PDF Attached

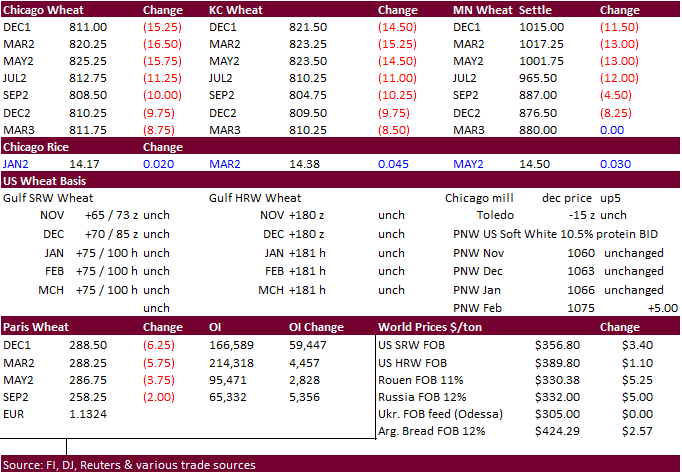

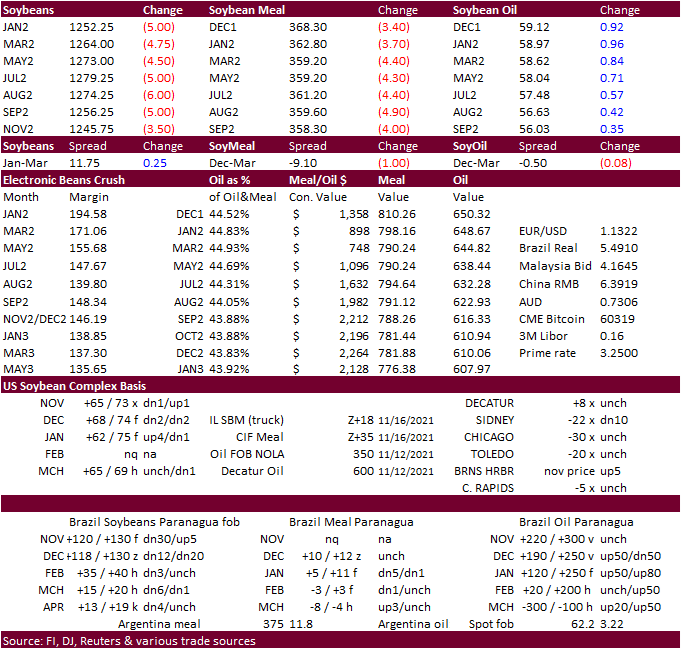

Soybeans,

meal, corn and wheat were lower. Soybean oil traded higher on product spreading. USD was up more than 40 points today to a 16-month high.

Lack of direction from the US/China talks ignited some profit taking. Algeria bought wheat and origin

was thought to be Russian, which pressured US and EU wheat futures. Egypt bought international sunflower oil and local soybean oil.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Well-timed

rainfall is still expected in both Brazil and Argentina over the next ten days - Sufficient

rain will support ongoing field progress; including the planting of summer crops and the advancement of early planted grain and oilseeds - Coffee,

citrus and sugarcane will remain in mostly good condition as well - Winter

crop harvesting in the south of Argentina and southern Brazil will advance around the expected rain - Australia’s

greatest rainfall will be near the coasts leaving most interior crop areas dry for a while - The

environment will be good for winter crop maturation and harvest progress - Summer

crop planting will also advance favorably following recent rain - More

moisture is needed in Queensland and western parts of New South Wales where range and pasture conditions are still not ideal, although improving - Unirrigated

summer crops in these areas also need a boost in precipitation - Western

grain, oilseed and cotton production areas of South Africa need greater rain to support dryland planting and early season crop development - Irrigated

summer crops in South Africa are in good condition with little change likely - Eastern

dryland production areas in South Africa will get some timely rainfall in the next ten days to support improved planting and early season crop development potential - Southern

