PDF Attached

Sharply

lower WTI crude oil weighted

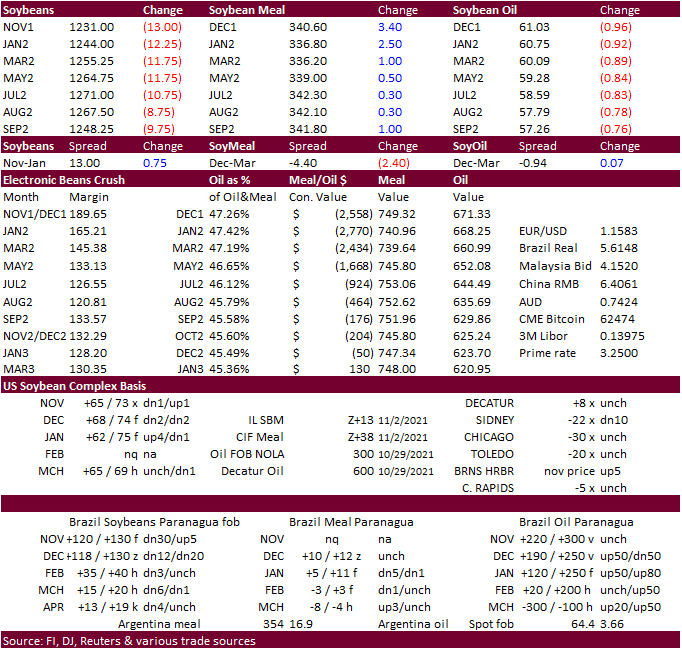

on CBOT agriculture commodity futures. Soybean meal rallied on strong US domestic basis values and concerns over the slow soybean harvest pace across the eastern Corn Belt. Trade estimates for the US corn and soybean yields call for an upward revision on

November 9th.

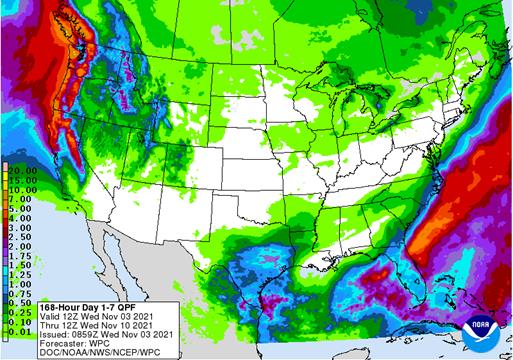

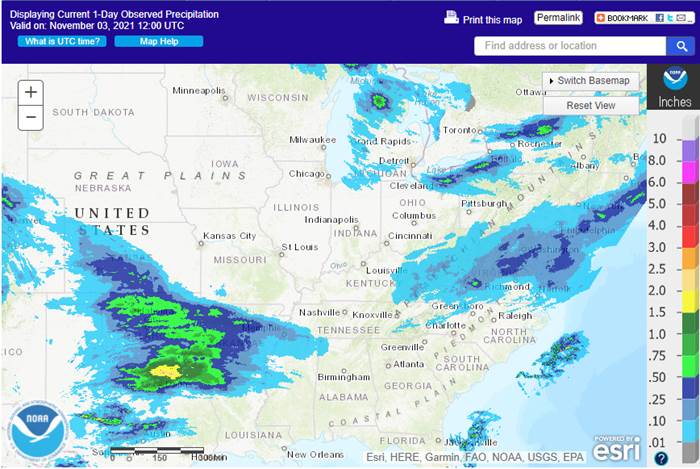

Weather

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- U.S.

harvest weather will remain very good over the next five to six days, although some of the wettest areas will need a couple of additional days of drying because recent cool weather slowed the drying pace - A

storm system advertised for mid- to late-week next week will set back fieldwork once again in the central and eastern U.S., but confidence in the event’s overall impact remains low today - U.S.

hard red winter wheat production areas will be driest in the west over the next ten days to two weeks - Any

showers that occur in the high Plains will be brief and light - Precipitation

Tuesday and early today from central Kansas into central Texas was good for winter crop establishment - U.S.

