PDF Attached

Private

exporters reported sales of 132,000 metric tons of soybeans for delivery to unknown. Another day of heavy selling in agriculture (exception meal) over fears of global economic slowdown amid new Covid-19 variant. Many of the outside markets sold off. WTI traded

below $65 during the session, first time since August. OPEC meets later this week.

Managed

money funds for soybeans are near flat. The last time the soybean managed money futures and options combined position was net short was back on April 24, 2020.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Net

drying is still expected in central and eastern Argentina and southern Brazil as well as neighboring areas of Uruguay and southern Paraguay during the next ten days and perhaps longer - Crop

moisture stress is unlikely in this first week of the outlook due to seasonably to slightly milder than usual temperatures and good subsoil moisture sprinkled with a few showers as well - Crop

stress may begin to show in a few areas during the second week of December, but there will be no threat to production during these two weeks - Rain

will be imperative in the second half of December to protect production of soybeans and early corn as well as rice, cotton and a few other crops produced in the driest region. - Wheat

harvest progress in southern Brazil will advance well during the drier days

- Argentina

wheat development should advance relatively well with the moisture already in the ground and the anticipated drier tendency. - Center

west, northern center south and northeastern Brazil crop weather will continue plenty wet and crop development should advance relatively well during the next two weeks

- A

few areas may be a little too wet, but the impact on crops will not be very great unless this pattern continues into the harvest season – which is possible - South

Africa crop weather will be improving during the next two weeks as more frequent rain evolves and reaches into all of the nation with better coverage - Planting

of summer crops will advance better around the rainfall and early season crop development should advance well - Eastern

Australia will get a break from rain over the next several days and fieldwork will be slow to improve in parts of Queensland and New South Wales after recent weeks of frequent rain - The

region is expecting more rain to pop up late in this weekend through most of next week, but it should be more sporadic and variable favoring Queensland more than New South Wales - Resulting

rainfall will not be as heavy or as frequent as that in previous weeks, but any moisture in unharvested wheat, barley and canola areas might be a concern - The

bottom line looks better for eventual field progress for areas that have been most impacted by recent rain – at least for a little while. Summer crop planting and emergence along with early growth should improve for a few days while the wetter areas in Queensland

and New South Wales dry down for a little while. - Western

and southern Australia winter crop maturation and harvest weather has been mostly good and improving - These

trends will continue to favor farm progress and no threats of grain or oilseeds quality declines - China’s

weather during the next ten days will continue relatively quiet with only brief and light precipitation resulting

- Northern

wheat production areas were trending dormant or semi-dormant and winter crops should be adequately established - Rapeseed

planting should be winding down in the Yangtze River Basin - Soil

moisture is favorably rated for good rapeseed establishment - India’s

weather over the next week will be variable - A

tropical disturbance along the west coast of India will bring rain to southeastern Gujarat, northern and western Maharashtra and northwestern Madhya Pradesh over the next few days with rainfall of 2.00 to 6.00 inches along the coast and less than 1.00 inch

inland - the

exception will be in northern Maharashtra, southeastern Gujarat and northwestern Madhya Pradesh locations where 1.00 to 2.00 inches is possible - A

tropical cyclone will evolve near the Andaman Islands today and Wednesday before moving toward the Odisha coast Thursday and Friday - The

storm may follow the upper east coast of India to the north impacting Odisha, West Bengal and Bangladesh late this week and into the weekend - Some

heavy rain will fall along the coast, but very little crop damage is expected except possibly in coastal areas - Good

harvest and planting weather will continue from the heart of India northward through the next ten days due to limited rain and warm temperatures. - Western

