PDF Attached includes our updated US corn S&D

Commitment of Traders will be out this weekend or Monday morning

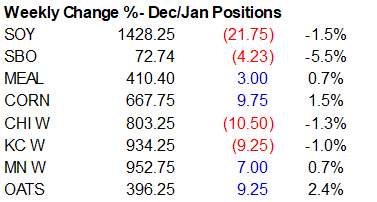

CBOT

agriculture futures ended mixed for the grains and higher for the soybean complex.

Another round of selling in WTI crude oil limited gains for back month soybean oil and nearby corn contracts.

Soybean

meal gained on soybean oil for this week. We could see that momentum continue into early next week if global SBO premiums soften on Monday. Paris wheat futures sold off well from session highs to settle 1.25 euros higher.

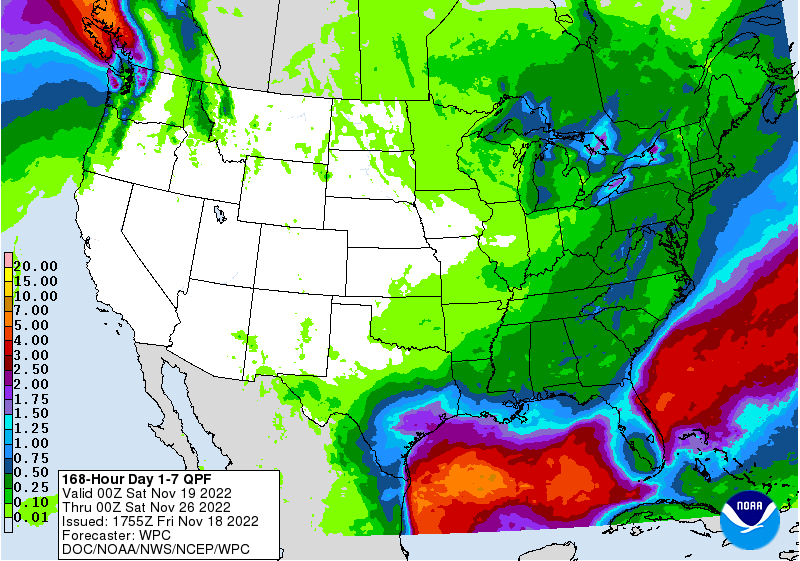

Weather

US

weather forecast was unchanged this morning. Temperatures will trend warmer over the next ten days after plunging late this weekend. The Great Plains will see rain return to the far southern areas Saturday through Monday. Rest of the US Great Plains wheat

areas will remain dry. The Midwest will see snow across the northeast through Saturday. Other areas will be mostly dry. Some rain will fall across La Pampa and southwest BA Thursday through Friday and Cordoba Saturday. Brazil’s Mato Grosso, Goias, and Minas

should see rain through Sunday and MGDS, Parana and nearby surrounding and states early next week. Precipitation increases for the EU over the next week and the Black Sea will be active bias southern Ukraine and Volga Valley.