Meal

was the leader on Friday on strong US cash prices. Algeria and Iraq are in for wheat. Egypt seeks vegetable oils on Tuesday.

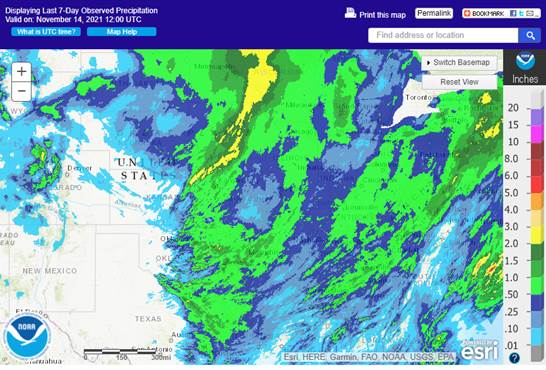

Wet

weather over the weekend for the US Midwest likely slowed harvesting progress. CFTC COT is delayed until Monday.

USDA

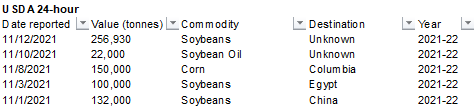

24-hour: Private exporters reported sales of 256,930 metric tons of soybeans received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year.

![]()

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Incredibly

strong wind speeds occurred Thursday western South Dakota and into north-central Nebraska where gusts of 65 to 76mph occurred - An

extreme gust of 82mph was noted near Midland, South Dakota - Wind

gusts over 50 mph occurred as far to the south as Nebraska and as far to the west as eastern Montana

- Windy

conditions continued overnight, but to a lesser degree of intensity impacting the eastern Dakotas and Western Minnesota and extending southward into Kansa and Missouri - Snow

and blowing snow occurred across central and eastern North Dakota, a few areas in South Dakota and throughout Minnesota into northeastern Iowa overnight. - Accumulations

varied from a dusting to 3 inches except in northeastern Minnesota where accumulations to 7 inches had occurred so far through the pre-dawn hours - Rain

disrupted farming activity from the Delta and interior southeastern states through the central and eastern Midwest Thursday and early today - Most

of the precipitation was not heavy enough to induce a prolonged delay to farming activity.

- Rain

also fell in the Pacific Northwest with coast areas of Washington and northern Oregon most impacted - Dry

weather prevailed elsewhere in the U.S. - Temperatures

turned colder than usual in the north-central parts of the nation with afternoon readings Thursday in the upper 20s and 30s Fahrenheit - U.S.

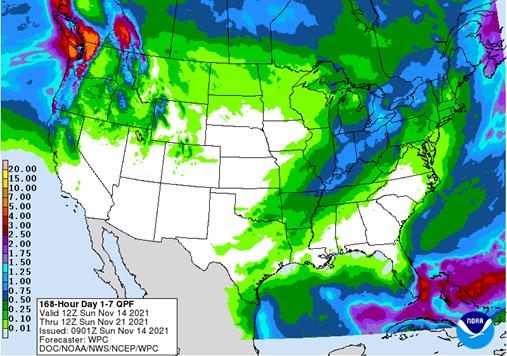

weather over the next ten days will bring some periodic precipitation to the Midwest and a part of the northern Plains - The

moisture will occur infrequently enough to limit the impact on farming activity except possibly in Michigan, northern Illinois, southern Wisconsin, northern Indiana and Ohio where enough moisture will fall to keep late season harvest and planting progress

a little sluggish at times. - The

next storm to impact the northern U.S. Plains and northern Midwest is expected this weekend following some rain and snow that will impact many of these same areas today - Snowfall

of a dusting to 3 inches will occur this weekend from north-central through eastern North Dakota and far northeastern South Dakota into much of Minnesota and areas east into Wisconsin and Michigan

- Some

snow and rain will also fall immediately to the south into northern Illinois, northern and central Indiana and Ohio - Most

of the precipitation from this system will stay north of the Delta and southeastern states and may not impact the lower Midwest either

- A

frontal system moving through the Midwest during mid-week next week will produce another round of rain in the central and eastern crop areas disrupting fieldwork once again - No

snow is expected with this event and previous snow may melt due to warmer temperatures - Moisture

totals of 0.25 to 0.75 inch and a few amounts over 1.00 inch will result from Missouri to Michigan and Ohio

- A

few showers will occur in the northern Delta, but the southeastern states and lower Delta will likely be left dry or mostly dry - A

couple of follow up frontal systems will bring periods of rain to the U.S. Midwest and Delta during the second week of the outlook (Nov. 20-26) with only limited rain in the southeastern states

- No

significant precipitation is expected in western U.S. hard red winter wheat production areas southward into West Texas during the next ten days - Moisture

shortages in wheat areas from Colorado to the Texas Panhandle will maintain concern over unirrigated winter crop conditions - West

Texas cotton and other summer crop harvest weather should be mostly good over the next week to ten days - U.S.

