PDF Attached

Attached

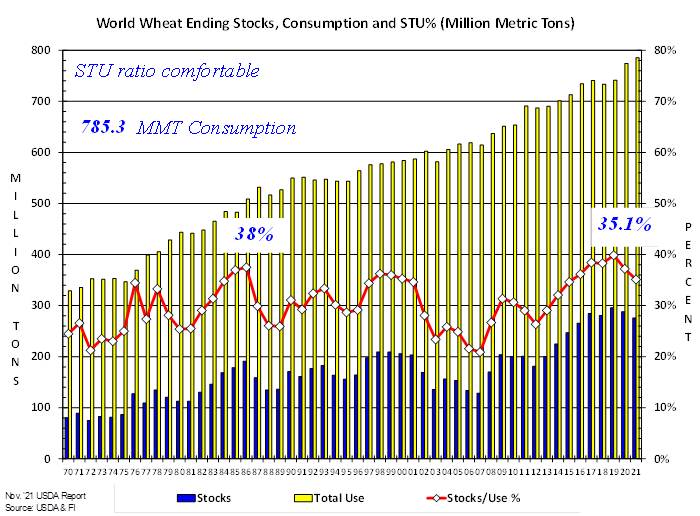

are our world stocks, use and STU % graphs.

Yo-yo

session in grains today while soybeans stayed lower on weakness in meal and improving SA weather. SBO rallied. Egypt seeks vegetable oils on Thursday. Australian wheat quality concerns lifted spot KC and Chicago to new contract highs. There are no major US

weather risks during the balance of this month but it will remain dry across the southern Great Plains.

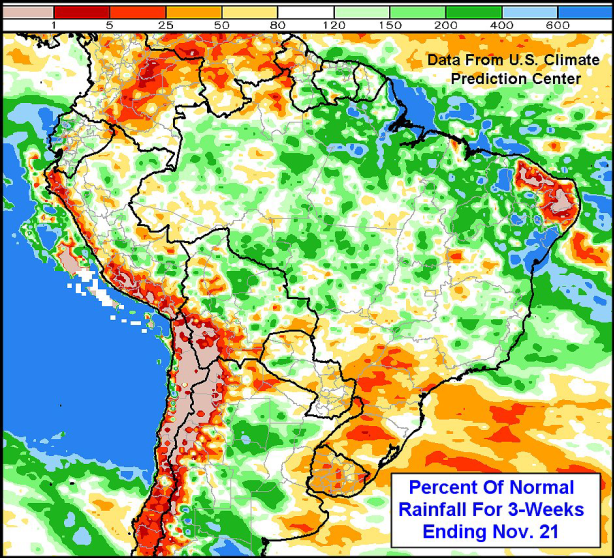

Source:

US CPC, World Weather Inc

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Eastern

Australia winter crop conditions will be in decline again for a while this week as additional rain falls through Thursday followed by periodic showers during the weekend and next week.

- Too

much rain too often will threaten the quality of unharvested wheat, barley and canola in New South Wales and could threaten some crops in Victoria and a few of the remaining unharvested crops in Queensland - The

moisture will be very good for summer crops especially those in Queensland without irrigation - Improved

livestock grazing conditions will result as well because of rain - Sugarcane

improvements are expected along the Queensland coast - Argentina’s

weather today is advertised a little wetter this weekend than advertised Monday - Two

rain events this week one Wednesday and the other this weekend will help maintain a good outlook for grain, oilseeds and other crops - Recent

warm temperatures have accelerated drying, but these two rain events should provide adequate relief to carry crops for a while - Next

week looks drier biased - Temperatures

will be seasonable after today - Central

and northern Argentina temperatures recently were in the 80s and 90s Fahrenheit

- High

temperatures Monday reached over 100 in Santiago del Estero and areas to the northwest while solidly in the 90s in most of central and northern Argentina - An

extreme high of 108 occurred in west-central Santiago del Estero - Brazil’s

weather is still advertised to be well mixed over the next two weeks - However,

month to date rainfall in southern Brazil has continued lighter than usual

- As

rain intensity continues lighter than usual over the next few weeks the potential for drying topsoil will rise

