PDF Attached

Largest

U.S. rail labor union votes against contract, raising strike possibility – Reuters News We expect Congress to vote on it to keep rail lines open. The White House said a rail shutdown is unacceptable.

Commodity

selling was seen early in the session on thoughts that that Saudi Arabia may increase production but that report was denied, causing ags and energies to turn around into the close. Shortened week with US on holiday this Thursday and early close Friday.

China economic slowdown concerns continue to circulate. US covid and flu cases are also on the rise. Ukraine/Russia situation is of concern following the shelling over the weekend of the Zaporizhzhia area. Argentina is closer to roll out a second “soybean

dollar” sometime in December. Range was estimated between 215-225 pesos per USD. That would be up from 200 back in September. December CBOT options expire on Friday.

Weather

No

major changes were seen Monday morning for the US and South America weather forecast from that of Friday. US trends drier this week with a few showers for eastern TX and wintery mix for the Midwest areas of the northwestern states later this workweek. Argentina

will see light rain across Cordoba and northern Santa Fe today before drying down through Friday. Brazil will see additional rain through Wednesday. West-central Brazil will begin to dry down soon and will remain dry throughout the week.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Argentina

rainfall Friday through early Sunday afternoon was light from southeastern Santiago del Estero and northern Cordoba through central Santa Fe to Entre Rios, as well as in eastern most Buenos Aires

-

Rainfall

was less than 11 millimeters (0.43 inch) and that was not enough to counter evaporation -

Rainfall

in most other areas ranged from 0.20 to 0.60 inch with local totals of 1.00 to 2.00 inches in southwestern Cordoba, east-central San Luis, eastern La Pampa, northwestern and central Santiago del Estero and central and southwestern Buenos Aires -

All

of the rain was welcome, but much more was needed to seriously improve long term soil moisture in central and some eastern portions of the nation. The last two rain events have missed areas from southern Santiago del Estero to central Santa Fe and some areas

in both Corrientes and Entre Rios leaving need for greater rainfall in those areas. Recent rain elsewhere has supported summer crop planting, emergence and establishment, but much more is needed to ensure that favorable crop development will last more than

a few days at a time. -

Argentina

is advertised to be dry again most of this week and into the coming weekend with only a few showers expected -

That

will translate into net drying once again -

Argentina’s

next rain event could be 8-10 days away, although a few showers will pop up periodically especially in the west and south.

-

Warmer

temperatures will be returning to Argentina later this week that will accelerate evaporation rates and return crop moisture stress to some areas that have recently received rain while those areas that have been missed by recent rain experience a steady decline

in crop conditions -

Brazil

weekend precipitation was greatest in eastern Mato Grosso into Tocantins, Bahia and a few areas in northern Goias and interior western Minas Gerais -

Rain

totals in these areas ranged from 1.00 to 2.00 inches -

Some

of this moisture fell in a part of Mato Grosso that had been quite dry previous shrinking the area that remains too dry, but more rain is still needed to fix low subsoil moisture -

Dry

weather occurred in most other areas in the nation during the weekend and temperatures were seasonable -

Aggressive

fieldwork should have occurred in the dry areas -

Most

summer grain, oilseed, cotton, citrus, sugarcane and coffee development advance well during the past week because of a good distribution of rain and sufficient sunshine combined with seasonably to slightly cooler than usual temperatures -

All

of Brazil is expecting timely rainfall in this coming week to ten days -

Rain

amounts will be abundant to excessive in a few areas from Espirito Santo to Tocantins while a little lighter than usual from Mato Grosso to western and southern Rio Grande do Sul and Paraguay -

Despite

the lighter than usual rainfall in western and southern areas there will be sufficient rainfall to support most crop needs

-

Follow

up rain will be very important, though, and drier weather is expected from late this week through the first half of next week

-

Crop

production potentials in Brazil remain high, despite an unusual pattern in which much of the recent rain has been coming from mid-latitude frontal systems instead of monsoon moisture. Any missed rainfall in December could lead to crop moisture stress especially

if temperatures trend warmer than usual which is not expected in the first week of the month.

