PDF Attached

The

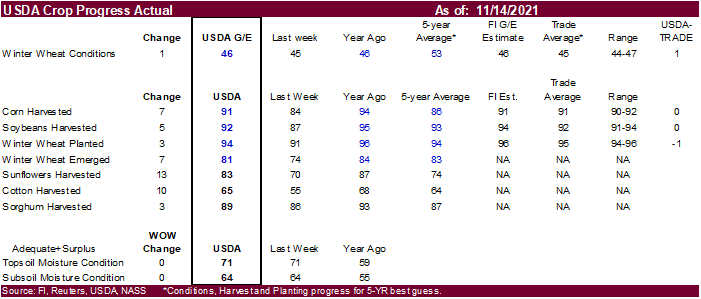

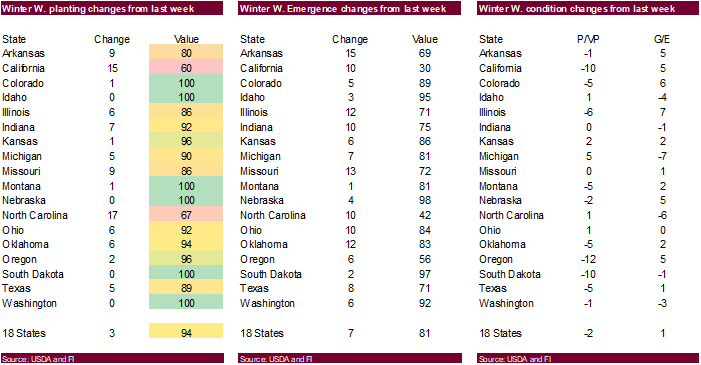

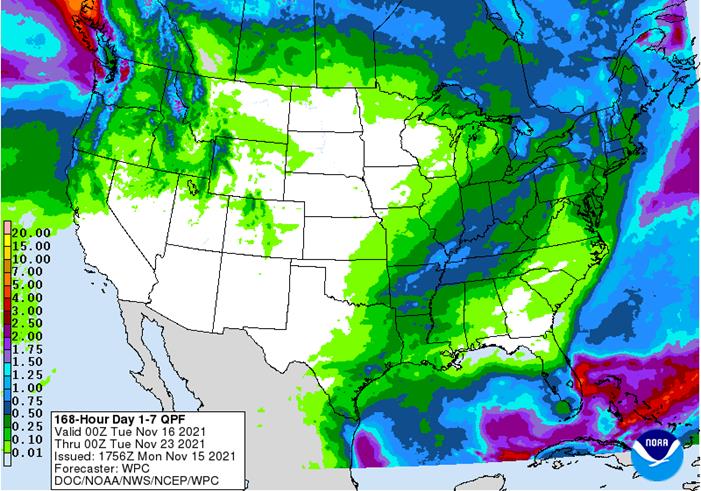

US saw light snow/rain over the weekend across the upper US (bias Dakotas into MI) preventing late harvesting and winter wheat plantings. Central and southern Great Plains were dry. The US WCB will see restricted rainfall over the next couple of weeks while

the ECB and Delta will see some waves of precipitation. Harvesting activity and fieldwork activity looks to be ok through the rest of the month. Argentina saw rain over the weekend and the outlook calls for a few brief periods of showers during the rest

of the month. Central Brazil saw rain over the weekend while the southern areas were mostly dry. Brazil will be active over the next 10 days. China is seeing winter grain planting delays.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

-

Not

many changes occurred overnight around the world -

U.S.

late season harvest weather will advance relatively well with lower eastern Midwest and Delta getting most of the coming ten days of rain -

Net

drying will occur in the U.S. hard red winter wheat areas, the southeastern states and interior parts of the Pacific Northwest as well as California into the southern Rocky Mountains and southwestern desert areas -

Canada’s

Prairies will see a mid-week blizzard this week -

Australia’s

wet biased weather will ease up for several days this week and then resume in the south keeping some interest on wheat, barley and canola conditions in that nation -

Southern

India will be wet biased for the next ten days and some of the moisture might not be welcome for early maturing crops in the region -

Russia

and Ukraine are turning too cold for winter crop development, but crops should be favorably established

-

North

Africa still needs rain throughout Morocco, northwestern Algeria and some interior crop areas of northeastern Algeria and Tunisia -

Brazil

and Argentina weather will be mostly good for crop development and fieldwork, despite net drying in southern Argentina

-

China’s

weather will be mixed, but mostly good for agriculture -

Central

Vietnam coastal flooding is expected this week -

Rain

fell in most of Argentina during the weekend with rainfall of 1.00 to 2.00 inches from western Buenos Aires to Chaco and western Corrientes -

All

other areas reported 0.10 to 1.00 inch of rain with western Cordoba, western Santiago del Estero and southeastern Buenos Aires driest.

