PDF Attached

Today is a US and French holiday, due to the US closure, export sales will be delayed until Friday. Prices rallied through the EU close, but profit-taking set-in midday US session nearly wiped out most of the gains. There were rumors China bought US and Brazilian soybeans and was pricing Ukrainian corn.

![]()

Weather

World Weather Inc.

MOST IMPORTANT WEATHER AROUND THE WORLD

- Tropical Cyclone 04B has reached into southern India this morning

- The storm was 13 miles west of Chennai, Tamil Nadu at 1200 GMT today

- The storm brought some heavy rain to the lower east coast of India the past couple of days with nearly 5.00 inches reported in the most recent 24 hours

- No serious crop damage is likely, although local flooding will continue to in the Chennai area

- Remnants of the storm will move west northwesterly into Karnataka causing some disruption to summer crop maturation and early harvesting; including sugarcane, rice and a small amount of cotton and groundnuts.

- Central Vietnam coastal areas will receive excessive rain and flooding from Friday through Tuesday

- Rain totals of 5.00 to 15.00 inches will be widespread with local amounts to 20.00 inches

- The region from Da Nang to Nha Trang will be wettest

- Flooding will result and property damage is possible once again

- This region experienced frequent floods in October

- The area does not produce many crops

- Vietnam’s Central Highlands should be west of the excessive rain event and mostly unaffected

- India’s central and north will experience good harvest weather over the next week to ten days due to generally dry weather and seasonable temperatures

- Planting of wheat, rapeseed, millet and other winter crops will advance swiftly as well

- Eastern and southern Australia will experience some frequent rainfall into Friday, but after that these areas will see less frequent and less significant rain

- The drier bias will help improve wheat, barley and canola harvest conditions and fieldwork should advance well next week while rainfall is more limited

- Rain through Friday will be most welcome in unirrigated areas of Queensland and New South Wales where recent rainfall has been restricted

- The moisture will improve livestock grazing conditions and raise soil moisture for unirrigated cotton and sorghum planting and development

- Brazil weather will remain mostly good for the next two weeks, based on the recent forecast model runs

- However, concern remains for Sao Paulo and northern Parana where rainfall will be restricted for another week

- Net drying has already been occurring for a while

- Rain advertised in the second week of the outlook for these areas will be very important

- Rio Grande do Sul is also expected to see restricted amounts of rainfall over the next two weeks, although some rain will occur briefly early next week

- Drying in far southern Brazil does not seem to last long enough to create any big problems for corn, soybeans or rice, but stay watchful of the area since La Nina does favor below average rainfall for the region

- The active Brazil weather pattern should last another ten days

- Argentina weather has been and will likely continue to be favorably mixed for planting and crop development

- No area looks to be left out of the timely rainfall pattern that should last for ten days

- The situation will be closely monitored, but there is no sense fighting the trend when the jet stream seems so strong and active.

- This will not likely prevail through all of November, but it will last long enough to get many crops planted and off to a favorable start

- Temperatures will be near to slightly cooler biased for the next ten days

- A mini-blizzard will evolve in the upper Midwest today into Friday

- The storm will produce 3 to 6 inches of snow and locally more in far northern Minnesota, extreme northeastern North Dakota and southern Manitoba, Canada as well as neighboring areas of western Ontario and northwestern Wisconsin

- Snowfall of a trace to 3 inches will occur in the remainder of North Dakota, southern Minnesota and northeastern South Dakota as well as the remainder of Wisconsin

- Strong wind speeds of 30-45 mph and gusts over 50 will be possible during the height of the storm’s intensity Thursday and Friday

- Rain from the same blizzard noted above will move from west to east across the central and eastern Midwest today into Friday causing a brief disruption to farming activity

- Moisture in will also occur in the Delta and southeastern states today and Friday

- A follow up storm in the northern U.S. Plains and northern Midwest this weekend will produce additional snow and rain

- Snowfall of a dusting to 3 inches will occur from northwest to southeast across North Dakota and in northeastern South Dakota, much of Minnesota and areas east into Wisconsin and Michigan

- Traces of snow are expected immediately to the south into northern Illinois, northern Indiana and northern Ohio

- Most of the precipitation from this system will stay north of the Delta and southeastern states and may not impact the lower Midwest either

- A frontal system moving through the Midwest during mid-week next week will produce another round of rain in the central and eastern crop areas disrupting fieldwork once again

