PDF Attached

The

EPA did not release an update on RVO mandates, but in a separate statement the agency did propose expanding the credit trenches of uses of renewable fuel production processes. Under the 24-hour announcement system USDA reported private exporters sold 122,000

tons of soybeans to unknown. Today we see follow though buying in soybeans & corn, and technical selling/positioning in wheat. StatsCan reported a smaller than estimated Canada canola crop, higher than expected wheat, and larger than expected soybean crop.

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Latest

La Nina data shows a more gradual weakening trend after the late December early January peak in the event. - Previous

NOAA model runs had La Nina weakening aggressively - Now

La Nina still has some influence into April – if their forecast is correct - World

Weather, Inc. believes there is potential for this La Nina event to linger longer and it would not be surprising to see it last through the spring

- That

is just speculation for now, but similar conditions have occurred in other 22-year solar cycles - The

implication of a longer lasting La Nina in the spring would be greater concern for ongoing dryness in the Plains and a part of the western Corn Belt - Still

just speculation for now - Did

you know the Joint Institute for the Study of the Atmosphere and Ocean (JISAO)’s original Pacific Decadal Oscillation Index (PDO) fell to its lowest level since 1956 in October of this year - Some

believe strongly negative PDO events that last over multiple months lead to droughts especially when they occur in the summer

- Keep

an eye on this event for 2022 U.S. agricultural weather especially if La Nina stays longer - Strongly-positive-phased

Arctic Oscillation (AO) present in the Northern Hemisphere today is ensuring that no mid-latitude winter agricultural region in the Northern Hemisphere will be subjected to threatening cold for the next ten days and probably not for two weeks - This

is true for the United States, Europe and all of Asia - Canada

and the far northern U.S. Plains will see two days of bitter cold Sunday and Monday, but it will be quick to abate without going any farther to the south - Indian

Ocean Dipole is still in its neutral mode with a slight bias toward negative IOD that leaves its Influence in Australia and India relatively limited - Tropical

Cyclone 05B has evolved in the Bay of Bengal as expected - The

storm move along the upper east coast of India and into southern Bangladesh during the Saturday through Monday Period - Rainfall

of 2.00 to 7.00 inches will result and possibly a little more with peak wind speeds not likely to surpass 60 mph - Damage

potential to crops and personal property are low, but some flooding is expected along with windy conditions - Typhoon

Nyatoh remained between Japan and the Mariana Islands in the western Pacific Ocean posing no threat to land - The

storm will move off to the northeast during the weekend and have little to no influence on the region except some possible shipping rerouting

- Net

drying is still expected in eastern Argentina and southern Brazil as well as neighboring areas of Uruguay and southern Paraguay during the next ten days and perhaps longer - Crop

moisture stress is unlikely in this first week of the outlook due to seasonably to slightly milder than usual temperatures and good subsoil moisture sprinkled with a few showers as well - Crop

stress may begin to show in a few areas during the second week of December, but there will be no threat to production during these two weeks - Rain

will be imperative in the second half of December to protect production of soybeans and early corn as well as rice, cotton and a few other crops produced in the driest region. - Wheat

harvest progress in southern Brazil will advance well during the drier days

- Argentina

wheat development, maturation and harvesting should advance relatively well with the moisture already in the ground and the anticipated drier tendency. - Center

west, northern parts of center south and northeastern Brazil crop weather will continue plenty wet and crop development should advance relatively well during the next two weeks

- A

few areas may be a little too wet, but the impact on crops will not be very great unless this pattern continues into the harvest season – which is possible - South

Africa crop weather will be improving during the next two weeks as more frequent rain evolves and reaches into all of the nation with better coverage - Planting

of summer crops will advance better around the rainfall and early season crop development should advance well - Eastern

