PDF Attached

US

inflation hit a 30-year high in October. Higher trade in nearly all US agriculture markets led by wheat on fears the world’s top exporter, Russia, will claw back on grain exports. USDA announced 22,000 tons of soybean oil sold to unknown. Last time we saw

a USDA soybean oil announcement was on 12/28/2020. USD was up a whopping 88 points as of 2 pm CT.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- A

tropical disturbance in the Bay of Bengal will intensify to tropical depression status today and may become a tropical storm before it reaches the upper east coast of Tamil Nadu and lower coast of Andhra Pradesh Thursday - The

system is not likely to bring much more than flooding rain to coastal areas and some moderate wind speeds - No

serious crop damage is likely, although local flooding is expected - India’s

central and north will experience good harvest weather over the next week to ten days due to generally dry weather and seasonable temperatures - Planting

of wheat, rapeseed, millet and other winter crops will advance swiftly as well - Eastern

and southern Australia will experience some frequent rainfall into Friday, but after that these areas will see less frequent and less significant rain

- The

drier bias will help improve wheat, barley and canola harvest conditions and fieldwork should advance well next week while rainfall is more limited - Rain

through Friday will be most welcome in unirrigated areas of Queensland and New South Wales where recent rainfall has been restricted - The

moisture will improve livestock grazing conditions and raise soil moisture for unirrigated cotton and sorghum planting and development - Brazil

weather will remain mostly good for the next two weeks, based on the recent forecast model runs

- However,

concern remains for Sao Paulo and northern Parana where rainfall will be restricted for another week - Net

drying has already been occurring for a while - Rain

advertised in the second week of the outlook for these areas will be very important - Drying

in far southern Brazil does not seem to last long enough to create any big problems for corn, soybeans or rice, but stay watchful of the area since La Nina does favor below average rainfall for the region - The

active Brazil weather pattern should last another ten days - Argentina

weather has been and will likely continue to be favorably mixed for planting and crop development - No

area looks to be left out of the timely rainfall pattern that should last for ten days - The

situation will be closely monitored, but there is no sense fighting the trend when the jet stream seems so strong and active.

- This

will not likely prevail through all of November, but it will last long enough to get many crops planted and off to a favorable start - Temperatures

will be near to slightly cooler biased for the next ten days - A

mini-blizzard will evolve in the upper Midwest Thursday into Friday of this week

- The

storm will produce 3 to 6 inches of snow and locally more in northern Minnesota, northeastern North Dakota and southern Manitoba, Canada as well as neighboring areas of western Ontario and northwestern Wisconsin - Snowfall

of a trace to 3 inches will occur in the remainder of North Dakota, southern Minnesota and eastern South Dakota as well as the remainder of Wisconsin - Strong

wind speeds of 25-35 mph and gusts to 45 will be possible during the height of the storm’s intensity Thursday and Friday - Rain

from the same blizzard noted above will move from west to east across the Midwest later today into Friday causing a brief disruption to farming activity - Central

and eastern U.S. Midwest farming weather today will be very good as it should be in Delta and southeastern states - Moisture

in will also occur in the Delta and southeastern states Thursday and Friday

- A

couple of follow up storms in the northern U.S. Plains and northern Midwest this weekend into next week will produce additional snow and rain - Snowfall

of a dusting to 3 inches will occur from northwest to southeast across North Dakota and in northeastern South Dakota, southern Minnesota and areas east into southern Michigan - Traces

of snow are expected immediately to the south into northern Illinois, northern Indiana and northern Ohio - Most

of the rain from these systems will stay north of the Delta and southeastern states and may not impact the lower Midwest either

- No

significant precipitation is expected in western U.S. hard red winter wheat production areas southward into West Texas during the next ten days - Rain

is expected in some eastern wheat areas today - Moisture

shortages in wheat areas from Colorado to the Texas Panhandle will maintain concern over unirrigated winter crop conditions - West

Texas harvest weather should be mostly good over the next week to ten days - U.S.

