PDF Attached

CANADIAN

PACIFIC RAILWAY CP.TO ESTIMATES IT WILL RESTORE B.C. SERVICE SEVERED BY FLOODS BY MID-WEEK – STATEMENT – Reuters News

Weather

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- U.S.

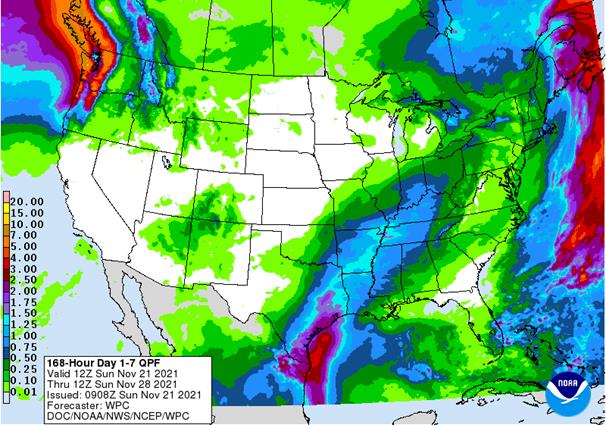

Southern Plains are still advertised to be wet Wednesday into Saturday of next week - This

impacts Texas and central Oklahoma with very little to no rain in the Texas Panhandle or most of hard red winter wheat country away from central Oklahoma - Some

of the rain is overdone on the GFS model run this morning - Areas

from the Texas Blacklands and surrounding areas will be wettest - The

moisture in Texas will be welcome for soil moisture replenishment for 2022 crops - U.S.

hard red winter wheat areas will get a little rain in the far southeast part of the production region late next week, but the bulk of the production region will be left dry for the next ten days and perhaps longer - U.S.

Delta, Tennessee River Basin and lower and eastern portions of the Midwest will be impacted by waves of rain during the next ten days resulting in further delays to late season harvest progress - Some

cotton quality declines are expected, and fieldwork will continue advance slower than usual because of the precipitation - U.S.

Southeastern states will not receive high volumes of rain anytime soon and late season harvest progress should advance relatively well around what few showers impact the region - U.S.

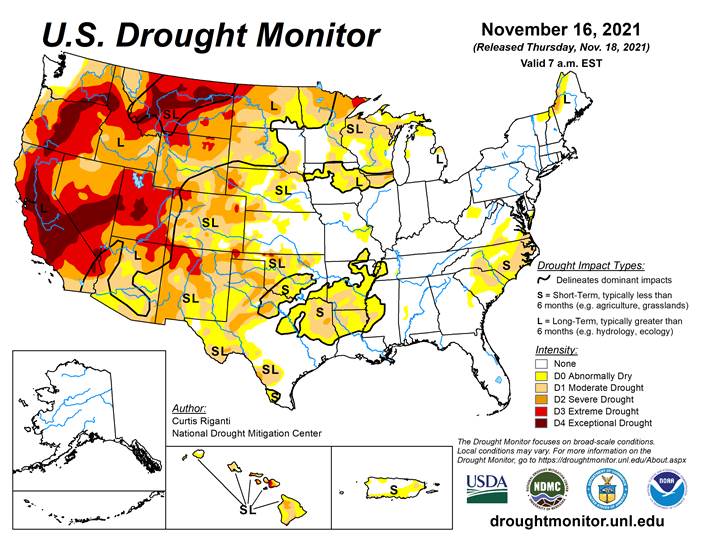

northern and west-central Plains will receive restricted amounts of precipitation during the next ten days to two weeks leaving many areas from Montana into western Kansas and eastern Colorado with a drier bias - Central