-

Temperatures

were near to above average with highs in the upper 70s and 80s Fahrenheit in the south and in the 90s to near 100 in the north -

Argentina’s

rainfall will be most restricted in Buenos Aires, La Pampa and southern San Luis during the coming ten days, although not completely dry -

Rainfall

will be less than 0.75 inch with many of these areas experiencing net drying conditions -

Most

other areas in Argentina get rain periodically and sufficiently to support normal summer crop development and additional planting progress -

Rain

today into Tuesday will occur in 80% of the nation with 0.05 to 0.60 inch in the central and south while varying from 0.50 to 2.50 inches in the far north -

Rain

is expected in most of the nation again Nov. 21-23 with up to 0.40 inch in the south, 0.50 to 2.00 inches in central areas and 0.30 to 1.00 inch in the northeast

-

Scattered

showers will occur again Nov. 25-26 -

Brazil

weekend precipitation was greatest from Mato Grosso and Mato Grosso do Sul to Minas Gerais and Bahia -

Rainfall

varied from 0.10 to 1.00 inch with a few local totals of 1.00 to 2.25 inches -

Dry

weather occurred southern Goias and southern Minas Gerais Rio Grande do Sul -

Temperatures

were near to below average -

All

of Brazil will get rain periodically during the next ten days to two weeks -

Amounts

will be light in parts Rio Grande do Sul and parts of Parana, but sufficient to support crop needs -

Greater

volumes of rain may be needed a little later in the month and in December for these lighter rainfall areas to ensure normal summer crop development -

Rainfall

in these lighter rainfall areas will vary from 0.50 to 1.50 inches occurring mostly in two events; the first Tuesday and Wednesday of this week and the second being Monday through Wednesday of next week.

-

Rainfall

in most other areas will occur frequently enough to maintain or improve soil moisture with 10-day rain amounts of 2.00 to 4.00 inches and local amounts over 5.00 inches -

Portions

of Mato Grosso may be wettest -

In

contrast, portions of Bahia will receive less than 1.00 inch of rain and may experience net drying -

Both

Brazil and Argentina get timely rainfall over the next two weeks maintaining a mostly good environment for summer crop planting and development as well as winter wheat conditions in Argentina. Wheat harvest weather in southern Brazil will also remain very

good. Timely rainfall in corn, soybean, sorghum, cotton, rice, sugarcane, coffee and citrus areas should translate into good early season crop development as well as supporting aggressive late season planting and emergence.

-

U.S.

precipitation during the weekend scattered lightly across the Midwest with moisture totals mostly less than 0.20 inch -

Western

Michigan and north-central Indiana reported 0.50 to 1.28 inches of moisture while eastern Ohio reported up to 0.36 inch

-

Limited

rain fell in the Delta, although a few showers occurred in the north and the southeastern states were left dry -

Much

of the hard red winter wheat region was dry except for a few showers in the northeast -

The

southern Plains were dry -

Rain

fell in the Cascade Mountains and coastal areas of Washington and Oregon as well as the northern U.S. Rocky Mountains while the valleys of the Pacific Northwest were left dry.

-

No

rain fell in California or the southwestern desert region -

Temperatures

were colder than usual in the central U.S. and warmer than usual in the high Plains region and seasonable elsewhere -

Most

of the U.S. hard red winter wheat production area will be dry over the next two weeks -

A

few showers may impact Nebraska and some easternmost production areas will get rain, but amounts will not be very great in the areas that need moisture most

-

West

Texas cotton areas will be dry for the next two weeks with only a few brief bouts of precipitation expected

-

The

environment will be good for late season farming activity -

U.S.

western Corn Belt precipitation will be restricted over the next couple of weeks, but especially in the coming ten days.

-

Eastern

U.S. Midwest precipitation will come and go in waves over the next two weeks -

Rain

will fall today, Wednesday into Thursday, briefly Saturday and Nov. 23 as well as Nov. 26 -

In

each event rainfall varies from 0.15 to 0.60 inch with a few amounts of 0.60 to 1.25 inches Wednesday into Thursday -

Alternating

periods of sunshine and light precipitation will allow late season fieldwork to advance normally, although with more disruption than in the western Midwest -

U.S.

Delta rainfall is expected Wednesday into Thursday, next Sunday and Nov. 24-25

-

Rain

amounts this week and next Sunday will range from 0.10 to 0.60 with a few amounts of 0.60 to 1.30 inches possible infrequently -

U.S.

southeastern states will receive rain erratically Thursday into Friday and Sunday into Monday with Sunday into Monday the wettest event

-

Rain

totals Sunday into Monday will vary from 0.10 to 0.60 inch with a few amounts to 0.85 inch -

Any

showers that occur prior to that period will not be significant -

U.S.