Russia, Ukraine and much of Europe will experience an active weather pattern during the next ten days to two weeks - Waves

of rain and some snow will occur through this first week of the Outlook, but in the second week the wettest conditions will occur in Russia, Ukraine, Baltic States and Belarus - Precipitation

totals will be sufficient to bring a boost in soil moisture and runoff - Winter

crops will continue dormant or semi-dormant in much of the European Continent and western Asia, though some warming is expected in eastern parts of this region - Western

portions of the Middle East will experience wetter conditions this week raising soil moisture for winter crop planting, establishment and early development - Eastern

parts of the region may experience net drying for a while - North

Africa rainfall is expected to occur most frequently and significantly in eastern and central coastal areas of Algeria and northern Tunisia late this week starting on Wednesday - A

boost in rainfall is needed in Morocco, northwestern Algeria and interior parts of northeastern Algeria and Tunisia - West-central

Africa rainfall during the next ten days will be greatest in coastal areas leaving most interior coffee, cocoa, sugarcane, rice and cotton production areas in a favorable maturation and harvest environment

- U.S.

weather was dry in many important crop areas Monday - Temperatures

were unusually warm in the central U.S. with most of hard red winter wheat country reporting highs in the 70s Fahrenheit - Extreme

highs in the lower 80s occurred from south-central Kansas into the Texas Panhandle - U.S.

Hard red winter wheat production areas will not likely get significant precipitation over the next ten days - U.S.

precipitation in the coming ten days will be greatest from eastern Texas and the Delta into the lower and eastern most Midwest

- Some

rain will fall in the Midwest later today and Wednesday with moisture totals of 0.05 to 0.40 inch - The

greatest rain this week will be from eastern Texas and the Delta through the Tennessee River Basin to the lower eastern Midwest Saturday into Sunday and again during mid-week next week

- Some

areas will end up with 1.00 to 2.50 inches of rain by late next week with this week’s precipitation lightest and most sporadic - A

few showers will also occur in the interior southeastern states, but the region will experience net drying

- Brief

periods of light snow and rain will impact the northern Plains with greater precipitation in along the Canada border especially this weekend when 2-6 inches may accumulate and locally more - Stormy

weather in the Pacific Northwest will continue to include heavy rain in coastal British Columbia, the Cascade Mountains of western Washington and western Oregon as well as the mountains of northern Idaho and immediate neighboring areas

- West

Texas will be mostly dry as will California crop areas - Southeastern

Canada’s grain and oilseed areas will experienced alternating periods of rain and snow slowing late season fieldwork at times - the

moisture will maintain favorable conditions for wheat use in the spring - The

bottom line for the United States and southern Canada will change little over the next ten days. Dry conditions in hard red winter wheat areas may be a concern, but crops will stay in favorable condition until spring due to winter dormancy or semi-dormancy.

The exception to that will be from the Texas Panhandle to Colorado and extreme western Kansas as well as Montana where conditions are driest. There is also concern for unirrigated wheat in Oregon. Late season summer crop harvesting is winding down in the Midwest,

Delta and southeastern Canada (Ontario and Quebec) where there is need for better drying conditions. Dryness in southern California and the southeastern United States is great for summer crop harvesting and winter crop planting.

- Colombia

and Venezuela rainfall was lighter than usual earlier this month - Precipitation

is expected to occur more often in coffee and sugarcane production areas during the next ten days in Colombia and western Venezuela - No

excessive rain is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Today’s

Southern Oscillational Index was +11.73 and it was expected to move erratically over the coming week

- New

Zealand rainfall is expected to be below normal over the next week to ten days except along the west coast of South Island where rainfall will be greater than usual - Temperatures

will be seasonable

Tuesday,

Nov. 30:

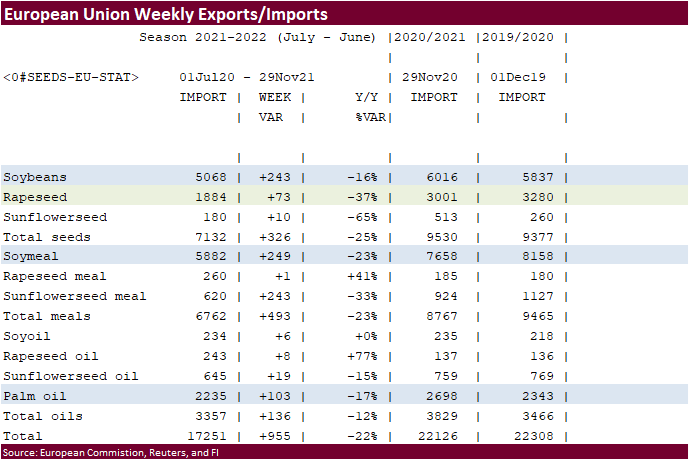

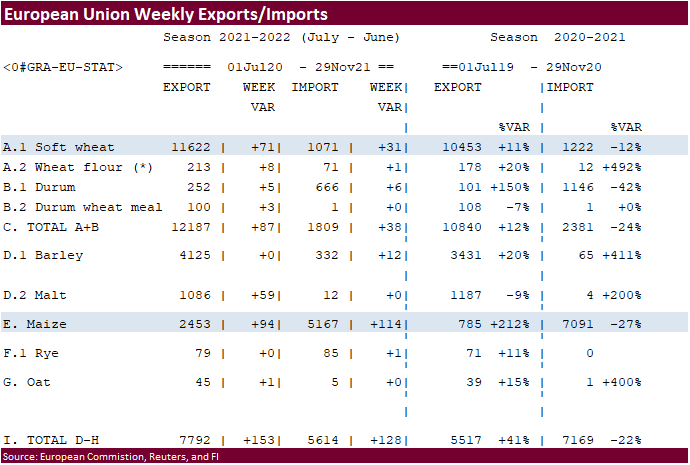

- EU

weekly grain, oilseed import and export data - Malaysia’s

November palm oil exports - U.S.

agricultural prices paid, received, 3pm - Australia’s

quarterly crop report

Wednesday,

Dec. 1:

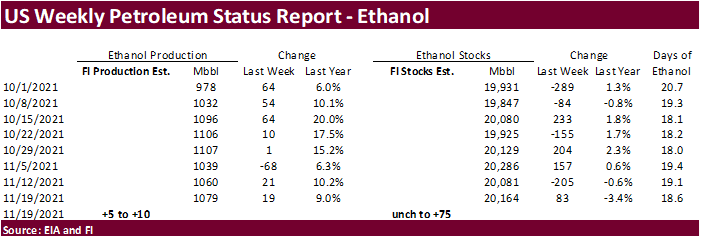

- EIA

weekly U.S. ethanol inventories, production - Gapki’s

Indonesian Palm Oil Conference, day 1 - Brazil

Unica sugar output, cane crush data (tentative) - U.S.

DDGS production, corn for ethanol, 3pm - USDA

soybean crush, 3pm - Australia

Commodity Index

Thursday,

Dec. 2:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Gapki’s

Indonesian Palm Oil Conference, day 2

Friday,

Dec. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Canada’s

Statcan releases wheat, durum, canola, barley, soybean production data - FranceAgriMer

weekly update on crop conditions

Macros

Canadian

Annualized GDP (Q/Q) Q3: 5.4% (est 3.0%; prev -1.1%; prevR -3.2%)

–

GDP (M/M) Q3: 0.1% (est 0.0%; prev 0.4%; prevR -0.8%)

–

GDP (Y/Y) Q3: 3.4% (est 3.3%; prev 4.1%)

India’s

GDP has grown at 8.4% in second quarter compared to 7.4% contraction last year

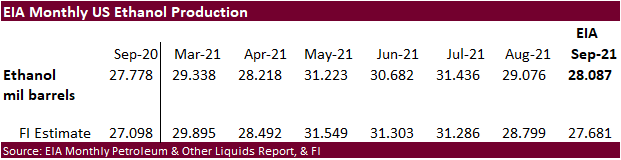

EIA:

US Crude Oil Production Fell 380K Bpd In Sept To 10.809M Bpd (Vs Revised 11.189M Bpd In Aug)

–

Oil Production In Aug Revised Up By 48K Bpd To 11.189M Bpd

84

Counterparties Take $1.518 Tln At Fed Reverse Repo Op. (prev $1.459 Tln, 79 Bids)

·

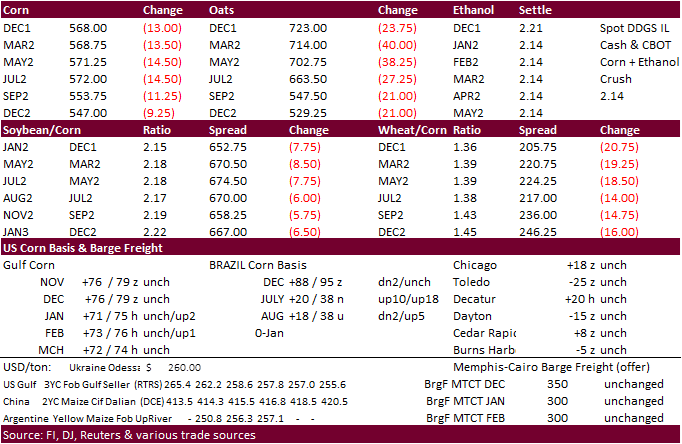

CBOT corn

traded sharply lower, at a three-week low, on weakness in the outside commodity and equity markets despite a sharply lower USD.

WTI

crude oil and other markets sold off from ongoing concerns over the omicron after a major drug company told a newspaper that the existing vaccines are less effective against the latest variant. WTI crude oil traded below $65/barrel for the first time since

August.

·

The funds sold an estimated net 30,000 corn contracts.

·

Note OPEC meets later this week.

·

We heard December ethanol swaps are off about 36 cents from yesterday’s settles amid stops. Some traders fear short term erosion in US ethanol demand if lockdown restrictions expand.

·

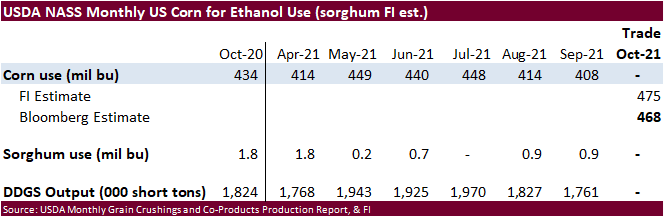

US September ethanol production came in slightly above expectations. As we mentioned yesterday, weekly ethanol production has been running higher than expected over the last few weeks. We estimate corn for ethanol use at 5.325

billion, 75 million above USDA and above 5.028 used during the 2020-21 marketing year.

·

CBOT First Notice Day corn deliveries were 2.

·

German reported a case of bird flu H5N1 in northern Germany on a farm with about 33,000 poultry.

Export

developments.

·

None reported.