Pacific Northwest weather will remain active into next week before drier biased conditions evolve in the following weekend and deeper into late this month - Northern

California stormy weather pattern has ended for a while with a period of more limited precipitation to follow for up to ten days - Limited

precipitation is still expected in the northwestern U.S. Plains and central parts of Canada’s Prairies through the next ten days, but these areas will start seeing some periodic shots of snowfall - U.S.

temperatures this week will be near to below normal with the coolest bias expected from the northern Plains into the heart of the Midwest this weekend through early next week

- Today

will still be a warm biased day in the eastern U.S. - Brazil

weather will remain mostly good for the next two weeks, based on the recent forecast model runs

- However,

concern remains for Sao Paulo and northern Parana where rainfall will be restricted until late next week

- Net

drying has already been occurring for a while - Rain

advertised for late next week in these areas will be very important since drier weather will follow in the second weekend of the outlook a few days thereafter - Rio

Grande do Sul is also expected to see restricted amounts of rainfall over the next two weeks, although some timely rain will occur briefly early to mid-week next week - This

event will need to be closely monitored because of the rain fails to evolve the region may be dry until Nov. 22 - Drying

in far southern Brazil does not seem to last long enough to create any big problems for corn, soybeans or rice, but stay watchful of the area since La Nina does favor below average rainfall for the region - The

active Brazil weather pattern should last another ten days - Argentina

weather has been and will likely continue to be favorably mixed for planting and crop development - No

area looks to be left out of the timely rainfall pattern that should last for ten days - The

situation will be closely monitored, but there is no sense fighting the trend when the jet stream seems so strong and active.

- This

will not likely prevail through all of November, but it will last long enough to get many crops planted and off to a favorable start - Temperatures

will be near to slightly cooler biased for the next ten days - Central

Vietnam coastal areas will receive excessive rain and flooding through Tuesday - Rain

totals of 5.00 to 15.00 inches will be widespread with local amounts to 20.00 inches - The

region from Da Nang to Nha Trang will be wettest - Nha

Trang already reported nearly 7.00 inches of rain in the most recent 24 hours ending at dawn Vietnam time today - Flooding

will result and property damage is possible once again - This

region experienced frequent floods in October - The

area does not produce many crops - Vietnam’s

Central Highlands should be west of the excessive rain event and mostly unaffected - India’s

central and north will experience good harvest weather over the next week to ten days due to generally dry weather and seasonable temperatures - Planting

of wheat, rapeseed, millet and other winter crops will advance swiftly as well - Southern

India will receive frequent bouts of rain through the next week to ten days maintaining wet field conditions - Late

season summer crop maturation and harvesting will be slow and a few early maturing crops may suffer a quality decline - A

tropical cyclone may impact the upper Andhra Pradesh coast late next week bringing some heavy rain inland - There

is some potential this storm will impact Odisha as well - Rain

fell significantly in eastern Australia Thursday - Rain

totals in Queensland varied from 0.20 to 1.07 inches with local totals of up to 2.50 inches

- New

South Wales crop areas received 0.15 to 1.00 inch of rain except near the western slopes of the Great Dividing Range where 1.00 to 2.32 inches resulted - Victoria

and South Australia also received rain - Grain

and oilseed harvest delays resulted, but the rain will move out soon enough to protect crop quality - The

moisture will improve livestock grazing conditions and raise soil moisture for unirrigated cotton and sorghum planting and development - Eastern

and southern Australia will experience some lingering rain today, but after that these areas will see less frequent and less significant rain

- The

drier bias will help improve wheat, barley and canola harvest conditions and fieldwork should advance well next week while rainfall is more limited - Northeastern

China’s weather will be much improved over the next week to ten days, although not necessarily perfectly dry - Much

of eastern China’s wheat and rapeseed areas will be dry - Harvest

progress in late summer crop areas should advance well - Winter

crops are suspected of establishing well - Recent

freezes in China’s wheat region had a low impact on crops, although warming is needed to allow late planted crops a little more time to establish prior to dormancy - Warming

is expected gradually over the coming week - Ukraine

and areas northeast into the middle Volga River Basin will likely see very little precipitation of significance in this coming week - Some

of this region has restricted soil moisture, but winter crops are either dormant or semi-dormant limiting the need for moisture until spring - Snow

cover will be needed during times of bitter cold to protect crops from any potential for winterkill - A

boost in precipitation is advertised for late next week and on out into the following weekend - Sufficient

moisture boosting will occur to help crop development in the spring - Snow

cover in Russia is widespread in the New Lands except near the Kazakhstan border - Snow

cover is expected to expand across much of western Russia during the coming week with the greatest depths in the north - Snow

cover will reach south to the Ukraine border by Nov. 21 - Temperatures

will be near to above normal - Europe

weather is expected to remain relatively tranquil during the next ten days to two weeks with the exception of Italy and the Adriatic Sea region where rain will fall moderately this weekend and into next week - No

snow is on the ground in Europe except the higher elevated areas and none was expected anytime soon - Temperatures

will be near to above normal - Coastal

areas of central and eastern Algeria will receive waves of rain over the coming week while most interior crop areas in northern Africa will be dry - Morocco

has the greatest need for rain followed by northwestern Algeria - Southwestern

Morocco has been in a multi-year drought - These

areas will not see much rain over the next ten days - Western

portions of South Africa need rain to support unirrigated summer crop planting - This

first week of the forecast does not provide much moisture to these drier areas - Showers

may evolve in the following week - Eastern

South Africa soil moisture is a little better than in western areas and some showers and thunderstorms are expected to occur over the next two weeks to slowly improve planting and emergence conditions - West-central

