PDF Attached

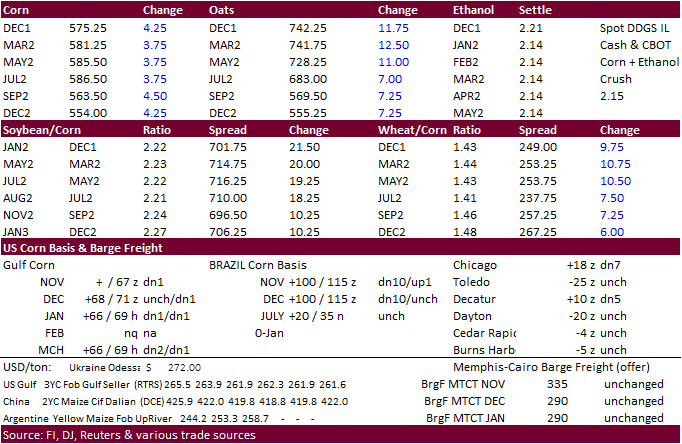

USDA:

Private exporters reported sales of

132,000

metric tons of soybeans for delivery to China during for 2021-22

30,000

metric tons of soybean oil for delivery to India for 2021-22

Higher

trade led by the soybean complex. Lysine shortages forcing domestic feeders to turn to using more soybean meal and export business to China and India supported soybeans & soybean oil.

The

US Great Plains will remain mostly dry through the end of the week. The Midwest will see rain across the northwestern areas today then the central and southern areas through Saturday. Brazil looks good over the next week.

Some areas of southern Brazil will remain dry through the end of the month. Argentina will trend drier for the balance of the week.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

-

Argentina

is advertised to be drier in the central and south during much of the next ten days and possibly for two weeks -

Completely

dry weather is not expected, but rainfall will be inadequate to counter evaporation as temperatures trend in a seasonable range -

Rain

will fall a little more often in the north favoring grain, oilseed and cotton crops -

Brazil

will experience a good mix of rain and sunshine throughout the nation during the next ten days -

Crop

development will advance quite favorably whether it is corn, soybeans, cotton, rice, sugarcane, citrus, coffee or cocoa -

Relief

to dryness is expected in Sao Paulo, far southern Minas Gerais and northern Parana where rainfall has been limited for the longest period of time -

Southern

Brazil may trend a little drier in the last days of this month, but no serious crop stress is expected -

Temperatures

will continue seasonable to slightly cooler than usual which will help to conserve soil moisture through lower evaporation -

Australia

weather has already begun to improve after too much rain earlier this month -

Victoria

and South Australia should be wettest in the coming week along with a few southern New South Wales locations -

The

moisture will fall in some of the most immature winter crop areas which should spare its impact -

Most

of the wheat, barley and canola areas that are ready for harvesting will receive very little rainfall during the next week to ten days allowing the wetter areas to dry down and to support aggressive crop maturation and harvest progress -

Planting

of sorghum, cotton and other crops in Queensland and northern New South Wales will advance well after recent rain, though more precipitation is needed -

Southern

India continues to get frequent rain and there is an expanding region of excessive moisture -

Flood

potentials will likely rise during the next week to ten days as rain frequency stays high -

Cotton,

rice and sugarcane quality declines are already suspected in a few areas and more of the same is expected through the next full week especially from Karnataka, Kerala and Tamil Nadu into Andhra Pradesh and a part of southern Telangana

-

West-central

India will receive some showers today through Friday inducing some disruption to summer crop maturation and harvesting -

The

areas impacted will be Gujarat, northern Maharashtra, western Madhya Pradesh and southern Rajasthan.