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

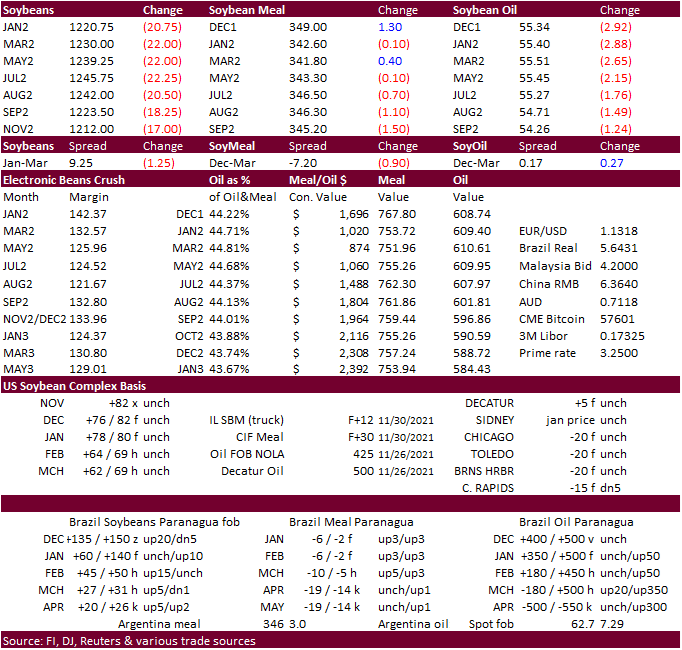

The soybean complex opened and ended lower in the non-expiring months. January soybeans were 24.25 cents lower, January meal $0.90 lower and January soybean oil 307 points lower (late September low). Meal rebounded during the

session as selling advanced in soybean oil, creating heavy product spreading.

January

soybean oil traded through its 200-day MA and also below our 55.50 support level.

Front

month soybean oil contracts were more than 350 points lower by late morning trade. Note the limit is 400 points, except for the expiring December contract.

https://www.cmegroup.com/trading/price-limits.html

·

The selloff in soybean oil was seen from disappointing September US soybean oil use for biofuels, Brazil’s decision to leave its 10% biodiesel mandate in place, technical selling, sharply lower energy markets, and widespread selling

in other commodity markets.

·

January oil share fell from 45.98% (yesterday modified settled) to 44.69%.

·

The funds sold an estimated net 20,000 soybean contracts, were even in soybean meal and sold 15,000 soybean oil.

·

The managed money funds are estimated net long only 5,000 soybeans, 42,000 soybean meal and net long 60,000 soybean oil. The last time the soybean managed money futures and options combined position was net short was back on

April 24, 2020.

·

ICE canola futures were down about $44.60 by 1:18 pm CT.

·

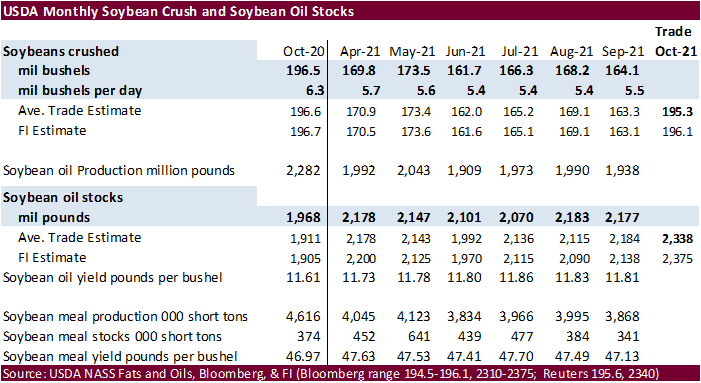

A Reuters trade guess calls for the October US crush to be reported at 195.6 million bushes (194.5-196.3 range), up from 164.1 million bushels previous month, and soybean oil stocks at 2.340 billion (2.310-2.375 range), up from

2.177 at the end of September.

·

Abiove is disappointed the Brazil government will leave their biodiesel blend rate at 10% versus a previous target of 13-14%, especially to crushers that invested in production.

·

US soybean export developments remain slow to China.

·

For First Notice Day, there were 106 SBO deliveries, one meal and zero oil.

·

Malaysia palm hit an 8-week low. Malaysian February palm futures were down 185 ringgit at 4672. Cash palm was down $35/ton to $1187.50/ton.

·

This comes even though AmSpec reported November palm oil shipments from Malaysia up 8.2% at 1.572 million tons from 1.453 MMT previous month. ITS reported a 13.6 percent increase to 1.669 million tons.