Temperatures in this first week of the outlook will be above normal from the Great Basin and California through the central and southern Rocky Mountains and most of the Plains to the Delta and southeastern states while seasonable readings occur elsewhere -

U.S.

temperatures next week will be cooler than usual in the northern Plains and most of the Midwest and Atlantic Coast States; including the Delta and southeastern states -

Warmer

than usual weather will continue in the Great Basin, Rocky Mountain region and southwestern desert area as well as California, Washington and Oregon -

The

bottom line for U.S. weather over the next two weeks looks very good for late season harvest progress and winter wheat planting in the Midwest, Delta and southeastern states. The best drying conditions will be in the Great Plains and western Corn Belt. Some

western high Plains wheat areas will continue to be too dry and concern over crop establishment in unirrigated fields will remain. Some of the interior Pacific Northwest will continue to receive light amounts of rain during the next two weeks maintaining concern

for soil moisture in unirrigated crop areas. -

Australia

rain fell abundantly in Victoria and parts of New South Wales during the weekend -

Moisture

totals varied from 0.25 to 1.07 inches in Victoria with local totals to more than 2.00 inches -

Rain

in sugarcane areas of Queensland also ranged from 1.00 to 2.32 inches in a few areas while varying up to 1.00 inch elsewhere -

Rain

in New South Wales ranged from 0.25 to 1.57 inches -

South

Australia received up to 0.57 inch of moisture -

Temperatures

were cooler than usual in the southeast and seasonable elsewhere -

Net

drying is expected in Australia’s key winter, spring and summer crop areas through Thursday, although a few showers will occur erratically in the far south -

Victoria

and South Australia will get rain late Thursday into Saturday -

Some

of this rain will reach into New South Wales Friday into Saturday as well -

Additional

rain is expected in eastern Australia early next week followed by a few days of drying -

Mostly

dry weather then follows in key crop areas Nov. 24-27 -

Southeastern

Australia will continue cooler than usual this week and for a little while early next week while seasonable readings occur in many other areas -

Western

Australia will be driest over the next two weeks -

Queensland

will get some rain next week, but amounts will be light away from the border -

The

bottom line for Australia crops will remain mostly good, but a close watch on the frequency of rainfall in some of the late season crop areas where some risk to crop quality might evolve; however, as of today there is still no area that has been wet enough

for a long enough period of time to summer a decline in crop quality. Drier weather is needed, though especially in the southeast.

-

South

Africa rainfall through early next week will be most significant in the east, although it will be erratic with some areas getting greater rain than other areas -

Net

drying is expected in the west and the need for rain in unirrigated areas of the west will steadily rise

-

Some

of these areas will have a couple of chances for rain after Monday of next week that will bring an opportunity for improved topsoil moisture and better planting and emergence conditions -

Eastern

crop areas in South Africa will see the best planting, emergence and establishment conditions, but more rain will be needed

-

North

Africa coastal areas of central and eastern Algeria and northern Tunisia will get rain into Thursday of this week and then some additional rain next week -

Moderate

to locally heavy rain may occur in a few coastal areas, but inland areas will not receive much rain nor will northwestern Algeria or Morocco -

Morocco

will receive a few showers Thursday and Friday of this week, but resulting rainfall will not be great enough to seriously change soil moisture -

Southwestern

Morocco is still suffering from a multi-year drought -

Morocco

and northwestern Algeria will be dry again this weekend into next week leaving drought in place along with a big need for significant rain -

West-central

Africa rainfall has been and will continue be sporadic and light along near the coast from Ivory Coast to Cameroon and Nigeria over the next two weeks while interior crop areas are seasonably dry -

Temperatures

will be cooler than usual in coastal areas due to frequent showers while warmer than usual in the drier interior crop areas -

Cotton

will benefit from the dry and warm bias speeding along crop maturation and supporting some early harvesting -

Coffee,

cocoa, rice and sugarcane will benefit from periodic rain, but will be looking for drier weather later this month and next -

East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops -

Russia

and Ukraine winter crops are dormant or semi-dormant and will not develop very much over the next few months -

Soil

moisture is a little light in the Volga River Basin and parts of Ukraine, but now that crops are dormant there is very little need for moisture outside of snow cover ahead of any cold surges that might come along -

No

threatening cold is expected over the next ten days -

Snow

cover is expected to continue expanding to the west in Russia, but will stay north of Ukraine and north of the central portions of Russia’s Southern Region -

Some

snow cover is expected in the Baltic States and Belarus next week, but not this week -

Europe

precipitation during the weekend was mostly limited to the region from Italy to the U.K.

-

The

moisture was greatest in northern Italy where 0.88 to 2.80 inches -

Net

drying occurred in other parts of the continent -

Temperatures

have been cool enough in the east to put some winter crops into a semi-dormant state -

India

rainfall during the weekend was greatest from Karnataka and Kerala to Odisha and a few Jharkhand locations during the weekend -

Resulting

rainfall was greatest along the coast of Odisha and the upper coast of Andhra Pradesh where 2.50 to more than 4.00 inches resulted

-

A

few areas in southern Jharkhand, central Karnataka and interior southern Andhra Pradesh reported 1.00 to 2.67 inches except in southern coastal areas of Kerala where more than 5.00 inches resulted -

Rainfall

elsewhere varied from 0.05 to 0.88 inch -

Dry

weather occurred elsewhere -

Unsettled

weather will continue in southern India over the next ten days to two weeks -

The

wet bias may threaten early maturing cotton and rice and may also delay all kinds of field operations; including the maturation and harvest of many crops.