-

U.S.

weekend weather was tranquil in most crop areas -

Rain

fell from central and southeastern Texas into coastal areas of Louisiana into the Florida Panhandle and immediate neighboring areas -

Temperatures

started to warm in the central United States after several very cold days last week

-

Cool

conditions continue in the eastern states, though with afternoon highs Sunday limited to the 40s Fahrenheit in the southeastern states, through Florida was in the 50s and 60s

-

Lowest

temperatures slipped to the teens and 20s Fahrenheit in the lower Midwest, Delta and Tennessee River Basin while in the single digits and teens in the northern Midwest and central and northern Plains as well as the Pacific Northwest -

Freezes

occurred southward into central Texas, northern Louisiana, central Mississippi, central Alabama and central Georgia -

Heavy

rain fell in southeastern Florida Sunday and early today with more than 4.00 inches resulting along the lower east coast near Miami.

-

U.S.

weather this week will steadily warm with temperatures rising above normal in the Great Plains and western Midwest late this week through the weekend and into early next week

-

A

new surge of cold will be building up over western Canada, the northern U.S. Plains and portions of the far west next week

-

U.S.

precipitation will be limited this week, although some rain and snow will fall in the northern Plains during mid-week this week and then in the Midwest, lower Delta and southeastern states late this week and through the weekend

-

Moisture

totals will vary from 0.05 to 0.50 inch in the northern Plains and upper Midwest while 0.20 to 0.75 inch in the eastern Midwest -

New

storm will arrive in the Pacific Northwest early next week that will move to the northern Plains and part of the Midwest during mid-week next week

-

Moisture

totals will be light once again varying from 0.20 to 0.75 inch -

West

Texas harvest weather will be good over the next ten days with very little rain likely -

Precipitation

in the U.S. Delta and southeastern states during the next ten days will be brief and light having a limited impact on late season fieldwork, although some periodic delay is expected -

U.S.

hard red winter wheat areas will continue dry biased and warming this week will attempt to stimulate new plant development in the southern Plains -

U.S.

Pacific Northwest precipitation will be greatest in the mountains leaving the valleys of Idaho, Washington and Oregon with limited precipitation, although not totally dry conditions -

Heavy

U.S. “Lake Effect” snowfall has occurred in the Great Lakes region and will continue early this week.

-

U.S.

navigable river levels will not rise much in the next two weeks leaving barge restrictions in place and maintaining concern over barge traffic and higher freight costs -

Quebec

and Ontario, Canada summer and winter crop areas will get a little moisture late this week and into the weekend delaying late season farming activity, but much of this year’s fieldwork should be winding down and winter crops are moving into dormancy -

Europe

weather will continue active this week with rain and mountain snow likely in many areas, though the Baltic Plain will experience the lightest and most infrequent precipitation -

Most

of the continent will either have favorable soil moisture or experience rising soil moisture during the coming week

-

Cool

temperatures will continue forcing winter crops in eastern Europe into dormancy or semi-dormancy, although temperatures in the next two weeks will trend a little warmer than usual -

CIS

weather in the next ten days will be seasonable with waves of rain and a little snow occurring periodically along with seasonable temperatures

-

Bitter

cold will be confined to eastern Russia -

Some

of the bitter cold in eastern Russia will seep into China this weekend into next week, but temperatures are unlikely to be a threat to winter wheat

-

East-central

and especially southeastern China will be abundantly moist during the next ten days -

Frequent

rain will bolster topsoil moisture near and south of the Yangtze River Basin improving the long term outlook for rapeseed, sugarcane, citrus and early 2023 rice

-

Precipitation

in northern China is not likely to be very great, but it will not be completely dry -

Snow

cover in China is restricted to portions of the northeast and in the mountains, but snow may increase as colder air arrives this weekend and next week in the North China Plain and northeastern provinces -

