PDF Attached

USDA SAYS RELEASE OF ITS WEEKLY CROP PROGRESS REPORT WILL BE DELAYED UNTIL NOV. 29 DUE TO “SYSTEM OUTAGES” – Reuters News

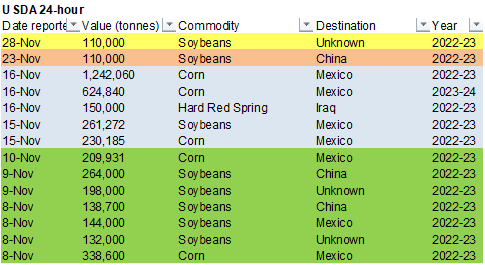

USDA: Private exporters reported sales of 110,000 metric tons of soybeans for delivery to unknown

Wide trading range in many commodity markets. Both the USD and WTI crude oil were sharply lower this morning, ending the day higher.

WTI crude earlier hit its lowest level since late December 2021. The soybean complex ended higher, corn mixed and wheat lower. Rising covid cases in China and Black Sea competition were a couple main influences on trading for the grains.

The soybean complex found support from a reversal in outside related markets.

Delayed…

Weather

Rain

over the weekend was as expected for the US Midwest & Delta and near expectations for the Great Plains. Precipitation will occur across the Midwestern south central and northwestern areas Tuesday, and eastern areas Wednesday. For the Great Plains, northern

CO and NE will see a wintery mix Tuesday. Rest of the Great Plains will see net drying through the end of the workweek. Argentina’s southwestern BA saw rain over the weekend. BA will see rain through Tuesday, while from Wednesday into Thursday, Argentina’s

Cordoba, south Santa Fe, Buenos Aires will benefit from precipitation. Brazil will see rain this week across most growing areas, drier bias MGDS and RGDS.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Argentina

weather offered no surprises during the weekend - Rain

was confined to the far south where moisture totals were no more than 0.62 inch

- Temperatures

were warm to hot except in the far southeast with highs in key crop areas in the 90s to 104 degrees Fahrenheit

- Net

drying continued with the greatest crop stress in central and northern parts of the nation due to nearly depleted soil moisture and very warm temperatures - Argentina

rainfall will be greatest Tuesday night and Wednesday with some lingering showers in the northeast early Thursday - Rainfall

of 0.25 to 1.00 inch will be common with 1.00 to 2.00 inches in eastern Buenos Aires and a few 1.00 to 2.00-inch amounts in southern Cordoba and southern Santa Fe

§

Northern Argentina will be driest and where crop stress will continue rising

- The

area produces cotton as well as minor grain and oilseeds - Relief

from dryness from Cordoba to eastern Buenos Aires will be greatest during mid-week with some short-term improvement expected to some crops

§

No other well organized rain event is expected for the coming ten days

- Southwestern

Argentina may get some needed rain in the second half of next week and into the following weekend, but only a limited amount of rain will occur until then - Argentina

temperatures will continue very warm to occasionally hot through the next ten days except during the wetter period during mid-week this week when cooling is expected for a little while.

- Argentina’s

bottom line remains one of concern for many crops, but mid-week rainfall this week should prove timely enough to offer some short-term relief from dryness and reduce the potential losses in production. However, follow up precipitation is an absolute must if

there is going to be any trend changes. The earliest that follow up rain is advertised is during the middle to latter part of next week. Crop moisture stress and worry over crop development will be greatest in northern Argentina over the next ten days because

of the most limited rainfall and warmest temperature bias will be in those areas. That includes cotton and minor soybean, corn and sunseed production areas. Relief is needed as soon as possible. Southwestern Argentina will get partial relief from a few showers

and thunderstorms this week, but the earliest opportunity for greater rain will hold off until late next week and the following weekend.

- No

surprises occurred in Brazil weather during the weekend with rain occurred erratically from Mato Grosso to Tocantins, Bahia and Minas Gerais - Rainfall

reached 1.25 inches in eastern Mato Grosso and varied from 1.00 to 2.67 inch in northern Minas Gerais and western Bahia to Tocantins where the ground remains saturated.