-

A

weak tropical cyclone in the Bay of Bengal will reach the Andhra Pradesh coast late this week before drifting inland during the weekend -

Moisture

from this storm may drift farther to the north in central India next week and a close watch on the distribution of rain is needed to determine its impact on summer crop harvesting in central India -

World

Weather, Inc. expects central India rainfall to be light and the moisture might eventually benefit winter crop planting, emergence and establishment while slowing fieldwork including the harvest of summer crops -

India’s

north will experience good harvest weather over the next week to ten days due to generally dry weather and seasonable temperatures -

Planting

of wheat, rapeseed, millet and other winter crops will advance swiftly as well -

Central

Vietnam coastal areas will receive additional excessive rain and flooding through Thursday -

Rainfall

through early this morning had reached 10.08 inches at Qui Nhon -

Additional

rain totals of 4.00 to 9.00 inches will be widespread from Hue through Da Nang and southward to north of Qui Nhon and south of Quang Ngai -

Flooding

will result and property damage is possible -

This

region experienced frequent floods in October -

The

area does not produce many crops -

Vietnam’s

Central Highlands should be west of the excessive rain event and mostly unaffected -

Heavy

rain was reported along the northern Malay Peninsula during the weekend with local totals of 5.00 to 11.18 inches

-

Flooding

resulted with some concern over a few crops of rice and sugarcane produced in the region -

Less

frequent and less significant rain is expected this week -

Northeastern

China’s weather will be dry biased through Wednesday -

Alternating

periods of rain and snow will occur in the region Thursday of this week through the first half of next week

-

The

moisture will maintain wet field conditions and if there is any late season harvest work left to be completely is may still be delayed for a while -

East-central

China will experience dry biased conditions through Thursday and then rain will develop Friday and Saturday before shifting farther to the south during the balance of the weekend -

East-central

China will be dry next week which will help rapeseed planting and other farming activities to advance favorably -

Recent

freezes in China’s wheat region had a low impact on crops, although warming is needed to allow late planted crops a little more time to establish prior to dormancy -

Warmer

biased conditions will return this week to help improve winter crop establishment -

Indonesia

and Malaysia weather will be favorably mixed over the next two weeks -

Sumatra

has experienced less significant rain in recent days which has helped reduce flood potentials after wet weather last week -

Sumatra

may continue to experience some net drying for a while this week and then trend wetter next week -

Most

other areas will get rain at one time another -

Heavy

rain fell during the weekend in central Kalimantan and interior western Java where 5.00 to more than 6.00 inches occurred in several areas -

In

contrast, Sumatra reported less than 0.75 inch with many areas dry -

Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks -

Mexico’s

weather will be drier biased for the next ten days except along the east coast where periodic rainfall is expected -

Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Guatemala -

Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days -

Coffee,

sugarcane, corn and a host of other crops may have been impacted by too much rain earlier this season resulting in some harvest delay -

Conditions

should be improving over the next ten days, although there will be a persistence of rain along the coast -

Today’s

Southern Oscillational Index was +6.70 and it was expected to move erratically over the next week

-

New

Zealand rainfall is expected to be above average along the west coast of South Island and near to below average elsewhere -

Temperatures

will be near to below normal

Monday,

Nov. 15:

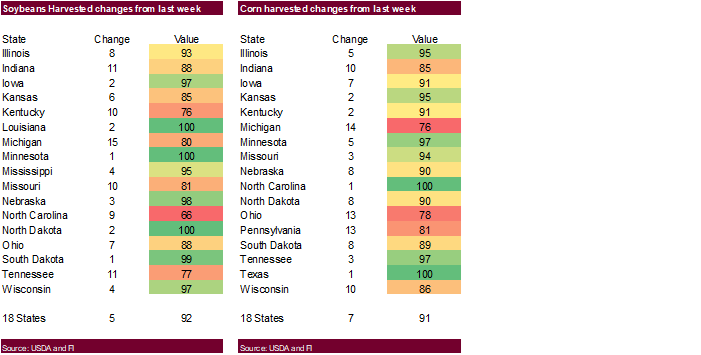

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

corn, soy and cotton harvested; winter wheat planted, 4pm - U.S.

