PDF Attached

Mixed

trade in US commodity markets and rally in US equities created a slow trade in CBOT agricultural futures, but in large part to lack of direction. News was also light. Some spreading commenced in wheat and corn. Others were looking at a bull situation in soybean

oil after global vegoil markets rallied early Monday. Funds have been buyers of ags in recent days, or at least until today (sold corn, soybeans and meal on Monday).

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Weekend

rainfall in South America was varied with southwestern Brazil, Paraguay, Uruguay and eastern Argentina dry - Argentina

rainfall was greatest in the heart of Buenos Aries and from there into southern Cordoba and northeastern Santa Fe where 0.75 to 1.34 inches resulted - Lighter

rain fell in other Cordoba and Santiago del Estero and southern Santa Fe locations with rainfall of 0.05 to 0.75 inch resulting - All

other areas in Argentina were dry - Temperatures

were seasonable - Rain

in Brazil was widespread in the north and southeastern parts of the nation leaving Rio Grande do Sul, western Santa Catarina, western Parana, Paraguay, Mato Grosso do Sul and southern Mato Grosso dry

- Rainfall

from northeastern Rio Grande do Sul through central and eastern Parana to central and western Sao Paulo and southern Minas Gerais varied from 0.05 to 0.75 inch with a few amounts of up to 1.50 inches - Greater

rain fell across central and northern Mato Grosso, eastern Bahia and east-central Minas Gerais where local totals of 1.00 to 2.00 inches and a few amounts more than 2.00 inches were noted.

- Temperatures

in Brazil were also seasonable - Even

though rain will eventually fall in the drier areas of interior southern Brazil the region will be dry today through Friday raising moisture stress in western Parana where the ground is already a bit dry along with a few neighboring areas - These

areas should get rain late this weekend into next week, but if they do not get the moisture, crop stress will rise further and the situation will need to be closely monitored - Brazil

crop areas from Mato Grosso to Bahia and Minas Gerais will get rain routinely over the next two weeks keeping crops in good condition - Crops

in Mato Grosso do Sul to Sao Paulo, Parana and Santa Catarina will get their precipitation late this weekend into next week with relatively dry biased conditions until then

- Flooding

rain is expected briefly this week in Espirito Santo, northeastern Minas Gerais and southeastern Bahia where 2.00 to 6.00 inches and local totals as great as 8.00 inches will fall by Friday morning - Limited

rainfall is still expected from eastern Argentina through southern Brazil and southernmost Paraguay during the coming ten days - Any

rain that falls in these areas will be very brief and light resulting in net drying conditions - The

area including Corrientes, much of Santa Fe, northeastern Buenos Aires, Chaco, eastern Formosa, Uruguay, Rio Grande do Sul and southernmost Paraguay - Pockets

of dryness may evolve and expand during the ten-day period ending Dec. 15, but serious crop stress will likely be slow to evolve due to favorable subsoil moisture and seasonable temperatures - The

need for rain in these areas will steadily rise especially during the weekend and next week after this week’s drying firms up the topsoil - The

urgency for rain will rise near and beyond mid-month if dryness is still persisting - Rio

Grande do Sul will be the first area to begin to experience notable moisture stress

- Tropical

Depression Jawad has had a minimal impact on India’s upper east coast - The

storm dissipated off the upper east coast of India Sunday - Rainfall

varied up to 3.50 inches through dawn today in Odisha and West Bengal, India. Some greater amounts were suspected, though - No