- All

that it will take for a firmer ground is a single missed or lighter than expected rain event and/or warmer temperatures - The

southern part of Brazil should continue to be closely monitored even through soil moisture and crop conditions are very good - Wheat

harvesting will advance well in the south - Late

soybean and corn planting are advancing well - Citrus,

sugarcane and coffee are rated well with little change likely for a while - Colombia

and Venezuela rainfall has been lighter than usual this month - The

change has helped to curb flooding and improve coffee, corn, citrus, sugarcane, rice and a host of other crops - Precipitation

will be periodic, but not excessive over the next two weeks - Southern

India remains plenty wet and some field are too wet - Rainfall

is expected to become most concentrated on the lower east coast as time moves along, but the entire southern one-third of the nation needs drier weather to expedite summer crop maturation and improved harvest progress - Tropical

disturbance expected to move along the lower east coast Thursday through Sunday will produce heavy to excessive rainfall resulting in coastal flooding - Commerce

could be briefly affected - Property

damage should be limited to a few rare occurrences and mostly along the lower coast - Central

and northern India will experience dry weather during much of the next ten days favoring winter crop planting, establishment and early growth - Northern

parts of the Malay Peninsula will receive excessive rainfall during the coming week with some areas getting 10.00 to 20.00 inches of rain by this time next week

- Only

a small amount of agriculture is produced in the impacted region, but rice and sugarcane will be negatively impacted - A

tropical cyclone may evolve in the Bay of Bengal next week at this time that will need to be closely monitored for possible impact on Bangladesh, far eastern India and/or Myanmar - South

Africa has been and will continue to experience sporadic daily showers and thunderstorms that will support summer crop planting across much of the nation over time.

- Many

areas still have need for significant rain today, but soil moisture should slowly improve over the next two weeks - Planting

and early crop emergence and establishment should advance well as soil conditions improve - China’s

weather should be relatively tranquil over the next ten days as precipitation becomes more limited and light - Snowfall

in the northeast from the latest storm will end today with a few lingering bouts of snow into Wednesday - Europe

weather is expected to gradually become more active as time moves along resulting in greater soil moisture - Winter

crops are mostly planted and the majority are established well enough to benefit from the moisture - Dormancy

and semi-dormancy has already settled into winter crops in the central and east - North

Africa will get some welcome rainfall over the next ten days improving topsoil moisture for winter wheat and barley planting - Turkey

and Greece rainfall is expected to increase during the next ten days - Some

western Turkey and Greece areas have been quite dry this month - West-central

Africa rainfall should occur most often near the coast allowing interior coffee, cotton, rice, cocoa and sugarcane to mature favorably - Cameroon

and coastal areas from Nigeria to Ivory Coast will receive rain periodically - Russia,

Ukraine, the Baltic States and Belarus (the western CIS) will experience more frequent rain over the next ten days resulting in a moisture boost which will be welcome in the spring - The

precipitation will occur as snow and rain - Some

snow melt is expected in areas near the Ukraine border - U.S.

crop weather Monday was generally dry biased and temperatures were cooler than usual in the Midwest and warmer than usual in the northwestern and west-central Plains as well as the southwestern states - U.S.

weather outlook will be a little tranquil for a while - Limited

precipitation potential remains for hard red winter wheat production areas - Any

precipitation that falls will not likely impact the driest areas leaving them quite dry - The

Texas Panhandle into eastern Colorado have been driest in recent weeks - Limited

precipitation will impact the northwestern U.S. Plains and neighboring areas of Canada’s central Prairies - There

is some potential for more frequent snow events to impact Montana and Wyoming as time moves along into early December - Much

of California, the southwestern desert region, southern Rocky Mountains and southern Great Basin will be dry biased during the next ten days - U.S.

Pacific Northwest will experience the greatest precipitation in the Cascade Mountains and areas west to the coast of Washington and Oregon as well as in the northern mountains of Idaho and western Montana - Most

interior valleys are unlikely to get much precipitation - U.S.