Winterkill

is not likely because of the snow and because temperatures will not be low enough to induce damage -

Snow

has accumulated in northeastern Europe; including northern and central Ukraine into western Russia where snow was absent last week

-

South

Africa summer crop planting and winter grain harvesting seems to be advancing quite favorably with little change likely during the next two weeks

-

Alternating

periods of rain and sunshine are expected that should bode well for both fieldwork and early season crop development -

Australia

weather during the weekend was wettest in Victoria and southeastern New South Wales where 0.50 to 1.00 inch of rain was common -

Rain

also fell in Western Australia and in New South Wales where moisture totals were no more than 0.40 inch

-

Temperatures

were very warm to hot in Queensland and remained mild in the southeast and southwestern portions of the nation -

Australia

weather will be favorable for New South Wales and Queensland into the early days of December supporting winter crop maturation and harvesting as well as some summer crop planting -

Totally

dry weather is not expected, but the few showers that occur periodically should not be great enough to induce new flooding or threaten crops with additional quality declines -

Many

areas will experience net drying and that will likely lead to receding flood water, drier soil in well-drained areas and improved field working conditions -

Harvesting

of winter crops should improve as the ground firms -

Planting

of summer crops should advance at its fastest pace of the season with improved emergence and establishment -

some

low-lying areas will remain too wet -

Rain

will fall most frequent in Victoria over the next ten days and that will translate into ongoing concern over crop conditions due to too much moisture -

Southern

India will remain wet, but no crop damage is expected -

A

tropical disturbance in the Bay of Bengal will bring some heavy rain to coastal areas of southern Andhra Pradesh this week, but resulting rainfall is not likely to be great enough to cause a serious threat to crops, although drier weather is needed -

Northern

and central India crop weather will be seasonably dry and warm supporting summer crop harvesting and winter crop planting -

A

tropical disturbance in the eastern Bay of Bengal will be closely monitored for possible impact on southern India early this week -

The

system may briefly become a tropical depression Monday prior to reaching land Tuesday or Wednesday, but it could dissipate as it approaches the coast -

Landfall

is expected in southern Andhra Pradesh, but it will be a minimal event if and when the system moves inland -

Indonesia,

Malaysia, Philippines, southern Vietnam, southern Cambodia and southern Thailand will be wet over the next ten days to two weeks

-

Flood

potentials may rise this week and into the last days of this month as a robust Madden Julian Oscillation (MJO) event evolves -

The

event will need to be closely monitored -

Mainland

Southeast Asia will turn much wetter during the second half of this week through next week after being drier biased for a while in recent weeks.

-

Mexico’s

seasonal rains have largely diminished for the season and good crop maturation and harvest weather is expected for a while this week, but there is potential for a boost in southern and eastern Mexico rainfall later this week and into the weekend -

The

moisture will be good for winter rice and citrus, but may disrupt some farming activity -

Central

America precipitation is expected to continue periodically during the next ten days, but no large region of excessive rain is expected this week -

Panama,

Costa Rica and portions of southern and eastern Nicaragua will be wettest with rain totals rising above normal -

Nicaragua

and Honduras will experience lighter than usual precipitation -

West-central

Africa rainfall will occur periodically enough to support southern coffee, cocoa, sugarcane, rice and other crops during the next couple of weeks -

The

precipitation will be greatest near the coast -

East-central

Africa rainfall will be sufficient to support coffee and cocoa as well as a few other crops -

Rain

will fall abundantly in Tanzania, southwestern Kenya and Uganda while it becomes more sporadic and light in Ethiopia -

Today’s

Southern Oscillation Index was +7.41 and it will move erratically over the next few days

Source:

World Weather INC

Monday,

Nov. 21:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop harvesting for corn and cotton; winter wheat plantation and condition, 4pm - MARS

monthly report on EU crop conditions - Malaysia’s

Nov. 1-20 palm oil exports - USDA

total milk production, 3pm - HOLIDAY:

Argentina

Tuesday,

Nov. 22:

- EU

weekly grain, oilseed import and export data - US

cold storage data for beef, pork and poultry, 3pm - EARNINGS:

Sime Darby Plantation

Wednesday,

Nov. 23:

- EIA

weekly US ethanol inventories, production, 10:30am - USDA

red meat production, 3pm - HOLIDAY:

Japan

Thursday,

Nov. 24:

- Port

of Rouen data on French grain exports - Cane

crush and sugar production data by Brazil’s Unica (tentative) - HOLIDAY:

US

Friday,

Nov. 25:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Nov. 1-25 palm oil export data

Source:

Bloomberg and FI

US

Chicago Fed Nat Activity Index Oct: -0.05 (est -0.03; prevR 0.17)

US

Chicago Fed Nat Activity Index – Full Report

USDA

Crop conditions and progress

US

Corn harvest 96% complete vs expectations of 97% and 90% 5-year average.

US

Winter Wheat 32% G/E vs expectations of 33% and 44% last year.

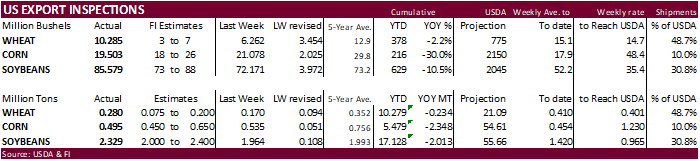

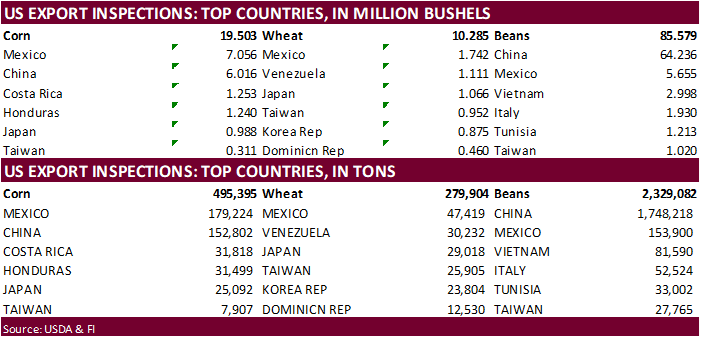

USDA

inspections versus Reuters trade range

Wheat

279,904 versus 75000-300000 range

Corn

495,395 versus 235000-700000 range

Soybeans

2,329,082 versus 1000000-2500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 17, 2022

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/17/2022 11/10/2022 11/18/2021 TO DATE TO DATE

BARLEY

0 147 96 1,708 9,839

CORN

495,395 535,416 826,140 5,479,500 7,827,218

FLAXSEED

0 100 100 200 124

MIXED

0 0 0 0 0

OATS

0 0 0 6,486 300

RYE

0 0 0 0 0

SORGHUM

53,665 3,087 238,986 274,692 753,689

SOYBEANS

2,329,082 1,964,181 2,516,355 17,128,301 19,141,214

SUNFLOWER

0 96 0 2,160 432

WHEAT

279,904 170,424 193,189 10,279,437 10,513,524

Total

3,158,046 2,673,451 3,774,866 33,172,484 38,246,340

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

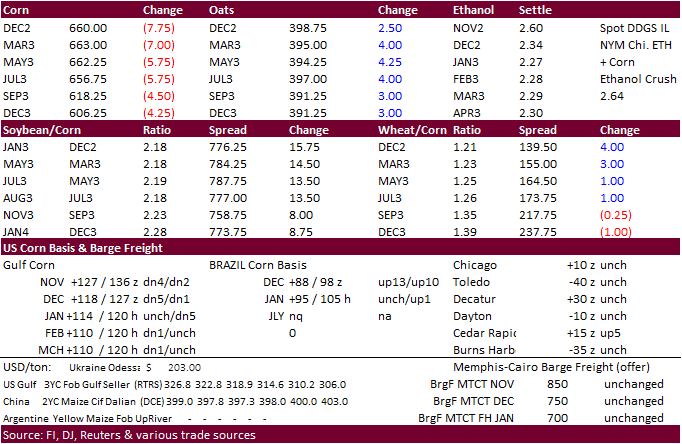

Corn futures ended

lower on a higher USD and worries over China locking down again over increasing COVID cases.