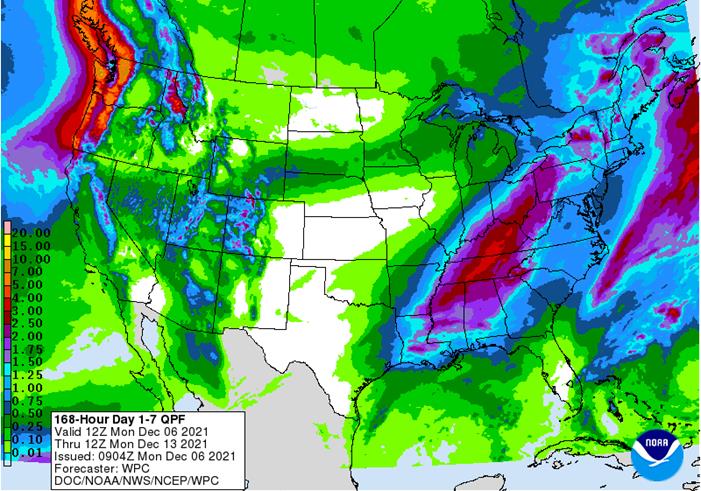

damage to rice, sugarcane or any other crop is expected, despite local flooding - U.S.

weekend precipitation was mostly confined to the northern states from Washington and northern Oregon through Montana to North Dakota, northern South Dakota and into the western Great Lakes region - Moisture

totals varied up to 0.50 inch except in the mountains of northern Idaho and in the Cascade Mountains where up to 0.84 inch and 1.25 inches occurred respectively.

- Snowfall

through dawn today varied from 2 to 6 inches except along U.S. Highway 2 from near Devils Lake to Lavina, MN in which 6- to 11-inch totals occurred with 12 inches at Tolna, N.D. and 14 inches at Solway, Minnesota - Some

of the snow reached in central and northern Wisconsin where 5-11 inches resulted - Similar

amounts occurred in northern Lower Michigan and most of Upper Michigan - Rain

developed in the eastern Midwest and northern Delta Sunday with moisture totals of 0.20 to 0.70 inch except near and south of the Ohio River where some 0.70 to 2.12-inch amounts resulted. - Kentucky

and north-central Tennessee were wettest with amounts over 1.00 inch - Most

other crop areas were dry in the U.S. were dry - U.S.

Outlook for the coming week….. - Today’s

snow in the northern Midwest will shift through the Great Lakes region to the Ontario and Quebec crop areas and a part of far northern New England the remainder of today

- Another

2-10 inches of accumulation is expected in southern Quebec, Ontario and both northern New York and northern New England

- Rain

will fall from the lower U.S. Delta region through the Tennessee River Basin to southern New England today with moisture totals of 0.50 to 1.50 inches and a few amounts over 2.00 inches - Lingering

showers will occur in the eastern U.S. Tuesday and then one more disturbance is expected in the Midwest, interior northern Plains and Delta Thursday into the weekend with moisture totals of 0.10 to 0.75 inch in the Midwest and local totals of 1.00 to 1.50

inches in the lower eastern Midwest, Delta and Tennessee River Basin - Snow

will fall from South Dakota to the western Great Lakes region Thursday and Friday with 3 to 9 inches of accumulation possible and moisture totals to 0.75 inch.

- Some

locally greater amounts are expected as well - Another

rain event is expected in the Delta, Tennessee River Basin and interior southeastern states to southern New England this weekend with rainfall of 0.50 to 2.00 inches - U.S.

temperatures will be near to above normal during most of this coming week, although today and Tuesday will be quite cold in the north-central states - U.S.

week two weather, Dec. 13-19 will be limited in the Great Plains and southwestern states as well as a part of the southeastern states while rain falls lightly in the northern and eastern Midwest and from California into the Great Basin - U.S.

hard red winter wheat production areas will receive a minimal amount of moisture during the next two weeks and temperatures will be warmer than usual - Net

drying is expected and crops will remain dormant or semi-dormant in the majority of areas, despite the warmer than usual bias - Restricted

precipitation will continue in the northwestern U.S. Plains over the next two weeks, although totally dry weather is unlikely - U.S.

southeastern states will also experience net drying conditions, especially in areas near the coast in South Carolina, Georgia and across much of Florida - U.S.