- Net

drying occurred form western and southern Mato Grosso through Mato Grosso do Sul and southern Goias as well as Paraguay to Rio Grande do Sul; including a fair amount of Sao Paulo

§

The drier bias began firming the soil

- The

most significant dryness remained in southern Mato Grosso and in a few immediate neighboring areas where soil moisture was rated short to very short - Temperatures

were seasonable with a slight milder than usual bias in the northeast - Brazil

weather will continue drier biased early this week from southern Mato Grosso and southern Goias through western Sao Paulo, Mato Grosso do Sul and Paraguay into Rio Grande do Sul - Brazil

weather is expected to gradually trend wetter in center west and southern parts of the nation during the next ten days to two weeks, but areas closest to Paraguay will be last to get rain and the same is true for some western Rio Grande do Sul locations - Relief

from dryness will be welcome and should prove to be timely enough to either support favorable production of to improve that production potential

§

Greater rain will still be needed in Paraguay and immediate neighboring areas

- Brazil

temperatures will continue seasonable with a slight cooler bias over the next two weeks

- Northeastern

Brazil will continue wettest with an abundance of soil moisture in Tocantins, Bahia, northern Minas Gerais, Espirito Santo and some areas in Maranhao and Piaui

§

Local flooding is possible, but very little crop damage is anticipated because of the wet conditions

- Brazil’s

bottom line should be mostly good, but there is concern for crops in a part of Mato Grosso and immediate neighboring areas because of dryness. Most other areas have either had favorable soil moisture or have been receiving timely rainfall to maintain a relatively

good environment for crop development. Remember, “normal” late spring and summer weather in Brazil is normally too much rain for ideal summer crop development and this year’s pattern could end up supporting some good yield potentials with the possible exception

of a few locations in Mato Grosso and a few in Paraguay where the driest weather has been and may continue for a while longer - U.S.

weekend rainfall was greatest from the lower Midwest into the southern Plains, Delta and interior southeastern states.

- Amounts

were greatest in central and eastern Texas, although a few areas from eastern Kansas to central Illinois received significant amounts through Sunday morning

§

Rain totals in each of these areas varied from 0.75 to a little more than 2.00 inches

- Rainfall

in the Texas Panhandle was no more than 0.16 inch - Snowfall

varied from a trace to 5.5 inches in southwestern portions of West Texas and immediate neighboring areas of eastern New Mexico - U.S.

hard red winter wheat areas were largely missed by the precipitation except in Oklahoma and a few areas in south-central Kansas where 0.30 to 1.21 inches resulted - Rain

and mountain snow fell in the Pacific Northwest while most of the interior western U.S. was dry.

- Temperatures

trended warmer in the central states and were mild elsewhere - U.S.