Pacific Northwest weather will remain active this week and into early next week before drier biased conditions evolve later next week - Northern

California stormy weather pattern has ended for a while with a period of more limited precipitation to follow for up to ten days - Most

U.S. crop areas were dry Tuesday, although rain continued from the northwestern and far northeastern corners of the nation - Limited

precipitation is still expected in the northwestern U.S. Plains and central parts of Canada’s Prairies through the next ten days, but these areas will start seeing some periodic shots of snowfall - U.S.

temperatures this week will be near to below normal with the coolest bias expected from the northern Plains into the heart of the Midwest this weekend through early next week

- Today

will still be a warm biased day with the same will be true Wednesday in the eastern U.S.

- China’s

big northeastern snowstorm that occurred this week is ending and much improved weather is expected over the next week to ten days, although not necessarily perfectly dry - Much

of eastern China’s wheat and rapeseed areas will be dry - Harvest

progress in late summer crop areas should advance well - Winter

crops are suspected of establishing well - Recent

freezes in China’s wheat region had a low impact on crops, although warming is needed to allow late planted crops a little more time to establish prior to dormancy - Warming

is expected gradually over the coming week - Ukraine

and areas northeast into the middle Volga River Basin will likely see very little precipitation of significance for a while - Some

of this region has restricted soil moisture, but winter crops are either dormant or semi-dormant limiting the need for moisture until spring - Snow

cover will be needed during times of bitter cold to protect crops from any potential for winterkill - Snow

cover in Russia is widespread in the New Lands except near the Kazakhstan border - Western

Russia is mostly snow free except near the Baltic States and east of Belarus where there is a little pocket of snow now on the ground - Snow

cover is expected to expand across much of western Russia during the coming week with the greatest depths in the north - Temperatures

will be near to above normal - Europe

weather is expected to remain relatively tranquil during the next ten days to two weeks with the exception of Italy and the Adriatic Sea region where rain will fall moderately this weekend and into next week - No

snow is on the ground in Europe except the higher elevated areas and none was expected anytime soon - Temperatures

will be near to above normal - Coastal

areas of central and eastern Algeria will receive rain over the coming week while most interior crop areas in northern Africa will be dry - Morocco

has the greatest need for rain followed by northwestern Algeria - Southwestern

Morocco has been in a multi-year drought - Southwestern

Morocco does have some potential to receive two bouts of rain briefly in the Nov. 18-25 period - Western

portions of South Africa need rain to support unirrigated summer crop planting - This

first week of the forecast does not provide much moisture to these drier areas - Showers

may evolve in the following week - Eastern

South Africa soil moisture is a little better than in western areas and some showers and thunderstorms are expected to occur over the next two weeks to slowly improve planting and emergence conditions - Central

Vietnam coastal areas will be impacted by copious amounts of rain later this week into next Tuesday - Rainfall

of 5.00 to 15.00 inches is expected with local totals possibly getting near 20.00 inches - Flooding

will result and property damage is possible once again - This

region experienced frequent floods in October - The

area does not produce many crops - Vietnam’s

Central Highlands should be west of the excessive rain event and mostly unaffected - West-central

Africa will experience a good mix of weather during the next ten days to two weeks - Less

frequent rain in cotton areas will translate into better crop maturation conditions - Coffee,

cocoa, sugarcane and rice will also benefit from less frequent and less significant rainfall, although completely dry weather is not likely for a while - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Indonesia

and Malaysia weather will be wet biased over the next two weeks with frequent rain expected over saturated or nearly saturated soil causing some flooding - Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Mexico’s

weather will drier biased for the next ten days except along the lower east and southwestern coasts where periodic rainfall is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Costa Rica and Panama - Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days - Coffee,

sugarcane, corn and a host of other crops may have been impacted by too much rain earlier this season resulting in some harvest delay - Conditions

should be improving over the next ten days - Today’s

Southern Oscillational Index was +8.16 and it was expected to drift higher over the coming week - New

Zealand rainfall is expected to be near to above average except along the lower east coast of South Island where precipitation may be a little lighter than usual

- Temperatures

will be seasonable.