Delta weather will improve after rain falls in parts of the region today - The

next weather event to impact planting and harvesting will be a week from now - U.S.

southeastern states will see a good mix of weather over the next two weeks with fieldwork to advance relatively well around brief bouts of precipitation - Northwestern

U.S. Plains and Canada’s central Prairies will continue quite dry biased for the next two weeks - Temperatures

in central and interior western parts of North America will rise well above average briefly late this week into early next week followed by some cooling late next week - Southern

California and the southwestern desert region will continue dry biased for the next two weeks - Argentina’s

weather offers a good mix of rain and sunshine over the next two weeks - The

greatest improvement in soil moisture is expected in the north - Eastern

Buenos Aires and Entre Rios may dry out for a while - Recent

rain and that which is forthcoming will help support corn, sunseed, soybean rice and cotton planting - Wheat

development continues to advance well and recent precipitation has been good for many crops - Brazil

weather will be well mixed for many crop areas in the nation during the next two weeks - Rain

frequency and intensity is expected to be above average from eastern Mato Grosso and Tocantins to Bahia and Minas Gerais where the ground will become saturated by mid-month - The

wet bias in these areas will help induce an earlier than usual start to soybean and cotton planting - Rain

frequency and intensity will be poorest in Sao Paulo and northern Parana where some net drying may occur at times during the next ten days - Far

southern Brazil will get some timely rainfall of light intensity and the region will stay in very good condition for wheat maturation and harvesting as well as supporting soybean and other crop development - Australia’s

rain frequency will be rising in the south and eastern parts of the nation during the next two weeks

- The

moisture boost will be great for summer crop planting, emergence and establishment, but the moisture will slow winter crop maturation and harvest progress - No

crop quality concerns are expected for a while, but a close watch on the harvest and rainfall will be warranted until wheat, barley and canola harvesting is complete - Southern

India will turn much wetter over the next week to ten days - The

precipitation will slow summer crop maturation and harvest progress and could raise a little cotton, rice and oilseed quality concern - The

wettest areas will include Andhra Pradesh, Tamil Nadu Kerala and Karnataka, although rain will fall in Maharashtra as well - Sugarcane

and coffee will benefit from the moisture - A

tropical cyclone may evolve in the eastern Arabian Sea later this week to the west of India.

- The

storm should move northwest across the Arabian Sea, although the European forecast model takes the system to near the Pakistan and Gujarat coast where it dissipates a week from now - China

will see periods of rain and some snow in many crop areas through the weekend followed by much colder temperatures and drier weather - Snow

may evolve significantly in northeastern China this weekend - Harvest

delays are expected because of the coming precipitation, but conditions should improve next week once the snow melts - Rapeseed

planting should advance well during the next two weeks in the Yangtze River Basin, although there will be a few bouts of rain to disrupt the process periodically - A

more active weather pattern in Russia during the coming two weeks will lead to a boost in snow cover for many areas in the north and central parts of the nation - Heavy

snow is expected in the eastern New Lands and Ural Mountain region - Ukraine

and southern Russia grain areas will receive some periods of rain during the week next week and into the following weekend - The

moisture will be good for use in the spring - Europe

weather will be favorable for fieldwork of all kinds, although it will have to advance around brief brought of light rainfall - South

Africa will start receiving some needed rain in the central and eastern summer crop areas later this week that will last through much of next week - The

moisture will improve planting, germination and emergence conditions, although the distribution will not be uniform and many western crop areas will stay dry biased - Temperatures

will be warmer than usual in the northeast and slightly below average in the southwest through the next week - Northeastern

Xinjiang, China will experience some snow over the next few days disrupting any late season harvesting that is still under way