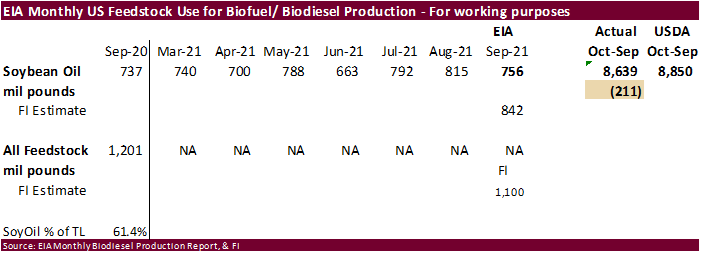

EIA

September soybean oil for biofuel

use of 756 million pounds was down from 815 million during August, below our expectations and well below USDA’s implied expectation of 967 million pounds. This puts Oct-Sep crop-year SBO for biofuel use at 8.639 billion pounds, 211 million below USDA’s November

estimate of 8.850 billion. Look for USDA to lower 2020-21 biofuel use and increase food use by a similar amount. We are still awaiting import/export data by Census for the month of September. NASS crush is due out Wednesday for October data that could include

revisions to September.

Export

Developments

·

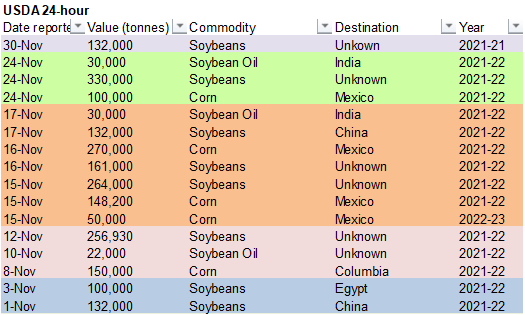

Under the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to unknown for 2021-22.

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range (down 25 cents, unch top end of range), March $11.75-$13.50 (down 25, unch)

Soybean

meal – January $320-$370 (down 20), March $315-$380 (down 15, down 20)

Soybean

oil – January 54.00-59.00 (down 100, down 150), March 54.00-62.00

down 400, down 200)

·

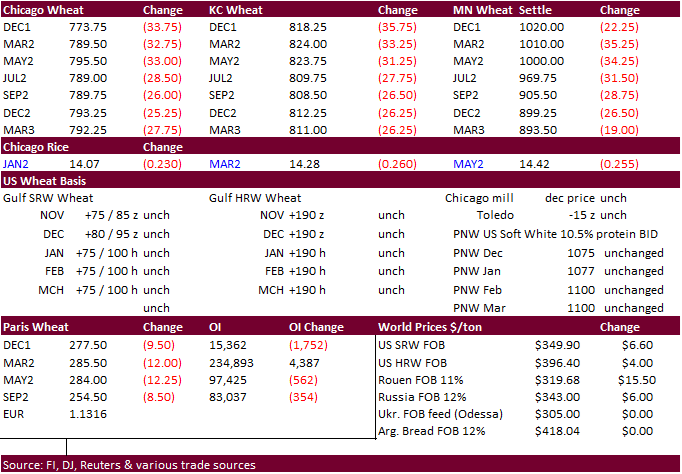

March Matif Paris wheat was 12.00 euros lower at 285.50, or 4%.

·

Funds sold an estimated net 23,000 SRW wheat contracts.

·

FND Chicago wheat deliveries were a large 1,054 contracts.

·

The US Great Plains will remain mostly dry over the next week.

·

Egypt said they have enough wheat to last 5.1 months. They also said sugar supplies are large enough for 3.5 months and vegetable oil reserves for 5.4 months.

Export

Developments.

·

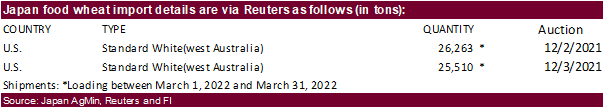

Japan seeks 51,773 tons of food wheat later this week, all from the US.

·

Jordan seeks 120,000 tons of wheat on December 2. Possible shipment combinations are in 2022 between May 1-15, May 16-31, June 1-15 and June 16-30.

·

Jordan seeks 120,000 tons of barley on December 1 for shipment between May 1-15, May 16-31, June 1-15 and June 16-30.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.