PDF Attached

Under the 24-hour announcement system, USDA reported private exporters reported sales of 209,931 tons of corn for delivery to Mexico during the 2022-23 marketing year.

US CPI inflation data was better than expected and this crushed the USD and sent US stocks higher. Easing inflation could be an indicator the Feds pivot sometime in 2023 by eventually

lowering interest rates but assume another hike this December. The agriculture markets saw weaker trade despite the “risk on” moves following the better-than-expected CPI data.

|

|

Corn |

Bean |

Chi. Wheat |

Meal |

Oil |

|

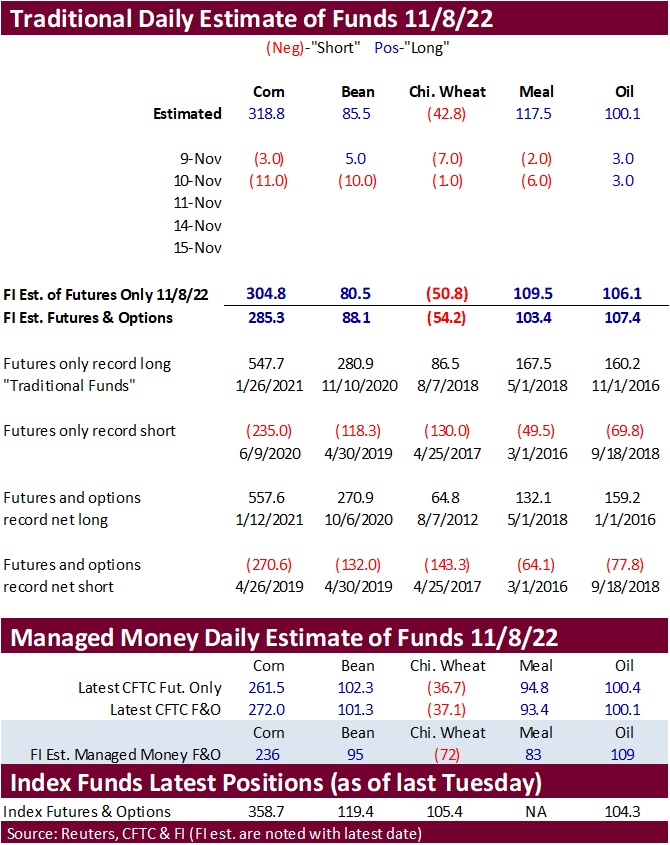

FI Est. Managed Money F&O |

236 |

95 |

(72) |

83 |

109 |

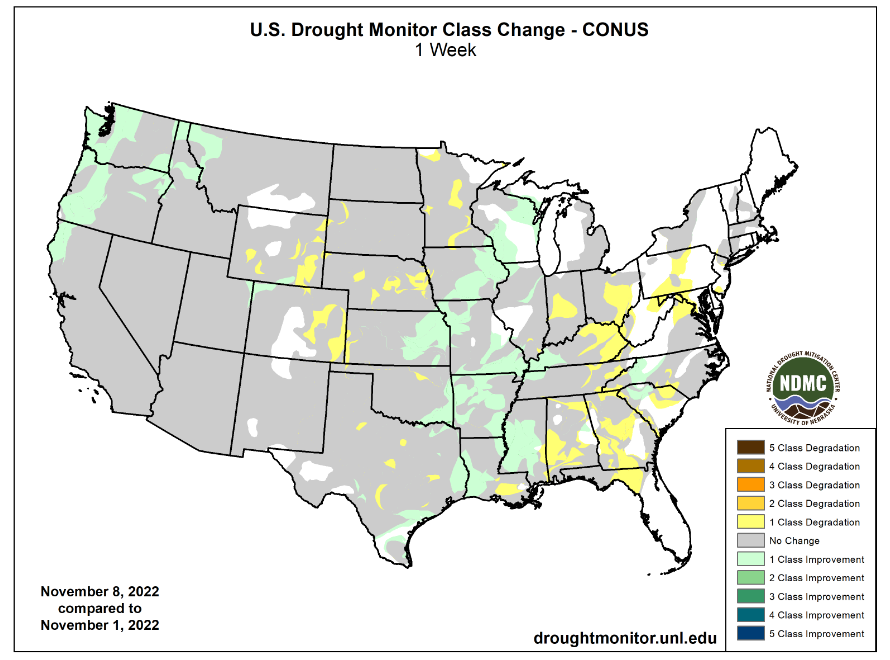

Weather

The US CPC sees a 76 percent chance of La Nina during the Northern Hemisphere winter (Dec-Feb).

Western NE will see a wintery mix today. Rain will fall across eastern KS, eastern OK today. Eastern TX will see precipitation Friday. KS, OK, and TX has an opportunity for light rain Monday. Other parts of the Great Plains will see net drying. The Midwest

will see showers across the northwestern areas through today and eastern areas Friday. Rain fell across Brazil yesterday, favoring Goias and southern Minas Gerais. Many areas of Brazil will see rain through early next week. Argentina should see rain return

to western Santa Fe, Cordoba, La Pampa, and western Buenos Aires through Sunday.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Argentina

reported light rainfall today and it was the beginning of a wetter pattern that will prevail through early next week -

Most

of the rainfall so far today was not much more than 0.20 inch, but the event was just beginning -

Waves

of rain will occur through the next five days resulting in relief to the nation’s drought pattern

-

Much

more rain will be needed, but any precipitation will be welcome -

Rainfall

of 0.30 to 1.25 inches is expected in the southeastern part of the nation while amounts elsewhere will vary from 0.50 to 2.00 inches with local totals of 2.00 to 3.00 inches

