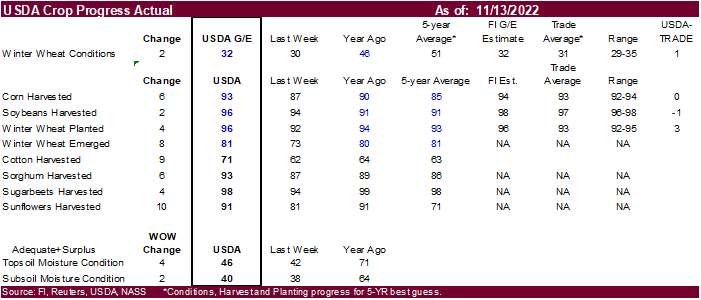

PDF Attached includes crop progress and commitment of traders

USD

was up 56 points (3.:09 pm CT), WTI crude off $3.78 and US equities lower. Increasing concerns over the number of covid cases in China weighted on several commodity markets. The CBOT ag markets were mixed with the soybean complex lower, corn lower and wheat

higher. Wheat was underpinned by good global import demand and Argentina production concerns. South America saw as expected beneficial rain over the weekend.

Soybeans

steady to 4 lower

Corn

steady to 2 lower

Chicago

wheat 2-5 lower

Weather

US

rainfall for the Great Plains over the weekend was as expected. Temperatures will be on the cooler side this week for the majority of the US but expect late harvesting to proceed. The Midwest will see light precipitation today across the west-central areas,

and north-central areas Tuesday through Wednesday. South America saw rain over the weekend and will receive more over the next week, with exception of Argentina trending drier through Wednesday. Argentina may see isolated showers Thursday through Friday. Canada’s

Alberta, Saskatchewan, and Manitoba will see isolated snow showers through Wednesday.