Australia is getting a break from rain and it will last through Saturday - Fieldwork

will be slow to improve in parts of Queensland and New South Wales after recent weeks of frequent rain, but some fieldwork is expected soon - The

region is expecting more rain to pop up late in this weekend through most of next week, but it should be more sporadic and variable favoring Queensland more than New South Wales - Resulting

rainfall will not be as heavy or as frequent as that in previous weeks, but any moisture in unharvested wheat, barley and canola areas might be a concern - The

bottom line looks better for eventual field progress for areas that have been most impacted by recent rain – at least for a little while. Summer crop planting and emergence along with early growth should improve for a few days while the wetter areas in Queensland

and New South Wales dry down for a little while. Summer crop development and fieldwork will also improve in Queensland and parts of New South Wales.

- Western

and southern Australia winter crop maturation and harvest weather has been mostly good and improving - These

trends will continue to favor farm progress and no threats of grain or oilseeds quality declines - India

rainfall Thursday was sporadic and light - Most

of the precipitation occurred across the heart of the nation from west-central to northeastern crop areas, but the moisture was sporadic and light having a minimal impact on harvesting or winter crop planting and establishment - Waves

of rain are expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia - Delays

in the loading and shipping of some goods and services may result due to flooding, but the worst of the stormy pattern may be passing - Frequent

rain could still induce some delays - China’s

weather during the next ten days will continue relatively quiet with only brief and light precipitation resulting

- Northern

wheat production areas were trending dormant or semi-dormant and winter crops should be adequately established - Rapeseed

planting should be winding down in the Yangtze River Basin - Soil

moisture is favorably rated for good rapeseed establishment - Western

Russia, Ukraine and much of western and southern Europe will experience an active weather pattern during the next ten days to two weeks - Waves

of rain and some snow will occur through this first week of the Outlook, but in the second week the wettest conditions will occur in Russia, Ukraine, Baltic States and Belarus - Precipitation

totals will be sufficient to bring a boost in soil moisture and runoff - Winter

crops will continue dormant or semi-dormant in much of the European Continent and western Asia, though some warming is expected in eastern parts of this region - Western

Russia and eastern Europe will trend colder next week and into the following weekend, although no bitter cold conditions are expected - Middle

East weather is a little dry from Syria, Iraq and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Eastern

parts of the Middle East may experience additional drying for a while - Northern

Iraq and Iran are advertised to be wetter in the Dec. 10-16 period, although confidence is a little low - Western

Turkey will be wettest - North

Africa rainfall is expected to occur periodically during the next ten days, but southwestern Morocco will be missed by significant rain - Coastal

areas of central and eastern Algeria will be wettest - West-central

Africa rainfall during the next ten days will be greatest in coastal areas leaving most interior coffee, cocoa, sugarcane, rice and cotton production areas in a favorable maturation and harvest environment

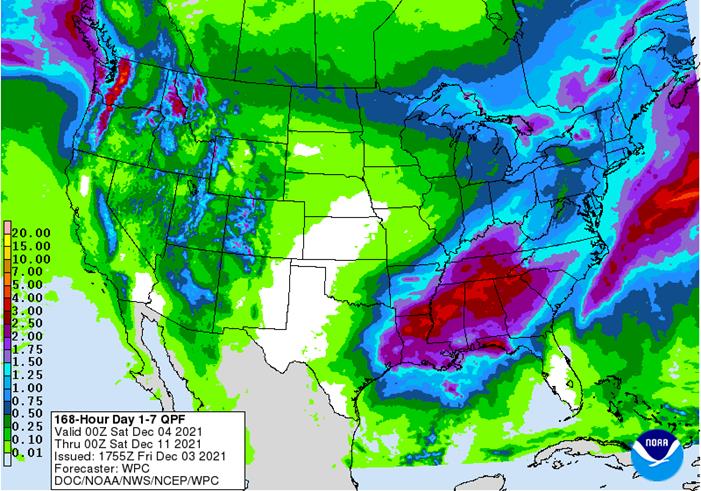

- U.S.