Delta weather will be wettest in this first week of the outlook with less precipitation in the second week of the outlook - California

may experience a boost in precipitation throughout the state for a little while next week

- The

moisture will increase mountain snow pack and short term soil moisture - Mexico

precipitation will be limited to the east coast over the next ten days with areas from Tamaulipas to Veracruz and Chiapas most impacted - Resulting

rainfall will rarely bolster soil moisture for very long - Net

drying is expected in most other areas - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Eastern

Australia harvest weather will be better in the next two weeks than in the past several weeks - Rain

will fall infrequently with early to mid-week this week wettest in Queensland and a few New South Wales crop areas most impacted - Friday

of this week through the middle part of next week will be drier biased providing another good opportunity for winter crop harvest progress and summer crop planting and early season spraying fertilizing - Southern

Australia will be dry during much of the next ten days supporting good to excellent winter crop maturation and harvest weather - Australia

weekend precipitation was mostly confined to a few locations in Victoria and mostly the Pacific Coast from southeastern Queensland to northeastern New South Wales

- Rainfall

will vary up to 0.30 inch with a few totals in northeastern New South Wales in Dairy and sugarcane areas getting 1.00 to 2.00 inches

- Temperatures

were quite warm to hot in north-central and northwestern parts of the nation outside of key crop areas where highs in the 90s to 108 Fahrenheit was common

- Mostly

from central and western Queensland to northern parts of Western Australia - South

Africa received frequent showers and thunderstorms during the weekend with nearly 85% of the nation getting rain at one time or another - Moisture

totals varied widely with some 1.00- to 2.00-inch totals occurring erratically across the nation while other areas received less than 0.60 inch resulting in net drying conditions - A

more uniform distribution of rain is needed - South

Africa’s rainfall distribution will continue erratic over the next two weeks, but all areas will be impacted at one time or another and the environment will be supportive of summer crop development - Temperatures

will be close to normal - The

bottom line for South Africa should be good for long term crop development - Europe

precipitation was bolstered higher during the weekend, although none of it was a surprise - France

was wettest along with a few areas from Italy into Bulgaria and Serbia where 0.35 to 1.00 inch totals were common with a few amounts of 1.00 to 200 inches - Spain,

Portugal and far eastern Europe were driest - Temperatures

were mild to cool keeping winter crops dormant or semi-dormant except in the far south and west-central parts of the region where a little more growth may have occurred briefly - Europe

will receive periods of rain and mountain snowfall during the next ten days to two weeks.

- Most

areas will be impacted at one time or another and the moisture will be of great use in the spring - Precipitation

is needed most in parts of Romania, Spain and Portugal where the soil is still running short to very short of moisture - Temperatures

will be slightly cooler-biased - Russia,

Ukraine, Baltic States and Belarus are unlikely to see threatening cold in the next ten days and waves of snow and rain are expected - CIS

soil moisture will slowly improve in this weather pattern - Not

many areas need moisture, but dryness remains in northern Kazakhstan and southernmost parts of Russia’s New Lands - Some

southward expansion of cold air in the CIS New Lands is advertised for next week, but the cold will stay out of winter wheat production areas - Latest

La Nina data shows a more gradual weakening trend after the late December early January peak in the event. - Previous

NOAA model runs had La Nina weakening aggressively - Now

La Nina still has some influence into April – if their forecast is correct - World

Weather, Inc. believes there is potential for this La Nina event to linger longer and it would not be surprising to see it last through the spring

- That

is just speculation for now, but similar conditions have occurred in other 22-year solar cycles - The

implication of a longer lasting La Nina in the spring would be greater concern for ongoing dryness in the Plains and a part of the western Corn Belt - Still

just speculation for now - Did

you know the Joint Institute for the Study of the Atmosphere and Ocean (JISAO)’s original Pacific Decadal Oscillation Index (PDO) fell to its lowest level since 1956 in October of this year - Some

believe strongly negative PDO events that last over multiple months lead to droughts especially when they occur in the summer

- Keep

an eye on this event for 2022 U.S. agricultural weather especially if La Nina stays longer - Strongly-positive-phased