-

Argentina

will be drier from mid-week next week into the following Friday with a brief bout of rain possible in parts of the nation Nov. 18-19 -

Resulting

rainfall will be quite light once again -

All

of Brazil will get rain at one time or another this weekend through the middle part of next week -

Showers

today and Friday will be more sporadic and light -

Total

rainfall by this time next week will vary from 2.00 to 4.00 inches from Minas Gerais, Rio de Janeiro and Espirito Santo to Tocantins, 1.00 to 3.00 inches from Paraguay into western Parana and a part of western Mato Grosso do Sul, and 0.50 to 2.00 inches in

most other areas -

Relief

is expected to dryness in Mato Grosso and Goias, but there will be need for much more rain in a few areas -

Rio

Grande do Sul rainfall will also be brief and light, although all crop areas in the state will get rain Sunday into Tuesday -

Another

bout of drying is expected in center west and southern Brazil during the second half of next week and into the following weekend -

Follow

up rain will be necessary and the relief will only be temporary -

Monsoonal

moisture in the Amazon River Basin continues to be poorly accumulated suggesting erratic monsoonal rainfall will continue in brazil for a while longer -

Cold

surge into the central United States will occur over the next few days with temperatures falling well below normal

-

Extreme

lows in the positive and negative single digits will occur in the northern Plains -

Freezes

will reach southward in the southwestern Plains and New Mexico early next week and then will shift to the northern Delta during mid- to late-week next week

-

Some

of the cold will reach across parts of the Midwest by early next week -

U.S.

temperatures Nov. 14-19 will be colder than usual in most areas with well below normal readings in the Plains

-

The

cold will abate to the north during the Nov. 20-24 period returning warmer biased conditions to the middle of North America in the last week of this month -

Northern

Plains and upper Midwest snow and rain event today into Friday will produce 0.40 to 1.50 inches of moisture with 6-12 inches of snow and local totals to 15 inches or more occurring from North Dakota through northern Minnesota to southeastern Manitoba and southern

Ontario -

Livestock

stress is likely -

Travel

delays are likely, although North Dakota and northern Minnesota into southeastern Manitoba will be most impacted -

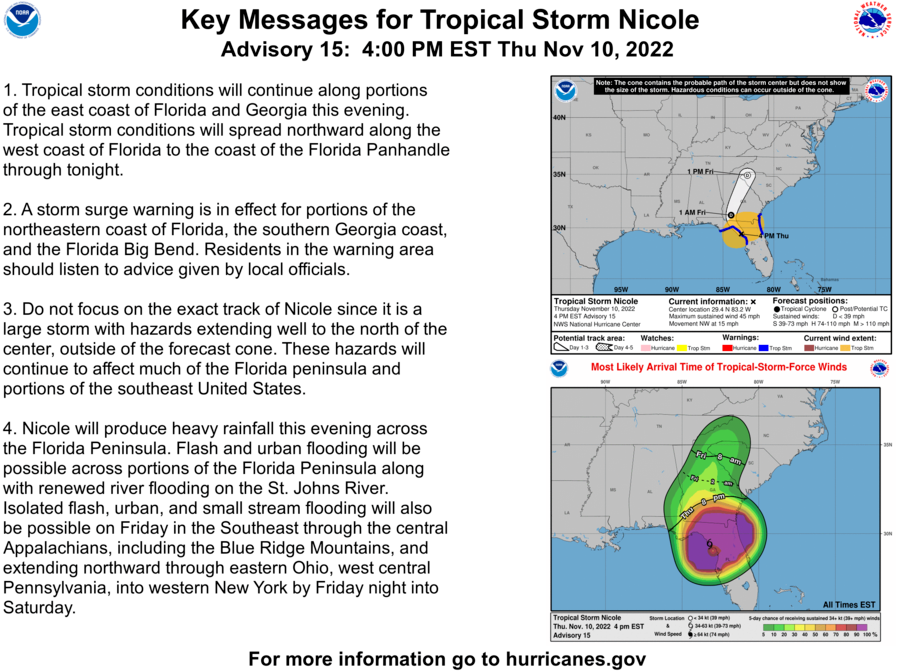

Hurricane

Nicole reached the central east coast of Florida overnight -

Landfall

was near Fort Pierce -

Wind

speeds were reaching 75 mph near the center of the storm at the time of landfall

-

Wind

gusts of 50 to 73 mph were reported in east-central Florida overnight and early today possibly bringing some citrus fruit to the ground -

Rainfall

varied from 2.00 to 5.75 inches in east-central Florida and 1.00 to 2.69 inches in southern parts of the state -

West-central

and far southern Florida was least impacted by the storm -

No

damage to sugarcane was suspected -

Citrus

fruit droppage should be low -

Nicole

was located east northeast of Tampa and west southwest of Orlando at 0700 EST today moving west northwesterly and was downgraded to tropical storm status -

Tropical

Storm Nicole will move north northwesterly into southern Georgia this afternoon and tonight and then north northeasterly to the western Carolinas Friday