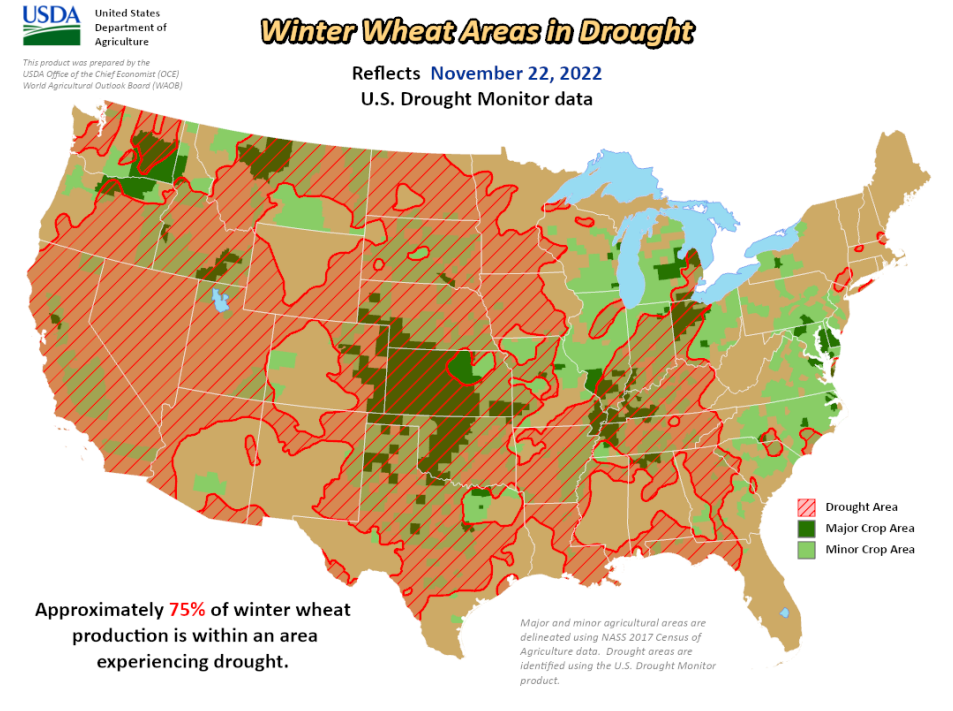

hard red winter wheat areas will continue to receive limited precipitation over the next two weeks, although brief bouts of snow and some rain may occur briefly Tuesday into Wednesday of this week, sporadically this weekend and possibly again early next week

- None

of the precipitation will change drought conditions and cooling next week will push crops back into a dormant or semi-dormant status - West

Texas harvest weather will improve this week after weekend precipitation, but some additional precipitation is possible briefly this weekend into early next week

- U.S.

precipitation in the next two weeks will be greatest in the Delta, Tennessee River Basin, eastern Midwest and a part of the southeastern states where a boost in soil moisture is expected - Runoff

may improve river and stream flows in some areas - California

weather will turn more active again during the latter part of this week into next week with a welcome boost in mountain snowpack expected while light rain occurs in the central valleys A few coastal areas will get greater rainfall as well - Canada’s

Prairies weather will continue to be a little more active in this coming week with waves of snow expected - A

short break in the precipitation is expected later this week, and then more moisture will evolve next week

§

The rising snowpack will be good for easing dryness in the spring of 2023

- Ontario

and Quebec, Canada precipitation will be frequent this week and then some drier weather is expected for a little while before more precipitation occurs next week - Soil

moisture will be plentiful and some snow is likely to accumulate later this week - Europe

temperatures will trend colder than usual in the northeast along with western Russia later this week and into the weekend - Temperatures

in western and southern Europe will be mild to warm this week with some cooling in the northwest next week - Negative

North Atlantic Oscillation may bring more cold farther west in Europe this weekend and next week than advertised today - Negative

Arctic Oscillation and North Atlantic Oscillation may bring temperatures down across the central and interior eastern parts of the U.S. for a little week while next week - Europe

precipitation will occur in many areas this week, although it will be light - Weekend

and next week precipitation will increase across southern parts of the continent; including the Mediterranean region this weekend and especially next week

§

This will occur in association with the negative North Atlantic Oscillation

- Most

of the CIS crop areas will experience waves or rain and snow during the next two weeks, although most of it should be light - Cooling

is expected in western Russia, the Baltic States, Belarus and northern Ukraine in the next week to ten days, but there is no risk of crop damaging cold - Europe

and western Asia snow cover is present from eastern Poland through the Baltic States, Belarus and northern and western Ukraine through the most other areas in Russia except the Southern Region. Northern Kazakhstan is also buried in snow - North

Africa will get rain early this week in northern Tunisia and northeastern Algeria, but changing weather late this week and especially next week should bring rain to Morocco and eventually across the remainder of northern Africa - The

moisture will be well timed and good for wheat and barley emergence and establishment after recent dryness - China

weather will be most active and wettest during the next ten days in the Yangtze River Basin and areas southward

- A

wintry mix of precipitation types will occur Tuesday into Thursday of this week stressing livestock and slowing travel

- Weather

elsewhere in eastern China will be less disruptive with only light amounts of snow and a little rain expected

- Cooling

in China briefly this week will bring on greater energy demand and will push northern winter crops into at least semi-dormancy, although warming is expected again next week - Eastern

and southern Australia will experience favorable drying conditions during the coming week