-

The

rain is not likely to be persistent or heavy enough to induce a serious threat to crop conditions, but fieldwork will be stalled briefly and worry will rise for many producers -

Cotton

is most at risk of a quality change, but as along as drier weather returns during the weekend and lasts through next week as expected the impact should be low -

China

will experience another late week and weekend snowstorm in Heilongjiang and Jilin as cold air pushes into the east-central and northeastern parts of the nation -

Snowfall

of several inches is expected causing travel delays -

Winter

crops in the north are unlikely to be negatively impacted by colder weather this weekend into early next week, although new crop development will be slowed and some crops may be pushed into semi-dormancy -

China’s

rapeseed planting and establishment will continue advance in east-central China under favorable weather and field conditions -

Much

of southeastern Asia will see alternating periods of rain and sunshine -

This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia -

Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome -

Western

summer crop areas in South Africa still have need for rain, but the region may have to wait until next week for rain to evolve -

Eastern

South Africa crops areas will experience more frequent rainfall in the next ten days favoring a boost in soil moisture, better summer crop planting conditions and improved early season crop development -

Parts

of Morocco will receive much needed rain late this week and early in the weekend, but resulting amounts will be sporadic and mostly too light to seriously change topsoil moisture or water supply -

Drought

has been prevailing for a few years and substantial rain is needed to improve water supply and soil moisture enough to support winter crop planting -

Some

follow up showers may occur late next week, but greater rain will still be needed -

Northern

Algeria and coastal areas of Tunisia have the greatest soil moisture in all of northern Africa

-

Winter

crop planting conditions will be best in these areas, but more rain is needed farther inland and that is not likely to occur for a while -

West-central

Africa rainfall has been and will continue be sporadic and light along near the coast from Ivory Coast to Cameroon and Nigeria over the next two weeks while interior crop areas are seasonably dry -

Temperatures

will be cooler than usual in coastal areas due to frequent showers while warmer than usual in the drier interior crop areas -

Cotton

will benefit from the dry and warm bias speeding along crop maturation and supporting some early harvesting -

Coffee,

cocoa, rice and sugarcane will benefit from periodic rain, but will be looking for drier weather later this month and next -

East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops -

Parts

of Spain may get some needed rain this weekend with a part of that precipitation expected to reach into France early next week -

The

moisture will be welcome for winter crop planting and for moistening the topsoil after a long dry season -

The

remainder of Europe will experience a mostly tranquil weather pattern with infrequent precipitation of light intensity

-

Winter

crop planting should be winding down in many areas with eastern parts of the continent cool enough for crops to be semi-dormant -

Western

parts of Russia, the Baltic States, Belarus and a few neighboring areas will experience some gradual increase in snow cover during the next ten days -

Precipitation

in Ukraine is expected to be limited for a while and amounts in Russia’s Volga Basin should be light for a while.

-

Vietnam

central coastal areas will continue to receive frequent rainfall during the next ten days to two weeks, but the precipitation is not likely to be quite as persistent and heavy as that seen in previous weeks -

Drier

weather will still be needed, though -

Rainfall

of 3.00 to 9.00 inches may occur over the next seven days -

U.S.

weather outlook has not changed much since Tuesday -

Hard

red winter wheat areas will be mostly dry for the next ten days -

West

Texas cotton areas will be mostly dry for next ten days -

U.S.

southeastern states will see restricted rainfall over the next ten days -

U.S.

Delta and Tennessee River Basin weather will likely be among the wettest causing some periodic delays to farming activity, but there will be some dry days as well -

U.S.

northern Plains precipitation will be limited over the next ten days and drought will prevail in the west -

U.S.

Pacific Northwest precipitation will continue limited in the valleys, but frequent in the mountains -

Not

much precipitation will occur in California, the Great Basin, southwestern desert areas or the southern Rocky Mountain region during the next ten days -

Much

of Mexico will continue dry biased over the next ten days except along the lower east coast where some rain is expected periodically -

This

is seasonal drying -

Canada’s

Prairies were subjected to blizzard conditions Tuesday and more of the same will occur in the eastern Prairies today

-

Moisture

content in the snow expected will be low, but welcome wherever it occurs -

Travel

delays have occurred and will continue in the east today -

Alternating

periods of snow and sunshine are expected through the next ten days -

Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Guatemala -

Colombia,

northern Peru and Ecuador rainfall is expected to be light over the next week to ten days -

Coffee,

sugarcane, corn and a host of other crops may have been impacted by too much rain earlier this season resulting in some harvest delay -