·

The US has a gap in the trading week with US on holiday this Thursday and early close Friday. Expect a thin trade as the week matures.

·

Turned down…Two key US railroad unions voted yesterday on the White House brokered labor agreement. Results against it. Congress could assemble and pass legislation to avoid a standstill within the industry. So far, three unions

voted against ratifying the deal and seven accepted it.

·

China economic slowdown concerns continue to circulate. A single Covid positive test put a major University on lockdown. Beijing cases more than doubled the past few days. US covid and flu cases are also on the rise.

·

December CBOT options expire on Friday.

·

CFTC’s Commitment of Traders report indicated funds were heavy net sellers for the futures only and futures and & options position for corn as of last Tuesday and ended up largest percentage sellers since mid-March 2020. They

likely dumped long positions ahead of the official Russia announcement to extend the Black Sea shipping deal.

None

reported

Updated 11/17/22

December

corn is seen in a $6.50-$6.80 range. March $6.00-$7.15 range.

·

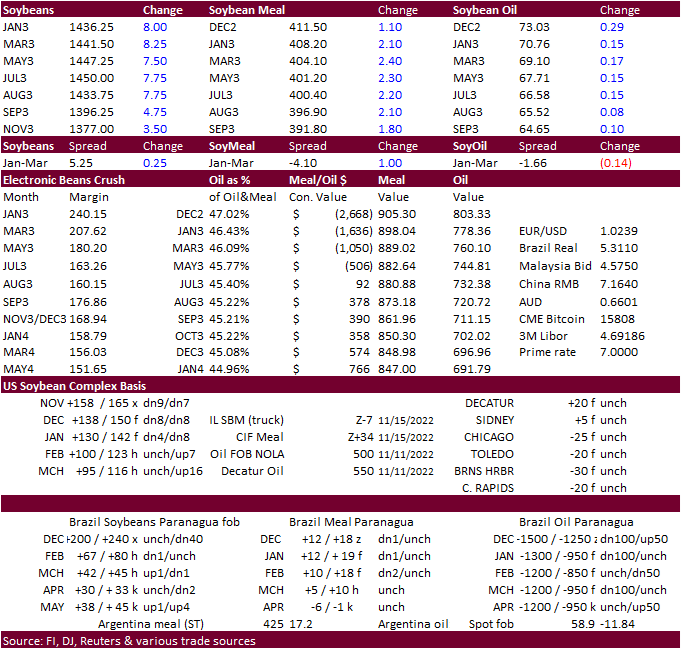

CBOT soybean complex finished higher as

crude oil turned around prompting “risk-on” flow into ags.

·

Argentina was on holiday today.

·

Both Reuters and Bloomberg are reporting that Argentina is closer to roll out a second “soybean dollar” sometime in December. Range was estimated between 215-225 pesos per USD. That would be up from 200 back in September when

they last rolled it out. Argentine producers sold 72.2% of the 44 million tons soybean production for the 2021-22 crop (USDA 43.9MMT), down slightly from 74.2% during the same period year ago. 49.5 million tons is what USDA has penciled in for 2022-23, down

from 51 million tons estimated back in September. We are hearing Argentina crush rates are not as good as they were when they rolled out the September bump, so more soybeans this round could end up exported rather than be crushed. Either way, look for March

CBOT soybean oil and meal product premiums to come under pressure versus other contract months as Argentina could boost exportable product supply by as early as January 1.

·

The Buenos Aires grains exchange reported 12% of the Argentina soybean crop planted versus 29 percent year ago. They are using a 16.7 million hectare area.

