PDF Attached

There

was no formal EPA announcement at the time this was written.

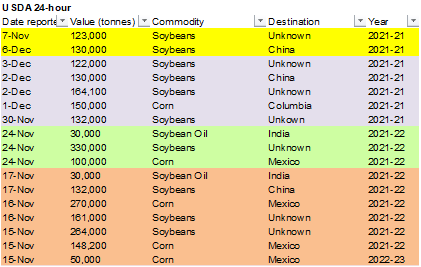

Private

exporters reported the following: 123,000 metric tons of soybeans to unknown during the 2021/2022 marketing year.

Corn

and wheat ended higher while the soybean complex sold off. Throughout the session several newswire headlines highlighted potential EPA mandate and waiver decisions. The trade viewed the leaked mandates as negative for the biofuel industry. USDA also announced

grants/relief to biofuel companies negatively impacted by Covid-19 economic slowdown.

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Crop

moisture stress is evolving in western Parana and some immediate neighboring areas in Mato Grosso do Sul and Paraguay - Rain

is needed in these areas and some may evolve, but not before Sunday and more likely next week when scattered showers and thunderstorms evolve - That

rain will be very important since without moisture stress could become significant to slow crop develop and raise production worries - Rio

Grande do Sul, Uruguay, eastern Entre Rios, Argentina and Corrientes along with southern Paraguay are expecting to dry out as well, but moisture stress for these areas will not evolve as quickly as that of western Parana.

- Dryness

in these areas will be more persistent and will raise the potential crop moisture stress as mid-month approaches - Some

minor crop stress may evolve next week - Other

crop areas in Argentina will remain in favorable condition for the next ten days to two weeks with good plant development expected - Wheat

yields in Argentina are still looking favorable with more of that crop filling and maturing with accelerating harvest progress under way - Center

west and center south Brazil crop development will continue to advance favorably - The

region may run into excessive rainfall during the soybean harvest season late this month and in January, but it is too soon to predict how impactful that may or may not be

- Australia

winter crop harvest weather has improved and will continue more favorably through the next ten days to two weeks - No

more crop quality concerns are expected through at least Dec. 17. - Australia

summer crop conditions are improving after abundant to excessive rain last month - China’s

weather will continue rather tranquil through the next ten days to two weeks with brief periods of precipitation and more sunshine

- Temperatures

will be non-threatening to wheat, rapeseed and livestock - Southern

India weather has been improving this week and this trend will continue for a while - Too

much rain in November hurt the quality of some late season crops and raised the need for replanting of many winter crops - Absolute

dryness is not likely, but rain expected should be brief and light enough to allow some crop development and farming activity to advance relatively well.

- Central

and northern India weather will remain good for winter crop planting and establishment. - Most

winter crops are likely in the ground and are establishing well - Early

planted wheat and other small grains may be in the vegetative to early joint stage of development - Harvest

progress for summer crops has advance well recently and little change is expected - Morocco

and northwestern Algeria remain too dry and significant rain must fall soon to get crops planted and established properly - Soil

moisture and rainfall have been sufficient in northeastern and north-central Algeria and far northern Tunisia, but greater rain is needed in interior crop areas - Rain

prospects for the drier areas are not very good for the next ten days - Europe’s

more active weather of late is expected to shift a little more to the east over the next week to ten days - Romania

and Spain are the two driest counties in the continent today and some relief should come to Romania by mid-month, but Spain may be left dry for a while - Soil

moisture elsewhere in Europe has been will continue favorable for winter crops which are moving into dormancy in many areas

- Western

parts of Russia, Belarus and central and western Ukraine will get periods of rain and snow through the next ten days maintaining favorable soil moisture for use in the spring - No

crop threatening cold is expected in any winter crop region - Limited

precipitation will continue in the lower half of the Volga River Basin, far eastern Ukraine and Russia’s Southern Region for a while - South

Africa summer crops will experience a good mix of rain and sunshine over the next ten days supporting additional planting and establishment - Production

potentials are good this year especially with La Nina prevailing - West-central

Africa rainfall is expected to be greatest in Liberia and Sierra Leon during the next ten days - Coastal

areas of Ivory Coast will also be wet biased while most other coffee, cocoa, sugarcane, rice and cotton areas in the region will be left dry

- Favorable

harvest conditions will prevail outside of the wettest areas - Ethiopia

rainfall will be minimal over the next ten days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 17 - Indonesia,

Malaysia and Philippines rainfall will be abundant during the next couple of weeks.