Conditions

should be improving over the next ten days, although there will be a persistence of rain along the coast -

Today’s

Southern Oscillational Index was +5.88 and it was expected to move erratically over the coming week -

New

Zealand rainfall is expected to be near to slightly above average along the west coast of South Island and below average elsewhere -

Temperatures

will be near to below normal

Wednesday,

Nov. 17:

- EIA

weekly U.S. ethanol inventories, production - Singapore

International Agri-Food Week, day 3 - Global

Grain Geneva conference, day 2 - Brazil’s

Unica releases cane crush, sugar production data (tentative)

Thursday,

Nov. 18:

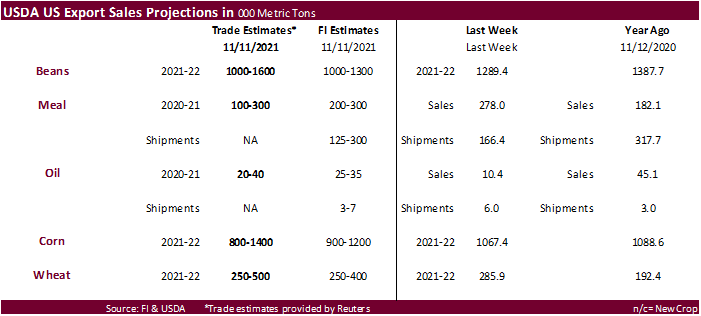

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

FAS releases world sugar market balance, trade report, 3pm - China’s

trade data, including corn, wheat, sugar and cotton imports - International

Grains Council monthly report - Singapore

International Agri-Food Week, day 4 - Global

Grain Geneva conference, day 3 - Bloomberg

New Economy Forum: session on Feeding the World at 11:20am Singapore - USDA

total milk production, 3pm - Port

of Rouen data on French grain exports

Friday,

Nov. 19:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

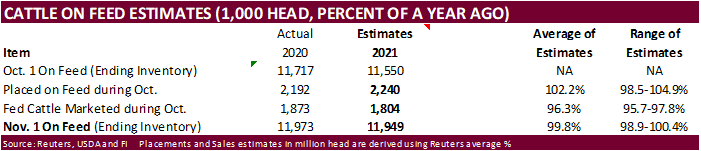

cattle on feed, 3pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Saturday,

Nov. 20:

- China’s

third batch of October trade data, including soy, corn and pork imports by country

Source:

Bloomberg and FI

79

Counterparties Take $1.520 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.467 Tln, 80 Bidders)

US

Housing Starts Oct: 1520K (est 1579K; prev 1555K; prevR 1530k)

–

Building Permits Oct: 1650K (est 1630K; prevR 1586K; prevR 1586k)

–

Housing Starts (M/M) Oct: -0.7% (est 1.5%; prev -1.6%; prevR -2.7%)

–

Building Permits (M/M) Oct: 4.0% (est 2.8%; prevR -7.8%; prevR -7.8%)

Canadian

CPI NSA (M/M) Oct: 0.7% (est 0.7%; prev 0.2%)

–

CPI (Y/Y) Oct: 4.7% (est 4.7%; prev 4.4%)

Canadian

CPI Core- Common (Y/Y) Oct: 1.8% (est 1.9%; prev 1.8%)

–

CPI Core-Median (Y/Y) Oct: 2.9% (est 2.9%; prev 2.8%)

–

CPI Core-Trim (Y/Y) Oct: 3.3% (est 3.4%; prev 3.4%)

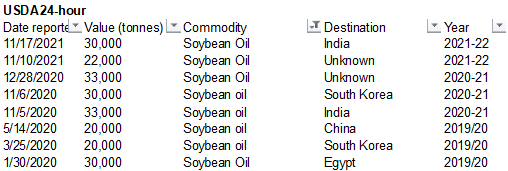

Corn

·

CBOT corn futures traded higher but gains were limited on wheat & soybean spreading against corn. Soybean meal surged today on talk of lysine shortages. Animal unit end users have been increasing soybean meal use and using less

corn and other feedgrains to make up for the lysine shortage.

