PDF Attached

Higher

than expected Australian wheat, barley and canola estimates kicked off selling for the day session. Wheat was the first agricultural commodity to turn lower. Australia estimated a record wheat and canola crop and second highest barley crop. The USD was up

28 points by the time CBOT closed. Monday was position day for December contracts.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Very

little precipitation of significance will occur over the next ten days from central or eastern northern Argentina through far southern Brazil - Totally

dry weather is not expected, but very few areas will get more than 0.50 inch of moisture

- Temperatures

will be seasonable which will lead to net drying - However,

current soil moisture in parts of Argentina is very good today and will take some time to dry out enough to threaten crops - Rio

Grande do Sul Brazil will have a head start on drying and will have a firmer topsoil sooner than Argentina

- Interior

southern Brazil (north of Santa Catarina) will get some rain Saturday into next Monday with rainfall of 0.30 to 1.00 inch resulting

- This

favors Parana, Mato Grosso do Sul, southeastern Paraguay and southern Sao Paulo, but greater rain may be needed to ensure adequate soil moisture remains - Center

west and center south Brazil will receive routinely occurring rainfall over the next ten days to two week supporting ongoing favorable crop development potential - No

area is expected to be too dry or excessively warm or cool - Brazil’s

bottom line remains favorable for long term crop development in center west and center south crop areas. The far south will likely dry down raising crop stress in southern Rio Grande do Sul and immediate neighboring areas in the next couple of weeks while

interior southern Brazil gets some timely rain. If any of the interior southern Brazil rainfall falters or is much lighter than expected and/or temperatures are warmer than expected, the potential for some crop areas to become too dry should rise and that

warrants a continued close watch. - Rain

will fall in Argentina late this week and into the weekend with 0.20 to 0.75 inch and a few totals of 1.00 to 2.00 inches; favoring the far south and extreme north - Much

of Argentina will be dry again next week especially in eastern Argentina, Uruguay , parts of Paraguay and Rio Grande do Sul - Weekend

rain in Argentina was nearly widespread with heavy amounts in the interior southeast and from northern Cordoba to Chaco and eastern Formosa - Rainfall

varied from 1.00 to 3.50 inches in central, northeastern and southern Buenos Aires, 1.00 to 2.00 inches from northern Cordoba to eastern Chaco and northern Corrientes and 0.15 to 1.00 inch elsewhere - The

southeastern corner of Entre Rios received 1.00 to 2.00 inches of rain as well - Temperatures

were a little warmer than usual with highs in the 80s and to near 90 Fahrenheit - Argentina’s

bottom line is good for today’s soil moisture and crop development. Not all of the nation has good soil moisture, but the majority of areas do. Over the next week to ten days portions of central and eastern Argentina will be drying down and the situation will

need to be watched a little closer especially in eastern Argentina and neighboring areas of southern Brazil, Uruguay and Paraguay. The situation is not dire and is not likely to become critical right away, but the situation does need to be monitored because

any missed rain event or hotter temperatures could accelerate drying and induce crop stress. This pattern has been advertised by La Nina, the 18-year cycle and the 22-year solar cycle and confidence is high that these areas will be drier than usual in coming

weeks. - South

Africa’s scattered showers and thunderstorms during the weekend were beneficial in parts of corn, soybean, cotton, sunseed and groundnut production areas, but there were many areas that did not get enough rain to counter evaporation.

- Central

and eastern North West and parts of eastern Free State were wettest with 0.20 to 0.92 inch and a few amounts near or slightly over 1.00 inch.

- Western

Cape also reported some significant rain - The

moisture was good for summer crop planting and establishment, but unharvested wheat in the southwest may have been negatively impacted by rain and some harvest delay resulted - None

of the wheat harvest delays will last long - Greater

rain is needed in summer crop areas - South

Africa will continue to receive periodic rainfall over the next two weeks with improved topsoil moisture expected to support better summer crop development potential - Eastern