Africa will experience a good mix of weather during the next ten days to two weeks - Less

frequent rain in cotton areas will translate into better crop maturation conditions - Coffee,

cocoa, sugarcane and rice will also benefit from less frequent and less significant rainfall, although completely dry weather is not likely for a while - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Indonesia

and Malaysia weather will be wet biased over the next two weeks with frequent rain expected over saturated or nearly saturated soil causing some flooding - Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Mexico’s

weather will drier biased for the next ten days except along the lower east and southwestern coasts where periodic rainfall is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Costa Rica and Panama - Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days - Coffee,

sugarcane, corn and a host of other crops may have been impacted by too much rain earlier this season resulting in some harvest delay - Conditions

should be improving over the next ten days, although there will be a persistence of rain along the coast - Today’s

Southern Oscillational Index was +8.47 and it was expected to drift higher over the coming week - New

Zealand rainfall is expected to be near to above average in the west and a little lighter than usual in the east

- Temperatures

will be seasonable.

Monday,

Nov. 15:

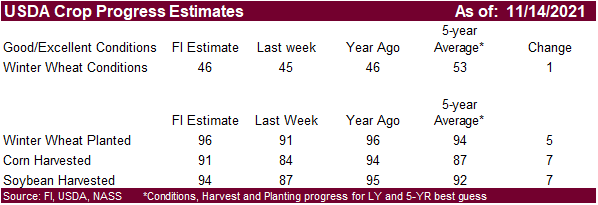

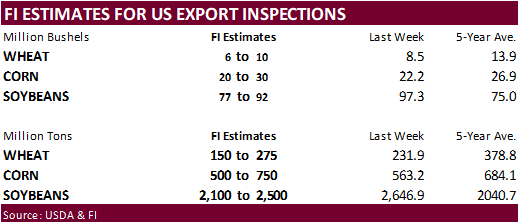

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

corn, soy and cotton harvested; winter wheat planted, 4pm - U.S.

Green Coffee Association releases monthly inventory data - Singapore

International Agri-Food Week, day 1 - UBS

Australasia Virtual Conference, day 1 - Ivory

Coast cocoa arrivals - Malaysia’s

Nov. 1-15 palm oil exports - HOLIDAY:

Brazil

Tuesday,

Nov. 16:

- EU

weekly grain, oilseed import and export data - Singapore

International Agri-Food Week, day 2 - UBS

Australasia Virtual Conference, day 2 - Global

Grain Geneva conference, day 1 - New

Zealand global dairy trade auction

Wednesday,

Nov. 17:

- EIA

weekly U.S. ethanol inventories, production - Singapore

International Agri-Food Week, day 3 - Global

Grain Geneva conference, day 2 - Brazil’s

Unica releases cane crush, sugar production data (tentative)

Thursday,

Nov. 18:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

FAS releases world sugar market balance, trade report, 3pm - China’s

trade data, including corn, wheat, sugar and cotton imports - International

Grains Council monthly report - Singapore

International Agri-Food Week, day 4 - Global

Grain Geneva conference, day 3 - Bloomberg

New Economy Forum: session on Feeding the World at 11:20am Singapore - USDA

total milk production, 3pm - Port

of Rouen data on French grain exports

Friday,

Nov. 19:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Saturday,

Nov. 20:

- China’s

third batch of October trade data, including soy, corn and pork imports by country

Source:

Bloomberg and FI

77

Counterparties Take $1.418 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.449 Tln, 77 Bidders)

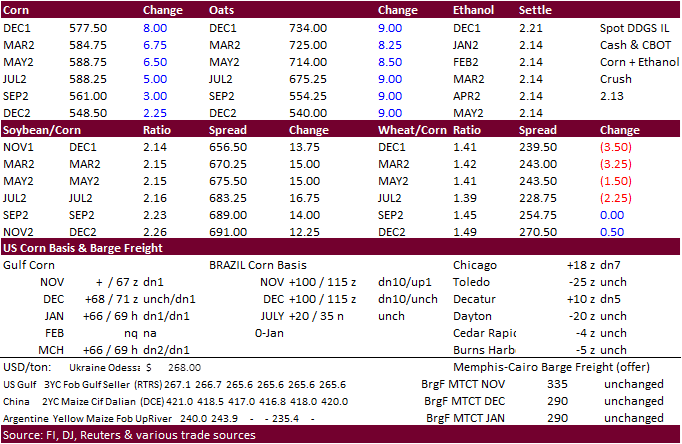

Corn

·

Corn futures rallied on Friday after soybean meal surged higher.

The December contract did not take out its absolute recent high of $5.86/bu made on November 2 but could test that level next week if we see soybeans and meal continue to appreciate. We can’t get too bullish corn over the short term as US export developments

have slowed. SK bought corn this week either from SA and/or South Africa.

