PDF Attached

WTI

crude oil rallied on expectations for OPEC to cut oil production and rumors of China easing covid controls. Not all agree with that. A WSJ article this afternoon mentioned a group of delegates expect them to keep production levels flat. It will be interesting

how crude oil futures trade tonight.

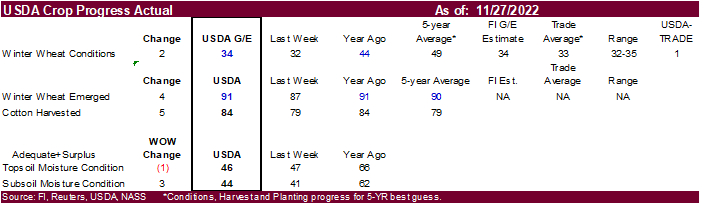

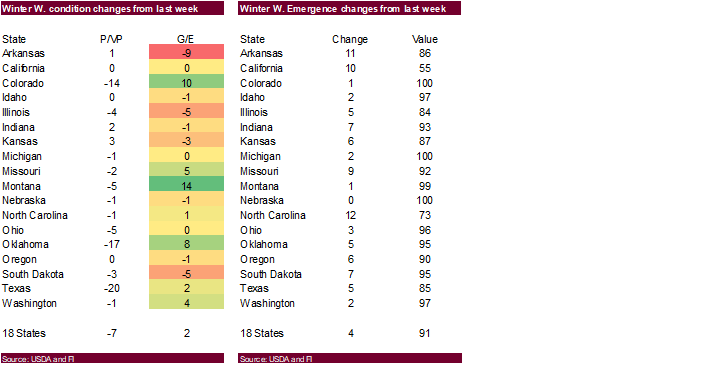

The

USD started lower but rallied by afternoon trading. CBOT agriculture futures ended mixed. US Winter wheat conditions improved two points but are far from normal for this time of year. The improvement reflects the improvement in rains across the southern Great

Plains and part of the reason why wheat futures are near multi week lows. The trade is waiting for the EPA to roll out their RVO mandates that are due out by end of November, for 2023, 2024, and 2025.

https://www.epa.gov/renewable-fuel-standard-program/news-notices-and-announcements-renewable-fuel-standard

December CBOT First Notice Day deliveries will be out tonight.

Weather

The

weather outlook improved for the US Midwest, Delta and Brazil than that of yesterday. Precipitation will occur across the Midwestern south central and northwestern areas today, and eastern areas Wednesday. For the Great Plains, northern CO and NE will see

a wintery mix today. Rest of the Great Plains will see net drying through the end of the workweek. Argentina’s BA will see rain through today, while from Wednesday into Thursday, Argentina’s Cordoba, south Santa Fe, Buenos Aires will benefit from precipitation.

Brazil will see rain this week across most growing areas, drier bias MGDS and RGDS.