PDF attached does not include daily estimate of funds

Calls

steady for agriculture futures

USD

was down about 77 points as of 2:18 pm CT, WTI crude oil was 63 cents lower and US equities higher. CBOT soybeans were lower, meal mixed, and soybean oil higher. Corn and Chicago wheat were lower. KC and MN wheat were lower. China denied it was considering

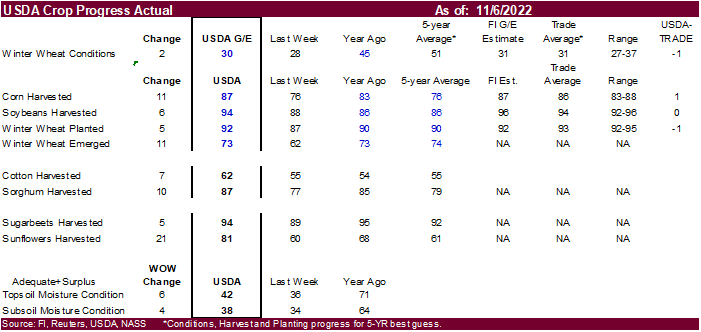

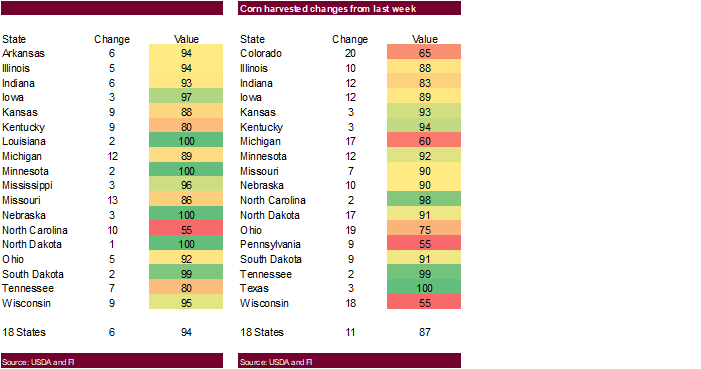

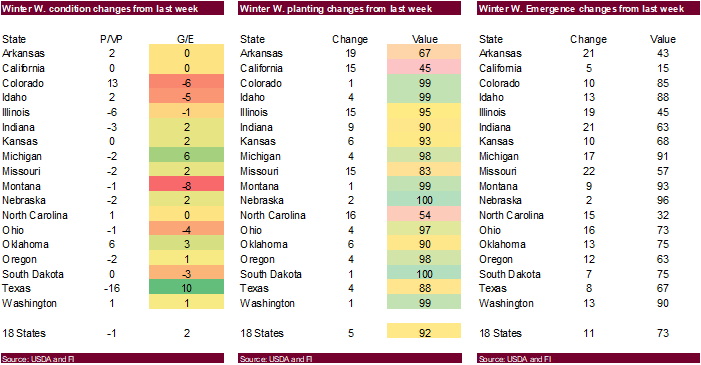

easing its zero-COVID policy. China on Sunday reported its highest number of new COVID-19 infections in six months. Egypt cancelled their import tender for wheat. US crop progress was near expectations.

USDA

released 2023 budget projections. https://www.usda.gov/oce/commodity-markets/baseline

Weather

Much

of Brazil and Paraguay remained dry and Brazil saw good planting progress during the weekend, with rain noted in a few central, northern, and southern areas. Paraguay is done with soybean plantings. Argentina remained mostly dry during the weekend and dry

weather and “good planting progress will be most common through the next two weeks with showers in the southwest Wednesday into Thursday and nearly widespread rain Friday into Sunday important for many western, central, and northern areas,” according to World

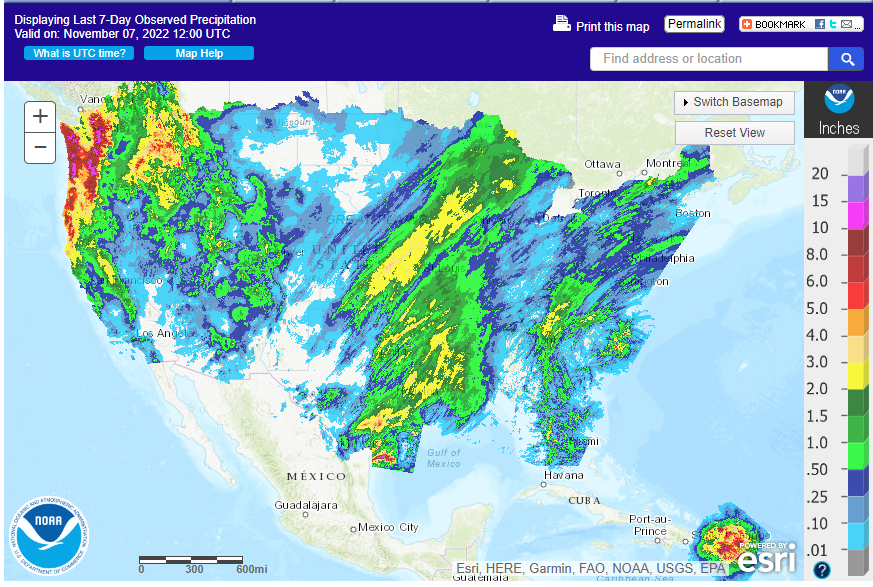

Weather Inc. The US weather forecast for the Great Plains turned slightly negative. Parts of OK and TX will see rain through Tuesday. The upper Midwest will see rain over the next 7 days.

![[Key Messages]](https://www.eoxlive.com/wp-content/uploads/2022/11/image009-9.png)