India will get too much rain over the next week to ten days and drier weather is needed to protect grain, oilseed and cotton quality - Local

flooding is possible, but the biggest concern is over field working delays and crop quality issues - Drying

is expected but not until late this month - West-central

India will receive rain briefly Wednesday into Saturday of this week - The

moisture will disrupt cotton, rice, corn, soybean and peanut harvesting - Most

of the precipitation will be too light and brief to raise a serious threat to crop quality, but the situation should be closely monitored - Northern

India weather will remain ideal for planting winter crops and late season harvesting of summer crops - Winter

crops areas in Russia’s Volga River Basin and neighboring areas of Ukraine will receive some light precipitation in this coming week, but today’s forecast models increase precipitation potentials for the second week of the outlook, Nov. 24-30.

- The

moisture boost would be good for winter crop use in the spring - Winter

crops are dormant or semi-dormant today - Increasing

snow cover in the western CIS throughout the next two weeks will help protect winter crops that might not have been as well as established as desired this autumn - There

is no threatening cold weather coming, but cooling is expected in many areas of western Russia in the Nov. 24-30 period - China’s

most active weather is expected in the far northeast and south of the Yangtze River during the next ten days - Most

other areas will see a good mix of rain and sunshine which will prove very good for rapeseed planting and establishment - Much

of the 2022 wheat and barley crop should be planted and favorably established - Vietnam

central coastal areas will continue to receive frequent rainfall during the next ten days to two weeks, but the precipitation is not likely to be quite as persistent and heavy as that seen in previous weeks - Drier

weather will still be needed, though - Rainfall

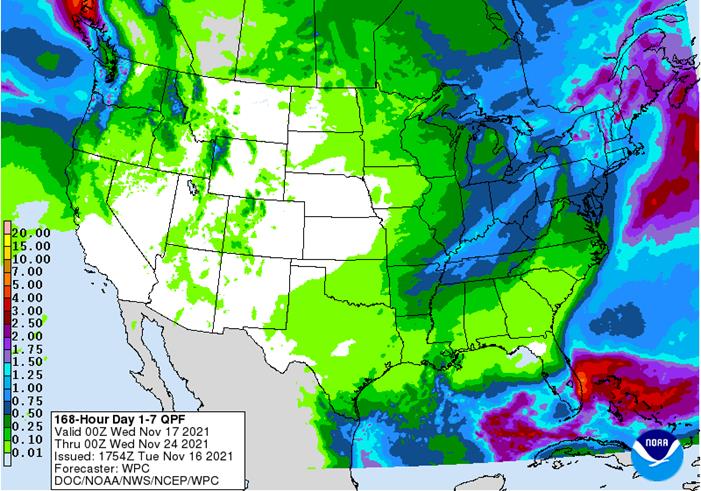

of 3.00 to 9.00 inches may occur over the next seven days - U.S.

weather outlook has not changed much since Monday - Hard

red winter wheat areas will be mostly dry for the next ten days - West

Texas cotton areas will be mostly dry for next ten days - U.S.

southeastern states will see restricted rainfall over the next ten days - U.S.

Delta weather will likely be among the wettest causing some periodic delays to farming activity

- U.S.

northern Plains precipitation will be limited over the next ten days and drought will prevail in the west - U.S.

Pacific Northwest precipitation will continue limited in the valleys, but frequent in the mountains - Not

much precipitation will occur in California, the Great Basin, southwestern desert areas or the southern Rocky Mountain region during the next ten days - Much

of Mexico will continue dry biased over the next ten days except along the lower east coast where some rain is expected periodically - This

is seasonal drying - Canada’s

Prairies will be subjected to blizzard conditions over the next two days - Moisture

content in the snow expected will be low, but welcome wherever it occurs - North

Africa coastal areas of central and eastern Algeria and northern Tunisia will get rain into Thursday of this week and then some additional rain next week - Moderate

to locally heavy rain may occur in a few coastal areas, but inland areas will not receive much rain nor will northwestern Algeria or Morocco - Morocco

will receive a few showers Thursday and Friday of this week, but resulting rainfall will not be great enough to seriously change soil moisture - Southwestern