Green Coffee Association releases monthly inventory data - Singapore

International Agri-Food Week, day 1 - UBS

Australasia Virtual Conference, day 1 - Ivory

Coast cocoa arrivals - Malaysia’s

Nov. 1-15 palm oil exports - HOLIDAY:

Brazil

Tuesday,

Nov. 16:

- EU

weekly grain, oilseed import and export data - Singapore

International Agri-Food Week, day 2 - UBS

Australasia Virtual Conference, day 2 - Global

Grain Geneva conference, day 1 - New

Zealand global dairy trade auction

Wednesday,

Nov. 17:

- EIA

weekly U.S. ethanol inventories, production - Singapore

International Agri-Food Week, day 3 - Global

Grain Geneva conference, day 2 - Brazil’s

Unica releases cane crush, sugar production data (tentative)

Thursday,

Nov. 18:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

FAS releases world sugar market balance, trade report, 3pm - China’s

trade data, including corn, wheat, sugar and cotton imports - International

Grains Council monthly report - Singapore

International Agri-Food Week, day 4 - Global

Grain Geneva conference, day 3 - Bloomberg

New Economy Forum: session on Feeding the World at 11:20am Singapore - USDA

total milk production, 3pm - Port

of Rouen data on French grain exports

Friday,

Nov. 19:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Saturday,

Nov. 20:

- China’s

third batch of October trade data, including soy, corn and pork imports by country

Source:

Bloomberg and FI

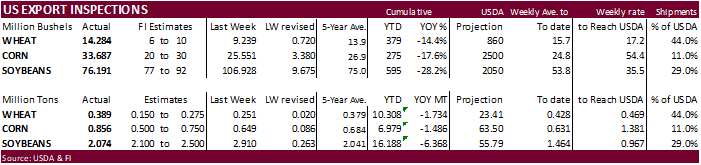

USDA

inspections versus Reuters trade range

Wheat

388,743 versus 150000-375000 range

Corn

855,698 versus 485000-750000 range

Soybeans

2,073,579 versus 1625000-2500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 11, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/11/2021 11/04/2021 11/12/2020 TO DATE TO DATE

BARLEY

0 0 2,096 9,743 14,258

CORN

855,698 649,023 862,235 6,978,566 8,465,039

FLAXSEED

0 0 0 24 413

MIXED

0 0 0 0 0

OATS

0 0 0 200 1,296

RYE

0 0 0 0 0

SORGHUM

7,497 7,698 187,358 511,569 977,422

SOYBEANS

2,073,579 2,910,100 2,530,722 16,188,121 22,556,586

SUNFLOWER

0 0 0 432 0

WHEAT

388,743 251,452 333,917 10,307,783 12,041,285

Total

3,325,517 3,818,273 3,916,328 33,996,438 44,056,299

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

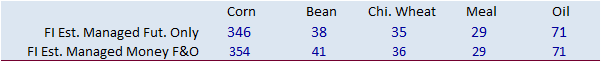

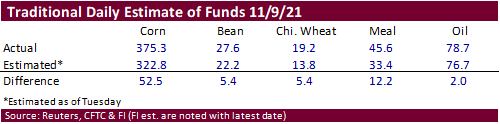

For

the second week in a row, the funds futures only net corn position was well off from estimates. They were off 53,000 (more long) than estimated. Previous week there were more long by 38,000 contracts.

US

Empire Manufacturing Survey Nov: 30.9 (est 22.0; prev 19.8)

–

New Orders Index: 28.8 (prev 24.3)

–

Prices Paid Index: 83.0 (prev 78.7)

–

Employment Index At: 36.9 (prev 17.1)

–

Six-Month Business Conditions Index: 36.9 (prev 52.0)

Canadian

Manufacturing Sales (M/M) Sep: -3.0% (est -3.1%; prev 0.5%)

–

Wholesale Trade Sales (M/M) Sep: 1.0% (est 1.1%; prev 0.3%)

78

Counterparties Take $1.392 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.418 Tln, 77 Bidders)

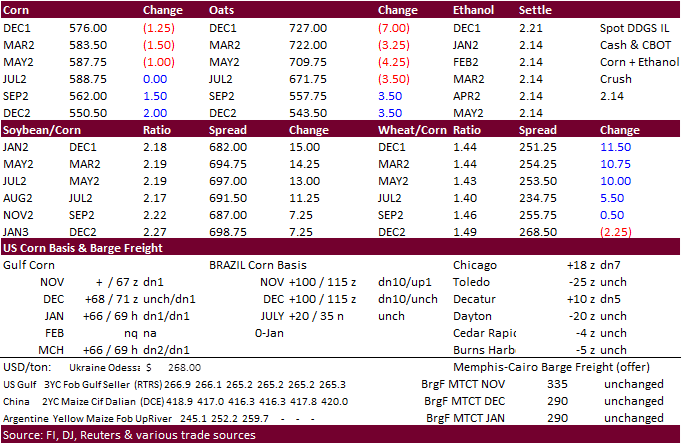

Corn

·

Corn futures traded

lower in the front months and ended lower which the back months rallied to close higher. News was quiet.