Arctic Oscillation (AO) present in the Northern Hemisphere today is ensuring that no mid-latitude winter agricultural region in the Northern Hemisphere will be subjected to threatening cold for the next ten days and probably not for two weeks - This

is true for the United States, Europe and all of Asia - Some

“cooler” air will be around in a few areas, but no crop threatening cold is anticipated - Canada

and the far northern U.S. Plains will see two days of bitter cold Sunday and Monday, but it will be quick to abate without going any farther to the south - India

rainfall during the weekend was limited - Odisha

and West Bengal were wettest with 0.50 to 2.00 inches resulting mostly because of Tropical Cyclone Jawad - Rain

also fell from western Maharashtra to Tamil Nadu where 0.30 to 1.77 inches resulted - Most

other areas were dry - India

rainfall in the far south will slowly diminish bringing a period of welcome dry conditions that will support much improved summer crop maturation and harvest conditions and better winter crop harvest conditions - Many

areas will be dry during the weekend and on into early next week - Waves

of rain are expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia - Delays

in the loading and shipping of some goods and services may result due to flooding, but the worst of the stormy pattern may be passing - Frequent

rain could still induce some delays - Friday

through the weekend coming up will be the next stormy period - China’s

weather during the next ten days will continue relatively quiet with only brief periods of light precipitation expected - The

precipitation is expected to be most significant in the northeastern and east-central provinces where snow and rain will fall respectively - Northern

wheat production areas were trending dormant or semi-dormant and winter crops should be adequately established - Rapeseed

planting should be winding down in the Yangtze River Basin - Soil

moisture is favorably rated for good rapeseed establishment - Middle

East weather is a little dry from Syria, Iraq and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Eastern

parts of the Middle East may experience additional drying for a while - Northern

Iraq and Iran are advertised to be wetter in the Dec. 13-19 period, although confidence is a little low - Western

Turkey will be wettest - North

Africa rainfall is expected to occur periodically during the next ten days, but Morocco (especially the southwest) will be missed by significant rain - Coastal

areas of central and eastern Algeria will be wettest - West-central

Africa rainfall during the next ten days will be greatest in coastal areas leaving most interior coffee, cocoa, sugarcane, rice and cotton production areas in a favorable maturation and harvest environment

- Sierra

Leone and Liberia will be wetter than any other country to the east into Cameroon and Nigeria - Colombia

and Venezuela precipitation is expected to occur often in coffee and sugarcane production areas during the next ten days, but no excessive rain is expected - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact the Philippines, Indonesia and Malaysia most often with some net drying expected in interior parts of mainland Southeast Asia - Today’s

Southern Oscillational Index was +13.1 and it was expected to move a little higher this week

- New

Zealand rainfall is expected to be near to above average this week with temperatures warmer than usual in the north and cooler than usual in the central and south - Temperatures

will be seasonable

Tuesday,

Dec. 7:

- China’s

first batch of November trade data, including soybean, edible oil and meat imports - Abares’

quarterly agricultural commodities report - French

agriculture ministry’s monthly crop production estimate - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data

Wednesday,

Dec. 8:

- EIA

weekly U.S. ethanol inventories, production - Fitch

ESG Outlook Conference Asia Pacific, day 1 - FranceAgriMer’s

monthly grains report

Thursday,

Dec. 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - China

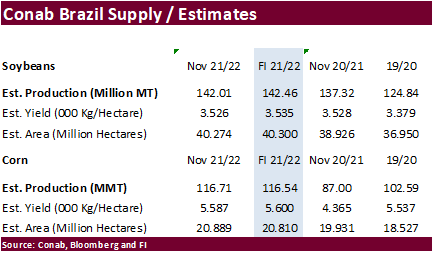

farm ministry’s monthly crop supply-demand report (CASDE) - Brazil’s

Conab report on yield, area and output of corn and soybeans - Fitch

ESG Outlook Conference Asia Pacific, day 2 - Port

of Rouen data on French grain exports

Friday,

Dec. 10:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board’s data on November palm oil reserves, output and exports - Malaysia’s

Dec. 1-10 palm oil exports - HOLIDAY:

Thailand

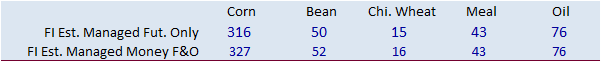

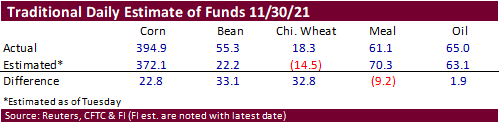

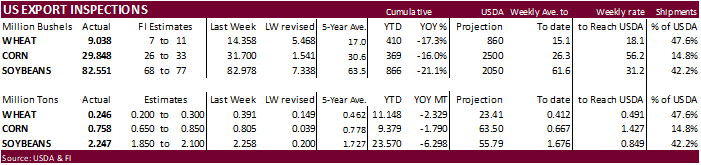

FI

estimates below

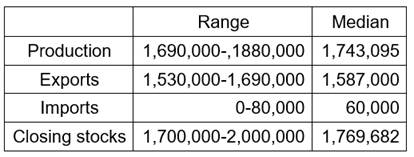

USDA

inspections versus Reuters trade range

Wheat

245,963 versus 150000-400000 range

Corn

758,169 versus 600000-1000000 range

Soybeans

2,246,664 versus 1850000-2325000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 02, 2021

— METRIC TONS —

—————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/02/2021 11/25/2021 12/03/2020 TO DATE TO DATE

BARLEY

73 98 1,397 10,010 17,751

CORN

758,169 805,214 824,506 9,378,792 11,168,642

FLAXSEED

0 0 24 124 437

MIXED

0 0 0 0 0

OATS

0 0 0 300 1,595

RYE

0 0 0 0 0

SORGHUM

169,626 190,649 73,503 1,113,964 1,528,975

SOYBEANS

2,246,664 2,258,305 2,595,351 23,569,566 29,867,072

SUNFLOWER

0 0 0 432 0

WHEAT

245,963 390,771 537,077 11,147,986 13,476,544

Total

3,420,495 3,645,037 4,031,858 45,221,174 56,061,016

—————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

74

Counterparties Take $1.488 Tln At Fed Reverse Repo Op. (prev $1.475 Tln, 73 Bids)

(Reuters)

– Oil prices rose by more than $3.40 a barrel on Monday after top exporter Saudi Arabia raised prices for its crude sold to Asia and the United States, and as indirect U.S.-Iran talks on reviving a nuclear deal appeared to hit an impasse.

·

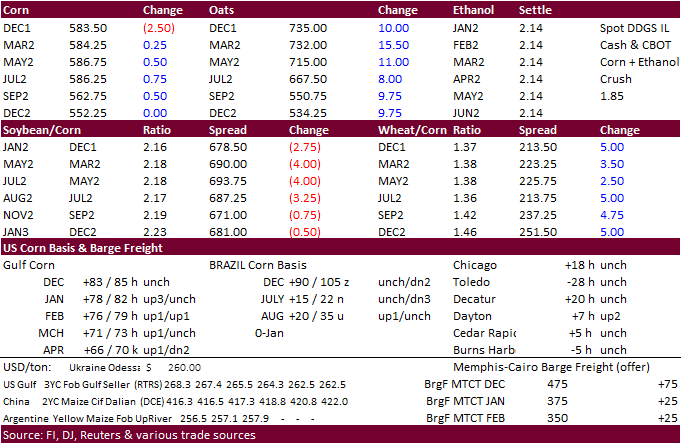

CBOT corn fell in the front three months and was higher in the back months on spreading. The lower front month trade was in part to weakness in soybeans and wheat futures plus slow USDA export inspections.

·

Funds sold an estimated net 4,000 CBOT corn contracts.

