PDF Attached

USDA

updated their S&D’s and corn and soybean production for the US was upward revised. CBOT agriculture markets ended mixed. Soybeans and soybean oil were higher, meal lower and grains lower. Most markets traded two-sided. WTI crude oil was down about $3.00 and

US equities lower as of 1:25 pm CT. China’s month CASDE (S&D) offered no surprises. Conab increased Brazil 2022-23 soybean production and trimmed corn output. Malaysia MPOB October S&D is due out later this evening CT. USDA export sales report and US CPI

are due out Thursday morning.

USDA

reported private exporters reported the following sales activity:

-264,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-198,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

![]()

USDA

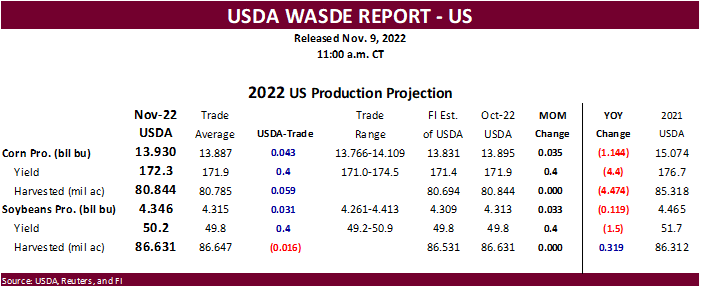

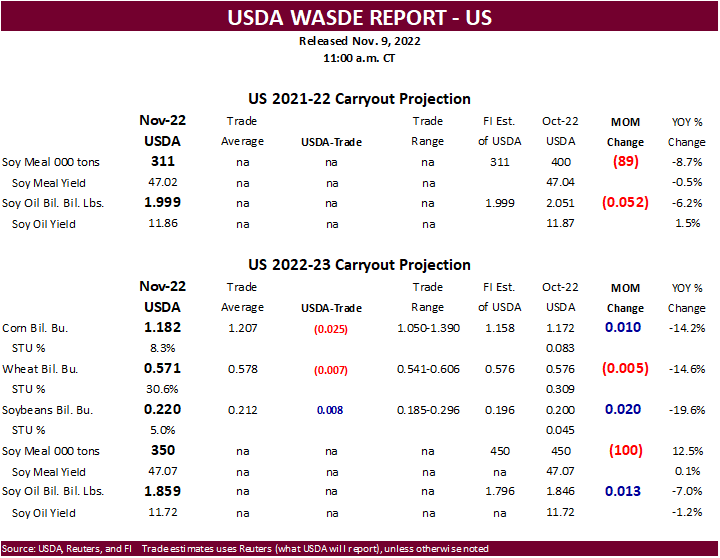

released their November S&D report

Reaction:

initially

bearish soybeans and lessor extend grains. Largest

surprise to us was the US soybean and corn yield/production estimate, both increasing from the previous month. The corn yield was up 0.4 bu/ac from October and soybeans also up 0.4 bu/ac. Trade was looking for lower yields for corn and soybeans. 2022-23 US

soybean stocks were upward revised 20 million bushels and corn by 10 million. All-wheat US stocks were revised lower by 5 million bushels. USDA did not change US corn exports despite the slow start to commitments and inspections. USDA left Brazil corn and

soybean production unchanged. For Argentina, they lowered soybeans by 1.5 million tons and left corn production unchanged. We thought that would be the other way around due to some producers shifting away from corn to soybeans. Argentina wheat production was

taken down 1.5 million tons to 15.5 million tons. We think USDA is at least 2 million tons too high on Argentina wheat output.

Look

for prices to trade sideways over the short term unless geopolitical headlines move the markets, such as a concrete decision on the Black Sea grain shipping deal by Russia, and/or major changes in weather patterns develop. The November USDA S&D otherwise was

not that eventful. With USDA boosting US soybean production by an unexpected 33 million bushels, they had some room to lift crush higher by 10 million bushels to 2.245 billion, above 2.204 billion a year ago. US soybean meal domestic use was upward revised

250,000 short tons. SBO for biofuel use was left unchanged and food use was lifted higher by 150 million pounds. US soybean oil exports were lowered 100 million pounds to 1.300 billion, lowest since 2005-06 season. USDA raised corn for feed by 25 million bushels

and left exports unchanged. USDA made minor changes in the US wheat balance.

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

New-crop

in brief

US

soybean stocks 220 vs. 200 last month (20), 8 million vs. trade

US

corn stocks 1182 vs. 1172 last month (10), -25 million vs. trade

US

wheat stocks 571 vs. 576 last month (-5), -7 million vs. trade

WLD

soy stocks 102.2 vs. 100.5 last month (1.7), 1.6 million vs. trade

WLD

corn stocks 300.8 vs. 301.2 last month (-0.4), 0.2 million vs. trade

WLD

wheat stocks 267.8 vs. 267.5 last month (0.3), 1.3 million vs. trade

Brazil

Soy 152.0 vs. 152.0 last month (0), -0.2 million vs. trade

Arg.

Soy 49.5 vs. 51.0 last month (-1.5), -1.1 million vs. trade

Brazil

Corn 126.0 vs. 126.0 last month (0), -0.3 million vs. trade

Arg.

Corn 55.0 vs. 55.0 last month (0), 0.9 million vs. trade

Attached

PDF includes FI’s full snapshot

Weather

Tropical

storm Nicole intensified over the last day and is expected to hit Florida Thursday morning.

![[Key Messages]](https://www.eoxlive.com/wp-content/uploads/2022/11/image004-11.png)

The

US central and lower Great Plains will see net drying this weekend. Light rain fell in the southern areas yesterday and parts of eastern NE, eastern KS, and OK will see rain Thursday into Friday. The Midwest will see showers across the northwestern areas through

Thursday and eastern areas Friday. Many areas of Brazil will see rain this week. Argentina should see rain return to western Santa Fe, Cordoba, La Pampa, and western Buenos Aires today through Sunday.