Delta the lower and eastern parts of the Midwest and Tennessee River Basin will receive rain most frequently and stay wettest over the next ten days - U.S.

southeastern states will see a mix of rain and sunshine that may result in net drying for parts of the region - Ontario

and Quebec, Canada will receive some periodic precipitation possibly slowing the late harvest

- The

moisture will be good for winter crops, although temperatures are trending cooler and wheat will soon turn semi-dormant - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Today’s

Southern Oscillational Index was +8.21 and it was expected to move erratically over the coming week - New

Zealand rainfall is expected to be below normal over the next week to ten days except along the west coast of South Island where rainfall will be greater than usual - Temperatures

will be seasonable

Tuesday,

Nov. 23:

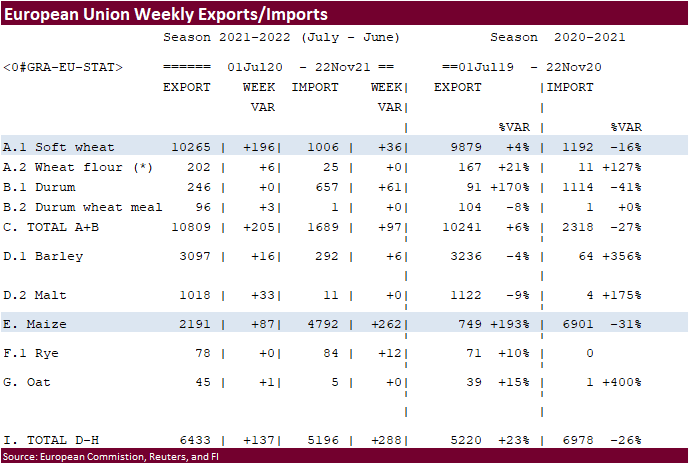

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases sugar and cane production data (tentative) - Council

of Palm Oil Producing Countries online webinar - U.S.

poultry slaughter, 3pm - HOLIDAY:

Japan

Wednesday,

Nov. 24:

- EIA

weekly U.S. ethanol inventories, production - USDA

red meat production, 3pm

Thursday,

Nov. 25:

- Malaysia’s

Nov. 1-25 palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

U.S.

Friday,

Nov. 26:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

(Reuters)

– The United States said on Tuesday it would release millions of barrels of oil from strategic reserves in coordination with China, India, South Korea, Japan and Britain to cool prices after OPEC+ producers repeatedly ignored calls for more crude.

Philadelphia

Fed Non-Manufacturing Regional Business Activity Index Nov: 46.1 (prev 33.4)

–

Firm Level Business Activity 47.0 (prev 34.3)

–

New Orders 19.2 (prev 14.6)

–

Full Time Employment 15.2 (prev 12.5)

–

Wage And Benefit Cost Index 60.0 (prev 51.3)

Canada

October Manufacturing Sales Most Likely Rose By 4.1% – Statscan Flash Estimate

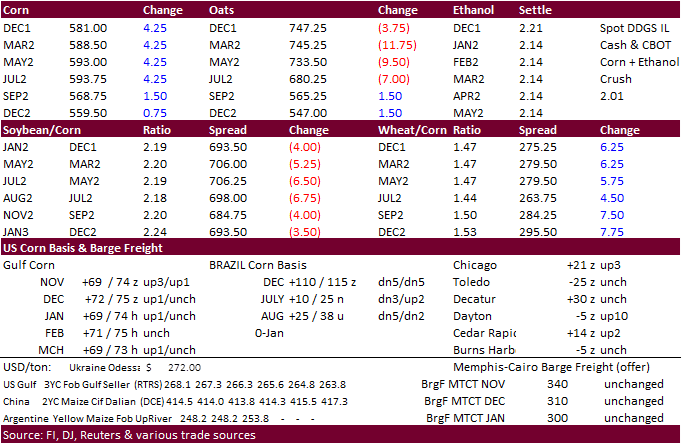

Corn

·

CBOT corn opened lower and was higher by mid-morning trading. Dec was up 3.75 cents to $5.8050. A recovery in wheat prices supported corn. Outside commodity and equity markets were volatile today and we think the price fluctuations

impacted grains.