Australia received additional rain during the weekend with eastern wheat, barley, cotton, sorghum and canola areas in New South Wales reporting 0.20 to 0.62 inch of rain with local totals to nearly 1.50 inches - Rainfall

in interior southeastern Queensland was similar, but slightly greater with 0.20 to 1.30 inches and local totals to 1.81 inches - Dry

weather occurred elsewhere - Queensland,

Australia will receive abundant rain early this week with totals by 1200 GMT Wednesday varying from 1.50 to 4.00 inches and a few amounts to nearly 6.00 inches - That

is additional rain over already saturated soil - Local

flooding is expected and further delays to summer crop planting and routine farming activity is expected - Unharvested

winter grains will experience additional quality decline - Today

will be wettest - Drier

weather is expected the remainder of this week and into the weekend with some rain expected again early next week - New

South Wales, Australia rainfall over the next couple of days will be diminishing, but enough rain will linger to maintain concern over crop quality for unharvested wheat, barley and canola - Drier

weather is expected the remainder of this week and showers should be limited next week as well - The

bottom line for eastern Australia is still not good. Too much rain has been falling and will linger early this week. Unharvested winter grain and oilseed quality declines have impacted New South Wales and southeastern Queensland. Summer crop planting and routine

field activities have either been stalled or moving very slowly. Better weather this week should allow for some improvement in crop and field conditions, but the break may not last long and the wet biased conditions should return later in December.

- Elsewhere

in Australia, winter crop maturation and harvest conditions will continue mostly good through the next ten days due to restricted rainfall and seasonable temperatures - China

weather late last week and early in the weekend was generally dry with cool temperatures in the northeast and mild to warm elsewhere - China’s

weather during the next ten days will continue relatively quiet with only brief and light precipitation resulting

- Only

a part of northeastern China will receive significant snow and some rain - Northern

wheat production areas were trending dormant or semi-dormant and winter crops should be adequately established - Rapeseed

planting should be winding down in the Yangtze River Basin - Soil

moisture is favorably rated for good rapeseed establishment - India’s

weekend rainfall was excessive from eastern Tamil Nadu to southern Andhra Pradesh - Coastal

areas reported 6.22 to 10.16 inches and flooding resulted. - Some

damage to crops and property may have occurred along the coast - Interior

areas in far southern India reported mostly less than 2.00 inches of rain - Most

other areas in India were favorably and beneficially dry - Improved

summer crop harvest conditions occurred in interior southern India during the weekend and both planting and harvesting continued to advance well in the central and north parts of the nation - India’s

weather over the next week will be variable - A

tropical disturbance along the west coast of India may bring rain to southeastern Gujarat, northern Maharashtra and northwestern Madhya Pradesh during mid-week with rainfall of 2.00 to 5.00 inches along the coast and less than 1.00 inch inland - A

tropical cyclone will evolve near the Andaman Islands Tuesday before moving toward then Odisha coast Thursday and Friday - The

storm may follow the east coast of India to the north impacting Odisha, West Bengal and Bangladesh late this week and into the weekend - Some

heavy rain will fall along the coast, but very little crop damage is expected except possibly in coastal areas - Good

harvest and planting weather will continue from the heart of India northward through the next ten days due to limited rain and warm temperatures. - Western

Russia, Ukraine and much of Europe will experience an active weather pattern during the next ten days to two weeks - Waves

of rain and some snow will occur through this first week of the Outlook, but in the second week the wettest conditions will occur in Russia, Ukraine, Baltic States and Belarus - Precipitation

totals will be sufficient to bring a boost in soil moisture and runoff - Winter

crops will continue dormant or semi-dormant in much of the European Continent and western Asia, though some warming is expected in eastern parts of this region - Western

portions of the Middle East will experience wetter conditions this week raising soil moisture for winter crop planting, establishment and early development - Eastern

parts of the region may experience net drying for a while - North

Africa rainfall is expected to occur most frequently and significantly in eastern and central coastal areas of Algeria and northern Tunisia - A

boost in rainfall is needed in Morocco, northwestern Algeria and interior parts of northeastern Algeria and Tunisia - Showers

during the weekend were greatest from northern Morocco to northern Algeria with rainfall of 0.20 to 0.60 inch with a few local totals to 1.00 inch

- West-central

Africa rainfall during the next ten days will be greatest in coastal areas leaving most interior coffee, cocoa, sugarcane, rice and cotton production areas in a favorable maturation and harvest environment