- Some

flooding may evolve, although western parts of Luzon Island and a part of Mindanao will only receive light precipitation - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain

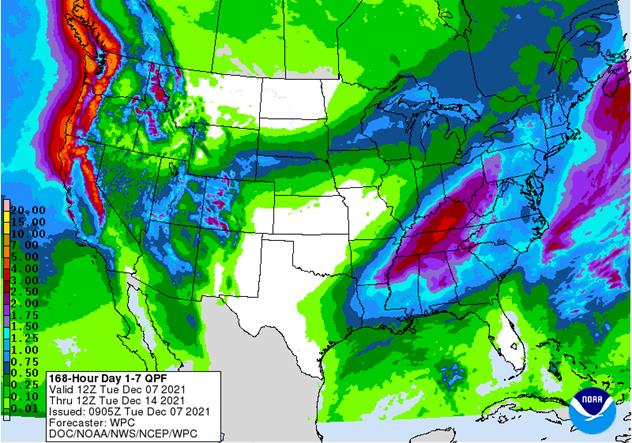

- U.S.

weather outlook has not changed much today relative to that of Monday - Hard

red winter wheat areas will experience little to no rain during the next ten days - Much

of Texas will be dry except in the far east - Brief

periods of light snow and some rain will impact the northwestern U.S. Plains

- Snow

will fall late this week from southern and eastern South Dakota and far northern Nebraska into southern Minnesota and upper Michigan where 3 to 6 inches and local totals to nearly 10 inches will be possible - U.S.

Delta, Tennessee River Basin and lower eastern parts of the Midwest along with the Carolinas and Virginia will get periodic rainfall much of which may occur tonight and again this weekend - Greater

rain and mountain snow is expected in California beginning this weekend and continuing next week

- The

precipitation will increase runoff potentials in the spring by accumulating some significant mountain snowpack - The

moisture will also improve topsoil moisture in the central Valleys - Some

wetter biased weather is also expected in the Pacific Northwest, but mostly outside of the Yakima Valley - Florida

will continue drier than usual - U.S.

temperatures will be warmer than usual during the next ten days with some of the readings well above normal

- Bitter

cold in the far northern fringes of the U.S. Plains and upper Midwest Monday and early today resulted in high temperatures below zero Fahrenheit in northeastern North Dakota and northern Minnesota Monday as well as in parts of Canada’s Prairies - This

cold will not be allowed any farther to the south and will likely retreat northward during the balance of this week and weekend - Cold

air did reach down into the lower Midwest briefly overnight with low temperatures in the teens as far south as central Illinois, central Indiana and west-central Ohio with subzero degree temperatures in Wisconsin and northern Minnesota - Waves

of rain are expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia - Delays

in the loading and shipping of some goods and services may result due to flooding, but the worst of the stormy pattern may be passing - Frequent

rain could still induce some delays - Friday

through the weekend coming up will be the next stormy period - Ontario

and Quebec weather will not be nearly as stormy in the next couple of weeks, although some brief bouts of snow and rain are still expected through the weekend - Next

week will be drier biased - Mexico

precipitation will be limited to the east coast over the next ten days with areas from Tamaulipas to Veracruz and Chiapas most impacted - Resulting

rainfall will rarely bolster soil moisture for very long - Net

drying is expected in most other areas - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Not

much change is expected through Monday - Rain

next week may impact a few northern Iraq and western Iran locations while other areas from Syria to Jordan and Israel will remainder biased through most of next week - Colombia

and Venezuela precipitation is expected to occur periodically in coffee and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillational Index was +12.92 and it was expected to move a little more erratically over the next few days - New

Zealand rainfall is expected to lighten up after heavy rain along the west coast of South Island - Near

to below average precipitation is expected - Temperatures

will be seasonable

Tuesday,

Dec. 7:

- China’s

first batch of November trade data, including soybean, edible oil and meat imports - Abares’

quarterly agricultural commodities report - French

agriculture ministry’s monthly crop production estimate - New

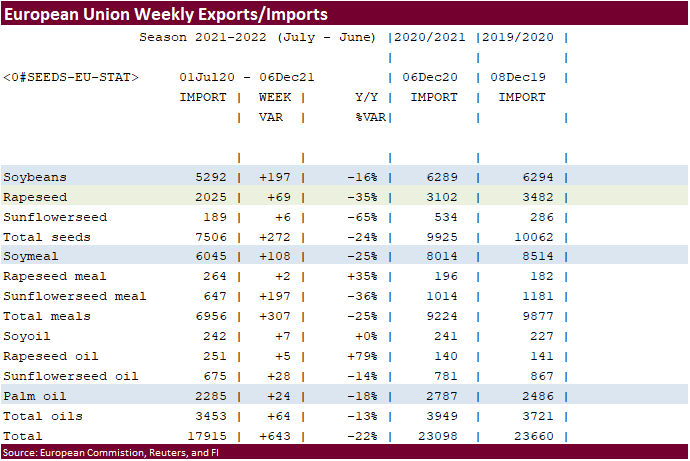

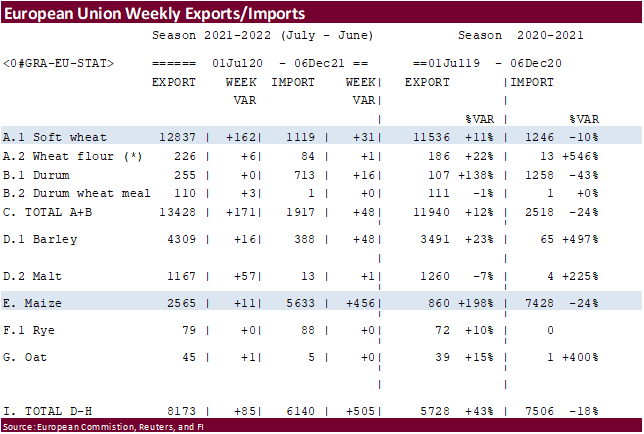

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data

Wednesday,

Dec. 8:

- EIA

weekly U.S. ethanol inventories, production - Fitch

ESG Outlook Conference Asia Pacific, day 1 - FranceAgriMer’s

monthly grains report

Thursday,

Dec. 9:

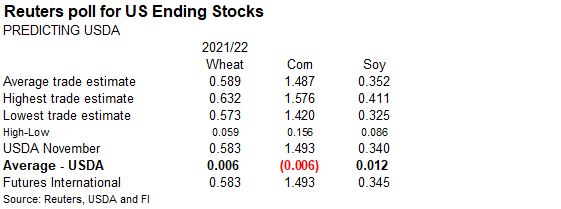

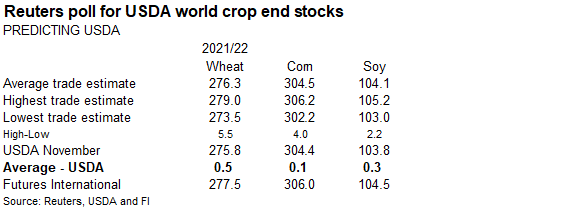

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - China

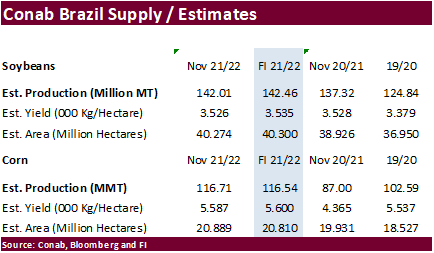

farm ministry’s monthly crop supply-demand report (CASDE) - Brazil’s

Conab report on yield, area and output of corn and soybeans - Fitch

ESG Outlook Conference Asia Pacific, day 2 - Port

of Rouen data on French grain exports

Friday,

Dec. 10:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board’s data on November palm oil reserves, output and exports - Malaysia’s

Dec. 1-10 palm oil exports - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Macros

US

Trade Balance (USD) Oct: -67.1B (exp -66.8B; R prev -81.4B)

US

Nonfarm Productivity Q3 F: -5.2% (exp -4.9%; prev -5.0%)

–

Unit Labour Costs Q3 F: 9.6% (exp 8.3%; prev 8,.3%)

Canadian

International Merchandise Trade (CAD) Oct: 2.09B (exp 2.08B; prev 1.86B)

73

Counterparties Take $1.455 Tln At Fed Reverse Repo Op. (prev $1.488 Tln, 74 Bids)