Canada’s Prairies are expecting very little precipitation for a while, but totally dry weather is not likely - Ontario

and Quebec, Canada have received rain and snow this week and additional precipitation is expected this weekend and early next week slowing field progress - California

and the southwestern desert region of the United States are not likely to get enough precipitation to make much difference to soil moisture, water supply or crop conditions - Argentina’s

best rain potential key summer grain and oilseed areas in the central and south will be Wednesday and Thursday of next week - Some

of the advertised rainfall may be a little overdone this morning, but any moisture of significance will be welcome after net drying between now and then - A

follow up rain event is possible late in the following weekend - Northern

Argentina may be driest until the week of Nov. 18 when rain will fall more significantly - Argentina

temperatures will trend a little warmer than usual over the coming five days and that will accelerate drying across the nation - Brazil

crop weather will remain mostly very good during the next week to ten days - Keep

an eye on Rio Grande do Sul where restricted rainfall is expected during much of that forecast period - Coffee,

citrus and sugarcane conditions will remain largely very good as time moves along - Soybeans

and corn are developing quite favorably with little change likely - Australia’s

eastern New South Wales will receive rain this weekend especially near the western slopes of the Great Dividing Range, but more rain is expected Wednesday and Thursday of next week - The

rain events will induce a disruption to harvest progress and adds a little worry to the quality of unharvested crops - There

has already been a small grain quality decrease in Queensland and northern New South Wales this season - Most

other crop areas in Australia are unlikely to suffer from too much rain in the coming week to ten days and moisture will be great for summer crops - Southern

India continues to get frequent rain and there is an expanding region of excessive moisture - Flood

potentials will likely rise during the next week to ten days as rain frequency stays high - Cotton,

rice and sugarcane quality declines are already suspected in a few areas and more of the same is expected through the next full week especially from Karnataka, Kerala and Tamil Nadu into Andhra Pradesh and a part of southern Telangana

- Interior

southern India received moderate to heavy rainfall Thursday with amounts of 2.00 to 5.55 inches resulting - Areas

from southern Andhra Pradesh into northeastern Tamil Nadu and neighboring areas of southeastern Karnataka were wettest - These

same areas had reported 7.00 to more than 18.00 inches of rain for the month prior to Thursday’s moisture - Flooding

and crop quality concerns continue to be a concern - West-central

India received some rain Thursday and more will fall into the weekend - The

areas impacted Thursday were mostly in southern Rajasthan where up 1.57 inches resulted - Additional

rain into the weekend will impact Gujarat, northern Maharashtra, western Madhya Pradesh and southern Rajasthan.

- The

rain is not likely to be persistent or heavy enough to induce a serious threat to crop conditions, but fieldwork will be stalled briefly and worry will rise for many producers - Cotton

is most at risk of a quality change, but as along as drier weather returns during the weekend and lasts through next week as expected the impact should be low - The

moisture will be good for future winter crop planting and for the establishment of previously sown crops - China

will experience another late week weekend snowstorm in Heilongjiang and Jilin as cold air pushes into the east-central and northeastern parts of the nation - Snowfall

of several inches is expected causing travel delays Sunday through Tuesday - Blizzard

or near blizzard conditions will occur disrupting travel and commerce - Winter

crops in the north are unlikely to be negatively impacted by colder weather this weekend into early next week, although new crop development will be slowed and some crops may be pushed into semi-dormancy - China’s

rapeseed planting and establishment will continue advance in east-central China under favorable weather and field conditions - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Coastal

areas of Vietnam and east coastal areas of Luzon Island Philippines will receive heavy rain from a strengthening northeast monsoon - Local

flooding will be possible - South

Africa summer crop areas will receive waves of rain over the next two weeks

- The

moisture will be welcome and should improve grain, oilseed and cotton planting prospects

- Many

areas in the nation area little too dry for optimum crop development - The

coming rainfall should greatly improve topsoil moisture - Parts

of Morocco will receive scattered showers into the weekend, but resulting rainfall will be sporadic and mostly too light to seriously change topsoil moisture or water supply - Drought

has been prevailing for a few years and substantial rain is needed to improve water supply and soil moisture enough to support winter crop planting - Some

follow up showers may occur late next week, but greater rain will still be needed - Northern

Algeria and coastal areas of Tunisia have the greatest soil moisture in all of northern Africa

- Winter

crop planting conditions will be best in these areas, but more rain is needed farther inland and that is not likely to occur for a while - West-central