-

Rainfall

of 1.00 to 3.00 inches and wind speeds mostly under 45 mph are expected -

No

new crop damage is expected and property damage will below -

No

flooding is expected -

A

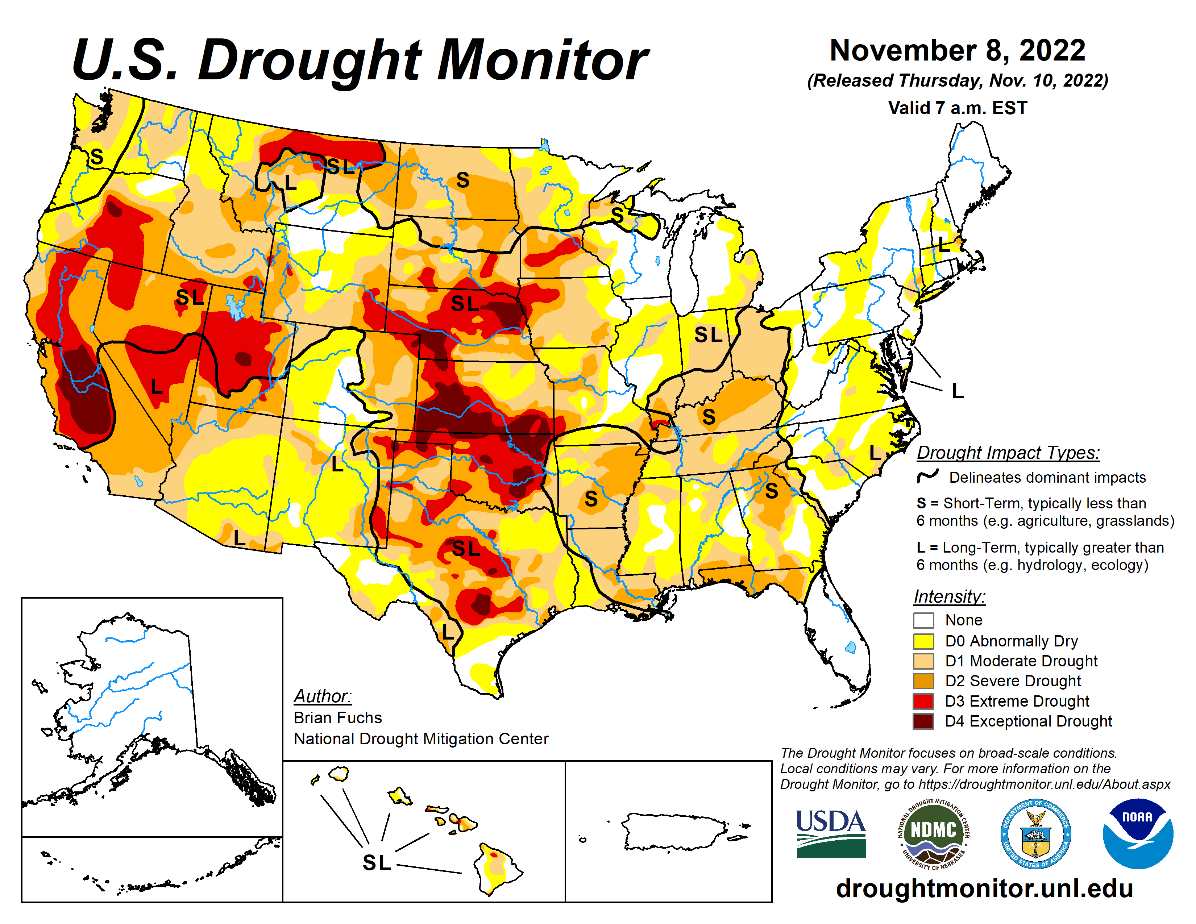

weak southern U.S. Plains storm system is expected late Sunday and Monday producing rain and a little wet snow from the Texas Panhandle and a part of West Texas cotton country east into much of Oklahoma and the remainder of Texas -

Moisture

totals of 0.20 to 0.75 inch will occur in West Texas and the Texas Panhandle while 0.30 to 1.00 inch and a few amounts to 1.50 inches occur elsewhere -

The

precipitation will offer some welcome relief to dryness in hard red winter wheat areas, although much more rain will be needed -

U.S.

Delta crop areas will get a few showers Friday and greater rain Monday into Tuesday and some of that rain will fall in the southeastern states as well

-

Delays

to harvesting will occur, but Nicole’s rain and that which comes from the mid-latitude frontal system next week will bolster soil moisture for winter crop use -

California,

the U.S. Great Basin and northwestern states all received precipitation earlier this week to east dryness, but no additional precipitation is expected for a while -

Drought

remains and so does a huge need for greater moisture -

U.S.

central Plains and central Midwest precipitation should be limited over the next ten days to two weeks -

U.S.

navigable river water levels will drift lower in the coming week, although parts of the lower Delta will get enough moisture for a short term boost in water levels briefly next week

-

Ontario

and Quebec, Canada weather will be mostly good for advancing corn and soybean harvesting and winter crop planting during this workweek -

Precipitation

days will be limited and moisture totals should be light -

A

boost in precipitation is likely Friday and Saturday as remnants of Tropical Storm Nicole pass near the region -

Showers

of snow and a little rain will occur infrequently thereafter through Nov. 23 -

Europe

and western CIS temperatures will be warmer than usual over the next ten days, although portions of Russia will turn colder next week -

Southern

Russia, Ukraine and Russia’s Eastern New Lands will be colder than usual Nov. 15-20, though the temperature anomalies will be greatest in the eastern New Lands and not very significant in Ukraine -

Restricted

precipitation is expected across eastern Europe and western Asia during the next week to ten days -

Totally

dry weather is unlikely, but the precipitation that falls should be light -

Western

areas will be wetter than the east -

Snow

cover will remain restricted in western Asia through much of the forecast period, although a little snow will accumulate in the New Lands over time next week when temperatures are colder -