·

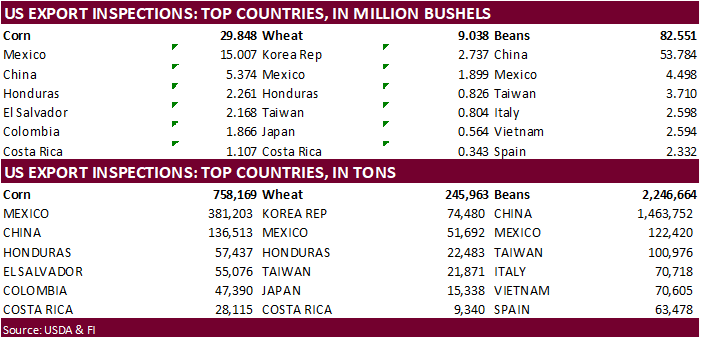

USDA US corn export inspections as of December 02, 2021 were 758,169 tons, within a range of trade expectations, below 805,214 tons previous week and compares to 824,506 tons year ago. Major countries included Mexico for 381,203

tons, China for 136,513 tons, and Honduras for 57,437 tons.

·

Keep an eye on southern Brazil where it has been dry and will remain dry during at least the first half of this week.

Argentina is also expected to dry over the next couple of weeks, but we are hearing crops are in good

shape and could withstand the net drying.

·

China’s statistics bureau pegged corn output up 4.6% in 2021 to 272.6 million tons. China’s 2021 corn planting acreage was up 5% from the previous year at 650 million mu (43.32 million hectares).

Export

developments.

·

None reported

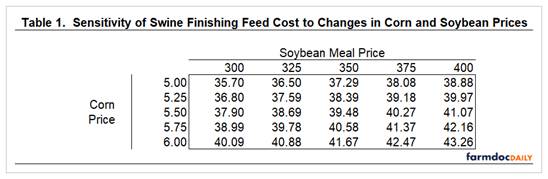

Prospects

for Swine Feed Costs in 2022

Langemeier,

M. “Prospects for Swine Feed Costs in 2022.” farmdoc daily (11):161, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 3, 2021.

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

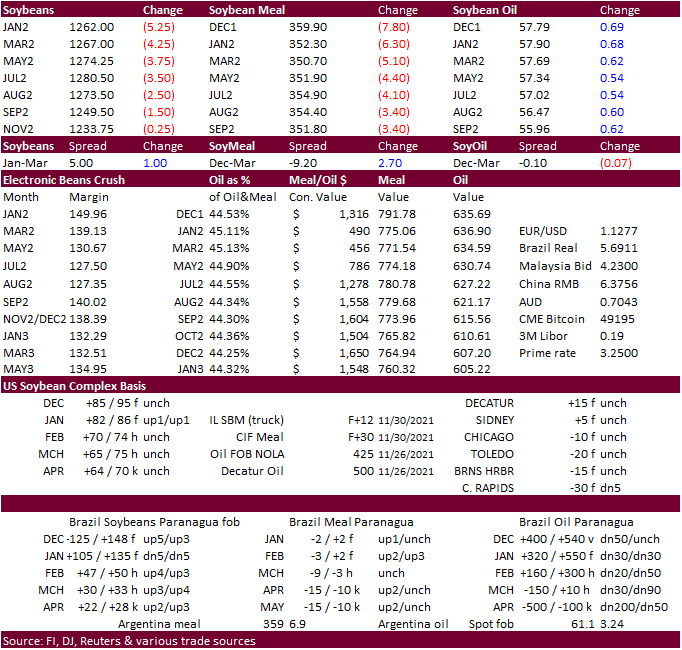

Soybeans

and meal ended lower while SBO settled higher in part to higher Malaysian palm overnight and strength in China vegetable oils. There has been some disappointment over China buying of SA soybeans when it’s a time US dominates market share. The trade is expecting

an announcement from the EPA soon over biofuel mandates. As we mentioned Friday, some traders might be looking for a bullish announcement.

·

Brazil was 94% planted for soybeans as of late last week, meaning FH January shipments are likely with early plantings this year.

·

USDA US soybean export inspections as of December 02, 2021 were 2,246,664 tons, within a range of trade expectations, below 2,258,305 tons previous week and compares to 2,595,351 tons year ago. Major countries included China for

1,463,752 tons, Mexico for 122,420 tons, and Taiwan for 100,976 tons.