Africa rainfall has been and will continue be sporadic and light along near the coast from Ivory Coast to Cameroon and Nigeria over the next two weeks while interior crop areas are seasonably dry - Temperatures

will be cooler than usual in coastal areas due to frequent showers while warmer than usual in the drier interior crop areas - Cotton

will benefit from the dry and warm bias speeding along crop maturation and supporting some early harvesting - Coffee,

cocoa, rice and sugarcane will benefit from periodic rain, but will be looking for drier weather later this month and next - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Ethiopia

may dry out a little more than desired and a close watch on the region may be warranted for a while - Parts

of Spain may get some welcome rain this weekend into early next week The moisture will be welcome for winter crop planting and for moistening the topsoil after a long dry season - The

remainder of Europe will experience a mostly tranquil weather pattern with infrequent precipitation of light intensity through the weekend, but starting next week and continuing into late month temperatures are expected to trend colder and periods of rain

and some snow will begin to fall in a few areas - Winter

crop planting should be winding down in many areas with eastern parts of the continent cool enough for crops to be semi-dormant - Western

parts of Russia, the Baltic States, Belarus and a few neighboring areas will experience some gradual increase in snow cover during the next ten days - Precipitation

in Ukraine is expected to be limited for a while and amounts in Russia’s Volga Basin should be light for a while.

- Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Guatemala - Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days - Coffee,

sugarcane, corn and a host of other crops will benefit from the moisture after recent drying - Today’s

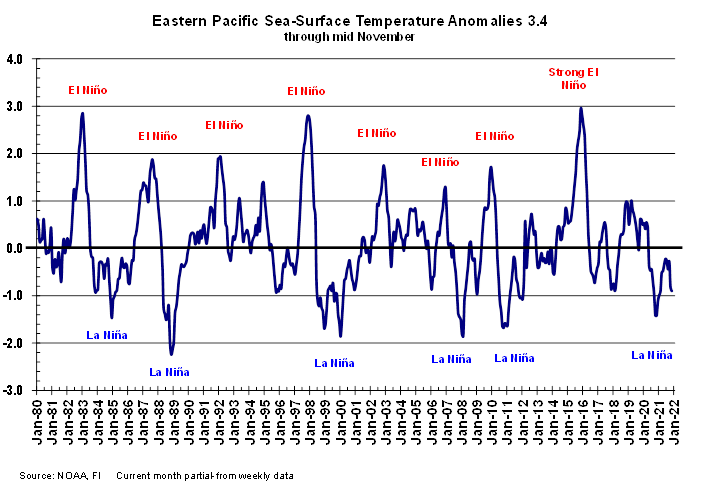

Southern Oscillational Index was +6.19 and it was expected to move erratically higher over the coming week - New

Zealand rainfall is expected to be near to below normal over the next week to ten days

- Temperatures

will be near normal

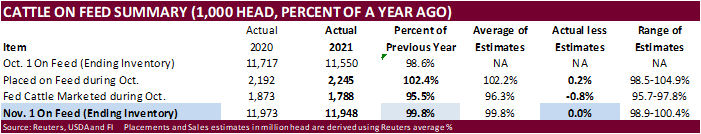

Friday,

Nov. 19:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Saturday,

Nov. 20:

- China’s

third batch of October trade data, including soy, corn and pork imports by country

Monday,

Nov. 22:

- Monthly

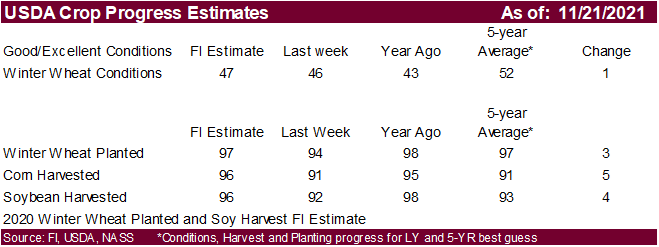

MARS bulletin on crop conditions in Europe - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

winter wheat condition, cotton harvest data, 4pm - Ivory

Coast cocoa arrivals - Malaysia’s

Nov. 1-20 palm oil exports - U.S.

cold storage data — pork, beef and poultry, 3pm - HOLIDAY:

Argentina

Tuesday,

Nov. 23:

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases sugar and cane production data (tentative) - Council

of Palm Oil Producing Countries online webinar - U.S.

poultry slaughter, 3pm - HOLIDAY:

Japan

Wednesday,

Nov. 24:

- EIA

weekly U.S. ethanol inventories, production - USDA

red meat production, 3pm

Thursday,

Nov. 25:

- Malaysia’s

Nov. 1-25 palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

U.S.