China

temperatures will be warmer than usual over the next ten days -

China

precipitation late this week and into the weekend will be greatest in the Yellow River Basin and north China Plain

-

This

event will produce 0.20 to 0.80 inch of moisture with a few 1.00 to 2.00-inch amounts in a part of winter wheat country

-

Winter

crops will become better established because of this precipitation -

Some

of this rain will reach the northern Yangtze River Basin this weekend and more likely early next week with moisture totals of 0.10 to 0.75 inch

-

Some

moisture “may” also reach the heart of rapeseed country in the Yangtze River Basin next week and into the following weekend -

China’s

southern coastal provinces received welcome rain in the past week and more will occur late next week and into the following weekend -

Waves

of rain are still expected in far southern India over the next five days week keeping the ground abundantly to excessively wet -

Rainfall

will vary from 2.00 to 6.00 inches and local totals over 7.00 inches -

Wettest

along the lower east coast and in Kerala -

Indonesia,

Malaysia, Philippines, southern Vietnam, southern Cambodia and southern Thailand will be wet over the next ten days to two weeks

-

Some

areas of local flooding are likely periodically -

Rain

will resume in eastern Australia this weekend, but it should not be excessively great -

Fieldwork

will be disrupted and rain amounts should vary from 0.65 to 2.00 inches -

No

new flooding is expected -

A

few showers will already impact the region later today and Friday -

A

return of restricted precipitation is expected later next week -

Western

Australia will be colder than usual the remainder of this week and into the weekend before the cool air spreads east during the late weekend and next week

-

Temperatures

this week will be near normal in the far east and a little warmer than usual in south-central parts of the nation -

Western

Australia winter crops are still well on their way to yielding very well with high quality as well.

-

Rain

will be minimal until the second half of next week when some increase is likely in parts of the region -

South

Africa has received rain frequently in recent days and more will fall periodically over the next two weeks -

Summer

crop planting will advance around the moisture -

Some

delay to farming activity will occur periodically, but progress will be made slowly -

Good

harvest weather is expected for wheat and canola in the western part of the nation where rainfall is expected to be very limited over the next two weeks -

Temperatures

will be seasonable -

Mexico’s

seasonal rains have largely diminished for the season and good crop maturation and harvest weather is expected into next week -

Some

rain will fall lightly in the southeast periodically in the coming week to ten days

-

Central

America precipitation is expected to continue periodically during the next ten days, but no large region of excessive rain is expected this week -

Panama,

Costa Rica and portions of southern and eastern Nicaragua will be wettest -

Some

increase in rainfall may occur next week -

West-central

Africa rainfall will occur periodically enough to support southern coffee, cocoa, sugarcane, rice and other crops during the next couple of weeks -

The

precipitation will be greatest near the coast -

East-central

Africa rainfall will be sufficient to support coffee and cocoa as well as a few other crops -

Rain

will fall in portions of Ethiopia, Tanzania and Uganda -

Today’s

Southern Oscillation Index was +11.29 and it will move erratically over the next few days

Source:

World Weather INC

Thursday,

Nov. 10:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s data on stockpiles, production and exports - Malaysia’s

Nov. 1-10 palm oil export data - Cane

crush and sugar production data by Brazil’s Unica

Friday,

Nov. 11:

- ICE

Futures Europe weekly commitments of traders report - DELAYED:

CFTC commitments of traders weekly report on positions for various US futures and options, usually released Fridays, will be published Monday, Nov. 14 - New

Zealand Food Prices - HOLIDAY:

US, France, Canada

Saturday,

Nov. 12:

- Atlantic

Council Global Food Security Forum, Bali, day 1

Sunday,

Nov 13:

- Atlantic

Council Global Food Security Forum, Bali, day 2

Source:

Bloomberg and FI

USDA

export sales

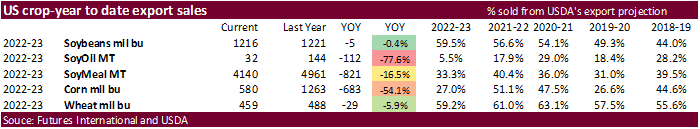

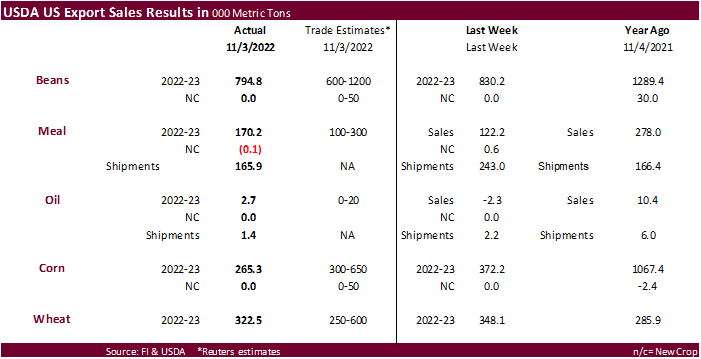

Soybean

export sales slowed from the previous week to 794,800 tons for 2022-23. Sales were primarily for China (927,100 MT, including 594,000 MT switched from unknown destinations and decreases of 13,000 MT). Meal and soybean oil sales were within expectations but

slow for this time of year. Corn export sales were below expectations at only 265,300 tons and crop year to date commitments are running 54 percent below this time last year. All wheat sales of 322,500 tons were within expectations.