- Totally

dry weather is not likely, but the resulting precipitation should be light enough to allow crop development and fieldwork to advance relatively well - Eastern

and northern Queensland will experience a boost in rainfall early to mid-week this week that will be good for sugarcane and eastern cotton production areas - Drying

in interior Queensland and New South Wales will be ideal for advancing winter crop maturation and harvest progress, although much of the harvest in Queensland should be complete - Western

Australia crop weather remains very good for the normal maturation of winter crops and their harvest with little change likely for the next couple of weeks

§

Any rain that evolves will only briefly disrupt field progress

- India

weather will be fine for summer crop harvesting and winter crop planting, although periods of rain will fall in the far south of India periodically which is not unusual at this time of year - South

Africa’s summer crop areas will continue to experience alternating periods of rain and sunshine during the next two weeks favoring normal planting and early season crop development

- Southeast

Asia will continue to experience an active weather pattern with nearly all crop areas from Thailand and Vietnam to Indonesia, and the Philippines receiving rain - Some

of the precipitation may be heavy at times resulting in local flooding - A

tropical disturbance may develop near the southern Philippines this week before moving to the northern Malay Peninsula this weekend and into the Bay of Bengal nest week

- Mexico’s

rains have largely diminished for the season and good crop maturation and harvest weather is expected for a while, but there is potential for a boost in southern and eastern Mexico rainfall later this week into the weekend

- The

moisture will be good for winter rice and citrus, but may disrupt some farming activity - Central

America precipitation is expected to continue periodically during the next ten days, but no large region of excessive rain is expected this week - Panama,

Costa Rica and portions of southern and eastern Nicaragua will be wettest with rain totals rising above normal - Nicaragua

and Honduras will experience lighter than usual precipitation - West-central

Africa rainfall should be mostly confined to southernmost coffee and cocoa production areas - The

precipitation will be greatest near the coast - Some

of the precipitation may drift northward this weekend and next week - East-central

Africa rainfall will be sufficient to support coffee and cocoa as well as a few other crops - Rain

will fall abundantly in Tanzania, southwestern Kenya and Uganda while it is more sporadic and light in Ethiopia - Today’s

Southern Oscillation Index was +4.18 and it will move erratically over the next few days

Source:

World Weather INC

Monday,

Nov. 28:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop harvesting for corn and cotton; winter wheat planting and condition, 4pm

Tuesday,

Nov. 29:

- Vietnam’s

General Statistics dept releases November coffee, rice and rubber export data - EU

weekly grain, oilseed import and export data - Roundtable

on Sustainable Palm Oil (RSPO) 2022 conference, Kuala Lumpur, Nov. 29-30

Wednesday,

Nov. 30:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

November palm oil exports - US

agricultural prices paid, received, 3pm

Thursday,

Dec. 1:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Australia

commodity index - USDA

soybean crush, DDGS production, corn for ethanol, 3pm

Friday,

Dec. 2:

- FAO

World Food Price Index - Canada’s

StatCan to release wheat, canola and barley production data, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