Hard red winter wheat production areas will not likely get significant precipitation through next Thursday - Any

showers that evolve are not likely to have an impact on soil or crop conditions - Dryness

will prevail - Dec.

10-16 will bring at least one opportunity for snow and rain in portions of wheat country that may be followed by a short term bout of colder weather - Southeastern

crop areas in the wheat belt and a few areas in Colorado, far western Nebraska and northwestern Kansas may be favored for the precipitation

- U.S.

precipitation in the coming ten days will be greatest from eastern Texas and the Delta into the lower and eastern most Midwest

- The

greatest rain this week will be from eastern Texas and the Delta through the Tennessee River Basin to the lower eastern Midwest Sunday into Monday and again during mid- to late-week next week

- Some

areas will end up with 1.00 to 2.50 inches of rain by late next week with this week’s precipitation lightest and most sporadic - Heavier

rain has been advertised in the Delta and Tennessee River Basin where some flooding might occur - Rain

totals in these areas may range from 2.00 to 4.00 inches with some forecast models suggesting more than 6.00 inches - A

few showers will also occur in the southeastern states, but the region southeast of the Appalachian Mountains will experience net drying through Wednesday and then get some moisture late next week - Brief

periods of light snow and rain will impact the northern Plains with greater precipitation in along the Canada border especially this weekend when 3-8 inches and locally more accumulate - Northern

North Dakota, northern Minnesota, far southern Manitoba and extreme southern Saskatchewan will be most impacted along with southern Alberta - Stormy

weather in the Pacific Northwest will continue to include heavy rain in coastal British Columbia, the Cascade Mountains of western Washington and western Oregon as well as the mountains of northern Idaho and immediate neighboring areas

- Flooding

in southwestern British Columbia and western Washington may continue to impact transportation and more delays in shipping are expected - Daily

rainfall will not be as great as it has been - West

Texas will be mostly dry as will southern California crop areas - Southeastern

Canada’s grain and oilseed areas will experienced alternating periods of rain and snow maintaining a slow finish to late season fieldwork at times - the

moisture will maintain favorable conditions for wheat use in the spring - The

bottom line for the United States and southern Canada will change little over the next ten days. Dry conditions in hard red winter wheat areas may be a concern, but crops will stay in favorable condition until spring due to winter dormancy or semi-dormancy.

The exception to that will be from the Texas Panhandle to Colorado and extreme western Kansas as well as Montana where conditions are driest. There is also concern for unirrigated wheat in Oregon. Late season summer crop harvesting is winding down in the Midwest,

Delta and southeastern Canada (Ontario and Quebec) where there is need for better drying conditions. Dryness in southern California and the southeastern United States is great for summer crop harvesting and winter crop planting.

- Colombia

and Venezuela rainfall was lighter than usual earlier this month - Precipitation

is expected to occur more often in coffee and sugarcane production areas during the next ten days in Colombia and western Venezuela - No

excessive rain is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Today’s

Southern Oscillational Index was +12.34 and it was expected to move erratically over the coming week

- New

Zealand rainfall is expected to be near normal in the coming week except along the west coast of South Island where excessive rain is possible - Temperatures

will be seasonable

Friday,

Dec. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

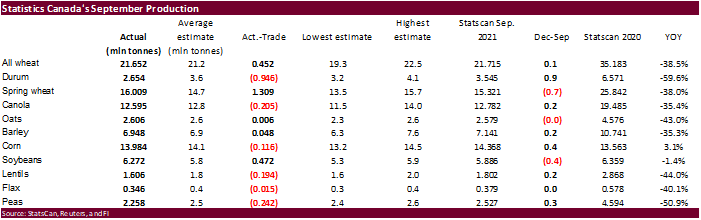

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Canada’s

Statcan releases wheat, durum, canola, barley, soybean production data - FranceAgriMer

weekly update on crop conditions

Monday,

Dec. 6:

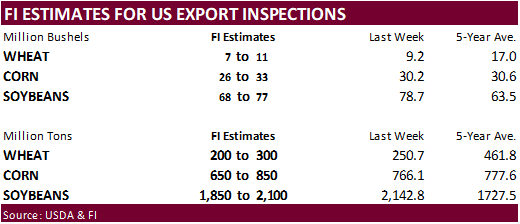

- USDA

export inspections – corn, soybeans, wheat, 11am - CNGOIC

monthly report on Chinese grains and oilseeds - Ivory

Coast cocoa arrivals - New

Zealand Commodity Price - U.S.

Purdue Agriculture Sentiment, 9:30am - Sucden

coffee briefing - HOLIDAY:

Thailand

Tuesday,

Dec. 7:

- China’s

first batch of November trade data, including soybean, edible oil and meat imports - Abares’

quarterly agricultural commodities report - French

agriculture ministry’s monthly crop production estimate - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data

Wednesday,

Dec. 8:

- EIA

weekly U.S. ethanol inventories, production - Fitch

ESG Outlook Conference Asia Pacific, day 1 - FranceAgriMer’s

monthly grains report

Thursday,

Dec. 9:

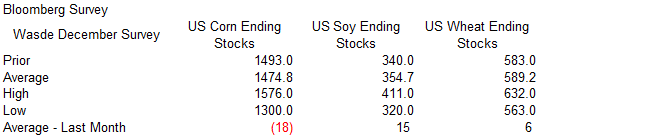

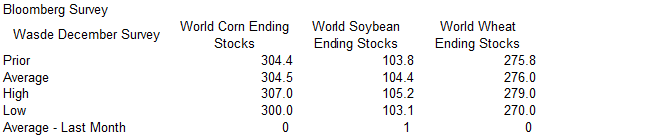

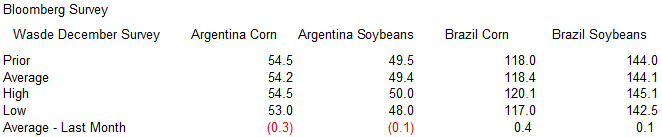

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - China

farm ministry’s monthly crop supply-demand report (CASDE) - Brazil’s

Conab report on yield, area and output of corn and soybeans - Fitch

ESG Outlook Conference Asia Pacific, day 2 - Port

of Rouen data on French grain exports

Friday,

Dec. 10:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board’s data on November palm oil reserves, output and exports - Malaysia’s

Dec. 1-10 palm oil exports - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Statistics