·

Next week the US and China will hold meetings, mainly over trade and climate issues. Both countries promised to work out a climate pledge to lower carbon and methane emissions.

·

China this week also has been an active buyer of Brazil soybeans, Ukrainian corn, and Australian wheat.

·

Global tender business was quiet overnight.

·

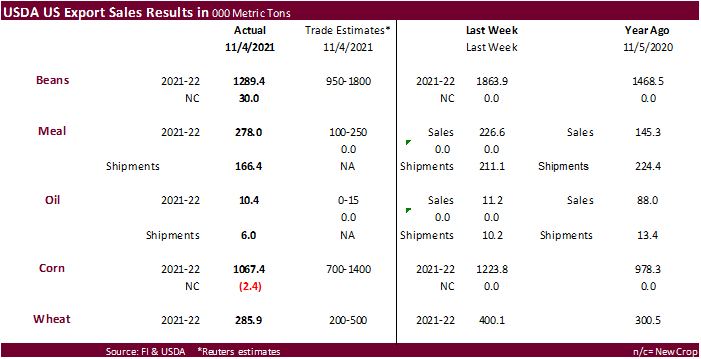

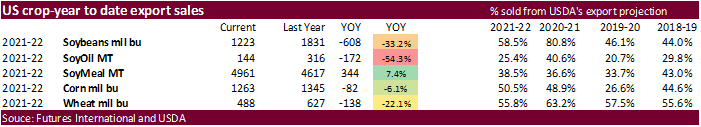

USDA export sales of 1.067 million tons were within expectations but down from the previous week.

·

The USD traded slightly lower after a two-day mid-week rally. WTI was down $0.90.

·

Ukraine corn export commitments have significantly increased. Ukraine grain exports were 1.8 million tons this week led by 1.05 million tons of corn, with another 1.7 million tons of corn scheduled to be shipped in coming weeks.

·

SA plantings are advancing. Argentina’s BA Grains Exchange reported corn plantings of 31 percent and are lagging year ago but keep in mind the expected area is greater than last year.

·

France collected 83 percent of their corn crop as of November 8, up from 73% previous week and below 97% year earlier.

Export

developments.

-

Turkey

seeks 325,000 tons of corn on November 15 for shipment sought between Dec. 20 and Jan. 20.

Updated

11/01/21

December

corn is seen in a $5.30-$5.80 range

March

corn is seen in a $5.25-$6.00 range

·

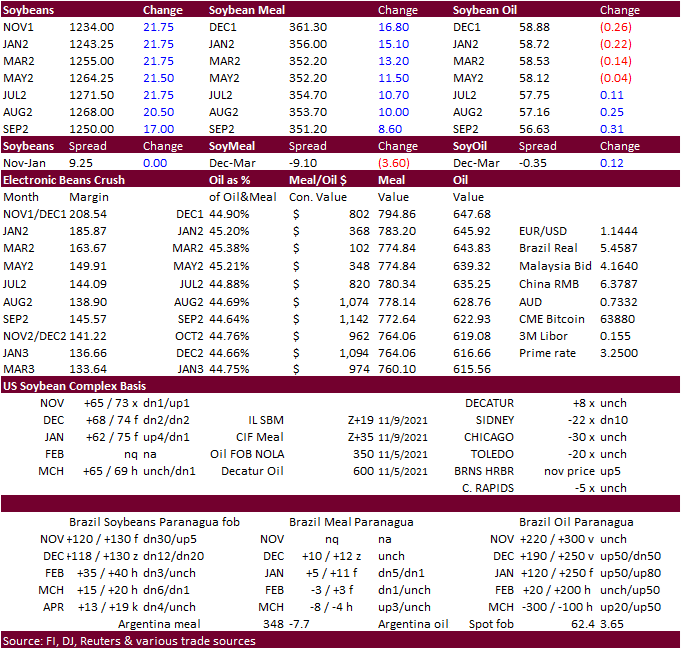

CBOT soybeans

rallied ahead of the China/US meeting next week with rumors of China buying this week. USDA announced 256,930 tons of soybeans to unknow, an amount much lower than what the trade rumors suggested over the last couple of sessions. USDA export sales were within

expectations for soybean oil and soybeans, and positive for soybean meal. January soybeans were up 22.75 cents, December meal up $17.60 and December soybean oil down 17. Short covering was noted for soybean meal. Global demand for soybean meal has increased

over the past month and this ignited a firm undertone in CBOT soybean meal over the past week. Note China this week has been an active buyer of Brazil soybeans, Ukrainian corn, and Australian wheat.

·

Soybean meal basis for the US interior remain strong. On Friday Decatur, AL increased an impressive $15/short ton to 40 over the December position, and that was noted during the morning trade when December (Z) meal futures were

trading $6.40 higher. Futures soon took off to the upside by late morning. Meal basis for Cedar Rapids was up $3 (5 over Z), Sioux City, IA, up $4 to 4 under Z, Council Bluff, IA, up $5/short ton to 10 over the Z, and KC, Missouri up $10/short ton to 10

over the December.