Friday,

Nov. 26:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

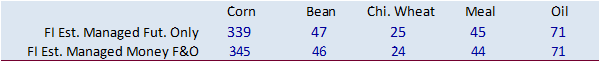

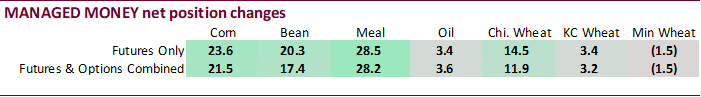

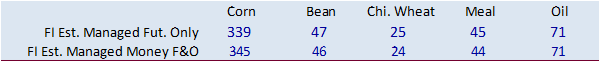

The

CFTC Commitment of Trader report showed no major surprises this week as the traditional net positions came in near trade expectations. The net long position for corn of nearly 400,000 contracts was roughly 150,000 below record long and after today, stands

at around 343,000 contracts. The soybean meal traditional net long fund position is around 44,000 contracts. Around mid-October funds were net short meal.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

250,399 18,303 409,407 3,910 -607,947 -21,934

Soybeans

-3,737 12,701 196,671 2,046 -149,448 -10,175

Soyoil

30,280 -3,800 125,581 1,367 -165,393 -599

CBOT

wheat -8,270 10,629 123,644 7,016 -106,928 -14,606

KCBT

wheat 29,267 2,165 61,012 -458 -94,150 -4,395

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

341,135 21,526 231,339 -2,168 -588,039 -19,474

Soybeans

29,488 17,351 145,419 -3,321 -155,711 -8,949

Soymeal

37,488 28,189 86,940 -1,807 -180,548 -29,959

Soyoil

76,212 3,606 99,313 -1,040 -173,901 730

CBOT

wheat 15,258 11,931 69,991 4,439 -85,245 -14,724

KCBT

wheat 60,560 3,178 30,474 -2,578 -84,231 -1,517

MGEX

wheat 14,963 -1,533 1,164 -31 -33,338 1,019

———- ———- ———- ———- ———- ———-

Total

wheat 90,781 13,576 101,629 1,830 -202,814 -15,222

Live

cattle 52,010 3,937 83,643 -223 -139,926 -2,005

Feeder

cattle -4,551 -726 4,183 291 2,573 191

Lean

hogs 46,872 6,456 59,084 -495 -97,034 -2,878

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

67,423 395 -51,858 -279 2,075,468 73,356

Soybeans

24,289 -510 -43,487 -4,572 785,185 19,618

Soymeal

26,872 2,401 29,247 1,175 519,884 20,712

Soyoil

-11,157 -6,330 9,533 3,033 495,844 10,988

CBOT

wheat 8,442 1,392 -8,446 -3,038 565,036 41,777

KCBT

wheat -10,674 -1,772 3,871 2,689 273,576 8,616

MGEX

wheat 10,188 222 7,022 323 82,158 -2,284

———- ———- ———- ———- ———- ———-

Total

wheat 7,956 -158 2,447 -26 920,770 48,109

Live

cattle 17,979 -548 -13,705 -1,162 350,878 7,898

Feeder

cattle -282 -310 -1,925 554 49,179 2,247

Lean

hogs 7,289 -3,474 -16,211 391 286,158 -406

=================================================================================

74

Counterparties Take $1.575 Tln At Fed’s Fixed Rate Reverse Repo (prev $1.584 Tln, 74 Bidders)

Canadian

Retail Sales (M/M) Sep: -0.6% (exp -1.7%; prev 2.1%)

–

Retail Sales Ex-Auto (M/M) Sep: -0.2% (exp -1.0%; prev 2.8%)

Canadian

New Housing Price Index Oct: 0.9% (exp 0.5%; prev 0.4%)

·

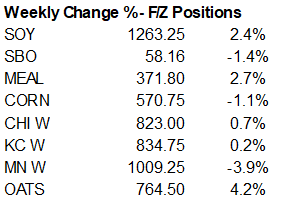

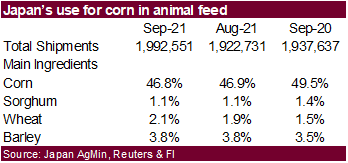

CBOT corn traded lower in a risk off trade. Slowing US export developments and sharply lower WTI crude oil weighed on prices. The USD was 46 points higher today. WTI January was down about $2.49 around 1:30 pm CT. Nearby corn

was down 1.1% for the week and oats were up 4.2%.