No

surprises

Reuters

table

SUPPLEMENTAL

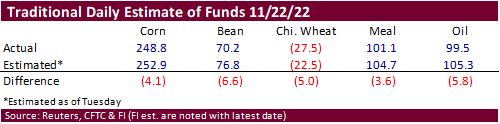

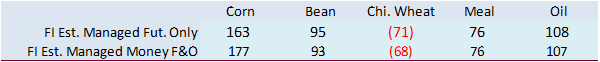

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

91,410 -12,207 359,660 -1,691 -421,686 5,707

Soybeans

31,201 -13,059 130,764 5,298 -135,127 5,634

Soyoil

62,796 -6,143 105,999 -2,638 -180,916 11,619

CBOT

wheat -65,691 -5,201 103,486 -3,571 -35,589 4,840

KCBT

wheat 116 -3,549 46,259 -528 -46,205 3,767

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

170,767 -6,065 236,688 -1,483 -420,505 4,123

Soybeans

82,135 -10,830 83,233 1,162 -128,179 6,486

Soymeal

71,815 -3,895 86,650 1,254 -203,318 1,422

Soyoil

100,274 -10,098 83,989 1,469 -197,400 10,150

CBOT

wheat -53,402 -6,622 64,050 -2,616 -28,704 4,892

KCBT

wheat 17,308 -3,973 33,153 648 -46,875 3,189

MGEX

wheat -652 -810 1,691 69 -2,890 -1,210

———- ———- ———- ———- ———- ———-

Total

wheat -36,746 -11,405 98,894 -1,899 -78,469 6,871

Live

cattle 62,389 12,228 53,737 411 -122,968 -6,529

Feeder

cattle -3,554 3,052 2,733 -502 4,416 -475

Lean

hogs 54,277 -1,525 46,225 -55 -81,636 2,867

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

42,434 -4,768 -29,383 8,192 1,766,134 -85,072

Soybeans

-10,349 1,055 -26,839 2,127 718,082 6,435

Soymeal

22,453 578 22,401 642 433,521 -7,399

Soyoil

1,017 1,319 12,121 -2,839 520,069 -16,509

CBOT

wheat 20,264 415 -2,209 3,931 443,433 -5,019

KCBT

wheat -3,415 -174 -171 310 165,174 -8,804

MGEX

wheat 2,447 824 -597 1,126 45,442 -3,461

———- ———- ———- ———- ———- ———-

Total

wheat 19,296 1,065 -2,977 5,367 654,049 -17,284

Live

cattle 14,886 -985 -8,043 -5,126 354,749 6,605

Feeder

cattle -1,337 1,121 -2,260 -3,196 53,996 -7,537

Lean

hogs -6,281 -188 -12,584 -1,099 264,489 5,290

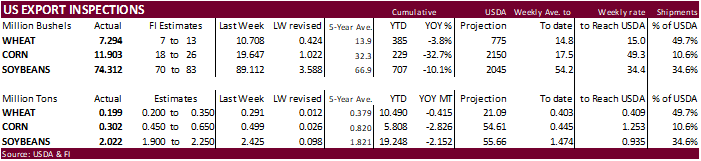

FI

First Notice Day Delivery estimates

|

USDA |

||||

|

Wheat |

198,519 |

versus |

200000-400000 |

range |

|

Corn |

302,350 |

versus |

400000-850000 |

range |

|

Soybeans |

2,022,443 |

versus |

1800000-2250000 |

range |

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 24, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/24/2022 11/17/2022 11/25/2021 TO DATE TO DATE

BARLEY

0 0 98 1,708 9,937

CORN

302,350 499,068 806,390 5,807,815 8,633,608

FLAXSEED

0 0 0 200 124

MIXED

0 0 0 0 0

OATS

0 0 0 6,486 300

RYE

0 0 0 0 0

SORGHUM

3,068 53,665 190,649 277,760 944,338

SOYBEANS

2,022,443 2,425,237 2,259,136 19,248,392 21,400,350

SUNFLOWER

0 0 0 2,160 432

WHEAT

198,519 291,427 390,771 10,489,503 10,904,295

Total

2,526,380 3,269,397 3,647,044 35,834,024 41,893,384

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

90

Counterparties Take $2.055 Tln At Fed Reverse Repo Op (Prev $2.031 Tln, 90 Bids)

·

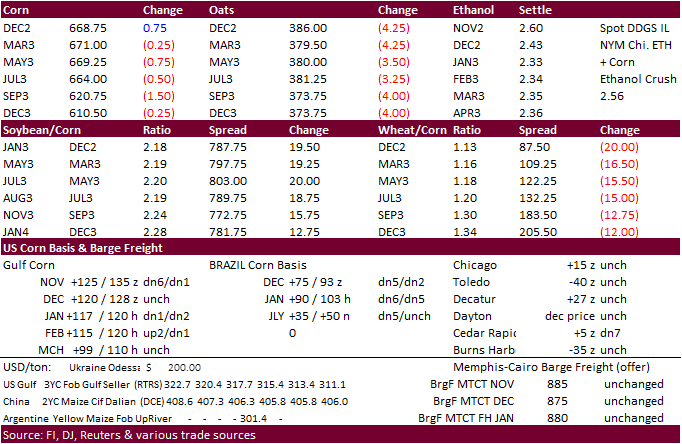

Corn futures were

lower for the majority of the session, follow wheat, but a sharply higher close allowed for corn to end mixed. Earlier the energy markets were weaker and dragging on corn. USDA export inspections were reported below a range of expectations.