Morocco is still suffering from a multi-year drought - Morocco

and northwestern Algeria will be dry again this weekend into next week leaving drought in place along with a big need for significant rain - West-central

Africa rainfall has been and will continue be sporadic and light along near the coast from Ivory Coast to Cameroon and Nigeria over the next two weeks while interior crop areas are seasonably dry - Temperatures

will be cooler than usual in coastal areas due to frequent showers while warmer than usual in the drier interior crop areas - Cotton

will benefit from the dry and warm bias speeding along crop maturation and supporting some early harvesting - Coffee,

cocoa, rice and sugarcane will benefit from periodic rain, but will be looking for drier weather later this month and next - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Indonesia

and Malaysia weather will be favorably mixed over the next two weeks - Sumatra

has experienced less significant rain in recent days which has helped reduce flood potentials after wet weather last week - Sumatra

may continue to experience some net drying for a while this week and then trend wetter next week - Most

other areas will get rain at one time another - Heavy

rain fell during the weekend in central Kalimantan and interior western Java where 5.00 to more than 6.00 inches occurred in several areas - In

contrast, Sumatra reported less than 0.75 inch with many areas dry - Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Guatemala - Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days - Coffee,

sugarcane, corn and a host of other crops may have been impacted by too much rain earlier this season resulting in some harvest delay - Conditions

should be improving over the next ten days, although there will be a persistence of rain along the coast - Today’s

Southern Oscillational Index was +6.11 and it was expected to move erratically over the coming week - New

Zealand rainfall is expected to be above average along the west coast of South Island and near to below average elsewhere - Temperatures

will be near to below normal

Tuesday,

Nov. 16:

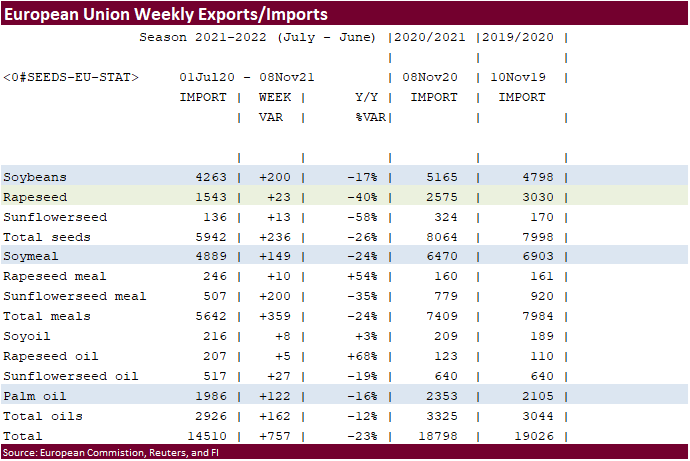

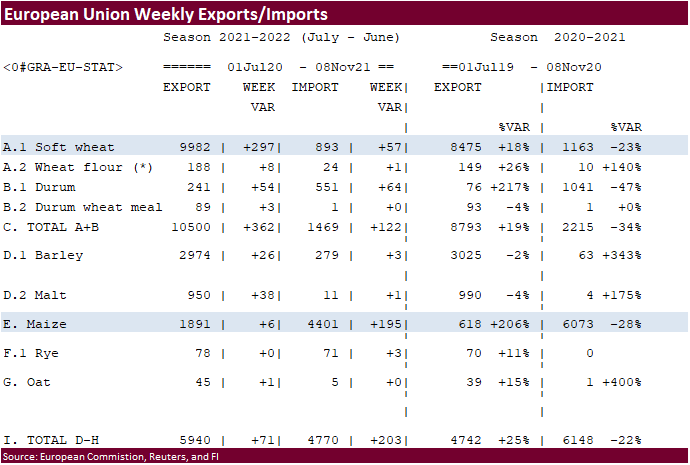

- EU

weekly grain, oilseed import and export data - Singapore

International Agri-Food Week, day 2 - UBS

Australasia Virtual Conference, day 2 - Global

Grain Geneva conference, day 1 - New

Zealand global dairy trade auction

Wednesday,

Nov. 17:

- EIA

weekly U.S. ethanol inventories, production - Singapore

International Agri-Food Week, day 3 - Global

Grain Geneva conference, day 2 - Brazil’s

Unica releases cane crush, sugar production data (tentative)

Thursday,

Nov. 18:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

FAS releases world sugar market balance, trade report, 3pm - China’s

trade data, including corn, wheat, sugar and cotton imports - International

Grains Council monthly report - Singapore

International Agri-Food Week, day 4 - Global

Grain Geneva conference, day 3 - Bloomberg

New Economy Forum: session on Feeding the World at 11:20am Singapore - USDA

total milk production, 3pm - Port

of Rouen data on French grain exports

Friday,

Nov. 19:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Saturday,

Nov. 20:

- China’s

third batch of October trade data, including soy, corn and pork imports by country

Source:

Bloomberg and FI

Corn

90.8, down 1.6 million from previous. 2021 USDA 93.304

Soybeans

87.9, up 600,000 from previous. 2021 USDA 87.235

All

wheat 49.4, up 570,000 from previous. 2021 USDA 46.703

80

Counterparties Take $1.467 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.392 Tln, 78 Bidders)

Canadian

Housing Starts Oct: 236.6K (est 255.0K; prev 251.2K; prevR 249.9K)

US

Retail Sales Advanced (M/M) Oct: 1.7% (est 1.5%; prev 0.7%; prevR 0.8%)

–

Retail Sales Ex-Auto (M/M) Oct: 1.7% (est 1.0%; prev 0.8%; prevR 0.7%)

–

Retail Sales Ex-Auto And Gas Oct: 1.4% (est 0.7%; prev 0.7%; prevR 0.5%)

–

Retail Sales Control Group Oct: 1.6% (est 0.9%; prev 0.8%; prevR 0.5%)

US

Import Price Index (M/M) Oct: 1.2% (est 1.0%; prev 0.4%)

–

Import Price Index Ex-Petroleum (M/M) Oct: 0.5% (est 0.3%; prev 0.1%; prevR 0.2%)

–

Import Price Index (Y/Y) Oct: 10.7% (est 10.3%; prev 9.2%; prevR 9.3%)

–

Export Price Index (M/M) Oct: 1.5% (est 1.0%; prev 0.1%; prevR 0.4%)

–

Export Price Index (Y/Y) Oct: 18.0% (prev 16.3%; prevR 16.5%)

US

Industrial Production (M/M) Oct: 1.6% (est 0.9%; prev -1.3%)

–

Capacity Utilization Oct: 76.4% (est 75.9%; prev 75.2%)

–

Manufacturing (SIC) Production Oct: 1.2% (est 0.8%; prev -0.7%)

Corn

·

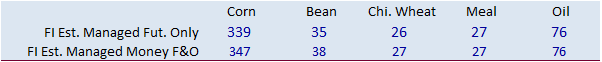

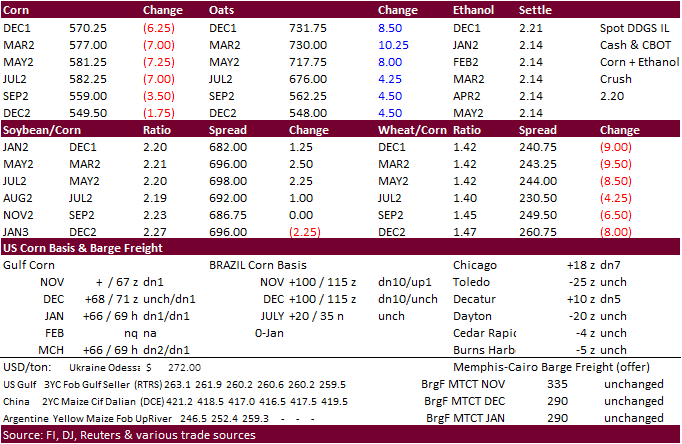

Corn futures traded

lower led by bear spreading on weakness in wheat and a higher USD. US export demand is starting to pick up. USDA announced Mexico bought 270,000 tons of corn under the 24-hour reporting system. Funds sold an estimated net 7,000 corn contracts.