- No snow is expected with this event and previous snow may melt due to warmer temperatures

- No significant precipitation is expected in western U.S. hard red winter wheat production areas southward into West Texas during the next ten days

- Moisture shortages in wheat areas from Colorado to the Texas Panhandle will maintain concern over unirrigated winter crop conditions

- West Texas cotton and other summer crop harvest weather should be mostly good over the next week to ten days

- U.S. Pacific Northwest weather will remain active into early next week before drier biased conditions evolve later next week

- Northern California stormy weather pattern has ended for a while with a period of more limited precipitation to follow for up to ten days

- Limited precipitation is still expected in the northwestern U.S. Plains and central parts of Canada’s Prairies through the next ten days, but these areas will start seeing some periodic shots of snowfall

- U.S. temperatures this week will be near to below normal with the coolest bias expected from the northern Plains into the heart of the Midwest this weekend through early next week

- Today will still be a warm biased day in the eastern U.S.

Friday, Nov. 12:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Monday, Nov. 15:

- USDA export inspections – corn, soybeans, wheat, 11am

- U.S. corn, soy and cotton harvested; winter wheat planted, 4pm

- U.S. Green Coffee Association releases monthly inventory data

- Singapore International Agri-Food Week, day 1

- UBS Australasia Virtual Conference, day 1

- Ivory Coast cocoa arrivals

- Malaysia’s Nov. 1-15 palm oil exports

- HOLIDAY: Brazil

Tuesday, Nov. 16:

- EU weekly grain, oilseed import and export data

- Singapore International Agri-Food Week, day 2

- UBS Australasia Virtual Conference, day 2

- Global Grain Geneva conference, day 1

- New Zealand global dairy trade auction

Wednesday, Nov. 17:

- EIA weekly U.S. ethanol inventories, production

- Singapore International Agri-Food Week, day 3

- Global Grain Geneva conference, day 2

- Brazil’s Unica releases cane crush, sugar production data (tentative)

Thursday, Nov. 18:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- USDA FAS releases world sugar market balance, trade report, 3pm

- China’s trade data, including corn, wheat, sugar and cotton imports

- International Grains Council monthly report

- Singapore International Agri-Food Week, day 4

- Global Grain Geneva conference, day 3

- Bloomberg New Economy Forum: session on Feeding the World at 11:20am Singapore

- USDA total milk production, 3pm

- Port of Rouen data on French grain exports

Friday, Nov. 19:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. cattle on feed, 3pm

- FranceAgriMer weekly update on crop conditions

- HOLIDAY: India

Saturday, Nov. 20:

- China’s third batch of October trade data, including soy, corn and pork imports by country

Source: Bloomberg and FI

Conab updated their Brazil supply estimates and soybean and corn production came in 2.1 and 2.6 million tons below expectations, at 142 and 116.7 million tons, respectively. Brazil corn production is still seen 30 million tons above last year and soybeans up nearly 5 million tons to a record. Conab tends to be conservative on yield changes near the beginning of the crop season. Most of the trade sees the Conab numbers too low. Soybeans should end up near 145MMT in the end.

· Corn futures finished mixed as the prompt month December held onto a quarter-cent gain while the back months settled lower. The higher USD weighed on grains all session, but profit-taking pushed the market lower midday.

· News in corn was light. Much of Europe was on holiday. Many US government agencies were closed today for holiday. USDA export sales were delayed one day until Friday.

· Brazil is investigating two possible cases of mad cow disease in the state of Rio de Janeiro. Brazil last reported 2 cases in early September that prompted China to suspend beef imports.

- India aims to blend 20% ethanol by April 2023 with petrol and 20% ethanol with gasoline by 2025, ahead of their previous target.

- Brazil’s CONAB raised its projection for total corn production for 2021/22 to 116.7 million tons from 116.3 million tons.

Export developments.

- South Korea’s FLC bought 65,000 tons of corn from South America or South Africa at an estimated $318.40 a ton c&f for arrival in South Korea around Feb. 20, 2022. Yesterday MFG bought 137,000 tons at $317.00 and $317.15 a ton.

- Turkey seeks 325,000 tons of corn on November 15 for shipment sought between Dec. 20 and Jan. 20.

Updated 11/01/21

December corn is seen in a $5.30-$5.80 range

March corn is seen in a $5.25-$6.00 range

· CBOT soybean complex started mixed with soybeans and soymeal holding gains through the session. Bean oil closed lower in the first 5 contracts and rose in the back months.