- An

extended period of drier weather will then occur from late this week through most of next week to help get harvest back under way - Central

and western Xinjiang harvest weather will be nearly ideal during the next couple of weeks with only a few brief showers of insignificance expected late this week - Indonesia

and Malaysia weather will be wet biased over the next two weeks with frequent rain expected over saturated or nearly saturated soil causing some flooding - Coastal

areas of southern Vietnam will likely trend wetter than usual next week, but restricted rainfall is expected until then - Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Portions

of North Africa will get some needed rain late this week through the weekend - Northwestern

Algeria may get some excessive rain resulting in some coastal flooding - Northwestern

Algeria has been drier than usual in recent past years and this will be a good opportunity to improve soil moisture and water supply ahead of aggressive wheat and barley planting - Southwestern

Morocco remains in a multi-year drought with little rain of significance expected over the next couple of weeks - West-central

Africa will experience a good mix of weather during the next ten days to two weeks - Less

frequent rain in cotton areas will translate into better crop maturation conditions - Coffee,

cocoa, sugarcane and rice will also benefit from less frequent and less significant rainfall, although completely dry weather is not likely for a while - East-central

Africa rainfall will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Mexico’s

weather will turn drier in the southwest leaving most of the nation with a good environment for crop maturation and harvesting

- Some

showers will occur along the east coast - Most

other areas will experience seasonal drying - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Costa Rica and Panama - Western

and northern Colombia, Ecuador and Peru agricultural areas will be closely monitored over the next few weeks as the potential for flooding increases.

- The

risk may be greatest starting in the second week of the forecast and continuing into mid-November.

- Coffee,

sugarcane, corn and a host of other crops may eventually impacted by too much rain in Colombia

- Western

Venezuela may also be involved with the excessive moisture - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +6.50 and it was expected to level off before moving a little higher the remainder of this week and into next week - New

Zealand weather is expected to be drier than usual during the coming week except in eastern parts of North Island where some heavy rain will continue today and end Thursday - Temperatures

will be seasonable. - Tropical

Storm Wanda was 700 miles west of the Azores and expected to move closer to the islands this weekend - The

storm poses no threat to North America and will merge with a mid-latitude cold front next week while bringing rain to northwestern Europe

Wednesday,

Nov. 3:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Japan

Thursday,

Nov. 4:

- FAO

World Food Price Index - USDA

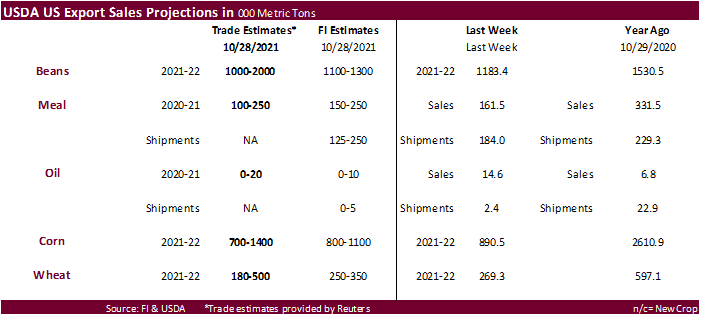

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price, 8pm Wednesday ET time - Port

of Rouen data on French grain exports - HOLIDAY:

India, Malaysia, Singapore

Friday,

Nov. 5:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish demand-supply reports on corn, soy and other commodities - FranceAgriMer

weekly update on crop conditions - Malaysia

Nov. 1-5 palm oil exports - HOLIDAY:

India

Source:

Bloomberg and FI

IHS

Markit

Corn

yield 178.7 / production 15.204 (USDA 176.5 / 15.019)

Soybean

yield 51.5 / production 4.454 (USDA 51.5 / 4.448)

FED

SAYS TAPER STARTING NOVEMBER, MONTHLY REDUCTIONS OF $15B

FED

SAYS PREPARED TO ADJUST PACE OF TAPER AS WARRANTED *

FED:

INFLATION ELEVATED DUE FACTORS EXPECTED TO BE TRANSITORY

Futures

Show Traders Are Expecting 2 Hikes By Dec. 2022 After’s Fed’s Sep. Statement

74

Counterparties Take $1.343 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.329 Tln, 77 Bidders)