·

The USD was up more than 40 points to a 16-month high by early afternoon trading, ahead of US economic reports due out later this week.

·

We are hearing new-crop corn delivered to the PNW is in good shape, similar to a year ago.

·

The US weather forecast was largely unchanged and US corn harvest is nearing completion.

Argentina

apparently will distribute 1.0 million tons of old crop corn licenses and 500,000 new crop wheat.

·

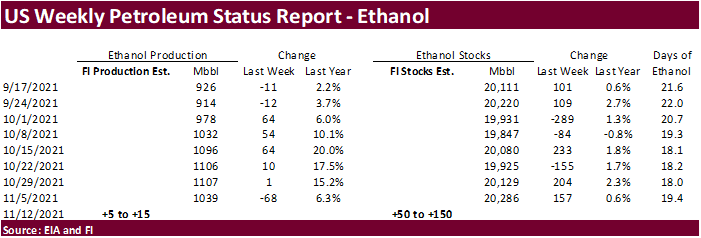

A Bloomberg poll looks for weekly US ethanol production to be up 19,000 barrels to 1.058 million (1030-1100 range) from the previous week and stocks up 155,000 barrels to 20.441 million.

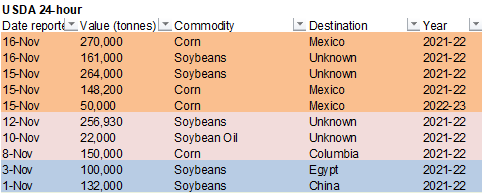

Export

developments.

·

Under the 24-hour reporting system, private exporters sold 270,000 tons of corn to Mexico for 2021-22 delivery.

·

South Korea’s NOFI group bought 68,000 tons of corn at around $318.90/ton c&f for arrival around February 15. Another news source mentioned SK’s NOFI bought up to 137,000 tons of corn at 277 cents over the March and $319.53/ton.

-

Turkey

bought 325,000 tons of corn at $310.45-$322.90/ton for shipment sought between Dec. 20 and Jan. 20.

Updated

11/15/21

December

corn is seen in a $5.45-$5.90 range

March

corn is seen in a $5.25-$6.25 range

·

CBOT soybeans

ended lower, meal lower (nearby contracts traded two-sided), and soybean oil sharply higher (product spreading). Some of the weakness in soybeans was from lack of developments from the US/China talks, and confirmation of big soybean sales. Last week there

was speculation China would secure large amounts of US soybeans ahead or during the meetings. USDA did however announce 161,000 tons of soybeans were sold to unknown.

·

Funds sold an estimated net 3,000 soybeans, sold 2,000 soybean meal and bought 5,000 soybean oil.

·

Lower soybeans, higher meal (before it turned lower) and higher soybean oil pulled the January crush above $2.00/bu (Jan soybeans and Jan products). It settled 7.75 cents higher at $1.95. On a nearby contract rolling basis,

last time crush reached $2.00 was July 2018.

·

Egypt bought 12,000 tons of sunflower oil and local soybean oil for Jan 10-30 arrival.

·

Argentina will trend drier for the balance of the week.

·

Argentina’s opposition group won the mid-term election and they now have majority control of the senate. Some believe export taxes on agriculture goods will not increase going forward, but more importantly traders will need to

monitor how the government will deal with the IMF. Either Argentina agrees with the IMF or choose to go to default. Argentina will likely renegotiate with the IMF, so keep an eye on developments . This might become a hot topic through at least the end of

the year.

·

German oilseeds industry association UFOP estimated Germany’s winter rapeseed planted area at around 1.03 to 1.08 million hectares versus 991,000 hectares sowed in 2021.