·

The USD was slightly lower by the time CBOT ags closed and US energy markets were lower.

·

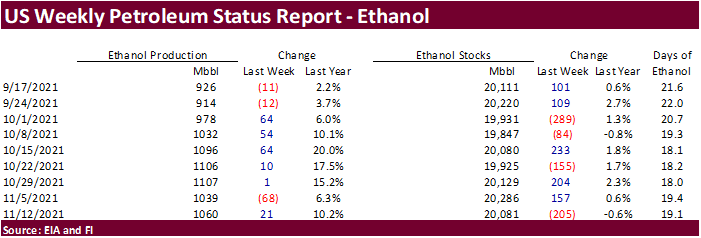

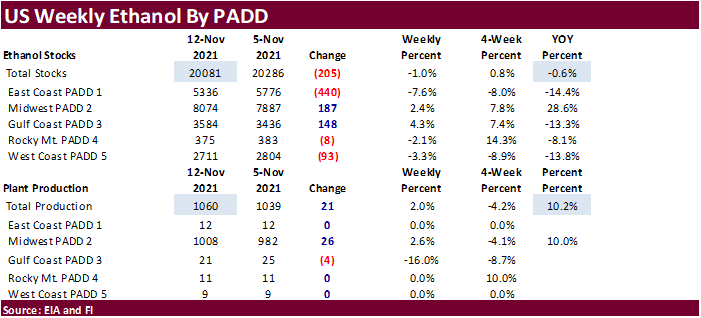

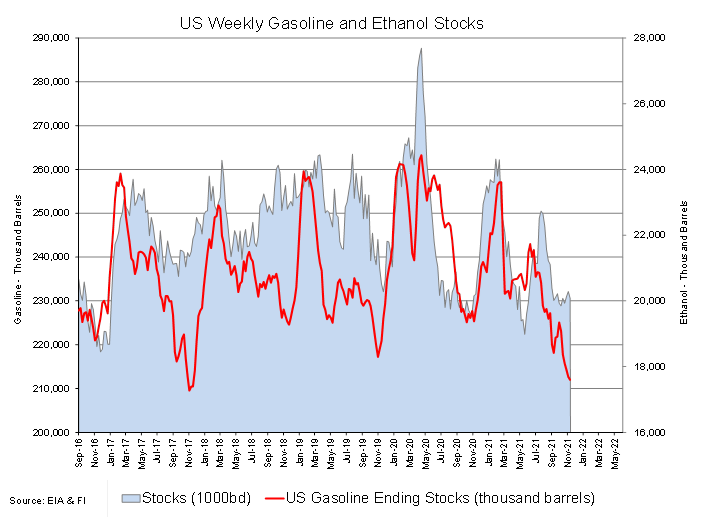

Traders saw an improvement in US ethanol production.

-

Note

December options expire November 26. -

The

weekly USDA Broiler Report showed broiler eggs set in the US up 7 percent and chicks placed up 4 percent. Cumulative placements from the week ending January 9, 2021 through November 13, 2021 for the United States were 8.34 billion. Cumulative placements were

up slightly from the same period a year earlier.

US

DoE Crude Oil Inventories (W/W) 12-Nov: -2101K (est +1200K; prev +1002K)

–

Distillate Inventories: -824K (est -1000K; prev -2613K)

–

Cushing OK Crude Inventories: +216K (prev -34K)

–

Gasoline Inventories: -707K (est -750K; prev -1555K)

–

Refinery Utilization: 1.2% (est 0.5%; prev 0.4%)

2022

Grain Farm Income Projections Negatively Impacted by Fertilizer Cost Increases

Schnitkey,

G., C. Zulauf, K. Swanson, N. Paulson and J. Baltz. “2022 Grain Farm Income Projections Negatively Impacted by Fertilizer Cost Increases.”

farmdoc

daily

(11):156, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 16, 2021.

Export

developments.

·

South Korea’s KFA bought about 64,000 tons of corn, optional origin, and $316.95/ton c&f for arrival in South Korea around February 15. They passed on a second cargo.