Wednesday,

Nov. 10:

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

customs department publishes October commodity trade data - Malaysian

Palm Oil Board’s data on October output, exports, and stockpiles, 12:30pm Kuala Lumpur - Malaysia’s

Nov. 1-10 palm oil export numbers by cargo surveyors - FranceAgriMer

monthly grains report

Thursday,

Nov. 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab releases data on yield, area and output of corn and soybeans (tentative) - New

Zealand Food Prices - HOLIDAY:

France

Friday,

Nov. 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

77

Counterparties Take $1.449 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.377 Tln, 76 Bidders)

US

CPI (M/M) SA Oct: 0.9% (est 0.6%; prev 0.4%)

–

CPI (Y/Y) NSA Oct: 6.2% (est 5.9%; prev 5.4%)

–

Core CPI (M/M) SA Oct: 0.6% (0.4%; prev 0.2%)

–

Core CPI (Y/Y) NSA Oct: 4.6% (4.3%; prev 4.0%)

US

Initial Jobless Claims 6 Nov: 267K (est 260k; prev 269k; prevR 271k)

–

Continuing Jobless Claims 30 Oct: 2.160M (est 2.050M; prev 2.105M; prevR 2.101M)

US

DoE Crude Oil Inventories (W/W) 05-Nov: +1002K (est +1600K; prev +3290K)

–

Distillate Inventories: -2613K (est -1000K; prev +2160K)

–

Cushing OK Crude Inventories: -34K (prev -916K)

–

Gasoline Inventories: -1555K (est -1250K; prev -1488K)

–

Refinery Utilization: 0.4% (est 0.75%; prev 1.2%)

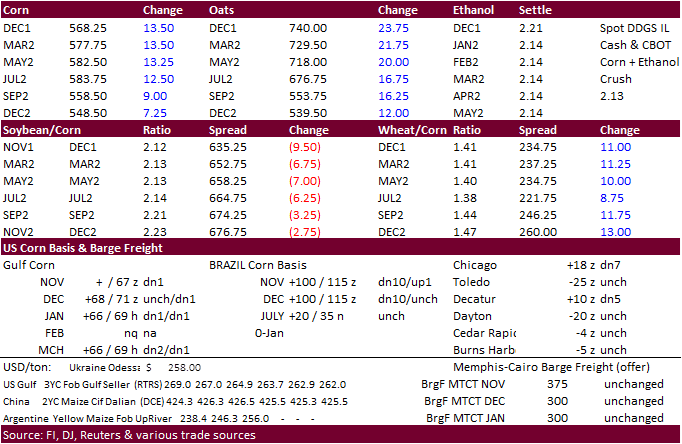

Corn

·

Corn futures surged 7.75-14.50 cents on sharply higher wheat futures and technical buying despite US ethanol production dropping by a larger amount for the week ending November 5, and a sharply higher USD (up 87 points @ 2 pm

CT). Recall USDA upward revised for US corn ethanol use on Wednesday by 50 million bushels, nearly

offsetting an upward revision in production. The rally today was mainly driven by the rally in wheat following Russia’s comments that that may curb grain exports and adjust the wheat export tax formula. We heard China bought Ukraine corn. Black Sea corn

prices are down this week and freight rates are trending lower. China typically does not commit to large amounts of corn around this time of year as producers are busy harvesting and the government is active is replenishing reserves.

-

French

growers group Arvalis expects France to realize a record corn yield of 11 tons per hectare from favorable weather.

-

Germany

reported another bird flu (H5N1) case, this one in north Germany, affecting about 39,000 ducks.

-

The

weekly USDA Broiler Report showed eggs set in the US up 7 percent and chicks placed down 1 percent. Cumulative placements from the week ending January 9, 2021, through November 6, 2021 for the United States were 8.16 billion. Cumulative placements were up

slightly from the same period a year earlier.