·

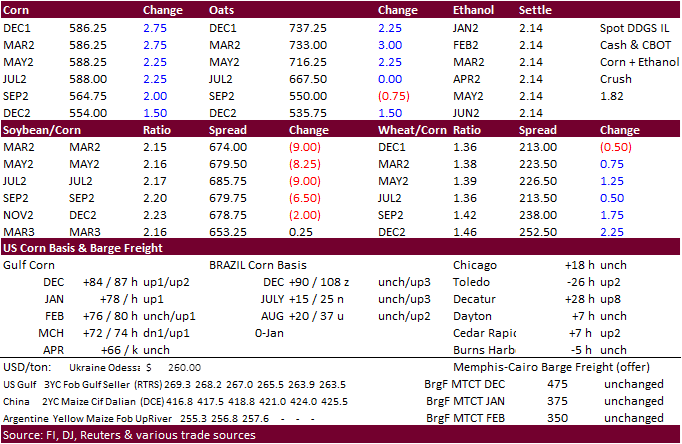

CBOT corn started lower then turned higher after leaked EPA biofuel mandate headlines came out. Also, the USDA is offering financial assistance to biofuel companies impacted by the economic slowdown during the pandemic. Higher

WTI and rally in US equities was seen friendly for CBOT corn.

·

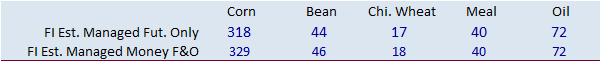

Fund bought an estimated net 2,000 CBOT corn contracts.

·

USDA announced they will provide $700 million in new biofuel grants to help companies that were impacted by the Covid-19 pandemic (USDA Pandemic Assistance for Producers initiative). Some traders thought this announcement was

a smokescreen as the EPA was expected to come out with disappointing ethanol blend biofuel mandate.

·

The EPA may also deny 65 small refinery applications for biofuel waivers.

·

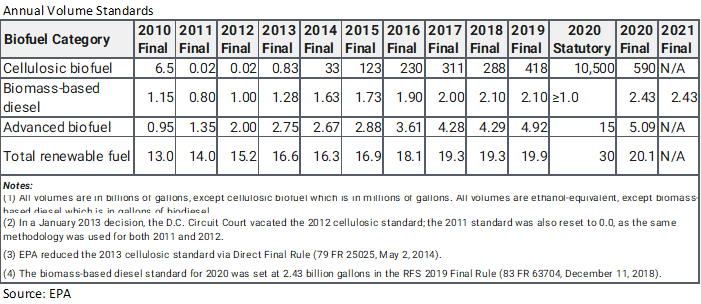

For the total biofuel program, using Reuters leaked figures from a previous story, the EPA naturally reduced the 2020 RVO, slightly increased 2021 from a leaked story and raised 2022. Bloomberg noted for 2020, the EPA is revising

down the total renewable fuel quota to 17.13 billion gallons, from a 20.09 billion-gallon target established in December 2019.

·

Leaked Reuters: CONVENTUAL BIOFUEL MANDATES

-

12.6

billion gallons for 2020 -

13.8

billion for 2021 -

15

billion for 2022.

·

There was talk China bought US and Ukrainian corn this week. We can’t verify that but do know they were active buyers of Ukraine corn over the last couple of weeks.

·

October US corn exports were 150 million bushels, 50 million above September (hurricane month) and 5 million above October 2020.

·

Brazil corn exports were projected at 3.470 million tons for the month of December according to ANEC, compared to 3.822 million tons during December 2020.

·

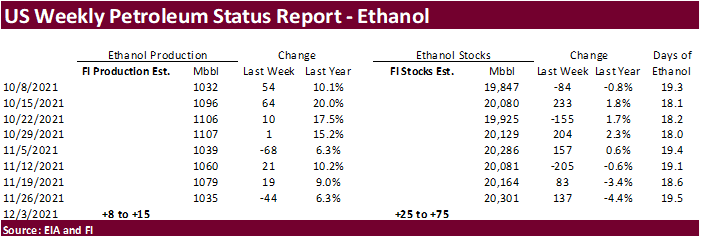

A Bloomberg poll looks for weekly US ethanol production to be up 11,000 barrels to 1.046 million (1025-1071 range) from the previous week and stocks up 130,000 barrels to 20.431 million.