Canada

November

estimates of production of principal field crops

2019 2020 2021 2019-2020 2020-2021

thousands of tonnes % change

Total

wheat 32670 35183 21652 7.7 -38.5

Durum

wheat 5017 6571 2654 31.0 -59.6

Spring

wheat 25952 25842 16009 -0.4 -38.0

Winter

wheat 1701 2770 2989 62.9 7.9

Barley

10383 10741 6948 3.4 -35.3

Canary

seed 175 178 109 1.8 -38.7

Canola

19912 19485 12595 -2.1 -35.4

Chick

peas 252 214 76 -14.8 -64.5

Corn

for grain 13404 13563 13984 1.2 3.1

Dry

beans 317 490 386 54.5 -21.2

Dry

field peas 4237 4594 2258 8.4 -50.9

Fall

Rye 326 475 466 45.9 -1.9

Flaxseed

486 578 346 18.9 -40.2

Lentils

2382 2868 1606 20.4 -44.0

Mustard

seed 135 99 50 -26.6 -49.4

Oats

4227 4576 2606 8.2 -43.0

Soybeans

6145 6359 6272 3.5 -1.4

Sunflower

seed 63 101 82 61.0 -19.3

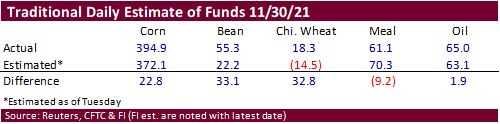

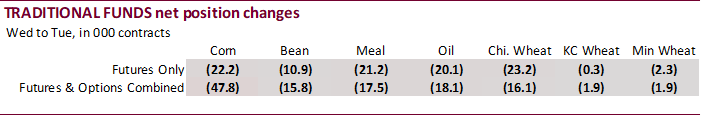

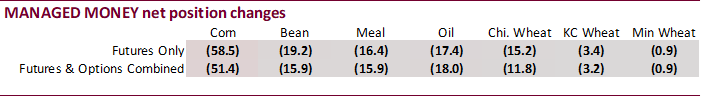

The

funds for the week ending November 30 did not sell as much as expected contracts for corn, soybeans and wheat. They sold a more than expected soybean meal.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

221,644 -41,771 431,043 13,288 -606,683 27,702

Soybeans

6,555 -11,289 191,511 -4,700 -156,618 18,676

Soyoil

16,631 -19,011 128,273 1,340 -148,514 25,048

CBOT

wheat -22,095 -16,099 120,363 -3,452 -90,908 18,318

KCBT

wheat 33,204 -383 58,370 -1,722 -92,823 2,432

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

315,269 -51,423 270,497 38,216 -606,174 8,788

Soybeans

33,425 -15,931 149,093 6,048 -166,754 12,453

Soymeal

37,681 -15,878 92,701 4,817 -176,788 15,703

Soyoil

64,360 -17,994 98,601 -1,031 -156,094 26,494

CBOT

wheat 6,200 -11,763 68,563 -809 -72,625 15,686

KCBT

wheat 62,368 -3,242 27,748 360 -80,927 1,828

MGEX

wheat 14,204 -932 1,345 -169 -28,970 2,911

———- ———- ———- ———- ———- ———-

Total

wheat 82,772 -15,937 97,656 -618 -182,522 20,425

Live

cattle 78,517 9,484 80,696 -2,474 -161,515 -6,724

Feeder

cattle 4,907 5,364 3,840 -347 -1,467 -1,611

Lean

hogs 56,373 897 57,286 -2,152 -100,853 -428

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

66,413 3,637 -46,004 781 1,681,394 -418,180

Soybeans

25,685 119 -41,448 -2,687 790,880 -32,489

Soymeal

20,119 -1,586 26,288 -3,057 430,317 -67,517

Soyoil

-10,478 -91 3,609 -7,378 436,518 -61,816

CBOT

wheat 5,224 -4,347 -7,361 1,234 449,530 -136,514

KCBT

wheat -10,437 1,381 1,248 -327 251,380 -33,646

MGEX

wheat 9,116 -934 4,306 -876 79,324 -4,012

———- ———- ———- ———- ———- ———-

Total

wheat 3,903 -3,900 -1,807 31 780,234 -174,172

Live

cattle 21,154 1,629 -18,853 -1,915 369,380 6,618

Feeder

cattle 3 -947 -7,282 -2,460 45,537 -1,281

Lean

hogs 6,710 2,294 -19,515 -610 289,238 -8,378

Source:

CFTC, Reuters and FI

Macros

US

Non-Farm Payrolls Nov: 210K (est 550K; prev 531K)

US

Unemployment Rate Nov: 4.2% (est 4.5%; prev 4.6%)

–

Avg Hourly Earnings (M/M) Nov: 0.3% (est 0.4%; prev 0.4%)

–

Avg Hourly Earnings (Y/Y) Nov: 4.8% (est 5.0%; prev 4.9%)

US

Private Payrolls Nov: 235K (est 536K; prev 604K)

–

Manufacturing Payrolls Nov: 31K (est 45K; prev 60K)

–

Avg Weekly Hours Nov: 34.8 (est 34.7; prev 34.7)

–

Labour Force Participation Rate Nov: 61.8% (est 61.6%; prev 61.6%)