- U.S.

weekend weather was dry in many important crop areas - Showers

and thunderstorms occurred in Texas and parts of Louisiana and southern New Mexico with rainfall of 0.05 to 0.70 inch and locally more - The

Texas Blacklands were among the wettest areas - Snow

and some rain in the Great Lakes region was mostly very light with less than 0.20 inch of moisture - Greater

precipitation fell in the far northeastern states and in the Pacific Northwest – mostly in the mountains - Excessive

rain continues to fall in some of the mountainous areas from the Cascade Mountains northward into British Columbia and into coastal Washington - Temperatures

were warm in the central U.S. and cool in the northern and eastern Midwest and northeastern states - U.S.

Hard red winter wheat production areas will not likely get significant precipitation over the next ten days - U.S.

precipitation in the coming ten days will be greatest from eastern Texas and the Delta into the lower and eastern most Midwest

- Showers

will also occur in the interior southeastern states - Brief

periods of light snow and rain will impact the northern Plains with greater precipitation in Canada’s Prairies

- Stormy

weather in the Pacific Northwest will continue to include heavy rain in coastal British Columbia, the Cascade Mountains of western Washington and western Oregon as well as the mountains of northern Idaho and immediate neighboring areas

- West

Texas will be mostly dry - Southeastern

Canada’s grain and oilseed areas will be experienced alternating periods of rain and snow slowing late season fieldwork at times - The

bottom line for the United States and southern Canada will change little over the next ten days. Dry conditions in hard red winter wheat areas may be a concern, but crops will stay in favorable condition until spring due to winter dormancy or semi-dormancy.

The exception to that will be from the Texas Panhandle to Colorado and extreme western Kansas as well as Montana where conditions are driest. There is also concern for unirrigated wheat in Oregon. Late season summer crop harvesting is winding down in the Midwest,

Delta and southeastern Canada (Ontario and Quebec) where there is need for better drying conditions. Dryness in southern California and the southeastern United States is great for summer crop harvesting and winter crop planting.

- Colombia

and Venezuela rainfall was lighter than usual earlier this month - Precipitation

is expected to occur more often in coffee and sugarcane production areas during the next ten days in Colombia and western Venezuela - No

excessive rain is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Today’s

Southern Oscillational Index was +11.31 and it was expected to move erratic over the coming week with some drop in the index possible.

- New

Zealand rainfall is expected to be below normal over the next week to ten days except along the west coast of South Island where rainfall will be greater than usual - Temperatures

will be seasonable

Monday,

Nov. 29:

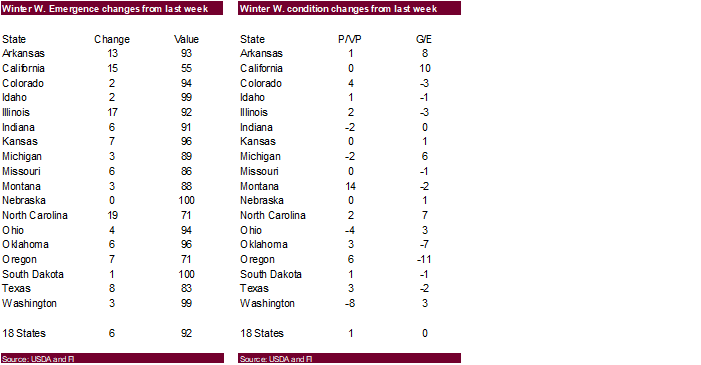

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

winter wheat conditions, cotton harvest data, 4pm - Vietnam’s

General Statistics Office releases November trade data - Ivory

Coast cocoa arrivals

Tuesday,

Nov. 30:

- EU

weekly grain, oilseed import and export data - Malaysia’s

November palm oil exports - U.S.

agricultural prices paid, received, 3pm - Australia’s

quarterly crop report

Wednesday,

Dec. 1:

- EIA

weekly U.S. ethanol inventories, production - Gapki’s

Indonesian Palm Oil Conference, day 1 - Brazil

Unica sugar output, cane crush data (tentative) - U.S.