·

SEA reported India’s palm oil imports in 2020-21 increased 15.2% from a year ago to 8.32 million tons. Soybean oil imports fell 15% to 2.87 million tons. India all vegetable oil imports were 13.53 million tons, slightly above

13.52 million tons a year ago. Although import volume was near unchanged, they paid a record $15.7 billion, up 63% from 2020-21.

·

China soybean futures were down 0.9%, meal 0.9% higher, SBO near unchanged, and palm up 0.8%.

Export

Developments

- Egypt’s

GASC bought 12,000 tons of sunflower oil for Jan 10-30 arrival at $1,425/ton. They passed on soybean oil for the international import tender but bought 8,000 tons of local soybean oil

at

about $1,377.7 per ton for arrival Jan. 1-20. Earlier the lowest

offers for the international import tenders were $1,439 per ton c&f for 30,000 tons of soyoil and $1,425 per ton c&f for 12,000 tons for sunflower oil. Egypt last bought soybean oil in an international tender back on October 5 at around $1,390 per ton.

·

Under the 24-hour reporting system, private exporters sold 161,000 tons of soybeans to unknown for 2021-22 delivery.

·

Turkey seeks 6,000 tons of sunflower oil on November 23 for December shipment.

- South

Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

Updated

11/15/21

Soybeans

– January $12.00-$13.50 range, March $12.00-$13.50

Soybean

meal – December $350-$395, January $340-$390, March $325-$400

Soybean

oil – December 55.60-59.50 cent range, January 55.00-60.50, March 56-64

·

US wheat futures traded lower from a higher USD, light fund selling, and SK passing on feed wheat. EU wheat traded lower, in part on talk of Algeria buying Russian origin wheat, passing on EU. Funds were net sellers of an estimated

net 9,000 Chicago soft red winter wheat contracts.

·

Due to a large amount of flooding across interior BC, Canada, all rail service to and from the Port of Vancouver was suspended.

·

December Paris wheat was down 6.25 euro at 289.00/ton.

·

(Bloomberg) — Ukraine’s wheat crop may decline to 27.1m tons in 2022 from 31.9m tons this year due to challenging weather, consultant SovEcon said in an emailed note.

Export

Developments.

·

Algeria started buying milling wheat today. Amounts are unclear but up to 600,000 tons was noted by two sources. Most of the origin was thought to be Russian. Initial estimates of purchase price were around $382.50 to $384.00

a ton c&f for shipment in both the second half of December 2021 and in January 2022. They increased the insect-damage limit to 1 percent from 0.5 percent.

·

SK’s NOFI passed on 2 cargoes of feed wheat.

·

Turkey seeks 320,000 tons of feed barley on November 23 for January shipment.

·

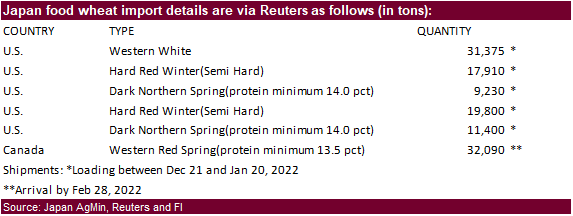

Japan seeks 121,805 tons of food wheat this week.

·

The Philippines seek four cargoes of feed wheat for late Jan through early April shipment on November 17.

·

Jordan seeks 120,000 tons of feed barley on November 17.

-

Taiwan

seeks 48,000 tons US wheat on November 18 for shipment in 2022 from the U.S. Pacific Northwest coast between Jan. 9 and Jan. 23.

·

Bangladesh’s state grains buyer seeks 50,000 tons of milling wheat on November 22.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

None reported

Updated

11/15/21

December

Chicago wheat is seen in a $7.80‐$8.40 range, March $7.50-$8.75

December

KC wheat is seen in a $7.90‐$8.75, March $7.50-$8.75

December

MN wheat is seen in a $9.75‐$10.60, March $9.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.