·

On Friday funds sold an estimated net 4,000 corn contracts.

·

US corn basis along major river points firmed on Friday.

·

The increase in Covid-19 lockdown concerns across Europe may weigh on commodity investor sentiment next week, but to a much lesser extent that seen in the past. It did weigh on some US stocks on Friday.

·

Southern Brazil and Argentina will see limited rain over the next week. There is some concern over recently planted first crop corn across Rio Grande do Sul, Brazil.

·

Safras calls for a 25.7 million ton Brazil summer corn crop, unchanged from their August estimate.

·

France collected 91 percent of their corn crop as of November 15, up from 82% week earlier but 11 days behind a 5-year average.

Export

developments.

·

South Korea’s KFA bought about 64,000 tons of corn at $316.60/ton for arrival around March 10.

Updated

11/15/21

December

corn is seen in a $5.45-$5.90 range

March

corn is seen in a $5.25-$6.25 range

·

Soybeans traded two-sided today, ending mostly 0.50-2.0 cents lower. The low for January found some support as it approached its 50-day MA ($12.5450), but never tested it. US soybean basis was steady to firm on Friday. ECB basis

remains very strong. Producers are reserve sellers in hopes prices continue to appreciate. Extremely high crush margins are allowing crushers to bid up cash prices. Some soybean fields across northern IN, lower MI into OH and PA are still unharvested after

a wet fall season.

·

Lower WTI crude oil weighed on soybean oil with Dec settling off 101. Soybean meal rallied $1.40-$2.80 short ton after the open from ongoing talk of strong US demand and ended higher.

·

Some traders are speculating soybean oil will be delivered late next week. Recall NOPA reported a record soybean oil production for last month.

·

Funds on Friday sold 1,000 soybeans, bought 1,000 meal and sold an estimated 6,000 soybean oil.

·

Nearby soybeans were up 2.4% for the week, meal up 2.7% while soybean oil was down 1.4%.

·

Argentina is on holiday Monday.

·

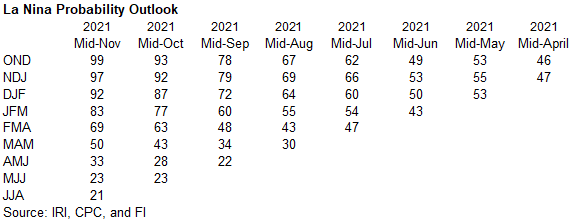

It will be important to keep an eye on southern Brazil and Argentina’s weather patterns over the next couple of months. La Niña strengthened in the last month. The IRI noted a 97 percent probability of La Nina over the Nov through

January period.

·

China soybean imports from the US during October were 775,331 tons, down 77 percent from 3.4 million tons year ago.

·

China imported 3.3 million tons of Brazilian soybeans in October, down 22% from 4.233 million tons in the previous year. Total October soybean imports were 5.11 million tons, down 41% from a year earlier and lowest level since

March 2020.

·

Britain’s rapeseed area is expected increase 12.9% in 2022 to 345,000 hectares, according to the Britain’s Agriculture and Horticulture Development Board.

·

Malaysia palm futures were up second consecutive week despite closing moderately lower on Friday. It may open higher on Monday.

·

ITS reported Malaysian November palm oil exports up 18.1% from the same period month earlier to 1.130 million tons.

·

AmSpec reported November 1-20 Malaysian palm oil exports up 9 percent to 1.067 million tons from 978,917 tons previous period last month.

·

China crush margins on our analysis was last $2.30/bu ($2.31 previous), compared to $2.66 at the end of last week and compares to $0.89 a year ago.

Export

Developments

- Results

awaited: South Korea is in for 115,000 tons of GMO-free soybeans on November 17 for arrival in South Korea in 2023.

·

Turkey seeks 6,000 tons of sunflower oil on November 23 for December shipment.