·

So, what is going on? Feedgrains are expensive that might be attracting soybean meal demand. The US soybean 2020-21 carryout is lowest since 2015-16. ECB shortages (slowing crush) and crop quality problems during harvest season.

Some soybean cracking was noted for the ECB. October and November (so far) soybean meal exports are exceeding last couple years comparing to same periods.

·

Perfect storm? Global oilmeal import demand has picked up over the last several weeks and that has spread traders putting pressure on vegetable oils, which have been labeled as inflated.

·

We like selling oil share over the short term. Long term we still have a bullish outlook on vegetable oils.

·

Argentina’s BA Grains Exchange reported 19 percent of the soybean crop planted, up from 12% previous week and compares to 18 percent year ago.

·

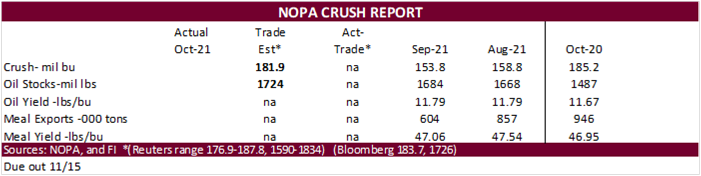

Reuters NOPA survey is predicting US soybean crush at 181.945 in October. The survey is to be release to subscribers at 1100 CST on Monday. The NOPA monthly report will no longer include soymeal exports due to inadvertent underreporting.

·

China crush margins on our analysis was last $2.66/bu ($2.58 previous), compared to $2.30 at the end of last week and compares to $0.85 a year ago.

Export

Developments

- Egypt’s

GASC on November 16 (Tuesday) seeks at least 30,000 tons of soybean oil and 10,000 tons of sunflower oil for arrival from Jan.10-30 and it will pay under a 180-day deferred payment system , or at sight.

- USDA:

256,930 metric tons of soybeans received during the reporting period for delivery to unknown destinations.

·

South Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

Updated

11/8/21

Soybeans

– January $11.60-$12.50 range, March $11.50-$13.50

Soybean

meal – December $320-$340, March $310-$360

Soybean

oil – December 57-60 cent range, March 56-65

·

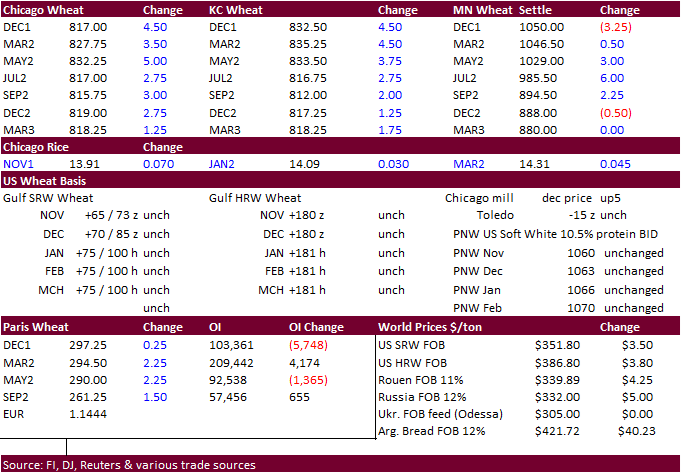

US wheat futures opened lower but traded higher on fund buying. The December Chicago and KC wheat contracts hit new all-time intraday highs on Friday. MN is close to that level.

·

December Paris wheat was up 0.25 euro at 298.25/ton.

·

Global tender business was quiet on Friday before Iraq and Algeria announced import tenders.

·

Russia’s formula for wheat export tax indicates wheat prices will be increasing starting November 17 to $77.10/ton from $69.90/ton, an indication less exportable supplies will be snapped up from the number one global supplier.

·

Ukraine wheat exports since the start of the season of 13.1 million tons are running 17 percent above the same period year ago.

·

Ukraine’s grain harvest is 91 percent complete at 73.4 million tons. That includes 32.3 million tons of wheat, 9.6 million tons of barley, 28.1 million tons of corn and small volumes of other grains, according to the AgMin.

Ukraine could use more rain for winter grain establishment.

·

France planted 87% of their soft wheat crop as of November 8 versus 86% year ago. France is expected to see good weather over the next several days.

·

The upper Midwest will see 3-6 inches of snow in far northern Minnesota, northeastern North Dakota and southern Manitoba, Canada. A small amount to 3 inches will occur in the remainder of North Dakota, southern Minnesota and

northeastern South Dakota and parts of Wisconsin.

Export

Developments.

·

Algeria seeks 50,000 tons of milling wheat on November 15, valid until the 16th. Reuters noted shipment is for three periods from the main supply regions including Europe: in 2021 between Dec. 16-31, and in 2022 between

Jan. 1-15 and Jan. 16-31. If sourced from South America or Australia, the shipment is one month earlier. They increased the insect-damage limit to 1 percent from 0.5 percent.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

·

Jordan seeks 120,000 tons of feed barley on November 17.