Canadian

Net Change in Employment Nov: 153K (est 37.5K; prev 31.2K)

–

Unemployment Rate Nov: 6.0% (est 6.6%; prev 6.7%)

–

Full Time Employment Change Nov: 79.9K (prev 36.4K)

–

Part Time Employment Change Nov: 73.8K (prev -5.2K)

Canadian

Hourly Wages Rate Perm. Employees Nov: 3.0% (prev 2.1%)

–

Participation Rate Nov: 65.3% (est 65.4%; prev 65.3%)

Canadian

Labour Productivity (Q/Q) Q3: -1.5% (est -0.6%; prev 0.6%)

·

CBOT corn rallied despite a late selloff in WTI crude oil and poor US jobs number that pressured US equities. We think the market was spreading against wheat and also following strength in soybeans.

·

March corn briefly traded below its 20-day MA ($5.78) but for the majority of the session it remained above it. The action today was technical (bullish), we think.

March

corn is seen in a sideways trading range over the short term, although wide range, and a resistance is seen at $5.9675, its November 24 absolute session high.

·

Funds bought an estimated net 4,000 CBOT corn contracts.

·

Bulgaria reported an outbreak of bird flu affecting 80,000 chickens in the southern village of Tsalapitsa.

Export

developments.

·

None reported

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

The soybean complex traded higher despite a lower USD and lower equities. USDA announced another 122,000 tons to unknown, providing some support. Some bull traders might have been getting ahead of a potential RVO announcement.

The mandates for advanced biofuel are expected to increase.

·

There was no EPA announcement for the US RVO mandate decision today as traders expected something. Earlier this year Reuters picked up that the EPA was planning on

reducing blending

mandates for 2020 and 2021 to about 17.1 billion gallons and 18.6 billion gallons, respectively, compared to the 20.1 billion gallons finalized for 2020 before the pandemic.

·

Funds bought an estimated net 11,000 soybean contracts, bought 7,000 soybean meal and bought 5,000 soybean oil.

·

(Reuters) – The Biden administration is expected to propose expanding the kinds of renewable fuel production processes that are eligible to receive credits under the U.S. Renewable Fuel Standard program, three sources familiar

with the matter said.

·

Russian plans to increase the sunflower oil export tax to $280.80/ton in January from $276.70/ton currently.

·

China crush margins on our analysis was last $2.22, versus $2.17 at the end of last week (unchanged) and compares to $0.81 a year ago.

Export

Developments

·

Private exporters reported the following:

-122,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range, March $11.75-$13.50

Soybean

meal – January $320-$370, March $315-$380

Soybean

oil – January 54.00-59.00, March 54.00-62.00

·

US wheat started mostly higher but collapsed on fund selling. Minneapolis wheat kicked off the selling. March Matif Paris wheat was 5.75 euros lower at 290.00. The contract failed to fill the gap made earlier this week of 297.00,

but we are thinking it eventually will.

·

Funds sold an estimated net 7,000 soft red winter wheat contracts.

·

Traders are awaiting on Saudi Arabia’s import tender.

·

Russia may impose a grain export quota for the February 15- June 30 period

at

14 million tons, including 9 million tons of wheat. The 14 million tons is 20 percent less than the 17.5 million ton cap that was put on last year for the February 15 through June 30, 2021 period. July through November 2021 grain exports were estimated by

SovEcon at about 21.2 million tons, down 16 percent from the same period year ago. Russia harvested 125.5 million tons of grain by the end of the third week of November, down from 137.2 at the same time year ago, down about 9 percent. Wheat production is

down roughly 11 percent to 78-79 million tons.

·

Russian wheat export taxes for December 8-14 were set at $84.90/ton, up from $80.80/ton December 1-7.

Export

Developments.

·

Japan bought 25,510 tons of Australian Standard wheat.

·

Saudi Arabia seeks 535,000 tons of wheat today for arrival between May and July 2022.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.