·

AmSpec reported November 1-20 Malaysian palm oil exports at 921,808 tons, up 2.9% from 895,522 tons from the same period during October.

·

Cargo surveyor ITS reported November 1-20 palm oil shipments from Malaysia at 997,216 tons, up from 909,817 tons previous period month earlier, or up 9.6% increase.

·

Egypt’s GASC seeks vegetable oils on Tuesday for January 10-31 shipment via 180-day letters of credit. They are also in for local vegetable oils.

·

China plans to auction off 500,000 tons of soybeans from reserves on November 25.

Updated 11/17/22

Soybeans

– January $13.50-$15.00

Soybean

meal – December $390-$420, January $375-$450

Soybean

oil – December 70.00-75.00, January 67.00-74.00 range

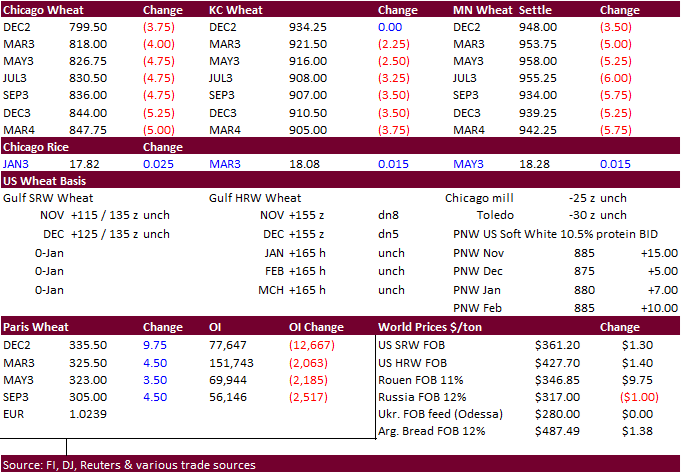

·

US wheat futures finished lower on slowing global trade developments and higher USD. Look for a light trade all of this week, which could also lead to some volatile swings.

·

Paris December wheat closed sharply higher, up 5 euros to 330.75 euros a ton while March French wheat ended 0.75 euros higher at 321.75 euros/ton.

·

IKAR estimated Russia 2022-23 grain exports at 53.5 million tons, up 1 million from previous. They see wheat at 44 million tons, up 2 million from their last estimate.

·

The Rosario BOT estimated Argentina will only export 6.5 million tons of wheat in 2022-23, down from 7 million previous and below a 5-year average of 11.7 million tons.

US

Wheat Associates

“(US)

Basis was mixed in both the Gulf and PNW this week. Wheat traders noted that while export prices need to soften to attract export business, a strong domestic market is keeping basis from softening more. Farmer selling is slow, leading to a slight increase

in HRS basis in the Gulf and a firm HRS basis in the PNW. Railroads originated more grain carloads this week than last, and secondary rail rates decreased week-over-week. However, challenges with railroad logistics remain said one wheat trade. Although Russia’s

agreement to continue the Black Sea grain deal is relevant, grain markets were subdued following the extension’s announcement.”

·

China sold 40,152 tons of wheat from reserves, 100 percent of what was offered at an average price of 2,934 yuan per ton ($409.52/ton).

·

Algeria’s OAIC seeks 50,000 tons of durum wheat on November 23 for December/January shipment.

·

Jordan seeks 120,000 tons of barley on November 23 for March and April shipment.

·

Turkey seeks 40,000 tons of rice on November 25 for Dec 5-Feb 15 shipment.

·

Pakistan is in for 500,000 tons of wheat on November 28.

·

Jordan seeks 120,000 tons of hard milling wheat on November 29 for March/April shipment.

Rice/Other

·

None reported

Updated 11/17/22

Chicago – December $7.75-$8.50, March $7.75 to $10.00

KC – December $9.00-$9.75, March 8.50-$10.50

MN – December $9.00-$10.00, March $9.00 to $10.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.