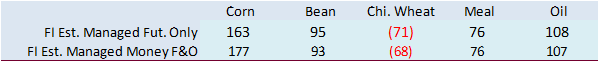

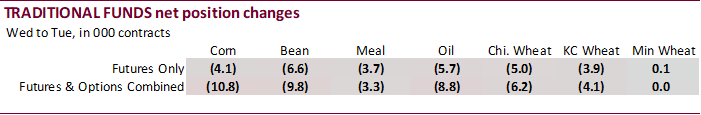

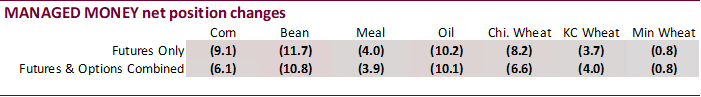

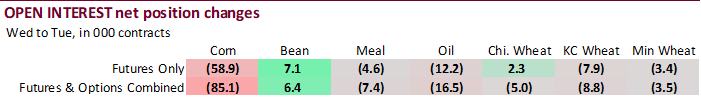

·

Funds were even in corn today.

·

WTI crude oil fell below $74 before rally back to $77.11 as of 1:54 pm CT.

·

The USD started the day lower and reversed to trade 65 points higher by 1:53 pm CT. Earlier the USD briefly hit its lowest level since the second week of August.

·

US domestic corn remains tight in the WCB.

·

Mexico’s president and U.S. Secretary of Agriculture Tom Vilsack held a meeting this afternoon over GMO corn. We are awaiting details. Mexico previously announced they are banning GMO corn imports starting 2024.

·

Position day is Tuesday for December expiry commodities. FI estimates are above for deliveries.

·

US railroad strike could come as early as December 9. Roughly 30% of US freight, when measured by weight, is handled by trains.

·

South Korea’s NOFI group bought 138,000 tons of optional origin corn for March arrival at $332.39/ton c&f, $1.8270 over the March contract, and $1.7900 over the March.

Updated 11/25/22

·

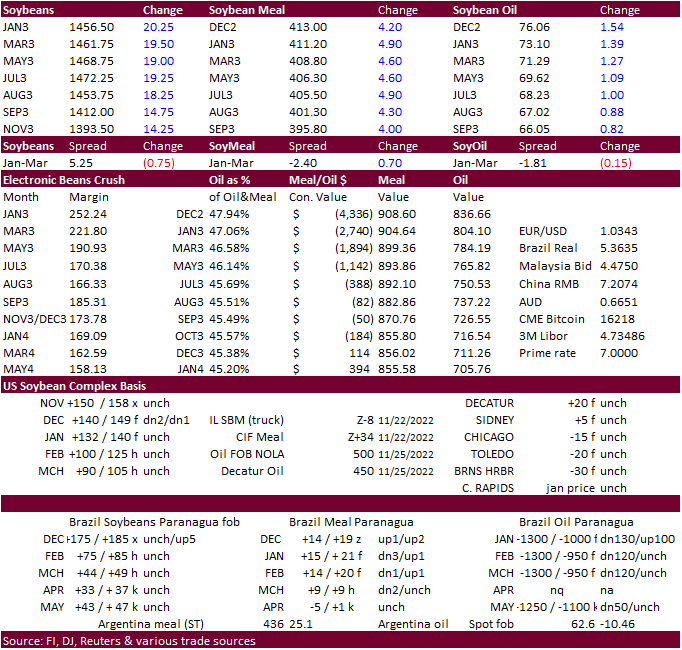

Despite the rollout of the Argentina soybean dollar and global economic recession concerns, the soybean complex rallied. Soybean meal was higher throughout most of the day. Soybean oil opened sharply lower but rallied hard on

buy stops after WTI crude oil started to recover. WTI saw a wide trading range and was up about 90 cents as of 1:50 pm CT. Soybeans also saw buy stops. January soybeans closed 20.50 cents higher, January soybean oil 141 points higher and January meal $5.40

higher.