·

Bangladesh’s state grains buyer seeks 50,000 tons of milling wheat on November 22.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

·

Results awaited: The UN is in for 110,000 tons of milling wheat for Ethiopia. 40,000 tons was for delivery between Dec. 20, 2021, and Jan. 5, 2022, another 20,000 tons for delivery between Jan. 5–20, 2022, and 50,000 tons also

for delivery between Jan. 5–20, 2022.

·

Results awaited: Separate import tender. Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

·

None reported

Updated

11/01/21

December

Chicago wheat is seen in a $7.50‐$8.25 range, March $7.25-$8.40

December

KC wheat is seen in a $7.50‐$8.35, March $7.00-$8.50

December

MN wheat is seen in a $10.00‐$11.25, March $9.00-$11.75

USDA

Export Sales

U.S.

EXPORT SALES FOR WEEK ENDING 11/4/2021

|

|

CURRENT |

NEXT |

||||||

|

COMMODITY |

NET |

OUTSTANDING |

WEEKLY |

ACCUMULATED |

NET |

OUTSTANDING |

||

|

CURRENT |

YEAR |

CURRENT |

YEAR |

|||||

|

|

THOUSAND |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

|

59.7 |

1,853.9 |

1,600.6 |

93.0 |

3,365.9 |

4,585.3 |

0.0 |

0.0 |

|

|

7.8 |

533.2 |

420.9 |

74.6 |

1,382.9 |

944.6 |

22.5 |

22.5 |

|

|

156.6 |

1,141.7 |

1,553.8 |

40.3 |

2,467.8 |

3,274.6 |

0.0 |

0.0 |

|

|

62.6 |

748.3 |

1,973.2 |

42.9 |

1,650.4 |

2,161.8 |

0.0 |

0.0 |

|

|

-0.8 |

52.4 |

202.7 |

19.2 |

96.5 |

340.0 |

0.0 |

0.0 |

|

|

285.9 |

4,329.6 |

5,751.1 |

270.0 |

8,963.6 |

11,306.4 |

22.5 |

22.5 |

|

BARLEY |

0.0 |

22.8 |

31.0 |

0.0 |

7.3 |

11.8 |

0.0 |

0.0 |

|

CORN |

1,067.3 |

25,464.2 |

26,582.7 |

718.0 |

6,611.5 |

7,584.8 |

-2.5 |

334.9 |

|

SORGHUM |

261.1 |

2,929.1 |

3,132.9 |

80.0 |

349.4 |

686.0 |

0.0 |

0.0 |

|

SOYBEANS |

1,289.4 |

19,010.4 |

30,111.6 |

3,701.7 |

14,283.0 |

19,720.0 |

30.0 |

49.8 |

|

SOY |

278.0 |

3,881.6 |

3,517.2 |

166.4 |

1,079.3 |

1,099.9 |

-0.1 |

36.8 |

|

SOY |

10.4 |

117.1 |

248.8 |

6.0 |

27.2 |

67.2 |

0.0 |

0.1 |

|

RICE |

|

|

|

|

|

|

|

|

|

|

2.2 |

216.1 |

405.7 |

8.4 |

324.3 |

278.7 |

0.0 |

0.0 |

|

|

0.0 |

6.8 |

20.3 |

0.0 |

2.3 |

8.6 |

0.0 |

0.0 |

|

|

1.2 |

9.5 |

10.8 |

0.1 |

16.5 |

10.9 |

0.0 |

0.0 |

|

|

14.3 |

68.5 |

19.7 |

0.1 |

14.4 |

29.9 |

0.0 |

0.0 |

|

|

8.2 |

91.3 |

96.5 |

3.2 |

221.7 |

117.0 |

0.0 |

0.0 |

|

|

17.3 |

79.5 |

154.6 |

5.4 |

100.0 |

108.4 |

0.0 |

0.0 |

|

|

43.2 |

471.7 |

707.6 |

17.1 |

679.2 |

553.5 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND |

||||||

|

UPLAND |

128.0 |

6,490.4 |

5,611.1 |

87.9 |

2,146.4 |

3,490.9 |

11.6 |

868.5 |

|

|

6.5 |

212.1 |

265.0 |

9.6 |

93.8 |

182.6 |

0.0 |

1.8 |

This

summary is based on reports from exporters for the period October 29 – November 4, 2021.

Wheat: Net

sales of 285,900 metric tons (MT) for 2021/2022 were down 29 percent from the previous week and from the prior 4-week average. Increases primarily for the Philippines (152,000 MT), Japan (57,400 MT), Mexico (37,200 MT, including decreases of 1,400 MT), Italy

(29,200 MT, including 20,000 MT switched from unknown destinations and decreases of 800 MT), and Guatemala (24,200 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (51,800 MT) and Nigeria (30,300 MT). Total

net sales of 22,500 MT for 2022/2023 were for unknown destinations. Exports of 270,000 MT were up 98 percent from the previous week and 15 percent from the prior 4-week average. The destinations were primarily to Mexico (105,900 MT), Thailand (51,100 MT),

Colombia (43,500 MT), Japan (30,900 MT), and Italy (19,200 MT).