DDGS production, corn for ethanol, 3pm - USDA

soybean crush, 3pm - Australia

Commodity Index

Thursday,

Dec. 2:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Gapki’s

Indonesian Palm Oil Conference, day 2

Friday,

Dec. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

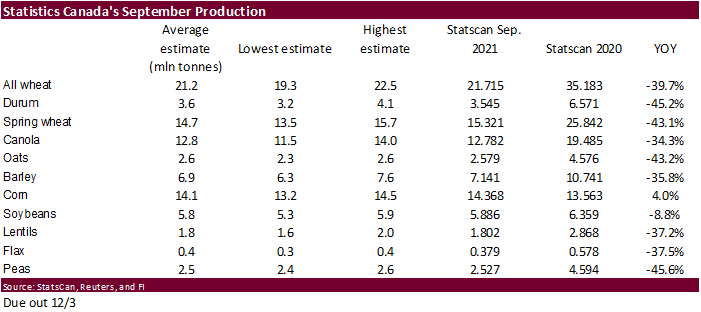

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Canada’s

Statcan releases wheat, durum, canola, barley, soybean production data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Statistics

Canada

will release Canadian crop production on Friday at 7:30 a.m. CST. Traders are looking for all-wheat to be up about 500,000 tons from September (durum average 100,000 tons below Sep.), and a slightly upward revision to barley, corn and soybeans. For canola,

the average trade guess suggests no change.

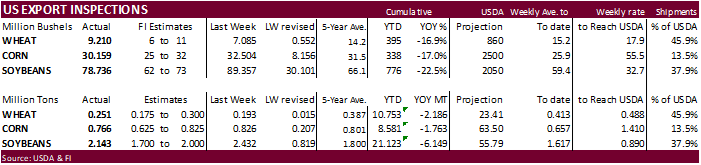

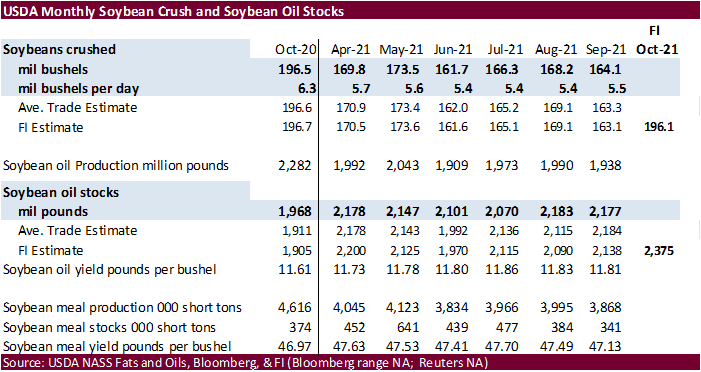

USDA

inspections versus Reuters trade range

Wheat

250,651 versus 175000-400000 range

Corn

766,063 versus 575000-1200000 range

Soybeans

2,142,844 versus 1000000-2000000 range

Soybean

inspections were good with China taking 1.385 million tons. China took nearly 93,000 tons of corn. Inspections need to improve in order to reach USDA’s targets for corn, soybeans and wheat.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 25, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/25/2021 11/18/2021 11/26/2020 TO DATE TO DATE