US

ADP Employment Change Oct: 571K (est 400K; prev 568K)

US

DoE Crude Oil Inventories (W/W) 3- Nov: 3290K (est 2250K; prev : 4268K)

–

Distillate: 2160K (est -1250K; prev -432K)

–

Cushing OK Crude: -916K (prev -3899K)

–

Gasoline: -1488K (est -1250K; prev -1993K)

–

Refinery Utilization: 1.20% (est 0.50%; prev 0.4%)

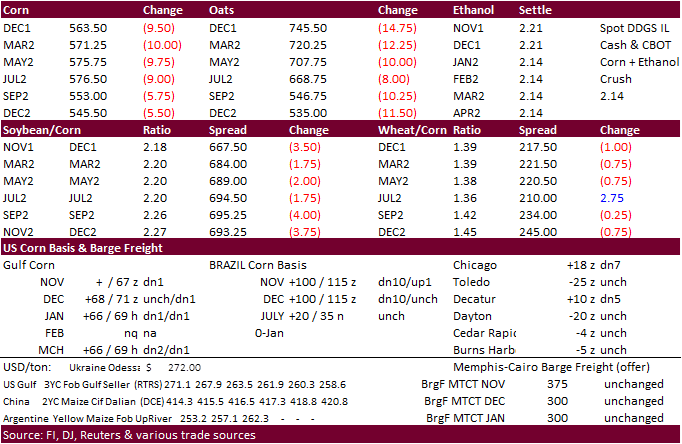

Corn

·

Corn futures ended sharply lower on consolidation and lower energy markets. US weather suggests good corn harvest progress, at least for the WCB as producers are still concentrated on soybeans in the ECB.

·

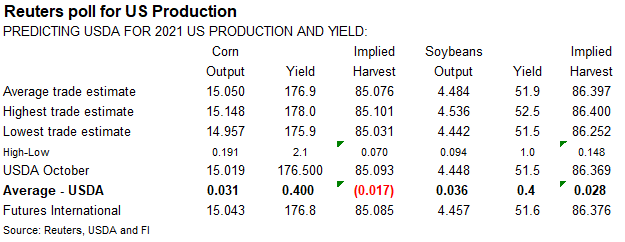

Trade estimates for US corn yield call for an increase to 176.9 bu/ac from 176.5 October.

·

Funds sold an estimated net 10,000 net corn contracts.

·

U.S. Crude Oil Futures Settle At $80.86/BBL, Down $3.05, 3.63Pct (livesquawk)

·

Brent Crude Futures Settle At $81.99/BBL, Down $2.73, 3.22Pct (livesquawk)

·

Producers in central Indiana are finally started to harvest corn. Some of the bean producers are still struggling.

·

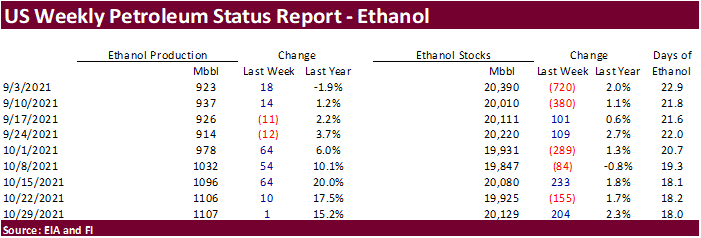

US ethanol production increased 1,000 barrels to 1.107, just shy of its 1.108 million weekly record, and stocks increased by a more than expected 204,000 barrels. The report gave little direction to CBOT corn prices, and sentiment

likely continued to focus on lower crude oil prices.

·

Brazil exported 1.8 million tons of corn in October, well down from 5 million tons during October 2020.

·

China said it will guarantee supplies of daily necessities, including meat and vegetable oils.

·

Baltic Dry Index fell 9.3% to 2,892 points. It’s down about 20 percent from the previous week.

·

Denmark reported an outbreak of H5 bird flu at a turkey farm in the central part of country.