·

A higher trade in crude oil also underpinned corn prices. Jan WTI was up $2.00 by noon CST.

·

South Korea continues to turn to South America for corn and soybean meal.

·

Oat futures traded sharply lower this morning but paired some losses after corn prices recovered.

·

A shortage of food cans is straining the supply of cranberry sauce ahead of the US Thanksgiving Holiday, another reminder of shipping woes seen across the agriculture industry.

·

December options expire Friday.

·

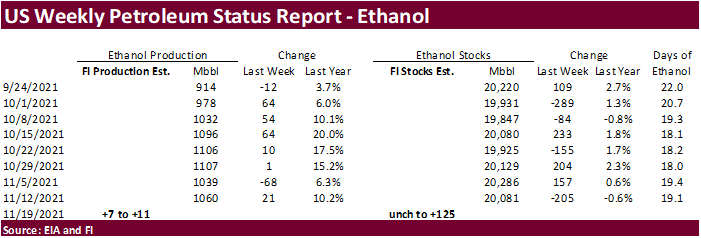

A Bloomberg poll looks for weekly US ethanol production to be up 5,000 barrels to 1.065 million (1049-1088 range) from the previous week and stocks up 108,000 barrels to 20.189 million.

Export

developments.

·

South Korea’s MFG bought 48,500 tons of corn from South America at an estimated $318.25 a ton for arrival around April 25.

Updated

11/23/21

December

corn is seen in a $5.65-$5.90 range

March

corn is seen in a $5.25-$6.25 range

·

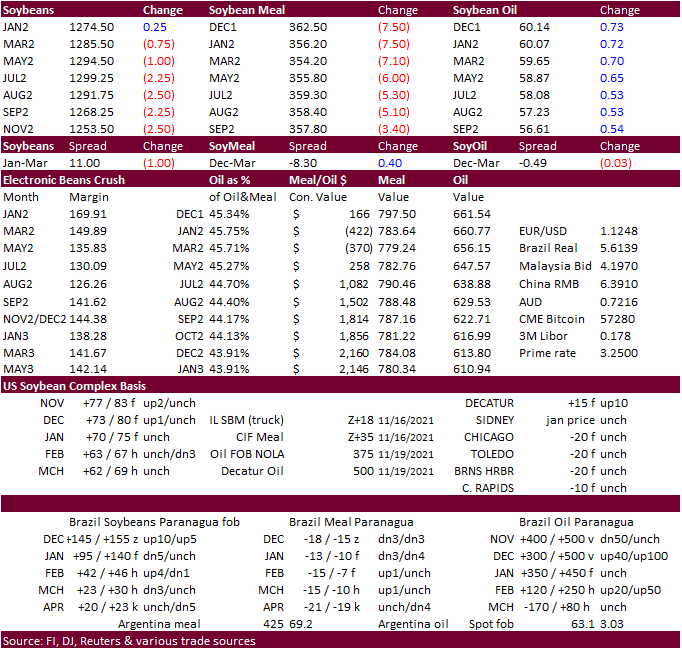

CBOT soybeans traded lower in a risk off trade, lack of Chinese soybean buying so far this week, and lower soybean meal. Argentina’s weather forecast for this weekend slightly improved. January soybeans were down 1.25 cents, Dec

meal off a large $7.80/short ton, and Dec SBO rallied 73 points. Soybean oil is up 3.4% over the past two sessions while meal was down 2.6%.

·

CBOT crush margins eased today. The January crush was down 6.75 cents to 175.25 cents and are well off their absolute high of 202 cents established November 16.

·

US soybean and corn basis bids were firmer today at processors. Decatur, IL soybeans were up 10 cents. Morristown, IN was up 10 cents. Council Bluff, IA, was up 5 cents.