·

Funds bought an estimated net 9,000 soybeans, bought 4,000 meal and bought 5,000 soybean oil.

·

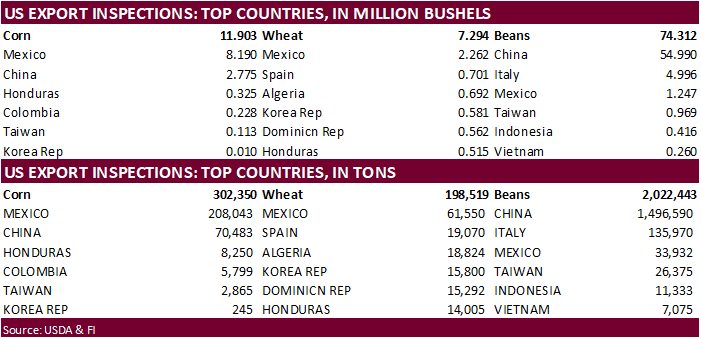

USDA US soybean export inspections as of November 24 were 2,022,443 tons, near the high end of a range of trade expectations. Major countries included China for 1,496,590 tons, Italy for 135,970 tons, and Mexico for 33,932 tons.

US soybean inspections have been good over the past few weeks and on a daily adjusted basis so far for the month of November, they are running a touch better than October. We raised our November soybean export estimate by 15 million bushels and our 2022-23

crop year forecast was lifted by the same amount to 1.990 billion bushels, still well below 2.045 billion projected by USDA. Our US carryout is 275 million bushels, down from 15 previous and compares to 220 million by USDA.

·

Despite the start of the Argentina soybean dollar, South American business was slow today. We heard about 500,000 tons of soybeans moved today and crushers bought them all.

·

Argentina officially launched their new “soybean dollar” at a rate of 230 pesos per USD. It includes products. The official rate is currently around 165 pesos. The government aims to collect around $3 billion to strengthen reserves.

We heard they are lowering the soybean meal and soybean oil tax rate by two points to 31 percent, an incentive for crushers looking to export products. We look for any soybeans sold to flow more so to crusher than exporters. Earlier last week we read up to

12 million tons of old crop soybeans could be theoretically sold, but the government said that number is closer to 5 million tons. Cash traders agree with the 5 million tons. In September about 13 million tons of soybeans changed hands.

·

It was rumored China may buy 1.0-1.5 million tons of soybeans from Argentina for Dec-Jan coverage. China was last estimated 30 percent covered for January.

·

AgRural reported Brazil’s 2022-23 soybean planting progress at 87% complete as of November 24, up 7 points from a week earlier and compares to 90% last year. They are using a 150.5-million-ton soybean production estimate.

·

A US RVO announcement should be announced this week as the deadline for 2023, 2024, and 2025, is by end of business day November 30.

https://www.epa.gov/renewable-fuel-standard-program/news-notices-and-announcements-renewable-fuel-standard

·

Egypt’s vegetable oil reserves are sufficient for five months.

(PRN)

CARGILL ANNOUNCES ACQUISITION OF OWENSBORO GRAIN COMPANY

MINNEAPOLIS,

Nov. 28, 2022 /PRNewswire/ — Cargill and Owensboro Grain Company, a fifth-generation family-owned soybean processing facility and refinery located in Owensboro, Ky., today announced that they have entered into a definitive agreement where Cargill will add

Owensboro Grain Company (OGC) to its North American agricultural supply chain business.

·

Under the 24-hour announcement system, private exporters sold 110,000 tons of soybeans to unknown.