· Traders will be watching to see if USDA confirms the rumors China bought US soybeans on Wednesday and Thursday, when they release, if any, 24-hour announcements Friday morning.

· We heard China bought soybeans out of the Gulf on Thursday and 14-16 cargoes were thought to have been sold combined between the US and Brazil. There is speculation China has been buying US agriculture products ahead of the Biden and Xi meeting next week. We have seen big purchases precede these meetings in the past.

· CNGOIC reported China’s crush for the week ending November 7 increased to 2.07 million tons from 2.53 million tons previous week. Anything over 2 million tons is a healthy weekly crush for China, IMO, because it suggests crush will exceeded over 100 million tons on an annualized basis. USDA projects 2021-22 China crush at 98 million tons for the Oct-Sep period, up from 93 million tons for 2020-21. AgriCensus noted the 2.07 million tons is at a 10-week high.

· Indonesia September palm oil exports reached 2.89 million tons (GAPKI), 4.7% higher than year ago and down from 4.62 million tons in August. Indonesia produced 4.57 million tons of palm oil in September (4.62MMT August) and stocks at the end of September were 3.65 million tons, up 6.4% from August.

· Cargo surveyor SGS reported month to date November 10 Malaysian palm exports at 563,093 tons, 66,397 tons above the same period a month ago or up 13.4%, and 116,463 tons above the same period a year ago or up 26.1%.

· Reuters NOPA survey is predicting US soybean crush at 181.945 in October. The survey is to be release to subscribers at 1100 CST on Monday. The NOPA monthly report will no longer include soymeal exports due to inadvertent underreporting.

Export Developments

- South Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

Updated 11/8/21

Soybeans – January $11.60-$12.50 range, March $11.50-$13.50

Soybean meal – December $320-$340, March $310-$360

Soybean oil – December 57-60 cent range, March 56-65

· US wheat futures led markets higher on continued inflation buying. The US SRW contract touched the highest levels seen in nine years before profit-taking took over.

· December Paris wheat finished up 2.00 euros at 296.75/ton. Earlier its rallied to an all time high of 300.50 euros per ton.

· Brazil approved GMO wheat flour imports from Argentina despite backlash from domestic end users over GMO consumption. It’s worthy to note only a fraction of the Argentina crop is GMO. Bioceres said 55,000 hectares in Argentina have been planted with the GMO wheat on an experimental basis. Brazil is Argentina’s largest wheat export customer, taking about half.

· Russia’s customs reported wheat exports total 23.9 million tons in the first nine months of 2021 from 24.7 million tons a year ago.

· Russia harvested 122.6 million tons of grain for the 2021 crop, bunker weight, according to the AgMin.

· Eastern and southern Australia will see some frequent rainfall through Friday before lighter rains occur after that. Harvesting activity has stalled for much of eastern Australia.

· The upper Midwest will see 3-6 inches of snow in far northern Minnesota, northeastern North Dakota and southern Manitoba, Canada. A small amount to 3 inches will occur in the remainder of North Dakota, southern Minnesota and northeastern South Dakota and parts of Wisconsin.

Export Developments.

· Bangladesh’s state grains buyer seeks 50,000 tons of milling wheat on November 22.

· Jordan seeks 120,000 tons of feed barley on November 17.

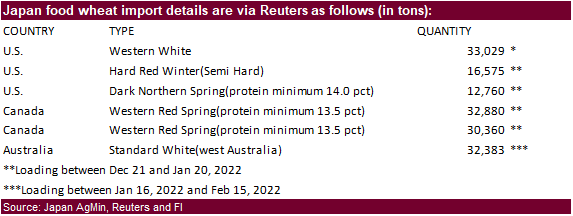

· Japan bought 157,987 tons of food wheat this week from the US, Canada, and Australia. Original tender details below. Possible shipment combinations in 2022 are March 1-15, March 16-31, April 1-15 and April 16-30.

· Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

· Results awaited: The UN is in for 110,000 tons of milling wheat for Ethiopia. 40,000 tons was for delivery between Dec. 20, 2021, and Jan. 5 2022, another 20,000 tons for delivery between Jan. 5–20, 2022, and 50,000 tons also for delivery between Jan. 5–20, 2022.

· Results awaited: Separate import tender. Ethiopia seeks 300,000 tons of milling wheat on November 9.

· Ethiopia seeks 400,000 tons of wheat on November 30.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.