Export

developments.

·

Taiwan’s MFIG bought about 130,000 tons of corn from Argentina at 224.78 cents/bu c&f over the Chicago May contract and 210.79 cents over the July. Shipment was between Feb. 17 and March 8, 2022 and March 10 and March 29.

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

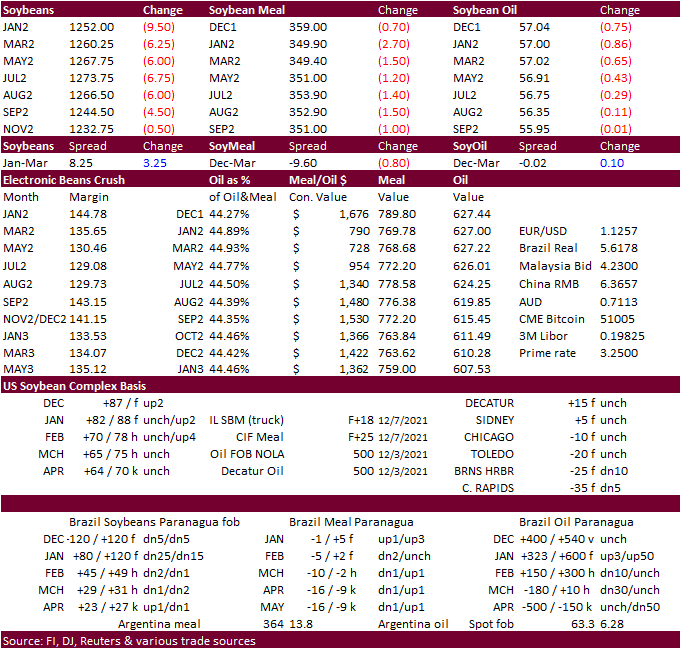

Buy the rumor, sell the fact? The soybean complex ended lower led by selling in soybean oil after leaked headlines came out over EPA’s biofuel mandate. Some traders were looking for higher biofuel mandates. January soybeans fell

11.25 cents, January SBO down 76 points and January meal down $2.90/short ton. Another two cargoes were announced under the 24-hour reporting system, but this did little to cool the selling in soybeans. Bear spreading in soybeans was a feature.

·

Funds sold an estimated net 6,000 soybean contracts, sold 3,000 soybean meal and sold 4,000 soybean oil.

·

Then SBO started to selloff. It recovered only to trade and settle lower. Some spreading among the soybean products limited losses in meal.

·

USDA announced they will provide $700 million in new biofuel grants to help companies that were impacted by the Covid-19 pandemic.

·

USDA also announced they will provide $100 million in new biofuel infrastructure aid to help companies that were impacted by the Covid-19 pandemic. That was a supportive headline, IMO.

·

The mandates rumored today were not as high as what some of the trade expected.

·

Leaked Reuters: ADVANCED BIOFUEL MANDATES

-

4.63

BLN GLNS FOR 2020 -

5.2

BLN GLNS FOR 2021 -

5.7

BLN GLNS FOR 2022

·

No official announcement was out at the time this was written.

Old

2020 official RVO below.

From

Scott Irwin from U of I via Twitter. We agree with his other comments that were posted.

https://twitter.com/ScottIrwinUI

·

Malaysian palm rallied 179 points and cash was up $25/ton. Indonesia rejected a bid to reinstate two company palm oil plantation permits in Papua. The plantations are small but will still have a slight impact on production.

·

The January/March soybean complex spreads were active today. The Goldman Roll started today.

·

Brazil’s crush was up 15 percent last month. Soybean oil premiums in Brazil have been under pressure from the increase in crush and government announcement to keep the biodiesel blend rate at 10 percent. Premiums are below Argentina

SBO. Argentina offers for soybean oil are drying up after that country committed a large number of exports to India.

·

Argentina will be on holiday Wednesday.

·

Brazil soybean exports were projected at 2.579 million tons for the month of December according to ANEC, compared to 161,024 tons during December 2020.

·

October US soybean exports of 386 million bushels were less than expected (411 FI estimate), above 80 million in October and below 428 million during October 2020. Sep-Nov soybean exports are estimated at 856 million bushels,

235 million below Sep-Nov 2020. We lowered our crop year export projection by 10 million bushels to 2.020 billion, 30 million below USDA’s 2.050 billion and compares to 2.265 billion for 2020-21.