Updated

11/15/21

December

corn is seen in a $5.45-$5.90 range

March

corn is seen in a $5.25-$6.25 range

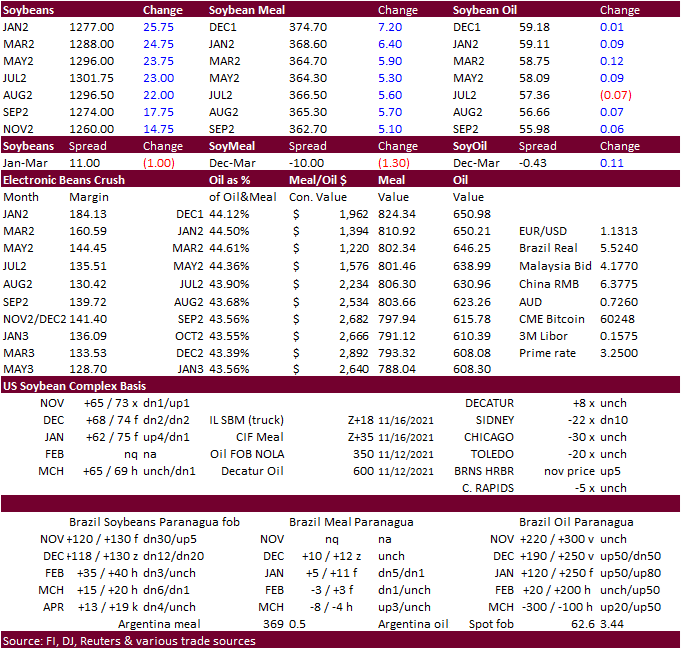

·

Soybeans ended 19.75-25.75 cents higher after USDA reported China bought US soybeans and strength in soybean meal. Soybean oil rallied by more than 100 points but gave up most of its gains after crude oil sold off and renewed

meal/oil spreading. The back and forth on product spreading has been knocking around CBOT crush values. Yesterday January CBOT crush hit $2.02, highest on a rolling basis since July 2018, but today rolled over to close at $1.85, 17 cents off Tuesday absolute

high. Crush values are strong and suggest no slowdown in processing rates, if end users can find the soybeans. Soybean meal prices charged higher on ongoing talk the hog industry is having a hard time sourcing lysine. Soybean meal’s lysine as a percent as

fed basis is 2.8% where corn is around 0.2%. Other feed ingredients rich in lysine include dried skin milk, soybeans, tankage meat meal, rapeseed meal, meat & bone meal, and fish meal (highest around 4.1-5.0%). Import/shipping logistic problems of chemically

produced lysine have created a supply shortage.

·

USDA reported 132,000 tons of soybeans to China. Before the USDA announcement, rumors circulated China did end up buying at least 30 soybean cargoes from the US and Brazil last week.

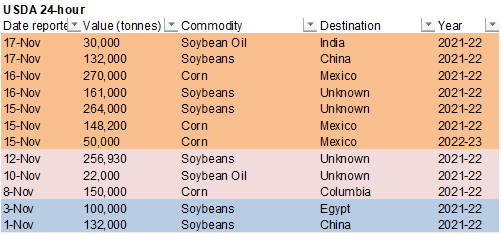

·

USDA reported 30,000 tons of soybean oil was sold to India under its 24-hour reporting system. Last 24-hour sale to India was November 5, 2020, of 33,000 tons. In all of 2020, only 36,000 tons of US soybean oil was sold to India.

Recall last week 22,000 tons of soybean oil was sold to unknown. That should show up in tomorrow’s USDA export sales report. In general India was an active buyer (other origins) for SBO yesterday based on negative palm import margins and Argentina supplies

for export were thin.

·

There is talk the Philippines bought a small amount of soybean meal out of the Gulf.

·

Rail access to the port oof Vancouver is currently shut down, limiting grain, canola and product exports, after heavy rains across BC caused flooding. Some oil pipelines are also down. Reuters also noted the U.S. National Weather

Service on Tuesday issued a flash flood in Mount Vernon, Washington, “due to the potential for a levee failure.”

Export

Developments

- Under

the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to China and 30,000 tons of soybean oil to India.