Macros

US CPI (M/M) Oct: 0.4% (est 0.6%; prev 0.4%)

US CPI Core (M/M) Oct: 0.3% (est 0.5%; prev 0.6%)

US CPI (Y/Y) Oct: 7.7% (est 7.9%; prev 8.2%)

US CPI Core (Y/Y) Oct: 6.3% (est 6.5%; prev 6.6%)

US CPI Index NSA Oct: 298.012 (est 298.488; prev 296.808)

US CPI Core Index SA Oct: 299.471 (est 300.094; prev 298.660)

US Initial Jobless Claims Nov 5: 225K (est 220K; prevR 218K)

US Continuing Claims Oct 29: 1493K (est 1487K; prevR 1487K)

US Real Avg Hourly Earnings (Y/Y) Oct: -2.8% (prev -3.0%)

US Real Avg Weekly Earnings (Y/Y) Oct: -3.7% (prev -3.8%)

US Freddie Mac 30-Year Fixed Rate Mortgages Nov 10 Wk: 7.08% (prev 6.95%)

·

US CPI inflation data was better than expected which prompted a “risk-on” move which grains did not participate in. Corn ended lower in part to very poor USDA export sales. The USD selloff likely limited losses in corn.

·

Export sales were poor for corn, slow but within a trade range for soybeans and wheat.

·

Traders are waiting to see if positive news comes out of the meeting between the UN and Russia on Friday over the Black Sea grain deal. Russia was said to be planning a withdrawal from Kherson.

·

The US EPA sent their RFS 2023 and beyond, biofuel proposal to the Office of Management and Budget. November 30 is the decision deadline.

U

of I: Outlook for Nitrogen Prices in Spring 2023

Schnitkey,

G., C. Zulauf, N. Paulson and J. Baltz. “Outlook for Nitrogen Prices in Spring 2023.” farmdoc daily (12):168, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 9, 2022.

·

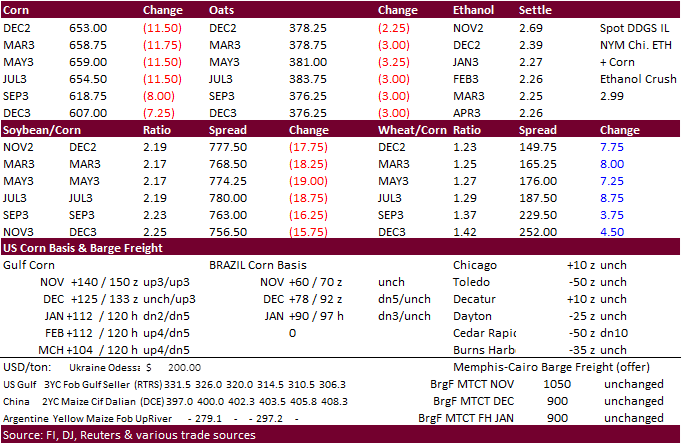

South Korea’s MFG bought 134,000 tons of corn at $333.33/ton c&f and 175 cents c&f over the March contract, for arrival around Feb. 25.

·

South Korea’s FLC bought 60,000 tons of corn at $328.99/ton c&f for shipment between Nov. 25 and Dec. 25.

Updated 11/10/22

December

corn is seen in a $6.40-$6.75 range. March $6.50-$7.50 range.

·

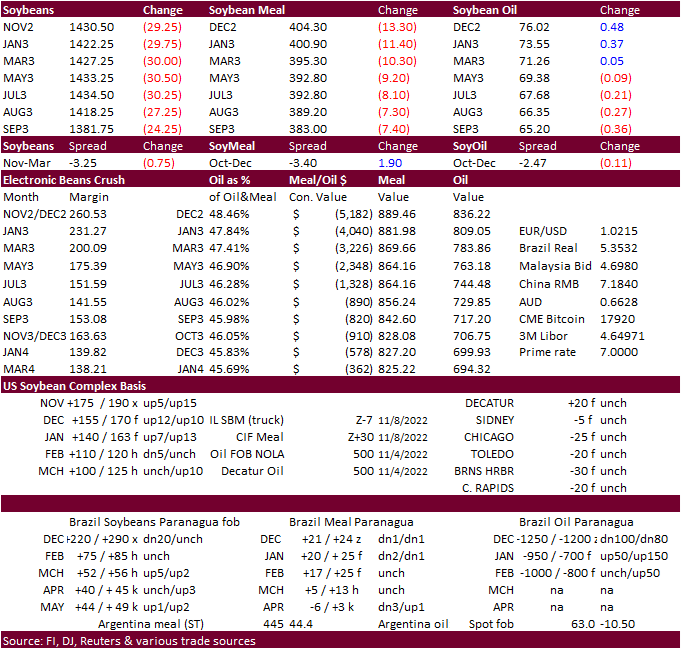

CBOT soybeans and soybean meal closed sharply lower. Soybean oil was higher on spreading. US domestic demand for soybean oil remains robust and SA premiums remain firm. South America’s weather pattern improves through early next

week with Argentina and most of Brazil getting rain.

·

Earlier we were hearing Brazil biofuel producers were bidding on soybean oil for January and/or February positions. This could reflect a potential increase in Brazil biodiesel mandate increase set to kick in at the early next

year.

·

Soybean meal was under pressure from soybean oil/meal spreading and a potential boost in Argentina’s January/February crush.

·

Rumors of Argentina rolling out another “soybean dollar” late next month slowed local producer sales yesterday ahead of what we could see as another surge in producer selling sometime by the end of the year. We think soybean meal

and soybean oil premiums could get hit when an official announcement is made. Rumors are circulating over the dollar amount which ranges from 215 to 250, up from 200 last round.