·

US producer selling is slow this week.

·

China November soybean imports were 8.57 million tons, up from 5.11 million in October. Jan-Nov imports were 87.65 MMT, down 5.5% from same period year ago.

·

China imported 673,000 tons of vegetable oils in November and Jan-Nov year were 9.573 million tons, up 1.6% on the year.

·

Part of the Mississippi River was closed near Rosedale, Miss, after several barges ran aground.

USDA

on India: Oilseeds and Products Update

CME:

Approved Application for Decrease in Soybean Oil Regularity

South

Dakota Soybean Processors, LLC.

(registrations

are zero at that location)

https://www.cmegroup.com/notices/market-regulation/2021/12/MKR12-03-21.html

Export

Developments

·

Private exporters reported the following:

-123,000

metric tons of soybeans to unknown during the 2021/2022 marketing year

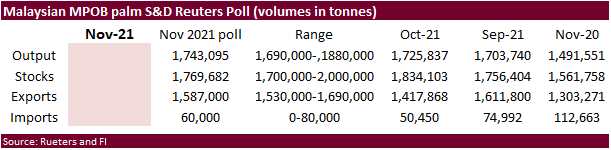

November

MPOB estimates via Reuters

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range, March $11.75-$13.50

Soybean

meal – January $320-$370, March $315-$380

Soybean

oil – January 54.00-59.00, March 54.00-62.00

·

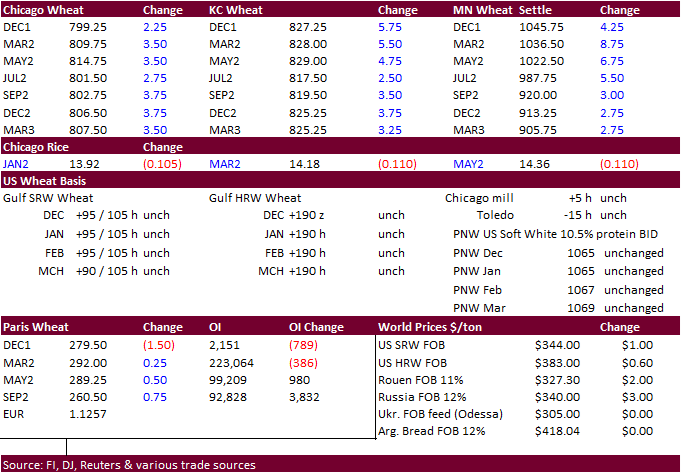

US wheat started lower and ended higher on lack of direction. We think after fund selling dried there was light short covering. Higher corn added to the support.

·

Funds bought an estimated net 2,000 Chicago soft red winter wheat contracts.

·

October US all-wheat exports were 45 million bushels, well below 85 million during September and 64 million during October 2020.

·

Look for traders to monitor the Ukraine/Russia situation.

·

Egypt said they have enough wheat stocks to last 5.3 months.

·

March Matif Paris wheat was 1.00 euro lower at 290.75.

·

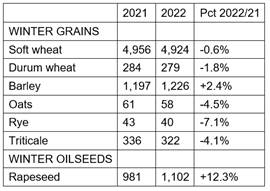

France estimated the soft winter wheat area at 4.92 million hectares, down from 4.96 million year before. Winter barley area was pegged at 1.23 million hectares, up from 1.20 million hectares the prior year.

France

winter area estimates

Export

Developments.

·

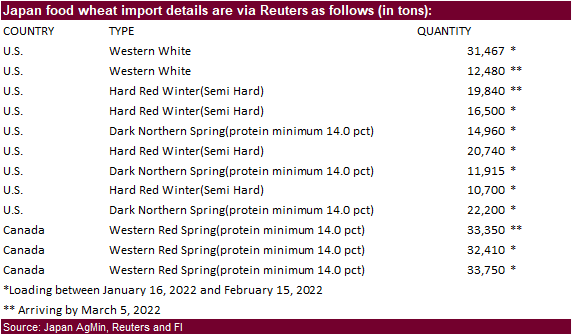

Japan seeks 260,312 tons of food wheat from the US and Canada.

·

Jordan seeks another 120,000 tons of wheat on Dec 9 and seeks 120,000 tons of barley on Dec 8.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.