·

US crushing companies will ramp up capacity over the next couple of years. Latest we heard an IA crush plant plans to expand capacity sometime by Q3 2023. The American Soybean Association sees a 13% increase in new or expanding

crush facilities over the next several years, according to a Global Grain attendee source. Another source in early November put the US increase at 11%. We think there about 11 projects on the table for new or existing expansion. One of those locations include

a refined soybean oil production increase. The most the US crushed in any given month was 6.37 million bushels per during November 2020. That’s roughly 2.325 billion bushels a year. We estimate current US soybean crush capacity stands somewhere between 2.350

and 2.450 billion bushels.

·

Meanwhile Argentina’s crush rates have been steady over the past ten years.

·

Argentina is projected to see a little more rain this weekend than previously projected. 0.5-2.0” will fall Wednesday into Thursday

from

Cordoba and Santiago del Estero to Corrientes, Entre Rios, and central Buenos Aires. Then another round of rain will occur Friday into Saturday of 0.25-1.0”.

·

Central and southern Brazil has a chance for rain Thursday into Friday bias RGDS (0.50-2.0), and again December 3-5. Much of the northern growing areas will be active over the next two weeks.

·

IMEA sees good development for the soybean crop across Mato Grosso, Brazil.

·

US soybean meal basis bids were steady for several US domestic locations.

·

Cargo surveyor SGS reported November 1-20 Malaysian palm exports at 1,149,481 tons, 229,396 tons above the same period a month ago or up 24.9%, and 250,159 tons above the same period a year ago or up 27.8%.

·

GAPKI – Indonesia’s palm oil exports and production in 2021 are both likely to fall for a second straight year (Reuters)

·

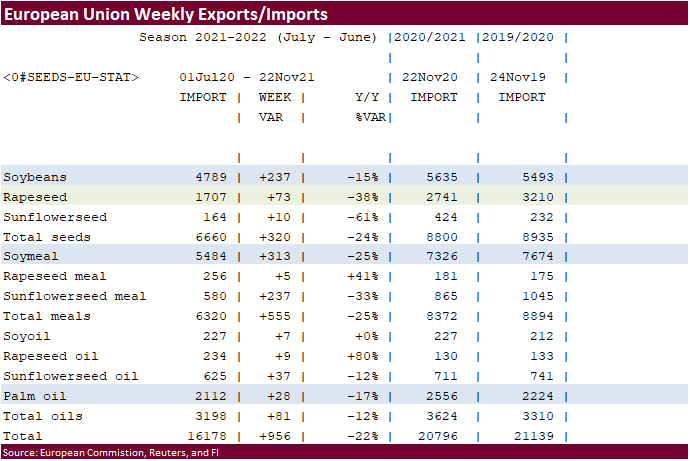

European Union soybean imports through November 21 total 4.79 million tons by Nov. 21, below 5.64 million tons by the same week year ago. Rapeseed imports total 1.71 million tons, compared with 2.74 million tons a year earlier.

Soybean meal imports are 5.48 million tons against 7.33 million a year ago. The Commission said that the data for France in the report was still only complete until July 2021.

·

Japan was on holiday today.

Export

Developments

·

Egypt’s GASC seeks vegetable oils on Thursday for January 15-31 arrival. It’s for payment at sight and/or 180-day letters of credit.

·

South Korea’s MFG bought 16,000 tons of soybean meal at an estimated $452.00/ton c&f for arrival around April 25.

·

Turkey bought 6,000 tons of sunflower oil at an estimated $1,471/ton c&f for Dec 1-20 shipment.