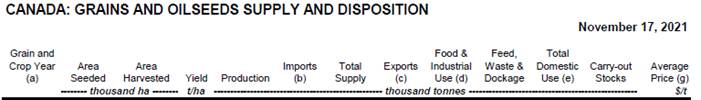

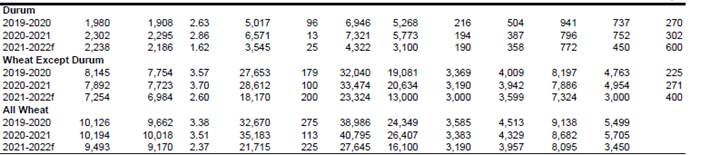

Source:

Statistics Canada (STC) and Agriculture AgriStatistics Canada (STC)

Updated

11/19/21

Soybeans

– January $12.00-$13.00 (down 50) range, March $12.00-$13.50

Soybean

meal – December $350-$395, January $340-$390, March $325-$400

Soybean

oil – December 56.50 (up 90) to

59.50 cent range, January 55.00-60.50, March 56-64

·

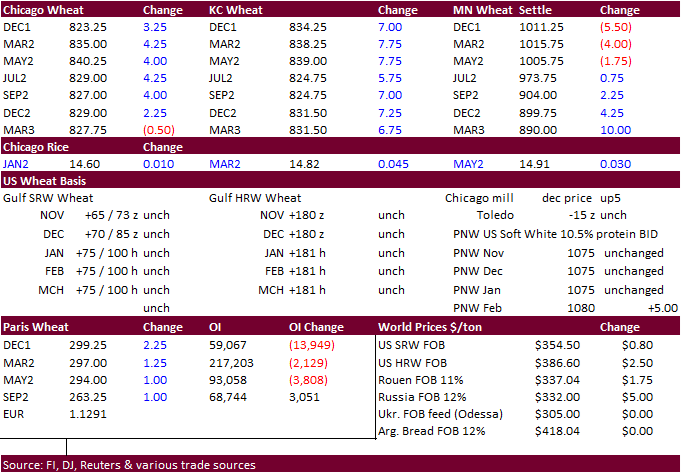

Nearby Minneapolis wheat was down 3.9% this week while Chicago was up 0.7% and KC up 0.2.

·

Russia set their wheat export tax at $78.30/ton for the November 24-30 period, up from $77.10/ton Nov 17-23.

·

March Paris wheat was 1.25 euros higher at 297.00. December was up 2.25 at 299.75, a record high. December hit 303.25 euros during the session. Option volume was heavy this week for Paris wheat. 43,476 lots traded on Thursday.

·

Britain’s wheat area is expected to increase in 2022 to 1.81 million hectares or 1.3 from 2021, according to the Britain’s Agriculture and Horticulture Development Board.

·

Ukraine reported 25.9 million tons of grain stocks as of November 1, 5.5 million tons above this time year ago, and includes 11.9 million tons of wheat.

·

Ukraine is 93.3% complete on harvesting at 76.7 million tons, with an average yield of 5.16 tons per hectare. That includes 32.3 million tons of wheat, 9.6 million tons of barley, 31.8 million tons of corn and small volumes of

other grains.

·

Iran imported 4 million tons of wheat since late April, providing relief to their annual supply shortfall. They also secured 4.5 million tons of wheat from local producers.

Source:

Statistics Canada (STC) and Agriculture AgriStatistics Canada (STC)

Export

Developments.

·

The Philippines bought about 38,000 tons of Australian wheat (for February loading, according to AgriCensus, at around $353.60/ton. We are awaiting results from a second Philippines group in for wheat.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

·

Jordan seeks 120,000 tons of feed barley on November 24.

·

Bangladesh’s state grains buyer seeks 50,000 tons of milling wheat on November 22.

·

Turkey seeks 370,0000 (320,000 previous) tons of feed barley on November 23 for January shipment.

·

Jordan seeks 120,000 tons of wheat on November 25 for shipment between March 16-31, April 1-15, April 16-30 and May 1-15.

·

Turkey seeks 385,000 tons of wheat on November 25.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

None reported

Updated

11/15/21

December

Chicago wheat is seen in a $7.80‐$8.40 range, March $7.50-$8.75

December

KC wheat is seen in a $7.90‐$8.75, March $7.50-$8.75

December

MN wheat is seen in a $9.75‐$10.60, March $9.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.