·

The USDA Broiler report showed eggs set in the US up 5 percent and chicks placed up 5 percent. Cumulative placements from the week ending January 9, 2021 through October 30, 2021 for the United States were 7.98 billion. Cumulative

placements were up slightly from the same period a year earlier.

University

of Illinois – Planting Decisions

Schnitkey,

G., N. Paulson, K. Swanson and C. Zulauf. “Planting and Acreage Decisions in 2022.”

farmdoc

daily

(11):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 2, 2021.

Export

developments.

-

South

Korea’s NOFI bought 69,000 tons of corn and South Korea’s KFA bought 65,000 tons of corn.

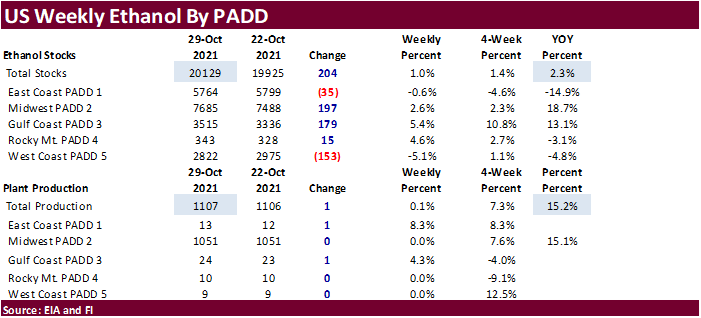

Weekly

ethanol production

was up 1,000 barrels per day to 1.107 million, about as expected, and stocks increased 204,000 barrels to 20.129 million (trade was looking for up 106,000 barrels). Weekly ethanol production is just shy of the record 1.108 million barrels established week

ending December 1, 2017. Ethanol stocks are highest since the late September and are 2.3% above around this time year ago. Early September to date ethanol production is running 8.3 percent above the same period a year ago. US gasoline stocks declined 1.49

million barrels to 214.3 million. Gasoline stockpiles are at their lowest level since November 2017. US gasoline demand was up from the previous week by 181,000 barrels to 9.504 million and using a past 4-week average (Oct 1-22) it recovered roughly 9.5%

a year ago and but is still off 1.6% from about the same period 2 years ago. US crude oil stocks fell to lowest since March. Crude inventories rose by 3.3 million barrels to 434.1 million barrels, compared with Reuters expectations for a 2.2 million barrel

increase.

Updated

11/01/21

December

corn is seen in a $5.30-$6.10 range

March

corn is seen in a $5.25-$6.25 range

·

CBOT soybeans ended lower by 8.75-12.50 cents with losses limited from a higher traded in soybean meal (bull spreading). Soybean oil started higher but turned south after WTI crude oil trended lower.

·

Funds sold an estimated 9,000 soybeans, bought 2,000 soybean meal and sold 5,000 soybean oil.

·

Trade estimates for US soybean yield call for an increase to 51.9 bu/ac from 51.5 October.

·

The slow harvest pace across the ECB over the past few weeks and good demand for soybean meal continues to underpin the meal basis and support CBOT contracts. Spot meal basis increased $5/short ton for rail locations in Chicago,

Decatur (IL), Morriston (IN) and Fostoria (OH). Decatur, IN, truck location was up $2/short ton. A central IL soybean crusher had to slow crush rates in part to poor (wet) quality of soybeans. There is light at the end of the tunnel. US harvest progress

is expected to increase across the ECB for the balance of the week.

·

WCB soybeans are in good shape.

·

SA plantings are running full steam.

·

CBOT lowered their soybean futures margins by 14.5% to $2650/ton from $3100 and initial margin rates will be 110% of maintenance margin rates, effective close of business day (Nov 3).

·

Brazil was on holiday today. The Brazilian Real yesterday hit a new low against the US Dollar.

·

Brazil soybeans are near competitive with US shipments, but exportable supplies are starting to dry. They are still active exporters. During October, Brazil exported 3.3 million tons of soybeans, up from 2.42 million tons from

October 2020.