·

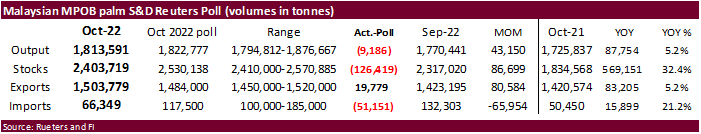

Malaysia MPOB October palm oil stocks rose to 2.404 million tons, highest since April 2020, but 126,400 tons below a Reuters trade guess. Palm oil production was 1.814 million tons, up for the 4th consecutive month

and slightly below a Reuters trade guess. Imports fell below expectations and were down sharply from the previous month. Exports were 1.504 million tons, slightly above a trade guess, 81,000 above the previous month and 5 percent above year ago.

·

Cargo surveyor SGS reported month to date November 10 Malaysian palm exports at 408,867 tons, 47,265 tons above the same period a month ago or up 13.1%, and 154,226 tons below the same period a year ago or down 27.4%. ITS reported

466,943 tons, a 33 percent increase. Cargo surveyor AmSpec reported Malaysian November 1-10 palm exports at 420,477 tons, compared to 373,030 tons month earlier or up 12.7%.

·

Egypt’s GASC bought 6,000 tons of sunflower oil at $1,474/ton for arrival between Dec. 20 & Jan. 5, and 180-day letters of credit. Earlier the lowest offer for sunflower oil was $1,490 per ton c&f for 6,000 tons and for soybean

oil $1,641 per ton c&f for 10,000, 14,000 and 24,000 tons, respectively.

·

China plans to auction off 500,000 tons of soybeans from reserves on November 11.

Updated 11/8/22

Soybeans

– January $13.50-$15.00

Soybean

meal – December $400-$435, January $400-$475

Soybean

oil – December 73-77, January wide 67.00-76.00 range

·

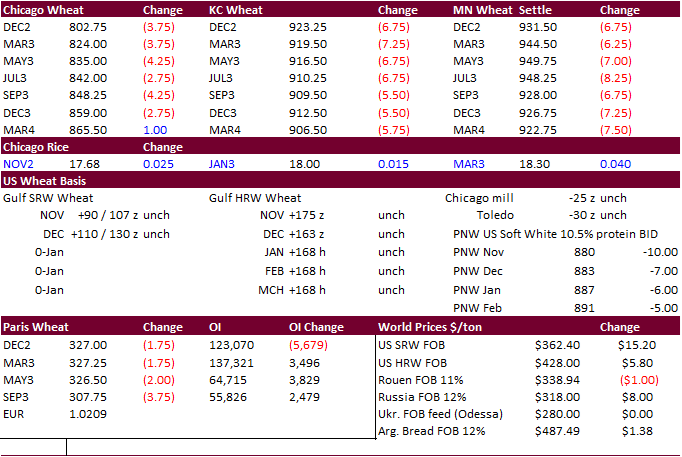

US wheat futures settled lower on liquidation. Although many longs are still in the market via upside calls, traders decided liquidate futures today as momentum is shifting to Ukraine in this 10-month conflict.

·

Wheat was underpinned on a downward revision to the Argentina wheat crop (Rosario @ 11.8 million tons from 13.7 million previous). Global grain import demand is picking up.

·

The Rosario Grain exchange put the Argentine wheat production at only 11.8MM tons vs USDA estimate of 15.5MM. We think USDA is now at least 3 million tons too high.

·

Paris December wheat closed down 1.50 euros earlier at 327.25 euros a ton.

·

Egypt’s GASC buys 280,000 tons of Russian wheat at $362.50/ton for December shipment.

·

Saudi Arabia seeks 595,000 tons of wheat on November 11 with results expected November 14 for arrival between April and June.

·

Tunisia seeks 100,000 tons of soft wheat, 100,000 tons of durum, and 75,000 tons of barley, all on November 11 for shipment between Dec. 5, 2022, and Jan. 25.

·

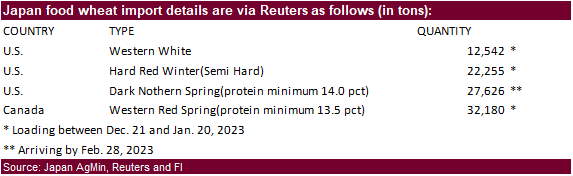

Japan was in for 94,603 tons of wheat this for arrival by February 28. Original tender details as follows:

·

Jordan issued an import tender for 120,000 tons of hard milling wheat set to close November 15 for March/April shipment.

·

Jordan is back in for 120,000 tons of barley for March/April shipment on November 16 for March/April shipment.

·

Japan in a SBS import tender seeks 70,000 tons of wheat and 40,000 tons of barley on November 16 for arrival by February 24.

Rice/Other

·

None reported

Updated 11/9/22

Chicago

– December $7.75-$8.75, March $8.00 to $10.00

KC – December

$9.00-$10.15, March 8.50-$10.50

MN – December

$9.00-$10.30, March $9.00 to $10.50

This

summary is based on reports from exporters for the period October 28-November 3, 2022.

Wheat:

Net sales of 322,500 metric tons (MT) for 2022/2023 primarily for unknown destinations (77,500 MT), South Korea (63,000 MT), Japan (60,600 MT), Thailand (55,800 MT), and Spain (20,000 MT – late), were offset by reductions for Colombia (500 MT) and Ecuador

(100 MT). Exports of 151,500 MT were primarily to the Philippines (65,000 MT), Japan (38,000 MT), Mexico (18,100 MT), Ecuador (10,000 MT), and Colombia (9,500 MT).