·

Soybean meal basis across selected US locations fell $2-$7/short ton. Meal demand should remain robust with high corn prices.

·

Funds sold an estimated net 6,000 soybean contracts, sold 7,000 soybean meal and bought 3,000 soybean oil.

·

Last week it was thought China bought 25-30 cargoes of soybeans.

·

US/China political tensions increased over the weekend after the US threatened to boycott the Olympics. This was talked about before and we don’t read too much into this but something to keep an eye on.

November

MPOB estimates via Reuters

Export

Developments

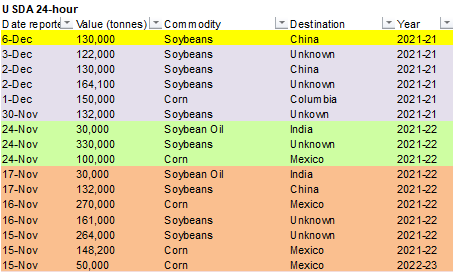

·

Private exporters reported the following:

-130,000

metric tons of soybeans to China during the 2021/2022 marketing year

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range, March $11.75-$13.50

Soybean

meal – January $320-$370, March $315-$380

Soybean

oil – January 54.00-59.00, March 54.00-62.00

·

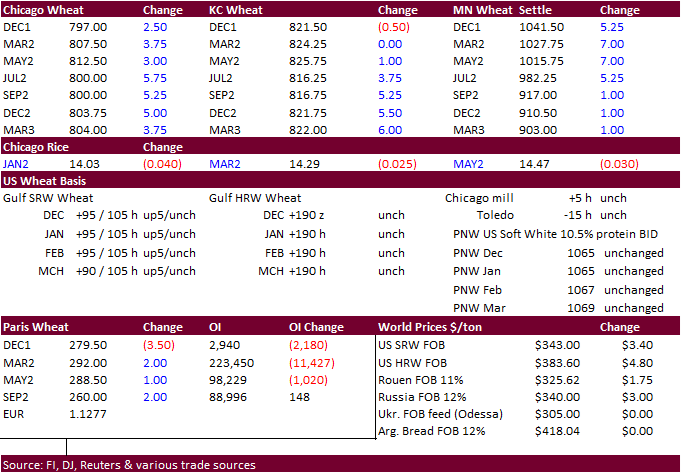

After a two-sided trade, US wheat settled mostly higher (Chicago and MA higher, KC nearby on the defensive) on spreading and good export demand out of the Black Sea region, leaving many to worry US exports are waning. Although

some traders noted a declined in Russian fob wheat export prices that sent giggers to the Paris market. But Mastiff rebounded to close higher. March Matif Paris wheat settled 2.00 euros higher at 291.75.

·

Reuters: “Russian wheat with 12.5% protein loading from Black Sea ports for supply in December was quoted at $337 a ton free on board (FOB) at the end of last week, down $3 from the previous week” – IKAR”

·

USDA US all-wheat export inspections as of December 02, 2021 were 245,963 tons, within a range of trade expectations, below 390,771 tons previous week and compares to 537,077 tons year ago. Major countries included Korea Rep for

74,480 tons, Mexico for 51,692 tons, and Honduras for 22,483 tons.

·

A gradual improvement to the eastern Australian weather outlook over the next 10 days limited gains.

·

Funds bought an estimated net 2,000 Chicago soft red winter wheat contracts.

·

China’s statistics bureau pegged wheat production at 136.9 million tons.

·

Russia may impose a grain export quota for the February 15- June 30 period

at

14 million tons, including 9 million tons of wheat.

Export

Developments.

·

Saudi Arabia bought 689,000 tons of wheat at an average $365.14/ton

for

arrival between May and July 2022.

That amount was more than expected.

·

Jordan seeks another 120,000 tons of wheat on Dec 9 and seeks 120,000 tons of barley on Dec 8.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.