·

China non-GMO soybean futures appreciated to their highest level since early March, in part to a shrinking soybean at the expense to corn.

·

Argentina has a chance for showers, but precipitation amounts will remain well below normal.

Export

Developments

·

Egypt’s GASC bought sunflower oil and passed on soybean oil. They bought 15,000 tons of sunflower oil at $1,440/tons for arrival between December 25 and January 15. They were in for 30,000 tons of soybean oil and 10,000 tons

of sunflower oil

Updated

11/03/21

Soybeans

– January $11.80-$13.25 range, March $11.50-$13.50

Soybean

meal – December $315-$360, March $310-$360

Soybean

oil – December 59.50-63.00 cent range, March 56-65

·

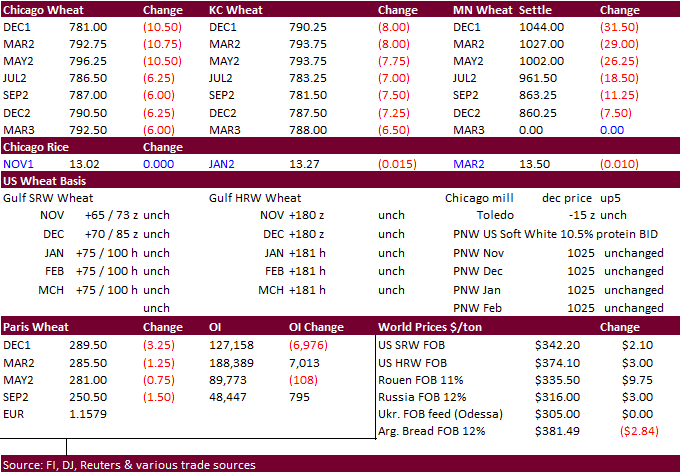

US wheat futures traded sharply lower on profit taking after several contracts made multiyear highs earlier this week. Chicago wheat was 6-10.75 cents lower, KC down 6.50-7.75 cents, and Mn dropped 7.50 to 31.50 cents (led by

nearby contracts). The USD fell 20 points. Import announcements have been quiet since last weekend and some traders are eying another week of poor US all-wheat export inspections when updated Monday. Thursday, we get export sales and see commitments around

average for this time of year (250-350k FI estimates). Trade estimates range from 180,000 tons to 500,000.

·

Funds sold an estimated 9,000 Chicago SRW wheat contracts.

·

South Korea’s NOFI passed on wheat. Jordan bought 60,000 tons of wheat.

·

Paris December wheat was down 3.25 euros at 289.50, after hitting an all-time high on Tuesday.

·

Russia’s grain harvest is around 90 percent complete.

·

US wheat lower in part to good rains occurring across the southern Great Plains. Dry weather sets in today lasting through Sunday for this area. Note net drying will extend in west central and southwestern areas.

Export

Developments.

·

Jordan bought 60,000 tons of wheat, optional origin, at an estimated

-

South

Korea’s NOFI passed on wheat.

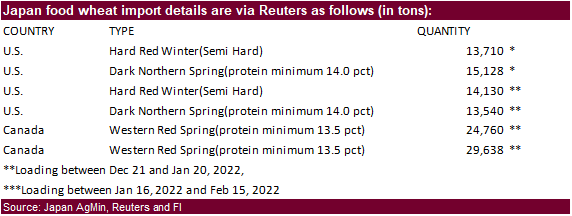

·

Japan seeks 143,396 tons of food wheat.

·

Pakistan issued an import tender for 90,000 tons of wheat set to close Nov. 4 for Jan through April shipment.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

·

There were 57 rice deliveries and registrations fell 14.

·

Results awaited: Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

Updated

11/01/21

December

Chicago wheat is seen in a $7.30‐$8.25 range, March $7.25-$8.40

December

KC wheat is seen in a $7.35‐$8.35, March $7.00-$8.50

December

MN wheat is seen in a $9.70‐$11.50, March $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.