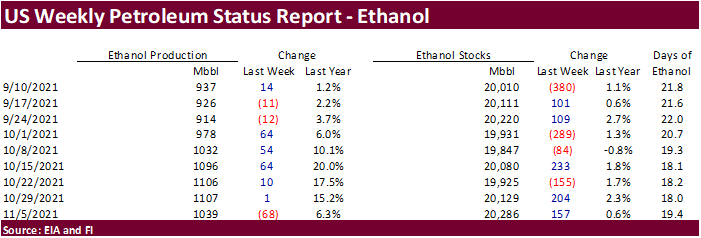

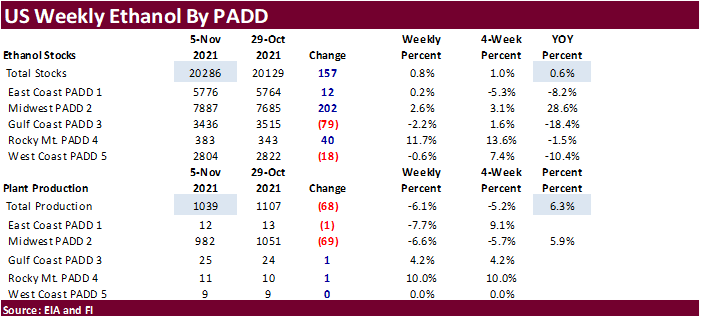

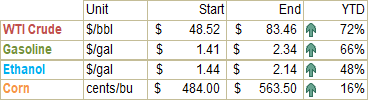

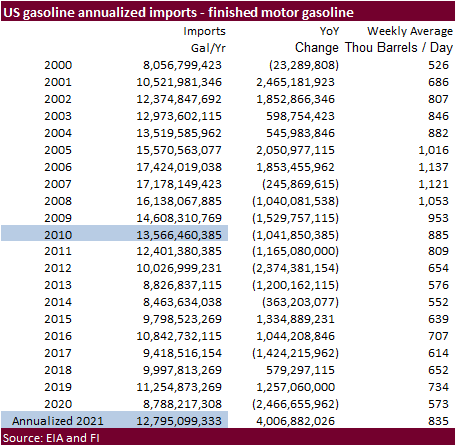

US

weekly ethanol dropped by 68,000 barrels per day to 1.039 million, lowest in a month, and steepest drop since 2/19/21. This was unexpected as the trade looked for a 10,000-barrel decrease. Midwest PADD2 production fell 69,000 barrels. We did hear there

was some power issued for at least one plant located in Illinois, but for US production to be down 68,000 for week ending 11/5 is unusual. Ethanol stocks increased 157,000 barrels to 20.286 million and stocks are now highest since early September. Early September

to date ethanol production is running 8.1% from the same period year ago. US gasoline stocks fell by 1.555 million barrels and are down for the fifth consecutive week, to 212.7 million barrels, lowest level since November 2017. US gasoline demand fell from

the previous week by 245,000 barrels to 9.259 million, and looking back at the previous 4 weeks, gasoline demand is running only 0.6% below the comparable period two years ago.

Year

to date

Export

developments.

-

South

Korea’s MFG bought 137,000 tons of SAS and/or South African. The corn was bought in two consignments, the first of 69,000 tons at $317.00 a ton c&f. Another 68,000 tons was bought at $317.15 a ton.

-

Turkey

seeks 325,000 tons of corn on November 15 for shipment sought between Dec. 20 and Jan. 20.

Updated

11/01/21

December

corn is seen in a $5.30-$5.80 range

March

corn is seen in a $5.25-$6.00 range

·

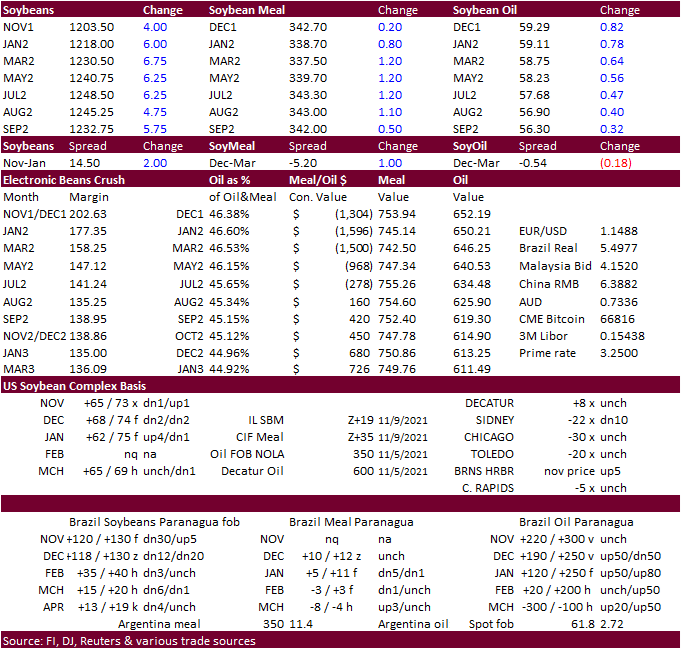

CBOT soybeans

traded higher but gains were capped by a surged in the US dollar, which was up 87 points by around 2 pm CT. Soybean meal was under a touch of pressure by afternoon trading and settled moderately lower in the font month and higher in the back months. Soybean