Late

Reporting:

For 2022/2023, net sales totaling 20,000 MT of hard red spring wheat were reported late for Spain.

Corn:

Net sales of 265,300 MT for 2022/2023 primarily for Mexico (157,500 MT, including decreases of 60,700 MT), Canada (48,800 MT, including decreases of 2,600 MT), Guatemala (29,500 MT), El Salvador (18,500 MT, including decreases of 14,000 MT), and unknown destinations

(11,100 MT), were offset by reductions for Honduras (24,200 MT) and Japan (1,500 MT). Exports of 259,400 MT were primarily to Mexico (214,500 MT), Canada (15,600 MT), Nicaragua (7,800 MT), El Salvador (7,000 MT), and Honduras (5,500 MT).

Export

Adjustments: Accumulated

exports of corn to Japan were adjusted down 3,000 for week ending October 6th. This shipment was reported in error.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Total net sales of 30,000 MT for 2022/2023 were for Sudan. Exports of 2,400 MT were to Mexico.

Rice:

Net

sales of 37,500 MT for 2022/2023 were primarily for Canada (17,700 MT), the United Kingdom (10,400 MT), Haiti (7,100 MT, including decreases of 100 MT), Guatemala (900 MT), and El Salvador (500 MT). Exports of 33,400 MT were primarily to Haiti (22,100 MT),

Mexico (3,700 MT), Canada (2,700 MT), South Korea (2,700 MT), and Jordan (700 MT).

Export

Adjustments: Accumulated

exports of long grain milled rice to the Dominican Republic were adjusted down 78,274 for week ending October 27th. This shipment was reported in error.

Soybeans:

Net sales of 794,800 MT for 2022/2023 primarily for China (927,100 MT, including 594,000 MT switched from unknown destinations and decreases of 13,000 MT), Japan (164,700 MT, including 102,000 MT switched

from unknown destinations and decreases of 600 MT), Mexico (124,600 MT, including decreases of 2,500 MT), the Netherlands (90,400 MT, including 84,500 MT switched from unknown destinations and decreases of 400 MT), and Turkey (80,700 MT, including 65,000 MT

switched from unknown destinations), were offset by reductions primarily for unknown destinations (767,000 MT). Exports of 2,752,300 MT were primarily to China (1,968,200 MT), Mexico (254,900 MT), Japan (107,400 MT), the Netherlands (90,400 MT), and Spain

(70,800 MT).

Optional

Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export

for Own Account:

For 2022/2023, the current exports for own account outstanding balance is 22,500 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 170,200 MT for 2022/2023 primarily for Morocco (54,000 MT), Japan (50,400 MT), Ecuador (27,300 MT, including 2,500 MT switched from Colombia and decreases of 300 MT), Canada (22,500 MT, including decreases of 200 MT), and Mexico (14,500 MT, including

decreases of 100 MT), were offset by reductions primarily for unknown destinations (60,000 MT). Total net sales reductions of 200 MT for 2023/2024 were for Canada. Exports of 165,900 MT were primarily to the Philippines (48,000 MT), Mexico (33,900 MT), Honduras

(19,700 MT), Canada (17,300 MT), and Nicaragua (14,200 MT).

Soybean

Oil:

Total net sales of 2,700 MT for 2022/2023 were for Canada. Exports of 1,400 MT were to Canada.

Cotton:

Net

sales of 145,800 RB for 2022/2023 primarily for China (57,300 RB), Pakistan (40,500 RB), Vietnam (23,400 RB, including 2,200 RB switched from Taiwan), Indonesia (8,100 RB), and Bangladesh (7,500 RB), were offset by reductions for Taiwan (1,100 RB). Net sales

of 11,400 RB for 2023/2024 were reported for Turkey (6,600 RB) and Pakistan (4,800 RB). Exports of 108,100 RB were primarily to China (36,800 RB), Bangladesh (16,200 RB), Mexico (15,300 RB), Pakistan (13,500 RB), and Turkey (8,700 RB). Net sales of Pima

totaling 600 RB were reported for Djibouti (400 RB), China (100 RB), and Indonesia (100 RB). Exports of 3,400 RB were to Peru (2,000 RB), Greece (900 RB), India (400 RB), and China (100 RB).

Optional

Origin Sales:

For 2022/2023, the current outstanding balance of 9,300 RB, all Malaysia.

Export

for Own Account:

For 2022/2023, the current exports for own account outstanding balance of 63,900 RB are for China (37,600 RB), Vietnam (23,900 RB), India (1,500 RB), Pakistan (500 RB), and Indonesia (400 RB).

Hides

and Skins:

Net sales of 506,900 pieces for 2022 primarily for China (315,700 whole cattle hides, including decreases of 13,000 pieces), Mexico (83,300 whole cattle hides, including decreases of 1,200 pieces), South Korea (48,500 whole cattle hides, including decreases

of 400 pieces), Brazil (36,000 whole cattle hides, including decreases of 300 pieces), and Turkey (10,700 whole cattle hides), were offset by reductions for Thailand (1,700 pieces), Vietnam (200 pieces), and Canada (100 pieces). Net sales of 89,700 pieces

for 2023 were reported for China (37,300 whole cattle hides), Thailand (28,000 whole cattle hides), Mexico (12,600 whole cattle hides), Indonesia (7,700 whole cattle hides), and Taiwan (4,100 whole cattle hides). In addition, net sales of 1,300 kip skins

resulting increases for Belgium (1,400 kip skins), were offset by reductions for Canada (100 kip skins). Exports of 491,100 whole cattle hides exports were primarily to China (298,600 pieces), Mexico (91,600 pieces), Thailand (42,300 pieces), South Korea

(32,100 pieces), and Brazil (7,000 pieces). In addition, exports of 1,300 kip skins were to Canada.