·

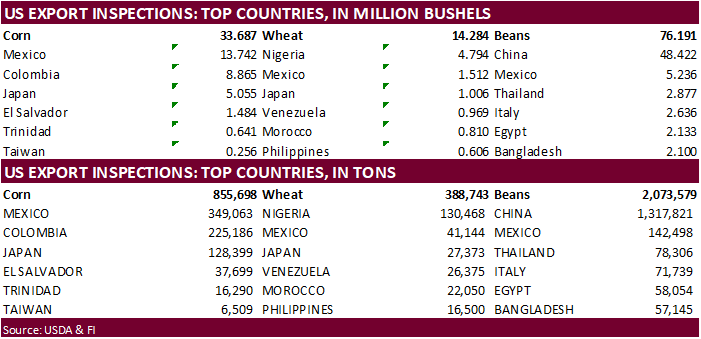

USDA US corn export inspections as of November 11, 2021 were 855,698 tons, above a range of trade expectations, above 649,023 tons previous week and compares to 862,235 tons year ago. Major countries included Mexico for 349,063

tons, Colombia for 225,186 tons, and Japan for 128,399 tons.

·

Reuters noted China bought 300-700 thousand tons of Ukraine corn last week at $330-$335/ton c&f for Jan/Mar shipment.

·

Traders will be monitoring news over US/China talks that began today.

·

Covid-19 concerns could be back on the table this week as selected countries are seeing a spike in cases and/or partial lockdowns.

·

Bird Flu continues to spread across Europe with Norway the latest country to report an outbreak. South Korea and Japan have also reported outbreaks this year, but it seems the bigger problem is within Europe now.

·

German reported an outbreak of ASF in east Germany in farm pigs.

Export

developments.

-

Turkey

bought 325,000 tons of corn at $310.45-$322.90/ton for shipment sought between Dec. 20 and Jan. 20. -

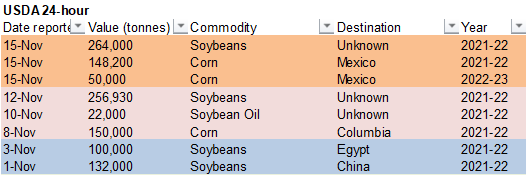

USDA

reported 148,200 tons of corn sold to Mexico for 2021-22 marketing year and 50,000 tons of 2022-23 corn sold to Mexico.

Updated

11/15/21

December

corn is seen in a $5.45-$5.90 range

March

corn is seen in a $5.25-$6.25 range

·

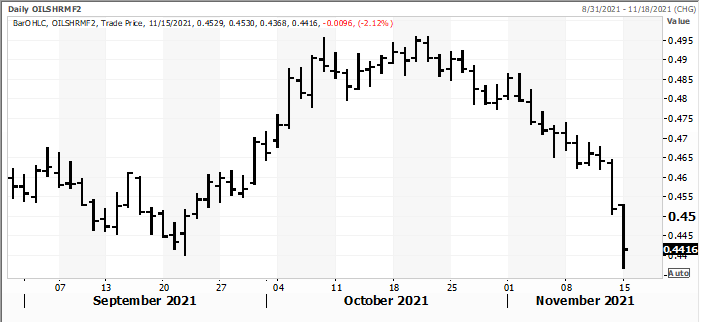

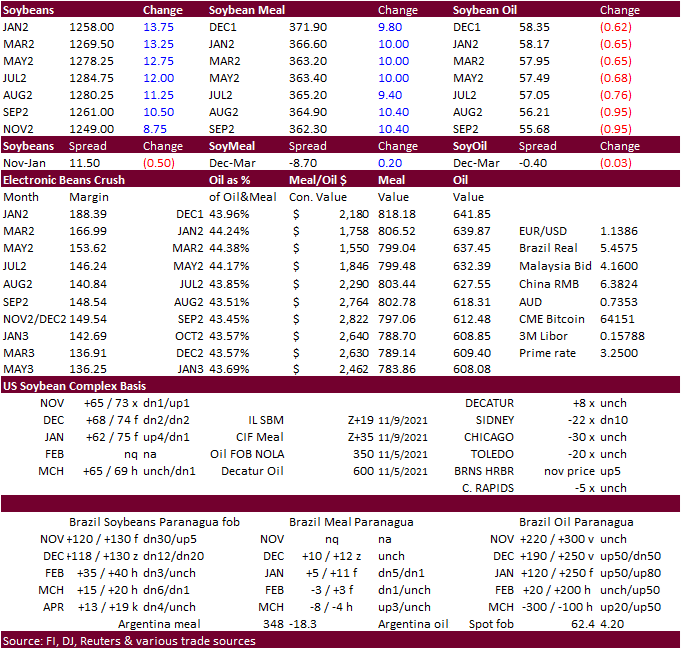

CBOT soybean

complex was mixed with follow through buying in soybean meal (strong domestic demand and poor NOPA meal yield), lower soybean oil (spreading and large NOPA stocks) and higher soybeans (24-hour sales, good inspections, and higher than expected October crush).

