PDF Attached

Private

exporters reported the following sales activity:

-264,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-240,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

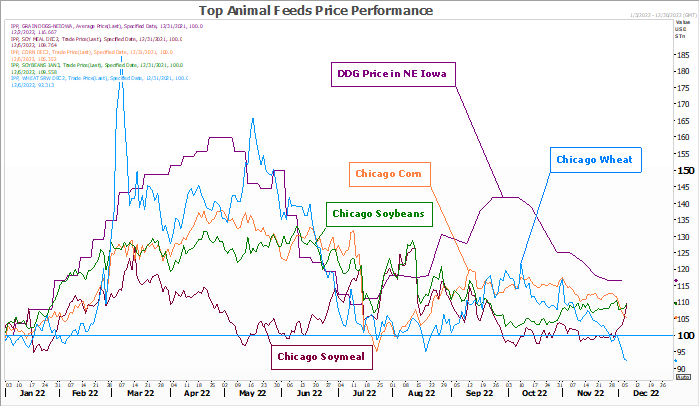

Below

based on 100 index as of January 1, 2022. Note the downturn in wheat.

Soybean

meal appreciated by most in more than a month on Argentina and Paraguay weather concerns, easing China covid restrictions and unwinding of soybean oil/meal spreads. Soybeans were higher, following meal and a pickup in demand from China. CBOT crush was firm

in the nearby positions. Soybean oil traded lower in part to a large decline in WTI crude oil & product spreading. Corn and wheat traded lower. Chicago wheat hit its lowest level in more than a year (early October 2021). Grain export developments increased

Monday into Tuesday, but this did little to ease selling in corn and wheat.

Weather