BARLEY

0 96 0 9,839 16,354

CORN

766,063 825,650 1,045,800 8,581,472 10,344,136

FLAXSEED

0 100 0 124 413

MIXED

0 0 0 0 0

OATS

0 0 0 300 1,595

RYE

0 0 0 0 0

SORGHUM

190,649 238,986 355,681 944,338 1,455,472

SOYBEANS

2,142,844 2,431,895 2,424,357 21,123,202 27,271,721

SUNFLOWER

0 0 0 432 0

WHEAT

250,651 192,822 534,534 10,753,221 12,939,467

Total

3,350,207 3,689,549 4,360,372 41,412,928 52,029,158

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

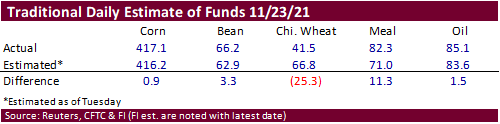

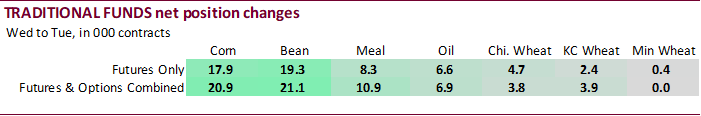

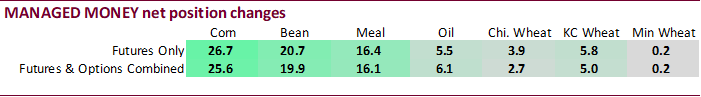

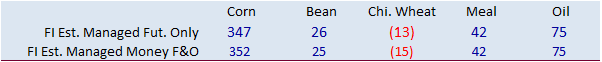

Chicago

wheat net long position came in much less long than expected for the week ending November 23. The net long position for soybeans, meal and oil were more long than expected. We don’t see much in the way of price direction as this report was delayed one day,

but the trade may note the less than expected wheat position.

Macros

(Bloomberg)

— Hong Kong’s stock benchmark closed at the lowest level in more than a year on Monday, as the omicron Covid-19 strain fueled worries about the outlook of border reopening and economic growth.

Canadian

Industrial Products Price (M/M) Oct: 1.3% (est 1.3%; prev 1.0%)

–

Raw Materials Price Index (M/M) Oct: 4.8% (est 3.5%; prev 2.5%)

livesquawk

US Energy Envoy Says Biden Prepared To Release Even More Oil Reserves To Cool Markets – CNBC

79

Counterparties Take $1.459 Tln At Fed Reverse Repo Op. (prev $1.451Tln, 74 Bids)

·

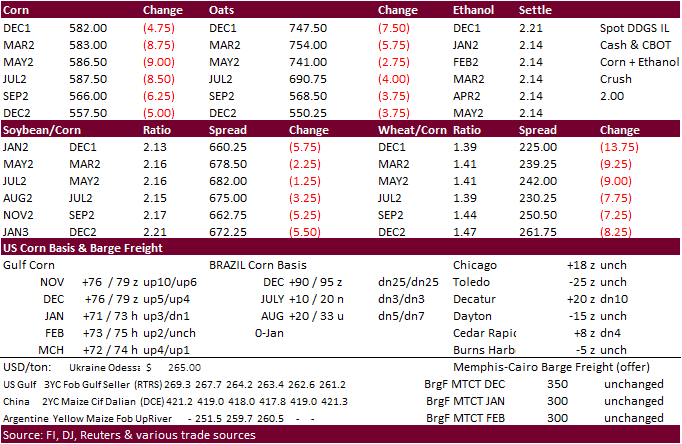

CBOT corn

traded lower in a risk off session amid uncertainty over the latest omicron Covid-19 variant. Earlier it appeared traders were shrugging off the negative market sentiment stirred up on Friday but after US wheat turned lower post day session open, that pressured

corn futures. The USD was 28 points higher by the corn close due in large part to a weaker euro. There was no fresh news for the corn market today. Inspections were ok but the pace needs to increase to reach USDA’s export projection.

·

The funds sold an estimated net 15,000 corn contracts.

·

WTI crude oil was up over $1.20. That market paired some of the early gains.

·

USDA US corn export inspections as of November 25, 2021 were 766,063 tons, within a range of trade expectations, below 825,650 tons previous week and compares to 1,045,800 tons year ago. Major countries included Mexico for 327,440

tons, Japan for 118,406 tons, and Colombia for 95,349 tons.