·

December meal hit buy stops after trading through its 200-day $366 resistance level, which was also its Friday high.

·

We understand the shortage of lysine is forcing processor to increase the amount of soybean meal in their feed mixture.

https://www.nationalhogfarmer.com/news/l-lysine-shortage-impacts-diet-formulation

·

Brazil was on holiday.

·

AgRural noted Brazil was 78 percent planted for soybeans as of late last week, 8 points above last year.

·

USDA US soybean export inspections as of November 11, 2021 were 2,073,579 tons, within a range of trade expectations, below 2,910,100 tons previous week and compares to 2,530,722 tons year ago. Major countries included China for

1,317,821 tons, Mexico for 142,498 tons, and Thailand for 78,306 tons.

·

China is proposing to ease rules on GMO seeds.

·

Cargo surveyor SGS reported month to date November 15 Malaysian palm exports at 911,875 tons, 207,412 tons above the same period a month ago or up 29.4%, and 249,499 tons above the same period a year ago or up 37.7%. AmSpec reported

November 1-15 Malaysian palm oil exports at 798,399 tons, up from a revised 723,561 tons during the same period in October. ITS reported a 26.6% increase to 882,385 tons.

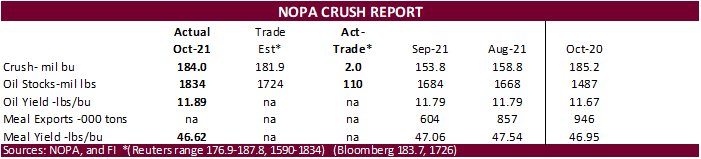

NOPA

reported the October crush at 184 million bushels, 2 million above trade expectations and third largest in history, but below 185.2 million a year ago. Note figures this month reflects the withdrawal of one NOPA member from reporting. They also dropped soybean

meal exports from the report. The daily crush rate of 5.94 million bushels per day is up from 5.13 during September and fourth for any month in NOPA’s history, and down from 5.98 million crushed during October 2020. NOPA’s soybean oil stocks at the end of

October of 1.834 billion pounds were 110 million above trade expectations, above 1.684 billion at the end of September and above 1.487 billion year ago. Soybean oil stocks are up four consecutive months and highest since May 2020. Soybean oil stocks were

also up in every region from previous month. The large stocks are due in part to a very high soybean oil yield of 11.89 pounds per bushel (up from 11.67 pounds year ago). Soybean oil production for October ended up at a record 2.187 billion pounds, for any

month. We will likely raise our crop-year soybean oil yield if the November NOPA yield verifies the large year on year increase. NOPA’s October soybean meal yield hit a multi-year low (for all months).

Jan

Share traded as low as .4368 (On 10/20 it traded .4946)

Export

Developments

- Under

the 24-hour reporting system, USDA reported 264,000 tons of soybeans sold to unknown for 2021-22 delivery.

- Egypt’s

GASC on November 16 (Tuesday) seeks at least 30,000 tons of soybean oil and 10,000 tons of sunflower oil for arrival from Jan.10-30 and it will pay under a 180-day deferred payment system , or at sight. Egypt is also in for local vegetable oils.