- There

is talk the Philippines bought a small amount of soybean meal out of the Gulf.

- South

Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

·

Turkey seeks 6,000 tons of sunflower oil on November 23 for December shipment.

Updated

11/15/21

Soybeans

– January $12.00-$13.50 range, March $12.00-$13.50

Soybean

meal – December $350-$395, January $340-$390, March $325-$400

Soybean

oil – December 55.60-59.50 cent range, January 55.00-60.50, March 56-64

·

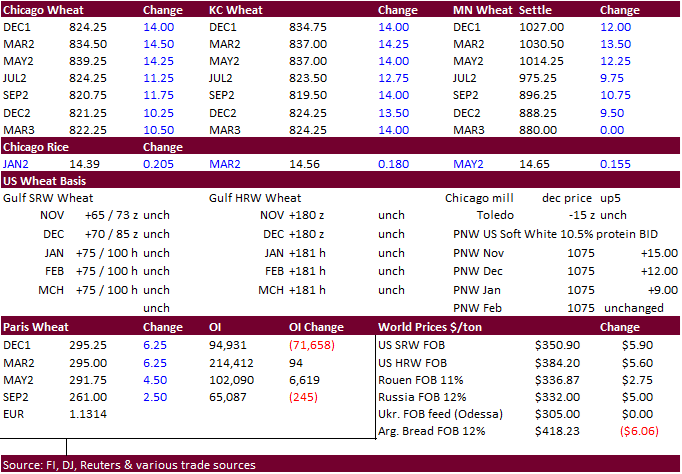

US wheat futures traded sharply higher from good global import demand, higher soybeans and a slightly lower USD.

·

EU December wheat managed to climb 6.25 euros to 295.50 euros, back to near a 14-year high.

·

Ukraine is not planning on curbing wheat exports at this time but may do so later this season if the export pace remains robust. By mid-November Ukraine exported 52% of the 25.3MMT annual export volume that was agreed between

exporters and government officials.

·

Argentina is set to produce a record wheat crop after rain benefited production. BA Grains Exchange is currently at 19.8 million tons, above 19 million record. Rosario exchange is at 20.4 million. One independent analyst is

at 23 million tons.

·

Due to a large amount of flooding across interior BC, Canada, all rail service to and from the Port of Vancouver was suspended.

·

Iraq warned they may see a 2-million-ton domestic production wheat deficit.

Export

Developments.

·

Egypt bought 60,000 tons of Romanian wheat at $346.97/ton (plus $25/ton freight) for January 1-15 shipment.

·

Turkey seeks 385,000 tons of wheat on November 25.

·

Algeria ended up buying a more than expected 800,000 tons of wheat and about 250,000 tons was Russian origin. Other countries included Argentina.

·

The Philippines bought 220,000 tons of feed wheat for Jan/Apr shipment, at around $340/ton. Origin was Australia and India.

·

Jordan passed on 120,000 tons of barley.

·

Turkey seeks 320,000 tons of feed barley on November 23 for January shipment.

·

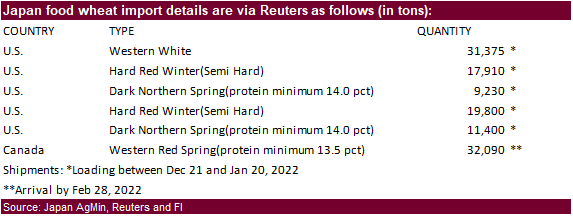

Japan seeks 121,805 tons of food wheat this week.

-

Taiwan

seeks 48,000 tons US wheat on November 18 for shipment in 2022 from the U.S. Pacific Northwest coast between Jan. 9 and Jan. 23.

·

Bangladesh’s state grains buyer seeks 50,000 tons of milling wheat on November 22.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

None reported

Updated

11/15/21

December

Chicago wheat is seen in a $7.80‐$8.40 range, March $7.50-$8.75

December

KC wheat is seen in a $7.90‐$8.75, March $7.50-$8.75

December

MN wheat is seen in a $9.75‐$10.60, March $9.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.