Corn:

Net sales of 1,067,300 MT for 2021/2022 were down 13 percent from the previous week and 4 percent from the prior 4-week average. Increases primarily for Canada (357,600 MT), Colombia (304,600 MT, including 19,900 MT switched from unknown destinations and

decreases of 38,800 MT), Mexico (272,200 MT, including decreases of 48,700 MT), Japan (151,100 MT, including 93,300 MT switched from unknown destinations and decreases of 56,800 MT), and the Dominican Republic (11,500 MT), were offset by reductions primarily

for unknown destinations (45,600 MT) and Costa Rica (13,700 MT). Total net sales reductions for 2022/2023 of 2,500 MT were for Canada. Exports of 718,000 MT were down 4 percent from the previous week and 15 percent from the prior 4-week average. The destinations

were primarily to Mexico (313,700 MT), Japan (182,900 MT), Colombia (91,600 MT), Honduras (52,100 MT), and Canada (42,900 MT).

Optional

Origin Sales:

For 2021/2022, options were exercised to export 65,000 MT to South Korea from other than the United States. The current outstanding balance of 443,300 MT is for unknown destinations (379,000 MT), Italy (55,300 MT), and Saudi Arabia (9,000 MT).

Barley:

No net sales or exports were reported for the week.

Sorghum:

Total net sales of 261,100 MT for 2021/2022 were down 2 percent from the previous week, but up 57 percent from the prior 4-week average. The destination was China. Exports of 80,000 MT were up noticeably from the previous week and from the prior 4-week average.

The destinations were to China (79,400 MT) and Mexico (600 MT).

Rice:

Net

sales of 43,200 MT for 2021/2022 were up 45 percent from the previous week and 1 percent from the prior 4-week average. Increases primarily for El Salvador (14,800 MT, including 14,500 MT switched from Guatemala), South Korea (14,200 MT), Japan (13,000 MT),

Jordan (5,200 MT), and Canada (2,200 MT), were offset by reductions primarily for Guatemala (13,000 MT). Exports of 17,100 MT were down 66 percent from the previous week and 65 percent from the prior 4-week average. The destinations were primarily to Mexico

(5,100 MT), El Salvador (5,000 MT), Jordan (2,800 MT), Canada (2,100 MT), and Saudi Arabia (800 MT).

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 200 MT, all Canada.

Soybeans:

Net sales of 1,289,400 MT for 2021/2022 were down 31 percent from the previous week and 25 percent the prior 4-week average. Increases primarily for China (939,300 MT, including 583,000 MT switched from unknown destinations and decreases of 15,000 MT), Germany

(311,400 MT), Egypt (231,400 MT, including 119,000 MT switched from unknown destinations and decreases of 1,700 MT), Portugal (82,100 MT, including 66,000 MT switched from unknown destinations), and Mexico (80,700 MT, including decreases of 300 MT), were offset

by reductions primarily for unknown destinations (847,400 MT). Total net sales of 30,000 MT for 2022/2023 were for unknown destinations. Exports of 3,701,700 MT–a marketing-year high–were up 40 percent from the previous week and 70 percent from the prior

4-week average. The destinations were primarily to China (2,337,700 MT), Germany (311,400 MT), Egypt (142,900 MT), Bangladesh (113,200 MT), and Taiwan (99,300 MT).

Export

for Own Account:

For 2021/2022, exports for own account totaling 66,400 MT to Canada were applied to new or outstanding sales.

Export

Adjustments: Accumulated

export of soybeans to the Netherlands were adjusted down 70,704 MT for week ending September 30th, 127,295 MT for week ending October 14th, and 113,448 MT for week ending October 21st. The correct destination for these shipments

is Germany.

Soybean

Cake and Meal:

Net sales of 278,000 MT for 2021/2022 were up 23 percent from the previous week and 12 percent from the prior 4-week average. Increases primarily for Mexico (69,600 MT, including decreases of 11,300 MT), the Philippines (65,900 MT), Colombia (57,100 MT, including

decreases of 1,200 MT), Ecuador (18,800 MT, including decreases of 200 MT), and Canada (11,100 MT, including decreases of 800 MT), were offset by reductions for Costa Rica (5,700 MT).

Net sales reductions of 100 MT for 2022/2023 resulting in increases for the Netherlands (500 MT), were more than offset by reductions for primarily for Japan (500 MT).

Exports of 166,400 MT were down 21 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to Mexico (48,700 MT), Peru (31,900 MT), Canada (22,300 MT), Colombia (18,400 MT), and Honduras (13,400 MT).

Soybean

Oil:

Net sales of 10,400 MT for 2021/2022 were down 7 percent from the previous week and 14 percent from the prior 4-week average. Increases were primarily for the Dominican Republic (3,100 MT), Colombia (2,500 MT), Venezuela (2,500 MT), Honduras (900 MT), and

Mexico (800 MT). Exports of 6,000 MT were down 41 percent from the previous week, but up 14 percent from the prior 4-week average. The destinations were primarily to Venezuela (3,500 MT), Mexico (1,100 MT), and Honduras (1,000 MT).