·

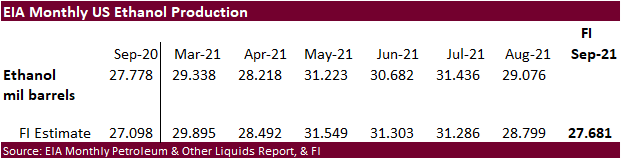

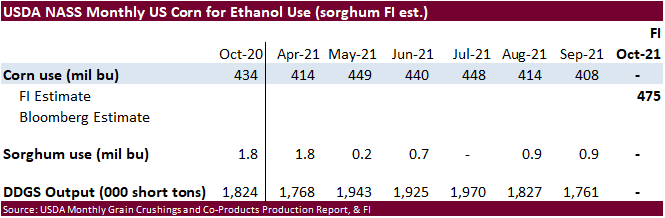

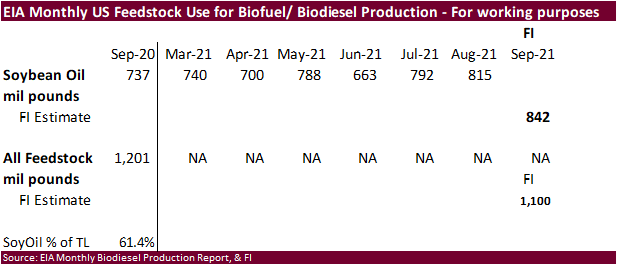

Weekly ethanol production has been running higher than expected over the last 3 out of four weeks. Based on the current pace and gradual decline in ethanol output from December through August 2022, we increased our corn for ethanol

use by 25 million bushels to 5.325 billion, 75 million above USDA and above 5.028 used during the 2020-21 marketing year.

Export

developments.

·

None reported.

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

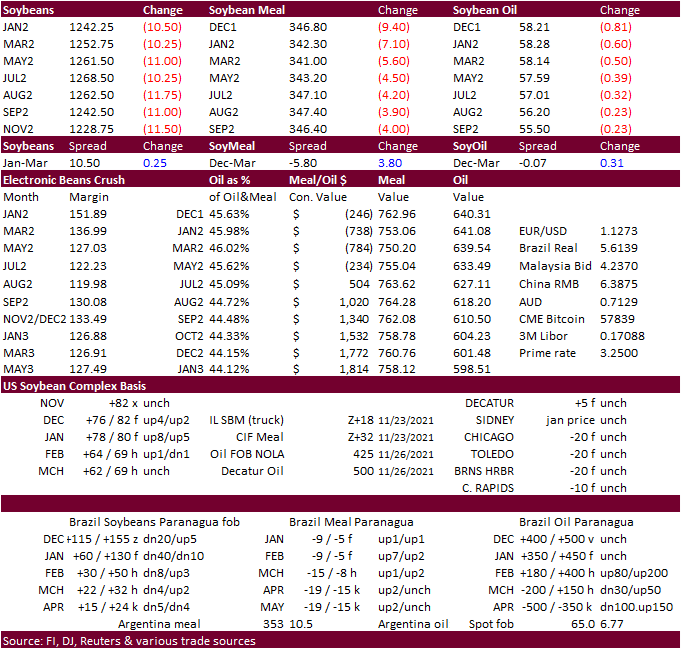

Soybeans started higher and ended lower led by soybean meal and lower trade in soybean oil. The favorable start to the Brazil planting and establishment of their upcoming crop also weighed on prices. We see no major weather issues

for NA and SA.

·

The funds sold an estimated net 8,000 soybean contracts, sold 6,000 soybean meal and sold 2,000 soybean oil.

·

57 cents January soybean oil is not out of the question (Sep 24 level), but before that may find some resistance at 57.84 and 57.29.

·

USDA US soybean export inspections as of November 25, 2021 were 2,142,844 tons, above a range of trade expectations, below 2,431,895 tons previous week and compares to 2,424,357 tons year ago. Major countries included China for

1,385,016 tons, Egypt for 275,447 tons, and Mexico for 104,418 tons.

·

There is talk China has been slowly shifting away from meal and using more feed wheat. We are still at 100 million tons for soybean imports but something to monitor. China’s weekly crush slowed mid-Nov. Soybean crush fell 60,000

tons to 1.89 million as of Nov 21 and are about 240,000 tons below year ago.

·

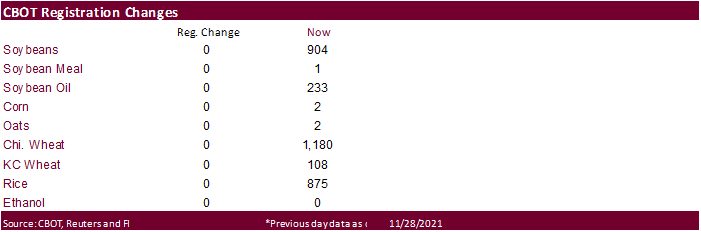

There were no changes in CBOT ag registrations

as of Friday evening. (will be update this evening)

·

Brazil is 91% complete on soybean plantings according to Safras & Mercado, up from 84% previous week and 83% year ago.