- South

Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

Updated

11/15/21

Soybeans

– January $12.00-$13.50 range, March $12.00-$13.50

Soybean

meal – December $350-$395, January $340-$390, March $325-$400

Soybean

oil – December 55.60-59.50 cent range, January 55.00-60.50, March 56-64

·

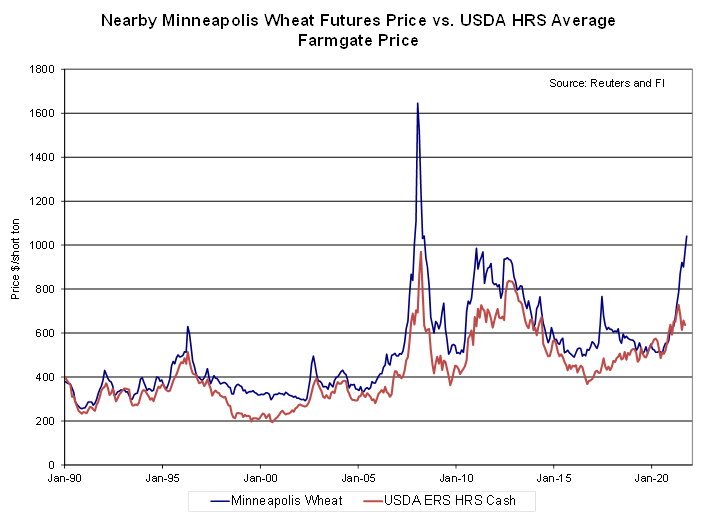

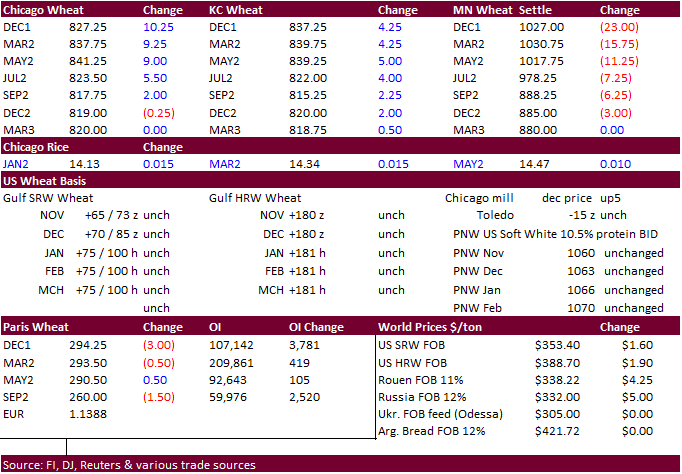

US wheat futures traded mixed with nearby Chicago and KC higher and Minneapolis sharply lower led by the December to the downside. Global import tender developments over the weekend were thought to be supportive. Algeria did

delay their import tender. USDA export inspections exceeded expectations.

·

Chicago wheat hit a 9-year high.

·

Long liquidation in Minneapolis was likely related to overbought conditions, the upper Great Plains seeing precipitation over the weekend, and increase in Russian wheat exports last week, in addition to the wide discrepancy between

the USDA average farmgate cash price for hard red spring wheat and the Minneapolis contract (see chart below).

·

USDA US all-wheat export inspections as of November 11, 2021 were 388,743 tons, above a range of trade expectations, above 251,452 tons previous week and compares to 333,917 tons year ago. Major countries included Nigeria for

130,468 tons, Mexico for 41,144 tons, and Japan for 27,373 tons.

·

The upper Great Plains and Midwest saw winter grain planting delays over the weekend and central and southern Great Plains were dry.

·

December Paris wheat was down 3.00 euros at 294.75/ton.

·

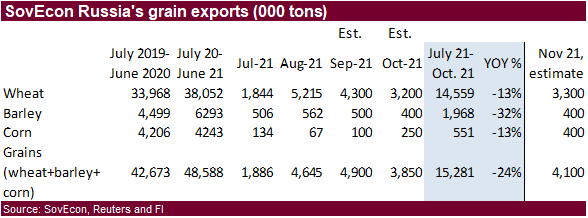

Russia’s wheat exports as of November 11 reached 700,000 tons despite higher export taxes, a 14 percent increase from the previous week. Season to date is 16.6 million tons, 16% below the same pace year ago.

·

SovEcon estimated July – October Russian wheat exports down 13 percent.

USDA

ERS:

U.S.

Wheat Price Projected at 9-Year High

The

2021/22 Season-Average Farm Price (SAFP) is raised 20 cents per bushel to $6.90 based on the continued strong farmgate prices as reported in the October 29 National Agricultural Statistics Service (NASS) Agricultural Prices report as well as rising futures

and cash prices. The September 2021 all-wheat farmgate price was estimated at $7.55, which is up from $7.13 in August 2021 and 63 percent above the $4.73 in September 2020. Through the last month, futures prices have surged higher, reaching contract highs

on November 1 before trending down this week. Most notably, the Minneapolis spring wheat contract gained 16 percent from October 1 and reached $10.75 per bushel, the highest since July 2008. This futures rally contributes to the expectation that the farmgate

wheat price in the coming months will continue to remain robust.

Note

the hard red spring average farmgate price declined from $8.00/bu to $7.94/bu for September, and White wheat surged from $6.99/bu to $8.27/bu.

Some

US wheat cash prices are not keeping up with futures, such as hard red spring.

Export

Developments.

·

Algeria suspended negotiations in buying at least 50,000 tons of milling wheat and may buy on Tuesday. Reuters noted shipment is for three periods from the main supply regions including Europe: in 2021 between Dec. 16-31, and

in 2022 between Jan. 1-15 and Jan. 16-31. If sourced from South America or Australia, the shipment is one month earlier. They increased the insect-damage limit to 1 percent from 0.5 percent.

-

Taiwan

seeks 48,000 tons US wheat on November 18 for shipment in 2022 from the U.S. Pacific Northwest coast between Jan. 9 and Jan. 23.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

·

Jordan seeks 120,000 tons of feed barley on November 17.

·

Bangladesh’s state grains buyer seeks 50,000 tons of milling wheat on November 22.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

Rice/Other

·

South Korea sees their rice production rising for the first time in 6 years, to 3.88 million tons for 2021, up 10.7 percent from 2020.

Updated

11/15/21

December

Chicago wheat is seen in a $7.80‐$8.40 range, March $7.50-$8.75

December

KC wheat is seen in a $7.90‐$8.75, March $7.50-$8.75

December

MN wheat is seen in a $9.75‐$10.60, March $9.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.