Net

sales of 254,700 wet blues for 2022 reported for Thailand (262,700 unsplit), China (6,400 unsplit), Vietnam (4,000 unsplit), Japan (3,200 grain splits), and Mexico (2,100 unsplit), were offset by reductions for Italy (23,600 unsplit) and Taiwan (100 unsplit).

Total net sales of 29,900 wet blues for 2023 were for Italy. Exports of 130,000 wet blues were primarily to China (43,000 unsplit), Italy (33,800 unsplit and 1,800 grain splits), Thailand (23,900 unsplit), Vietnam (19,200 unsplit), and South Korea (2,700

grain splits). Total net sales reductions of 600 splits were for South Korea. No exports were reported for the week.

Beef:

Net sales of 13,700 MT for 2022 primarily for South Korea (7,100 MT, including decreases of 600 MT), Japan (4,700 MT, including decreases of 300 MT), Taiwan (1,800 MT, including decreases of 100 MT), Mexico (800 MT), and Canada (700 MT, including decreases

of 100 MT), were offset by reductions for China (2,600 MT) and Vietnam (100 MT). Net sales of 700 MT for 2023 were reported for South Korea (300 MT), Japan (300 MT), and Canada (100 MT). Exports of 18,100 MT were primarily to

Japan (5,300 MT), South Korea (5,100 MT), China (2,600 MT), Mexico (1,200 MT), and Canada (1,000 MT).

Pork:

Net sales of 10,800 MT for 2022 primarily for Mexico (9,100 MT, including decreases of 400 MT), South Korea (3,500 MT, including decreases of 500 MT), China (2,400 MT, including decreases of 100 MT),

the Dominican Republic (900 MT, including decreases of 100 MT), and Colombia (600 MT, including decreases of 100 MT), were offset by reductions primarily for Australia (3,500 MT), Japan (2,300 MT), and Canada (900 MT).

Net sales of 700 MT for 2023 were reported for South Korea (600 MT) and Australia (100 MT).

Exports of 28,400 MT were primarily to Mexico (13,500 MT), China (3,900 MT), Japan (3,000 MT), South Korea (2,000 MT), and the Dominican Republic (1,500 MT).

U.S. EXPORT SALES FOR WEEK ENDING 11/3/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

117.6 |

873.6 |

1,853.9 |

21.7 |

2,596.9 |

3,365.9 |

0.0 |

6.3 |

|

SRW |

14.0 |

502.5 |

533.2 |

19.6 |

1,676.5 |

1,382.9 |

0.0 |

6.6 |

|

HRS |

77.3 |

1,157.9 |

1,141.7 |

4.5 |

2,536.9 |

2,467.8 |

0.0 |

10.8 |

|

WHITE |

113.7 |

931.7 |

748.3 |

105.7 |

2,078.7 |

1,650.4 |

0.0 |

0.3 |

|

DURUM |

0.0 |

61.7 |

52.4 |

0.0 |

77.7 |

77.3 |

0.0 |

0.0 |

|

TOTAL |

322.5 |

3,527.3 |

4,329.6 |

151.5 |

8,966.6 |

8,944.3 |

0.0 |

24.0 |

|

BARLEY |

0.0 |

10.1 |

22.8 |

0.0 |

3.9 |

7.3 |

0.0 |

0.0 |

|

CORN |

265.3 |

10,327.6 |

25,464.2 |

259.4 |

4,402.1 |

6,611.5 |

0.0 |

311.0 |

|

SORGHUM |

30.0 |

307.4 |

2,929.1 |

2.4 |

46.5 |

349.4 |

0.0 |

0.0 |

|

SOYBEANS |

794.8 |

20,449.6 |

19,010.4 |

2,752.3 |

12,643.0 |

14,213.0 |

0.0 |

0.0 |

|

SOY MEAL |

170.2 |

3,320.9 |

3,881.6 |

165.9 |

819.3 |

1,079.3 |

-0.2 |

2.0 |

|

SOY OIL |

2.7 |

24.7 |

117.1 |

1.4 |

7.6 |

27.2 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

1.4 |

72.3 |

216.1 |

2.1 |

117.3 |

324.3 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

10.7 |

6.8 |

0.1 |

7.4 |

2.3 |

0.0 |

0.0 |

|

L G BRN |

2.8 |

7.9 |

9.5 |

0.8 |

4.9 |

16.5 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

4.6 |

68.5 |

0.2 |

3.1 |

14.4 |

0.0 |

0.0 |

|

L G MLD |

25.5 |

114.2 |

91.3 |

26.0 |

170.3 |

221.7 |

0.0 |

0.0 |

|

M S MLD |

7.7 |

48.5 |

79.5 |

4.1 |

80.2 |

100.0 |

0.0 |

0.0 |

|

TOTAL |

37.5 |

258.1 |

471.7 |

33.4 |

383.1 |

679.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

145.8 |

6,001.9 |

6,490.4 |

108.1 |

2,774.0 |

2,146.4 |

11.4 |

1,112.7 |

|

PIMA |

0.6 |

80.8 |

212.1 |

3.4 |

23.7 |

93.8 |

0.0 |

0.9 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.