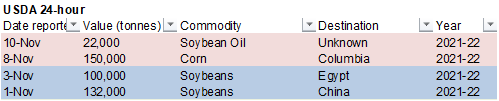

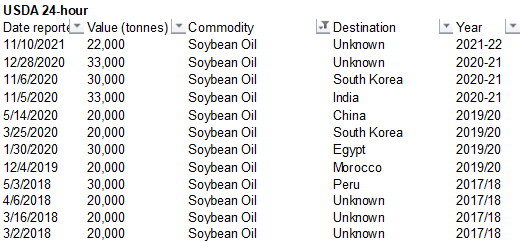

oil rallied 40-67 points on higher palm futures and USDA announcing 22,000 tons of soybean oil was sold to unknown destinations. Some think it was for South Korea. One source mentioned Central America while another India.

·

We heard China bought a few US PNW soybean cargoes and few boats out of Brazil, both for December.

·

Decatur, IL soybean meal basis was up $8.00 at 30 over the December.

·

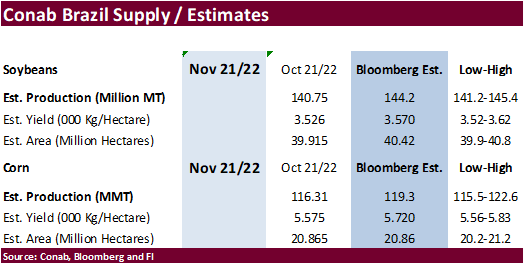

Conab is due out Thursday morning with updated 2021-22 Brazil soybean and corn production estimates and traders are looking for a large 3.4 million ton increase in soybeans and 3 million tons for corn, to 144.15 and 119.29, respectively,

according to Bloomberg estimates.

·

Brazilian stock exchange B3 SA plans to launch a local soybean futures contract in partnership with the CME Group, tied to the Santos port export price that will be cash settled. It will start trading November 29.

·

Cargo surveyor AmSpec reported Malaysian palm oil exports for the November 1-10 period at 543,944 tons, an 8.7% increase from the same period month earlier.

·

ITS reported an 8 percent increase to 571,450 tons.

·

Malaysian palm was up 128 ringgit, rebounding from a 5-week low, and cash palm increased $25/ton to $1257.50/ton. Yesterday the futures market was down 103.

·

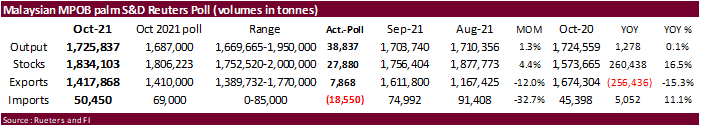

MPOB released Malaysian palm data and October stocks, production, exports, and imports were near expectations. Stocks at the end of October increased 4.4% to 1.834 million tons, but well below normal for this time of year. Malaysian

palm production was 1.726 million tons, a 13-month high. Exports were 1.418 million tons, down 12% from September and 15% from year ago. Imports fell 32.7% to 50,540 tons from the previous month.

Export

Developments

- Under

the 24-hour reporting system, private exporters sold 22,000 tons of soybean oil to unknown. Last time we saw a USDA soybean oil announcement was on 12/28/2020.

- Egypt

cancelled their vegetable oil import tender. They received offers for vegetable oils for arrival Jan. 5-Jan. 25. Lowest offer for 11,500 tons of sunflower oil was $1,440.00 per ton c&f. The lowest offer for 30,000 tons of soyoil was $1,444.00 per tons c&f.