·

Indonesia set its December CPO reference price at $1,365.99/ton, up from November’s $1,283.38 per ton.

US

shipments to China since September 1 are running well behind year ago.

Export

Developments

·

None reported

Updated

11/19/21

Soybeans

– January $12.00-$13.00 range, March $12.00-$13.50

Soybean

meal – January $340-$390, March $325-$400

Soybean

oil – January 55.00-60.50, March 56-64

·

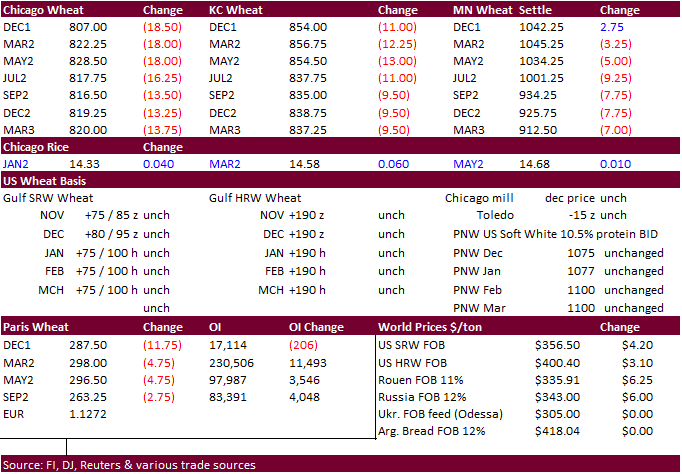

Funds sold an estimated net 12,000 SRW wheat contracts.

·

Egypt ended up buying 600,000 tons of wheat. This might be the largest single wheat purchase by Egypt.

Going back, largest I could find was 540,000 tons bought December 22, 2008.

·

Australia’s ABARES estimated the 2021-22 winter crop production at record 58.4 million tons, up 5 percent from 2020-21. This includes a record 34.4 million ton wheat crop. Last year was the previous record. We think about 4-6

million tons of that could be feed wheat, up from 2 million tons normally. ABARES noted the new grain production record is driven by a record high production in Western Australia and the second highest on record in New South Wales. Production in other states

is also well above average. USDA’s Australian wheat crop was pegged at 31.5 million tons versus 33.0 million tons for 2020-21. ABRES estimated barley production at 13.3 million tons, second highest on record. Canola was estimated at a record 5.7 million

tons.

https://www.awe.gov.au/abares/research-topics/agricultural-outlook/australian-crop-report/overview

·

USDA US all-wheat export inspections as of November 25, 2021 were 250,651 tons, within a range of trade expectations, above 192,822 tons previous week and compares to 534,534 tons year ago. Major countries included Philippines

for 115,970 tons, Mexico for 57,879 tons, and Colombia for 30,700 tons.

·

The US Great Plains will remain mostly dry over the next ten days and this is a little concerning for the last batch of wheat entering dormancy.

·

Russia exported 18 million tons of grain since July, down 24% from the same period year ago. Wheat exports are down 23 percent from the same period year ago.

Export

Developments.

·

Egypt’s GASC bought 600,000 tons of wheat for Jan 9-20 shipment at $375.90-$379.10/ton . It included 240,000 tons of Romanian wheat, 240,000 tons of Russian wheat and 120,000 tons of Ukrainian wheat. Earlier the lowest offer was

$350.85 per ton fob for 60,000 tons of Romanian origin and looks like they got 60,000 tons at that price, plus freight. They last paid $371.97/ton, including freight, on November 17.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

·

Jordan seeks 120,000 tons of wheat on December 2. Possible shipment combinations are in 2022 between May 1-15, May 16-31, June 1-15 and June 16-30.

·

Jordan seeks 120,000 tons of barley on December 1 for shipment between May 1-15, May 16-31, June 1-15 and June 16-30.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

None reported

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.