Cotton:

Net sales of 128,000 RB for 2021/2022 were down 8 percent from the previous week and 51 percent from the prior 4-week average. Increases primarily for China (78,800 RB), Bangladesh (16,800 RB), Turkey (13,300 RB), Pakistan (8,100 RB), and South Korea (7,900

RB), were offset by reductions primarily for Indonesia (12,900 RB). Net sales of 11,600 RB for 2022/2023 were reported for Costa Rica (5,000 RB), Pakistan (4,400 RB), and Turkey (2,200 RB). Exports of 87,900 RB were down 38 percent from the previous week

and 16 percent from the prior 4-week average. The destinations were primarily to China (36,700 RB), Mexico (18,000 RB), Vietnam (8,100 RB), Indonesia (7,100 RB), and Pakistan (3,300 RB). Net sales of Pima totaling 6,500 RB were down 80 percent from the previous

week and 63 percent from the prior 4-week average. Increases were primarily for India (3,900 RB), China (900 RB switched from Vietnam), Peru (700 RB), Germany (400 RB), and Bahrain (300 RB). Exports of 9,600 RB were up 25 percent from the previous week and

48 percent from the prior 4-week average. The destinations were primarily to India (7,900 RB), Greece (400 RB), South Korea (400 RB), Bangladesh (400 RB), and Austria (300 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 100 RB is for Vietnam.

Hides

and Skins:

Net sales of 638,400 pieces for 2021 were up 38 percent from the previous week and 50 percent from the prior 4-week average. Increases were primarily for China (510,400 whole cattle hides, including decreases of 4,900 pieces), South Korea (47,800 whole cattle

hides, including decreases of 300 pieces), Mexico (38,600 whole cattle hides, including decreases of 500 pieces), Thailand (14,100 whole cattle hides, including 1,900 whole cattle hides switched from Taiwan and decreases of 600 pieces), and Canada (6,200 whole

cattle hides, including decreases of 1,200 pieces). Total net sales of 2,600 kip skins were for China. Net sales of 16,300 pieces for 2022 were reported for China (10,200 whole cattle hides), Taiwan (3,600 whole cattle hides), Vietnam (1,800 whole cattle

hides), and Canada (700 whole cattle hides). Exports of 361,300 pieces were down 10 percent from the previous week and 11 percent from the prior 4-week average. Whole cattle hide exports were primarily to China (227,800 pieces), South Korea (43,800 pieces),

Mexico (31,800 pieces), Thailand (14,200 pieces), and Indonesia (12,200 pieces). In addition, exports of 1,300 kip skins were to China.

Net

sales of 40,600 wet blues for 2021 were down 56 percent from the previous week and 68 percent from the prior 4-week average. Increases for Mexico (11,100 grain splits and 900 unsplit), Vietnam (10,700 unsplit, including decreases of 1,600 unsplit), China

(10,400 unsplit), Italy (4,500 unsplit, including decreases of 300 unsplit), and South Korea (3,200 grain splits), were offset by reductions for Italy (100 grain splits). Net sales of 29,800 wet blues for 2022 were reported for Italy (28,200 grain splits)

and Vietnam (1,600 unsplit). Exports of 94,700 wet blues were down 29 percent from the previous week and 39 percent from the prior 4-week average. The destinations were primarily to Italy (35,100 unsplit and 5,500 grain splits), China (30,700 unsplit), Vietnam

(18,200 unsplit), Brazil (2,300 unsplit), and Mexico (2,000 grain splits). Total net sales of 54,100 splits were for China. Exports of 449,100 pounds were to Vietnam (240,000 pounds) and China (209,100 pounds).

Beef:

Net

sales of 20,600 MT for 2021 were up 23 percent from the previous week and 39 percent from the prior 4-week average. Increases primarily for China (8,200 MT, including decreases of 300 MT), Taiwan (4,300 MT, including decreases of 100 MT), Japan (2,200 MT,

including decreases of 300 MT), Mexico (2,200 MT), and South Korea (1,600 MT, including decreases of 700 MT), were offset by reductions for Panama (200 MT) and Colombia (100 MT). Net sales of 400 MT for 2022 resulting in increases for Japan (600 MT), China

(200 MT), and Mexico (100 MT), were offset by reductions for South Korea (500 MT). Exports of 17,000 MT were up 1 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to South Korea (5,000 MT), Japan

(3,700 MT), China (3,200 MT), Mexico (1,300 MT), and Taiwan (1,200 MT).

Pork:

Net

sales of 23,300 MT for 2021 were down 49 percent from the previous week and 28 percent from the prior 4-week average. Increases primarily for Mexico (7,800 MT, including decreases of 500 MT), China (5,800 MT, including decreases of 300 MT), Japan (5,400 MT,

including decreases of 100 MT), Canada (3,700 MT, including decreases of 500 MT), and the Dominican Republic (1,000 MT), were offset by reductions primarily for South Korea (2,400 MT). Net sales of 13,600 MT for 2022 were primarily for South Korea (13,300

MT). Exports of 32,000 MT were down 5 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to Mexico (14,200 MT), Japan (4,500 MT), China (3,600 MT), South Korea (2,900 MT), and Colombia (2,400 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.