 2,565,929 tons previous week and compares to 2,390,548 tons year ago. Major countries included China for

1,431,732 tons, Mexico for 199,178 tons, and Italy for 134,283 tons.

·

Brazil truckers are protesting high fuel prices but according to a Reuters story there were no major disruptions roads or port entrances.

·

AgRural: Brazil 2021-22 soybean crop plantings reached 52% of the estimated area as of Oct. 28 (second-fastest pace ever for this time of year), up 14 percentage points from the previous week and higher than the 42% for the same

period of 2020-21.

·

Cargo surveyor SGS reported October Malaysian palm exports at 1,476,645 tons, 229,068 tons below month ago or down 13.4%, and 238,134 tons below year ago or down 13.9%.

·

CBOT soybean deliveries were 917 contracts that included some commercial activity. Registrations were unchanged.

Export

Developments

·

Under the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to China.

·

Egypt’s GASC seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on Wednesday for arrival Dec. 20 – Jan. 10, with 180-day letters of credit and/or at sight.

·

The USDA seeks 20 tons of vegetable oil in 4-liter cans for Dec 1-13 shipment on November 2.

Updated

11/01/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59.50-64.50 cent range (up 50, down 50 back end),

March 56-65

·

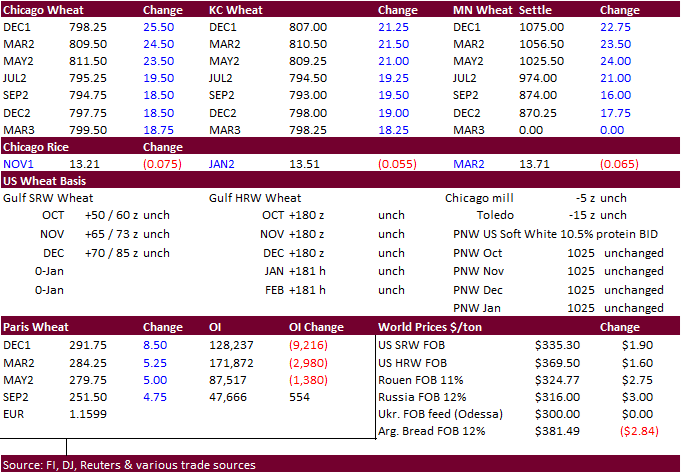

US wheat futures were sharply higher on strong global wheat demand and fund money inflow. Egypt and Saudi Arabia bought wheat. Chicago wheat traded above $8.00/bu, first time since June 2011. Around that level there was light

profit taking. Chicago ended 24.50 cents higher at $7.9725/bu. Funds bought an estimated net 15,000 Chicago soft wheat contracts. MN wheat hit its highest level since June 2011, settling at $10.7550, up 23.25 cents. KC wheat also surged, settling 20.75

cents higher at $8.0650/bu. The nearby KC wheat contract hit its highest level since May 2014.

·

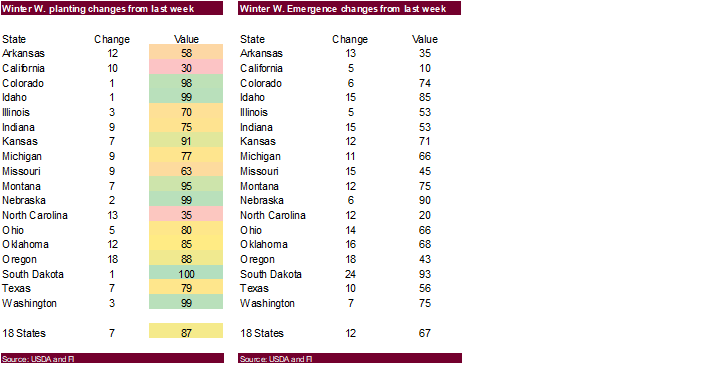

US winter wheat conditions fell one point to 45 percent from the previous week, above 43 year ago and compares to 53 percent 5-year average. This was 3 points below an average trade guess.

·

US planting progress increased 7 points from the previous week to 87 percent and compares to 88 percent year ago and 86 average. The 87 points was 1 point below an average trade guess.

·

Paris wheat traded at a 13-1/2 year high, settling 8.50 euros higher at 291.75 euros. It peaked at 293.25 today, highest since Q1 2008.

·

The higher traded didn’t seem to be affected by low USDA export inspections.

·

USDA US all-wheat export inspections as of October 28, 2021 were 115,341 tons, below a range of trade expectations, below 197,479 tons previous week and compares to 313,355 tons year ago. Major countries included Mexico for 30,537

tons, Honduras for 23,401 tons, and Jamaica for 22,482 tons. By class, HRW wheat conditions fell 0.9% using our adjusted calculation, SRW increased 0.3% from the previous week and the winter white increased 1.5% from last week after the PNW and related states

saw heavy rains.

·

Some weather forecasts are calling for dryness to build across winter wheat areas of the Black Sea despite some improvement seen for eastern Ukraine and Russia’s central region this week.

·

US Great Plains weather improves this week with some showers early to mid-week across the southern Great Plains.

USDA:

US all wheat ground for flour during the third quarter 2021 was 231 million bushels, up 3 percent from the second quarter 2021 grind of 223 million bushels but down 1 percent from the third quarter 2020 grind of 234 million bushels. Third quarter 2021 total

flour production was 106 million hundredweight, up 3 percent from the second quarter 2021 but down 2 percent from the third quarter 2020. Whole wheat flour production at 4.97 million hundredweight during the third quarter 2021 accounted for 5 percent of the

total flour production. Millfeed production from wheat in the third quarter 2021 was 1.68 million tons. The daily 24-hour milling capacity of wheat flour during the third quarter 2021 was 1.59 million hundredweight.

Export

Developments.

·

Egypt’s GASC bought 180,000 tons of Russian wheat.

–

60,000 tons of Russian wheat at $331.90 a ton, plus and $31.93 freight, equating to $363.83 a ton.

–

60,000 tons of Russian wheat at $332.55 and $31.93 freight, equating to $364.48 a ton.

–

60,000 tons of Russian wheat at $332.55 and $31.93 freight, equating to $364.48 a ton.

was

$331.90 per ton fob for 60,000 tons of Russian wheat, for December 11-20 shipment.

·

Saudi Arabia bought 1.268 million tons of wheat at an average price of $377.54/ton for Q1 2022 arrival. There were in for 655,000 tons. Most origins were unknown at this time but at least 120,000 tons may come from Russia.

·

Pakistan issued an import tender for 90,000 tons of wheat set to close Nov. 4 for Jan through April shipment.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

CBOT rice registrations fell 134 lots.

·

Results awaited: Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

Updated

11/01/21

December

Chicago wheat is seen in a $7.30‐$8.25 range (up 15, up 25), March $7.25-$8.40 (up 25, up 40)

December

KC wheat is seen in a $7.35‐$8.35 (up 25, up 40), March $7.00-$8.50 (up 25)

December

MN wheat is seen in a $9.70‐$11.50 (up 20, up 75), March $9.00-$11.75

(unch, up 25).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.