- South

Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

Updated

11/8/21

Soybeans

– January $11.60-$12.50 range, March $11.50-$13.50

Soybean

meal – December $320-$340, March $310-$360

Soybean

oil – December 57-60 cent range, March 56-65

·

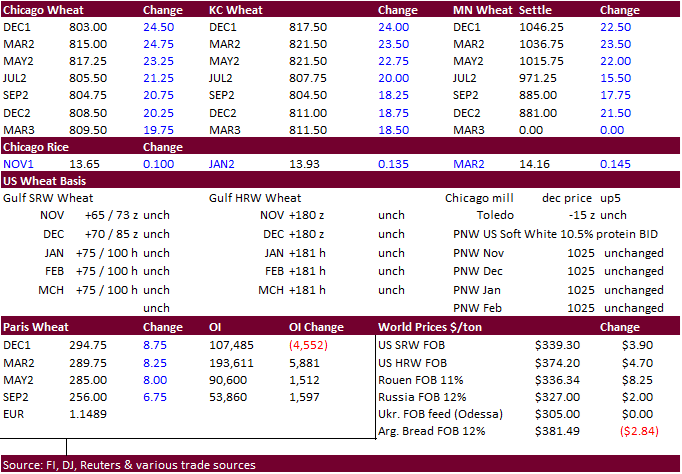

US wheat futures surged 15.50-24.00 cents on concerns Russia will further claw back on exports after they mentioned they plant to reevaluate the export formula. Tight global supplies for high protein wheat have sent wheat futures

to multi-year highs recently. EU wheat basis the March contract hit a 13-year high (based on rolling second month contract). December Paris wheat is near its contract high. The USD rocketed higher by 82 points by early afternoon trading. The cost of US

wheat was up about 4 percent today if you were a foreign buyer.

·

Russia is looking to adjust its way to calculate its grain export tax in case of significant price increases. The formula for wheat export tax may change is the price reaches $400/ton, about $75/ton greater than where fob was

quoted late last week. The wheat tax is set at $69.9 per a ton of wheat for Nov. 10-16. They are also looking into setting grain export quotas, including wheat, by mid-February, around the time inventories tend to get tight. They also plan to roll out tax-free

quotas for beef and pork imports. Russian domestic inflation is near a 5-year high. The quota for beef will be 200,000 tons for 2022, and for pork at 100,000 tons for the first six months of 2022.

·

FranceAgriMer lowered its 2021-22 forecast of French soft wheat exports for outside the European Union to 9.4 million tons from 9.6 million estimated in October. Soft wheat sales within the EU 27 was estimated at 7.8 million

tons from 8.0 million seen last month.

·

Paris December wheat was up 8.25 euros at 289.75/ton.

·

The US weather forecast calls for a follow up snowstorm to fall across the northern Plains and upper Midwest this weekend. Snowfall of 2 to 6 inches will occur from northwest to southeast across North Dakota and 2 to 5 inches

in northeastern South Dakota, southern Minnesota, and areas east into southern Michigan, according to World Weather Inc.

·

Australia will see active weather for a few more days. Drier weather is seen this weekend into early next week which will be good for the wheat crop.

·

Ukraine is still in need of more precipitation.

Export

Developments.

·

Tunisia bought 100,000 tons of soft wheat and 50,000 tons of barley. The wheat was bought at $380.89, $385.60, $380.30 and $381.30 a ton c&f. The barley was bought at $356.49 and $358.49 a ton c&f. The wheat was sought for

shipment between Dec. 1, 2021 and Jan. 15, 2022. The barley was sought for shipment between Dec. 15, 2021 and Jan. 20, 2022.

·

Jordan saw offers from 3 participants for their import tender for 120,000 tons of barley for shipment combinations of March 1-15, March 16-31, April 1-15 and April 16-30.

·

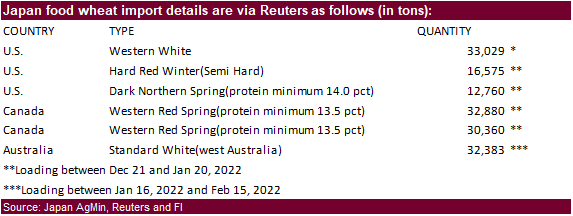

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

·

Japan seeks 157,987 tons of food wheat this week from the US, Canada, and Australia.

·

Results awaited: The UN is in for 110,000 tons of milling wheat for Ethiopia. 40,000 tons was for delivery between Dec. 20, 2021, and Jan. 5 2022, another 20,000 tons for delivery between Jan. 5–20, 2022, and 50,000 tons also

for delivery between Jan. 5–20, 2022.

·

Results awaited: Separate import tender. Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

·

None reported

Updated

11/01/21

December

Chicago wheat is seen in a $7.50‐$8.25 range,

March $7.25-$8.40

December

KC wheat is seen in a $7.50‐$8.35,

March $7.00-$8.50

December

MN wheat is seen in a $10.00‐$11.25,

March $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.