Updated 11/25/22

Soybeans

– January $13.50-$15.00

Soybean

meal – January $375-$450

Soybean

oil – January 67.00-74.00 range

·

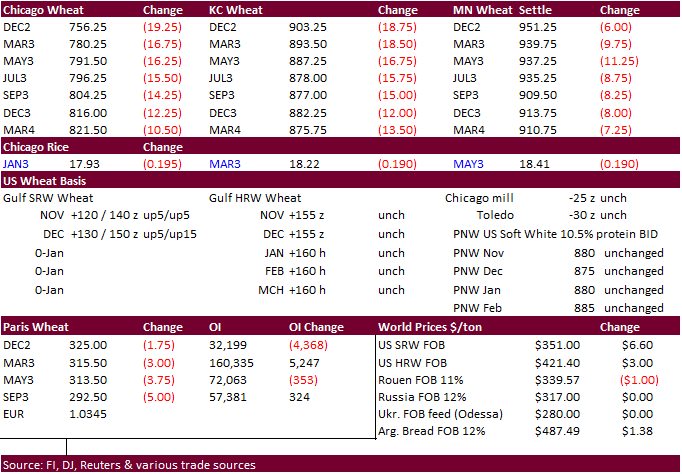

US wheat futures traded lower on technical selling, poor USDA export inspections, higher USD and good competition out of the Black Sea (Russia wheat exports are cheap despite ticking up last week). High protein wheat demand by

major importing countries capped losses for MN type wheat futures. After most of the southern Great Plains saw rain over the last week, US weather is expected to be dry for the US Great Plains after a small system far out west wraps up mid-week.

·

Funds were net sellers of an estimated 10,000 Chicago wheat contracts.

·

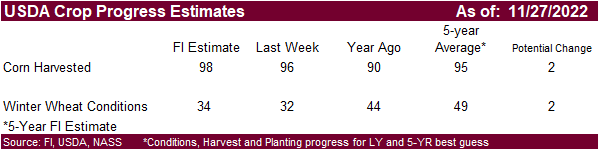

US winter wheat crop rating was expected by the trade to increase one point. Estimates ranged from 32% to 35%. For the US winter wheat area, 75% was experiencing drought as of November 22. Kansas, which produced about a quarter

of the winter wheat crop, was at 89% (46% exceptional). Note for the spring wheat area, 77 percent was experiencing drought.

·

USDA US all-wheat export inspections as of November 24 were 198,519 tons, below a range of trade expectations.

·

Russia increased its export quota on nitrogen fertilizers by 750,000 tons until the end of 2022.

·

Russian wheat prices last week were up $3/ton from the previous week to $317.00 per ton FOB, according to IKAR.

·

Egypt said they have enough wheat reserves to last more than five months and sugar for four months. They bought 3.72 million tons so far for 2022-23.

·

APK-Inform lowered its Ukraine 2022 grain crop to 51.8-53.7 million tons from 53.2-53.6 previous, including 19 million tons of wheat.

·

Ukraine’s grain exports since July 1 fell 31.9% 17.2 million tons compared to the same period last year.

6.6MMT

of wheat, down 54% y/y

1.4

MMT of barley, down 73% y/y

9.1

MMT of corn, up 66% y/y

·

Algeria seeks 50,000 tons of optional origin soft milling wheat on Wednesday (November 30), valid until December 1, for January shipment.

·

China auctioned off 39,995 tons of wheat from reserves, nearly 100 percent offered, on November 23, at 2,815 yuan per ton. China plans to auction off another 40,000 tons mid this week.

·

Turkey seeks 455,000 tons of milling wheat on November 29 for Dec/Jan shipment.

·

Jordan seeks 120,000 tons of hard milling wheat on November 29 for March/April shipment.

·

Pakistan is in for 500,000 tons of wheat on November 30, two days later than previous announcement.

·

Turkey seeks 495,000 tons of feed barley on December 1 for Jan through Feb shipment.

Rice/Other

·

Results awaited: Turkey seeks 40,000 tons of rice on November 25 for Dec 5-Feb 15 shipment.

Updated 11/25/22

Chicago

– March $7.75 to $10.00

KC

– March 8.50-$10.50

MN

– March $9.00 to $10.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.