PDF Attached

![]()

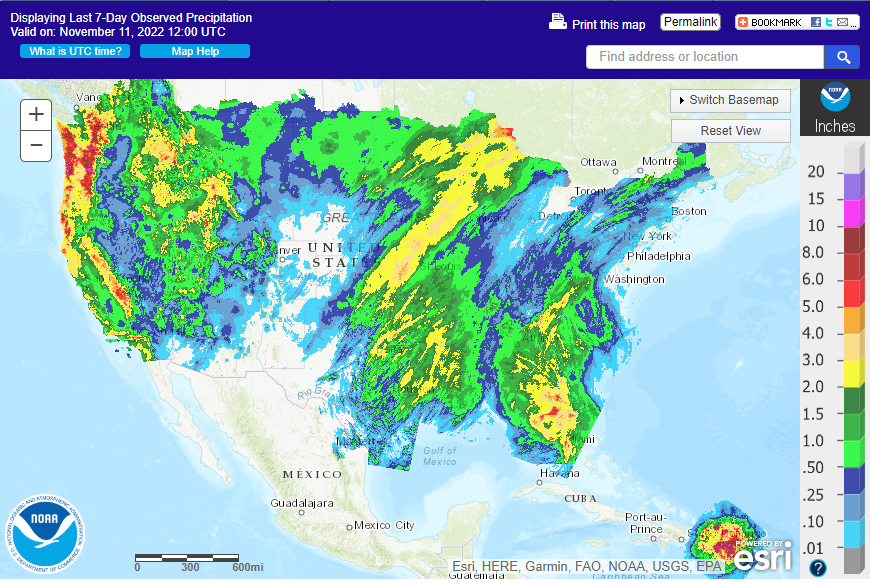

Weather

Eastern

TX, and eastern TX will see precipitation today. KS, OK, and TX has an opportunity for light rain Monday. Other parts of the Great Plains will see net drying. The Midwest will see showers across the northwestern areas through today. Many areas of Brazil will

see rain through early next week. Argentina saw less than expected rain yesterday. Argentina should see widespread rain through Sunday, then again late next week.