Updated

11/19/21

Soybeans

– January $12.00-$13.00 range, March $12.00-$13.50

Soybean

meal – December $350-$395, January $340-$390, March $325-$400

Soybean

oil – December 56.50 to 59.50 cent range, January 55.00-60.50, March 56-64

·

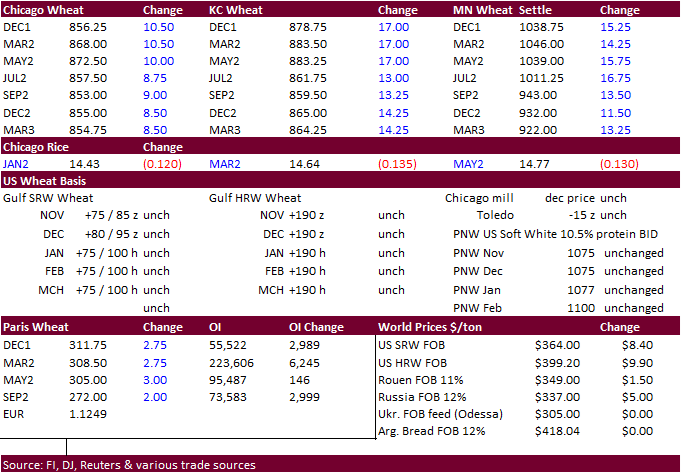

Dec Chicago wheat was up 10.25 cents, Dec KC up 17.00 cents, and Dec Mn was up 15.25 cents. December MN’s contract absolute contract high was $10.8650. It settled today at $10.3825.

·

March Matif Paris wheat was 2.75 euros higher at 308.50.

It hit an all-time high of 309.25 earlier.

·

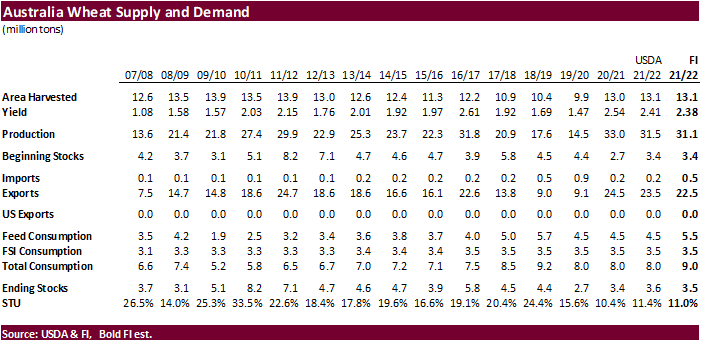

Rain is in the forecast for eastern Australia and threatens wheat quality. The wettest locations include southern New South Wales into the western slopes of northeastern New South Wales and southeastern Queensland. The above normal

rainfall is a result from La Nina strengthening. New South Whales may see 30-40% of production at risk, according to a Reuters article. One brokerage group estimated Ausi feed wheat production at 6 million tons, up from 2 million previous.

·

10.5% protein Ausi wheat (APW) was quoted around $365/ton fob versus $325 for 9% (ASW), according to Reuters. The spread is normally around $10/ton.

·

There are no major US weather risks we see during the balance of this month but it will remain dry across the southern Great Plains.

·

Egypt said they have enough wheat to last five months.

·

Russia’s Federal Center of Quality and Safety Assurance for Grain and Grain Products reported wheat exports are down 18% through November 18 from the same period year ago to 17.2 million tons. Wheat exports slowed from the previous

week.

·

Ukraine will see rain through the end of this month, benefiting recently planted winter grains but also could delay corn harvesting.

·

US wheat conditions fell 2 points to 44 percent and compare to 43 percent year ago. With US winter wheat plantings at 96% (normal for this time of year), US wheat is 86 percent emerged, one point below 5-year average.

·

EU soft wheat exports since July 1 reached 10.3 million tons through November 21, above 9.88 million tons year earlier.

The

global problem for wheat is not total supply,

it’s the amount of available high protein wheat availability. Weather problems for the EU, North America and now eastern Australia have driven up prices.

Export

Developments.

·

Turkey bought 370,000 tons of feed barley at $349.85-$362.90/ton for January shipment.

·

Jordan seeks 120,000 tons of feed barley on November 24.

·

Jordan seeks 120,000 tons of wheat on November 25 for shipment between March 16-31, April 1-15, April 16-30 and May 1-15.

·

Turkey seeks 385,000 tons of wheat on November 25.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

Rice/Other

·

None reported

Updated

11/23/21

December

Chicago wheat is seen in a $8.25‐$8.55 range, March $7.50-$8.75

December

KC wheat is seen in a $8.55‐$8.85, March $7.50-$8.75

December

MN wheat is seen in a $10.15‐$10.50, March $9.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.